- Surging Share Price: BigBear.ai’s stock (NYSE: BBAI) has been on a volatile upswing in late 2025. As of September 23, 2025, shares traded around the mid-$7 range after jumping ~13% on news of a U.S. Navy AI partnership stocktwits.com. The stock climbed roughly 45% over the two weeks leading up to that date stockinvest.us, extending an 8-session winning streak, and is up about 82% year-to-date (and a stunning 422% over the past 12 months) stocktwits.com – although it remains well below past highs.

- Q2 Earnings Hit & Guidance Cut: Recent financial results have been mixed. In Q2 2025, revenue fell to $32.5 million (down 18% YoY) with a net loss ballooning to $228.6 million due largely to one-time charges (fair-value adjustments on convertible notes and a goodwill write-down) ir.bigbear.ai ir.bigbear.ai. Management slashed its full-year 2025 revenue outlook to $125–$140 million (from an original ~$160–$180 million range) coincentral.com, and even withdrew EBITDA guidance amid uncertainty ir.bigbear.ai. The disappointing Q2 news in August triggered a ~25% plunge in BBAI’s stock price as investors digested the lower guidance and continued losses 1 .

- Major Deals and Partnerships: BigBear.ai is aggressively pursuing growth through strategic deals:

- U.S. Navy Contract: On Sep. 23, BigBear announced it will deploy its AI technology with partner SMX for the U.S. Navy’s UNITAS 2025 multinational naval exercise, enhancing maritime domain awareness for the Navy’s 4th Fleet stocktwits.com 2 .

- Middle East Expansion: In June, BigBear forged a strategic partnership in the UAE with Easy Lease (an International Holding Company subsidiary) and Vigilix, aiming to accelerate AI solutions across the region ir.bigbear.ai. This marks BigBear’s first major international expansion beyond its U.S. government base.

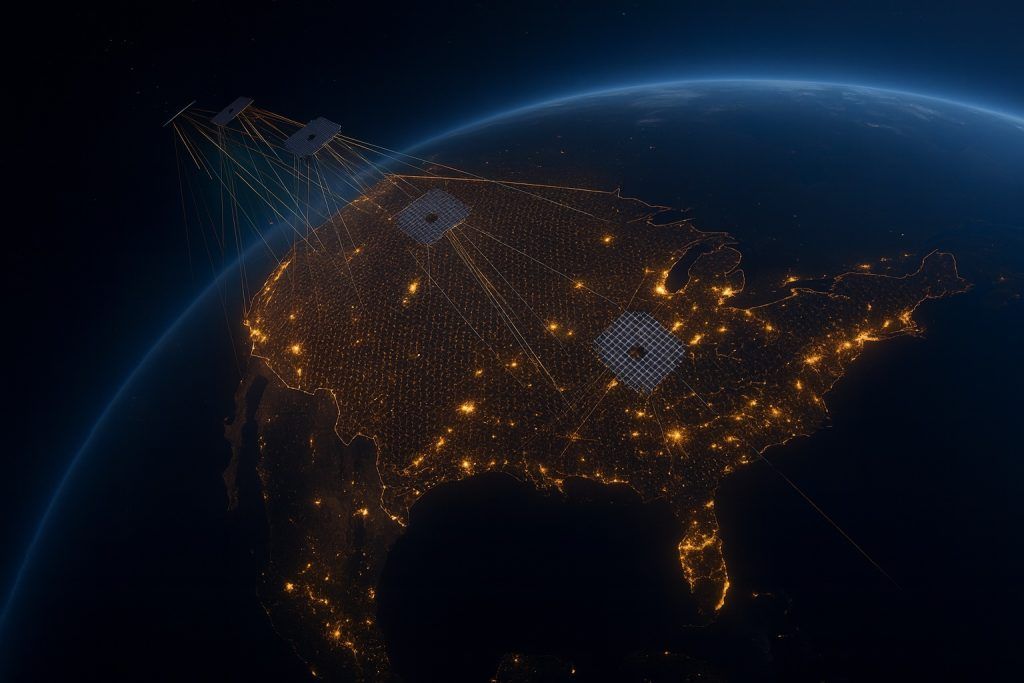

- Global Supply Chain Security: In August, BigBear teamed with Panama’s Narval Holdings to launch an AI-powered cargo security platform in Panama – leveraging biometric tracking to protect the vital Panama Canal trade corridor bigbear.ai 3 .

- Other Notables: The company’s tech is also being adopted in civilian use cases like aviation security – e.g. its veriScan facial recognition platform was rolled out at Nashville International Airport to speed up U.S. customs clearance stocktwits.com. In a branding move, BigBear even inked a landmark partnership with the NFL’s Washington Commanders, gaining naming rights to the team’s training facility (the “BigBear.ai Performance Center”) and exploring ways to showcase its tech to enhance fan experiences bigbear.ai 4 .

