Key facts (as of Nov 5, 2025, UTC)

- A global semiconductor rout wiped out roughly $500 billion in market value as angst over stretched AI valuations spread from Wall Street to Asia and Europe. Bloomberg

- Asia led the slide: South Korea’s Kospi plunged as much as 6.2% intraday; Japan’s Advantest sank ~10%; TSMC dropped >3%. Bloomberg

- U.S. tech and chips cracked first: On Nov 4, the Nasdaq fell 2.04%, and the Philadelphia Semiconductor Index (SOX) slid 4%. Reuters

- Policy shock in China: Beijing ordered state‑funded data centers to use only domestic AI chips, a blow to Nvidia, AMD and Intel and a tailwind for Huawei and local rivals. Reuters

- Tariff thaw—but not for soybeans: China will suspend some retaliatory tariffs on U.S. goods from Nov 10, but U.S. soybeans still face a 13% levy. Reuters

- Live snapshot (approx. 10:45 UTC):NVDA $198.69 (~‑3.9%), AMD $250.05 (~‑3.6%), ASML $1,030.14 (~‑3.4%), TSM $294.05 (~‑3.5%); chip ETFs SOXX (~‑4.1%) and SMH (~‑3.7%) trade sharply lower. (Live quotes.)

What just happened—and why it matters

Global markets were jolted on Wednesday, Nov 5, as an AI‑led selloff in U.S. megacaps rolled through Asia and then Europe. The immediate trigger: rising skepticism that AI‑exposed winners can sustain nosebleed valuations, compounded by fresh policy headlines out of China and high‑profile warnings from Wall Street heavyweights. Reuters+1

Asia’s hit list. Korea’s memory giants Samsung and SK Hynix led the initial downdraft, dragging the Kospi down as much as 6.2% before some buyers stepped in. In Japan, chip‑equipment and testing names were pummeled, with Advantest sliding around 10%; TSMC fell over 3% in Taiwan. Bloomberg

Europe followed. By mid‑session, the STOXX 600 flirted with two‑week lows, with European chip suppliers (e.g., ASM International, BE Semiconductor) pacing declines as the tech rout broadened. Reuters

U.S. set the tone on Tuesday. The Nasdaq dropped 2.04%, with the SOX down 4%—its worst day since October 10—after Morgan Stanley and Goldman Sachs chiefs warned a broader pullback may be brewing, given how far and fast AI champions have run. Reuters

