- AI stocks fueling market highs: A handful of tech giants have driven U.S. indexes to record levels in 2025. The S&P 500 and Nasdaq hit all-time highs in early October, powered by “Magnificent 7” mega-caps and AI leaders reuters.com. Wall Street’s optimism over artificial intelligence has lifted equities ~30% year-to-date for AI-heavy stocks, versus just ~8% gains for the rest of the market ts2.tech ts2.tech.

- Market concentration at extremes: The top 5 companies – Nvidia, Microsoft, Apple, Alphabet, and Amazon – now make up nearly 30% of the S&P 500’s value, the highest concentration since 1964 qz.com. This has stretched valuations: the S&P trades around 23× forward earnings, well above its 10-year average (~18.7×), reaching levels some consider “frothy” reuters.com. High valuations in big tech pose a risk if lofty AI spending doesn’t pay off, analysts caution reuters.com.

- Sky-high stock winners: Nvidia, Palantir, and Super Micro Computer (SMCI) are among 2025’s hottest stocks – but also face growing scrutiny. Palantir (PLTR) has rocketed roughly 300% this year, recently trading around $175–$180 (≈$400 billion market cap) ts2.tech, thanks to blockbuster AI deals (like a $10 billion U.S. Army contract) and surging demand for its AI platforms ts2.tech. Super Micro (SMCI) is up ~80% year-to-date qz.com amid an AI server boom, with FY2025 AI hardware revenue up 47% to $21.97 billion ts2.tech. Nvidia (NVDA), the AI chip leader, notched record highs in October and is up about 30% in 2025 qz.com after an astonishing decade-long climb (Nvidia’s stock has increased ~350× in ten years) ts2.tech ts2.tech.

- Bubble warnings from experts: Veteran analysts fear the AI frenzy has pushed these stocks to unsustainable levels. “The recent rally has been disproportionately fueled by a handful of AI and semiconductor stocks, pushing their valuations to euphoric, and frankly, unsustainable levels,” says David Jaffe of Best Stock Strategy qz.com. Palantir’s valuation – over 100× sales (≈200× earnings) – is “difficult to justify” at current prices ts2.tech, and one short-seller argues its share price could plunge 70%+ if fundamentals don’t catch up ts2.tech. Former IMF economist Gita Gopinath even warns that an AI-driven bust could wipe out over $20 trillion in U.S. household wealth – a hit potentially “larger than the dot-com crash” if the bubble bursts ts2.tech.

- Bullish bets vs. caution: Despite jitters, many on Wall Street remain bullish about AI’s long-term potential. Wedbush Securities predicts Palantir could reach a $1 trillion valuation in coming years as a core AI winner ts2.tech. UBS analysts see Nvidia’s latest AI investments (like a mooted $100 billion OpenAI stake) adding $400 billion in future revenue and helping target a $3–4 trillion AI market by 2030 ts2.tech. Yet even optimists acknowledge today’s prices bake in perfection. “A lot has to go right” to justify Nvidia’s rich multiples (over 300× normalized earnings and ~26× sales) qz.com, notes finance professor Robert Johnson, who says many AI stocks have “little or no margin of safety” at current levels qz.com.

AI Stocks Propel a Record Tech Rally

After a turbulent summer, U.S. markets have soared back near all-time highs, largely on the back of AI euphoria. Investor optimism about emerging AI technology has lifted major indices despite macro headwinds like trade tensions and war fears qz.com. In fact, the S&P 500 and Nasdaq Composite both notched record closing highs in early October, buoyed by outsized gains in a few AI-focused giants reuters.com.

The rally’s narrow leadership is striking. Mega-cap tech firms – especially those at the forefront of AI – have vastly outperformed. A select “AI basket” of titans (Alphabet, Amazon, Nvidia, Microsoft, Meta, Oracle, Palantir, etc.) is up roughly 30% this year, compared to about 8% for the other 490+ S&P stocks ts2.tech ts2.tech. As a result, market breadth is thin and concentration risks are rising. The top five names alone now account for nearly one-third of the S&P’s entire value qz.com, a level of dependence unseen in six decades.

