As Rachel Reeves prepares the 2025 UK budget, business leaders warn against “death by a thousand taxes”, the OBR readies lower growth forecasts, nuclear regulation faces a radical reset, and AI-fuelled productivity gains offer a rare bright spot.

- UK employers’ group CBI is urging Chancellor Rachel Reeves to make “hard choices” and stop ignoring business concerns on energy costs and labour reforms ahead of Wednesday’s budget. 1

- The Office for Budget Responsibility (OBR) is expected to downgrade economic growth forecasts for 2026 and beyond, opening up a £20–30bn hole in the public finances. 2

- Reeves is reported to be scrapping the controversial two‑child cap on welfare benefits and considering a new property tax surcharge on high‑value homes. 3

- A major review says the UK needs a “radical reset” of nuclear regulation as it has become the most expensive place in the world to build reactors – with the government banking on Sizewell C and small modular reactors (SMRs). 4

- New reporting on AI in the services sector highlights how automation is turning tasks that took two weeks into two‑hour jobs, raising hopes of finally fixing Britain’s long‑running productivity problem. 5

- Live market and corporate coverage points to a booming valuation for Revolut, new investment moves by AstraZeneca, and rising tension around Labour’s Employment Rights Bill and big infrastructure mergers. 6

Budget week opens with business backlash

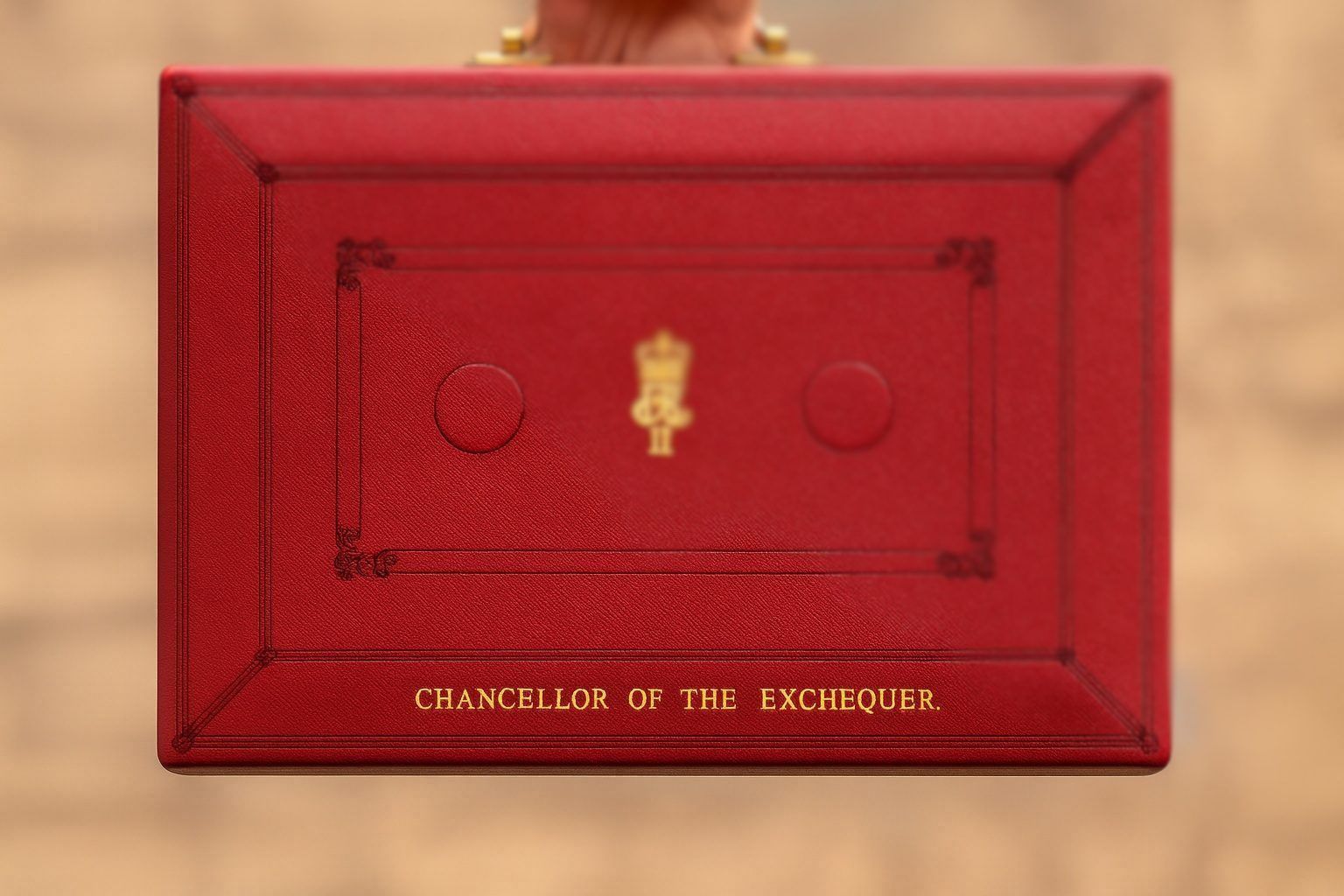

With the 2025 UK budget due on Wednesday 26 November, Rachel Reeves is walking into one of the most politically charged weeks of her Chancellorship.

At the Confederation of British Industry (CBI) annual conference today (24 November), CBI chief executive Rain Newton‑Smith is set to accuse Reeves of shutting business out of key decisions on energy costs, employment law and pensions – and to demand that she makes “hard choices” in the budget rather than piling on ad‑hoc tax tweaks. 1

According to advance extracts of her speech, Newton‑Smith will argue that:

- The government should opt for one or two broad‑based tax rises instead of a scattergun approach that risks feeling like “death by a thousand” individual measures. 7

- Businesses have seen little serious engagement from the Treasury on high industrial energy prices and proposed reforms to employment rights. 1

- Planned changes to pension schemes could quietly increase the cost of hiring, just as firms are trying to invest and expand. 7

Her warning lands against the backdrop of an economy that has largely been stuck in low‑growth mode since the 2007–08 financial crisis – the very stagnation Reeves and Prime Minister Keir Starmer promised to end when Labour returned to power in 2024. 7

