- In June 2025, Austrian startup Revo Foods partnered with Slovenia’s Juicy Marbles to debut a 3D-printed plant-based fish fillet called “Kinda Cod,” leveraging mycoprotein and high-throughput 3D printing, and it launched direct-to-consumer in the US via Juicy Marbles’ online store with UK and EU rollout planned.

- In April 2025, Bel Group teamed with Standing Ovation to upcycle acid whey into high-value casein proteins via precision fermentation for more sustainable cheese production.

- On July 17, 2025, GEA opened a 10,000 m² Food Application & Technology Center in Wisconsin, its second global pilot plant, housing 50–500 liter bioreactors to help startups scale fermentation and cultivated meat from lab to industrial scale.

- In June 2025, University of Tokyo researchers published findings that aging cultured beef cells increased free amino acids—particularly glutamic acid—and adding specific amino acids to growth medium boosted flavor compounds, aiming to taste like real meat (Food Chemistry).

- In early 2025, The Cultivated B announced TCB-2, a small synthetic molecule that can replace fetal bovine serum in growth media, achieving about 70% of the standard growth rate in a serum-free medium.

- In June 2025, the U.S. FDA cleared Wildtype’s cell-cultured salmon for market with a no-questions letter, marking the first cultivated seafood approval in the United States and the fish was served as ceviche at a Portland restaurant.

- In June 2025, Australia’s FSANZ approved Vow’s cultivated Japanese quail meat for sale, the first cultivated meat approval in Oceania, with initial rollout to select restaurants in Sydney; Vow already sells the quail product in Singapore and Hong Kong since 2024.

- By mid-2025, the U.S. regulatory landscape remained patchwork with Mississippi and Nebraska banning cultivated meat (effective 2025), Indiana imposing a one-year moratorium, while Arizona required explicit labeling, and the EU reviewed first applications via EFSA with €350 million funding announced in July 2025 under the EU Life Sciences strategy to boost fermentation-enabled alt-proteins.

- Major industry moves included Tyson Foods and Cargill taking equity stakes in cultivated-meat startups and Brazil’s JBS building a dedicated cultivated meat production facility to scale output once approvals arrive.

- In the market and investment outlook, Q1 2025 alt-protein funding totaled $235 million, with fermentation securing about $146 million (≈62%), Formo securing a $36 million loan from the European Investment Bank, Vivici raising $33.8 million in Series A, and forecasts projecting 15.37 million tons of demand by 2032 at 10.2% CAGR, potentially exceeding $400 billion by 2034.

The months of June and July 2025 have been momentous for FoodTech, especially in the realms of alternative proteins and cellular agriculture. Around the globe, startups and food industry giants launched new products, achieved scientific milestones, and navigated shifting regulatory landscapes. Consumers showed evolving attitudes toward novel proteins, while experts weighed in on the future of food. This report provides a comprehensive overview of mid-2025 developments – from cultivated meat approvals and product innovations to market trends and investment patterns – with a focus on alternative protein sources and cell-cultured foods.

Breakthrough Product Launches and Innovations

Several high-profile product launches and collaborations in mid-2025 signaled a maturation of the alternative protein industry. In June 2025, Austrian startup Revo Foods partnered with Slovenia’s Juicy Marbles to debut a 3D-printed plant-based fish fillet called “Kinda Cod,” leveraging mycoprotein and high-throughput 3D printing to create a flaky, tender alternative to cod agfundernews.com agfundernews.com. Marketed as an answer to the “rubbery” faux-fish of the past, Kinda Cod offers a raw, unbreaded fish alternative enriched with omega-3s and B-vitamins. It launched direct-to-consumer in the US via Juicy Marbles’ online store, with plans for UK and EU rollout agfundernews.com agfundernews.com. This collaboration, branded “Juicy Marbles & Friends,” exemplifies a new strategy in plant-based meat: startups pooling expertise to diversify product offerings without incurring prohibitive R&D and capital costs agfundernews.com agfundernews.com. “Our collaboration…is a prime example of how the field can move forward,” said Revo Foods CEO Robin Simsa, noting that many earlier alt-protein firms tried to go it alone and struggled with high costs agfundernews.com agfundernews.com. This partnership approach suggests a “Plant-Based 3.0” era focused on creativity and cooperation, rather than simply mimicking meat one product at a time agfundernews.com.

