- Surging Stock Price: Micron Technology’s stock has nearly doubled in 2025, recently hitting all-time highs around the $185–$190 rangets2.tech. On October 3, shares spiked as high as $191.85 intraday before closing at $187.83marketbeat.com – a massive year-to-date rally driven by enthusiasm for Micron’s role in the AI boom.

- Record-Breaking Earnings: Fiscal 2025 was Micron’s best year ever. Revenue jumped ~49% to $37.4 billion (with net income of $8.54 billion)ts2.tech. In the latest quarter (Q4 FY2025), sales hit $11.3 billion (+46% YoY) and non-GAAP earnings were $3.03 per share – well above analyst estimates (~$11.1 B and $2.86)ts2.tech. These results confirm a sharp rebound from the memory-chip downturn of last year.

- AI Demand Turbocharges Growth: Explosive demand from artificial intelligence data centers is driving Micron’s resurgence. Its cloud/server memory business saw revenues soar 213% year-on-year last quarter, with hefty 59% profit margins on those AI-tailored productsts2.tech. High-Bandwidth Memory (HBM) chips – critical for AI models – are effectively sold out, as Micron’s HBM sales neared $2 billion in Q4 alone to feed voracious GPU-driven demand1 .

- Stellar Outlook: Micron issued bullish guidance for the current quarter (Q1 FY2026), projecting roughly $12.5 billion in revenue and about $3.75 in EPSts2.tech. This blows past Wall Street’s prior forecasts (~$11.9 B and ~$3.0 EPS) and implies ~35–40% growth YoY – an astonishing accelerationts2.tech. Management also guided to ~51.5% gross margins (vs. ~46% consensus), signaling strong pricing power as memory supply tightens2 .

