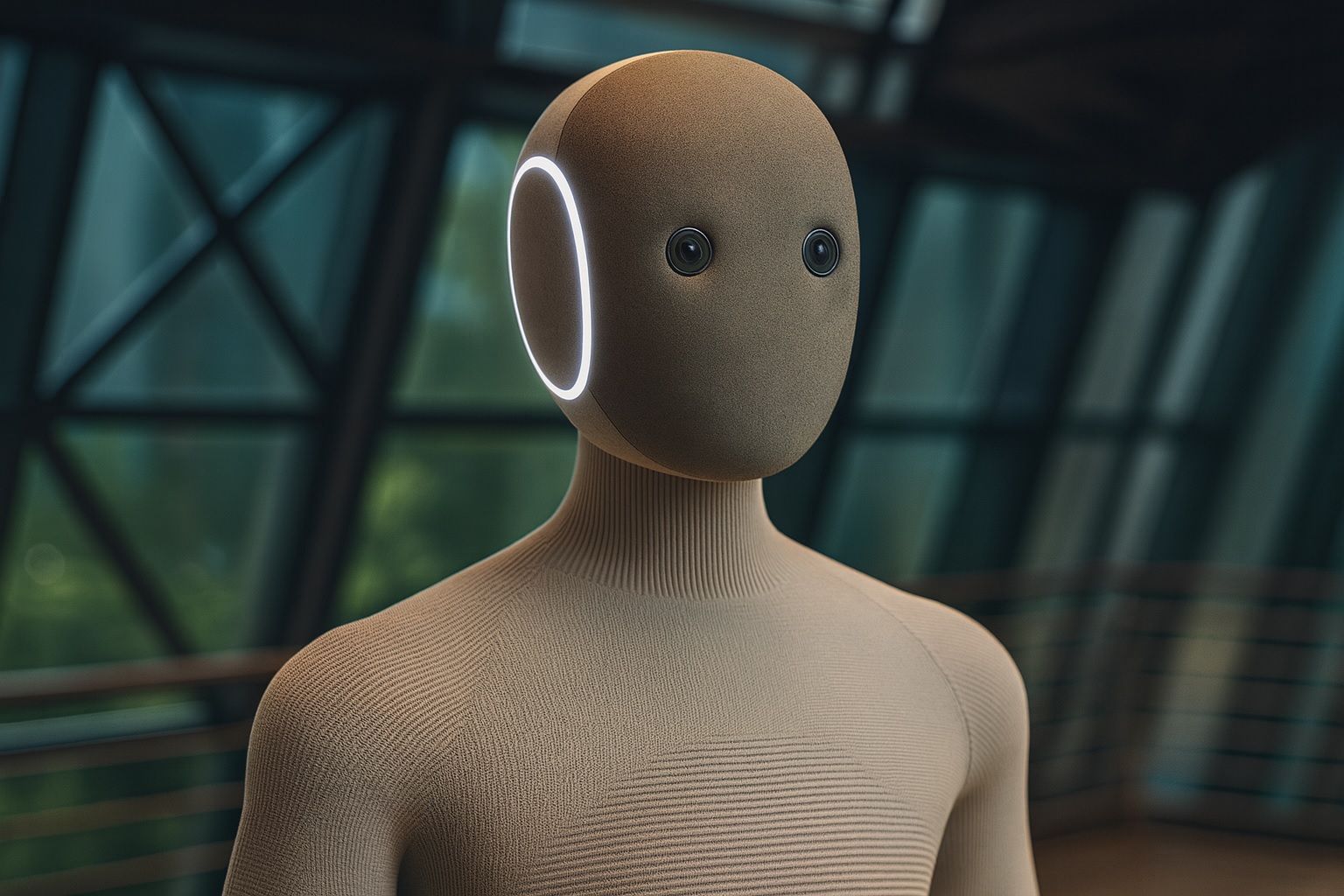

- 1X Technologies has opened pre-orders for Neo, a 5′6″ humanoid home assistant robot touted as “the world’s first consumer-ready humanoid” ts2.tech. Neo will ship to early US customers in 2026 (with broader availability in 2027) and costs $20,000 upfront (or $499/month on subscription) ts2.tech 1 .

- Task list: Neo can do basic chores – it can fold laundry, carry groceries, fetch items, toggle lights and even greet visitors ts2.tech indianexpress.com. It has 22-degree-of-freedom arms and hands, can lift over 150 lbs, and operates quietly (just 22 dB of noise, quieter than a refrigerator) indianexpress.com. Onboard AI – including a built-in large-language model – gives Neo voice and visual recognition so it can chat with you, recognize faces/voices, suggest recipes from kitchen ingredients, and remember past conversations for personalized assistance ts2.tech indianexpress.com. Neo even has speakers embedded in its chest and pelvis, essentially making it a moving smart speaker that can play music or podcasts at home 2 .

