- Deutsche Börse AG – Germany’s stock exchange operator – runs the Frankfurt Stock Exchange (FWB) and a host of platforms (like Xetra for stocks and Eurex for derivatives) while owning post-trade giant Clearstreamen.wikipedia.orgen.wikipedia.org. Its diversified business spans trading, clearing, settlement, market data and indices.

- Frankfurt Stock Exchange (FWB), founded in 1585, is one of the world’s oldest and Europe’s largest exchanges. Based in Frankfurt’s financial district, it handles ~90% of German equity tradingen.wikipedia.org, listing thousands of securities (shares, ETFs, bonds, funds, etc.) across market segments like Prime Standard (EU-regulated premium market) and Scale (SME-oriented)boerse-frankfurt.deboerse-frankfurt.de. Trading runs on the Xetra electronic platform and via traditional floor brokers, from 8:00–22:00 CET (Xetra’s main session 9:00–17:30)1 .

- Key Indices linked to Frankfurt include the DAX, MDAX, and TecDAX. The DAX tracks 40 top blue-chip companies (expanded from 30 in 2021) listed on FWB’s Prime Standarddeutsche-boerse.com, serving as the chief barometer of Germany’s economy. The MDAX covers the next 50 mid-cap firms, and the TecDAX tracks 30 leading tech-sector stocks. All are reviewed quarterly based on free-float market capitalizationdeutsche-boerse.com and are widely used benchmarks (with index futures and ETFs allowing investors to trade on their performance).

- Financials: As of October 2025, Deutsche Börse AG’s stock trades around €230 per share, valuing the company at roughly €45–46 billion in market capitalizationcompaniesmarketcap.com. The group posted record revenues in 2024 (€5.83 billion) and continues to see secular growth in 2025en.wikipedia.org. Its earnings are fueled by transaction fees, clearing and settlement income, and market data/index licensing. Over 60% of revenue is recurring, providing resiliencedeutsche-boerse.com2 .

- Recent Developments (Oct 2025): Frankfurt’s IPO market is stirring back to life – prosthetics maker Ottobock just debuted on the Prime Standard segmentdeutsche-boerse.com. Deutsche Börse is capitalizing on fintech trends, partnering with Circle to advance euro-based stablecoins in Europedeutsche-boerse.com and launching a service to pipe market data onto blockchains via Chainlinkdeutsche-boerse.com. The group is also exploring strategic moves like a potential IPO of its index subsidiary (STOXX/Qontigo), or alternatively buying out partner General Atlantic’s stakereuters.com. Analysts currently have a Hold stance on Deutsche Börse stock on average, with price targets in the €240–320 rangevalueinvesting.io. The broader outlook is cautiously optimistic – Goldman Sachs predicts European equities could rise ~5% over the next yearts2.tech – but much depends on market volatility and IPO sentiment heading into 2026.

Deutsche Börse AG: Structure, Divisions & Subsidiaries

Deutsche Börse AG is the backbone of Germany’s capital markets infrastructure. Founded in 1992 as a joint-stock company, it has grown into a multinational marketplace organizer for securities trading and related servicesen.wikipedia.org. The group’s structure spans the entire trade lifecycle:

- Trading & Clearing: Deutsche Börse operates trading venues for a variety of asset classes. Its flagship is the Frankfurt Stock Exchange (FWB) – Germany’s principal stock market – which the group fully owns and operatesen.wikipedia.org. Equity trading on FWB is now almost entirely electronic via the Xetra platform, which handles ~90% of German stock trading volumeen.wikipedia.orgen.wikipedia.org. Deutsche Börse also runs Eurex, one of the world’s largest derivatives exchanges, offering futures and options on stock indices (e.g. DAX futures), bonds, and other instruments. Eurex provides both the trading platform and the central counterparty clearing service for these products. In addition, the group controls the European Energy Exchange (EEX), a leading marketplace for power and commodity trading. (Notably, EEX has been expanding its reach – in 2024 it sought to acquire Nasdaq’s Nordic power exchange businessreuters.com.) All trades on Deutsche Börse’s markets are routed through its clearing houses (like Eurex Clearing) which manage counterparty risk.

- Post-Trading (Settlement & Custody): Through Clearstream, Deutsche Börse performs the critical “plumbing” of financial markets. Clearstream, based in Luxembourg and Frankfurt, is a central securities depository and clearing house that settles trades and safely custodies securities for investorsen.wikipedia.orgen.wikipedia.org. It handles the settlement of stock and bond trades and holds trillions of euros in assets for banks and institutional clients. This segment earns fees for each transaction settled and for assets under custody, as well as interest income on cash deposits (treasury activities). Clearstream is a key profit engine for the group, benefiting from scale and recurring revenues in post-trade services.