- Financial Position: Despite ongoing losses, BigBear.ai’s balance sheet has been fortified. The company ended Q2 with a record $390.8 million cash on hand ir.bigbear.ai, thanks to recent capital raises (including issuing convertible notes and warrants). This liquidity “gives [BigBear] the ability to make significant transformational investments” according to CEO Kevin McAleenan benzinga.com. Backlog stood at $380 million in contracts as of mid-2025 ir.bigbear.ai, providing revenue visibility. Nonetheless, shrinking revenues (first-half 2025 sales were down ~8% YoY) and negative Adjusted EBITDA (–$8.5 M in Q2) reflect the challenges in reaching profitability ir.bigbear.ai 5 .

- Analyst & Investor Sentiment: Wall Street’s view on BBAI is cautiously optimistic but mixed. H.C. Wainwright recently reiterated a Buy rating, citing BigBear’s potential to benefit from a “One Big Beautiful Bill” surge in federal AI spending (e.g. an extra $170 billion for DHS and $150 billion for DoD in new legislation) tipranks.com. The analyst set an $8 price target, seeing ~17% upside from mid-$6 levels tipranks.com. Overall, the small analyst coverage yields a Moderate Buy consensus (2 Buys, 1 Hold), though the average target (~$5.83) actually sits below the current price tipranks.com – underscoring some skepticism about near-term valuation. On the bullish side, BlackRock took a noteworthy stake in BigBear, buying ~12.1 million shares in Q2 (an ~$83 million position) as part of its bet on the AI theme tipranks.com tipranks.com. Meanwhile, retail investor sentiment has been extremely bullish, with BBAI becoming a trending “AI play” on social platforms following the recent Navy contract news stocktwits.com. However, options trading implies elevated volatility, and the stock’s rollercoaster history (down ~69% from its all-time high despite recent gains coincentral.com) keeps more cautious investors wary.

- Position in the AI Landscape: BigBear.ai pitches itself as a “mission-ready AI” provider for defense, intelligence, and critical infrastructure – effectively a smaller-cap counterpart to Palantir in the government data analytics arena coincentral.com. The company’s niche focus on customized AI solutions for military and federal agencies has yielded significant contracts (including a $165 million U.S. Army project won in 2024) coincentral.com. Yet scalability remains a concern: unlike Palantir’s off-the-shelf platforms, BigBear often develops one-off solutions per client, resulting in much lower gross margins (≈25–30% vs. Palantir’s ~80% coincentral.com) and slower growth. In fact, BigBear’s annual revenue has grown under 10% since 2022, whereas larger peer Palantir expanded ~85% over a similar period coincentral.com. Palantir just hit $1 billion in quarterly sales, dwarfing BigBear’s ~$32 million quarterly revenue coincentral.com. Competition in AI-driven analytics also comes from firms like C3.ai and other emerging players, but BigBear’s strength is its deep roots in U.S. government contracting and specialized domains (from battlefield decision support to border security to supply-chain monitoring). With Washington now pouring new funding into defense tech and AI, BigBear aims to capture its share – but it will need to scale its offerings and improve efficiency to truly replicate a Palantir-like trajectory coincentral.com 6 .

BBAI Stock Performance (Late September 2025)

BigBear.ai’s stock has experienced extreme volatility in 2025, rallying sharply in the fall after a rocky summer. On September 23, 2025, BBAI surged in early trading – up over 11–13% at one point – after announcing its role in a high-profile Navy exercise stocktwits.com. The stock had closed the prior session (Sept. 22) at $7.08 stockinvest.us, capping an 8-day run of gains. Over the preceding two weeks, BBAI share price leapt by ~45% stockinvest.us, an unusually rapid rise that technical analysts noted is rarely sustained without at least a brief pullback. Indeed, intraday swings have been large – e.g. on Sept. 22 the stock ranged from a low of $6.31 to a high of $7.21 (a 14% intraday swing) 7 .

Despite that volatility, BigBear’s momentum has been undeniably strong through September. A combination of company-specific news and macro tailwinds fueled the rally. The Federal Reserve’s pivot to interest rate cuts (a 0.25% cut in mid-September) sparked renewed investor appetite for speculative growth stocks, and BigBear.ai’s shares jumped ~35% in that week alone following the Fed’s decision coincentral.com coincentral.com. This broader “risk-on” wave in tech – coupled with BigBear’s own contract announcements – propelled BBAI to levels not seen in months. As of late September, the stock is sitting on roughly a +78–82% gain year-to-date stocktwits.com, vastly outperforming the S&P 500 and many peer AI stocks. Notably, over a one-year horizon BBAI has skyrocketed ~422% stocktwits.com, reflecting a rebound from its late-2024 lows around $1–2 per share.

