- Gabon’s internet usage reaches about 72% of the population in January 2025, with roughly 1.84 million internet users out of a ~2.57 million population.

- Over 91% of Gabon’s population is urban, yet about 1,253 villages lacked any mobile coverage as of early 2024, with 200 additional villages planned for Phase 2 in 2024.

- Moov Africa Gabon Telecom and Airtel Gabon dominate the mobile market in 2025, each with roughly half the subscribers, offering 2G/3G/4G nationwide and no commercial 5G yet.

- CanalBox FTTH from Group Vivendi Africa (GVA) launched in 2017, with Libreville fiber passing over 130,000 homes and businesses and typical speeds around 50 Mbps.

- Airtel Gabon was granted Gabon’s first fixed-line license outside the incumbent in January 2025 and announced a 208 km fiber link between Libreville and Port-Gentil costing 4.3 billion FCFA.

- Fixed broadband subscriptions rose from about 10,700 in 2014 to around 80,000 by 2022, reflecting growing fiber and enterprise upgrades.

- Gabon is connected to multiple submarine cables (SAT-3 since 2002, ACE since 2012, and 2Africa), with Medusa announced to land in Port-Gentil in March 2025 bringing 400 Tbps capacity.

- Starlink is not yet live in Gabon as of mid-2025 but is expected to launch in 2025, with Airtel Africa as a partner and hardware costs of 300–700 USD and monthly 25–50 USD for speeds of 50–150 Mbps and 20–40 ms latency.

- The World Bank approved a 68.5 million USD Digital Gabon loan in January 2024 to accelerate digital public services, with ANINF leading e-government initiatives such as the RAG network.

- Between 2016 and 2018, Gabon deployed 18 solar-powered rural towers to extend mobile coverage to remote villages as part of universal service efforts.

Overview of Internet Penetration in Gabon

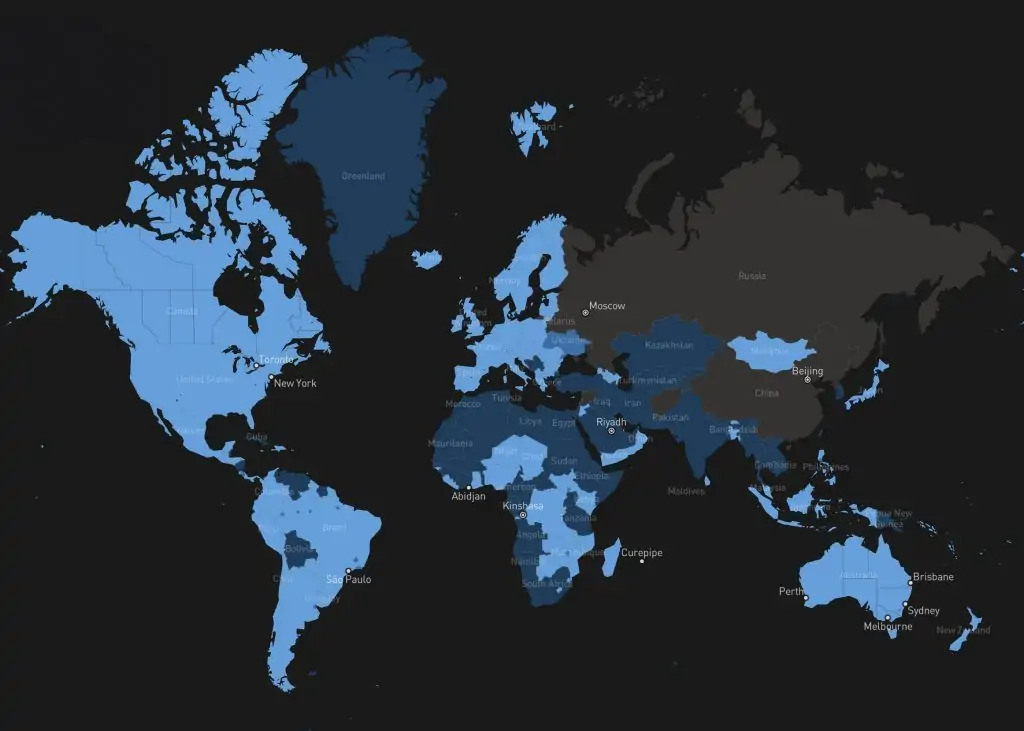

Gabon stands out as one of Central Africa’s most connected countries, with internet usage reaching roughly 72% of the population in early 2025 datareportal.com datareportal.com. According to DataReportal, about 1.84 million people in Gabon were using the internet as of January 2025, out of a population of ~2.57 million datareportal.com datareportal.com. This high penetration rate places Gabon well ahead of many neighboring countries – for instance, Cameroon’s internet penetration is around 42% datareportal.com, and the Democratic Republic of Congo’s is below 30% datareportal.com. Gabon’s achievement is even more notable given that 91% of Gabon’s population is urban (mostly in Libreville and other cities) datareportal.com, which has facilitated network rollout.

