- AI chips market to skyrocket: The global AI chip market is set to explode from tens of billions today to well over $400 billion by 2030, driving overall semiconductor sales toward a projected $1 trillion boom idtechex.com 1 .

- U.S. leads in design, China plays catch-up: American firms like NVIDIA and AMD dominate in cutting-edge AI processor design – NVIDIA alone logged about $80 billion in data center GPU sales in 2024 idtechex.com – while China’s tech giants (Huawei, Alibaba, Baidu) and startups (Cambricon, Biren, etc.) rush to develop domestic chips amid import bans 2 .

- Taiwan’s outsized role: Taiwan manufactures around 90% of the world’s most advanced chips (at “sub-10nm” sizes) reuters.com. The island’s flagship foundry TSMC is the primary maker of high-end AI chips for firms globally, making Taiwan a critical – and vulnerable – hub in the supply chain idtechex.com 3 .

- Surging demand across industries: AI chips power everything from data centers (training generative AI like ChatGPT) to consumer gadgets (smartphones with AI features), autonomous cars and robots, and even tiny edge devices like smart cameras. Data centers are the largest driver – growing 8× from 2018 to 2024 techinsights.com – but edge and automotive uses are rising fast.

- Supply chain and geopolitics intertwined: The U.S. has imposed strict export controls to cap China’s access to advanced AI chips and chipmaking tools idtechex.com, while investing billions (the CHIPS Act) in new fabs at home. China, in turn, is pouring state funds (over $100 billion) into its semiconductor sector reuters.com and even restricting exports of critical raw materials. These moves come as both superpowers seek tech independence – and as Taiwan’s semiconductor “silicon shield” becomes ever more strategically important.

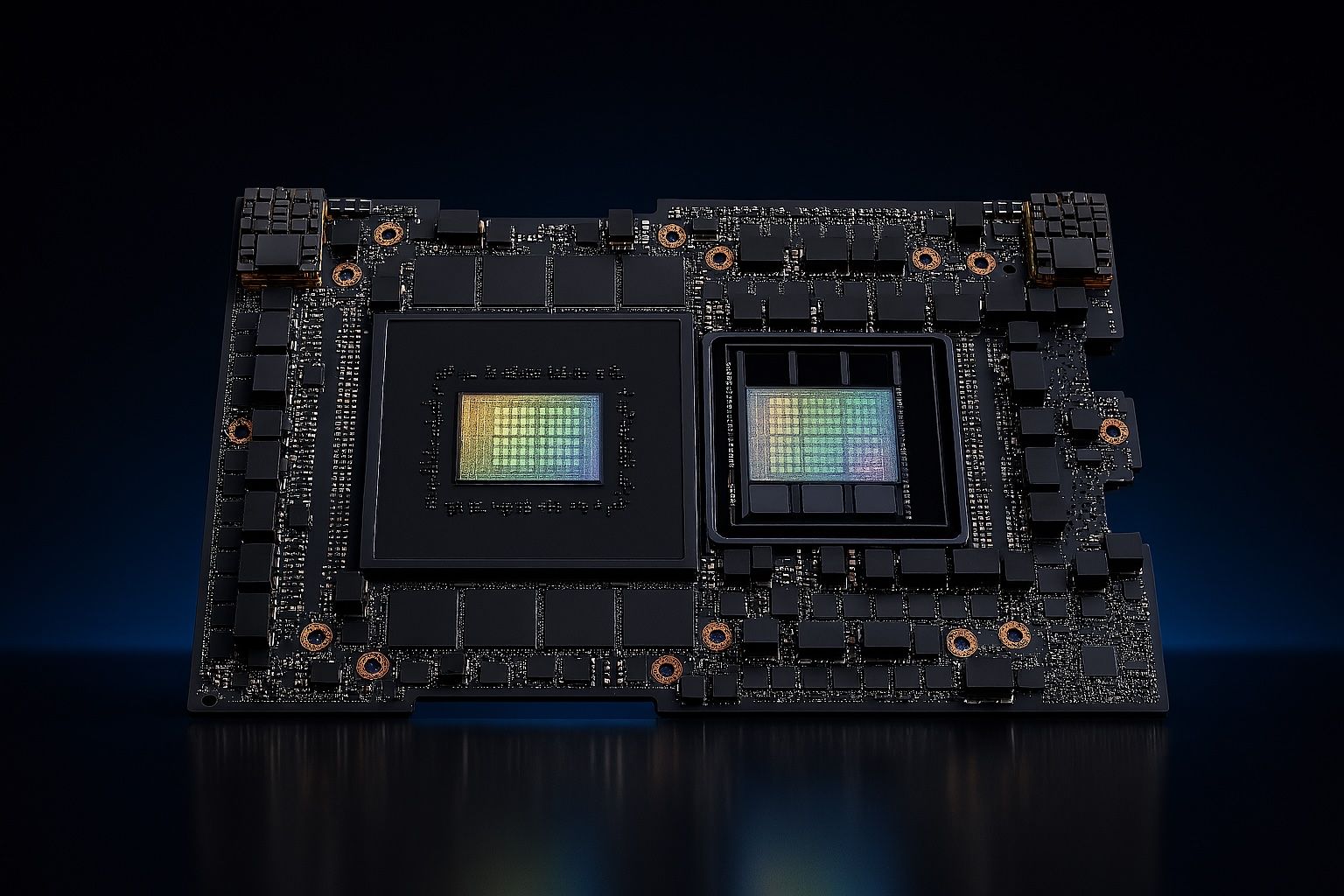

- Technological leaps on the horizon: Generative AI’s computing needs are breaking records, forcing new solutions like chiplet architectures (smaller chip modules tiled together) and 3D stacking for better performance. 100% of cutting-edge AI chips now use multi-die (chiplet) designs to pack more power and memory bandwidth semiengineering.com. Industry leaders predict unprecedented demand – AMD’s CEO Lisa Su projects the AI chip market could top $500 billion within a few years foxbusiness.com – as AI becomes ubiquitous from cloud to edge.

Introduction

The race for dominance in AI chips – the specialized processors that power artificial intelligence – has become a core battleground in technology and geopolitics. In 2025, the United States, China, and Taiwan stand as key players, each with a different role: the U.S. is home to the leading chip designers, China is a massive and ambitious consumer and emerging producer, and Taiwan is the manufacturing epicenter. AI chips are not only critical for flashy applications like generative AI (think ChatGPT or image generators) but also for a wave of smart devices and autonomous machines. As a result, nations are treating semiconductor leadership as a strategic priority akin to an arms race. The global AI chip market is already enormous and growing exponentially – valued around $50–$60 billion in the mid-2020s and projected to climb to several hundred billion by 2030 idtechex.com nextmsc.com. This report dives into the current landscape and future outlook of the AI chip market in the U.S., China, and Taiwan, covering market size, key companies, use cases, supply chains, government policies, tech trends, and the geopolitical forces at play.