However, the stock’s path has not been straight up. Earlier in the summer, disappointing earnings news sent shares tumbling. When Q2 results hit in August (see Financial Updates below), BBAI plunged – losing about 20–25% of its value in a single day benzinga.com and briefly sinking into the mid-$5 range in mid-August. Even after the recent rebound to ~$7–8, BigBear.ai remains roughly 69% below its all-time high reached during the 2021–22 SPAC-era surge coincentral.com. Long-term holders have endured whiplash: the stock has swung from penny-stock territory under $2 to double-digits and back multiple times as hype cycles and setbacks alternate. Traders should note that volume and liquidity fluctuate as well – for example, during the September run-up, trading volumes spiked well above normal levels (a sign of heavy speculative interest), then actually dipped on the day of the final spike stockinvest.us. Some analysts caution that rising prices on declining volume can indicate a tiring rally stockinvest.us. In short, BBAI’s recent price action has delivered big gains for momentum traders, but with a beta and risk level as high as 136% implied volatility (far above average) it demands careful watching. The stock’s RSI technical indicator hit overbought levels by late September stockinvest.us, suggesting the potential for near-term consolidation even if the longer-term trend remains positive.

Financial Performance and Updates

Q2 2025 Earnings Miss and Outlook Change

BigBear.ai’s second-quarter 2025 financial report (released August 11, 2025) revealed both deteriorating fundamentals and significant one-off charges, which together prompted management to cut guidance. Revenue for Q2 came in at $32.5 million, an 18% drop from the $39.8 million achieved a year earlier ir.bigbear.ai. The decline was attributed largely to reduced activity on certain U.S. Army programs ir.bigbear.ai – a reflection of federal contract “efficiency” efforts that caused unexpected disruptions in BigBear’s pipeline ir.bigbear.ai. This revenue shortfall also meant BigBear missed analysts’ expectations (Wall Street had expected ~$41 million in Q2 sales) benzinga.com 8 .

Profitability metrics were even more concerning. BigBear posted a net loss of $228.6 million for the quarter, a dramatic widening from the -$14.4 million loss in Q2 2024 ir.bigbear.ai. Importantly, much of this loss was driven by non-cash accounting items: the company had to mark-to-market the value of recently issued convertible notes and warrants, resulting in a $135.8 million charge, and it also booked a $70.6 million goodwill impairment ir.bigbear.ai. These charges, while painful on paper, do not reflect ongoing operating losses. Excluding such items, BigBear’s Adjusted EBITDA was -$8.5 million for Q2, versus -$3.7 million a year ago ir.bigbear.ai. The deeper adjusted loss was mainly due to lower gross profit (gross margin fell to 25.0% from 27.8% YoY) and higher R&D spending ir.bigbear.ai ir.bigbear.ai. On a per-share basis, the company lost -$0.71 in GAAP EPS for the quarter, massively missing the consensus estimate of about -$0.06 benzinga.com benzinga.com. In short, BigBear’s core operations are still far from breakeven, and Q2 underscored the challenge of covering a bloated cost base with declining revenues.

Given those results, BigBear.ai dramatically lowered its forward guidance. The company cut its full-year 2025 revenue forecast to $125–$140 million, down from prior guidance that had implied 1%–14% growth year-on-year (approx. $160–$180 million) to a new outlook of an 11%–21% decline coincentral.com. For context, BigBear generated $158.2 million revenue in 2024, so the revised midpoint (~$133 million) would be a sizable drop coincentral.com. Management explained that delays and consolidations in federal contracts – particularly the Army data architecture programs – forced the downgrade ir.bigbear.ai ir.bigbear.ai. The company also withdrew its Adjusted EBITDA guidance for 2025 ir.bigbear.ai, citing uncertainty around the timing of new contract ramps and an intention to increase growth investments in H2 2025. Analysts noted this was effectively an admission that profitability (even on an adjusted EBITDA basis) will take longer to achieve. The market reacted swiftly: BigBear’s stock plunged ~23% in after-hours trading following the Q2 report benzinga.com, falling from around $7 to the mid-$5s as investors digested the deeper losses and outlook for shrinking revenue.

On the positive side, BigBear highlighted its strengthened balance sheet and backlog. Thanks to capital-raising efforts in Q2 (more on that below), the company ended the quarter with a “record” cash balance of $390.8 million ir.bigbear.ai. This war chest, in the words of CFO Sean Ricker, provides the fuel to “make significant investments, both organically and inorganically, in an order of magnitude that was not possible before” ir.bigbear.ai ir.bigbear.ai. In other words, BigBear has ample liquidity to fund R&D, pursue acquisitions or strategic partnerships, and bridge its losses for the foreseeable future. The backlog stood at $380 million as of June 30, 2025 ir.bigbear.ai – roughly 3 times the company’s annual revenue – which includes multi-year government contract awards that have yet to be fully realized. BigBear’s CEO emphasized that the backlog and cash position put the company in a position to “accelerate growth” once the environment stabilizes ir.bigbear.ai 9 .