- Indices & Market Data: Deutsche Börse’s Qontigo subsidiary (created in 2019) houses its index and analytics business. Qontigo includes STOXX Ltd., the index provider behind the DAX, EuroStoxx 50, and many other benchmarks. It also offers analytical tools (via the Axioma platform) for portfolio risk management. The group earns licensing fees from index-linked products worldwide – for example, ETFs and futures that track the DAX or STOXX indices pay royalties. (Deutsche Börse has been considering an IPO of this index unit ISS STOXX to unlock value, or alternatively buying out minority investor General Atlantic’s stakereuters.com.) Market data is another revenue stream: the group sells real-time price feeds and historical data to financial firms. In October 2025, Deutsche Börse’s Market Data + Services division announced an innovative partnership with Chainlink to deliver trusted market price data to blockchain smart contracts, aiming to serve the growing decentralized finance sector3 .

- New Ventures & Tech: Deutsche Börse has shown an appetite for fintech and growth acquisitions. In 2023 it acquired a majority of SimCorp, a Danish provider of investment management software, bolstering its “Software Solutions” arm. It also has a venture capital arm (DB1 Ventures) and investments in digital asset infrastructure – for example, it owns a stake in Crypto Finance AG (a Swiss crypto custody and brokerage firm) and has a digital assets exchange joint venture. These moves reflect a strategy to diversify beyond traditional exchange operations, tapping into the fintech and digital asset boom.

- Financial Performance: The group’s income is well-diversified across these divisions. In 2024, Deutsche Börse AG generated net revenue of €5.83 billionen.wikipedia.org, split across trading (cash equities, derivatives, energy), clearing/post-trade (Clearstream’s settlement and custody fees, which also include banking-style net interest income), and data/indices. Over 60% of revenues are “sticky” recurring streamsdeutsche-boerse.comdeutsche-boerse.com – e.g. custody fees, software subscriptions, index licensing – which helped the company increase turnover and profits even during volatile periods like the 2020 pandemic. This resilience and diverse model have made Deutsche Börse one of Europe’s top exchange groups (third-largest by market cap after Euronext and LSE)en.wikipedia.org. The company is a constituent of its own DAX index (traded under symbol DB1 on Xetra) and has rewarded shareholders with both stock price appreciation and rising dividends (most recently €4.00 per share, ~1.7% yield as of Oct 2025)4 .

- Leadership and Strategy: Theodor Weimer has served as CEO since 2018, overseeing a growth strategy dubbed “Compass 2023” focused on organic expansion and acquisitions. (A new CEO, Stephan Leithner, is slated to take the helm in 2025 as Weimer’s term endsreuters.com.) The company’s direction emphasizes building a “360° capital markets ecosystem” – connecting issuers, traders, and investors with end-to-end services. Deutsche Börse’s management highlights trends like secular growth in index investing, electronification of trading, and demand for post-trade risk management as tailwinds for its business. “Together with planned growth, our net revenue and profit were slightly above our initial expectations,” noted CFO Gregor Pottmeyer regarding Q1 2025 results, adding that the full-year outlook could be raised if market volatility remains elevatedmarketsmedia.com. In essence, when market activity spikes (e.g. during crises or rallies), Deutsche Börse often benefits from higher trading volumes and clearing balances – a built-in hedge that can make the exchange operator a “safe port” in turbulent markets.

Frankfurt Stock Exchange (FWB): History, Market Structure & Trading Platforms

The Frankfurt Stock Exchange – Frankfurter Wertpapierbörse (FWB) – is the crown jewel of Deutsche Börse Group and the epicenter of German equity trading. It traces its origins back to 16th-century trade fairs and has operated as a formal exchange since 1585, making it one of the oldest in the worlden.wikipedia.org. Today, FWB is ranked among the top global exchanges by market capitalization of listed companies (around $2.4 trillion as of 2023)en.wikipedia.orgen.wikipedia.org. It is Europe’s third-largest stock market after Euronext (which includes Paris) and the London Stock Exchange5 .

Role in Europe: Frankfurt has long been Germany’s financial hub, and FWB serves as the primary venue for German companies to raise capital. It lists heavyweight multinational corporations (the likes of Siemens, SAP, Volkswagen, and Deutsche Bank) as well as mid-sized and emerging firms. Given Germany’s export-driven economy, many FWB-listed firms are global leaders in manufacturing, chemicals, autos, and tech. This makes the DAX index (comprising the top 40 FWB-listed companies) a closely watched barometer for European marketsen.wikipedia.org. The exchange’s health often reflects broader economic trends: for instance, in 2025 the DAX index climbed to all-time highs near 24,000 (on a total-return basis) amid a broader European stock rallyts2.tech. Frankfurt is also a gateway for international investors to access continental Europe – roughly 200 trading member firms from 16 countries (plus Hong Kong and UAE) connect to its Xetra system1 .