Market Size and Growth Through 2030

The market for AI chips – which include graphics processing units (GPUs), specialized accelerators, and AI-enabled system-on-chips – is on a steep upward trajectory. Today’s AI chip market is already significant, with estimates around $53 billion in 2024】 nextmsc.com. Thanks to surging demand, various forecasts see explosive growth through the decade:

- Hundreds of Billions by 2030: Market analyses predict the AI chip sector will reach anywhere from about $300 billion nextmsc.com to $450+ billion idtechex.com in annual revenues by 2030. This implies a compound annual growth rate on the order of 14–33%, vastly outpacing broader tech industry growth.

- Driving a $1 Trillion Chip Industry: To put this in perspective, analysts at major industry gatherings have declared that AI is the “main driver” propelling the entire semiconductor industry toward $1 trillion in global sales by 2030 ainvest.com. In other words, AI chips could account for nearly half of all chip revenues by the end of the decade, a stunning share for what was a niche category just a few years ago.

This growth is fueled by an AI boom that shows no sign of abating. Ever-larger AI models and wider adoption of AI in products are demanding more silicon. It’s estimated that compute requirements for cutting-edge AI (measured in operations per second) have been rising by over 4× per year – far beyond the pace of Moore’s Law – as companies train massive models like OpenAI’s GPT-4 and beyond idtechex.com. The result: data center operators and cloud providers are buying AI accelerators as fast as firms can produce them, and new applications for AI chips are emerging constantly in other industries.

However, not all segments of AI chips are equal. The lion’s share of current revenue comes from data center AI processors, which have recently exploded in demand. In fact, data center AI chip spending grew from just $1.6 billion in 2018 to around $138 billion in 2024 – an 8× increase in six years techinsights.com. This hockey-stick growth has been a boon to companies like Nvidia (whose high-end GPUs are the workhorses of AI computing) and to cloud computing giants. By contrast, the “edge” AI chip market – chips in smartphones and IoT devices – was larger than data center AI until 2022 but has since plateaued techinsights.com. Early on, billions of mobile devices each year, each with built-in AI coprocessors (NPUs for things like face recognition or photo enhancement), drove volume. Now, that segment’s growth has leveled off, even as server-side AI surges ahead. The expectation is that new use cases (augmented reality glasses, smart appliances, etc.) could re-ignite edge AI growth, but the real gold rush through 2030 is clearly in cloud and enterprise AI infrastructure.

Put simply, all projections agree on one thing: the AI chip market is poised for extraordinary expansion through 2030, with the U.S., China, and Taiwan each playing pivotal roles in this story.

Key Players by Country

AI chips are produced and used via a complex global network, but certain companies and countries stand out. Here’s a look at the key players in the United States, China, and Taiwan:

United States: Chip Design Powerhouse

The United States is home to many of the world’s top semiconductor designers and technology firms, especially in AI chips:

- NVIDIA: Arguably the flagship of AI chip companies, California-based NVIDIA has become synonymous with AI accelerators. Its GPUs (originally made for graphics) became the default hardware for training AI models in the 2010s. NVIDIA now dominates the high-end AI processor market, with its A100 and H100 data center GPUs in extreme demand worldwide. In 2024, NVIDIA’s data center division (largely AI chips) reportedly pulled in over $80 billion in revenue amid the generative AI boom idtechex.com. This dominance has made NVIDIA one of the most valuable tech companies and given the U.S. a commanding lead in AI chip IP.

- AMD (Advanced Micro Devices): Another American fabless chip designer, AMD has risen as a key competitor to NVIDIA in both GPUs and custom AI accelerators. Led by CEO Lisa Su, AMD has been investing heavily in AI chips (like its MI300 series accelerators) and claims some performance wins. Su has very high expectations for the field, noting that global demand for AI chips could exceed $500 billion within a few years foxbusiness.com. AMD’s strategy combines high-performance CPUs and GPUs, and it has even acquired adaptive chip maker Xilinx to bolster its AI offerings.

- Intel: Long the giant of PC CPUs, Intel was slower to capitalize on the AI trend but is still a major U.S. player. It produces AI-capable processors and acquired Habana Labs for dedicated AI accelerators, while also pushing into GPU territory. Intel is notable for its integrated approach – it both designs chips and operates some of its own fabs – and it has signaled AI as a priority in its turnaround plan.

- Big Tech’s In-House Chips: U.S. cloud titans like Google, Amazon, and Microsoft are also key players via custom chips. Google’s Tensor Processing Units (TPUs) are specialized AI chips used in Google’s own data centers to train models like Bard and AlphaGo. Amazon Web Services designs chips such as Inferentia and Trainium for AI inference and training in its cloud. These efforts underscore that much of AI chip demand is driven by hyperscalers (who sometimes make their own silicon if off-the-shelf options don’t perfectly suit their needs).

- Startups and Others: The U.S. has a vibrant ecosystem of AI chip startups – e.g., Cerebras Systems (known for a wafer-sized AI engine), Graphcore (originally UK but with U.S. presence, focused on AI accelerators), SambaNova, Groq, and more – often backed by big-name investors. While these companies are smaller, they contribute innovation in architectures and keep pressure on the incumbents. The U.S. is also strong in supporting tech like EDA software (Synopsys, Cadence) and chip equipment crucial for making AI chips.

In summary, America’s strength lies in innovation and design. U.S. companies account for roughly half of global semiconductor revenue reuters.com, thanks to leadership in R&D and chip architecture. However, most of these firms rely on overseas partners (like Taiwan’s TSMC) to manufacture their cutting-edge designs – a fact that has Washington strategists increasingly uneasy.

China: Rising Demand and Homegrown Challengers

China is the world’s largest market for semiconductors, buying over 60% of the world’s chips for its electronics industry reuters.com. Yet it produces only a fraction of those domestically, especially at the high end. In AI chips, China’s situation is a mix of dependency and ambitious drive for self-reliance:

- Heavyweights (Huawei & Alibaba): Chinese tech giants have moved into designing their own AI chips to reduce reliance on foreign tech. Huawei, in particular, has developed the Ascend series AI accelerators for data centers and its Kirin chips for smartphones (with AI coprocessors). Despite U.S. sanctions cutting off its access to leading-edge manufacturing, Huawei stunned observers by releasing new chips (e.g., a 7nm phone SoC in 2023) fabricated domestically – a sign of determination to advance. Alibaba has a semiconductor unit (T-Head), which designed the Hanguang 800 AI inference chip and others aimed at cloud and edge computing. These companies leverage their massive domestic cloud and device businesses to test and deploy homegrown silicon.

- AI Chip Startups: A wave of Chinese startups has sprung up, often with government support, to build AI chips. Cambricon Technologies is a notable example – originally supplying neural network coprocessors for Huawei phones, it now produces AI accelerator chips for servers and has IPO’d in China. Biren Technology designed high-end GPUs claimed to rival NVIDIA’s (though faced setbacks due to export controls on manufacturing). Horizon Robotics focuses on automotive AI chips, powering smart driver-assistance systems in cars. Moore Threads is another startup developing GPUs, and Tencent and Baidu have also backed semiconductor projects (Baidu’s Kunlun AI chips are already used in its data centers idtechex.com). The list goes on, illustrating a broad-based push for indigenous innovation.