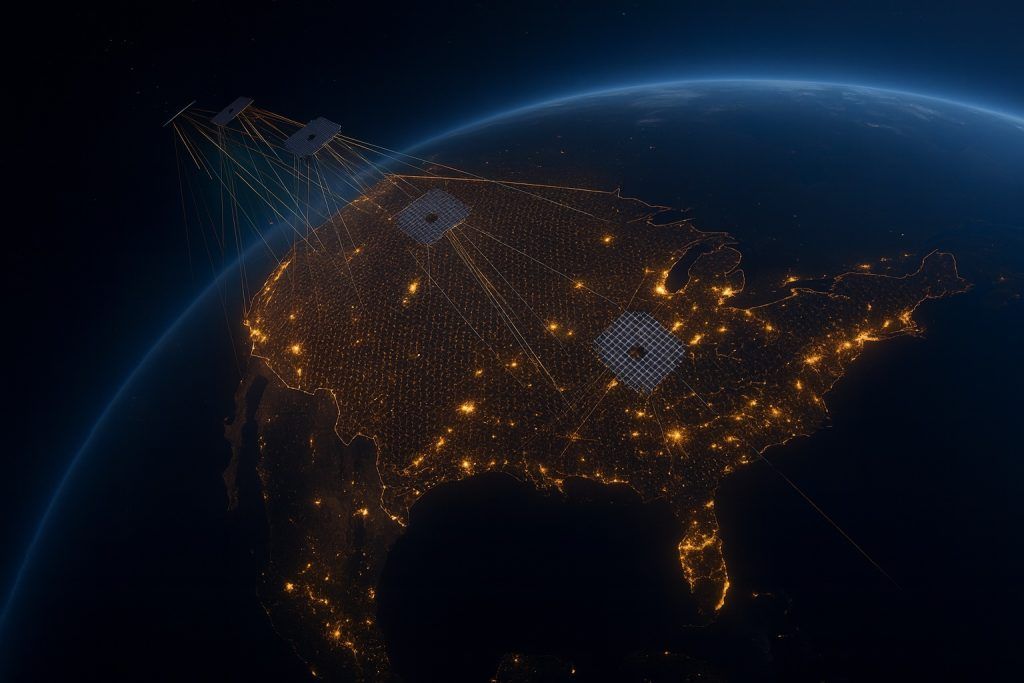

- Strategic Moves & Support: The company is retrenching in weaker segments while doubling down on strategic priorities. Micron was awarded $6.2 billion under the U.S. CHIPS Act to expand domestic productionts2.tech. It is also exiting the low-margin mobile NAND flash business (for smartphones), even cutting ~300 jobs in China as it pivots away from that segmentts2.tech. Meanwhile, geopolitical headwinds persist – China banned Micron’s chips in critical infrastructure, prompting Micron to invest in “friendlier” regions (new U.S. fabs, a $7 B packaging plant in Singapore) to secure its supply chain3 .

- Bullish Analyst Sentiment: Wall Street’s outlook on MU is broadly optimistic. Most analysts rate Micron a Buy (≈26 Buys vs 5 Holds) with a consensus 12-month price target around $180–$185marketbeat.com. Many firms have hiked their targets after the latest earnings; for example, Wedbush raised its target to $200 in September, saying Micron’s outlook is “underpinned by a strong memory cycle” with AI tailwinds prolonging the uptrendts2.tech. (KeyCorp analysts went even further, eyeing $215 as a fair value for MU4 .)

Stock Performance Soars in 2025

Micron’s stock has been on a tear in 2025, far outpacing the broader market. As of early October, MU shares have climbed over 90% year-to-date (including an eye-popping 40% surge in September alone)ts2.tech. The stock recently notched a fresh all-time high, touching $191.85 before pulling back slightlymarketbeat.com. By October 6, Micron was trading in the upper $180s – nearly double its price at the start of the yearts2.tech. This rally vastly exceeds the gains of major indices. It comes amid a broader tech rebound, but even within the red-hot semiconductor space Micron has been a standout performer.

Investors have piled into Micron on hopes it will be a big winner of the AI-driven chip cyclets2.tech. The company’s products are crucial for artificial intelligence and advanced computing, which has put Micron in the market’s spotlight. Indeed, the entire chip sector has surged on AI enthusiasm – the Philadelphia Semiconductor Index has logged multiple weeks of gains, with industry leaders like NVIDIA hitting record highs in recent daysts2.tech. Memory chip makers are riding this wave as well. Micron’s two main rivals, Samsung Electronics and SK Hynix, have likewise seen their stocks soar to record levels on the back of surging demand for chipsts2.tech. In short, Micron’s share price momentum reflects both company-specific optimism and the broader 2025 “AI mania” lifting the semiconductor industry.

Record Earnings Powered by AI Demand

Micron’s latest financial results underscore a remarkable turnaround. Fiscal 2025 proved to be record-breaking – Micron generated $37.4 billion in revenue (up ~49% year-on-year) and $8.54 billion in GAAP net incomets2.tech, the highest in its history. The momentum accelerated into the fourth quarter of FY2025, where sales hit $11.32 billion, a 46% YoY jump and Micron’s highest quarterly revenue everts2.tech. Earnings followed suit: non-GAAP EPS came in at $3.03, far above the ~$2.86 analysts expected (and more than double the $1.18 earned in the year-ago quarter)ts2.tech. Gross profit margins expanded to roughly 46% in Q4 (vs ~36% a year prior), reflecting improved pricing and efficiencyts2.tech. In short, Micron’s financials have swung decisively back to growth, leaving the 2022 memory-chip slump in the rearview. CEO Sanjay Mehrotra summed it up by calling it a “record-breaking fiscal year” with exceptional fourth-quarter performance, highlighting Micron’s leadership in technology and executionts2.tech5 .