Market Segments: The Frankfurt Stock Exchange operates with segmented markets to accommodate different sizes and transparency needs of issuers:

- Regulated Market: This is the official EU-regulated market, overseen by German federal law and EU directives. It has two tiers: General Standard and Prime Standard. General Standard complies with basic EU listing requirements, while Prime Standard imposes extra transparency rules (e.g. quarterly reporting in English, investor days) and is aimed at companies seeking international investors. Only Prime Standard companies are eligible for the flagship indices like DAX, MDAX, TecDAXdeutsche-boerse-cash-market.comdeutsche-boerse.com. The Prime Standard is considered one of Europe’s strictest listing segments, ensuring a high level of disclosure and corporate governancedeutsche-boerse-cash-market.com. Most blue-chips and large mid-caps are listed here.

- Open Market (Freiverkehr): This is an exchange-regulated market with lighter requirements, used for smaller companies and secondary listings. Within the Open Market, Scale is a dedicated segment for small-to-medium enterprises (SMEs) that meet certain criteria (like having a Deutsche Börse-approved Capital Market Partner sponsor). Scale companies agree to somewhat higher transparency than the basic Open Market, but far less than Prime Standard. Many startups and growth companies choose Scale as a stepping stone to the main marketboerse-frankfurt.deboerse-frankfurt.de. Other Open Market listings fall into the Basic Board (formerly “Quotation Board”), which includes international companies, unsponsored ADRs, etc., and carries minimal reporting obligations. It’s worth noting that Open Market securities are not eligible for the main indices and are typically considered higher risk.

This multi-tier structure gives companies flexibility – for instance, a firm can list on the entry-level Scale segment to access capital with lower costs, then graduate to Prime Standard once it grows. Investors, in turn, get clarity on the regulatory environment governing each stock. As Deutsche Börse explains, segments are designed to ensure appropriate transparency: “Companies in the Regulated Market meet the highest European transparency requirements… The Open Market with Scale provides easier access for SMEs, with lower entry hurdles”boerse-frankfurt.de6 .

Trading Platforms – Xetra and the Trading Floor: Unifying this market structure is a dual system of trading venues:

- Xetra: Launched in 1997, Xetra is Frankfurt’s all-electronic order-driven trading platform. It is the primary venue for continuous trading of equities, exchange-traded funds (ETFs), ETNs, ETCs, and some bonds. Over 90% of all stock trades in Germany are executed via Xetra’s ultra-fast matching engineen.wikipedia.orgen.wikipedia.org. Traders worldwide can connect to Xetra; buy and sell orders are matched by price-time priority, with market makers ensuring liquidity for less-traded stocks. Xetra runs daily from 9:00 AM to 5:30 PM CET for its main session, and its pricing is the reference for German stocks – e.g., the DAX index is calculated based on Xetra pricesen.wikipedia.org. Because of Xetra’s efficiency and liquidity, the traditional “floor” is no longer the main avenue for trades (as of 2015, floor trades accounted for under 10% of volume). Xetra has effectively made Frankfurt a virtual exchange accessible globally; participants include banks, brokers, and high-frequency trading firms across Europe, the US, and Asia. The platform also underpins other exchanges – Vienna, Dublin, and others have at times used Xetra technology for their local markets.