- Manufacturing and Foundries: China’s greatest weakness in AI chips is manufacturing at the cutting edge. Its top chip foundry, SMIC (Semiconductor Manufacturing International Corp.), is years behind TSMC – currently able to mass-produce at perhaps 14nm and working on nodes like 7nm with limited yield reuters.com. U.S. export bans on extreme ultraviolet (EUV) lithography machines mean SMIC cannot easily advance to the 5nm and 3nm processes needed for top-tier AI chips reuters.com. That said, China does have sizable capacity at older nodes and is the world leader in assembly and packaging of chips. Companies like FX Technology, Tongfu Microelectronics, and others handle chip packaging/testing, and memory makers YMTC (flash) and CXMT (DRAM) aim to support a domestic supply chain idtechex.com. China is trying to build a fully “closed loop” supply chain – from equipment to chips – but it faces steep challenges in tooling and talent reuters.com 4 .

- Market Size and Players: Despite domestic efforts, China today still depends heavily on foreign AI chips, especially from NVIDIA. Chinese firms are some of NVIDIA’s largest customers – so much so that the U.S. government now restricts NVIDIA from selling its top AI GPUs (like the A100/H100) to Chinese buyers without a license idtechex.com. In response, NVIDIA has created slightly neutered models (H800, etc.) for China, but even those have come under tighter bans idtechex.com. This has spurred Chinese buyers to stockpile chips via alternate routes and fueled the sense of urgency for local substitutes. The Chinese government has also invested in “national champion” chip companies (through its Big Fund and other programs) to foster domestic alternatives at all levels of the stack.

In short, China sees mastering AI chips as essential for its future economy and security, and it’s investing massively. A decade ago, China had virtually no presence in this domain; by 2030, it aims to be a major player. The country’s tech companies are increasingly capable chip designers, but U.S. sanctions and technology gaps still constrain their ability to achieve parity at the cutting edge. The next few years will test whether China’s “great semiconductor leap forward” reuters.com can succeed or if reliance on imports will persist.

Taiwan: The Manufacturing Linchpin

Taiwan may not have the household-name brands that consumers recognize, but it is a superstar in the chip world because of one company: TSMC (Taiwan Semiconductor Manufacturing Company). TSMC is a foundry, meaning it manufactures chips that others design, and it has no peer when it comes to making the most advanced chips at scale. For AI chips and many other semiconductors, Taiwan is truly the linchpin of global production:

- TSMC’s Dominance: As of mid-decade, over 90% of the world’s most advanced chip manufacturing capacity (at process nodes under 10nm) is located in Taiwan (TSMC alone) reuters.com. South Korea’s Samsung holds most of the remaining single-digit percentage. This means that virtually every cutting-edge AI chip – whether designed by Apple, NVIDIA, AMD, or a Chinese startup – likely relies on a Taiwanese fab to be produced. TSMC’s ability to execute bleeding-edge processes (5nm, 3nm, and in development 2nm) years ahead of most competitors has made it the go-to manufacturer for high-performance chips. AI accelerators, which need the densest, most power-efficient transistors, are fabbed at TSMC in huge volumes. The company’s importance is hard to overstate: It earned a place among the top 10 most valuable corporations in the world reuters.com, and its annual capital investment (over $30 billion in 2023) even dwarfs Taiwan’s military budget 5 .

- Other Taiwanese Players: While TSMC is the giant, Taiwan has a whole ecosystem of semiconductor firms. MediaTek, for instance, is a leading fabless chip designer known for mobile system-on-chips and 5G modems (it often ranks #2 globally in fabless revenue, after Qualcomm). MediaTek is incorporating more AI features into phone chips, keeping Taiwanese design in the game. UMC (United Microelectronics Corp.) is another Taiwanese foundry (focused on mid-tier process nodes). Companies like ASE Technology are world leaders in chip packaging and testing. Dozens of smaller IP design houses and materials suppliers on the island contribute to the supply chain. This dense cluster of expertise has been dubbed a “silicon shield” for Taiwan – a term reflecting the hope that the island’s crucial role in tech will deter aggression by China.

- Strategic Restraints: Taiwan’s government has long guarded its semiconductor crown jewels. For example, it has forbidden TSMC and others from building their most advanced fabs in China (TSMC operates some older-generation fabs in China, but nothing cutting-edge) reuters.com. This policy, in place since the late 1990s, aims to prevent critical technology from being offshored or potentially seized. It has helped ensure that if you want the best chips, you must come to Taiwan – a strategic leverage point. At the same time, Taiwan is cautious not to appear monopolistic or irreplaceable; TSMC has begun investing in overseas sites (a notable new fab in Arizona, and others in Japan and Europe are planned) in part due to customer and political pressure to diversify manufacturing locations.

- Taiwan’s Role in AI: Virtually every key player’s AI chips rely on Taiwan. NVIDIA’s GPUs, Apple’s Neural Engine chips, Amazon’s Inferentia, even Huawei’s Kirin chips (until sanctions) have been produced at TSMC. Taiwanese firms don’t necessarily design these marquee AI processors (they leave that to clients), but without TSMC’s fabrication prowess, the AI revolution would sputter. It’s telling that experts warn a disruption of Taiwan’s chip industry – say, from a conflict – would “bring the international electronics supply chain to a halt” and be a “devastating blow” to economies and even military capabilities reuters.com reuters.com. This global reliance on Taiwan gives the tiny democracy outsized strategic importance.

In essence, Taiwan is the workshop where the world’s silicon dreams (including AI) become reality. Morris Chang, TSMC’s founder, famously likened Taiwan’s semiconductor sector to a “holy mountain range protecting the country” reuters.com. It not only underpins Taiwan’s economy but also acts as a geopolitical buffer, since so many nations (the U.S. included) need access to its output. Taiwan’s continued leadership in manufacturing will be critical through 2030, although the rest of the world is now racing to augment capacity elsewhere for redundancy.

Use Cases: From Data Centers to Devices

AI chips have a wide array of applications. Here are the major use cases driving demand, each with distinct requirements:

- Data Center & Cloud Computing: This is the primary engine of AI chip growth. Advanced GPUs and AI accelerators are deployed by the thousands in data centers to train and run AI models for cloud services. Examples include training large language models (for chatbots, translation, search), image and video analysis at scale, and providing AI-as-a-service APIs. These chips are designed for maximum throughput – doing parallel computations on massive datasets. They tend to be expensive (a single top-tier AI GPU can cost tens of thousands of dollars) and power-hungry, but one server outfitted with them can replace dozens of traditional servers for AI tasks. Companies like Google (TPU pods) and Meta build entire AI supercomputers with such hardware. As generative AI adoption grows in enterprise and consumer services, cloud providers are scrambling to expand AI capacity.

