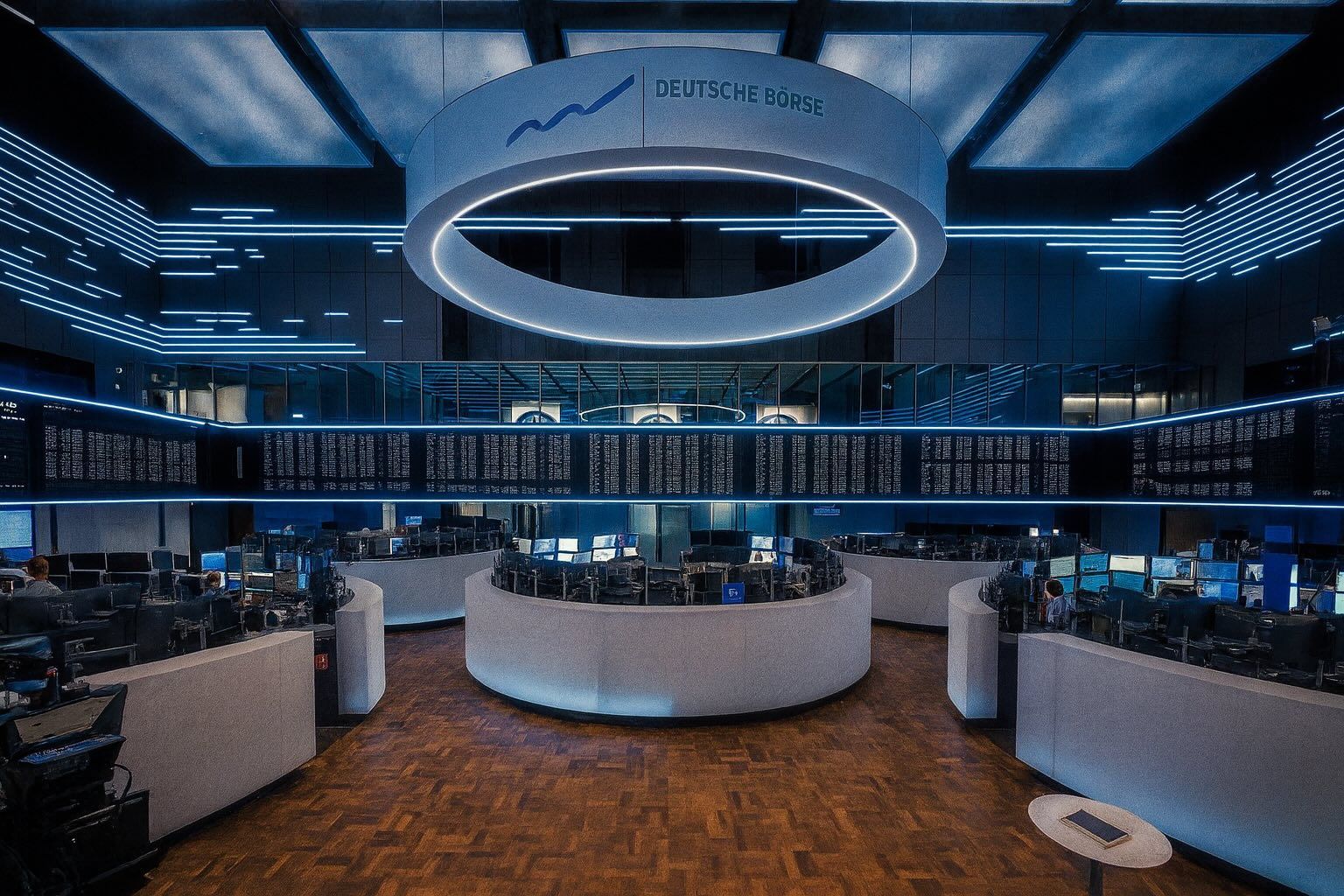

The German blue‑chip index DAX and the Frankfurt Stock Exchange started the new week on a cautious note. While trading opened with small gains, the market quickly slipped back under the psychologically important 24,000‑point mark as investors weighed fresh regulatory changes at Deutsche Börse, an ongoing share buyback, and renewed warnings from the European Central Bank (ECB) about elevated financial‑market risks. 1