Mobile connectivity is a major driver of internet access. In fact, mobile subscriptions exceed the population – ARCEP (the telecom regulator) reported a 169% mobile phone penetration (many users have multiple SIMs) and 120.3% internet subscription rate in early 2023 techpoint.africa. This indicates that many Gabonese maintain more than one internet-enabled SIM card or service plan. In terms of speed, internet users enjoy improving broadband performance. Fixed broadband speeds have a median download of about 42 Mbps as of 2025 datareportal.com, a healthy increase from the previous year. Mobile network speeds are lower but sufficient for common applications; 4G users in urban areas often experience several Mbps up to double-digit Mbps in downloads, whereas rural users on 3G or 2G see slower speeds. The steady growth in both coverage and capacity suggests Gabon’s digital landscape is advancing rapidly.

Key Providers and Available Technologies

Despite its small market size, Gabon has a diverse mix of internet service providers (ISPs) and technologies delivering connectivity:

- Mobile Network Operators (MNOs) – The country has two dominant mobile operators, Moov Africa Gabon Telecom (the incumbent, partly owned by Maroc Telecom) and Airtel Gabon. These two share essentially the entire mobile market after a smaller operator (Azur) shut down in 2018 prepaid-data-sim-card.fandom.com. Moov (formerly Gabon Telecom/Libertis) and Airtel each have roughly half the subscriber base in 2025, a duopoly that drives competition in pricing and coverage towerxchange.com. Both offer 2G, 3G, and 4G/LTE services nationwide, with 4G available in urban centers and many towns gigago.com. As of mid-2025, neither has launched 5G commercially (see below), but they continue to upgrade 4G networks. In addition to mobile broadband, Gabon Telecom historically provided ADSL broadband over copper lines and now, under the Moov brand, also offers some fiber connectivity for enterprises. Airtel, for its part, has traditionally been mobile-only but recently obtained a technology-neutral fixed network license to deploy fiber-to-the-home (FTTH) and other broadband services techpression.com 1 .

- Fixed Broadband (Fiber and DSL) – Gabon’s fixed broadband sector is developing thanks to investments in fiber optics. Group Vivendi Africa (GVA), a French firm, entered the market in 2017 with its CanalBox FTTH service. GVA built out a fiber network in Libreville that now passes over 130,000 homes and businesses, offering packages around 50 Mbps download speeds developingtelecoms.com. By mid-2022, GVA expanded to the second city Port-Gentil, with plans to reach other provincial capitals developingtelecoms.com. This has introduced true high-speed home internet. Meanwhile, Gabon Telecom (Moov) still maintains DSL lines for some customers (though DSL subscriptions are modest). The government and regulator encourage fiber deployment: in January 2025, Airtel was granted Gabon’s first fixed-line license outside the incumbent, with a mandate to roll out FTTH networks in major cities techpression.com techpression.com. Airtel immediately announced a project to lay 208 km of fiber linking Libreville and Port-Gentil (at a cost of 4.3 billion FCFA) to improve backbone connectivity techpression.com. This new competitive push in fixed broadband is expected to drive down prices and extend coverage. According to the CIA World Factbook, Gabon had on the order of 80,000 fixed broadband subscriptions by 2022 cia.gov – a figure that is rising as fiber networks grow.

- Wi-Fi Hotspots and Local Access – In urban areas, public and private Wi-Fi hotspots provide an additional layer of internet access. Many cafes, hotels, and businesses in Libreville offer Wi-Fi to patrons, and the Leon M’ba International Airport in Libreville now provides free, unlimited high-speed Wi-Fi to travelers libreville-aeroport.com. A decade ago, several small ISPs (e.g. Boost Africa Wifly) offered WiMAX or Wi-Fi based internet services oxfordbusinessgroup.com. Today, with 4G widely available, standalone WiMAX/Wi-Fi ISPs have a smaller niche, but Wi-Fi remains crucial for home and office networking. Notably, many households access the internet via Wi-Fi routers fed by 4G SIMs or fiber modems. The government also at times sponsors connectivity in public spaces – for example, it has considered community Wi-Fi programs as part of digital inclusion, though the cellular network is the primary vehicle for public internet access in Gabon.

The table below summarizes the main internet service options in Gabon and their characteristics:

| Provider / Service | Type | Coverage & Availability | Typical Speeds | Notes |

|---|---|---|---|---|

| Moov Africa Gabon Telecom | Mobile (2G/3G/4G); DSL; Fiber (enterprise) | Nationwide mobile coverage; fixed-line in cities | 4G up to ~10 Mbps (advertised) globenewswire.com; DSL in Mbps range | Incumbent operator; ~20+ years in market. Testing 5G since 2019 qz.com. |

| Airtel Gabon | Mobile (2G/3G/4G); (FTTH starting 2025) | Nationwide mobile; new fiber rollout starting Libreville | 4G up to ~10 Mbps; FTTH can offer 50–100 Mbps | Second mobile operator; entering fixed broadband in 2025 techpression.com to offer high-speed fiber. |

| GVA – CanalBox | Fixed FTTH (Fiber to Home) | Libreville (130k homes passed) developingtelecoms.com; Port-Gentil and expanding | 50 Mbps (standard plan) developingtelecoms.com | Launched 2017 as first fiber ISP; flat-rate unlimited plans, competitive pricing. |

| IG Telecom (Internet Gabon) | VSAT Satellite & Wireless | Available countrywide (satellite); focused on enterprises | Varies by plan (few Mbps to tens) | Leading VSAT operator (500+ sites) ir.echostar.com; partnered with O3b MEO satellites for low-latency backhaul oxfordbusinessgroup.com. |

| Other ISPs (Solsi, IPI9, etc.) | Wireless ISP, Corporate services | Libreville and select areas (niche market) | Varies (WiMAX, etc. few Mbps) | Small providers serving corporate clients; often resell capacity or use radio links. |