- Consumer Electronics: AI capabilities are now standard in many gadgets. Smartphones use on-chip AI (NPUs or “Neural Engines”) for features like camera enhancements, voice assistants, and augmented reality. Chips like Apple’s A-series or Huawei’s Kirin have dedicated AI modules. Smart home devices (speakers, thermostats, TVs) also include AI inferencing chips to enable voice recognition and personalization. While these consumer AI chips may not be as beefy as data center GPUs, their sheer volume (hundreds of millions of units a year) makes this an important segment. Moreover, as privacy and latency concerns grow, there’s a trend toward more on-device AI processing – e.g. your phone recognizing speech or faces without sending data to the cloud, which necessitates efficient edge AI chips.

- Automotive (Self-Driving & ADAS): Modern vehicles, especially high-end cars, are becoming “computers on wheels.” AI chips are critical for autonomous driving systems and advanced driver-assistance systems (ADAS) that handle tasks like collision avoidance, lane-keeping, and smart cruise control. Companies like Tesla have developed custom self-driving chips for their cars, while NVIDIA offers its Drive series AI platforms to automakers, and Qualcomm’s Snapdragon Ride and others compete in this space. Chinese firms too (e.g. Huawei and Horizon Robotics) are vying to supply the brains of smart cars. These automotive AI chips process camera feeds, radar/lidar data, and other sensors in real-time to make split-second decisions. They must be extremely reliable and energy-efficient (to fit in a car’s power and thermal constraints) while delivering supercomputer-like performance – a challenging balance. As the industry moves toward higher levels of autonomy, the silicon content in each car is rising dramatically, making automotive a huge potential market for AI chips by 2030.

- Robotics & Drones: From warehouse robots to delivery drones to industrial automation arms, robots are increasingly using AI to navigate and perform tasks autonomously. Many robots use compact AI accelerators (like NVIDIA’s Jetson platform or Google’s Coral chips) for vision recognition, movement planning, and learning on the fly. The robotics sector values chips that can handle AI workloads efficiently on the edge, sometimes in rugged conditions. As robotics deployment grows – in logistics, manufacturing, healthcare (e.g. AI-driven surgery assistants) – so will the demand for capable edge AI processors that give these machines smarts without relying on constant cloud connectivity.

- Edge Computing & IoT: Beyond the above, a broad category of edge AI devices is emerging. This includes things like smart security cameras that do on-site facial recognition, sensors in retail stores that track inventory with AI, or wearable devices that monitor health signals using AI algorithms. The edge AI chip market covers any scenario where data is processed locally using AI rather than sent to a distant server. The challenge at the edge is to deliver adequate AI performance within very tight power/size budgets (sometimes running on battery or harvesting energy). Specialized low-power AI chips and accelerators (many based on novel architectures or neuromorphic concepts) are being developed for this arena. While each device is cheap, collectively the edge could see billions of AI-enabled endpoints, making it a volume driver. However, as noted earlier, growth here has been a bit slower recently compared to the heady pace of cloud AI adoption techinsights.com. The next wave of edge AI could be spurred by applications like smart cities, Internet of Things analytics, and 5G/6G network devices with built-in AI for managing traffic.

In summary, data center AI chips are the blockbuster segment today (thanks to the AI training boom), but AI is proliferating everywhere – so over time, more and more devices around us will contain some form of AI silicon. Each use case (big server versus tiny sensor) might use different chip designs, but they all contribute to the overall growth of the AI chip market. Importantly, leadership in one use (say, cloud) doesn’t automatically guarantee leadership in another (like mobile) – which is why we see a variety of players tailoring products to each niche.

Supply Chain Dynamics and Manufacturing

The journey of an AI chip from concept to customer spans a remarkably global and complex supply chain. Understanding who does what – and where – is key to grasping the U.S.-China-Taiwan dynamic:

- Design vs. Manufacturing Split: Many leading U.S. and Chinese companies in AI chips are fabless – they design the chip’s circuitry and architecture, but outsource the physical fabrication to contract manufacturers (foundries). For instance, NVIDIA designs its chips in Silicon Valley, but the silicon wafers are etched in Taiwan (TSMC) or sometimes Korea (Samsung). This specialization lets each party focus on what it does best, but also means no single country owns the whole pipeline.

- Taiwan’s Foundries: As discussed, Taiwan (TSMC) is currently indispensable for high-end manufacturing. It has a reputation for exceptional precision and an ability to implement cutting-edge lithography at scale earlier than others. Another Taiwanese firm, UMC, handles a lot of mid-range chip production. Because of this, Taiwan has deep relationships with U.S. chip designers – Apple, Nvidia, AMD, and Qualcomm are all major TSMC clients – and increasingly with some Chinese firms (though the most advanced tech is off-limits to Chinese customers due to both Taiwan’s own rules and U.S. pressure 6 ).

- South Korea’s Role: Though our focus is the U.S., China, and Taiwan, it’s worth noting South Korea as a significant piece of the supply chain jigsaw. Samsung operates advanced foundries (it both designs and builds chips, including its own AI-oriented chips and contract manufacturing for others). More so, Korea (Samsung and SK Hynix) is a leader in memory chips, particularly the High-Bandwidth Memory (HBM) that is crucial for AI accelerators. In fact, nearly all top AI chips use HBM stacks to feed data quickly, and those memory stacks come mainly from SK Hynix, Samsung, or the U.S.’s Micron idtechex.com. So, an AI hardware system might involve: an Nvidia GPU (US design) made by TSMC (Taiwan) with Hynix HBM (Korea), assembled on a board in China or Mexico – truly global.

- United States Manufacturing: The U.S. still has notable chip fabs (Intel in Oregon/Arizona, GlobalFoundries in New York, some Texas Instruments and Micron facilities, etc.), but very few produce leading-edge chips needed for the newest AI processors. Intel is aiming to catch up and even become a foundry for others, but its current tech lags TSMC by a couple of years. This is why the U.S. government, alarmed by dependency on Asia, is investing heavily to boost domestic fab capacity (more on policy in the next section). Companies like TSMC and Samsung are building new fabs in the U.S. (Arizona and Texas, respectively), though even those initially will not match the absolute bleeding edge in Taiwan/Korea due to costs and time lags.

- China’s Manufacturing Push: China has built a lot of chip fabrication plants (“fabs”) in recent years, but mostly for older generations of chips or specialized niches (like power electronics). It does have a few fabs attempting 14nm, 7nm processes (SMIC’s Beijing and Shanghai facilities, using some creative workarounds to lack of EUV). There are also memory fabs (like YMTC for NAND flash) – however, U.S. sanctions in 2022-2023 cut off those fabs from the top equipment, stunting their progress idtechex.com idtechex.com. Notably, equipment is a choke point: the machines that etch and pattern silicon wafers are dominated by a few countries (ASML in Netherlands for lithography idtechex.com, Applied Materials and Lam Research in the US, Tokyo Electron in Japan, etc.). The U.S. has successfully pushed these suppliers to stop selling cutting-edge tools to China, which makes it nearly impossible for Chinese fabs to advance beyond a certain point for now. That’s why we see China investing in older nodes and trying to develop homegrown tools, but that could take years or decades to catch up.