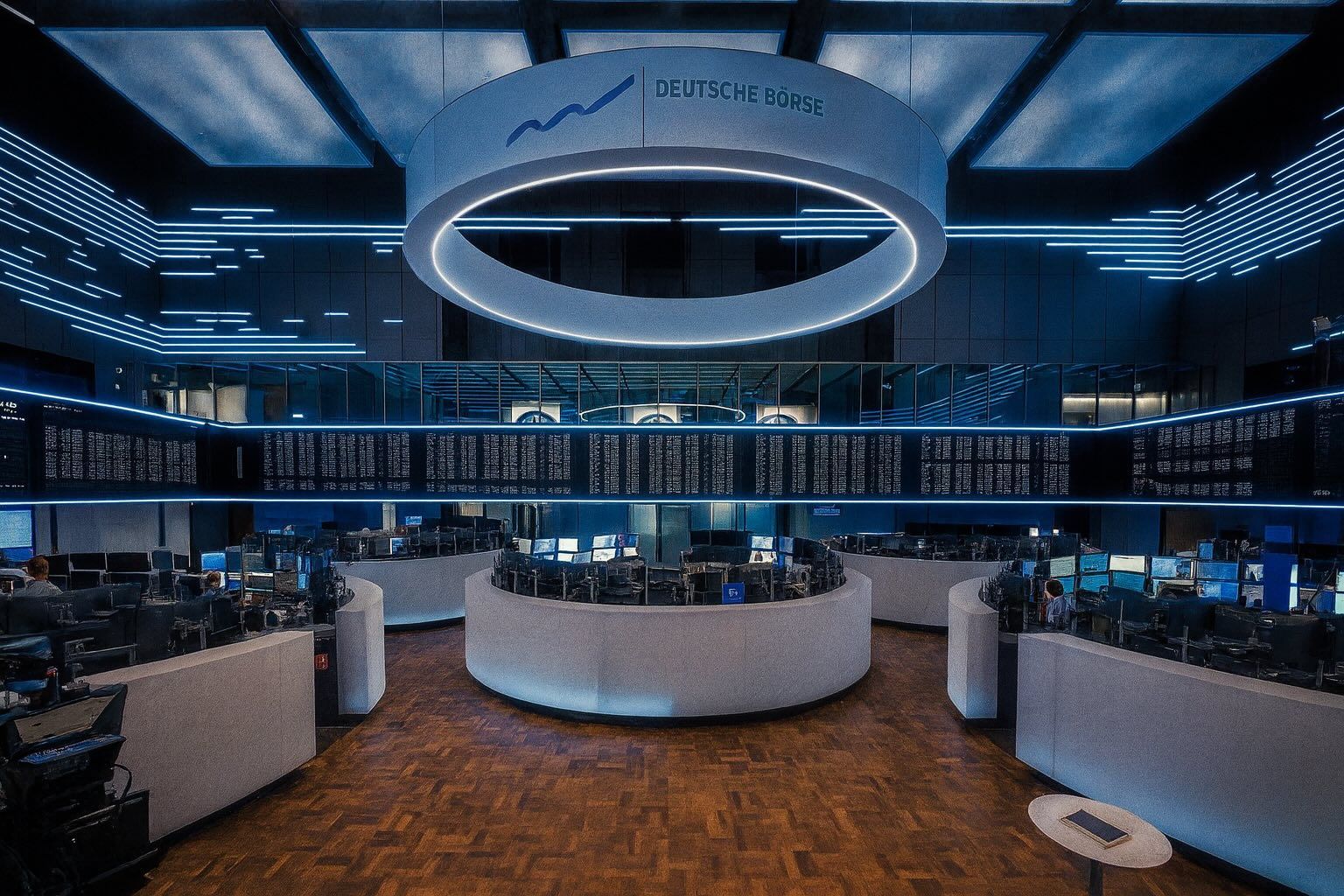

- Börse Frankfurt (Floor Trading): Despite the dominance of Xetra, Frankfurt retains a physical trading floor located at the historic Börsenplatz exchange building. This is operated under the venue name “Börse Frankfurt” (as opposed to Xetra). Floor trading is mainly geared toward retail investors and certain structured products. It employs human specialists (Skontrofuehrer) who oversee order books for less-liquid securities, ensuring orderly price fixing. The floor offers continuous trading from 8:00 AM to 8:00 PM CET for many securities, and even until 10:00 PM for some (notably, structured products and bonds)en.wikipedia.org. While its market share is small for blue-chip stocks, the floor remains important for secondary listings, bond trading, and certificates/warrants that benefit from market specialist attention. It also serves a symbolic and educational role – the iconic bull and bear statues outside, and the media broadcasts from the trading hall, underscore Frankfurt’s image as a financial center. In essence, Xetra is where most of the action is, but the floor market complements it by catering to niche instruments and investors who prefer or require human-intermediated trading.

Types of Securities: The Frankfurt Stock Exchange lists a wide array of securities:

- Equities: Shares of German and international companies (the latter often via dual listings). Nearly all large German firms are listed in Frankfurt, and many foreign companies choose Frankfurt’s Open Market to reach European investors.

- Exchange-Traded Funds (ETFs) and ETPs: Frankfurt is a major European ETF trading hub with over 2,500 ETFs plus hundreds of ETCs (commodity ETFs) and ETNs listeddeutsche-boerse-cash-market.comcompaniesmarketcap.com. These track indices, commodities, and strategies, and most trade on Xetra for high liquidity.