Table: Major Internet Providers and Technologies in Gabon (2025). Speeds are indicative. globenewswire.com developingtelecoms.com 2

Mobile Internet: 4G Usage and 5G Prospects

Mobile broadband is the lifeblood of Gabon’s internet access – over 98% of internet subscriptions are mobile-based oxfordbusinessgroup.com oxfordbusinessgroup.com. Both Moov and Airtel have invested in expanding 3G/4G networks to meet booming data demand. Thanks to these efforts, 88% of mobile connections were on 3G/4G (broadband) by 2025 datareportal.com. 4G LTE was introduced in 2014 and now covers Libreville, Port-Gentil, and most populated areas. Users typically experience anywhere from 5–20 Mbps on 4G in good conditions, enabling smooth use of social media, YouTube, and other apps. Even smaller towns often have at least 3G service. The government’s universal service strategy explicitly targeted “white spots” with no signal – since 2016, a fund (financed by operator contributions) has been used to extend mobile coverage to rural villages globenewswire.com globenewswire.com. In 2024, Moov and Airtel jointly agreed to cover 200 additional villages that were still unconnected, as part of ARCEP’s Universal Service project (Phase 2) techpoint.africa techpoint.africa. This followed an initial phase (2016–2018) that put up 18 solar-powered rural cell towers for 33 villages techpoint.africa. ARCEP estimates that after these efforts, about 1,253 villages (~6.5% of the population) still lacked any mobile internet coverage as of early 2024 techpoint.africa. The continued rollout in 2024–2025 aims to close that gap, bringing at least basic 3G/4G to virtually all communities.

5G technology in Gabon remains in trial stage. Notably, Gabon Telecom (Moov) was one of Africa’s early experimenters – it began testing 5G in Libreville in November 2019 qz.com. However, as of late 2024, those tests have not translated into a commercial 5G launch. The company’s CEO originally targeted 2023 for a rollout qz.com, but regulatory and market factors have delayed it. Gabon’s situation is similar to many African countries where 5G is in pilot but not yet in service for consumers qz.com qz.com. Challenges include the high cost of 5G spectrum and the fact that few consumers can afford 5G smartphones (often priced $300+ in Africa, far above the average income) qz.com. For now, Gabon’s focus is on maximizing 4G coverage and capacity. Both operators are likely to launch 5G in the coming 1–2 years once device adoption grows and after any necessary spectrum licensing. Encouragingly, Gabon Telecom did receive a trial 5G license and demonstrated the technology (reports in 2022 confirmed Libreville trials) globenewswire.com. So the groundwork is laid – when 5G does go live, likely starting in Libreville, it could quickly offer ultra-fast wireless broadband (1 Gbps+ speeds) to industries and consumers, complementing the fiber networks.

Fiber and Fixed Broadband Expansion

While mobile internet dominates, fixed broadband has seen significant improvements, moving from a luxury to a mainstream service in urban Gabon. A decade ago, fixed internet was limited to a few thousand ADSL lines in Libreville oxfordbusinessgroup.com oxfordbusinessgroup.com. That changed with strategic investments in fiber:

- National Fiber Backbone: Starting in 2012, Gabon invested heavily in fiber-optic infrastructure as part of the Central African Backbone (CAB) project worldbank.org worldbank.org. By laying over 1,100 km of terrestrial fiber and new submarine links, the government dramatically boosted domestic bandwidth. A fiber route now connects Libreville to Franceville (the third-largest city inland), largely along the Trans-Gabon Railway, with spurs planned to other provincial capitals oxfordbusinessgroup.com oxfordbusinessgroup.com. This backbone extension (built with Chinese firms and World Bank support) was aimed at bringing broadband to Gabon’s interior. Additionally, a domestic submarine cable was deployed linking Libreville to Port-Gentil under the ocean, improving reliability between the two key cities 3 .

- Submarine Cables and International Bandwidth: Gabon is connected to multiple high-capacity submarine fiber optic cables, ensuring it has ample international bandwidth. Since 2002, Gabon Telecom has been on the SAT-3/WASC cable (with a landing in Libreville) datacenterdynamics.com. In 2012, the newer Africa Coast to Europe (ACE) cable landed, quadrupling Gabon’s bandwidth at the time oxfordbusinessgroup.com. Indeed, ACE’s arrival dropped internet prices roughly tenfold from 2010 to 2018 (from ~CFA 10,000 to 1,500 per month for basic access) worldbank.org worldbank.org and spurred a sevenfold increase in subscribers worldbank.org worldbank.org. More recently, Gabon has joined the massive 2Africa cable (backed by Meta/Facebook), which also lands in Libreville datacenterdynamics.com. And in March 2025 it was announced that Medusa, a new trans-African subsea cable, will land in Port-Gentil, with local operator ACE Gabon as the landing partner datacenterdynamics.com datacenterdynamics.com. Medusa will bring an additional 400 Tbps of capacity to Gabon and include a branch to the Republic of Congo datacenterdynamics.com. In short, Gabon enjoys multiple submarine links (ACE, SAT-3, 2Africa, etc.) which provide resiliency and competitive wholesale pricing. This is a major advantage over some neighbors with only one cable. (One lesson was learned in 2015 when sabotage of an undersea cable caused a multi-day internet blackout in Gabon subtelforum.com. With more cables online now, such single-points of failure are mitigated.)