- Supply Chain Vulnerabilities: The concentration of key stages in particular countries means there are inherent vulnerabilities. For example, 100% of the most advanced (sub-10nm) chip production is done in East Asia – mainly Taiwan, with some in South Korea reuters.com. The U.S. and Europe produce 0% of these cutting-edge chips domestically today. Conversely, China is over 90% import-dependent for high-end chips reuters.com, making it vulnerable to export bans. The COVID-19 pandemic and chip shortage of 2020-2021 was a wake-up call about how a disruption in one link (e.g., a factory shutdown or logistics issue) can ripple worldwide. A much-feared scenario is that a Taiwan Strait crisis could cut off the supply of advanced chips overnight – an event that, according to one analysis, would literally halt global electronics production within weeks reuters.com.

- Resilience Measures: In response, there’s a strong trend toward “re-shoring” or “friend-shoring” chip production. The U.S., Europe, Japan, and India are all offering incentives to build fabs on their soil to decentralize the supply chain. Companies are also stockpiling inventory of critical chips and diversifying supplier bases where possible. But building new fabs is slow and costly – a state-of-the-art fab can cost $10–20 billion and take years to become operational. So, in the near term, the existing hubs (Taiwan, South Korea, some U.S.) remain vital.

In summary, the supply chain for AI chips is a highly interdependent web. The U.S. and Taiwan (and to a degree South Korea) currently form the backbone of cutting-edge production – the U.S. contributing design, equipment, and materials; Taiwan/Korea contributing manufacturing prowess. China, despite strides, is still largely a consumer and minor producer in this space, trying to move up the value chain. This interdependence has big implications for policy and geopolitics, as we’ll explore next.

Government Policies, Export Restrictions, and Subsidies

Governments have stepped to center stage in the AI chip saga, wielding policies to boost their own industries or hobble rivals. The U.S., China, and Taiwan each have taken notable measures:

- United States – The CHIPS Act and Export Controls: U.S. policymakers view semiconductor leadership as a national security imperative. In 2022, the U.S. passed the CHIPS and Science Act, dedicating approximately $52 billion in subsidies to encourage chip manufacturing and R&D in America. This is leading to new fab projects and expansions by TSMC, Samsung, Intel, and others on U.S. soil (though it will be a few years before those come online). In parallel, the U.S. has aggressively used export controls to maintain its edge. In October 2022, the Biden administration imposed sweeping rules to bar the export of top-tier AI chips to China and restrict Chinese companies from using advanced U.S. chipmaking tools idtechex.com. These rules were tightened further in 2023, closing loopholes, and expanded to include more equipment and even certain less-advanced chips idtechex.com. Essentially, any processor above a certain performance threshold or any tool needed to make chips around 14nm or better is now off-limits to China without a license. Most recently (as of late 2024 and into 2025), specific new chips like NVIDIA’s H100 or AMD’s MI300 were explicitly targeted for restriction idtechex.com. The U.S. is also reportedly considering limiting investments that U.S. firms can make in Chinese chip startups, to prevent capital and expertise from aiding China’s semiconductor progress.

- China – Big Funding and Self-Reliance Drive: China’s government has a well-publicized goal to dramatically increase self-sufficiency in semiconductors (often quoted as achieving 70% self-sufficiency by 2025, though analysts doubt that timeline). It has deployed massive funds and policies toward this end:

- The National Integrated Circuit Investment Fund (nicknamed the “Big Fund”) has poured tens of billions into domestic chip companies over the past decade.

- More recently, Chinese central and local governments have offered tax breaks, cheap loans, and other incentives to support fab construction, chip design startups, and talent recruitment. According to a U.S. government review, Beijing was directing $100 billion in subsidies to its chip industry, financing the construction of some 60 new fabs (though not all were successful) 7 .

- China’s 14th Five-Year Plan and other strategy documents put AI and chips at the forefront, calling for “technology self-reliance.” When the U.S. hit Huawei and others with sanctions, China responded by doubling down on indigenous tech, often under slogans of a “new Long March” for technology.

- On the flipside of export controls, China has begun leveraging its own control over critical materials. In mid-2023, China announced export restrictions on certain raw minerals like gallium and germanium (which are used in chipmaking and defense tech), in a move seen as retaliation or a warning shot in the tech trade war.

- Despite the big spending, China has encountered setbacks – reports of failed projects and corruption investigations in its chip programs suggest money alone isn’t a silver bullet. Still, China’s policy clearly is to throw everything at the wall to see what sticks, be it supporting multiple companies working on GPUs or even exploring older chip tech to circumvent Western chokepoints.

- Taiwan – Protect and Expand: Taiwan’s approach has been about ensuring its primacy and security. The government and industry in Taiwan have a close partnership: policies support the education and retention of tens of thousands of skilled engineers that TSMC and others need, and there are concerted efforts to maintain TSMC’s tech leadership through R&D incentives. Taiwan also coordinates with the U.S. and others on export control compliance (for example, TSMC immediately stopped servicing Huawei when U.S. rules changed in 2020, despite the loss of a major customer csis.org). At the same time, Taiwan lobbies for its companies to be treated fairly and not overtaken by political decisions – for instance, it warily participates in U.S.-led initiatives to diversify production, as long as that doesn’t erode its own industry. Taiwan’s leaders frequently emphasize that any instability or disruption to its chip industry would harm the entire world, a not-so-subtle message discouraging conflict.

- Geopolitical Alliances: The U.S. has been building coalitions to isolate China in chip tech. It formed an informal alliance sometimes dubbed the “Chip 4” (U.S., Taiwan, South Korea, Japan) to coordinate on supply chain security. The Netherlands and Japan agreed in 2023 to align with U.S. export curbs on chip equipment to China. On China’s side, there’s talk of partnering with countries like Russia, or doubling down on trade with friendly nations to get around restrictions (for example, using third-party distributors in Southeast Asia – something the U.S. is watching and looking to clamp down on idtechex.com). This all shows how semiconductors are deeply geopolitical now; summits and trade talks routinely feature chip policy as a top agenda item.

One striking aspect of this policy battle is how it’s often framed as part of a larger US–China strategic competition. American officials openly state that cutting-edge chips have military significance (for things like AI in weapons or code-breaking), and thus China must be prevented from obtaining them idtechex.com. Chinese officials, in turn, accuse the U.S. of trying to hold back China’s development unfairly and vow to innovate their way around it. Meanwhile, other regions (Europe, India) are also pursuing their own chip incentive programs to not be left behind, though with smaller budgets than the U.S. or China.

In short, government interventions – whether money or export bans – are drastically reshaping where and how AI chips are made. For businesses, this creates both opportunities (new grants, new factories) and risks (sudden loss of market access, need to redesign products). The next five years will likely see even more policy moves: perhaps tighter U.S. rules, Chinese counter-measures, and certainly lots of public investment in semiconductor capabilities worldwide.