Business minister Peter Kyle is trying to sweeten the mood with a consultation on a new scheme that could cut electricity prices for around 7,000 energy‑intensive manufacturers by up to 25% from 2027. But industry groups say support will have to be much broader if it is to move the dial, especially with UK firms still paying far more for power than competitors in the US, France and Germany. 7

OBR downgrade tightens the fiscal vice

If the CBI is one source of pressure, the numbers are another. Britain’s fiscal watchdog, the Office for Budget Responsibility (OBR), is expected to cut its economic growth projections for 2026 and for the remaining years of this parliament, according to a report first carried by Sky News and attributed to Reuters today. 8

The downgrade is significant because:

- The OBR’s growth and productivity forecasts are the base assumptions for all of Reeves’ tax and spending choices.

- A weaker outlook, combined with higher debt‑servicing costs, is thought to leave a £20–30bn shortfall in the public finances that must be closed with tax rises, spending restraint, or both. 2

Reeves has repeatedly stressed that she will not gamble with the bond market after the 2022 mini‑budget crisis under Liz Truss, and wants to prove to investors that Labour can combine higher investment with fiscal discipline. That means Wednesday’s budget is widely expected to include another round of tax increases – the second big revenue‑raising package since the election. 7

Welfare and wealth: scrapping the child benefit cap

On the social policy side, Reeves is now poised to scrap the controversial two‑child cap on welfare benefits, according to reports in several Sunday newspapers summarised by Reuters. 3

Key elements of the reported plan include:

- Removing the two‑child limit on benefits entirely, rather than going for a more limited partial reform.

- An estimated annual cost of around £3bn, which will need to be financed in the budget arithmetic. 3

To help pay for this, Reeves is also said to be preparing a property tax surcharge on homes worth £2m or more – a higher threshold than the £1.5m level that had previously been floated. Treasury officials have declined to comment, but such a move would fit with Labour’s broader push to raise more from wealth and assets while trying to avoid headline increases in basic income tax. 3

Earlier analysis from think tanks and financial commentators had already suggested that Reeves might look at more radical wealth‑focused measures to close a persistent fiscal gap, underlining how politically sensitive her choices now are.