Additionally, BigBear.ai pointed to major legislative tailwinds on the horizon. CEO Kevin McAleenan – formerly Acting Secretary of Homeland Security – has been lobbying for BigBear to capitalize on what he dubbed the “One Big Beautiful Bill” in Congress ir.bigbear.ai. This refers to anticipated U.S. government funding boosts for defense and homeland security technology. Indeed, a pending supplemental funding package is set to inject $170 billion into DHS and $150 billion into DoD for “disruptive defense technology” and border security modernization ir.bigbear.ai ir.bigbear.ai. McAleenan noted this is “not incremental funding for innovation – this is a transformative level of investment”, and argued that as a “mission-ready AI company with a national and border security focus, [BigBear] is directly in our lane” to benefit ir.bigbear.ai ir.bigbear.ai. This optimistic outlook implies that while 2025 is a down year for revenue, the company expects a wave of new contract opportunities and government spending to drive a rebound in 2026 and beyond.

Other Financial Developments

Capital Raises: BigBear’s hefty cash pile did not appear out of thin air – it’s the result of significant capital raising in the first half of 2025. In Q2, the company completed a private placement of $200 million of convertible notes due 2029, along with warrants, which provided a major influx of cash ir.bigbear.ai. (The downside is that those instruments introduce dilution and the complex derivative accounting that hit the Q2 income statement.) Additionally, earlier in the year BigBear issued equity to strategic investors: for example, International Holding Company (IHC) – the Abu Dhabi-based conglomerate – took a stake as part of the UAE partnership (IHC’s subsidiary Easy Lease is BigBear’s partner, suggesting IHC may have provided capital or resources). BlackRock’s purchase of 12.1 million shares in Q2, disclosed via 13F filings, also indicates institutional money flowing in tipranks.com. The net effect is a dramatically improved liquidity position: BigBear has more cash now than its total debt, giving it a solid runway to invest in growth initiatives even while operating cash flow remains negative.

Cash Burn and Runway: Through the first six months of 2025, BigBear.ai’s operations consumed cash (operating cash flow was negative, reflecting the net losses). However, with ~$390 million in cash, the runway appears ample – likely a few years at the current burn rate. Moreover, management has been taking steps to control costs: SG&A expense actually ticked down ~8% YoY in Q2 (to $21.5 M from $23.4 M) as legal and bonus expenses were reduced ir.bigbear.ai. R&D expense did rise as BigBear invests in product development. Going forward, investors will be watching how aggressively the company spends its cash on new initiatives (for instance, any acquisitions to complement its technology stack, or increased sales force to pursue the new government funding opportunities). The withdrawal of EBITDA guidance suggests BigBear might ramp spending near-term to seize growth, which could mean continued losses in the next couple of quarters. However, the strategic wager is that these investments will pay off in contract wins in 2026+, eventually restoring growth and moving toward breakeven.

H1 2025 Summary: For the first six months of 2025, BigBear’s revenues totaled $67.2 M (versus $72.9 M in H1 2024) ir.bigbear.ai ir.bigbear.ai – down about 7.8%, which tracks with the full-year decline now projected. The net loss for the half was enormous (~$240 M) due to Q2’s charges, but excluding those one-time items the core loss was more moderate (Adjusted EBITDA for H1 was roughly -$15 M). Gross margin for H1 was ~23% (down from ~24.7% in H1 2024), illustrating some erosion in profitability as certain fixed costs weren’t fully absorbed by lower revenue ir.bigbear.ai ir.bigbear.ai. BigBear has stressed that many of its contracts are in ramp-up or awaiting government funding, implying that revenue can scale up quickly if/when those projects kick in. For example, the company’s backlog-to-revenue ratio is high, and converting even a portion of that $380 M backlog in the next year would significantly boost the top line. However, until clear evidence of re-acceleration appears (such as quarterly revenue returning to YoY growth), investors are likely to remain cautious. This is evident in analysts’ current forecasts: consensus expects about $133.5 M revenue for full-year 2025 (–15.6% YoY) and only a partial rebound to ~$152 M in 2026 coincentral.com coincentral.com – still below 2024’s level. In other words, despite the AI hype, BigBear’s actual financial performance will need to catch up for the stock’s valuation to be justified longer term.