- Bonds: A variety of corporate and government bonds trade on FWB, though bond trading has traditionally been less centralized (often OTC). Still, Deutsche Börse lists Eurobonds, German government bonds (Bunds), etc., and in 2023 it partnered with other European depositories to start digitizing the Eurobond market via DLTdeutsche-boerse.com7 .

- Funds and REITs: Investment funds and real estate investment trusts can be listed on the exchange, providing an alternative to direct mutual fund subscriptions.

- Structured Products: Frankfurt is one of the world’s largest markets for structured certificates and warrants (“Zertifikate”). Börse Frankfurt Zertifikate AG, a subsidiary, oversees listing of tens of thousands of these leveraged or capital-protected products for retail investors.

- Derivatives: While derivative contracts (options, futures) are primarily traded on Eurex (a separate exchange under Deutsche Börse), the FWB floor hosts trading of some niche derivatives and helps facilitate retail access to warrants, etc. There’s a clear separation: standardized futures and options = Eurex; tailored warrants and certificates = FWB/Cert-X.

Market Surveillance and Regulation: Trading in Frankfurt is subject to robust oversight to ensure fairness. Exchange Supervisors (Hessian state exchange authority and an independent Trading Surveillance Office) monitor trading in real time for anomaliesen.wikipedia.org. Mechanisms like volatility interruptions are in place on Xetra to pause trading if a stock’s price moves too sharply, giving the market time to absorb informationen.wikipedia.org. Germany’s federal regulator BaFin also keeps an eye on market integrity and insider trading for Frankfurt-listed stocks. These layers of control have contributed to Frankfurt’s reputation as a stable and well-regulated marketplace.

Historical Milestones: Frankfurt’s exchange has reinvented itself many times over centuries. Key moments include the launch of the DAX index in 1988, which brought international prominence; the 1997 switch from traditional open-outcry to Xetra electronic trading, massively increasing efficiency; and the merger attempts in the 2000s (Deutsche Börse unsuccessfully tried to merge with London Stock Exchange and later Euronext). In recent years, Frankfurt benefited from the European trend toward exchange consolidation and “Capital Markets Union” efforts. For example, in 2023 Deutsche Börse joined forces with other EU exchanges to create EuroCTP, a unified tape of trading data across Europeen.wikipedia.org – a project aimed at making European markets more transparent and integrated by late 2027. This illustrates how Frankfurt, while deeply rooted in Germany’s economy, is very much involved in the pan-European market structure.

The DAX, MDAX, TecDAX: Indices that Define the Market

No discussion of Frankfurt would be complete without its stock indices, which are both barometers of market performance and tradeable assets in their own right. Deutsche Börse’s Qontigo unit manages a family of indices, but the flagships are:

- DAX 40: The DAX (Deutscher Aktienindex) is the blue-chip index tracking 40 of the largest and most liquid companies on the Frankfurt Stock Exchange’s Prime Standardboerse-frankfurt.de. As of 2021, it was expanded from 30 to 40 members to broaden sector representation (adding companies like Airbus, Siemens Healthineers, etc.)deutsche-boerse.com. To be included, companies must meet strict criteria: top-ranking by free-float market cap, sustained trading volume, and compliance with financial reporting rules (a reform after the 2020 Wirecard scandal tightened profitability requirements too). The DAX is a performance index, meaning it assumes reinvestment of dividends – one reason it’s scaled around 16,000–24,000 points in 2025 (higher than price-index equivalents). It’s often seen as a proxy for the German economy, with constituents spanning industries from autos (Mercedes, BMW) to pharma (Bayer), tech (SAP, Infineon), financials (Allianz, Deutsche Bank), and industrials (Siemens, BASF). Fund managers globally track the DAX; billions of euros are in DAX-based index funds and the Eurex DAX futures are among the most actively traded equity derivatives in Europe. When the DAX hits a record (as it did in 2021 and again in 2025), it makes headlines as a sign of market optimism.

- MDAX: The MDAX is the mid-cap index, containing the next tier of companies below the DAX. Currently it has 50 components (down from 60 pre-2021)deutsche-boerse.com. These are substantial businesses – often industry leaders in specialized fields – but just not large enough for DAX. Examples include companies like Airbus (which moved from MDAX to DAX), or those like Heidelberg Materials, Puma, or Carl Zeiss Meditec, depending on the latest reshuffle. The MDAX tends to be more domestically focused and slightly more volatile. Still, it’s closely watched as the benchmark for German Mittelstand stocks (midsize innovators). It often outperforms DAX in growth periods, given the smaller companies’ higher growth rates, but can underperform in downturns due to liquidity factors. MDAX is reviewed quarterly alongside DAX; changes occur via fast-entry/exit rules or regular assessmentsdeutsche-boerse.com. Like the DAX, it’s a performance index and has its own derivatives and ETFs.