“On the surface, the U.S. stock market appears strong, trading within a few percent of all-time highs. However, my outlook is that the market is priced to perfection,” warns David Jaffe, a veteran analyst. “The recent rally has been disproportionately fueled by a handful of AI and semiconductor stocks, pushing their valuations to euphoric, and frankly, unsustainable levels.” qz.com

This dynamic has echoes of past tech booms. Wall Street’s fear is that today’s AI darlings may be exhibiting bubble-like behavior, similar to late 1990s dot-com stocks. “Historically, even revolutionary technologies lead to bubbles where the eventual winners get dramatically overpriced before a significant correction,” Jaffe notes qz.com. Right now, AI optimism – combined with supportive factors like the Federal Reserve’s recent pivot to interest rate cuts reuters.com and robust bank earnings – is overpowering most cautionary signals. Even geopolitical risks and a U.S. government shutdown have barely dented enthusiasm reuters.com reuters.com. Investors are betting big that AI will transform entire industries and deliver decades of growth.

Yet the more the market leans on a few superstar stocks, the more vulnerable it becomes. Joseph Favorito, a wealth manager, points out that the “top 5 companies… make up nearly 30% of the S&P 500”, the heaviest weighting since 1964 indexbox.io. “That does not necessarily mean a crash is imminent,” he adds, noting these winners could “continue to go up for some time. Markets can remain irrational for a long time.” indexbox.io But such lopsided leadership – fueled by AI mania – has many seasoned investors on edge.

Skyrocketing Stocks Face Scrutiny

Few stocks embody 2025’s AI stock mania better than Palantir, Super Micro, and Nvidia. These once-unassuming companies have seen their share prices explode this year, attracting cult-like investor followings – and raising hard questions about sustainability.

- Palantir Technologies (PLTR): The data analytics firm has morphed from a secretive defense contractor into a $400 billion market cap market star practically overnight. Palantir’s stock has quadrupled in 2025 alone ts2.tech, making it one of the S&P 500’s top performers. As of this week, shares hover around $175–$180, up roughly 300% year-to-date ts2.tech and an astonishing +600% over the past three years ts2.tech ts2.tech. The rally is underpinned by booming demand for AI: Palantir blew past $1 billion in quarterly revenue for the first time in Q2 (a +48% YoY surge) and hiked its full-year forecast to ~$4.15 billion ts2.tech. It has also scored blockbuster deals – from a $10 billion U.S. Army AI contract to a £1.5 billion UK defense partnership and a new Boeing tie-up – stoking optimism about long-term growth ts2.tech. Some bulls, like Wedbush Securities, argue Palantir could eventually be a $1 trillion company as an “AI winner” ts2.tech. The concern: Palantir’s meteoric rise now far outpaces its fundamentals. The stock trades at over 100× sales (≈200× earnings) – a valuation one analyst called “absolutely wild” qz.com. “This jump simply isn’t matched by its earnings growth. So if the AI buzz cools or profits stumble… Palantir could well be among the first to lose ground, and it has a lot to lose,” warns Christian Harris, head analyst at Investing.co.uk qz.com. Noted short-seller Andrew Left recently slammed Palantir as “grossly overvalued,” noting its 588× forward P/E dwarfs even other AI peers ts2.tech. By Left’s math, applying a more reasonable (yet still high) AI-sector multiple to Palantir would imply the stock should be closer to $40 – an almost 80% collapse from current levels ts2.tech. While Palantir’s unique position in both military and enterprise AI gives it huge growth potential ts2.tech, skeptics argue the hype has run far ahead of reality. Even Wall Street’s analyst consensus reflects caution: the stock carries a lukewarm “Hold” rating and an average 12-month target of ~$130 ts2.tech, well below its current price.

- Super Micro Computer (SMCI): A less flashy name, Super Micro has nonetheless ridden the AI wave to become a market high-flyer. The San Jose-based company builds advanced servers and storage systems – exactly the hardware powering AI data centers. Demand bonanza: Super Micro’s AI-focused revenue hit $21.97 billion in FY2025, up 47% year-on-year, with roughly 70% of last quarter’s sales coming from AI-optimized “platform” systems (often packed with Nvidia GPUs) ts2.tech. Management is forecasting at least $33 billion in revenue for FY2026 (≈45% growth) as cloud giants and enterprises keep racing to add AI capacity ts2.tech. Not surprisingly, SMCI’s stock has surged about +82% this year through October qz.com, recently rebounding to ~$52 after a summer dip ts2.tech. Some hedge funds have piled in, seeing Super Micro as a pure-play winner of the AI server boom ts2.tech. The concern: Super Micro’s fundamentals haven’t scaled as fast as its share price. Profit margins are thin – last quarter’s gross margin was just 9.6%, with an operating margin under 4% ts2.tech. The company’s breakneck growth has also led to inventory buildup and rising costs, squeezing profitability qz.com. “Super Micro [is] an ‘over-rated growth star’” whose stock surge owes largely to AI hype, warns analyst Christian Harris, noting “its margins are falling and its inventory is mounting.” If AI hardware demand slows or cost controls falter, “I wouldn’t be surprised if its price stalled or dropped pretty rapidly,” he says qz.com. Veteran investor David Jaffe agrees, pointing out that while SMCI is a real company with real earnings, its valuation “has reached a level that prices in decades of flawless execution” qz.com – an almost impossible bar to meet. Indeed, by some metrics Super Micro looks cheap (its price-to-sales and EV/Revenue ratios are below peers) ts2.tech, but that may reflect doubts about its sustainability. Wall Street models peg the company’s earnings per share at only ~$2.5–$3.5 over the next two years ts2.tech, so even a $50 stock price implies a steep forward multiple. In short, execution risk is huge: any hint of a slowdown in the AI cycle or a slip in Super Micro’s ramp-up could trigger a sharp correction in the stock.

