- Shares Hit Records: Netweb’s stock surged to fresh highs in early October 2025, climbing 13–14% in one day and over 80–88% in a month upstox.com business-standard.com. In six weeks (Aug–Oct 2025), the smallcap tech stock more than doubled in price (≈102%) business-standard.com. At intraday peak on Oct 1, 2025 it traded above ₹4,150, far above its ₹500 IPO price. upstox.com business-standard.com. This rally has drawn investor attention even as larger IT peers were volatile.

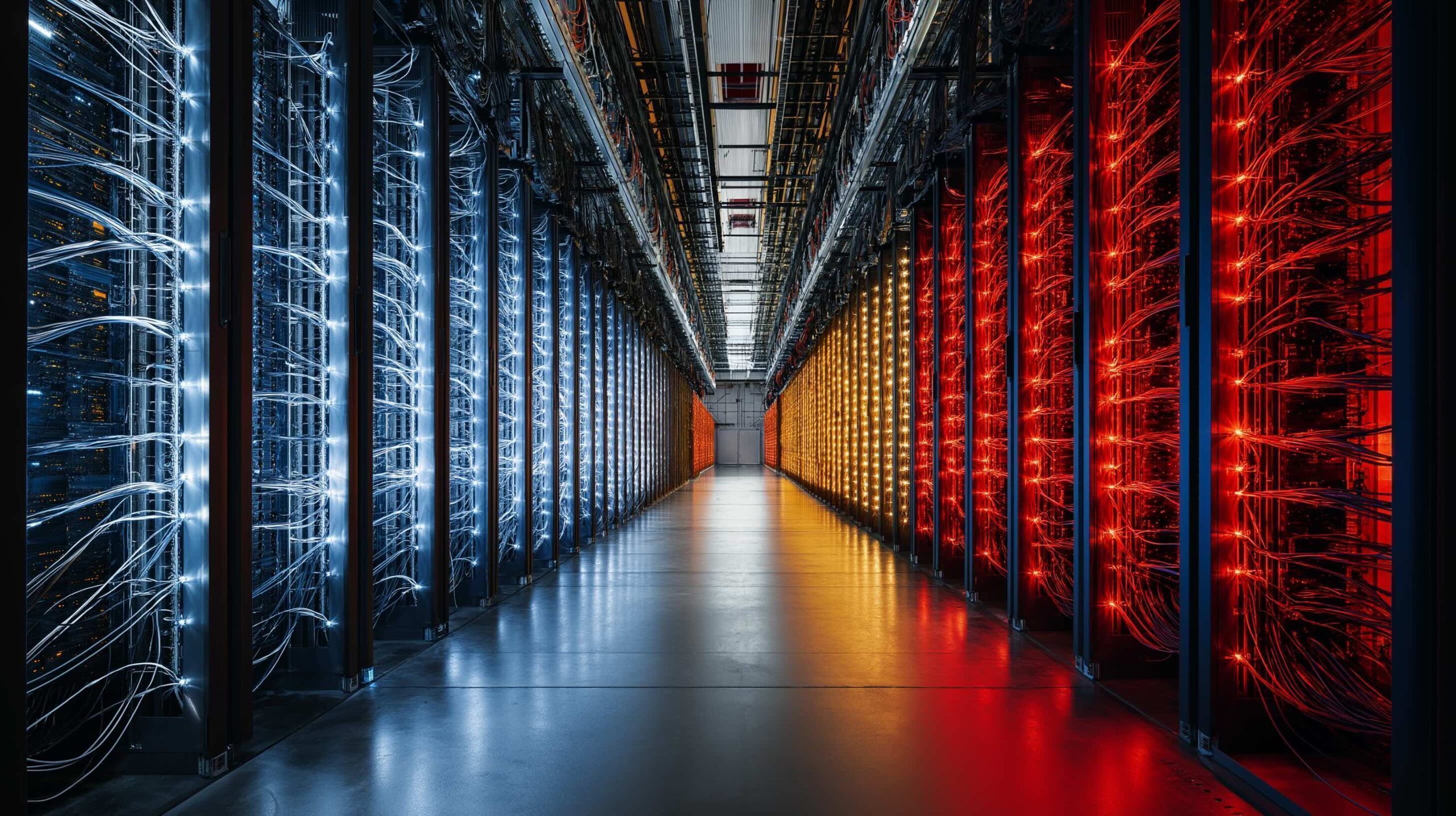

- AI Mega-Contracts: The surge is driven by two huge orders secured in September. On Sept 3, Netweb announced a ₹1,734 crore order to supply NVIDIA Blackwell‐architecture servers for India’s sovereign AI infrastructure (under the IndiaAI Mission) upstox.com economictimes.indiatimes.com. On Sept 19, it revealed another ₹450 crore purchase order for its “Tyrone” AI GPU-accelerated supercomputing systems upstox.com business-standard.com. Both deals are scheduled for execution by FY2025–26, and were placed by large technology and distribution partners (unspecified in filings) upstox.com 1 .