Technological Trends Shaping the Future

The AI chip sector is fast-evolving not just in size, but in technology. Several key trends are influencing the design and performance of next-generation chips:

- Generative AI & Super-sized Models: The rise of generative AI models (which create text, images, etc.) has been a game-changer. Training these models (like GPT-4, Google’s PaLM, or Meta’s Llama) requires staggering computational power – far beyond what typical CPUs can handle. For instance, one analysis noted that a state-of-the-art model with hundreds of billions of parameters might require thousands of top GPUs running for weeks to train idtechex.com. This has pushed chip designers to optimize for AI throughput: we see chips with greater numbers of processing cores, higher memory bandwidth, and faster interconnects to link multiple chips together. It’s also driven interest in AI-specific architectures (like Tensor Cores in NVIDIA GPUs or novel AI accelerators that skip graphics functions entirely). The need to serve these models to users (inference) also means new chips are being tailored for efficient inference – doing AI tasks with lower latency and power, which benefits things like AI assistants and real-time services.

- Chiplet and 3D Architectures: As mentioned, chiplet architecture is a major trend. Instead of one giant monolithic chip, designers are now breaking chips into multiple smaller “chiplets” and packaging them together on an interposer or substrate. This helps in several ways: smaller chiplets have better manufacturing yields and can mix-and-match different technologies (one chiplet for compute, another for I/O or memory). AMD has been a pioneer with its multi-chip module approach in CPUs and is applying similar ideas to GPUs. NVIDIA’s latest AI chips also use modular designs with high-speed links. Experts predict essentially all high-performance AI chips are now multi-die – it’s become “essential for future generations of semiconductors” as one Synopsys executive noted semiengineering.com. Additionally, 3D stacking (placing chips on top of each other) is emerging. For example, memory can be stacked atop logic to shorten distances, or even logic-on-logic stacking for ultimate density. While still early, by 2030 3D integrated AI chips could provide huge boosts in speed. All of this represents a shift in chip engineering: the package is the new “chip,” and advanced packaging technology (an area where Taiwan excels) is a crucial part of the innovation.

- Energy Efficiency and Specialized AI Cores: There’s a saying that “AI is basically matrix math.” Many AI computations boil down to linear algebra operations (like multiplying huge matrices of numbers). Chip designers are exploiting this by creating specialized units (tensor cores, neural engines, etc.) that perform AI math far more efficiently than general-purpose circuits. This is why an NVIDIA H100 massively outperforms a normal CPU in AI tasks while using less power for the same task – it’s purpose-built for the job. We’re also seeing more focus on lower precision computing (using 8-bit or 4-bit numbers instead of 32-bit) since AI algorithms can often tolerate it, thus boosting speed and cutting power. The overall trend is that future chips, whether in your phone or in a data center, will devote more silicon real estate to AI and accelerate those specific workloads. This is true even in consumer chips – e.g., Apple’s latest mobile processors have ever larger neural engine blocks to handle things like on-device ML.

- Edge AI and TinyML: At the opposite end of giant cloud chips, there’s innovation in ultra-low-power AI processing. TinyML refers to running machine learning on microcontrollers – think AI on a device running off a coin cell battery. New chips and neural network techniques are enabling simple voice or vision recognition at milliwatt power levels. While these aren’t about raw performance, they broaden the scope of where AI chips are used (e.g., smart sensors in remote areas). Companies and research groups are developing architectures optimized for this “small” AI, which could become a significant niche by 2030 as IoT expands.

- Competition of Architectures (GPUs vs ASICs vs FPGAs): Today’s AI landscape is dominated by GPUs (with some exceptions like Google’s TPUs). But there’s ongoing debate about the best architecture for AI. Some believe domain-specific ASICs (Application Specific Integrated Circuits) will eventually outperform GPUs for both training and inference because they can eliminate all unnecessary circuitry and be tailored to neural network operations. Companies like Cerebras (with its wafer-scale engine) or SambaNova are exploring unique form factors. FPGAs (field-programmable gate arrays), which can be reconfigured on the fly, have fans for certain AI uses where flexibility is key (Intel and Xilinx, now part of AMD, both advocate for FPGA usage in AI). We may end up with a heterogeneous mix – GPUs continuing to evolve, but augmented in many systems by specialized chips for particular tasks (e.g., a system might use a GPU + an ASIC that speeds up transformer model calculations, etc.). The common theme is intense experimentation to squeeze out more performance per watt for AI workloads.

- Integration of AI and Other Functions: Another trend is combining AI processing with other functions on the same chip. For instance, some network equipment now comes with built-in AI accelerators to do real-time analytics on data streams (so-called “smartNICs” or DPU – data processing units). Or memory manufacturers are looking at adding compute into memory chips (processing-in-memory) to handle AI tasks more efficiently where the data resides. This blurring of boundaries – computing happening in what used to be just pipes or storage – is driven by AI needs.

All these technical currents point to a future where AI capabilities are ubiquitous and drive the cutting edge of semiconductor development. Indeed, the pursuit of ever-better AI performance is a big reason behind the push for new manufacturing processes (3nm, 2nm) and new materials – AI can readily use any extra speed or efficiency the chip industry can deliver. This virtuous cycle (AI needs -> chip innovation -> enables more AI) suggests that as long as our appetite for smarter software grows, the AI chip sector will remain on the forefront of tech.

AI Chips vs. the Broader Semiconductor Market

It’s worth contextualizing the AI chip boom within the overall semiconductor and computer hardware market:

- Portion of the Pie: As of mid-2020s, AI-dedicated chips are still a subset of the roughly $500–600 billion global semiconductor market (which includes everything from PC CPUs to smartphone modems to memory chips). But it’s one of the fastest-growing subsets. Industry projections that semiconductor revenues will top $1 trillion by 2030 ainvest.com largely credit AI and high-performance computing as the catalysts. In other words, without the AI surge, the chip industry might be growing at a more modest pace in line with historical norms or GDP. AI is injecting a new S-curve of demand.

- GPU Market Transformation: GPUs were once thought to be a relatively niche market tied to PC gaming and graphics. AI turned them into strategic assets. NVIDIA’s market capitalization soared above the likes of Intel’s precisely because investors see AI as the new center of gravity. Competing GPU vendors (AMD, and newcomers like Intel’s Arc GPUs) are all repositioning to capture AI workloads as much as graphics workloads. Meanwhile, the traditional CPU market (PCs, servers) had stagnated or declined in recent years (PC sales slowed, Moore’s Law deceleration, etc.), so the broader processor industry is looking to AI for growth. The fact that data center spending is shifting towards GPUs/accelerators and away from just increasing CPU counts is a profound shift in IT architecture – sometimes dubbed the era of “accelerated computing.”

- Memory and Storage: AI’s growth benefits these sectors too. Training AI models is data-intensive, so sales of high-end memory (HBM, DDR5) and faster storage (SSDs) have gotten a boost from AI data centers. Some analysts predict AI workloads will eventually drive a significant share of all memory demand. So the ripple effects of AI chips extend throughout the supply chain.

