AI-driven growth of hyperscale data centers is driving unprecedented power use – global data-center electricity demand is projected to double by 2030 (reaching ~945 TWh)carbonbrief.org. Cutting-edge AI chips draw up to 1,200 watts each, so new racks can exceed 100 kW, far above historical normsspectrum.ieee.org. This surge is straining grids: U.S. utilities report contracts for 47 GW of new data centers (over Virginia’s entire current load)reuters.com. Environmental impacts include rising carbon and huge water use: data centers now consume ~1% of global powercarbonbrief.org, and large AI sites can use millions of gallons of water per day for coolingeesi.org. In response, industry is racing to deploy immersion and liquid cooling, on-site power (microgrids), and AI-driven thermal managementspectrum.ieee.orgnews.microsoft.com. Major tech players (Nvidia, Microsoft, Google) and utilities (Duke Energy, Dominion) are deeply involved: e.g. Nvidia’s market cap topped $5 trillion in Oct. 2025reuters.com, Microsoft and Alphabet near $4Treuters.com, while utilities are lifting earnings forecasts on booming power demandreuters.com1 .

1. Explosive Growth of AI Data Centers and Power Needs

AI workloads are causing a data-center boom worldwide. Hundreds of new hyperscale sites are planned or under construction, from Silicon Valley to Northern Virginia and beyonddatacenterknowledge.com. For example, Aligned Data Centers’ ODATA DC02 campus in Chile (photo) illustrates just one of many global expansionsdatacenterknowledge.com. The International Energy Agency (IEA) estimates global data-center electricity demand will double by 2030 (to ~945 TWh)carbonbrief.org. In the U.S., AI and cloud projects now drive about half of new power demand growthcarbonbrief.org. Hyperscalers are pouring huge capital into these projects: Amazon, Meta, Alphabet and Microsoft alone plan to spend an estimated $360 billion in 2025 on AI infrastructure, mostly data centersreuters.com. Goldman Sachs similarly found data-center power could grow 160% by 2030 due to AI2 .

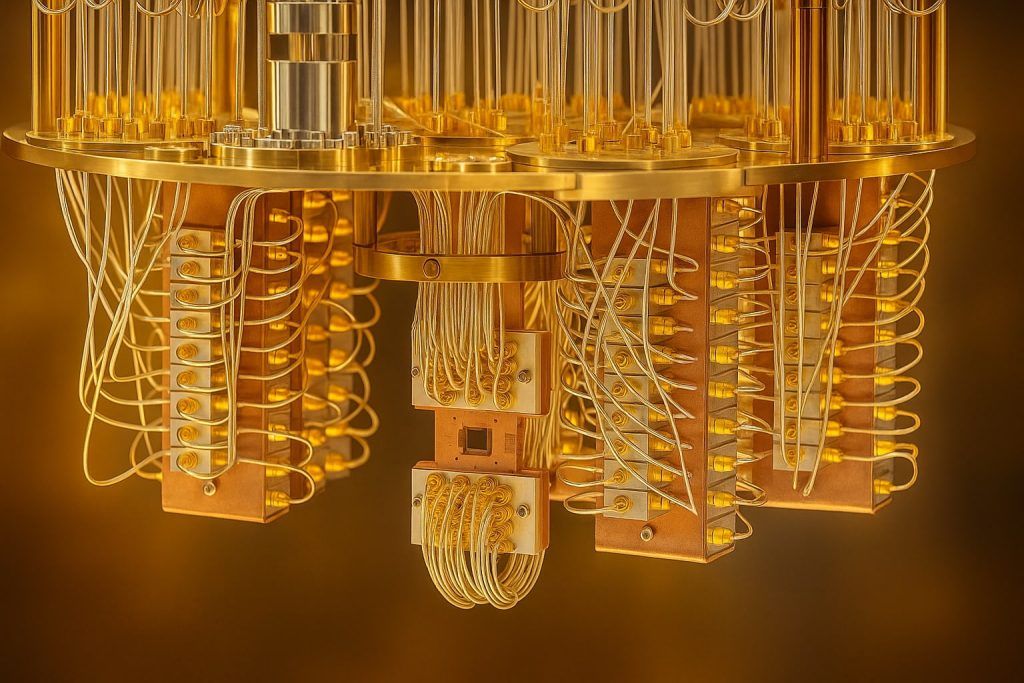

This energy surge is partly due to ever-higher chip power. GPUs in 2025 can draw 700–1200 W eachspectrum.ieee.org. A single rack of latest Nvidia “Blackwell” hardware can draw >100 kW, compared to ~20 kW a few years agospectrum.ieee.orgspectrum.ieee.org. As IEEE Spectrum notes, “AI adoption is creating a real urgency to figure out a better way to cool data centers”spectrum.ieee.org. Industry experts like Josh Claman point out that average rack density has climbed from ~8 kW to 100 kWspectrum.ieee.org. In short, the sheer scale and power density of AI data halls are unprecedented, requiring a re-think of infrastructure.