Major News Developments (Mid-2025 to September 2025)

BigBear.ai’s story in 2025 has been punctuated by headline-making deals and strategic moves. Below is a breakdown of the most significant developments around the September 23, 2025 timeframe:

- AI Deployment for U.S. Navy’s UNITAS Exercise (September 2025): Perhaps the most impactful recent news was BigBear.ai’s partnership with SMX to support the U.S. Naval Forces Southern Command during UNITAS 2025, one of the world’s longest-running multinational maritime drills. Announced on September 23, BigBear will deploy its AI orchestration and analytics technologies with the Navy’s 4th Fleet, integrating them across unmanned vessels and the hybrid fleet participating in the exercises ir.bigbear.ai ir.bigbear.ai. The goal is to provide a unified common operating picture at sea, with BigBear’s proprietary Arcas™ system delivering computer vision, pattern-of-life analysis, and risk forecasting to help naval operators interdict threats like drug trafficking and arms smuggling ir.bigbear.ai ir.bigbear.ai. BigBear will also showcase its ConductorOS platform, which can push AI models to the “edge” in austere, low-bandwidth environments – a crucial capability for military missions ir.bigbear.ai ir.bigbear.ai. CEO Kevin McAleenan highlighted that in complex maritime zones strained by illicit trafficking, “our AI-driven insights can provide operators with enhanced situational awareness and the advantage needed to achieve mission success” stocktwits.com. This Navy collaboration not only generated buzz (driving the stock pop noted above) but also serves as a validation of BigBear’s technology on a global stage. UNITAS 2025 involves 26 nations and ~8,000 personnel ir.bigbear.ai ir.bigbear.ai, so BigBear’s role puts it in front of a broad defense audience. The news reinforced BigBear’s positioning as a go-to for defense AI solutions and could open doors to further DoD contracts if the demonstration is successful. (Notably, SMX – BigBear’s partner – is an established defense IT contractor, so this tie-up may also signal deeper integration of BigBear’s tools into larger systems integration projects.) The market reaction to this announcement was clearly positive, as the stock’s double-digit jump showed. It also shifted the narrative somewhat from August’s earnings miss to September’s execution on strategic partnerships.

- Strategic Partnership in the Middle East (June 2025): In a move to expand internationally, BigBear.ai in June announced a landmark UAE partnership with Easy Lease PJSC (Abu Dhabi Exchange: EASYLEASE) and Vigilix ir.bigbear.ai. Easy Lease is a subsidiary of the Emirati conglomerate IHC (International Holding Company), and Vigilix is a tech investment firm in the Gulf region. This three-way partnership aims to accelerate AI innovation and deployment across the UAE – from mobility and smart infrastructure to industrial applications ir.bigbear.ai ir.bigbear.ai. BigBear will act as the core technology provider, adapting its AI solutions to local needs, while Easy Lease contributes operational scale (it manages one of the UAE’s largest vehicle fleets) and Vigilix offers regional market insight ir.bigbear.ai. Kevin McAleenan called it “a major first step in our international expansion” and “a powerful endorsement of our technology and values” ir.bigbear.ai. This partnership is significant because it takes BigBear beyond its U.S. government comfort zone into global commercial and government markets – potentially unlocking new revenue streams. It also brought in IHC, one of the Middle East’s largest investment firms, as an ally; IHC’s involvement suggests confidence in BigBear (IHC has been known to invest in frontier tech and was notably an early backer of Palantir in the region). For BigBear, success in the UAE could serve as a springboard to other international opportunities. From an investor standpoint, the announcement signaled that BigBear is proactively diversifying its customer base, rather than relying solely on U.S. federal contracts.

- AI for Global Supply Chain Security – Panama (August 2025): On August 15, 2025, BigBear.ai unveiled a partnership with Narval Holding Corp. in Panama to launch a next-generation cargo security management solution bigbear.ai bigbear.ai. This project leverages BigBear’s AI and biometric tech to secure shipping containers passing through the Panama Canal, a critical chokepoint in global trade. The system uses biometric verification (linking drivers and vehicles to specific cargo via facial recognition and digital seals) to ensure a chain-of-custody for containers from origin to destination bigbear.ai bigbear.ai. It provides real-time tracking and analytics in a central platform, helping to detect anomalies that could indicate smuggling or tampering bigbear.ai. Mario Pérez Balladares, Narval’s chairman, said the collaboration will “set a new global standard for cargo security – combining advanced AI, biometrics, and real-time monitoring” to give unprecedented visibility over shipments bigbear.ai bigbear.ai. This initiative positions BigBear in the global logistics and homeland security market. It’s also strategically important: Panama’s government and canal authority are stakeholders highly concerned with security, so a successful pilot there could lead to broader adoption in other ports or corridors. For BigBear, it demonstrates an ability to apply its AI beyond defense – into areas like customs and trade facilitation, which are massive markets themselves. This news didn’t move the stock as dramatically as the Navy deal, but it garnered positive coverage in tech and trade media as an example of AI improving real-world infrastructure security govconexec.com. It also complements BigBear’s existing work in veriScan (airport passenger screening), reinforcing the company’s narrative of securing “borders and flows” with AI.