What’s driving this boom? In a word: AI. Micron’s rebound has been fueled by an unprecedented surge in demand from artificial intelligence and cloud computing applications. Data centers running AI workloads require enormous amounts of memory – and Micron is reaping the rewards. The company’s newest Cloud Memory business unit (serving data center and AI customers) saw revenue skyrocket 213% year-over-year in Q4ts2.tech. These sales carry rich margins (nearly 59% in Q4) thanks to specialized products like high-performance DRAM and HBM (High-Bandwidth Memory) tailored for AI serversts2.tech. Micron reported that its latest HBM3E memory chips (used in cutting-edge AI accelerators like NVIDIA GPUs) are essentially sold out through 2026 under long-term supply agreementsts2.tech. In other words, customers are clamoring to secure as much Micron memory as possible to feed their AI training clusters. This spike in demand – alongside improving market conditions in PC and smartphone memory – has flipped the industry from glut to shortage. Micron, being the only U.S.-based DRAM manufacturer, is uniquely positioned to capitalize on these trends as companies seek reliable memory suppliers for AI projects6 .

Upbeat Guidance Signals More Growth Ahead

Micron’s management is signaling that the good times are set to continue into next year. In its earnings release, the company issued bullish guidance for the upcoming quarter (fiscal Q1 2026) that stunned many analyststs2.tech. Micron expects Q1 revenue around $12.2–$12.8 billion and adjusted earnings per share of $3.60–$3.90insidermonkey.com. That outlook blew Wall Street’s expectations “out of the water,” as one analyst put itinsidermonkey.com. (Consensus estimates had been only ~$11.9 B in sales and ~$3.0 in EPS.) If Micron hits the mid-point of its forecast, it would represent roughly 35–40% growth year-over-year and even about $1.2 billion in sequential revenue gain from Q4ts2.tech – a striking acceleration for a company of Micron’s size.

Crucially, Micron also guided for profit margins to continue expanding. Executives projected gross margin around 51.5% next quarter, well above the ~46% that analysts were modelingts2.techts2.tech. Achieving 50%-plus gross margins would be a first for Micron, reflecting excellent pricing power in a tightening memory market. Management noted that AI-driven demand is materializing faster than anticipated, creating favorable conditions to raise prices and ship more high-value productsts2.tech. In fact, Micron’s CFO remarked that even next-generation HBM4 orders (for post-2026 delivery) are already in discussion at significantly higher prices due to the limited supply in the marketts2.tech. All of this paints a picture of a company riding a strong upcycle. One news outlet called Micron’s forecast “stellar guidance” that reinforces the bullish thesis around AIts2.tech. Even some typically cautious voices had to acknowledge the blowout outlook – for example, Morningstar analyst William Kerwin noted on CNBC that Micron’s new guidance “really exceeded … estimates,” even though he believes a lot of the optimism was already priced into the stock7 .

Analyst Commentary and Institutional Outlooks

Micron’s dramatic comeback has drawn a flurry of attention from Wall Street. The consensus view is positive: according to MarketBeat data, Micron currently holds an average rating of “Moderate Buy” with no sell ratings. As of early October, 4 analysts rate MU a Strong Buy, 22 call it a Buy, and 5 have it on Holdmarketbeat.com. In total that’s about 26 bullish ratings out of 31 – a sign of broad confidence in Micron’s trajectory. The average 12-month price target sits around $184–$185 per sharemarketbeat.com, roughly where the stock trades now (and up sharply from consensus targets just a few months ago). Many investment banks have been raising their estimates in light of Micron’s earnings beat and rosy guidance. For instance, KeyCorp recently upped its price target to a Street-high $215 and maintained an Overweight rating, signaling belief in further upsidemarketbeat.com. Wedbush Securities likewise made headlines by boosting its target from $165 to $200 in September, arguing Micron’s outlook is “underpinned by a strong memory cycle” and that robust AI demand could prolong the current uptrendts2.tech. Other firms – Mizuho (to $182), Wells Fargo (to $170), Barclays (to $175), TD Cowen (to $180), and more – have all hiked their targets and reaffirmed bullish stances following Micron’s latest resultsts2.tech8 .