- Fiber to the Home (FTTH): The entry of CanalBox (GVA) in 2017 revolutionized consumer internet. Using aerial fiber on utility poles, GVA rapidly connected tens of thousands of households in Libreville developingtelecoms.com. They offer flat-rate packages (e.g. ~50 Mbps unlimited for around 25,000 FCFA, according to local reports) – a game-changer for families that relied on slow ADSL or expensive cellular data. By 2021, GVA’s network passed 130k homes in Libreville and was still expanding developingtelecoms.com. They turned Libreville into one of the best-connected capitals in the region. In 2022–2023, GVA extended FTTH to Port-Gentil and hinted at deployments in other cities developingtelecoms.com. This competitive pressure has pushed the incumbent to respond: Gabon Telecom (Moov) has reportedly partnered with government infrastructure companies to deploy some FTTx (fiber) connections for businesses and high-end users. Now, with Airtel’s new license (2025), a third player will join the fiber race techpression.com techpression.com. The government has explicitly welcomed this, noting that Airtel’s fiber build-out is key to “reliable, high-speed internet… for a data-driven future.” techpression.com techpression.com Airtel’s license even allows microwave backhaul to reach remote areas where fiber isn’t feasible, so they can deliver fixed wireless broadband to villages off the fiber grid 4 .

The fixed broadband subscriber base, while smaller than mobile, is climbing steadily. Official data show Gabon had only ~10,700 fixed internet subscribers in 2014 oxfordbusinessgroup.com, but by 2022 this was estimated around 80,000+ cia.gov and growing. The trend is toward higher-speed plans – many urban households now opt for a home Wi-Fi via fiber or cable modem as usage of video streaming, teleworking, and e-services grows.

Satellite Internet: Starlink and Other Options

Given Gabon’s dense forests and some communities in hard-to-reach areas, satellite internet has long been an important solution for connectivity – and it’s on the cusp of a new era with low-earth orbit (LEO) systems:

- Traditional VSAT: Several Gabonese ISPs built their backbone on satellite links in the past. For example, IG Telecom (Internet Gabon) became the leading VSAT operator in West/Central Africa with over 500 sites installed ir.echostar.com. Companies like IG Telecom and others (Solsi, IBN Corp, etc.) used VSAT and WiMAX to serve clients when terrestrial bandwidth was scarce oxfordbusinessgroup.com oxfordbusinessgroup.com. Even the mobile operators relied on satellite backhaul for remote cell towers. While VSAT offers coverage anywhere (important for oil operations in the interior and remote villages), it traditionally suffered from high latency ( ~600 ms) and high costs for limited bandwidth. To improve performance, IG Telecom partnered with O3b Networks (now SES Networks) in 2014 to utilize Medium Earth Orbit satellites, which cut latency significantly oxfordbusinessgroup.com oxfordbusinessgroup.com. O3b’s MEO constellation orbits closer to Earth, providing fiber-like latency (~150 ms) and decent throughput. This partnership allowed IG Telecom to extend service to areas with previously nonexistent or poor connectivity, using O3b capacity to deliver faster links oxfordbusinessgroup.com. VSAT services remain available in Gabon through various integrators (Belgium’s GlobalTT, BusinessCom, etc.) for businesses, NGOs, and government offices that need reliable links beyond the reach of fiber.

- Eutelsat Konnect and GEO broadband: In recent years, Eutelsat’s Konnect satellite has been providing high-speed GEO satellite broadband across Sub-Saharan Africa. With downlink speeds up to 50–100 Mbps advertised africa.konnect.com, Konnect targets rural consumers and SMEs. In Gabon, Konnect services are accessible via local distributors – a user can install a 75 cm dish and subscribe to packages (often with data caps) for home internet. While Konnect’s pricing is meant to be “affordable” relative to legacy VSAT, it is still considered premium, and uptake in Gabon has been limited to those who truly lack alternatives (remote lodges, mining camps, etc.). The latency remains high (~600 ms) since it’s geostationary, but for basic use it’s manageable. As of 2023, Eutelsat reported connecting hundreds of thousands of African users via Konnect satellitetoday.com connectingafrica.com, some of whom would be in countries like Gabon.