- Federal Contracts and Tech Milestones: Alongside these big partnerships, BigBear.ai continued to win and execute on U.S. federal contracts:

- In March 2025, BigBear announced a $13.2 million, 3.5-year contract with the Department of Defense Joint Staff (J-35) to modernize the ORION Decision Support Platform used for force management by the Chairman of the Joint Chiefs’ office bigbear.ai bigbear.ai. ORION DSP integrates data on military forces globally and helps in planning and analysis; BigBear’s role is to update this mission-critical system with AI-driven analytics and improved scalability bigbear.ai bigbear.ai. This sole-source award, obtained through the DoD’s Tradewinds AI procurement vehicle, highlights BigBear’s credibility at the highest levels of the Pentagon. It also directly ties into the “One Big Beautiful Bill” funding areas (force readiness and planning).

- In May 2025, BigBear (as a subcontractor) joined the U.S. Army’s Project Linchpin, focused on integrating AI/ML into future combat systems tipranks.com. This was a smaller collaboration with a prime contractor (Hardy Dynamics), but it places BigBear’s tech in the Army’s modernization initiatives.

- BigBear has also publicized that its biometric software (likely the veriScan platform) was deployed at “multiple U.S. Ports of Entry, including major international airports” by mid-2025 tipranks.com tipranks.com. In early September, Nashville International Airport became one of the latest to implement BigBear’s AI-powered Enhanced Passenger Processing (EPP) system for international arrivals stocktwits.com. This system uses a facial scan to match travelers to their passport data in seconds, allowing most passengers to clear customs without presenting a physical passport stocktwits.com. Such deployments showcase BigBear’s contributions to homeland security tech and improve its standing with agencies like CBP (Customs and Border Protection).

- Another interesting development: BigBear.ai’s foray into sports tech marketing via the Washington Commanders partnership. In August, BigBear became the official naming-rights partner of the NFL team’s 162-acre training facility in Ashburn, VA – now called the BigBear.ai Performance Center bigbear.ai bigbear.ai. This multi-year deal splashes BigBear’s brand across the Commanders’ practice jerseys, suite levels, and signage, and even had the two organizations ringing the NYSE Opening Bell together to celebrate bigbear.ai. While unusual for a small defense tech firm to sponsor an NFL facility, CEO McAleenan explained: “BigBear.ai is going on offense, and this partnership exemplifies our strategy… stepping onto the national stage with one of the NFL’s most recognized franchises” bigbear.ai. The move is aimed at boosting BigBear’s public profile and attractiveness as an employer (and perhaps smoothing its image in the D.C. area, where defense contractors compete for talent). It also hints at BigBear’s confidence – using marketing dollars to signal that the company plans to be a prominent player, not a niche obscurity. Investors had mixed reactions to this news (some questioned the expense given BigBear’s losses), but it underlines management’s commitment to raising BigBear’s visibility broadly.

In summary, BigBear.ai’s recent news flow paints the picture of a company aggressively expanding its reach – geographically (Middle East, Latin America), vertically (from military to airports to sports venues), and via partnerships (SMX, IHC/Easy Lease, Narval). These developments serve twin purposes: catalyzing growth opportunities and validating BigBear’s AI solutions through real-world deployments. Each successful project becomes a reference case to win the next contract. However, investors will ultimately be looking for these headline projects to translate into tangible revenue growth. BigBear’s challenge is to convert memoranda of understanding and pilot programs into steady, large-scale contracts. The Navy UNITAS deployment, for instance, could lead to follow-on work with Southern Command or other Combatant Commands if it impresses – a fact not lost on BigBear’s leadership, who touted it as evidence of their tech’s “mission-ready” impact ir.bigbear.ai ir.bigbear.ai. The coming quarters will reveal how much these strategic wins move the financial needle.

Analyst Commentary and Investor Perspectives

Analysts’ Views: Financial analysts covering BigBear.ai have acknowledged the company’s potential while flagging substantial risks. The coverage universe is small – as of Sept 2025, only a few sell-side firms actively rate BBAI – but their reports provide insight into how BigBear is perceived.