- Human in the loop: Crucially, Neo’s autonomy is still limited. If Neo encounters a task it hasn’t learned, the owner can summon a remote “1X Expert” – a real person at 1X – to teleoperate the robot and show it how to do the job ts2.tech. In other words, Neo’s first outings may feel more like a remote-controlled helper than an independent robot. As one observer quipped, 1X’s tech is effectively “part human” right now, since remote operators can control the robot “as if it were a marionette” fastcompany.com. Early demos bear this out: Wall Street Journal reporter Joanna Stern found Neo could walk and carry objects, but tasks like grabbing a bottle from a fridge required a mix of autonomy and human control 3 .

- Backers and hype: 1X (founded by former Halodi Robotics engineers) is backed by heavy hitters. OpenAI led a $23.5 M Series A in 2023 and Samsung’s fund joined a $100 M round in 2024 ts2.tech fastcompany.com. Nvidia has a strategic alliance (CEO Jensen Huang even accepted a custom jacket from Neo onstage), and other tech giants – from Tesla to Amazon – are plowing money into humanoid R&D ts2.tech fastcompany.com. Investors have poured $3.2 B into humanoid startups in 2025 alone ts2.tech, and rivals have commanded stratospheric valuations (for example, Figure AI’s latest funding implied a ~$39 B valuation ts2.tech). Wall Street analysts have likewise become bullish: Goldman Sachs projects a ~$38 B market by 2035, and a Morgan Stanley report even envisages as much as $5 trillion in humanoid robot revenues by 2050 (with over a billion units worldwide) ts2.tech 4 .

- Experts’ reality check: Not everyone is convinced these robots are just around the corner. UC Berkeley robotics professor Ken Goldberg cautions that claims of a robot revolution are still hype: “robots are advancing quickly, but not that quickly,” he says. He emphasizes that dexterous tasks – like picking up a wine glass or changing a lightbulb – remain unsolved for machines news.berkeley.edu news.berkeley.edu. Goldberg warns Neo-level assistants won’t be ubiquitous “in the next two years, or five years or even 10 years,” and he urges resetting expectations so we don’t create a speculative bubble news.berkeley.edu news.berkeley.edu. Similarly, seasoned industry insiders note that today’s home robots are essentially “beta testing” the long journey to fully autonomous helpers ts2.tech 5 .

- Stock and market impact: The humanoid buzz has rippled through the markets. Chipmaker Nvidia (NVDA) – which supplies AI processors to robotics firms – jumped roughly 5% on Oct 28 after CEO Huang’s positive keynote, reflecting investor enthusiasm for AI/robotics applications barchart.com. NVDA stock closed around $201 on Oct 28 and has an average analyst price target near $227 marketbeat.com marketbeat.com. Meanwhile, Tesla (NASDAQ: TSLA) – whose Optimus robot is a famous competitor – is trading around $460 per share marketbeat.com. Analysts’ forecasts for Tesla are mixed (targets range from about $247 to $520) marketbeat.com, but the prospect of major robot revenues (Musk has hinted Tesla could one day earn most of its value from robots, not cars) keeps investors watching. In general, the surge of funding and high-profile demos suggests a booming market: some analysts now predict hundreds of billions in service-robot revenues within a decade ts2.tech 6 .

With its launch on Oct 28, Neo has become a symbol of both promise and reality in home robotics. It embodies the cutting edge of AI and mechanical engineering – and a hint of sci-fi-level convenience – but it also underscores how far we have to go. As 1X’s CEO and robotics experts alike note, Neo will improve over time through data and software updates, but for now early adopters are effectively helping to train the robot. In the words of one expert, Neo is a “bold glimpse of our robot-assisted future” – exciting, but not yet the household Rosie the Robot we’ve imagined ts2.tech fastcompany.com.

Sources: Recent reports from TechStock²/ts2.tech ts2.tech ts2.tech, Fast Company fastcompany.com fastcompany.com, the Indian Express indianexpress.com indianexpress.com and other tech media have covered Neo’s debut and specs. Market data are from financial news outlets marketbeat.com barchart.com. Robotics experts including UC Berkeley’s Ken Goldberg were interviewed by Berkeley News news.berkeley.edu. All facts and quotes are cited above.