- Legacy Semiconductors: Not all semiconductors are hot growth areas – for instance, chips for appliances or older tech might grow slowly. But interestingly, even mature segments can find new life with AI. An example: analog chip makers (for sensors, power management, etc.) now market their products as “enabling AI at the edge” by providing the interface between the physical world and digital AI systems (think image sensors for vision AI, or specialized ADCs for voice AI). It shows how AI’s popularity is influencing the narrative and strategy across the industry.

- Competition and Collaboration: The broader semi industry has giants like Intel, Samsung, TSMC that are not going to cede ground easily. We see collaborations such as Intel partnering with companies like ASUS to package AI accelerators with its CPUs, or Nvidia partnering with fabs and systems integrators to lock in its supply and distribution. The lines between what is an “AI chip company” and a “regular chip company” are blurring – everyone is adding AI features. Even companies known for other products (like smartphone chip maker Qualcomm or FPGA maker Xilinx) have sizable AI R&D and market their chips for AI use cases (Qualcomm touts AI on phones, Xilinx FPGAs are used in AI inferencing systems, etc.).

- Market Volatility: One should note the semiconductor market is historically cyclical – periods of shortage and boom followed by possible gluts. There are questions about whether the AI chip frenzy could overbuild capacity or hype (a concern about an “AI bubble”). Some experts, however, believe that while there may be short-term corrections, the long-term trend line for AI-driven demand is robust and secular (not a fad) foxbusiness.com. The reasoning is that we’re just scratching the surface of what AI will do in industries like healthcare, finance, manufacturing, etc., so the 2023 AI craze (largely focused on chatbots) is likely just the first chapter.

In summary, AI chips are not an isolated phenomenon; they’re now a major pillar of the semiconductor industry’s future. This has realigned company strategies (e.g., traditional chip firms pivoting to AI) and even boosted the fortunes of countries that bet early on AI hardware (like how Taiwan’s TSMC, by serving Nvidia/AMD, became even more indispensable). It also means that trends affecting semiconductors at large – such as supply chain localization, talent shortages, and R&D costs – will shape AI chips too. The two can’t be decoupled.

Expert Commentary and Industry Perspectives

Voices from industry leaders and experts highlight just how significant the AI chip race has become:

- “Insane Demand” – Jensen Huang, NVIDIA CEO: Nvidia’s chief Jensen Huang has described the scramble for AI hardware in striking terms. In mid-2023, as his company’s valuation soared, Huang remarked that demand for Nvidia’s AI chips is “insane.” Customers worldwide were clamoring for more GPUs to train AI models, to the point that supply was short and “product shortages [were] making customers emotional,” he noted half-jokingly investopedia.com. This captures the almost gold-rush atmosphere in the current AI market – whoever can supply the shovels (chips) is in a fortunate position.

- Lisa Su on a Lasting Opportunity: AMD’s CEO Lisa Su has pushed back on the notion that the AI surge might be a short-lived bubble. Having met with government officials about strategy, she asserted, “America leads in AI today, and we need to run fast and even faster” to maintain that lead foxbusiness.com. Su emphasizes partnerships – with cloud firms, with government – to scale up. Her bold prediction that AI silicon could be a $500+ billion market in a few years foxbusiness.com reflects a belief that we are at the start of a multi-year, transformational trend. In other interviews, she’s pointed out that innovation in software (like new AI algorithms) will continuously open new needs for hardware, keeping demand strong.

- Morris Chang’s Caution and Pride: TSMC founder Morris Chang, often called the godfather of semiconductors, has spoken about U.S.-China tensions and Taiwan’s role. He humbly but pointedly noted that “global collaboration is vital for semiconductor success” reuters.com, alluding to how TSMC’s rise was aided by international cooperation – and how decoupling could hurt everyone. At the same time, Chang is proud of Taiwan’s achievement: likening TSMC to a “holy mountain range” protecting Taiwan reuters.com implies that having the world’s best chip industry has given Taiwan a strategic shield. His words resonate in Taiwan, where engineers are seen as quietly defending the nation by excelling in their work.

- Analysts on China’s Hurdles: Industry analysts from firms like TechInsights or the Semiconductor Industry Association often comment on China’s uphill battle. One common sentiment: “Money can buy you a lot in semiconductors, but it can’t instantly buy you innovation or experience.” The complexity of making advanced chips – “the most complex manufacturing process in human history,” as it’s been called reuters.com – means there are no quick shortcuts. Chinese companies face a steep learning curve and talent constraints, despite generous funding. Experts also note, however, that necessity can breed innovation – and Chinese engineers, now cut off from some Western tech, might find novel solutions or shift toward other paradigms (for example, focusing on chip designs that maximize older manufacturing nodes that they can produce).

- U.S. Officials on Security: American officials have been unusually candid about why they care about semiconductor dominance. A Pentagon representative told Congress in late 2021 that Taiwan’s chips were a key reason U.S. must defend Taiwan’s security reuters.com – because if China controlled TSMC, it would “gain the upper hand in every domain of warfare” by denying the U.S. cutting-edge chips reuters.com. Such statements underscore that AI chips aren’t just about tech industry profits; they’re seen as foundational to future military and economic power. This thinking is bipartisan in Washington, with commissions and think tanks frequently issuing reports urging more action to boost U.S. chip capacity and restrict adversaries.

- Chinese Perspective: While Chinese officials are more guarded publicly, one can glean perspective from state media and company communications. The message is often one of defiance and determination: despite “blockade” by the U.S., China will build its own “core technologies.” When Huawei launched its new smartphone chip in 2023, Chinese media hailed it as a breakthrough that showed U.S. sanctions couldn’t stop China’s progress bloomberg.com. At tech conferences in China, CEOs speak about balancing cooperation and self-reliance – they still want access to global markets and tools, but also vow not to be “strangled” by relying on others. This narrative is partly nationalistic rallying, but also reflects real initiatives at all levels of China’s tech ecosystem to close the gaps.

Across these perspectives, a common thread is the high stakes involved. People speak about AI chips with a sense of history – like it’s the space race of our time. There is excitement about innovation’s promise (curing diseases with AI, enabling new conveniences) but also a sober recognition that who leads in AI tech could shift global balances of power. It’s rare for a tech sector to be under such spotlight from CEOs, presidents, and generals alike, which shows how central AI chips have become.

Geopolitical Influences and Taiwan’s Strategic Role

We’ve touched on geopolitics throughout, but let’s draw together the threads of how US-China rivalry and Taiwan factor into the AI chip story:

US vs. China – The “Chip War”: Observers often describe the escalating competition as a “chip war” between the U.S. and China. Unlike a traditional war, this conflict is fought with export permits, blacklists, and investment dollars. AI chips are one of the most contested prizes because of their dual civilian-military use and economic importance. The U.S. aims to maintain a 2–3 generation technology lead over China in semiconductors, especially those used for AI and high-performance computing idtechex.com. By cutting off China’s access to top chips and equipment, the U.S. hopes to slow China’s advancement in AI-related fields (including potential military AI applications). China, on the other hand, feels it must develop an indigenous capability not just for pride but to ensure its tech economy isn’t crippled by foreign sanctions. This dynamic creates a feedback loop: more U.S. restrictions -> more Chinese resolve to be independent -> more U.S. concern and potentially more restrictions, and so on.