- Blowout Q1 Results: In Q1 FY2026 (ending June 30, 2025) Netweb’s revenue doubled year-over-year to about ₹301–302 crore and profit after tax (PAT) doubled to ~₹30.5 crore upstox.com economictimes.indiatimes.com. EBITDA jumped 127% to ₹44.8cr with healthy 14.9% margin economictimes.indiatimes.com. Crucially, its AI systems business exploded – revenue from AI servers surged ~300% YoY, now ~29% of total sales business-standard.com livemint.com. CEO Sanjay Lodha said the results reflect “a robust demand environment” and Netweb’s focus on disciplined execution 2 .

- Expansion & Outlook: Analysts note Netweb is a fully Indian‐owned HPC/AI OEM, leveraging “Make-in-India” advantages business-standard.com business-standard.com. Ventura Securities projects India’s AI infrastructure market will reach ≈₹8,700 crore by FY28 (29.5% CAGR) economictimes.indiatimes.com, a massive opportunity for Netweb. Ventura also forecasts Netweb’s revenues growing ~37% annually to ~₹2,938 crore by FY28 economictimes.indiatimes.com. Notably, Netweb’s order book was already high (≈₹4,142cr at June 2025, pre these orders business-standard.com livemint.com), and its AI segment has jumped from 7% of revenue two years ago to 29% in Q1FY26, with an expected ~40% CAGR ahead livemint.com. Chairman Sanjay Lodha lauded the landmark ₹1,734cr order as one that “will help India emerge as an AI superpower,” underscoring Netweb’s role in national AI initiatives economictimes.indiatimes.com 3 .

Record Stock Rally Amid AI Boom

Netweb Technologies’ share price has been on a tear. On October 1, 2025 the stock hit an intraday high of ₹4,156 (NSE) upstox.com, erasing earlier lows of ~₹1,278 (April 2025) and far exceeding its ₹500 issue price in mid‑2023. Business Standard reports the stock “more-than-doubled” (102%) in six weeks from late August to early October 2025 business-standard.com. Over six months, the rally is even more dramatic (≈170% gain) economictimes.indiatimes.com. Trading volumes spiked on these days – for example, on Oct 1 the NSE volume tripled compared to average, signaling strong investor interest upstox.com upstox.com. For context, Netweb is a smallcap on the BSE/NSE; such moves have made it one of the market’s best performers.

Financial news sites note the surge was unusual given a broader tech selloff (e.g. amid U.S. H-1B visa fee hikes), but Netweb stood out. Livemint reported the stock soared ~66% in September 2025 alone – “the biggest monthly gain since its listing” livemint.com. Analysts attribute this to specific triggers rather than a broader market trend: as Mint puts it, “the phenomenal rally was triggered following multiple order wins” when larger IT names were under pressure livemint.com. In short, the spike was fundamentally driven.

Securing Mega AI Contracts

Two orders in September lit the fuse. First, on Sept 3, 2025, Netweb disclosed a ₹1,734 crore strategic order under India’s national AI mission upstox.com economictimes.indiatimes.com. This contract, to supply servers built on NVIDIA’s cutting-edge Blackwell GPU architecture, is designated to boost India’s sovereign AI compute capabilities. It will be executed between FY2025–26 and FY2026–27 business-standard.com. Company filings described the customer only as “one of the largest Indian-headquartered global providers of tech distribution,” but emphasized its national importance (the IndiaAI Mission) upstox.com. In the wake of this announcement, shares initially jumped over 11% 4 .

Second, on Sept 19/21, 2025, Netweb announced it received (and on Sept 22 reported) a ₹450 crore purchase order for its homegrown “Tyrone” AI GPU-accelerated supercomputing systems upstox.com business-standard.com. This project involves deploying a major AI infrastructure facility using Netweb’s Tyrone AI GPU servers by end of FY26. The client was similarly undisclosed but said to be a top-tier technology supply chain firm. This news sent the stock up ~6% in one session business-standard.com. Netweb’s management underscored that neither order involved related parties, emphasizing it is an arms-length, strategic engagement 5 .

Both deals underline Netweb’s focus on AI/HPC: the company’s press material highlights that it designs and manufactures advanced computing gear (AI systems, HPC clusters, cloud servers, etc.) entirely in India pravinratilal.com business-standard.com. These orders are viewed as national-level projects. Chairman Sanjay Lodha told Entrepreneur India that the ₹1,734cr order “reflects the growing importance of sovereign compute capabilities in India’s digital future” and “will help India emerge as an AI superpower” economictimes.indiatimes.com entrepreneur.com. In other words, investors see Netweb as a key local partner for building India’s domestic AI infrastructure.

Stellar Q1 Financial Performance

Netweb’s September orders came on the heels of blockbuster Q1 results. For the quarter ended June 30, 2025 (Q1 FY26), Netweb reported:

- Revenue: ₹301–302 crore, up ~101–102% YoY upstox.com 6 .

- EBITDA: ₹44.8 crore, up 127% YoY, margin ~14.9% 7 .

- Profit (PAT): ₹30.5–30.48 crore, up 100% YoY, with ~10.1% PAT margin upstox.com 6 .

