- Business: WeRide Inc. (NASDAQ: WRD) designs autonomous vehicles and operates a One platform that offers robotaxi, logistics and sanitation services. By mid‑2025 the company claimed to run one of the largest fleets with 600+ robotaxis and 1 300+ autonomous vehicles across 30+ cities in 11 countries, accumulating roughly 55 million km of Level‑4 mileage 1 .

- Stock Performance: WRD shares traded around US$10.3–11.1 on 2‑Oct‑2025, up ~7–8 % on the day, but still down over 27 % year‑to‑date despite competitor Pony AI rallying more than 60 % benzinga.com. The 52‑week range was US$6.03–44.00 and the market cap about US$3.16 billion stockanalysis.com 2 .

- Financials: In Q2‑2025 WeRide reported revenue of $17.8 million (up 60.8 % YoY) and Robotaxi revenue of $6.4 million, surging 836.7 % YoY globenewswire.com. However, the company remains unprofitable with net income of −$338.7 million in the trailing 12 months 3 .

- Analyst Ratings: StockAnalysis shows four analysts rate WRD “Strong Buy” with an average 12‑month target price of $17.88, implying about 61 % upside 3 .

- Major News (late Sept–early Oct 2025):

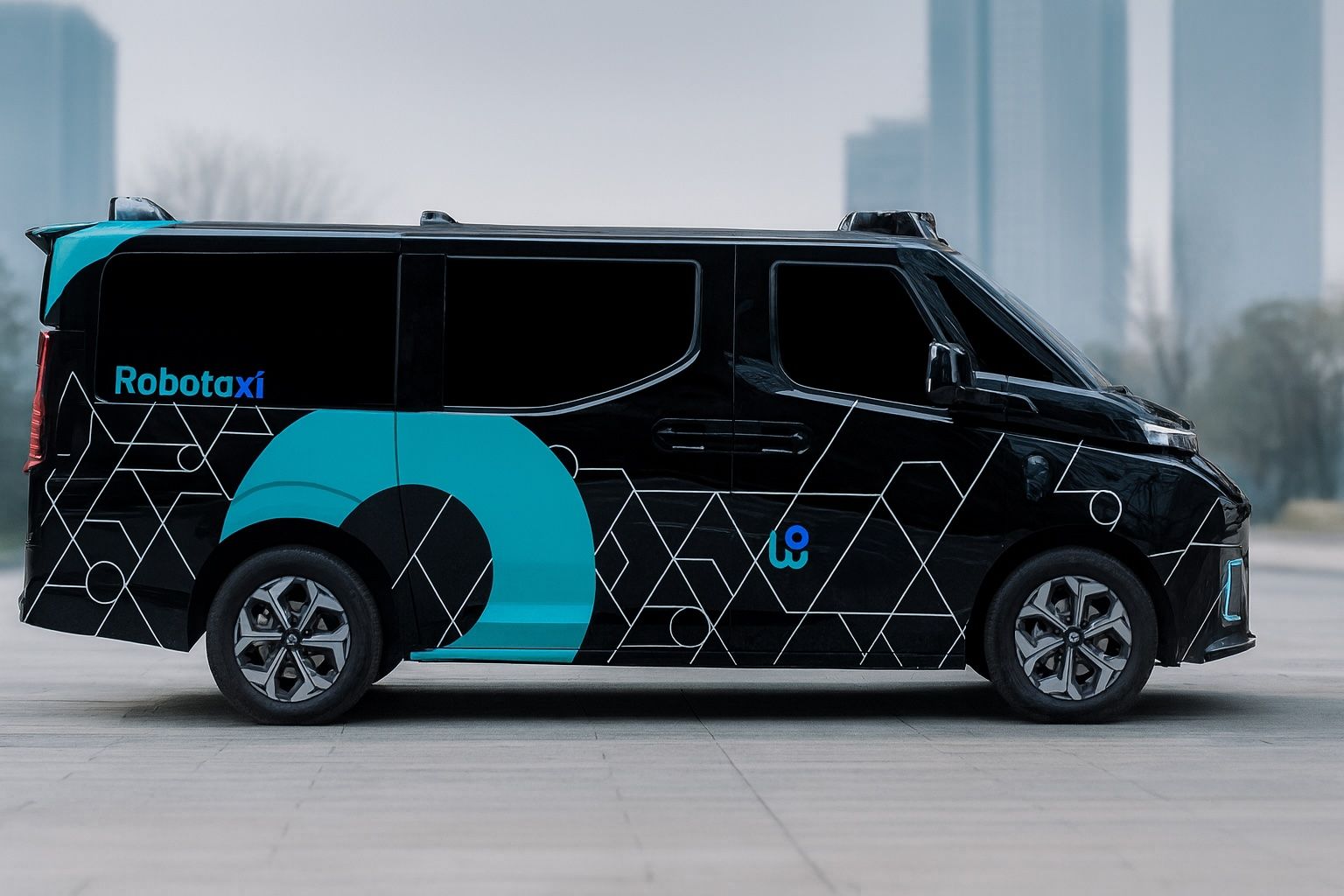

- Oct 2 – WeRide launched Robotaxi GXR and Robobus pilots in Ras Al Khaimah (RAK), its third emirate in the UAE, integrating into RAK’s public transport with commercial operations slated for early 2026 4 .

- Sept 26 – The company secured a robotaxi trial permit in Dubai, won first place at the Dubai World Challenge and announced plans to expand to 1 000 vehicles in the Middle East by 2030 globenewswire.com. China’s upcoming EV export licence rule weighed on the share price 5 .

- Sept 25 – WeRide was added to Fortune’s 2025 “Change the World” and “Future 50” lists, citing global expansion and significant revenue growth 6 .

- Sept 23 – WRD joined the Nasdaq Golden Dragon China Index, boosting visibility among U.S. investors; the company highlighted recent milestones such as winning Belgium’s first Level‑4 test permit and launching robotaxi pilots in Riyadh and Singapore 7 .

- Risk/Reward: Some commentators warn that while WeRide leads in permits and partnerships, the business remains cash‑intensive with significant losses and potential dilution 8 .