That said, not everyone is pounding the table unabashedly. A few analysts urge some caution given Micron’s big run. Morningstar’s William Kerwin, for example, has a neutral view on the stock despite the strong fundamentals. He praised Micron’s “exceptional” guidance that “blew past” expectations, but noted that the “relatively modest” stock pop after earnings suggests much of Micron’s upside was “already baked in” to the priceinsidermonkey.cominsidermonkey.com. In his words: “We think buying in at these levels is assuming even more upside… a lot of that upside is already baked in… the outlook… is well above estimates, but [it] really met maybe some of those buy side expectations”insidermonkey.com. The skeptical view is that memory chip cycles are still cyclical – and Micron isn’t entirely immune to old boom-bust patterns. Kerwin and others warn that competitors (like Samsung and SK Hynix) are ramping up supply, and any future glut or a macroeconomic slowdown could eventually pressure Micron’s pricing power againinsidermonkey.com. However, the bullish counterargument is that Micron’s current valuation (around ~20× forward earnings) is not stretched given its growth ratets2.tech. By some metrics (e.g. price-to-earnings-growth ratio ~0.4marketbeat.com), the stock even appears undervalued relative to its earnings trajectory. In short, institutional sentiment tilts positive on MU – with numerous analysts calling it a top pick in semiconductors – but expectations are now high. Going forward, Micron will need to execute and deliver on the rosy forecasts to justify further share appreciation, and investors should be mindful that memory markets can be volatile even in an AI age.

Recent News & Strategic Developments

Aside from earnings, several notable developments in recent months are shaping Micron’s story as of October 2025:

- Massive CHIPS Act Backing: Micron is one of the biggest beneficiaries of the U.S. government’s semiconductor subsidies. It has been awarded $6.2 billion under the CHIPS and Science Act to help fund expansion of domestic manufacturingts2.tech. Micron plans to invest over $40 billion in U.S. chip fabs this decade, including a new megafab in Boise, Idaho (its headquarters) and a planned $20 billion DRAM facility in New York state. Government grants are already flowing – Micron received an initial disbursement after hitting construction milestones in Idahots2.tech. These subsidies significantly offset Micron’s capital costs and underscore Washington’s strategic support for a secure U.S. memory supply. (There has even been talk of the Commerce Department taking equity stakes in chipmakers in return for grants, though Micron’s management indicated this is unlikely in its casets2.tech.) Internationally, Micron is also partnering with friendly governments: it announced a $7 billion investment in a cutting-edge chip packaging facility in Singapore, aided by that governmentts2.tech, and is collaborating with Japan on next-gen memory R&D. All told, public funding is bolstering Micron’s expansion and helping it keep pace with rivals in the race to build new capacity.

- Refocusing on Profitable Segments: In 2025 Micron made the tough call to exit the mobile NAND flash business – i.e. it will stop developing new NAND storage chips for smartphones. This segment had become brutally competitive (dominated by Asian manufacturers) and delivered poor returns. In August, Micron began winding down its mobile NAND operations and even cut around 300 jobs in China related to this unitts2.tech. By pulling back from low-margin products (like smartphone flash memory), Micron aims to concentrate on higher-value areas such as data center DRAM, high-bandwidth memory, and automotive/industrial chips. The strategic retrenchment should improve Micron’s profitability and reduce its exposure to oversupplied markets. Micron continues to produce NAND for certain uses (like solid-state drives), but it’s clear the company’s future bets are on segments with better growth prospects (e.g. AI server memory rather than phone storage).