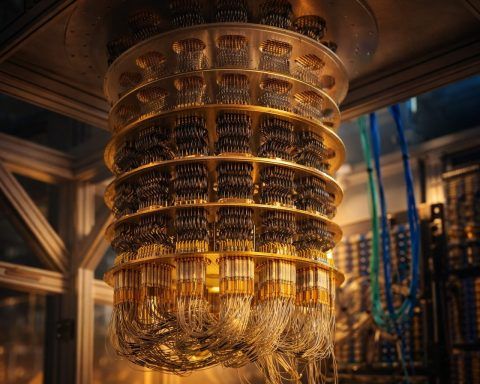

- Nvidia (NVDA): No company is more synonymous with the AI revolution than Nvidia, the chipmaker whose GPUs are the “brains” behind most AI systems. Nvidia’s stock soared more than 200% in 2023, and while 2025’s gains are a more modest ~30% qz.com, the company’s momentum is still fierce. In early October, Nvidia’s share price briefly hit an all-time high (near $190) amid excitement over its latest moves macrotrends.net. Even after a decade of staggering growth – Nvidia’s market value has increased roughly 350-fold in ten years ts2.tech ts2.tech – investors keep finding new reasons to buy. This fall, Nvidia revealed plans to invest up to $100 billion in OpenAI, the firm behind ChatGPT ts2.tech. The unprecedented deal would combine cash and Nvidia’s coveted AI chips to supercharge OpenAI’s computing power. Bulls hailed it as a genius strategic move: UBS analysts estimate such a partnership could unlock $400 billion in additional revenue for Nvidia in coming years and solidify its dominance in a projected $3–$4 trillion AI hardware market by 2030 ts2.tech. Wall Street is equally enthused by Nvidia’s other plays – from a $5 billion investment in rival Intel for chip co-development ts2.tech to booming data-center and automotive AI businesses. Little wonder bank analysts keep hiking price targets (Cantor Fitzgerald recently reiterated a bullish $300 target for NVDA, up from $240) and some foresee Nvidia as the first trillion-dollar chip company. The concern: Nvidia’s stock isn’t cheap by any stretch – and never has been. At ~$180/share, NVDA trades at a stratospheric valuation: on a “normalized” basis it is 339× earnings and about 26× sales qz.com. “In my opinion, many of the AI stocks are priced to perfection… including Nvidia,” says finance professor Robert R. Johnson. “A lot has to go right to justify those price multiples.” qz.com Even Nvidia’s CEO Jensen Huang has cautioned that the current surging demand may eventually moderate as customers digest recent huge orders ts2.tech. There are also competitive and regulatory risks on the horizon: rivals like AMD are gunning for a bigger slice of the AI chip market (AMD just clinched its own multi-year deal to supply chips to OpenAI reuters.com), and governments are eyeing tighter export controls on advanced semiconductors. Any stumble in Nvidia’s growth story could spur a swift re-rating of its richly valued stock. To justify its price, Nvidia arguably needs to maintain breakneck growth for years – a task even its biggest fans admit leaves no margin for error.

Boom, Bubble, or Somewhere In Between?