Company Overview

WeRide Inc. is a Chinese autonomous‑vehicle technology company founded in 2017. Its One platform integrates autonomous ride‑hailing (Robotaxi), delivery (Robovan) and sanitation (Robosweeper) services. The company operates in about 30 cities worldwide and has expanded beyond China into the UAE, Saudi Arabia, Singapore and Belgium globenewswire.com. The business model relies on providing autonomous mobility services via its own fleets and by partnering with transportation authorities and ride‑hailing companies. According to the company, its fleet comprises 600+ robotaxis and more than 1 300 vehicles that have accumulated roughly 55 million km of Level‑4 driverless mileage ir.weride.ai. WeRide emphasises a “One” multi‑city, multi‑vertical platform capable of serving passenger transport, logistics and municipal sanitation using common software and sensors 3 .

Financially, WeRide remains deeply unprofitable. StockAnalysis lists trailing‑12‑month revenue of $57.3 million and a net loss of $338.7 million stockanalysis.com. Despite rapid revenue growth, the negative earnings and negative forward P/E ratio reflect the capital‑intensive nature of robotaxi operations and heavy R&D expenditure. The company’s cash balance (not publicly available in open texts) appears sufficient for near‑term operations but management acknowledges that break‑even will require scaling to tens of thousands of vehicles 8 .

Stock Performance and Technical Signals

Historical volatility

WeRide’s shares have been extremely volatile since listing. On October 2, 2025 the stock traded around $10.32–$11.11, roughly 75 % below its 52‑week high of $44 yet over 60 % above the year‑to‑date low of about $6.03 stockanalysis.com. A technical analysis from StockInvest.us predicted a fair opening price of $10.16 with key support levels at $9.93 and resistance near $10.77 stockinvest.us. The site upgraded the stock from “Hold” to “Buy candidate” due to positive short‑term signals stockinvest.us, whereas the coin‑price forecaster CoinCodex predicted that the share price could drop by 33 % to around $6.89 by late October 2025 despite bullish sentiment coincodex.com. Such divergence underscores the uncertainty surrounding WRD.