- Starlink (SpaceX): The biggest buzz in 2024–2025 is around Starlink, Elon Musk’s LEO satellite network. Starlink is not yet live in Gabon as of mid-2025, but its arrival is imminent. SpaceX has been rapidly expanding Starlink in Africa – by May 2024 it was live in 8 countries and planned to be in ~15 more by end of 2024 blog.telegeography.com blog.telegeography.com. Gabon is on the roadmap for launch in 2025 extensia.tech. In fact, Starlink (through Airtel Africa as a partner) has applied for an operating license in Gabon and is awaiting approval developingtelecoms.com developingtelecoms.com. Once licensed, Starlink will offer Gabonese consumers and businesses a new option: high-speed (50–150 Mbps) internet with low latency (~20–40 ms) via a satellite dish, anywhere in the country. This could be transformative for rural areas that might never get fiber or even decent 4G. For example, Starlink can connect a village deep in the rainforest or serve as backup for critical infrastructure. However, cost may be a barrier. Starlink’s standard kit in Africa currently runs between $300 to $700 for hardware, and monthly subscriptions range from about $25 to $50 depending on the country blog.telegeography.com techcabal.com. (In Nigeria, after a recent price cut, the service is about $25/month and ~$290 for the dish blog.telegeography.com, whereas in Benin it’s around $50/month and $650 for equipment techcabal.com.) In Gabon – which has a relatively high GDP per capita by African standards – there will be a niche of affluent users, businesses, and government agencies ready to pay for Starlink’s performance, especially in locales with poor terrestrial coverage. The government itself might leverage Starlink to connect schools or clinics in remote zones, as Rwanda did. By 2025, we expect to see the first Starlink kits in Gabon (possibly used in pilot projects or by savvy consumers obtaining them from neighboring countries). Notably, Airtel’s partnership with Starlink means that once legal clearance is obtained, Airtel could resell Starlink connections bundled with its services developingtelecoms.com developingtelecoms.com – this might make Starlink more accessible, and even allow mobile towers to use Starlink for backhaul in isolated regions 5 .

In summary, satellite internet in Gabon is evolving from a last-resort technology to a dynamic component of the connectivity mix. Legacy VSAT ensures every corner (from Mayumba to Mekambo) can get at least some connection, and upcoming LEO constellations promise to raise the quality of that connection dramatically. Gabon’s small population spread over a sizable terrain makes satellites an attractive complement to ground networks, aligning well with the country’s digital inclusion goals.

Infrastructure Developments and Government Digital Policy

The Gabonese government has been proactive in developing ICT infrastructure and policies, recognizing connectivity as critical for economic diversification. Key initiatives and developments include:

- National Digital Strategy: The government formulated a strategic plan in the 2010s (often referred to under the “Gabon Digital” or “Plan Gabon Émergent” umbrella) aiming to make Gabon a regional ICT hub. A digital strategic plan (2012–2025) guided investments in fiber optics, e-government, and regulatory reform worldbank.org worldbank.org. As noted by the World Bank, Gabon’s efforts saw it rise 10 places on the ITU’s ICT Development Index by 2017, making it the 6th best-connected country in Africa at that time worldbank.org. The country leveraged public-private partnerships to finance infrastructure, such as the PPP that built the Libreville fiber landing station and terrestrial network, later managed by Axione/Bouygues under a concession oxfordbusinessgroup.com 6 .

- Regulatory Reforms: The telecom regulator ARCEP has enforced measures to promote competition and quality. For instance, in 2012 Gabon ended Gabon Telecom’s monopoly on international bandwidth, allowing all operators open access to the SAT-3 and ACE cables oxfordbusinessgroup.com oxfordbusinessgroup.com. It also facilitated new entrants like GVA. Licenses for mobile operators were renewed (Moov and Airtel both got 10-year renewals around 2021) with obligations to invest in coverage globenewswire.com globenewswire.com. ARCEP monitors QoS and has called out operators for coverage gaps and quality issues, pushing them to improve gabonmediatime.com. Additionally, Gabon has been a participant in regional initiatives like “free roaming” – in 2021 it struck an agreement with Congo-Brazzaville to eliminate mobile roaming charges between the two countries’ networks globenewswire.com, making cross-border communications cheaper.

- Universal Service and Rural Coverage: As discussed, the Universal Service Fund has been actively used to extend network reach. The recent Phase 2 rural coverage program (2024) was personally ordered to relaunch by the new transition President (Gen. Brice Oligui Nguema) after the 2023 political changes techpoint.africa. This underscores a continued government commitment to “digital inclusion” so that rural communities are not left offline. By subsidizing rural towers and possibly satellite links, the state is addressing the urban-rural digital divide (see next section).

- E-Government and Digital Services: The state has pursued an ambitious e-government agenda, led by the National Agency for Digital Infrastructure (ANINF). Projects under “Gabon Online” aimed to connect all government offices via a private network (RAG – Réseau Administration Gabonaise) using a mix of fiber, satellite, and radio links oxfordbusinessgroup.com oxfordbusinessgroup.com. By 2015, dozens of government sites were linked by fiber in Libreville and provincial capitals oxfordbusinessgroup.com. Initiatives have provided every civil servant with an email, digitized tax payments (an e-tax system launched in 2013), and planned services like e-visas for tourism oxfordbusinessgroup.com oxfordbusinessgroup.com. There’s also emphasis on ICT in education (digital classrooms, student ID systems) and health (electronic health records at local clinics), all of which depend on robust internet access oxfordbusinessgroup.com oxfordbusinessgroup.com. The World Bank’s “Digital Gabon” project approved in January 2024 (with a $68.5 million loan) is supporting many of these efforts – its goals are to “accelerate the adoption of digital public services” and increase the number of citizens with a digital ID for accessing services techpoint.africa. In essence, the government views connectivity as the backbone of a modern economy, and is aligning policy and funding accordingly.

- Data Centers and Local Content: As part of the digital economy push, Gabon is also investing in data infrastructure. In 2023, plans for a national data center were announced (e.g., by a firm called ST Digital) to host government and private data domestically powersofafrica.com. This goes hand in hand with developing local apps and content – a trend noted by industry observers: local digital services and content providers in Gabon have started to “take off,” offering platforms tailored to Gabonese users oxfordbusinessgroup.com. The government has promoted tech parks (like the proposed Mandji Island Cyber City in Port-Gentil’s special economic zone and similar IT parks in other cities) to attract ICT companies with tax incentives oxfordbusinessgroup.com oxfordbusinessgroup.com. These policies aim to turn Gabon from primarily a consumer of foreign internet content into a producer of digital services in Central Africa.

