Published: November 6, 2025

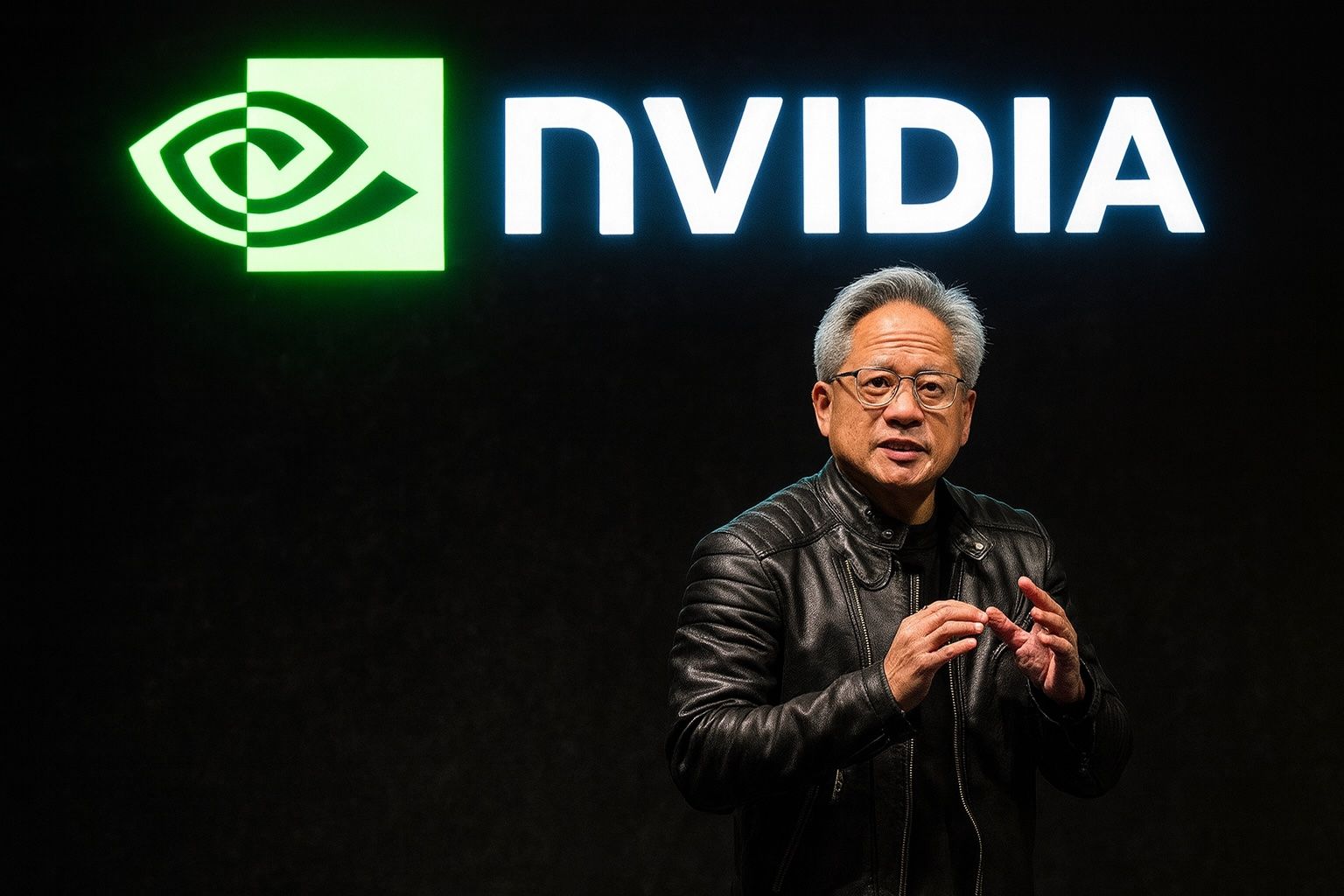

Summary: Nvidia CEO Jensen Huang said China is “going to win the AI race,” citing cheaper energy and lighter regulation, before clarifying in a later statement that China is only “nanoseconds behind” and that it’s “vital that America wins” by accelerating investment and growing its developer base. His remarks come amid continued U.S. curbs on advanced Nvidia chip sales to China and Beijing’s push to replace foreign AI chips. 1

Key points

- The quote heard ’round the Valley: “China is going to win the AI race,” Huang told the Financial Times on the sidelines of the FT Future of AI Summit in London. 1

- Clarification the same day: In a statement shared later on Wednesday, Huang said China is “nanoseconds behind” America in AI and argued it’s “vital that America wins by racing ahead and winning developers worldwide.” 2