Analyst and algorithmic outlooks

StockAnalysis consolidates Wall Street views and shows that four analysts rate WRD a “Strong Buy” with an average 12‑month target of $17.88—a ~61 % upside from the Oct 2 price stockanalysis.com. Directorstalkinterviews (July 2025) noted a target range between $13.08 and $21.14, implying 76 % upside and citing technical indicators like a rising MACD and neutral RSI directorstalkinterviews.com. In contrast, the independent site Intellectia AI predicted the stock would hover around $10.1 in the near term but drop to $8.12 by 2026; it still rated the stock a “Strong Buy” based on positive technical signals and mid‑term bullish outlook intellectia.ai. Overall, the consensus among bullish analysts is that WeRide’s first mover advantage and regulatory permits support long‑term upside; however, all forecasts remain speculative given the company’s early stage and regulatory risks.

Recent Developments and News

Expansion in the Middle East

On October 2, 2025, WeRide and the Ras Al Khaimah Transport Authority (RAKTA) announced the launch of Robotaxi GXR and Robobus pilot services in Ras Al Khaimah, United Arab Emirates globenewswire.com. The program integrated autonomous vehicles into the emirate’s public transport network with routes on Al Marjan Island and the city centre. The ruler of Ras Al Khaimah reportedly took the inaugural ride, highlighting local government support globenewswire.com. The pilot will have safety officers onboard initially, with full commercial operations scheduled for early 2026. This marks WeRide’s third UAE emirate after Abu Dhabi and Dubai and strengthens its presence in the Gulf region.

Just days earlier, on September 26, Dubai’s Road and Transport Authority granted WeRide a robotaxi trial permit and the company won first place at the Dubai World Challenge for Self‑Driving Transport, securing nearly US$1 million in prize money globenewswire.com. The trial will begin with 50 Robotaxi GXRs serving high‑traffic areas such as Dubai International Airport and later expand to 1 000 vehicles in the Middle East, with fully driverless operations targeted for 2026 benzinga.com. These Middle‑Eastern deployments underscore WeRide’s strategy to monetize its technology outside China and tap into governments that support autonomous mobility.

Global recognition and index inclusion

On September 25, Fortune listed WeRide in its 2025 “Change the World” ranking and Future 50 list, recognising companies addressing societal problems. The article noted that human error causes over 90 % of road accidents and that congested cities cost drivers more than 100 hours annually; it argued that autonomous vehicles could reduce crashes and commute times while cutting emissions globenewswire.com. WeRide’s Q2 results showed revenue rising 60.8 % YoY to $17.8 million and robotaxi revenue surging 836.7 %, reflecting rapid scaling globenewswire.com. The company also claimed 2 200 days of safe operations across its fleets 6 .

Two days earlier, WeRide announced its addition to the Nasdaq Golden Dragon China Index, which tracks U.S.-listed Chinese companies. Inclusion enhances visibility among U.S. investors and automatically attracts index‑tracking funds globenewswire.com. WeRide highlighted that the index has trended higher since early 2022 and could boost sentiment for Chinese technology stocks globenewswire.com. The company also emphasised milestones such as acquiring Belgium’s first Level‑4 test permit, launching robotaxi pilots in Riyadh and Singapore, and expanding a partnership with Uber 7 .

Singapore and Southeast Asia

On September 22, WeRide and ride‑hailing giant Grab announced that the company’s Robotaxi GXR and Robobus vehicles would power Grab’s Ai.R service in Singapore. Eleven vehicles will operate along two Punggol routes, with safety operators on board. The program is slated to begin in early 2026, and WeRide emphasised that its vehicles offer 360‑degree vision using cameras and LiDAR globenewswire.com. Grab’s COO Alex Hungate noted that the partnership would help train workers for the new technology and improve connectivity in underserved areas 9 .