- TecDAX: This index tracks 30 leading technology-sector stocks on the FWB, encompassing areas like software, biotech, renewable energy, and electronics. Notably, a company can be in both DAX/MDAX and TecDAX if it’s a tech firm – for instance, a DAX member like SAP or Siemens Healthineers can also appear in TecDAX. The TecDAX was introduced in 2003 (succeeding the Neuer Markt’s index after the dot-com crash) to highlight Germany’s tech champions. It includes names such as Infineon Technologies (semiconductors), SAP (enterprise software), Sartorius (biotech equipment), and various healthcare tech and IT firms. Given its composition, TecDAX is considered a growth index and is popular among investors seeking exposure to European tech without U.S. giants. Its performance can diverge significantly from DAX – for instance, in a year where industrials slump but software soars, TecDAX could strongly outperform. It’s also used as a gauge of investor appetite for innovation-driven companies in Germany.

In addition to these, Deutsche Börse also maintains the SDAX (70 small-caps), HDAX (DAX+MDAX+TecDAX combined), and sectoral indices, but those go beyond our scope. The key point is that DAX, MDAX, and TecDAX are selection indices based exclusively on Frankfurt-listed companies in the Prime Standarddeutsche-boerse-cash-market.comdeutsche-boerse.com. They are integral to investment strategies: many funds are benchmarked against them, and passive index-tracking funds replicate them. Changes in index composition – say a company gets promoted from MDAX to DAX or demoted – can cause significant stock price moves due to index fund rebalancing. Deutsche Börse provides transparent rules for these indices and has a dedicated Index Committee that consults on methodology. As the exchange operator, Deutsche Börse has a commercial interest here too: index licensing contributed to its revenues, and the indices bolster Frankfurt’s prominence (the DAX in particular is part of the global lexicon, often mentioned alongside the Dow Jones or FTSE).

Using the Indices: Beyond measuring performance, these indices are actively traded instruments. For example, the DAX Futures and options on Eurex allow investors to speculate or hedge on the German market’s direction in one trade. The DAX ETFs listed on FWB (like the iShares Core DAX UCITS ETF) let retail investors buy the “whole market”. Similarly, MDAX and TecDAX futures and ETFs exist. Thus, the indices create a virtuous cycle: they reflect market health and drive trading activity, which in turn benefits the exchange (through trading and clearing fees). During 2025, with European stocks climbing, DAX futures volumes were robust and the indices reached new peaks in tandem with the STOXX 600’s record highs8 .

In summary, the DAX, MDAX, and TecDAX serve as pulse indicators for Frankfurt’s market and the German economy at large. They encapsulate how the Frankfurt exchange connects investors to the fortunes of Germany’s corporate sector. A strong DAX often signals global confidence in Europe’s largest economy, whereas a swoon can send alarms well beyond Germany’s borders. Deutsche Börse’s stewardship of these indices (via its STOXX unit) ensures they evolve with the market – such as the 2021 reforms that increased DAX membership and tightened eligibility – keeping them relevant and investable.

Recent News and Developments (October 2025)

The past week (early October 2025) has brought several noteworthy developments for Deutsche Börse and the Frankfurt exchange:

- Prime Standard Revival – Ottobock IPO: Frankfurt’s primary market saw a high-profile newcomer as Ottobock SE & Co. KGaA got listed in the Prime Standard on October 9, 2025deutsche-boerse.com. Ottobock, a global leader in prosthetic limbs and mobility solutions, had been rumored for an IPO for much of the yearreuters.com. Its listing is significant not only as a sizable med-tech addition to the exchange, but also as a signal that the IPO window in Europe may be reopening. Earlier in 2025, geopolitical risks and valuation hurdles caused several German IPO candidates (e.g. Brainlab, Autodoc) to postpone offeringsreuters.comreuters.com. The successful float of Ottobock suggests improved sentiment. Equity capital markets bankers are cautiously optimistic that post-summer market calm and continued fund inflows to European stocks will “open the IPO gates” going forwardreuters.com. Indeed, Ottobock’s IPO is one of a few anticipated deals (others rumored include a relaunch of pharma firm Stada’s IPO attempt) that could build momentum into 2026reuters.com. For Deutsche Börse, more IPOs mean increased listing fees and trading volume – a welcome boost after a lean period for new listings. The exchange has also been active in courting tech startups through its Scale segment, so a marquee tech-related listing like Ottobock (which blends healthcare and high-tech engineering) is a reputational win.