2. Grid Impact – Utilities, Microgrids and Infrastructure

The tidal wave of demand is straining power grids. Utilities in data-center hubs are racing to upgrade transmission, generation and local delivery. Virginia’s Dominion Energy – the world’s biggest utility by data-center capacity – reports 47 GW of data centers under contract (17% growth Y/Y)reuters.com. Dominion’s CEO Robert Blue says demand is “robust”reuters.com, and the company is embarking on a $50 billion, 2025–2029 investment plan to expand generation, transmission and distribution in Virginia and South Carolinareuters.com. Other grid operators face similar pressures. The growing load has prompted both government and industry responses: U.S. DOE launched plans for on-site AI data centers at Oak Ridge (with dedicated power) and regulatory supportwhitehouse.gov3 .

On the other hand, the Biden administration has signaled grid concerns. In early Nov. 2025, microgrids grabbed headlines: Reuters reports U.S. microgrid capacity could hit 10 GW by 2025 (up from 4.4 GW in 2022) as Big Tech demands reliable off-grid powerreuters.com. Major companies, frustrated by long grid-connection delays, are building on-site generation and storage “colocation.” One analyst noted that “some data-center facilities require over 300 MW” and are “stretching a power network already under strain”reuters.com. This trend was highlighted by the Politico/E&E News piece, where energy consultant Theresa Pugh exclaimed: “I never in my lifetime expected electricity demand to increase the way it’s expected to.”eenews.net. Utilities warn that an 18-month demand cycle in AI far outpaces their usual 5–7 year buildout cycles4 .

Regions globally also react. In markets like Asia and Europe, regulators are pushing data centers to be more efficient or even use renewables. In China, officials mandated data-center power usage effectiveness (PUE) below 1.5 by 2025datacenterknowledge.com. In Australia, federal data centers must meet NABERS 5-star (PUE ~1.4) by mid-2025datacenterknowledge.com. The EU’s revised Energy Efficiency Directive now requires annual reporting of energy and water use for data centersdatacenterknowledge.com, with more stringent standards expected soon. The bottom line: grids and policy-makers worldwide recognize the squeeze on power systems from AI.

3. Environmental & Climate Impact (Emissions, Water Use)

The AI data-center boom has prompted concern about climate and resource use. Today, data centers consume roughly 1% of global electricity and ~0.5% of emissions, per CarbonBrief analysiscarbonbrief.org. But with current growth, models show this could rise: IEA forecasts data centers could demand 8–10% of global electricity growth by 2030carbonbrief.org. Emissions tied to that could exceed 1% of global CO₂ by 2030 under high-growth scenarioscarbonbrief.org. While that is smaller than big sectors (e.g. transportation), it represents a rare accelerating source of power-sector emissions in an otherwise decarbonizing world. Analysts warn that this growth “could threaten U.S. climate goals” if powered by fossil fuels5 .

Cooling also has major water implications. Most large data halls use evaporative cooling towers that vaporize water. US data centers in 2021 were already using ~450 million gallons per dayeesi.org. Cutting-edge AI sites can be even thirstier – a top data-center expert notes “large data centers can drink up to 5 million gallons of water per day”eesi.org. This is roughly equivalent to supplying tens of thousands of homes. Every complex AI task adds up: researchers at UC Riverside estimate a single 100-word AI prompt may indirectly consume ~0.52 liters of watereesi.org. With trillions of prompts daily, the footprint is staggering.

Data centers often rely on large water storage systems for cooling. (Image: Google data center cooling tanks in Berkeley County, SC – insulated reservoirs keep cooling water availabledatacenters.google.) Environmentalists warn that billions more gallons could be drawn if AI demand continues. Carbon-intensive generation is also in the mix: some utilities are burning more gas to satisfy data centers, and land-based renewables can’t always be scaled fast enough. The net effect can be an uptick in power-sector emissions. However, companies argue that modern servers are much more efficient than old ones – technology leaders note that newer AI servers can deliver much more compute per kWh (though independent benchmarking is limited).