One of the more bullish voices is H.C. Wainwright’s analyst Scott Buck. In a recent note (mid-September 2025), Buck highlighted BigBear’s unique positioning to benefit from the upcoming surge in U.S. federal AI spending. He specifically pointed to the huge funding boosts in the pipeline for homeland security and defense (the “One Big Beautiful Bill”), which align with BigBear’s core competencies tipranks.com. “We see an improved balance sheet and favorable industry and legislative trends as catalysts for long-term growth,” Buck wrote tipranks.com. He expects BigBear’s operational results a year from now to look materially stronger as these catalysts kick in tipranks.com. Consistent with that view, Wainwright reiterated a Buy rating on BBAI and set a 12-month price target of $8 tipranks.com. That target implies modest upside (about +17%) from the stock’s mid-September levels around $6.85 tipranks.com. Buck’s optimism stems from BigBear’s strengthened finances (post-capital raise) and the notion that government digital transformation initiatives will translate into new contracts for the company. Essentially, he is betting that 2025 is a trough year and that revenue and margins will improve as BigBear secures some big wins out of the new federal tech budgets.

The broader analyst consensus, however, is more tempered. According to TipRanks and other aggregators, BigBear.ai currently has a “Moderate Buy” consensus: out of 3 analysts, 2 rate it Buy and 1 rates it Hold tipranks.com. Importantly, the average price target among them is only about $5.83 tipranks.com – below the current trading price (~$7). This indicates at least one analyst has a much lower target (likely the Hold-rated analyst), suggesting they see the stock as overextended after its recent rally. In fact, the consensus implies a potential -15% downside from here tipranks.com, signaling caution. We can infer that the Hold-rated analyst is concerned about BigBear’s execution risk and rich valuation relative to near-term earnings prospects. For instance, one might worry that with revenue shrinking in 2025 and no profitability yet, a ~$3 billion market cap (the ballpark where BBAI was trading in September coincentral.com coincentral.com) is hard to justify unless growth accelerates dramatically.

Reputable financial media have echoed some of these concerns. A Motley Fool analysis posed the question “Is BigBear.ai stock a buy or a red flag?” after the Q2 plunge, noting the company’s falling revenue and ongoing cash burn fool.com. The article pointed out that BigBear’s gross profit margins (~25–30%) are far below those of more scalable software peers (Palantir’s ~80%), and that BigBear’s custom-contract model limits its ability to achieve operating leverage coincentral.com coincentral.com. It also flagged that analysts foresee revenue continuing to decline into next year despite the AI industry’s growth, highlighting a disconnect between BigBear’s story and its results coincentral.com coincentral.com. In Nasdaq.com’s stock commentary, it was noted that BigBear “stunned the bulls” in Q2 by shifting its guidance from growth to a double-digit decline, causing analysts to slash their forecasts accordingly nasdaq.com. These cautious takes underline that BigBear has to prove it can turn enthusiasm into earnings.

Investor Sentiment & Ownership: On the institutional side, one of the most eye-catching developments was BlackRock’s investment in BigBear.ai. BlackRock, the world’s largest asset manager, disclosed that during Q2 2025 it purchased about 12.1 million BBAI shares (worth ~$83 million at the time) tipranks.com tipranks.com. This gave BlackRock roughly a 5–6% stake in the company. The news of BlackRock “loading up” on BigBear was interpreted as a vote of confidence in BigBear’s long-term prospects and the AI sector tailwinds. BlackRock’s Global Head of Macro, Glenn Purves, has been quoted saying “We stick with the AI theme… [It] keeps driving U.S. equity performance”, and if these companies deliver 15–20% growth, “elevated valuations can be justified” tipranks.com tipranks.com. In that context, BlackRock’s stake in BigBear (and another small-cap AI firm, Serve Robotics) indicates they see it as a potentially undervalued participant in the AI boom, worthy of a speculative position. Such an endorsement can sway other institutional investors or at least bring BigBear onto more radar screens. Aside from BlackRock, BigBear’s shareholder base includes some AI-focused funds and possibly strategic investors linked to the partnerships (e.g., IHC via the UAE deal).

Retail investor sentiment, as evidenced on platforms like Stocktwits and Reddit, has been highly volatile but lately very bullish. Following the SMX Navy partnership announcement, BBAI became the top trending ticker on Stocktwits, and the community sentiment registered as “extremely bullish” stocktwits.com. Many retail traders view BigBear as a “pure-play AI” stock that, while risky, could offer explosive upside – essentially treating it as a mini-Palantir or a turnaround bet. Over the past year, BBAI has occasionally been swept up in meme-stock type rallies (its 422% 12-month gain attests to that), often correlating with AI hype in the media or speculative fervor around anything AI-related. Case in point: in early June, when the NVIDIA-led AI rally was in full swing, BBAI ran up significantly despite no new news, likely as part of a basket of small AI names that traders piled into. However, the retail crowd can also turn sour quickly – the stock’s collapse in 2022–2023 from over $10 to under $2 showed that hype can evaporate if results disappoint. For now, the late-2025 narrative in social forums is largely positive, with users citing BigBear’s government ties and “next Palantir” potential, but also acknowledging the high risk. Short interest in BBAI has been elevated at times (as high as ~15% of float earlier in 2025), reflecting some skeptics betting against the company’s execution. Any stumble in upcoming earnings or delays in converting partnerships to revenue could encourage those short sellers and shake out momentum traders. Conversely, continued good news could incite further short squeezes, as was seen in some past spikes.

