- Bloomberg today recaps why Nvidia’s Hopper and Blackwell GPUs still dominate the AI datacenter—and asks how long that lead can last. 1

- White House: “Not…interested in selling [Nvidia’s] Blackwell” to China “at this time,” keeping key export curbs in place. 2

- AMD beat Q3 expectations and guided Q4 revenue to ~$9.6B on strong AI demand; data‑center revenue rose to $4.3B. 3

- Super Micro (a major Nvidia server partner) missed estimates on delivery delays but lifted its full‑year outlook, underscoring supply‑chain strain. 4

- Market check (approx. 10:52 UTC): NVDA $198.69 (‑4.0%), AMD $250.05 (‑3.6%), INTC $37.03 (‑6.2%). Nvidia recently became the first $5T company. 5

The state of play: Nvidia’s grip on AI compute

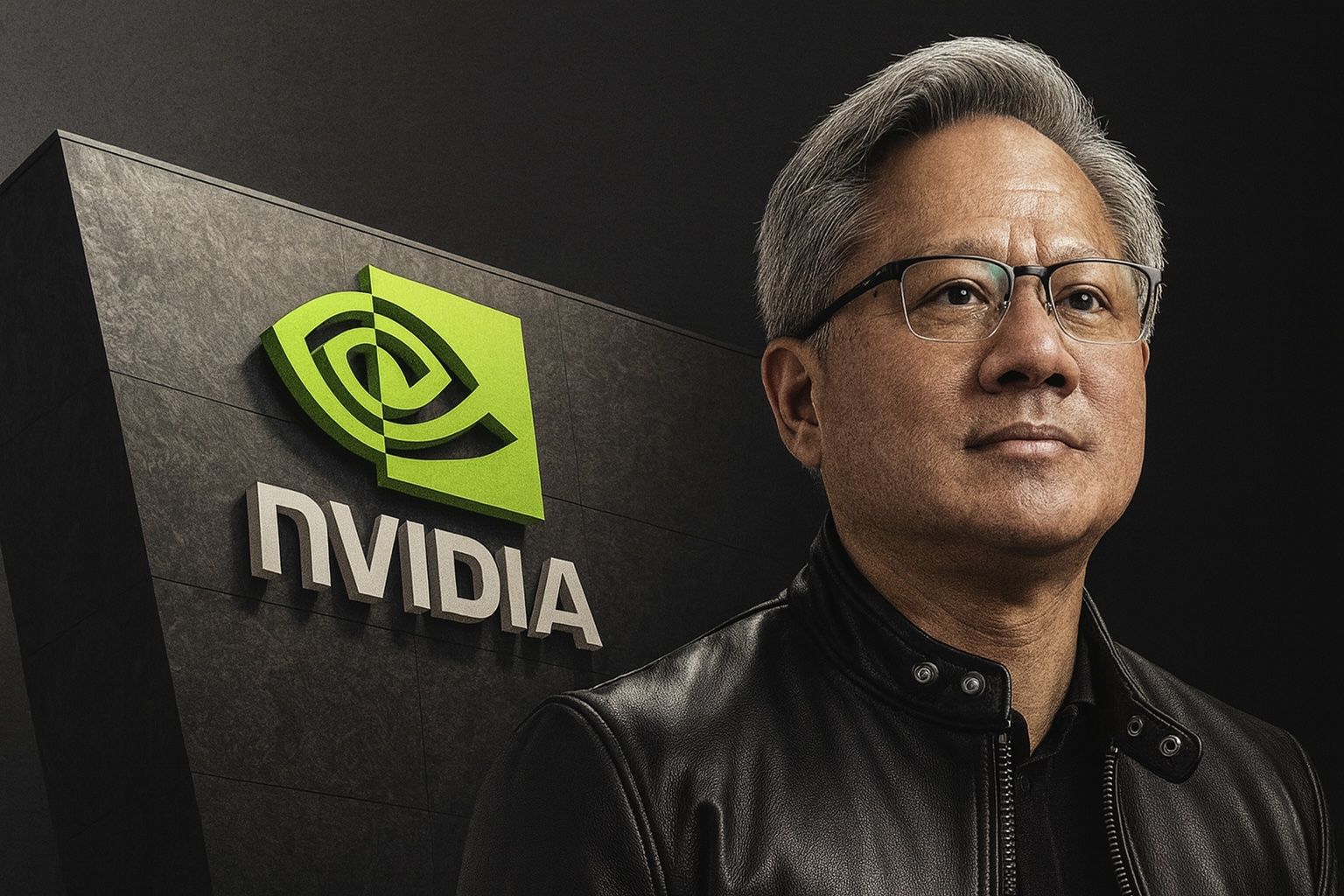

Nvidia’s AI accelerators built on Hopper (H100/H200) and now Blackwell (GB200/B200) remain the default choice for training and serving the largest AI models because they pair raw throughput with a full‑stack advantage—CUDA software, NVLink/NVSwitch interconnects, and networking that plugs into hyperscale data centers. Bloomberg’s explainer today makes the point starkly: investors pushed Nvidia past $5 trillion in late October, and the company is “on course to report more net income this year than its two main rivals will chalk up in sales, combined.” 1

That valuation surge has a geopolitical shadow. On Nov. 4, the White House said it isn’t permitting sales of Nvidia’s most advanced Blackwell chips to China “at this time,” freezing a lucrative market as Washington continues controls on top‑tier AI silicon. President Trump had earlier hinted at a carve‑out but later said the topic did not come up in talks with China’s Xi. 2

Nvidia CEO Jensen Huang struck a pragmatic tone last week in South Korea: the company had hoped for “non‑zero” share in China but is “now expecting zero,” adding it’s “foolish to underestimate Huawei.” 6

Why Nvidia still rules (for now)

- Ecosystem lock‑in. Years of CUDA tooling and libraries keep workloads sticky. Even when rivals ship competitive silicon, software migration is hard and slow. Bloomberg notes Nvidia’s grip across chips, systems and software is the central reason the “AI gold rush is still accelerating.” 1