- Why he thinks China is surging: Huang pointed to lower energy costs via subsidies and fewer, more centralized rules in China, while warning the U.S. faces a patchwork of state-level measures that could amount to “50” different regulations. 2

- Policy backdrop: The Trump administration continues to bar Nvidia’s most advanced chips from China; Trump has said Blackwell-class chips should be reserved for U.S. customers, while older or cut‑down parts might still be sold. 1

- China’s counter‑moves: Beijing is steering state‑funded data centers to domestic AI chips, squeezing room for Nvidia, AMD and Intel inside government‑backed projects. 3

What Huang said — and why it matters

Speaking to the FT in London, Huang’s headline remark — “China is going to win the AI race” — immediately ricocheted across markets and policy circles. He framed China’s edge around power prices and regulatory cohesion, arguing that those structural tailwinds help Chinese firms scale AI compute quickly. 1

Within hours, he narrowed the gap in his own framing: China isn’t ahead, but extremely close, and the strategic imperative for Washington is to “race ahead” and win developers globally. That clarification aligns with what Nvidia has told U.S. officials for months: American leadership depends on attracting the world’s AI talent and workloads, not walling off half the market. 2

The policy chessboard: U.S. curbs vs. China’s substitution drive

- U.S. stance: Washington has kept in place bans on Nvidia’s most advanced accelerators to China and has signaled the latest Blackwell chips should stay stateside; Nvidia has not sought new export licenses amid an increasingly hostile environment in China, Huang has said. 1

- China’s response: Beijing has issued guidance for state‑funded data centers to use homegrown AI chips, strengthening domestic players while reducing reliance on foreign silicon in government projects. 3

This policy divergence helps explain Huang’s emphasis on energy policy and regulatory clarity: data‑center build‑outs are power‑hungry and capital‑intensive, and stable, low‑cost electricity plus predictable rules can accelerate deployment — especially when paired with an enormous developer base. 2

What it means for Big Tech, investors, and geopolitics

- Compute economics are national strategy now. Subsidized energy in China and fragmented regulation in the U.S. create asymmetric conditions for scaling AI infrastructure — the very substrate of model training and inference. Expect more lobbying around power policy and federal preemption of state AI rules in the U.S. as firms chase lower operating costs and permitting certainty. 2

- Nvidia’s China exposure remains constrained. With state projects shifting to domestic chips and U.S. limits on high‑end exports, Nvidia’s near‑term growth will skew toward the U.S., Europe and Middle East, while China’s public sector tilts local. 3

- The race could hinge on developers, not just chips. Huang’s clarification underscores a strategic bet: win the global developer ecosystem, and America can sustain leadership even if rivals close hardware gaps. 2

The bigger picture

Huang’s comments fit a pattern: he has repeatedly warned that overly restrictive export policies can backfire, nudging China to ramp domestic alternatives while cutting U.S. firms off from talent and demand. Meanwhile, China is actively substituting foreign chips in government‑funded builds. The combined effect is a faster Chinese learning curve inside its own market — and mounting pressure on U.S. policymakers to pair security controls with pro‑growth energy and industrial policies at home. 1

What to watch next

- U.S. policy signals on permitting, power build‑outs, and any federal framework to preempt fragmented state AI rules. 2

- China’s procurement updates and benchmarks for domestic AI accelerators inside public‑sector data centers. 3

- Nvidia guidance on developer outreach and regional capacity additions following Huang’s call to “race ahead” in the U.S. 2

Quick FAQ

Did Huang say China already won?

No. He initially said “China is going to win the AI race”, then clarified: China is “nanoseconds behind” and the U.S. must “race ahead” and win developers worldwide. 1

Why bring up energy costs?

Training state‑of‑the‑art models consumes huge power; subsidized electricity can materially lower the cost of compute and speed deployment — a lever Beijing is using. 2

What’s the latest on U.S. chip restrictions?

The administration is keeping the most advanced Nvidia chips out of China; Trump has said top‑tier Blackwell parts should be reserved for Americans. 1

Sources & further reading

- Reuters: “Nvidia’s Jensen Huang: ‘China is going to win the AI race,’ FT reports” — includes Huang’s follow‑up statement and policy context. 1

- Axios: “Nvidia CEO says China on track ‘to win the AI race’” — details on energy subsidies, U.S. regulatory fragmentation, and Huang’s clarification. 2

- Reuters: “China bans foreign AI chips from state‑funded data centres, sources say” — the latest on Beijing’s substitution policy. 3

Note: This article focuses on developments reported on November 6, 2025 (local publication dates) and late November 5, 2025 London time for the FT Summit remarks, as corroborated in the sources above.