Overall, Gabon’s government has played a hands-on, enabling role in telecom development: from co-financing backbone infrastructure to adopting progressive regulations and investing in digital literacy. This holistic approach is a key reason Gabon leads its region in internet indicators.

Challenges and Barriers to Widespread Adoption

Despite the progress, Gabon faces several challenges in achieving truly ubiquitous, affordable internet access:

- High Costs for Users: Internet access, especially high-speed access, remains expensive for many Gabonese. Although prices dropped dramatically over the past decade (10× cheaper than 2010 in USD terms) worldbank.org worldbank.org, they are still high relative to average incomes outside the wealthy urban elite. Mobile data prices were significant enough that in early 2023 the government froze a proposed 50% tariff hike by operators, amid public outcry. A standard 4G data plan can consume a sizable share of a low-income user’s budget. The cost of devices is another issue – smartphones are common in Gabon, but the latest models (especially 5G-capable phones) are beyond reach for many. As noted in a study in Kenya (comparable market), 94% of people use phones under $200 qz.com; Gabon likely has a slightly higher smartphone penetration given higher GDP, but cost is still a limiting factor for device upgrades. For satellite services, the cost barrier is even steeper: a Starlink setup at ~$600 is unaffordable to the average household. Thus, affordability remains a top barrier to widespread adoption, even if coverage is available.

- Urban-Rural Digital Divide: There is a stark contrast between connected urbanites and underserved rural communities. With over 90% urban population datareportal.com, Gabon’s rural minority is small in number but geographically dispersed. Many villages deep inland struggle with limited electricity, which in turn hampers telecom expansion (tower equipment and user devices need reliable power). While the universal service projects are targeting these gaps, the last few percent of population are always the hardest to reach. Even where mobile coverage exists in rural areas, the quality might be poor (2G only, or congestion) and data plans may be too costly for subsistence farmers. Additionally, digital literacy is lower outside cities; people who have never used the internet will not immediately subscribe even if coverage arrives. The government and operators will need complementary programs (device subsidies, digital training, local content in vernacular languages) to drive adoption in rural zones.

- Quality of Service and Reliability: Users in Gabon sometimes experience network quality issues – dropped calls, slow speeds at peak times, etc. ARCEP has flagged that operators have not fully met their coverage and quality obligations in all areas gabonmediatime.com. The reasons range from under-investment to technical challenges (e.g., heavy rain fading wireless signals, or power outages affecting network uptime). Gabon’s equatorial climate and terrain can be tough on infrastructure. Furthermore, while multiple submarine cables provide resilience, outages still occur. For example, in August 2023 during a tense election period, the government ordered an internet shutdown for security reasons netblocks.org – this deliberate interruption (and a curfew) was ostensibly to prevent the spread of misinformation or violence france24.com. Such shutdowns (Gabon also cut internet during post-election unrest in 2016) erode user trust and highlight vulnerability of access to political decisions. Though not a technical barrier, political instability can thus pose a barrier to continuous internet availability. On the technical side, Gabon must maintain backup routes and disaster recovery plans – the 2015 sabotage of the SAT-3 cable showed that without redundancy, the country could be “offline” for days subtelforum.com. Today, redundancy is much improved, but operators still need to invest in network hardening (backup power for cell sites, redundant fiber paths domestically, etc.).

- Human Capacity and Local Ecosystem: Another challenge noted in the ICT sector is the shortage of skilled human resources oxfordbusinessgroup.com oxfordbusinessgroup.com. There are few training programs in-country for telecom engineers, network administrators, and IT entrepreneurs. As a result, companies either recruit expatriates or have to train local staff from the ground up oxfordbusinessgroup.com oxfordbusinessgroup.com. This talent gap can slow the deployment and maintenance of advanced internet services. The government, along with private sector and partners like UNESCO, has started initiatives to train young people in ICT (e.g., Airtel’s program to train 5,000 youth in tech skills) oxfordbusinessgroup.com. Overcoming this skills barrier is key to sustaining the internet ecosystem – not just for running networks but also for creating local online content and services that make the internet relevant to Gabonese users.

- Comparative High Pricing for Satellite and Fiber: While competition has increased, certain segments like satellite broadband or dedicated enterprise fiber lines remain costly due to limited providers. For instance, prior to Starlink’s entry, a business-grade VSAT link in Gabon could cost hundreds of dollars per month for a few Mbps. Similarly, corporate fiber leased lines from Gabon Telecom or GVA might be expensive for startups. Ensuring price competition in all market segments is an ongoing challenge. The regulator’s decision to license a second fixed network (Airtel) techpression.com is meant to address this by undercutting the incumbent’s fiber prices, but results will unfold in coming years.

In summary, the barriers in Gabon are less about coverage (which is steadily improving) and more about affordability, equality, and consistency of service. Targeted policies like device subsidies, rural telecom funds, and continuous regulatory oversight on pricing will be needed to surmount these hurdles and truly democratize internet access across all of Gabon’s society.