Climate analysts stress the need for green solutions. The Center for Biological Diversity notes one study suggesting AI data-center buildout “could account for 10% of U.S. economy-wide emissions by 2035” if powered by fossil fuelsbiologicaldiversity.org. But reputable forecasts like IEA’s envision continued growth in renewables and efficiency. Industry insiders, such as Uptime Institute’s Jay Dietrich, say governments must track and control energy use, noting “if data centers go down, it’s going to get ugly fast”datacenterknowledge.com. In summary, the climate impact hinges on how the data-center boom is powered – clean energy vs. carbon-heavy sources – and on mitigating huge water use in cooling.

4. Cooling Innovations and Power Efficiency

To address the heat problem, companies are deploying cutting-edge cooling tech. Liquid cooling is now widespread: IBM, Dell, and others add water or refrigerant channels to chips. Immersion cooling – submerging servers in dielectric fluid – is poised for growth. Reports indicate that when Nvidia’s Rubin Ultra GPUs arrive (~2027), immersion systems will “take off”trendforce.com. Intel and partners have even certified full liquid-immersion solutions for Xeon serverstrendforce.com. Immersion promises higher heat removal than air or cold plates, at the cost of new infrastructure. One analysis notes that while liquid (cold-plate) cooling is easier to retrofit, “future chips will inevitably require immersion cooling” for optimal performance6 .

Other innovations include microfluidic cooling at the chip level. Microsoft recently unveiled (Oct 2025) an in-chip liquid cooling system: micro-channels etched into the silicon let coolant hit hotspots directly. They reported it removed heat 3× better than traditional cold platesnews.microsoft.com. Critically, the system uses AI to sense thermal hotspots and adapt coolant flow on-the-flynews.microsoft.com. As Microsoft’s engineers explain, AI-directed microfluidics could enable higher power-density chips in the future7 .

Even simpler measures help: data centers are using exhaust heat reuse, adiabatic (wet-bulb optimized) cooling, and optimizing airflow. Many operators now employ AI-driven management too: for years, companies like Google have used machine-learning to finetune HVAC settings and reduce waste. (For example, Google reports using DeepMind to adjust cooling in real time, cutting cooling energy by ~30% – an idea pioneered in mid-2010s.) Hybrid strategies also emerge: Nortek’s Karin Overstreet notes that cutting-edge designs plan for “about 80% of the heat” carried away by liquid and only ~20% by traditional airspectrum.ieee.org. In summary, the industry is scrambling with innovations – from immersion tanks to smart controls – to keep servers cool as traditional chillers strain.

5. Financial and Market Implications (Stocks and Investments)

The AI energy surge is visible in markets. Nvidia (NVDA), the GPU leader powering AI, has seen its valuation soar. Its shares peaked around $207 on Oct 29, 2025reuters.com, valuing NVDA at $5.03 trillion. (As of Nov 5, 2025, NVDA trades near $199reuters.com.) Microsoft (NASDAQ: MSFT) and Alphabet (GOOGL.O) similarly hit record highs, each above $4 trillion market cap recentlyreuters.com. On Nov 5, 2025, MSFT was ~$514reuters.com and GOOGL ~$277reuters.com, reflecting continued investor enthusiasm despite some recent tech pullbacks. By contrast, traditional data-center REITs have lagged: Equinix and CyrusOne saw slowdowns, though Digital Realty (DLR) is doing well. DLR shares are ~$168 (market cap ~$57.8Breuters.com) and the company just raised its full-year revenue forecast on booming AI demand1 .

On the utility side, Duke Energy (DUK) and Dominion Energy (D.N) have been pushed by data-center loads. Duke’s stock is around $124reuters.com, near a 52-week high (~$130), as it expands in data-hub regions. Dominion’s shares trade near $58reuters.com. Dominion reported Q3 revenue up 15% YoY (to $4.53B), attributing much of the gain to data-center power salesreuters.com, and has guided to the high end of its earnings outlook. Analysts note that utilities’ capital plans are beefed up for new data centers and renewables; for example, Duke and Dominion are among a cohort of utilities rebuilding grids for higher loads.

Investment flows mirror this. A Deloitte report estimates that utilities will spend >$1 trillion on infrastructure in the next 5 years, and hyperscalers $1 trillion in 3–4 years on AI servers and chipsenergynow.com. Hyperscalers’ own statements back this: Amazon, Meta, Google and Microsoft expect to spend $360 billion in 2025 on AI-related capexreuters.com. This has fueled a recent run-up in electric utility and tech stocks – albeit with volatility. Indeed, markets have begun to fret over lofty valuations: on Nov 5, 2025, global tech stock indexes slipped, with Nvidia down ~4% in a tech selloffreuters.comreuters.com. Still, analysts see “bright prospects” for utilities given the load growthnasdaq.com and suggest Duke, Dominion and others as portfolio plays. Data-center REITs like Digital Realty are likewise seen as beneficiaries; DLR’s strategic partnerships (e.g. with Dell for on-site AI services) point to sustained leasing demand8 .