DAX on 17 November 2025: Nervous but orderly trading in Frankfurt

At the opening bell in Frankfurt, the DAX edged up around 0.14% to roughly 23,910 points, staying just under the 24,000 threshold that has acted as a ceiling since late October. 1

As the morning session progressed, the index drifted lower again, with real‑time estimates placing the DAX in the high‑23,700s to around 23,800 points, corresponding to a modest loss of roughly 0.3–0.5% versus Friday’s close. 2

Market breadth was mixed:

- Gainers included Siemens Energy, Airbus, Rheinmetall, Heidelberg Materials and MTU Aero Engines, each up around 1–2% in early action. 2

- Lagging stocks featured Siemens Healthineers, Bayer, Infineon, DHL and Siemens, which started the week in the red. 2

Despite today’s hesitation, the DAX still carries the footprint of last week’s rebound: it gained around 1.3% over the previous week, briefly pushing as high as about 24,441 points before doubts about further U.S. Federal Reserve rate cuts capped the move. 1

Germany’s performance is broadly aligned with the rest of Europe. The pan‑European STOXX 600 index was down roughly 0.2% in morning trade as investors reduced risk exposure across the continent. 3

Why global macro is weighing on Deutsche Börse’s markets today

Waiting for U.S. jobs data and Nvidia

Traders in Frankfurt are largely reacting to a global picture dominated by two forces: delayed U.S. economic data after the government shutdown and the looming earnings report from AI chipmaker Nvidia, due mid‑week. 3

A weekly outlook published by Deutsche Börse’s own Frankfurt portal describes a “roller‑coaster of emotions” in markets:

- Optimism after the end of the U.S. shutdown pushed risk appetite up.

- That optimism quickly faded as Fed officials signalled that another rate cut in December is far from guaranteed and as concerns over a potential AI bubble resurfaced. 4

Analysts quoted in the piece diverge on whether current AI valuations resemble the late‑1990s dot‑com mania. One camp warns of “run‑away” pricing in U.S. tech, while others argue that leading AI firms genuinely concentrate much of the future profit growth, making simple bubble analogies misleading. What they agree on:

- DAX level – The index closed Friday at about 23,877 points and hovered around 23,888 on Monday morning, almost unchanged. 4

- Sentiment vs. fundamentals – German and European equities are seen as fundamentally sound but lacking the “glamour factor” of U.S. megacap tech, which limits international investor enthusiasm. 4

The euro’s surprising “safe‑haven” twist

Adding to the cross‑winds, the euro has strengthened sharply in 2025, gaining about 12% against the U.S. dollar and touching record highs versus the yen and a two‑year high versus the British pound. 5

A Reuters macro column notes that investors may be rotating away from richly valued U.S. tech stocks and rebalancing across the Atlantic at the same time as leadership changes loom at the Fed and ECB over the next two years. 5

For export‑oriented German blue chips listed on Deutsche Börse Frankfurt and Xetra, a strong euro is a double‑edged sword:

- It signals confidence in the euro area and lower inflation risks.

- But it can pressure margins for exporters by making euro‑denominated goods more expensive abroad.

ECB: high valuations, non‑bank risks in focus

Speaking this morning at Frankfurt Euro Finance Week, ECB Vice‑President Luis de Guindos warned that euro‑area financial‑stability vulnerabilities “remain elevated,” even though inflation is now close to 2%. 6

Key points from his speech with direct relevance to Deutsche Börse’s markets:

- Equity valuations are high, boosted by a renewed risk‑on mood since spring. Concentration risks are rising as global markets hinge on a relatively small cluster of large U.S. tech names. 6

- Non‑bank financial institutions – including investment funds and hedge funds that are active on derivatives venues such as Eurex (part of Deutsche Börse Group) – remain exposed to sudden asset‑price corrections due to leverage and liquidity mismatches. 6

- Private markets in Europe have grown to more than €700 billion in assets, still small next to the €30 trillion banking system but increasingly interconnected with banks and insurers. A shock here could spill into listed markets and clearing systems. 6

For Deutsche Börse, the message is clear: regulators want robust infrastructure, better data on non‑banks and deeper equity markets – all areas where the group is directly involved via Xetra, Eurex, Clearstream and its data businesses. 7

Deutsche Börse AG share: slight dip despite technical “long signal”

Deutsche Börse AG’s own stock (DB1) mirrored the cautious tone.