Established food companies are also innovating. For example, French dairy giant Bel Group teamed up with startup Standing Ovation to transform cheese whey waste into high-value casein proteins via precision fermentation european-biotechnology.com european-biotechnology.com. Announced in April 2025, this initiative aims to upcycle a by-product (acid whey) into animal-free dairy proteins, enabling more sustainable cheese production. Bel’s director of open innovation lauded the “breakthrough” as opening “a whole new world of possibilities” for future recipes that combine nutrition, sustainability, and taste european-biotechnology.com european-biotechnology.com. Such collaborations highlight how incumbents are embracing FoodTech to reinvent traditional products like cheese.

Meanwhile, infrastructure for scaling alternative proteins is expanding. Multinational equipment supplier GEA opened a 10,000 m² Food Application & Technology Center in Wisconsin – its second global pilot plant – to help startups scale up fermentation and cultivated meat production european-biotechnology.com european-biotechnology.com. The facility, inaugurated on July 17, 2025, houses advanced bioreactors (50–500 liters) and downstream processing equipment, allowing companies to optimize processes from lab to industrial scale european-biotechnology.com european-biotechnology.com. GEA’s aim is to bridge the gap to large-scale manufacturing by providing pilot-scale fermentation and cell-culture capacity without firms having to invest in their own plants european-biotechnology.com european-biotechnology.com. According to European Biotechnology Magazine (June 2025), the U.S. – with 40% of alt-protein startups – is a prime location for such a center, and GEA noted robust demand from cultivated meat, precision fermentation, and alt-dairy companies for scale-up support european-biotechnology.com european-biotechnology.com. This reflects a broader industry push in mid-2025 to move from prototype to production, as many novel protein firms seek to commercialize their innovations at scale.