- Collaboration with Circle on Stablecoins: In a bid to embrace the fast-growing digital assets space, Deutsche Börse announced a partnership with Circle Internet Financial (issuer of the USDC stablecoin) on Sept 30, 2025deutsche-boerse.com. The collaboration aims to “advance stablecoin adoption in Europe”, specifically exploring infrastructure for a euro-denominated stablecoin and leveraging Deutsche Börse’s regulated market expertisedeutsche-boerse.com. This is a notable development at the intersection of traditional and crypto finance. Circle’s USDC (USD Coin) is one of the largest stablecoins, and a potential “e-euro coin” could facilitate faster settlement in trading and post-trade processes. By aligning with Circle, Deutsche Börse positions itself as a forward-looking player in digital currencies while ensuring any such stablecoin would meet high regulatory and transparency standards. It’s also likely no coincidence that Clearstream has been experimenting with digital ledger technology for settlement – a stablecoin tie-in could complement those efforts (for example, using tokenized cash for atomic settlement of securities). This partnership underscores a recognition that tokenization and cryptoassets are increasingly part of capital markets. As a Deutsche Börse executive described in the release, the goal is to “bridge traditional finance and Web3” by using Circle’s innovations on a regulated market infrastructure3 .

- Market Data via Blockchain (Chainlink partnership): Another crypto-related initiative: On October 1, 2025, Deutsche Börse’s Market Data + Services unit launched a service to provide market data to smart contracts using the Chainlink oracle networkdeutsche-boerse.com. Chainlink is a decentralized network that feeds real-world data into blockchain applications. Through this tie-up, Deutsche Börse will feed trusted price data (e.g. stock indices, interest rates) to blockchain developers who can use it for decentralized finance (DeFi) productsdeutsche-boerse.com. This move effectively monetizes the group’s market data in a new arena – every time a DeFi application calls Deutsche Börse’s data via Chainlink, the exchange could earn fees. It also boosts security for DeFi platforms that currently rely on less regulated data sources. The press release highlighted that reliable market data is crucial for on-chain finance, and Deutsche Börse aims to be the go-to sourcedeutsche-boerse.com. This development shows the exchange’s strategy of embracing innovation rather than seeing crypto as competition. By inserting itself as a data provider to the crypto ecosystem, Deutsche Börse both safeguards the accuracy of financial data used in DeFi and opens a new revenue stream.

- Index Business Moves – Possible STOXX IPO: As mentioned, Deutsche Börse confirmed it is evaluating an IPO for its index services arm, ISS STOXX/Qontigo, as one option to unlock valuereuters.com. STOXX (which manages the DAX, STOXX 50, etc.) is partly owned by private equity firm General Atlantic (GA) since Qontigo’s creation. The Reuters report in July 2025 noted that Deutsche Börse could instead choose to buy out GA’s stake if it foregoes an IPOreuters.com. This deliberation comes amid a broader trend of exchanges monetizing their data/index units (for example, London Stock Exchange’s FTSE Russell or S&P’s Dow Jones Indices have fetched high valuations). An IPO of Qontigo could highlight its fast-growing analytics business, especially as ESG and custom indices gain traction. However, it would also mean giving up full ownership of a strategic asset. No decision is made yet, but investors are watching closely – such a move could raise capital for Deutsche Börse to fund other acquisitions or shareholder returns. In any case, it underscores how valuable the index business has become within the group (some analysts estimate it contributes disproportionately to profit margins due to its license fee model).

- Volume and Trading Updates: Operational metrics released in early October show mixed trends. Eurex (derivatives) trading volumes for September 2025 were published on Oct 6deutsche-boerse.com: the report highlighted equity index derivatives volumes remained strong while interest rate derivatives were somewhat lighter amid uncertain rate outlook. On the cash market, Xetra trading volumes in September 2025 (released Oct 1) indicated a slight decline vs a year agodeutsche-boerse.com, as 2024 had seen unusually high volatility from central bank moves. Even so, trading activity in Q3 2025 overall was healthy, with particularly heavy turnover on days when the DAX hit new highs. Another bright spot is Eurex Repo and Clearstream’s collateral management businesses, which saw increased demand as banks adjust to regulatory liquidity needs (this is evidenced by Clearstream’s rising custody assets and the recent Clearstream-Euroclear collaboration to digitize Eurobonds3 ).