According to intraday data, the share:

- Closed Friday at about €206.10.

- Opened Monday at roughly €205.20, a decline of around 0.44%. 8

- Traded around €205.00 by midday, down about 0.24% on the day. 9

The stock sits nearly 30% below its 52‑week high near €291.80 and only slightly above a recent 52‑week low around €203.90. Based on free‑float capitalization of approximately €38.4 billion, Deutsche Börse carries about 1.8% weighting in the DAX. 8

Interestingly, chart technicians at finanzen.net point to a “Candlestick Hammer” pattern that formed in early November, a formation typically interpreted as a potential bullish reversal signal. Even so, today’s article from the same outlet notes that the share is again under mild pressure, reminding investors that technical signals rarely play out in a straight line. 9

(As always, such patterns are not guarantees and should not be viewed as individual investment advice.)

Share buyback: fresh purchases reported for 10–14 November

Deutsche Börse continues to support its share via a substantial share buyback programme of up to €500 million (or as many as 14 million shares), authorised by shareholders in May 2024 and active since February 2025. Repurchases are executed exclusively via Xetra, the Frankfurt Stock Exchange’s electronic platform. 10

Two sets of numbers matter today:

- Cumulative repurchases to 7 November 2025

- Around 1.82 million shares have been bought back at an average price close to €254, for a total cost of roughly €463 million. 10

- New announcement today for 10–14 November 2025

- A fresh EQS announcement, released at 10:06 CET, reports that 54,043 additional shares were repurchased last week.

- Daily average prices ranged from about €206 to €211 per share.

- Purchases were again carried out solely via Xetra by a mandated credit institution. 11

While Deutsche Börse hasn’t commented today on the strategic implications, buybacks at current prices continue to shrink the free‑float share count and may eventually underpin earnings per share – though this effect is currently overshadowed by macro concerns and the antitrust probe from Brussels. 12

New rulebook in force: Extended Xetra Retail Service and volatility tools

A major structural change is quietly going live this week. A Deutsche Börse circular dated 14 November announces amendments to: 13

- the Exchange Rules for the Frankfurt Stock Exchange,

- the Conditions for Transactions, and

- the Trading Regulation for the regulated unofficial market.

Extended Xetra Retail Service

Effective 17 November and 1 December 2025 (depending on the specific provision), Deutsche Börse is rolling out an Extended Xetra Retail Service: 13

- Previously, the Xetra Retail Service targeted retail order flow during regular hours (09:00–17:30) in the continuous trading with intraday auctions model.

- Going forward, early trading (08:00–09:00) and late trading (17:30–22:00) will be included via a new Mini‑Auction model.

- Execution in this segment remains reserved for Retail Member Organisations (RMOs) and Retail Liquidity Providers (RLPs), and trades are specially flagged in the system.

The move is designed to give private investors more flexible access to the market beyond core hours while maintaining strict counterparty and transparency rules.

Other key adjustments

The same circular outlines several technical—but important—tweaks that matter for professional traders and market‑structure watchers: 13

- Self‑Match Prevention (SMP) rules are expanded, allowing participants more flexibility in preventing inadvertent trades against their own orders.

- A new “Implied Reference Price” mechanism can be used in closing auctions when no recent trade exists, deriving a reference from the best bid and ask in the order book to calculate volatility corridors.

- During a Single Volatility Interruption, the exchange will in future also publish the dynamic and static price corridors applied to the affected security, increasing transparency around trading halts.

- References to Clearstream Banking AG are updated to Clearstream Europe AG, reflecting the corporate rename in the clearing arm.

Separately, the Conditions for Transactions on the Frankfurt Stock Exchange have been republished in a new version dated 17 November 2025, clarifying definitions, language hierarchy (German text remains legally binding) and how trades come into existence in both on‑book and off‑book segments involving Eurex Clearing and Cboe Clear Europe. 14

Corporate actions and technical notices for 17 November

Every trading day at Deutsche Börse brings a series of micro‑announcements that matter for specific securities. For 17 November 2025, the Xetra & Frankfurt Newsboard includes, among others:

- Ex‑dividend / interest dates on Frankfurt (XFRA) for several international stocks:

- US Physical Therapy (US90337L1089)

- Quad Graphics (US7473011093)

- Sturm Ruger & Co. (US8641591081)

- plus additional instruments such as AT0000986377 and DE0006289499, which also trade ex‑distribution today. 15

- A reference‑data change for the LBBW Tilg‑Anleihe 21/33 bond (DE000LB2CYB3), prompting automatic deletion of all open orders in that instrument as of 17 November. 16

These notices are routine, but they highlight the operational backbone that underpins Deutsche Börse Frankfurt and Xetra—ensuring that dividends, interest payments and instrument terms are reflected accurately in the order books.