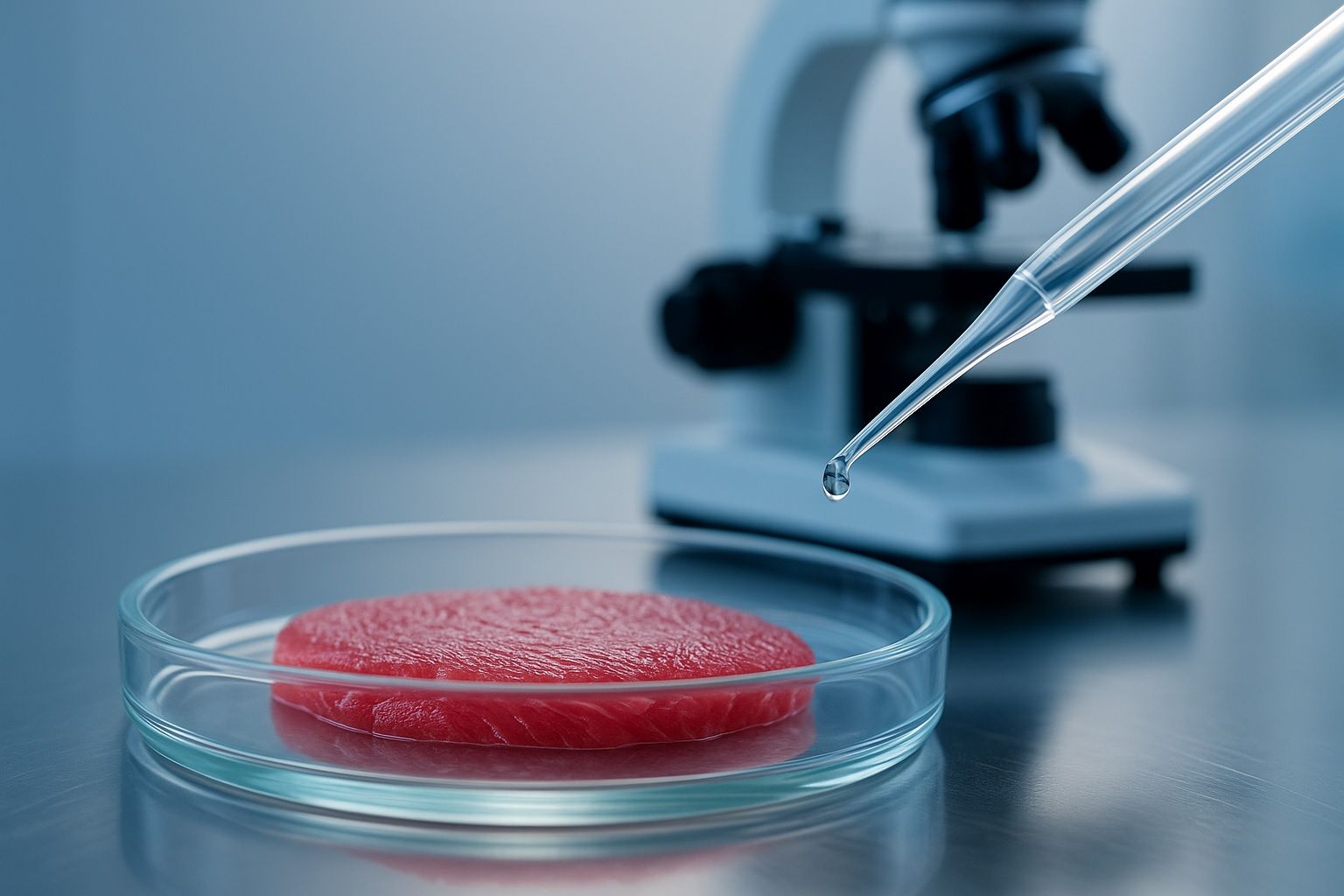

Scientific and Technological Breakthroughs

Researchers achieved significant scientific breakthroughs in flavor, formulation, and bioprocessing of cultivated proteins in 2025. One critical challenge for cultivated meat – flavor – saw progress with a June 2025 study from the University of Tokyo. Scientists found that by manipulating free amino acid levels in cell culture, they could enhance the taste of lab-grown beef phys.org phys.org. During experimentation, cultured muscle cells that underwent an aging process accumulated double the free amino acid content of conventional beef, especially glutamic acid (which imparts savory umami flavor) phys.org phys.org. Glutamate was the most abundant amino acid in the cultured cells, suggesting a naturally rich umami profile, whereas conventional beef had more alanine (sweet) phys.org phys.org. Crucially, the team showed that adding specific amino acids to the growth medium directly increased those flavor molecules in the meat tissue, providing a potential lever to tune the flavor of cultivated meat at will phys.org phys.org. “Increasing levels of a particular amino acid in the medium increased the levels in the cells…we should be able to control the flavor profile,” explained senior author Shoji Takeuchi phys.org. This peer-reviewed breakthrough (published in Food Chemistry, June 2025) represents a step toward making cell-based meat “taste just like the real thing” by replicating the nuanced flavor compounds of farm-raised meat phys.org phys.org.

Another milestone in cultivated meat production was solving the long-standing dependence on fetal bovine serum (FBS) as a growth medium component. In early 2025, German-Canadian startup The Cultivated B announced it had identified a small synthetic molecule (TCB-2) that can replace bovine growth factor in cell culture media european-biotechnology.com european-biotechnology.com. This molecule achieved about 70% of the cell growth rate obtained with traditional FBS-derived growth factor, while eliminating the ethical and practical issues of using serum harvested from calf fetuses european-biotechnology.com european-biotechnology.com. European Biotechnology Magazine (Feb 2025) noted this is a “major ethical and technological problem” overcome – FBS is not only costly and variable batch-to-batch, but also anathema to the cruelty-free promise of cultured meat european-biotechnology.com european-biotechnology.com. By using a stable chemical substitute in a serum-free medium, the process becomes more scalable, consistent, and aligns with the industry’s sustainability goals european-biotechnology.com european-biotechnology.com. This advance could significantly lower the cost of cultivated meat production (growth media have been a major expense) and preempt one criticism often raised by skeptics: that lab-grown meat relies on animal serum. Indeed, the discovery was hailed as taking wind out of opponents’ sails by removing the “highly unethical” FBS ingredient from the equation european-biotechnology.com european-biotechnology.com. Together with innovations in bioprocess hardware (such as new bench-top bioreactors with AI biosensors launched by the same startup in Canada european-biotechnology.com), the cultivated meat field in mid-2025 is rapidly addressing its technical bottlenecks in taste, cost, and scale.

Regulatory Changes and Approvals

Mid-2025 brought landmark regulatory approvals for cultivated meat, even as regulation remains a patchwork globally. Australia made history in June 2025 by becoming one of the first countries (and the first in Oceania) to greenlight a cultivated meat product. The Food Standards Australia New Zealand (FSANZ) authority approved Sydney-based startup Vow’s cultured Japanese quail meat, deeming it safe for sale foodnavigator.com foodnavigator.com. According to FoodNavigator (18-Jun-2025), this novel food approval came after a multi-year safety assessment, and paves the way for Vow’s cultivated quail foie gras to appear on restaurant menus in Australia within weeks foodnavigator.com foodnavigator.com. “Australia is embracing innovation and consumers are ready to try something new and delicious,” said Vow’s CEO, celebrating the milestone foodnavigator.com. Vow has already seen success in Asia; it sells the same quail product under its “Forged” brand in Singapore and Hong Kong (markets where it gained approval in 2024) foodnavigator.com. Demand has been strong – in Singapore, Vow’s cultivated quail has experienced 200% month-on-month sales growth since launch foodnavigator.com. The Australian approval highlights Asia-Pacific’s lead in regulatory openness: with Singapore, and now Australia, allowing commercial sales, APAC is outpacing regions like Europe where no cultivated meat is yet approved.