The central question: Can the AI-driven rally continue to defy gravity, or are we nearing a tipping point? On one side, optimists argue that the world is only in the “early innings” of an AI revolution that will fundamentally reshape businesses and the economy. They point to tangible signs that AI is delivering real value – from soaring chipmaker revenues to software firms posting record sales as enterprises adopt AI tools ts2.tech ts2.tech. “The AI revolution, Fed cuts and fading tariff uncertainty will all support growth,” says Barclays strategist Ajay Rajadhyaksha, suggesting that AI mega-cap stocks could keep outperforming in the medium term ts2.tech. With the Federal Reserve now shifting to an easier monetary stance (the Fed cut interest rates in September for the first time in years) reuters.com and the U.S. economy proving resilient, bulls contend there is room for corporate earnings – especially among tech giants – to grow into today’s valuations. In fact, upcoming third-quarter earnings for the Magnificent 7 are expected to be “very robust,” according to Ameriprise strategist Anthony Saglimbene reuters.com. If those profits materialize and companies continue to invest heavily in AI (U.S. firms are pouring billions into AI R&D and partnerships), the current rally could find support from actual earnings rather than just hype.

Skeptics, however, counter that much of the good news is already priced in – and then some. Valuations have hit levels some consider frothy, Reuters notes, with the S&P 500 now at ~23× forward earnings reuters.com. High valuations in megacap tech are particularly worrisome if growth even slightly disappoints reuters.com. One advisor estimates that to justify the rich market caps awarded to AI leaders, the sector would need to generate an additional $2–3 trillion in revenue by 2030 – a herculean jump that may prove unrealistic ts2.tech. Meanwhile, the easy money has already lured in huge inflows (U.S. equity funds saw ~$12 billion of new money in one week after Nvidia’s OpenAI announcement) ts2.tech, a sign of “bubbly” fever that often precedes a pullback. Market veterans also emphasize that external risks could puncture sentiment: higher interest rates (despite Fed easing, borrowing costs remain elevated), geopolitical strife (e.g. a widening Middle East conflict or US–China trade war flare-up reuters.com), or even an economic downturn could quickly shift the narrative from growth to fear.

Notably, regulators and policymakers are on alert. The U.S. Justice Department has signaled tougher antitrust scrutiny to ensure no tech firm monopolizes layers of the AI stack ts2.tech. And in a symbolic moment, a U.S. judge recently approved a $1.5 billion settlement against an AI company (Anthropic) over copyright claims ts2.tech – the first major legal penalty of the AI era. Greater regulatory oversight might rein in the wildest growth projections for the sector.

Perhaps the most sobering perspective comes from Gita Gopinath, former chief economist of the IMF. She warns that the next market crash could be amplified by today’s AI-driven concentration. With so much wealth tied up in a few high-flying tech stocks, a sharp reversal could have cascading effects. Gopinath projects that if the bubble bursts, American households might lose over $20 trillion in wealth (≈70% of US GDP) and foreign investors over $15 trillion ts2.tech. That scenario would rival or exceed the early 2000s dot-com crash in severity. Her cautionary message: the very forces lifting markets now – enthusiastic equity inflows, AI hype, and heavy reliance on tech – could “deepen the impact” of a downturn when euphoria turns to panic ts2.tech.

For now, the music is still playing. Despite periodic jitters (e.g. brief sell-offs on war news or rate fears), dip-buyers have consistently swooped in, keeping the uptrend intact ts2.tech. The S&P 500 remains near historic highs ts2.tech, and each earnings report from an AI bellwether is closely watched for justification of the optimism. The current market mood might be summed up as cautiously euphoric – investors know this can’t go on forever, but few want to miss out on further gains. As one market expert noted, “Markets can remain irrational for a long time” indexbox.io. The key question heading into late 2025 and 2026 is how long “long” will last – and whether the AI revolution will deliver enough real progress to gently deflate today’s sky-high expectations, or whether a painful reckoning awaits once the growth stories hit natural limits.

Bottom Line: The AI-fueled stock surge has minted huge profits and propelled markets to new heights, but it’s also testing the limits of valuation and concentration. Investors are effectively walking a tightrope between transformative tech-driven growth and a potential speculative bubble. The coming months – with big tech earnings, interest rate shifts, and geopolitical developments – could determine which narrative prevails. Will 2025 be remembered as the start of a sustainable AI boom, or the peak of a frenzy that went too far? The answer may hinge on whether these companies’ fundamentals can catch up to their share prices before investor sentiment flips. For now, the excitement – and the risk – remain at full throttle.

Sources: Quartz qz.com qz.com qz.com; Reuters reuters.com reuters.com; IndexBox/TechStock² indexbox.io indexbox.io; TechStock² (ts2.tech) ts2.tech ts2.tech ts2.tech ts2.tech