- Roadmap & supply. Nvidia is ramping Blackwell while preparing Rubin for 2026. Company materials and partner announcements reference Rubin NVL/CPX platforms and a 2026 production window, indicating next‑gen systems are already moving through tape‑out. 7

- Packaging bottlenecks easing—but still a moat. Nvidia and TSMC are shifting advanced packaging from CoWoS‑S to CoWoS‑L for Blackwell, a reminder that supply of the most complex packages remains a strategic choke point. 8

The challengers

AMD: Real traction from MI300 → MI350

AMD’s Q3 print was solid, and the company guided Q4 revenue to ~$9.6B (±$300M), explicitly tied to AI build‑outs. Its data‑center segment rose to $4.3B in the September quarter, helped by Instinct MI300/MI350 deployments; AMD also reaffirmed a push into full AI systems, not just GPUs. “We delivered record quarterly revenue of $9.2 billion,” CFO Jean Hu said. 3

At Computex/GTC‑season events this year, AMD detailed MI350X/MI355X (CDNA 4) with big generational gains—aimed at training and inference and leaning into lower‑precision formats (e.g., FP4/FP6). While vendor claims need independent validation at scale, the cadence shows AMD matching Nvidia’s annual rhythm. 9

What the market is saying: After hours around earnings, AMD shares dipped on mixed margin optics despite the upbeat revenue outlook—“investors are concerned about…valuations that may take time to grow into,” Michael Schulman of Running Point Capital said. 3

Intel: Resetting the playbook around inference

Intel is pivoting from the Gaudi line and now emphasizes an inference‑first GPU, Crescent Island, unveiled at the 2025 OCP Global Summit. It targets air‑cooled enterprise racks with 160GB LPDDR5X, a cost/efficiency play for running trained models; sampling is expected in 2H 2026. It’s a sober strategy that concedes training leadership to Nvidia/AMD while aiming for volume in inference. 10

The rest of the stack: servers & networking

Datacenter integrators matter. Super Micro—a key early mover on Nvidia’s reference designs—missed the quarter on delivery shifts tied to customer‑requested GPU‑rack changes, but raised its annual revenue outlook, suggesting demand remains robust even as execution gets trickier. Dell likewise raised long‑term growth targets on AI server demand. 4

On the wires, Broadcom is pushing new AI networking silicon to chip away at Nvidia’s data‑center network franchise, another area where Nvidia’s platform approach has been sticky. 11