FX and derivatives: 360T volumes down month‑on‑month, up strongly year‑on‑year

Beyond the equities floor, Deutsche Börse’s broader trading ecosystem is also in focus today thanks to updated analysis of foreign‑exchange volumes.

A report from specialist outlet The Full FX notes that exchange‑owned FX platforms had a “mixed bag” in October, with Deutsche Börse’s 360T seeing: 17

- Average daily volume (ADV) of about €172.5 billion,

- a 7.2% decline versus September, but

- a robust 20.8% increase year‑on‑year.

Non‑spot FX activity at 360T is estimated to have fallen just over 8% month‑on‑month, while rising more than 21% compared with October 2024. 17

The numbers underline how Deutsche Börse’s FX franchise remains heavily influenced by global macro volatility and central‑bank action—similar to its derivatives exchange Eurex, which earlier this month reported lower overall volumes in October amid calmer market conditions. 7

Legacy and politics: Frankfurt honours Friedrich von Metzler

Beyond the trading screens, Frankfurt is marking an important moment in the history of its financial centre.

This evening, the city will host a memorial service for banker Friedrich von Metzler in the historic Paulskirche. German Chancellor Friedrich Merz and Frankfurt’s mayor Mike Josef are scheduled to speak, recognising von Metzler’s role both as a long‑time senior partner of the private bank B. Metzler seel. Sohn & Co. and as a driving force in transforming the Frankfurter Wertpapierbörse into today’s Deutsche Börse AG. 18

Von Metzler, who passed away in November 2024, was also a prominent arts patron, supporting institutions such as the Städel Museum and the Senckenberg natural‑history museum. The ceremony underscores how closely Deutsche Börse’s modern identity is tied to Frankfurt’s broader economic and cultural life. 18

Antitrust clouds still in the background

Although not new today, investors in Deutsche Börse continue to track the European Commission’s competition investigation into alleged anticompetitive practices involving Deutsche Börse and Nasdaq in the listing, trading and clearing of derivatives. 12

The probe, formally opened on 6 November, focuses on whether an earlier cooperation agreement between Eurex (Deutsche Börse’s derivatives arm) and a Nordic exchange now owned by Nasdaq may have restricted competition in certain products. Both companies insist the arrangement was lawful and beneficial for markets, and analysts currently see limited financial impact, though potential fines and reputational risks cannot be discounted. 12

This issue remains part of the backdrop for Deutsche Börse’s share, alongside the buyback and this month’s “Making Capital Matter” rebranding of the cash‑market division, which unifies Xetra and Börse Frankfurt under the Deutsche Börse name. 19

What today’s moves mean for investors watching Deutsche Börse and Frankfurt

Putting it all together, 17 November 2025 at Deutsche Börse Frankfurt looks like this:

- Indices: The DAX is consolidating just below 24,000 after last week’s sharp swings, with sector performance split between energy/industrial winners and big‑cap losers. 1

- Single stock: Deutsche Börse AG’s share is slightly weaker but benefiting from a large buyback and technical support levels, even as it trades far below last year’s highs. 8

- Microstructure: New rules effective today extend retail trading hours, refine volatility controls and modernise the legal framework for trades and clearing—changes that should gradually improve access and transparency. 13

- Macro & policy: ECB warnings, the strong euro, AI‑valuation debates and the pending U.S. data and Nvidia results are keeping risk appetite in check. 4

- Structural business: FX platform 360T and Eurex volumes show that Deutsche Börse’s growth drivers remain global and multi‑asset, not just tied to the DAX. 17

For readers following Deutsche Börse, the Frankfurt Stock Exchange and the DAX, the key takeaway is that today’s price action is only part of the story. The more lasting impact may come from the infrastructure changes—extended retail trading, enhanced volatility mechanisms and evolving regulation—that quietly reshape how capital flows through Frankfurt every day.