In the United States, regulatory momentum continued in mid-2025 with a first approval for cultivated seafood. In early June, the U.S. Food and Drug Administration cleared Wildtype’s cell-cultured salmon for market, issuing a “no questions” letter that affirmed the sushi-grade cultivated fish is as safe as traditionally sourced salmon fooddive.com fooddive.com. This marks the FDA’s first greenlight for a cultivated fish product, expanding on the agency’s 2022–2023 clearances of cultivated chicken. Wildtype’s salmon, grown from Pacific salmon cells and assembled into fillets with plant-based scaffolding, made its debut as a ceviche offering at a fine-dining restaurant in Portland, Oregon fooddive.com fooddive.com. Food Dive (June 12, 2025) reports that Wildtype is only the fourth cultivated protein company to clear FDA’s pre-market safety process fooddive.com. (Upside Foods and Eat Just’s GOOD Meat received approvals for cultivated chicken in 2023, and a third company followed.) The USDA is also involved in final inspections for cultivated meat sales, but the FDA’s approval was the crucial hurdle for Wildtype. The company plans to expand to four more restaurants over the next few months fooddive.com.

However, the U.S. regulatory landscape is complicated by state-level legislation. Even as federal agencies cautiously approve products, several state governments have moved to restrict them. In 2024, Florida and Alabama enacted outright bans on the sale of lab-grown meat, and in 2025 this trend continued: Mississippi and Nebraska passed laws banning cultured meat sales, and Indiana imposed a temporary 1-year moratorium fooddive.com. Lawmakers backing these bans cite protection of traditional agriculture and unsettled consumer sentiment. By mid-2025, at least five U.S. states had implemented or proposed restrictions on cultivated meat fooddive.com. For example, Mississippi’s law (effective July 1, 2025) criminalizes sale of any cell-cultured meat with fines or jail for violators statecapitallobbyist.com statecapitallobbyist.com. Some states like Arizona chose a lighter approach, mandating clear labeling of “this product is derived from cultivated cells” without banning sales statecapitallobbyist.com. This patchwork of state rules creates uncertainty for startups. Wildtype’s founders have actively opposed such measures, testifying against Florida’s ban and arguing that cultivated fish and meat are vital innovations for sustainability fooddive.com fooddive.com. The federal stance remains supportive – USDA and FDA continue to review new applications – but companies must navigate a regulatory patchwork at the subnational level in the US.

Europe, meanwhile, has yet to approve any cultivated meat or dairy as of mid-2025, but regulatory developments are underway. The EU’s novel food process is deliberative: the first applications (e.g. from UPSIDE Foods and others) are under review by the European Food Safety Authority (EFSA), a process that can take 18–24 months european-biotechnology.com. Some European politicians have shown hostility (e.g. proposals in Italy, Austria, and Poland to ban cultured meats preemptively), but these have not become EU-wide law european-biotechnology.com. In fact, a majority of EU member states in 2025 have called for an “EU protein strategy” that includes cultivated and fermentation-based proteins, viewing them as tools to improve the agricultural sustainability and reduce carbon footprint european-biotechnology.com gfieurope.org. In a positive step, the European Commission in July 2025 announced €350 million in funding opportunities to boost food innovation, specifically highlighting fermentation-enabled alternative proteins as a growth area gfieurope.org gfieurope.org. The EU’s new Life Sciences strategy identifies advanced fermentation technologies (both biomass fermentation and precision fermentation) as having “significant potential” to develop sustainable protein ingredients and reduce reliance on imports gfieurope.org gfieurope.org. This includes plans to scale up fermentation capacity, foster public-private partnerships, and even host annual conferences to accelerate alt-protein collaboration gfieurope.org gfieurope.org. GFI Europe welcomed the strategy, noting it “can help enable the bloc’s SMEs to commercialise the findings of a growing network of European scientists” working on alternative proteins gfieurope.org gfieurope.org. While European consumers still await the first taste of approved cultivated meat, these policy moves in mid-2025 suggest a regulatory environment slowly warming to novel proteins, with significant public funding to back it.