6. Expert Commentary and Analyst Views

Industry experts emphasize the urgency of the issue. As AI leaders warn of power constraints, former Google CEO Eric Schmidt famously said “we need energy in all forms…and we need it quickly,” noting a single planned AI data center could demand 10 GW (10 nuclear plants) of powereconomictimes.indiatimes.com. Microsoft President Brad Smith has complained the U.S. grid is “ancient — 50 years old”, ill-suited for AI’s appetiteeconomictimes.indiatimes.com. Utilities and analysts share the alarm. EEI President Drew Maloney stresses alignment with government “on making the grid more reliable and energy more affordable”eenews.net. A former EEI adviser Richard Ward observes: “Utilities and technology companies still don’t speak the same language… Collaboration isn’t optional anymore; it’s the only way forward.”9 .

Cooling experts also speak out. Josh Claman (Asetek) said the AI chip power surge “has turned the data center cooling problem on its head”. Nortek’s Karin Overstreet notes AI chips “generate so much heat that we’ll probably solve 80% of it with liquid”spectrum.ieee.org. In finance, Wall Street sees AI as a double-edged sword: some analysts warn the rally may be stretchedreuters.com, while utilities conferences report investors citing AI as a key demand driver (DBRS: DC mentions up fivefold in callsenergynow.com). In short, voices across tech, energy and finance paint a picture of record-breaking growth tempered by caution – the scale of AI’s infrastructure needs is “something I’ve never seen” in power, as consultant Theresa Pugh put it10 .

7. Policy and Regulatory Responses

Governments are scrambling to address this new energy challenge. In the U.S., the Trump administration (July 2025) issued an executive order fast-tracking permits for AI data-center buildoutswhitehouse.gov. It directs federal agencies to ease restrictions, use public lands, and incentivize “Qualifying Projects” (>$500M, >100 MW) with loans or other supportwhitehouse.govwhitehouse.gov. DOE has engaged industry on demand forecasts (the E&E News said DOE asked for advice on meeting AI load spikeseenews.net), and FERC is considering data-center interconnection rules. Some states are exploring requirements: for example, future CPUC regulations might compel major data centers to commit to clean power or demand-response as a condition of incentives.

Internationally, regulatory trends include mandatory efficiency reporting and standards. The EU now forces data centers to report energy and water usage (EU Energy Efficiency Directive)datacenterknowledge.com; a mid-2025 review may impose minimum performance standards. China’s 2023 plan mandates that the average data-center PUE be below 1.5 by 2025datacenterknowledge.com. Singapore and Australia have introduced strict efficiency ratings for high-performance data centers. Finance regulators (e.g. EU’s CSRD) are also requiring firms to disclose data-center emissions. In sum, policies are shifting towards making data centers more sustainable and grid-friendly – though implementation is still catching up to the rapid growth.

8. Outlook – Forecasts and Investment Takeaways

Looking ahead, most analysts agree AI data-center demand will keep growing rapidly. The Deloitte infrastructure study forecasts AI server power could rise 30-fold by 2035 (from 4 GW in 2024 to 123 GW by 2035)energynow.com. US power demand is expected to keep climbing ~2–3% annually through 2026, partly due to AI centersnasdaq.com. New investments will flow accordingly: utilities plan record capital expenditures for power plants and grids, while hyperscalers are locking in supply and deals (e.g. Microsoft-IREN $9.7B AI infrastructure pact11 ).

For investors, the implication is a reshaped landscape. Tech and GPU stocks may remain volatile at high valuations, but data-center services and power providers look set to benefit. Data-center REITs and cloud operators are likely to enjoy steady demand – Digital Realty’s raised guidancereuters.com is an example. On the power side, utilities with strong positions in data-hub regions (like Dominion in Virginia) may see accelerated growth, while others (Duke, Entergy, etc.) could target expansion or partnerships in AI corridors. However, caution is warranted: high infrastructure spending and policy uncertainty could compress returns.

Overall, one expert summed up the era: AI data centers are fueling “the new space race – only this time, the battleground is electricity.”economictimes.indiatimes.com. Stakeholders – from engineers to policymakers to investors – will need to navigate this surge with innovative technology and forward-looking planning.

Sources: Authoritative news and reports including IEA/EnergyInfo, Reuters, IEEE Spectrum, CarbonBrief, data-center trade press, and company filings and statementscarbonbrief.orgspectrum.ieee.orgreuters.comeesi.orgspectrum.ieee.orgnews.microsoft.comreuters.com. All data are as of early November 2025.