Nuclear power review calls for a ‘radical reset’

Energy policy is another pillar of the week’s news – and one that intersects directly with the budget.

A major government‑commissioned review, published today, concludes that the UK needs a “radical reset” of its nuclear regulatory regime after the country became the most expensive place in the world to build nuclear power plants. 4

The review, ordered by Starmer’s Labour government in February, highlights:

- 47 recommendations aimed at speeding up approval and construction times, cutting costs and still maintaining robust safety standards. 4

- The need to get flagship projects such as Sizewell C – which has already secured more than £14bn in government support – built on time and on budget. 4

- A central role for small modular reactors (SMRs) as part of a new “golden age of nuclear”, according to energy minister Ed Miliband. 4

Reeves is expected to formally respond to the report in Wednesday’s budget, tying nuclear expansion into a wider mission to deliver net zero, lower bills and greater energy security – all while trying to keep capital spending within her self‑imposed fiscal rules. 4

AI: from two weeks to two hours – can it save UK productivity?

Amid the gloom, one story cutting through today is about artificial intelligence, and how it might finally help Britain escape its long‑running productivity trap.

A new report, based on a Reuters feature, highlights the example of mid‑tier accountancy firm Moore Kingston Smith. After rolling out AI tools in areas such as fraud checks and client reporting, staff were able to complete work that used to take two weeks in just two hours – with a visible boost to profit margins. 5

The piece underscores several wider themes:

- The UK’s services‑heavy economy could be especially well placed to benefit from AI‑driven efficiency gains.

- If widely adopted, automation could help lift productivity growth, which has lagged since the global financial crisis and is now central to the OBR’s more pessimistic outlook. 5

- Ironically, the short‑term fiscal pain of higher taxes in this week’s budget sits alongside the longer‑term hope that AI‑enhanced growth will eventually ease some of the pressure on Reeves’ spreadsheets. 5

For now, however, the AI dividend remains largely prospective – and voters are more likely to notice any near‑term tax rises than marginal gains in output per worker.

Markets, fintech and corporate Britain: what today’s live blog reveals

Beyond Westminster and Whitehall, UK plc has its own packed agenda today, as reflected in a live business blog on The Times’ site, summarised in external coverage. 6

Key corporate and market developments flagged there include:

- Revolut’s blockbuster valuation: The London‑based fintech has reportedly been valued at around $75bn following a secondary share sale involving big‑name investors including Nvidia – despite the firm still lacking a full UK banking licence. 6

- AstraZeneca’s strategic pivot: The pharma giant is committing roughly $2bn to expand manufacturing in the United States while pausing plans for a new UK research site, raising questions about Britain’s competitiveness as a life sciences hub. 6

- Industrial reshaping: Engineering group IMI is offloading defence‑related business Truflo Marine in a £225m deal, as it continues to streamline its portfolio. 6

- Advertising under strain: Agencies M&C Saatchi and S4 Capital have both issued profit warnings, blaming softer client spending and wider macro uncertainty – a reminder that even creative industries are feeling the squeeze. 7

- Infrastructure backlash: Investors are pushing back against a proposed £5.3bn merger between infrastructure funds HICL and Trig, wary of both valuation and strategy in a sector sensitive to interest‑rate and policy changes. 6

The same live coverage notes that global stock markets are generally buoyant on the day, helped by expectations of further interest rate cuts and renewed optimism around peace talks over Ukraine – a supportive backdrop that might soften market reaction to whatever Reeves unveils mid‑week. 6

Why this week matters

Taken together, today’s stories sketch out the challenge facing the Chancellor:

- Demands from business for predictable, growth‑friendly policy and cheaper energy.

- Fiscal reality, as the OBR lowers its growth sights and the welfare bill rises with the scrapping of the child benefit cap.

- Strategic bets on nuclear power and AI‑driven productivity to change Britain’s economic trajectory over the longer term.

- Market discipline, with investors ready to punish any hint of fiscal adventurism – but also eager for the UK to unlock new sources of growth and investment.

For Reeves, the test on Wednesday will be whether she can convince both voters and markets that higher taxes today will genuinely fund a more dynamic, fairer economy tomorrow – and whether business believes she is really “partnering with the builders”, not just sending them the bill.