- Geopolitical Hurdles (and Mitigations): U.S.–China tech tensions have loomed over Micron. In mid-2023, China’s government banned Micron chips from use in critical infrastructure systems, citing vague “security risks” amid the ongoing U.S.–China trade warts2.tech. While Micron said the China ban ultimately impacted only a small portion of its revenues, it highlighted the political risks facing U.S. chip firms in China. In response, Micron has been shifting its operations to more hospitable regions. Along with the aforementioned U.S. expansion, Micron has downsized its presence in mainland China – beyond the 300 layoffs, it has scaled back some R&D and support functions therets2.tech. The company is doubling down on manufacturing in the U.S., Southeast Asia, Japan, and other locales that offer supply chain security. The new Singapore packaging plant and planned capacity increases in Japan (where Micron was the first to introduce EUV lithography for DRAM) are part of building a geographically diversified production basets2.tech. These moves should help insulate Micron from geopolitical shocks, although they also reflect how essential Micron’s memory chips have become – countries are jockeying to ensure access to them. Micron’s status as the only major American memory-chip maker means U.S. policymakers have a keen interest in its success (and conversely, it’s a potential target in U.S.-China disputes). So far, Micron appears to be managing this balancing act by aligning closely with U.S. industrial policy and friendly nations’ tech initiatives.

Broader Semiconductor Trends and Micron’s Place

Micron’s fortunes are closely tied to the cyclicality of the memory chip market – and right now, that cycle is on an upswing. The entire semiconductor sector has been buoyant in 2025, thanks largely to the explosive growth of artificial intelligence, cloud computing, and advanced consumer devices. The tech sector overall is at record highs (the Nasdaq Composite recently hit all-time peaks) and chip stocks in particular are soaringts2.tech. NVIDIA’s stock, for example, has more than tripled on the back of AI chip demand, and the Philadelphia Semiconductor Index is up strongly for the yearts2.tech. Memory-focused companies are sharing in these gains. After two rough years of oversupply and collapsing prices, the memory industry has swung to shortage. Demand for DRAM and NAND is rebounding across PCs, smartphones, and especially data centers, while supply remains constrained from the deep production cuts and discipline that manufacturers imposed during the downturn. According to industry reports, major suppliers like Samsung and SK Hynix have even begun raising memory prices by double-digit percentages this year as customers scramble for chipsts2.tech. This is the classic sign of a “memory supercycle” – a period of extended growth and rising profitability for chip makers.

Within this context, Micron has emerged as a key player riding structural tailwinds. It is the world’s third-largest memory manufacturer (after Samsung and SK Hynix) and holds roughly ~13–15% share of the global DRAM marketts2.tech. Importantly, Micron is the only U.S.-based company in this top tier, which has earned it both government support and close partnerships with American OEMs. Micron is leveraging its strengths in advanced memory (like its GDDR6X graphics memory and HBM products) to win designs in AI systems, and it’s racing to catch up in the HBM segment where competitors currently lead in market sharets2.tech. The good news is that secular trends – AI, 5G, cloud services, autonomous vehicles – all point to rapidly growing memory needs in the coming years. This suggests that, while memory will likely always be somewhat cyclical, the peaks may be higher and the troughs more shallow going forward. Indeed, many analysts now argue that “this time is different” to a degree: AI and data-driven applications could sustain a higher baseline of demand, softening the traditional boom-bust pattern of memory chipsts2.tech. Micron’s leadership has echoed this optimism, indicating that the company’s long-term agreements for AI memory and its diversification into new markets (like automotive and industrial memory) will lend more stability.

Of course, risks remain on the horizon. A rapid increase in output by competitors or a global economic slowdown could eventually cool off the current supercycle. Memory makers have a history of “running hot” then suffering steep declines when oversupply hits. Investors should remember Micron’s stock has historically been volatile, and the memory cycle can turn quicklyts2.tech. But at least for now, Micron Technology sits in a sweet spot: robust end-market demand, constrained industry supply, supportive government policies, and a balance sheet fortified by recent profits. All these factors have converged to make Micron one of 2025’s breakout winners in the semiconductor world. As the AI revolution marches on, Micron’s ability to deliver the memory that fuels that revolution positions it firmly at the heart of the tech industry’s next growth wave.

Sources: Yahoo Finance; Tech Space 2.0 (TS2.tech)ts2.techts2.tech; Reuters; MarketBeatmarketbeat.commarketbeat.com; Insider Monkeyinsidermonkey.com; Micron Investor Relations.