Valuation & Outlook: At around $7–8 per share, BigBear.ai’s valuation implies a market capitalization near $3 billion coincentral.com, which is roughly 20× its revised 2025 sales forecast (and a very high multiple in relation to its negative earnings). This pricing encapsulates a lot of future growth expectation. Bulls argue that if BigBear can secure even one or two major chunks of the forthcoming federal AI funding, annual revenue could rapidly scale into the few-hundred-million range, which would justify the current valuation or higher. They also note that BigBear’s intellectual property and niche expertise (e.g. in predictive analytics for defense, or its AI models for logistics) could make it an acquisition target for larger defense contractors or tech companies looking to bolster AI offerings. With cash in hand, BigBear itself might acquire smaller AI startups to broaden its capabilities, potentially increasing its value proposition. On the other hand, bears caution that BigBear’s track record of revenue growth is modest (organically just single-digit % growth pre-2025) and that it faces heavy competition from far larger players in the AI/analytics space. Moreover, the U.S. government market, while lucrative, can be slow and lumpy – contracts often face delays or cutbacks (indeed, BigBear’s Army-related shortfall in Q2 is a case in point). If BigBear cannot achieve economies of scale and improve margins, it could remain unprofitable for years, which would eventually necessitate either more capital raises (dilution) or lead to a sliding share price.

A concrete example of the competitive landscape pressure: Palantir Technologies (PLTR), often cited as an analog, has established deep relationships and multi-billion-dollar contracts with the same agencies BigBear targets. Palantir’s sales force and platform approach could outcompete BigBear’s bespoke project approach unless BigBear finds defensible niches or partners with larger integrators. Another competitor, C3.ai (AI), targets enterprise AI but also has some federal deals; it too has seen growth stall and its stock struggle, suggesting that even well-funded AI firms have challenges converting hype to revenue. This wider context tempers some of the exuberance around BBAI.

However, BigBear’s leadership remains confident. CEO McAleenan has repeatedly emphasized that BigBear is a “mission-ready” AI company – meaning its solutions are already proven in critical operations – unlike some AI startups that are more theory than practice. He notes that BigBear’s tech has been used in everything from warfighting simulations to real-time airport screening, building credibility with customers tipranks.com tipranks.com. The company’s motto is delivering “clarity for the world’s most complex decisions,” and its bet is that as governments and industries drown in data, they will pay for clarity. If BigBear.ai can turn that vision into growing recurring revenues (and ideally, software-like margins), the current moment may indeed be an inflection point on the way to much bigger things. If not, the stock’s recent surge could prove fleeting.

Bottom Line: BigBear.ai stands at a crossroads as of September 2025. The stock’s exciting run-up reflects optimism about its high-profile deals and the AI spending boom, but under the surface lies a company working through real financial growing pains. Investors should keep an eye on upcoming earnings (Q3 2025 results in a few weeks) to see if revenue declines are stabilizing and whether management reinstates any profitability guidance. Watch also for any new contract wins – especially U.S. federal awards in Q4 – which could validate the bull thesis. In the meantime, expect the share price to remain news-driven and volatile. BigBear.ai has positioned itself in the right hot sector (AI) with the right connections (government and now global partners); the next test is turning that positioning into sustainable growth that lives up to the hype.

Sources:

- BigBear.ai Q2 2025 Earnings Press Release (Aug 11, 2025) ir.bigbear.ai 10

- Stocktwits/Finance News on Navy Partnership and Stock Surge (Sep 23, 2025) stocktwits.com 11

- Investing.com Market Update on BBAI (Sep 23, 2025) investing.com 12

- CoinCentral/Trader Edge Analysis comparing BigBear.ai vs. Palantir (Sep 21, 2025) coincentral.com 13

- TipRanks (TheFly) – BlackRock Stake & Analyst Quotes (Sep 2025) tipranks.com 14

- BigBear.ai Press Releases: UAE partnership (Jun 11, 2025) ir.bigbear.ai, Panama solution (Aug 15, 2025) bigbear.ai, Washington Commanders deal (Aug 20, 2025) 15

- Benzinga – Q2 Earnings Recap and Stock Reaction (Aug 11, 2025) benzinga.com 16

- Nasdaq.com & Motley Fool – Post-earnings analysis and revenue guidance cuts coincentral.com 17

- BigBear.ai Investor Presentation / Analyst Day remarks (via press quotes) ir.bigbear.ai 18