Taiwan – The Strategic Linchpin: Taiwan lies literally and figuratively between the U.S. and China. It’s geographically close to China (which views Taiwan as a breakaway province to be unified one day), yet Taiwan’s chip industry is closely entwined with U.S. and global companies. This has made Taiwan a focal point. On one hand, Taiwan’s chip capacity is a strategic asset for the U.S. – as noted, American military and economy rely on TSMC’s output, and thus the U.S. has a strong interest in Taiwan’s security and stability reuters.com reuters.com. On the other hand, if China were to control Taiwan, it would essentially control the world’s silicon faucet at the advanced end, which is an alarming prospect for the U.S. (and others). This has injected semiconductors into the debate about how far the U.S. would go to defend Taiwan in a crisis. Some call Taiwan’s chip industry a “silicon shield,” suggesting China would hesitate to damage it (for example, in an invasion scenario, the fabs could be destroyed or their personnel flee, denying China the prize it wants to capture). However, others argue that such interdependence may not ultimately prevent conflict if political and nationalistic motivations take over reuters.com. It’s a tense calculus.

Recent Developments: Tensions flared in 2022–2023 with high-profile visits, military drills near Taiwan, and explicit linkage of chips to security. Taiwan’s semiconductor executives have been meeting leaders in Washington, emphasizing that any conflict would ravage the global economy due to chip supply disruption – a message aimed at dissuading misadventures. Meanwhile, China has been trying to reduce reliance on TSMC by shifting some orders to SMIC or others, but the gap is huge. The U.S. has been bringing TSMC closer, encouraging its Arizona fab investment and integrating Taiwan into its “friend-shoring” network. This triangulation – U.S. and Taiwan closer on chips, China feeling squeezed – is a delicate balance.

Global Implications: Other countries are watching the US-China chip duel warily. Allies like South Korea and Japan have aligned somewhat with U.S. policies but worry about their own industries if China retaliates (South Korea, for instance, sells a lot of memory chips to China and has fabs there). Europe wants advanced fabs (e.g., Intel is building in Germany) and doesn’t want all chips coming from Asia either. So, a subtle reshaping of the global chip supply chain is under way: not exactly a total decoupling, but a shift toward a bifurcated system where China might have to rely on its own ecosystem for certain tech and the U.S.-led bloc relies on a separate one. AI chips could end up being a sector where tech standards and products diverge – Chinese cloud AI built on Chinese accelerators, Western cloud AI on Nvidia/AMD, etc. This scenario is still unfolding, and China remains behind for now. But by 2030 it’s conceivable we see two parallel AI chip supply chains if the political rift continues.

Taiwan’s Strategy: For Taiwan, the best scenario is to remain indispensable and peaceful. It continues to invest in next-gen tech (like 2nm and even research into beyond-silicon tech) to maintain its edge. It also is careful not to provoke China unnecessarily in the tech realm – for example, though TSMC complying with U.S. sanctions angered Beijing, Taiwan balanced that by not publicizing it too loudly, and still allowing some business with Chinese firms on legacy nodes. Taiwan also quietly boosts ties with other partners (like supplying chips to India’s space program or Europe’s auto industry) to broaden international support. It is a high-wire act: staying at the forefront of innovation (so everyone needs you) while navigating superpower rivalry.

In conclusion, geopolitics hangs like a cloud over the AI chip industry, with risk and opportunity. If cooperation prevails, all sides could benefit from the efficiency of trade and specialization (as they did in the past). If confrontation increases, we could see fractured markets and a slower pace of advancement due to duplicated efforts and restricted knowledge flow. For now, companies and governments are hedging – hoping for the best (market access) but preparing for the worst (self-reliance). And in the eye of this storm sits Taiwan, a democratic island of 23 million people that, by historical and technological twists, manufactures the chips that run the world’s AI. Its fate and the fate of the AI revolution are, to a degree, intertwined.

Conclusion

The next decade will be pivotal for the AI chips market, especially in how the U.S., China, and Taiwan navigate their interdependencies and rivalries. What’s clear is that AI chips are not just another tech product – they are the foundation of our digital future, enabling everything from smarter phones to autonomous cars to breakthrough scientific research. The U.S. enters this future with a strong lead in innovation and design, China brings massive scale and determination to catch up, and Taiwan provides the indispensable manufacturing muscle that keeps the whole engine running.

For the general public, the outcomes of this “AI chip race” will be felt in very real ways: faster and more capable gadgets, more responsive online services, and new AI-driven solutions to everyday problems. But lingering in the background is the knowledge that these tiny pieces of silicon have assumed outsized importance on the world stage. They have become entwined with national ambitions and security in a way few commodities ever do.

Will we see a collaborative ecosystem where AI technology flows freely for the benefit of all, or a splintered landscape of separate spheres? The answer may shape not only the tech economy but global stability. As of 2025, we witness a bit of both: fierce competition and astonishing progress on one hand, and protectionist walls and power plays on the other. The only certainty is that AI chips will continue to be at the heart of it all, silently crunching numbers in data centers and devices, while carrying the weight of economic hopes and geopolitical tensions on their unassuming wafers.

In this high-stakes race to 2030, one might frame it in a more optimistic light: whichever country or company “wins” in AI chips, humanity as a whole stands to gain from the leaps in capability that result. After all, a trillion-dollar market indicates society is investing heavily in smarter tools and infrastructure. If managed wisely, the AI chip boom could usher in an era of productivity and innovation that benefits everyone. The challenge will be ensuring that competition inspiring innovation does not tip into conflict impeding it. The world will be watching the USA, China, and Taiwan as they navigate this delicate balance on the cutting edge of technology.

Sources:

- IDTechEx Research – US Export Controls on AI Chips Boost Domestic Innovation in China (Jul 2025) idtechex.com 8

- TechInsights – Analysis: When Will the Edge AI Chip Market Bloom? (Sept 2025) techinsights.com 9

- Reuters – Special Report: Taiwan chip industry emerges as battlefront in U.S.-China showdown (Dec 2021) reuters.com 10

- Reuters – (quoting SIA/BCG report) reuters.com 11

- Reuters – (NSCAI report to Congress) 3

- Fox Business – AMD’s Lisa Su on AI chip demand (Sept 2025) foxbusiness.com 12

- Investopedia/ CNBC – Jensen Huang on “insane” AI chip demand (2023) 13

- SEMI (Ajit Manocha) – Global Semiconductor Industry $1 Trillion by 2030 (Feb 2024) semi.org 14

- AInvest News – AI Fuels Chip Industry Growth to $1tn by 2030 (Sep 2025) 1

- SemiEngineering – Chiplet architectures in AI chips (Jan 2025) 15

- IDTechEx – AI Chips Market Forecasts (2025-2030) 16

- Additional data from RAND, CSIS, etc. on China’s AI ambitions rand.org csis.org. (These provide context on government goals and have been referenced in discussion.)