(Table: Notable Cultivated Meat Approvals up to July 2025)

| Country/Region | Status (as of Jul 2025) | Details |

|---|---|---|

| United States | Approved: Yes (2023–25) | FDA & USDA cleared cultivated chicken by Upside Foods and GOOD Meat in 2023; first cultivated seafood (Wildtype’s salmon) cleared in June 2025 fooddive.com. State-level bans in some locales. fooddive.com |

| European Union | Approved: No (in review) | No cultivated food on market yet; EFSA reviewing first applications (process ~18+ months) european-biotechnology.com. EU exploring pro-innovation funding (≈€350M) for alt-proteins gfieurope.org. |

| Singapore | Approved: Yes (2020) | World’s first approval (12/2020) for Eat Just’s cultivated chicken; multiple products (chicken, quail) now sold in high-end restaurants foodnavigator.com. Regulator (SFA) established novel food framework early. |

| Australia | Approved: Yes (2025) | FSANZ approved Vow’s cultivated quail meat in June 2025 foodnavigator.com – first in Australia. Launching initially in select restaurants (e.g. Sydney). |

| Israel | Approved: Partial | No retail approval yet, but regulators approved limited tasting samples. Several startups (e.g. Aleph Farms) expect to seek approval soon. |

| China | Approved: No | Government investing heavily in cellular agriculture R&D (included in 5-Year Plan). No public sales yet, but building domestic technical capacity. |

| Others (HK, etc.) | Approved: Yes (HK) | Hong Kong has accepted imports of cultivated products (e.g. Vow’s quail, 2024). UK and others evaluating – Vow submitting dossier to UK FSA in late 2025 foodnavigator.com. |

Sources: FoodNavigator foodnavigator.com foodnavigator.com, Food Dive fooddive.com fooddive.com, GFI Europe (Jul 2025) gfieurope.org.

Consumer Trends and Adoption

As novel protein products inch into the market, consumer awareness and adoption are evolving in complex ways. A new survey in June 2025 suggests that younger consumers are significantly more receptive to cultured meat than older generations. Nearly half of Generation Z in the UK (47%) say they would eat lab-grown meat, compared to only about 21% of Baby Boomers, according to an Ipsos poll of 1,000+ adults (conducted mid-June) businessgreen.com businessgreen.com. The Grocer (July 2025) and BusinessGreen reported that Gen Z Brits are far more open to trying cultivated meat products, indicating a genuine growth market among younger demographics businessgreen.com. This generational divide – with Millennials and Gen Z showing the most interest – suggests that acceptance will likely rise as these cohorts gain purchasing power. The survey also found men and younger adults more inclined to approve of cultivated meat’s availability, whereas older people remain skeptical ipsos.com meatmanagement.com. Public opinion is still split overall, but the data imply future consumers may normalize alternative proteins in their diets, given the right product quality and price points.

Flexitarian diets continue to drive interest in alternative proteins. Industry analysts note that a substantial segment of consumers want to reduce (but not eliminate) meat consumption – an estimated 15% of Americans identify as flexitarians who primarily eat vegetarian but occasionally meat/fish fooddive.com. Cultivated and plant-based options cater to these flexitarians by providing familiar favorites with a smaller environmental footprint. However, converting stated interest into regular purchases has proven challenging. Executives in the plant-based sector observe that while curiosity is high, repeat adoption depends on taste, price, and cultural habits. “Everybody placed big bets on the flexitarians, but we’re now learning that changing people’s dietary habits is more difficult than changing their religion,” remarks Tilen Travnik, CEO of Juicy Marbles, illustrating the headwinds in altering food habits agfundernews.com. In times of economic uncertainty, consumers often revert to comfort foods – a trend that contributed to flat or declining sales for plant-based meat in 2022–2024. By mid-2025, retail sales data in the US and Europe show meat alternative volumes stagnating or down from their pandemic-era peak agfundernews.com. This “trough of disillusionment” in plant-based meats, as some call it, has seen many early products pulled from shelves due to low demand or insufficient “repeat buy” rates agfundernews.com.

On the other hand, novelty and premium experiences are drawing consumers to the best of these new foods. In the U.S., the first restaurants serving cultivated chicken (from Upside Foods and GOOD Meat) reportedly sold out reservations, indicating strong initial curiosity. In Singapore, as noted, Vow’s cultivated quail has consistently sold out at high-end venues, with demand climbing each month foodnavigator.com. This suggests consumers will seek out alternative proteins when positioned as unique, aspirational offerings – at least among food enthusiasts. Price remains a barrier for mass adoption: cultivated meat portions in mid-2025 are priced for upscale dining, and even plant-based products often cost more than their conventional counterparts. The Economic Times reports that in price-sensitive markets like India, bridging the cost gap with conventional meat and dairy is crucial for wider adoption economictimes.indiatimes.com economictimes.indiatimes.com. Indian consumers, for example, show interest in plant-based alternatives, but products must become more affordable and tailored to local tastes to gain traction economictimes.indiatimes.com economictimes.indiatimes.com.