A new China shock to the AI supply chain

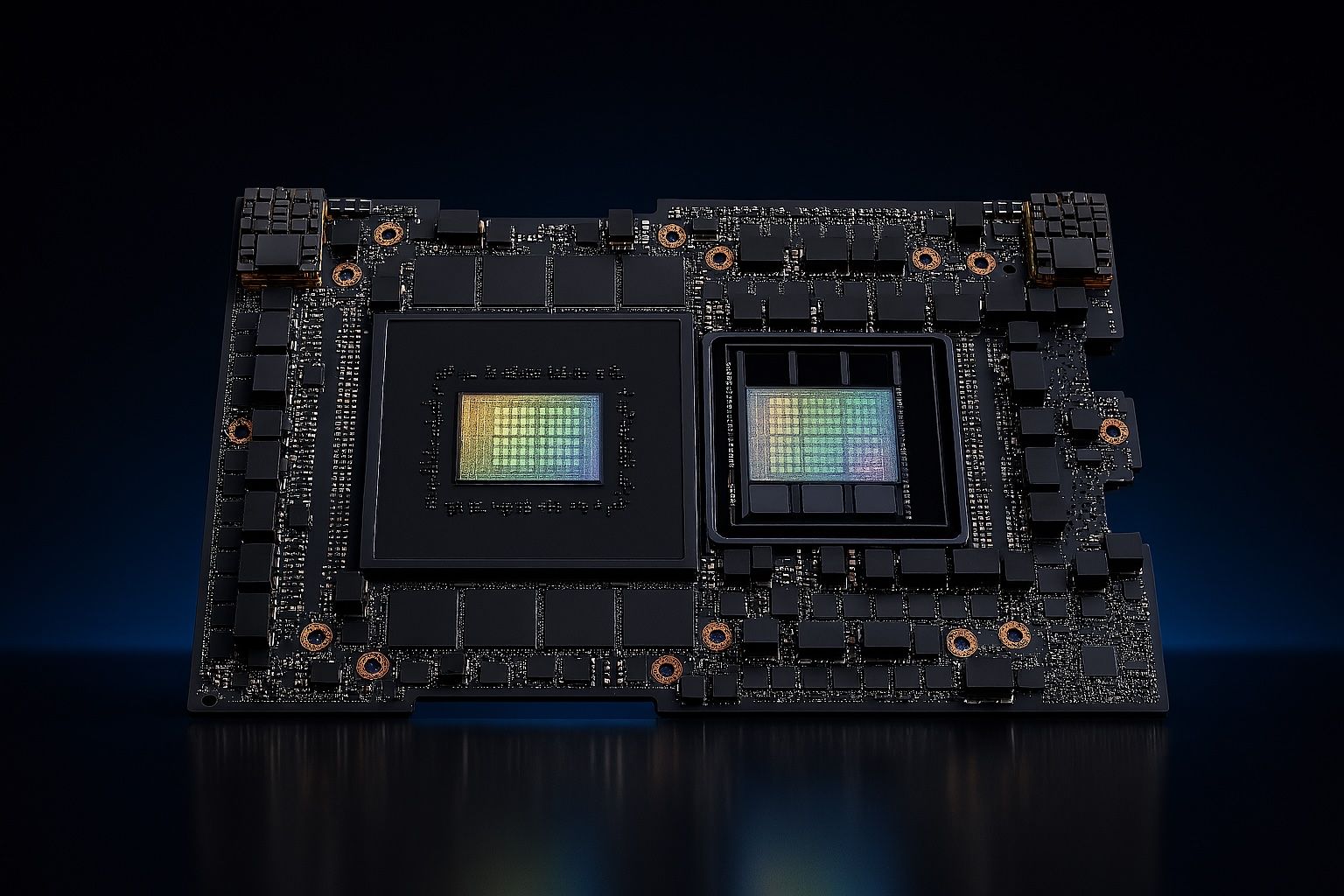

Adding fuel to the fire, Beijing has instructed state‑funded data centers to use only domestically produced AI chips, and to replace foreign chips in projects under 30% complete—measures likely to hit Nvidia, AMD and Intel while boosting Huawei and smaller Chinese challengers. Projects further along will be reviewed case‑by‑case. Nvidia’s H20, and even higher‑end B200/H200 (widely available via grey channels), are explicitly in scope. Reuters

This comes as the U.S. and China attempt a fragile tariff de‑escalation. China will remove some duties on U.S. farm goods from Nov 10 but keep 10% baseline tariffs and 13% on soybeans, a reminder that any “thaw” remains partial—and markets still face political risk. Reuters

What the pros are saying

- “AI story still intact … [a] moment of reassessment.” — Ecaterina Bigos, AXA Investment Managers (on Bloomberg TV), arguing the pullback is about positioning and pace, not the end of the AI thesis. Bloomberg

- “On the verge of an equity correction.” — Jim Reid, Deutsche Bank, warning that concentration and lofty valuations had primed markets for a wobble. The Guardian

- “Positioning‑driven … recent outperformers taking the worst of the move.” — Jon Withaar, Pictet Asset Management, on the mechanics behind the slide. Reuters

- “Classic … profit‑taking day.” — Angus McGeoch, Barrenjoey, noting funds are reluctant to “give up a lot” if the market turns back up. Reuters

- “Healthy” rather than panic. — Charu Chanana, Saxo, calling the shake‑out a needed reset after a blistering run. Reuters

The selloff in numbers

- $500bn of semiconductor market cap erased amid the global rout. Bloomberg

- Korea’s Kospi: down as much as 6.2% intraday; Japan’s Advantest ~‑10%; TSMC‑3%+. Bloomberg