Stocks today—and how Wall Street is framing the next leg

Live snapshot (approx. 10:52 UTC):

- NVDA $198.69 (‑4.0%)

- AMD $250.05 (‑3.6%)

- INTC $37.03 (‑6.2%)

The $5T milestone changed the conversation from if to how long. “Nvidia hitting a $5 trillion market cap is more than a milestone; it’s a statement,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown. UBS and BofA have raised price targets, reflecting that view. 12

Not everyone agrees. In a Nov. 3 opinion on Seeking Alpha, one contributor argued Nvidia is “priced to perfection” and urged caution. As always, consider the source—this is a single author’s view—but it captures mounting debate at these valuations. 13

Near‑term catalysts (next 3–6 months)

- Export policy: The Nov. 4 White House line on Blackwell to China keeps near‑term sales constrained; any change would be material. 2

- Blackwell ramp: Watch shipment cadence, system availability, and customer queue times into early 2026. 1

- AMD MI350 production/benchmarks at scale and software ecosystem momentum (ROCm, framework support). 9

- Intel Crescent Island disclosures and pilot wins as enterprises budget for inference in 2026. 10

- Supply chain: Advanced packaging (CoWoS‑L) capacity and any signs of bottleneck relief or shifts. 8

12‑month outlook & scenarios (not investment advice)

Nvidia (NVDA):

- Base case: Datacenter capex remains elevated into 2026; Blackwell volumes climb; China remains off‑limits for top parts. Platform and software keep retention high. Risks: export policy hardens; power/permitting slows AI‑factory builds; networking competition intensifies; ROI scrutiny from big buyers. 2

- Bull case: Early Rubin milestones hit; packaging tightness eases; incremental government/enterprise orders offset any China gap. 7

- Bear case: Customer digestion lengthens, server partners stumble on deliveries, and rivals close the software gap faster than expected; valuation compresses from today’s extremes. 4

AMD (AMD):

- Base case:MI350 ramps across a broader set of hyperscalers; Q4 guide proves conservative; system sales grow but margins are watched. 3

- Bull case: Multiple marquee wins (cloud and government) and smooth software porting yield share gains in training and inference; CPU attach tailwind in AI servers. 9

- Bear case: Supply prioritization favors Nvidia platforms; software friction persists; pricing pressure erodes the profit story.

Intel (INTC):

- Base case: Focused inference positioning finds a home in enterprise AI refreshes, but meaningful revenue impact is 2026+. Execution on cadence is the KPI. 10

- Bear case: Slippage on Crescent Island or lack of ecosystem pull delays relevance versus GPU incumbents.

Expert voices

- White House spokeswoman Karoline Leavitt (Nov. 4): “As for the most advanced chips, the Blackwell chip, that’s not something we’re interested in selling to China at this time.” 2

- Jensen Huang (Oct. 31): Nvidia had hoped for “non‑zero market share” in China but is now “expecting zero… [it’s] foolish to underestimate Huawei.” 6

- Matt Britzman, Hargreaves Lansdown: “More than a milestone; it’s a statement,” on Nvidia at $5T. 12

- AMD CFO Jean Hu (Q3 PR): “We delivered record quarterly revenue of $9.2 billion, up 36% year‑over‑year.” 14

- Seeking Alpha (Nov. 3): NVDA shares are “priced to perfection,” a contrarian caution at peak optimism. 13

Bottom line

Today’s news cements a familiar theme: Nvidia’s integrated stack and execution keep it in front, even as export curbs carve out China for now. AMD is the most credible near‑term challenger with MI350 momentum and growing systems ambitions; Intel is re‑focusing on inference with a 2026 timeline. For investors, that translates to a market still driven by supply chains, policy, and proof points on time‑to‑train, cost‑to‑serve, and software portability—plus whether end‑customers’ AI projects start throwing off enough cash to justify $5T‑era expectations. 1

Further reading & sources:

Bloomberg’s Nov. 5 explainer on Nvidia’s dominance; Reuters on $5T, export policy, AMD results; Nvidia/AMD/Intel official materials on product roadmaps; and Reuters/Dell/Super Micro updates on the server and supply chain backdrop. 1

This article is for general information only and is not investment advice.