Government and industry initiatives are aiming to educate consumers and improve comfort levels. In Europe, nonprofits are countering misconceptions about “ultra-processed” plant-based foods by highlighting health benefits (like lower LDL cholesterol and cancer risk for those who switch to plant proteins) gfieurope.org. Such information could alleviate public concerns and improve acceptance of new food tech. Overall, mid-2025 consumer trends reveal a mixed picture: excitement and openness among younger and eco-conscious consumers, but also skepticism and habit inertia in the broader population. The coming years will test whether alternative proteins can move from niche to normal – likely hinging on continued improvements in taste, price, and cultural messaging.

Industry Insights and Expert Commentary

Industry experts in mid-2025 paint a frank but hopeful picture of the alternative protein landscape. Many acknowledge that the sector underwent a wave of overhype and is now entering a more pragmatic phase. “Looking back, there was too much hype, too heavy capex, and too many companies focused for years on R&D without actually making revenues,” observes Revo Foods CEO Robin Simsa, reflecting on the flurry of startups around 2020 that over-promised agfundernews.com agfundernews.com. Simsa and others argue that the industry is now maturing by focusing on core competencies and partnerships. The collaborative launch between Revo and Juicy Marbles (with one contributing tech and the other market access) was cited as a model for this new era of specialization and cooperation agfundernews.com agfundernews.com. “I would hope more collaborations like these will emerge…at one point there were just too many companies all trying to do the same thing,” Simsa said agfundernews.com agfundernews.com, emphasizing efficiency over ego in innovation.

Executives are also candid about the current market correction in plant-based meat. “The market is being cleared of subpar products…which will result in the market looking smaller. But if you are a company in our position, that’s not necessarily a bad thing,” notes Tilen Travnik of Juicy Marbles agfundernews.com agfundernews.com. He suggests that as weaker offerings disappear, stronger brands can capture a “bigger percentage of a smaller market.” This winnowing process is seen as necessary for the industry to build a sustainable foundation with products that truly meet consumer expectations (on flavor, nutrition, and price). Travnik also highlights operational discipline: unlike some peers that raised huge sums and built shiny factories that sit idle, his company kept burn rates low and focused on getting viable products out efficiently agfundernews.com agfundernews.com. Such commentary implies that lean startup principles are becoming more valued in FoodTech, replacing the growth-at-all-costs mentality of a few years ago.

From the investment side, analysts at the Good Food Institute (GFI) and others have pointed out macro factors influencing the sector. “There’s no other way to put it: 2024 was a bleak year for food tech,” writes Anay Mridul in Green Queen, noting that post-Covid economic pressures, high interest rates, and even competition from the booming AI sector have made fundraising tough for alt-protein startups greenqueen.com.hk greenqueen.com.hk. GFI’s lead investor engagement manager, Helene Grosshans, highlighted one bright spot: fermentation-based protein companies are attracting interest by using waste feedstocks to create valuable food, aligning with cost-efficiency and sustainability goals for investors greenqueen.com.hk greenqueen.com.hk. But overall, the sentiment among experts is that alternative protein firms must weather a short-term downturn by hitting technical milestones and proving unit economics. “Few meaningful trends can be identified in a single quarter,” cautions GFI’s Daniel Gertner, urging a long-term view despite the current dip in funding greenqueen.com.hk.

Policymakers and public figures also added their voices. In Europe, Lea Seyfarth of GFI Europe praised the EU’s renewed focus on biotech in food, calling it “a step towards unlocking the EU’s potential to become an alternative protein world leader” gfieurope.org gfieurope.org. This optimism is echoed by industry leaders who see government support (through research funding, streamlined regulation, or sustainability targets) as crucial to scaling up novel proteins. On the flip side, traditional agriculture lobbies continue to voice concern. For instance, U.S. rancher associations and some politicians label cultivated meat as “Frankenfood” and push for labeling laws to clearly differentiate it from farm-raised meat. Such rhetoric indicates the cultural battle is still underway, even as the technological battle is being gradually won.