Urban vs. Rural: Regional Disparities Within Gabon

Gabon’s internet landscape has a pronounced urban-rural divide, though the country’s high urbanization tempers this to a degree. As noted, over 91% of Gabonese live in urban areas datareportal.com – primarily Greater Libreville (which includes nearly half the population), Port-Gentil, Franceville, Oyem, Moanda, etc. These cities and towns enjoy far better connectivity than the remote villages scattered in the rainforest.

- Urban Areas: Libreville, the capital, is by far the best-connected city. It has extensive 4G coverage by both Moov and Airtel, fiber-to-the-home networks (CanalBox covering most neighborhoods), numerous Wi-Fi hotspots, and plenty of internet cafes or businesses using broadband. The median user in Libreville likely has daily access to social media, streaming, and cloud services. Port-Gentil, as an oil industry hub, also has robust connectivity – 4G coverage and now fiber service since 2022 developingtelecoms.com. Secondary cities like Franceville, Oyem, Lambaréné have decent 3G/4G coverage and possibly fixed wireless or fiber links to major institutions (e.g., universities, government offices). Urban users benefit from competition (Airtel vs Moov) and generally more stable electricity supply for telecom infrastructure.

- Rural Areas: In stark contrast, many rural villages until recently had zero telecom service. The government identified 2,700 villages for connectivity upgrades in 2017 telecompaper.com – these are typically small settlements far from the existing fiber backbone or main roads. By 2023, about 1,253 villages still lacked any mobile signal techpoint.africa. This means roughly tens of thousands of mostly rural residents could not use a phone or internet locally. Those who needed connectivity might have had to travel to the nearest town or climb hills to catch a faint signal. With the ongoing universal service projects, the gap is slowly closing – e.g., the 33 villages covered in phase 1 (2016–18) and 200 villages planned in phase 2 (2024) techpoint.africa techpoint.africa. Typically, when a village gets covered, it’s via a 2G/3G solar-powered tower that gives basic voice and data (sometimes only 2G EDGE or 3G). So, while they come online, rural users will likely have lower speeds (a few hundred kbps to a couple Mbps) and less reliable service than urban 4G or fiber users. Also, rural communities face challenges like device cost (fewer can afford smartphones) and digital literacy (the population might not be as aware of internet benefits).

- Services and Content Disparity: Urban Gabonese can access advanced services – e-government portals, mobile banking, e-commerce – whereas rural folks may not have these available or even know about them. The government’s push for things like online schooling and telemedicine will depend on extending real broadband to rural clinics and schools. Until then, the disparity remains: a student in Libreville can watch online lectures over fiber, but a student in a village in Ogooué-Ivindo province might have no internet at school at all. Bridging this divide is a clear priority in national plans; projects like Digital Classroom (50 classrooms in Libreville with ICT equipment) oxfordbusinessgroup.com need replication in the provinces.

It’s worth noting that Gabon’s rural population is relatively small (perhaps ~200k people total, given 8.6% of 2.6 million datareportal.com). This means the country could feasibly achieve near-universal internet coverage by focusing efforts on those remaining pockets. The combination of new rural mobile towers, satellite connectivity (Starlink’s arrival could instantly connect a village that even a tower can’t reach economically), and community Wi-Fi could eliminate the digital divide in the coming years. The political will is there – the current leadership has explicitly linked digital inclusion with national development and even security.

Gabon vs. Neighboring Countries: A Regional Comparison

Within Central Africa, Gabon is a leader in internet access, outperforming most of its neighbors on key metrics:

- Internet Penetration: Gabon’s ~72% internet user rate datareportal.com far exceeds that of Cameroon (~42%), Republic of Congo (~36% estimated), and DR Congo (~27%) datareportal.com. Even Equatorial Guinea, another oil-rich small country, has around 60-67% penetration tradingeconomics.com – still a bit lower than Gabon. The only African countries ahead of Gabon are typically the island states or South Africa, Mauritius, Seychelles, etc., and some North African countries. In West/Central Africa, Gabon is among the top in connectivity. The ITU in 2017 ranked Gabon 6th in Africa on overall ICT development, behind only Mauritius, Seychelles, South Africa, Cape Verde, and Botswana 7 .

- Mobile and Broadband Services: Compared to neighbors:

- Cameroon – has more providers (4 mobile operators) but also a much larger, mostly rural population. Its 4G rollout has been slow outside major cities and internet is concentrated in Douala/Yaoundé. By numbers, Cameroon has ~12 million internet users datareportal.com, but due to population size its percentage lags Gabon. Fixed broadband in Cameroon is limited (mainly DSL in cities and a bit of fiber by Camtel); Gabon’s fiber coverage in Libreville is arguably more extensive proportionally.

- Republic of the Congo (Congo-Brazzaville) – similar population size (~5 million) but lower penetration. Congo has two main operators (MTN and Airtel) and only introduced 4G in late 2010s. Internet penetration was reportedly around one-third of the population as of mid-2020s. Brazzaville and Pointe-Noire have some fiber (e.g., MTN fiber), but rural northern Congo is mostly offline. Gabon’s dense coastal network and smaller geography give it an edge. Interestingly, Gabon and RoC have collaborated (free roaming, interconnecting fiber) globenewswire.com, which could help both.