Market reaction and macro context

Despite positive announcements, WeRide’s stock has been volatile. A Benzinga report noted that WRD had declined over 27 % year‑to‑date while competitor Pony AI gained more than 60 %, partly because the Chinese Ministry of Commerce announced that electric‑vehicle exporters must secure licences starting January 2026, raising investor concerns about supply chain disruption benzinga.com benzinga.com. Another article highlighted that WeRide’s shares surged earlier in 2025 when news broke that Nvidia held a stake in the company, though the partnership dates back to 2017 and does not necessarily imply a fresh investment marketbeat.com. Sentiment towards Chinese tech stocks also hinges on broader geopolitical tensions and regulatory uncertainty.

Cautious voices

While many analysts are bullish, some caution is warranted. A Seeking Alpha contributor argued that WeRide is aggressively expanding but still far from profitability, faces heavy operating losses and dilution, and may struggle to justify its valuation. The author rated the stock a “stay‑away” for most investors, suggesting that risk outweighs reward seekingalpha.com. The coin‑price forecaster CoinCodex similarly predicted a substantial price drop to $6.89 within a month 10 .

Expert Commentary and Market Forecasts

WeRide’s strong momentum in securing permits and launching pilot programs has impressed analysts. Directorstalkinterviews wrote that the company’s One platform and presence across 30 cities in ten countries make it a pioneer in autonomous mobility, and they highlighted a bullish MACD and neutral RSI that support technical upside directorstalkinterviews.com. Intellectia AI concluded that the stock is a strong buy in the medium term despite a negative trend in the short term 11 .

On the other hand, macro analysts caution that the market for robotaxis remains nascent. The International Energy Agency and S&P Global forecast tens of thousands of robotaxis by 2030, but the timelines depend on regulatory approvals, technology maturation and public acceptance. WeRide’s own investor presentation suggests that scaling to tens of thousands of vehicles is necessary to achieve profitability, implying heavy capital expenditures ir.weride.ai. Analysts also warn that the Chinese government’s new EV export licensing rules could dampen growth and increase costs for companies like WeRide that rely on international deployments 5 .

Sector and Macro Context

The autonomous‑vehicle industry has experienced a mix of optimism and reality checks. In the U.S., Waymo and Cruise have faced regulatory scrutiny after accidents, highlighting safety challenges. China’s government strongly supports intelligent transportation; however, 2025 regulations require that companies obtain permits for overseas autonomous vehicle exports. Geopolitical tensions and U.S. listing risks also influence investor sentiment toward Chinese stocks. Additionally, global interest rates in 2025 remain elevated compared with pre‑pandemic levels, pressuring high‑growth, unprofitable tech companies.

Conclusion and Outlook

WeRide is at the forefront of the robotaxi revolution, boasting a substantial fleet, an expanding international footprint, and recognition from Fortune and index providers. The company’s rapid revenue growth and strong analyst ratings signal that investors believe its early‑mover advantage and partnerships could translate into long‑term dominance. Recent news shows aggressive expansion in the Middle East and Southeast Asia, with governments embracing WeRide’s technology and offering supportive regulatory frameworks.

However, investing in WRD carries significant risks. The company has yet to achieve profitability, burns considerable cash, and may face further dilution to finance expansion seekingalpha.com. The stock’s extreme volatility—trading between $6 and $44 over the past year—means investors must tolerate large swings. Macro factors such as Chinese export licensing rules, potential U.S. delisting pressures and global economic uncertainty could further impact the stock.

Verdict: For investors with high risk tolerance and a long‑term horizon, WRD offers exposure to a pioneering player in autonomous driving. The near‑term outlook depends on successful pilot programs, regulatory approvals and the company’s ability to scale while controlling losses. Conservative investors should weigh the speculative nature of the stock and consider waiting for clearer signs of profitability.