In summary, expert commentary during this period underscores a maturing industry that is tempering expectations with realism. The consensus is that alternative proteins remain poised to transform the food system in the long run, but success will require scientific breakthroughs, smart partnerships, consumer education, and supportive policy – not just venture capital hype. As one Wildtype founder put it in the context of legislative pushback: “Through technology and innovation, we can sustain global food needs without dooming our planet. Meaningful behavioral change…takes longer than we can afford” fooddive.com fooddive.com. The urgency and mission-driven ethos remain strong, even as the path to mainstream adoption proves to be a marathon rather than a sprint.

Market Forecasts and Investment Trends

The financial climate for alternative proteins in mid-2025 reflects both cooling investment and optimistic long-term forecasts. After a record surge in 2020–21, funding for alt-protein startups has retrenched over the past two years. Global venture capital investment in alternative protein companies totaled just $1.1 billion in 2024, down 27% from 2023 (which itself was ~44% below the 2022 peak) greenqueen.com.hk. The downturn continued into early 2025: Q1 2025 saw only $235 million invested worldwide across plant-based, fermentation, and cultivated meat startups greenqueen.com.hk greenqueen.com.hk. Analysts attribute this slump to a convergence of factors – rising interest rates and economic uncertainty, the diversion of VC funds into AI startups, and a reality check on inflated valuations in food tech greenqueen.com.hk greenqueen.com.hk. According to Green Queen (May 30, 2025), “2024 was bleak…startups aiming to future-proof the food system bore the brunt of the impact”, as investors grew skittish and consumers tightened wallets greenqueen.com.hk.

Notably, different segments of alternative protein fared differently in financing. Fermentation-focused companies (e.g. those making protein via microbes or precision fermentation) have emerged as relative winners. In Q1 2025, fermentation startups attracted over 60% of the sector’s funding – about $146M of the $235M total greenqueen.com.hk. This included some of the largest individual deals, like precision fermentation dairy startup Formo securing a $36M loan from the European Investment Bank, and alternative egg protein firm Vivici raising $33.8M in Series A funding greenqueen.com.hk. Investors appear drawn to fermentation plays, perhaps because they often leverage existing industrial biotech infrastructure and can generate near-term revenue (e.g. B2B ingredients) greenqueen.com.hk. By contrast, plant-based meat companies garnered only $54M in Q1 (23% of total) greenqueen.com.hk, as this category is now seen as a more mature market with slower growth. Cultivated meat startups raised just $35M in Q1 (15% of total) greenqueen.com.hk, reflecting the fact that most are still in R&D or pilot stage and face high capital needs with uncertain timelines to profitability. (One of the larger cultivated meat infusions was $29M to Israel’s Aleph Farms as part of an ongoing round greenqueen.com.hk.) The table below summarizes the Q1 2025 funding breakdown:

| Alt-Protein Segment | VC Funding (Q1 2025) | Share of Total |

|---|---|---|

| Precision/Biomass Fermentation | $146 million greenqueen.com.hk | ~62% |

| Plant-Based Foods | $54 million greenqueen.com.hk | ~23% |

| Cultivated Meat/Seafood | $35 million greenqueen.com.hk | ~15% |

| Total (Q1 2025) | $235 million greenqueen.com.hk | 100% |

Source: GFI / Green Queen (analysis of Q1 2025 investments) greenqueen.com.hk greenqueen.com.hk.

Despite the current funding pullback, market forecasters remain bullish on the long-term growth of alternative proteins. A July 2025 report by ResearchAndMarkets projected the global alternative protein market will reach 15.37 million tons by 2032, growing at a 10.2% compound annual rate from 2025 veganhub.co. That volume would represent a multi-billion dollar industry; one analysis valued the market at $91 billion in 2025 and forecast it to exceed $400 billion by 2034 if an 18%+ CAGR is achieved globenewswire.com. Growth drivers cited include rising consumer demand for health and sustainability, technological improvements in food processing, and the environmental advantages of shifting away from animal agriculture veganhub.co veganhub.co. Notably, the plant-based protein segment is expected to dominate in market share through this period (thanks to familiarity and scaling), but insect protein is predicted to have the highest growth rate, especially in animal feed and niche human foods veganhub.co. Vegconomist (Jul 2, 2025) reported that Asia-Pacific will lead demand, with the region projected to have the fastest growth in alt-protein consumption due to its large population, increasing health awareness, and government support in countries like China veganhub.co. Indeed, emerging markets are seen as major opportunities: India’s alternative protein market, currently small ($40 million), is expected to swell to $4.2 billion by 2030 (Deloitte & GFI India estimate) economictimes.indiatimes.com economictimes.indiatimes.com, an indication of the untapped potential in populous nations if cost and supply issues can be resolved.