These gains were driven by surging demand for AI and high-performance computing products. Netweb’s own statements highlight that its “operating income grew by 101.7% year-on-year… reflecting the robust demand environment” upstox.com. In particular, AI systems revenue tripled YoY, becoming nearly one-third of the company’s sales economictimes.indiatimes.com business-standard.com. This pivot is striking – just two years ago the AI segment was a small fraction of Netweb’s business.

Netweb also remains conservatively financed. It reported a net cash balance (~₹47.5–47.6 crore) as of June 2025, which provides buffer for expansion economictimes.indiatimes.com. During Q1 the company’s Board expressed optimism about AI-led growth, further fueling investor enthusiasm economictimes.indiatimes.com. In short, the strong quarterly numbers gave confidence that the recent large orders can be absorbed profitably.

Building India’s High-End Computing Ecosystem

Netweb Technologies is headquartered in New Delhi and is a fully Indian-owned OEM (original equipment manufacturer) of high-end computing solutions business-standard.com pravinratilal.com. It markets its AI/HPC servers under the brand “Tyrone,” with specialized models (like the Tyrone Camarero platform) for large-scale generative AI and exascale computing entrepreneur.com livemint.com. Notably, Netweb has partnered closely with NVIDIA: it is a select manufacturing OEM for NVIDIA’s Grace CPU and GH200 GPU designs, and it will ship systems with NVIDIA’s latest chips (including 8× GPU HGX B200 units) entrepreneur.com business-standard.com. In effect, Netweb localizes design, R&D, and manufacturing of advanced GPU servers in India – a key capability as the government pushes for indigenously-built supercomputers.

The broader market opportunity is huge. According to Ventura Securities, India’s compute-infrastructure market is poised for rapid growth: by FY28, AI infrastructure could reach ~₹8,700 crore (at ~29.5% CAGR), and private cloud/HCI ~₹14,100 crore economictimes.indiatimes.com. High-performance computing (HPC) itself is forecast to grow by ~8% to ₹2,430 crore economictimes.indiatimes.com. Against this backdrop, Ventura projects Netweb’s revenues growing ~36.7% annually to about ₹2,938 crore by FY28 economictimes.indiatimes.com. Its models see especially strong growth in the AI systems and enterprise workstation segments (over 50% CAGR) economictimes.indiatimes.com. Other analysts at Mint have noted that the recent ₹450cr order alone is almost as large as Netweb’s entire projected sales for FY26, and about 72% of FY27 sales livemint.com – underscoring how an individual deal can dramatically impact growth.

Government initiatives also favor Netweb’s segment. Initiatives like the IndiaAI Mission and the National Supercomputing Mission are funneling investment into domestic AI computing capacity. Netweb explicitly mentions (in its annual report and filings) its alignment with these programs, making it a “key partner in building sovereign AI and compute infrastructure” in India business-standard.com business-standard.com. CEO Lodha has positioned Netweb as a fully integrated, “Make-in-India” provider whose products serve sectors from defense and healthcare to finance business-standard.com 8 .

Analyst & Expert Views

Market analysts have taken note. As one story summarized, policy tailwinds (digital infrastructure build-out, data localization) combined with new factory capabilities (an in-house SMT facility added in 2024) and NVIDIA collaborations have set the stage for Netweb’s leap economictimes.indiatimes.com. At least one brokerage (Ventura) explicitly forecasts robust AI-driven demand. Mint analysts highlight that each large order materially scales Netweb’s revenue base, and that the 66% September jump was largely due to investor recognition of this AI focus 9 .

In company comments, Netweb’s management remains bullish. At the AGM on August 30, 2025 (ahead of these order announcements), the MD sketched an “upbeat roadmap for AI-led growth,” which itself sparked buying interest economictimes.indiatimes.com. Chairman Lodha’s statements (e.g. “help India emerge as an AI superpower” economictimes.indiatimes.com) reinforce the narrative that Netweb is contributing to a national strategic shift.

Overall, experts say Netweb is benefitting from a multi-year transformation. The confluence of breakthrough deals, record sales growth and supportive industry trends has put the stock in the spotlight. As one report notes, India’s small cap tech stocks rarely rally by such magnitudes unless “multiple order wins” justify it livemint.com. In this case, the facts – large domestic AI contracts and doubling revenues – speak for themselves. That said, Netweb remains a small, volatile stock (up 650%+ from its IPO price) and future gains depend on continued execution. For now, however, it is riding one of the market’s steepest tech surges.

Sources: Company announcements and filings; market reports by Moneycontrol moneycontrol.com moneycontrol.com, Business Standard business-standard.com business-standard.com, Economic Times (ETMarkets) economictimes.indiatimes.com economictimes.indiatimes.com, Livemint livemint.com livemint.com, Upstox upstox.com upstox.com; expert analysis (Ventura Securities); filings. Sanjay Lodha quotes from official press releases economictimes.indiatimes.com upstox.com. All figures are for FY2026/Q1FY26 or latest reported period.