- U.S. (Nov 4 close):Nasdaq −2.04%, S&P 500 −1.17%, SOX −4.0%. Reuters

- Europe (Nov 5):STOXX 600 at two‑week lows with tech leading declines. Reuters

Why valuations were vulnerable

In the days leading up to the slump, Nvidia briefly hit $5 trillion in market value (Oct 29), capping a 12‑fold surge since late 2022 and stoking bubble talk. When expectations soar, even “good” earnings or guidance can disappoint and spark position unwinds across the AI supply chain—especially after exchanges flag runaway winners like SK Hynix for “investment caution.” Reuters+1

Macro and policy cross‑currents to watch

- U.S. Supreme Court tariff case (Nov 5): Justices heard arguments over the legality of President Trump’s sweeping tariffs—another variable for risk assets already fretting valuation and trade uncertainty. A ruling could reshape tariff policy pathways even if near‑term levies stay in effect. Reuters

- China’s AI‑chip localization: The guidance for state‑funded data centers creates a structural headwind for foreign chip sellers in China and may accelerate domestic ecosystem development (hardware and software), but migration frictions are real given Nvidia’s CUDA software moat. Reuters

Live market snapshot (indicative, ~10:45 UTC)

- Nvidia (NVDA) $198.69 (≈‑3.9%); AMD (AMD) $250.05 (≈‑3.6%); ASML (ASML) $1,030.14 (≈‑3.4%); TSMC (TSM) $294.05 (≈‑3.5%). SOXX ≈‑4.1%, SMH ≈‑3.7%. (Live quotes.)

- Bitcoin hovered near $101k after briefly dipping below $100k overnight as risk appetite wavered. The Guardian

Outlook: What could happen next (scenarios, not advice)

Base case (consolidation):

- Earnings and capex still supportive—hyperscale AI build‑outs and secular chip demand remain intact, but multiple compression tempers returns after outsized gains. Expect range‑bound trading into key catalysts (e.g., Nvidia earnings on Nov 19), while investors dissect commentary on AI orders, supply, and data‑center capacity. Reuters

Bull case (re‑acceleration):

- A benign tariff path from courts/negotiations plus evidence that AI infrastructure spend is re‑accelerating could revive animal spirits. Strategists emphasize the “AI story is still intact,” framing this week as a reassessment, not a regime shift. Reuters+1

Bear case (correction):

- Street leaders warn a pullback is plausible if valuations remain out in front of fundamentals. A broader de‑risking could see another 10%–15% drawdown in the most extended names, especially if China’s chip restrictions widen beyond state‑funded projects or if U.S. policy tightens. Reuters+1

What to watch in coming days

- Corporate guidance from chipmakers and AI infrastructure suppliers.

- Tariff headlines and any China follow‑through on domestic AI‑chip mandates.

- Positioning gauges (semiconductor ETFs like SOXX/SMH) for signs of stabilization versus further outflows.

Expert quotes (short excerpts)

- AXA IM’s Ecaterina Bigos: the AI story is “still intact” and the pullback is a “moment of reassessment.” Bloomberg

- Deutsche Bank’s Jim Reid: growing chorus asking whether we’re “on the verge of an equity correction.” The Guardian

- Pictet’s Jon Withaar: selling is “largely positioning‑driven.” Reuters

- Barrenjoey’s Angus McGeoch: a “short‑term profit taking” day. Reuters

- Saxo’s Charu Chanana: moves look “healthy,” not panic. Reuters

Sources & further reading

- Bloomberg: “Global Chip Selloff Erases $500 Billion in Value as Fears Mount.” (Nov 5, 2025). Bloomberg

- Financial Times: “Global stocks slip as US sell-off over AI valuations spreads.” (Nov 5, 2025). Financial Times

- Reuters: U.S. tech slump and bank‑CEO warnings (Nov 4, 2025); Asia/Europe risk‑off (Nov 5, 2025). Reuters+1

- Reuters (Exclusive): “China bans foreign AI chips from state‑funded data centres.” (Nov 5, 2025). Reuters

- Reuters: “Beijing lifts some tariffs on US farm goods but soybeans remain costly.” (Nov 5, 2025). Reuters

- The Guardian (live): “European markets down and Asian chipmakers tumble…” (Nov 5, 2025). The Guardian

Disclosure: This article is for information only and not investment advice. Markets and prices are volatile and may have moved since publication.