- Leadership & Governance: On September 19, 2025, Deutsche Börse’s Supervisory Board extended the contract of Thomas Book on the Executive Boarddeutsche-boerse.com. Book heads the Trading & Clearing division (including Eurex and Xetra) and is seen as a key architect of the group’s derivatives and clearing strategy. His renewal was viewed positively by the market, ensuring continuity in a core segment of the business. This stability at the top comes as Deutsche Börse transitions to new CEO leadership in 2025/26, and signals confidence in the current strategic course. Additionally, Deutsche Börse has been active in share buybacks through 2025 (retiring some shares to return capital to investors) – its investor relations reports show buyback tranches executed at average prices around €250deutsche-boerse.com, which management presumably sees as an attractive use of excess cash given the strong balance sheet.

- Market Sentiment: Deutsche Börse’s stock (ticker: DB1) has been a solid performer in 2025, up about +15% year-to-date as of Octobercompaniesmarketcap.com. It benefited from the general equity rally and the prospect of higher interest income at Clearstream (thanks to rising interest rates boosting treasury income). However, in the past month or two the stock traded sideways in the €220s, reflecting some profit-taking and uncertainty about the pace of trading activity normalization. The current analyst consensus is mixed – out of ~24 analysts, the majority rate it Hold, citing that much of the “exchange defensive premium” is already priced invalueinvesting.io. Price targets range widely (some bullish analysts see over €300 if Deutsche Börse executes more M&A or if volatility surges, while bearish views around €240 question how much incremental growth is left in a more stable-volumes environment)valueinvesting.io. From a market perspective, exchanges like Deutsche Börse are often seen as defensive stocks – they have high margins and benefit from market volatility (more trading = more fees) yet are not heavily cyclical in the traditional sense. In 2025, with global markets relatively buoyant, Deutsche Börse hasn’t had the spikes in trading that, say, 2020 did; but it has a steady upwards trajectory. “Markets appear to be shrugging off” recent risks like U.S. shutdown fears, noted one analyst, pointing to resilient trading volumests2.tech. If that confidence holds, Deutsche Börse could see a strong finish to the year, especially with a pivotal Q3 earnings report due on Oct 28, 2025 (the company will host an investor call thendeutsche-boerse.com). Any commentary on trading trends in October and the pipeline of listings will be closely watched.

- Broader Outlook for Frankfurt: The Frankfurt Stock Exchange itself stands at an interesting juncture. The DAX 40 is near record highs, recently closing above 15,800 in price terms (around 23,700 in performance terms)ts2.tech. Macroeconomic clouds – inflation, energy prices, geopolitics – have not derailed European equities; in fact, Europe’s STOXX 600 index hit a record in October 2025reuters.com. This positive backdrop bodes well for FWB: higher equity valuations encourage more trading and issuance. On the other hand, a concern is that German mid-caps have lagged; the MDAX’s performance has been more modest, suggesting investors remain selective. The outlook for 2026 will hinge on global factors (interest rate trajectories, China’s economy, etc.) and local ones (Germany narrowly avoided recession in 2024–25, but growth is slow). Nonetheless, market experts see structural strength: “The big picture for European IPOs – positive fund inflows and calmer volatility – looks good,” one investment banker told Reutersreuters.com. If that holds, Frankfurt could see a resurgence of listings (including tech and startup listings via the Scale segment) and further growth in its role as continental Europe’s financial hub – especially post-Brexit, with some trading activity having shifted from London to EU venues like Frankfurt.

In summary, Deutsche Börse AG and the Frankfurt Stock Exchange enter late 2025 on a strong footing. The exchange group is innovating (in digital assets and data), expanding (with new listings and services), and remains a linchpin of European capital markets. Its stock is trading near all-time highs, reflecting investor confidence in its stable revenues and growth initiatives. Challenges exist – competition from other global exchanges, the need to keep up in the fintech race, and reliance on healthy market activity – but Deutsche Börse’s diversified model and Frankfurt’s central status give it a resilient edge. As expert observers often point out, when volatility or opportunity strikes, the exchange wins either way: volumes spike during market turmoil and during bull runs. Little wonder then that many view Deutsche Börse as not just an exchange operator, but as a bellwether for the financial climate in Europe. If the DAX is soaring and new companies dare to IPO, it’s a fair bet Deutsche Börse is thriving – and right now, both seem to be the case.

Sources:

- Deutsche Börse AG – Company profile and key financialsen.wikipedia.org9

- Frankfurt Stock Exchange history and operations (Wikipedia)en.wikipedia.org1

- Deutsche Börse market segments and trading structureboerse-frankfurt.de6

- Deutsche Börse press releases (Sep–Oct 2025) – new listings and digital initiativesdeutsche-boerse.com3

- Reuters news – European IPO market and Deutsche Börse index unit plansreuters.com10

- Markets media / company reports – Deutsche Börse earnings and outlook commentarymarketsmedia.com11

- TS2.Tech market analysis – context on index performance and investor sentimentts2.tech12