Investment and corporate strategy trends also reflect a consolidation and pivot in 2025. Traditional food corporations and meat companies have not abandoned alternative proteins—in fact many are doubling down, but with adjusted tactics. For instance, meat conglomerates like Tyson Foods and Cargill have taken equity stakes in cultivated meat startups, and Brazil’s JBS is constructing a dedicated cultivated meat production facility (positioning to scale production once products gain approval) fooddive.com. Meanwhile, some highly valued startups from the 2019–2021 era have been acquired or restructured at lower valuations, indicating a market correction. The focus now is on efficiency and tangible milestones: investors want to see clear paths to price parity and profitability. As an example, a leading precision fermentation dairy startup dramatically cut its cash burn after a debt issue and reset its strategy to prioritize near-term product launches greenqueen.com.hk.

In conclusion, the mid-2025 financial outlook for FoodTech is one of cautious optimism. The sector is recalibrating after a period of exuberance, with investment flowing more selectively to areas like fermentation and to later-stage companies with proven tech. Yet, the overarching growth narrative remains intact – alternative proteins are expected to claim an ever-larger share of the global protein market over the next decade. Market analysts, citing both consumer trends and climate urgency, forecast a steady climb for meat and dairy alternatives, reaching potentially double-digit percentages of global protein consumption by the 2030s. The current slowdown may well be a momentary dip before the next ascent, as companies innovate and costs come down. As Ernst & Young noted in a recent analysis, alternative proteins (meat and dairy analogues) could command over 40% of the market by 2040 in an aggressive scenario alti-global.com – a reminder of the enormous prize that keeps entrepreneurs and investors in the game despite the bumps along the way.

Conclusion

The June–July 2025 period has underscored that the food tech revolution is progressing, albeit with tempered expectations and rigorous effort. Alternative proteins and cellular agriculture have moved from hype to execution: we’ve seen the first gourmet cultivated meats approved on new continents, innovative products that push beyond imitating into truly new food experiences, and scientific breakthroughs tackling flavor and cost barriers. Regulators around the world are slowly crafting pathways for these foods, even as some voices resist change. Consumers are increasingly aware of the options, with younger generations eager to embrace them, though wider adoption will require competitive pricing and cultural acceptance.

Investment trends reveal a sector in consolidation – one learning from early setbacks and focusing on sustainable growth. Leaders in the field emphasize collaboration, efficiency, and clear value propositions as the industry’s next chapter unfolds. The global view is instructive: the U.S. and Asia-Pacific lead in commercialization, Europe is marshaling its scientific strength with strategic funding, and emerging markets like India aspire to join the alternative protein wave for food security and economic opportunity.

Altogether, the developments of mid-2025 illustrate a critical inflection point. FoodTech is graduating from its novelty phase into a period of scaling up and proving out. The excitement of world-first tastings and approvals is now met with the practical work of integrating these foods into supply chains and diets. As the second half of 2025 and beyond approaches, the alternative protein sector appears more resilient and knowledge-driven than ever. The promise of a more sustainable, ethical, and innovative food system remains alive, fueled by the steady progress seen in these summer months. Each new product on the menu or investment on the table brings us a step closer to a future where burgers, fillets, and cheese can be enjoyed with a fraction of the environmental impact – truly a FoodTech future taking shape one bite at a time.

Sources:

- European Biotechnology Magazine (11 Jun 2025) european-biotechnology.com european-biotechnology.com; FoodNavigator (18 Jun 2025) foodnavigator.com foodnavigator.com; Food Dive (12 Jun 2025) fooddive.com fooddive.com; AgFunderNews (18 Jun 2025) agfundernews.com agfundernews.com; Economic Times (India) (4 Jun 2025) economictimes.indiatimes.com economictimes.indiatimes.com; Green Queen (30 May 2025) greenqueen.com.hk greenqueen.com.hk; GFI Europe (2 Jul 2025) gfieurope.org gfieurope.org; Phys.org (9 Jun 2025) phys.org phys.org; European Biotechnology (19 Feb 2025) european-biotechnology.com european-biotechnology.com; BusinessGreen (27 Jun 2025) businessgreen.com; The Grocer (Jul 2025) thegrocer.co.uk meatmanagement.com; FoodNavigator-Asia (18 Jun 2025) foodnavigator.com; Food Dive (10 Jun 2025) fooddive.com; Vegconomist (2 Jul 2025) veganhub.co veganhub.co.