- Equatorial Guinea – a very wealthy (per capita) but tiny population country. Equatorial Guinea has made strides, reaching ~60% internet penetration ts2.tech, and it benefits from substantial government investment. However, its absolute number of users (~0.9 million) datareportal.com is half of Gabon’s, and prices there have historically been extremely high (a legacy of monopoly). Gabon’s market competition likely offers more affordable options than Equatorial Guinea, where the state operator dominates. Both have similar challenges of reaching scattered rural communities on difficult terrain.

- Others – Central African Republic is far behind (less than 15% internet use, war-torn infrastructure). Cameroon, Congo, DRC all have lower 4G coverage percentages than Gabon, and none have a live consumer FTTH offer comparable to CanalBox Gabon (except perhaps Cameroon’s fledgling Camtel fiber in a few neighborhoods). In terms of satellite, Nigeria was the first in Africa to get Starlink (2023) blog.telegeography.com, and countries like Rwanda, Kenya, Nigeria have jumped on that trend earlier. But in Gabon’s immediate vicinity, no country had Starlink as of mid-2024, except maybe Zambia (further south) and Rwanda. So when Gabon launches Starlink (expected 2025 extensia.tech), it will be among the first in Central Africa (earlier than Cameroon or DRC).

- Infrastructure & Policy: Gabon also stands out for its foresight in infrastructure. It connected to ACE early, has multiple subsea cables whereas for example Cameroon only recently got ACE in addition to older SAT-3 and the new SAIL. Gabon’s internal fiber backbone is part of the Central African Backbone that connects into Cameroon and Congo – regional integration that will benefit all three. The removal of roaming fees between Gabon and Congo in 2021 was a pioneering move in Central Africa (similar free roaming zones exist in West Africa, but Central was lagging) globenewswire.com. This indicates Gabon’s readiness to cooperate for regional digital markets.

In short, Gabon compares very favorably to its neighbors, with higher internet penetration, better average speeds, and more advanced services available. Its only peer in the immediate region in terms of connectivity might be Equatorial Guinea due to similar economics, but Gabon’s market is more open. The country is often cited as a model for ICT development in the CEMAC (Central African Economic and Monetary Community) zone worldbank.org. That said, countries like Kenya, Nigeria, South Africa (outside the region) still surpass Gabon in absolute tech ecosystem scale and service diversity. So, Gabon will want to continue advancing to remain a continental leader.

Conclusion and Outlook

Gabon’s internet access landscape in 2025 is one of impressive progress with clear momentum for further improvement. The nation has leveraged its oil wealth and strategic vision to build a solid digital infrastructure: undersea cables linking it to the world, a growing fiber optic network crisscrossing the country, and nearly universal mobile coverage. A combination of fiber broadband in cities and expanding 4G mobile has pushed internet penetration to roughly three-quarters of the population – making Gabon a leader in Central Africa for connectivity. Key providers like Moov and Airtel continue to invest, while newcomers like GVA (CanalBox) have spurred faster speeds and competitive prices in fixed broadband.

Crucially, Gabon is poised to benefit from the next generation of satellite internet. With Starlink’s arrival in 2025 and partnerships like Airtel–SpaceX developingtelecoms.com, even the most isolated communities could soon have high-speed internet, a development that would have been hard to imagine a few years ago. Other satellite offerings (Eutelsat Konnect, O3b) further enrich the mix, ensuring redundancy and coverage where terrestrial networks are impractical.

Government policy remains a strong driving force – from universal service funds for rural towers to digital government services and training programs, the state clearly understands that bridging any digital divide is essential for inclusive development. One can expect continued public-private projects to connect the remaining unconnected villages (via 4G or satellite) and to keep internet tariffs in check so more Gabonese can come online.

Challenges do persist: internet access, especially at higher speeds, must become more affordable to low-income users; the quality and consistency of service should improve as networks modernize; and the urban-rural gap needs ongoing attention until every village is on the grid. The events of 2023 – an election-related internet shutdown netblocks.org and political transition – underline the importance of maintaining an open and reliable internet for all, even during crises. The new authorities in Gabon have signaled commitment to digital inclusion, which bodes well for the sector’s stability and growth.

In comparison with regional peers, Gabon is well ahead and can serve as a case study of how targeted investments and smart regulations can yield a thriving internet ecosystem in Africa. By 2025 and beyond, as 5G potentially launches and Starlink lights up across Gabon’s rainforests, the country could genuinely achieve near-universal connectivity – empowering its people with information access, fostering innovation, and diversifying the economy beyond oil. The trajectory is positive: Gabon is steadily transforming its internet access from elite privilege to a mainstream utility available to virtually all its citizens, whether via fiber in Libreville or a satellite dish in a remote village. The digital future of Gabon looks bright, and the ongoing efforts ensure that no Gabonese is left offline in the years to come.

Sources: Gabon Digital Report 2025 datareportal.com datareportal.com; Oxford Business Group oxfordbusinessgroup.com oxfordbusinessgroup.com; ARCEP/Techpoint Africa techpoint.africa techpoint.africa; BuddeComm/GlobeNewswire globenewswire.com globenewswire.com; Developing Telecoms techpression.com techpression.com; DataCenter Dynamics datacenterdynamics.com datacenterdynamics.com; Extensia Tech extensia.tech; TechCabal techcabal.com; TeleGeography blog.telegeography.com; Quartz Africa qz.com; Internet Society/NetBlocks 8 .