- Apple’s stock steadies: Apple Inc. (AAPL) closed around $248 on Oct. 14, 2025 – nearly flat after a volatile session – as Wall Street digested new U.S.–China trade war threats and dovish Fed signals, leaving the tech giant’s shares only ±0.1% changed on the dayreuters.commarkets.chroniclejournal.com.

- Trade tensions vs. Fed relief: Markets plunged early Tuesday on news of escalating tariffs – President Trump vowed 100% levies on Chinese imports from Nov. 1, and Beijing retaliated with new fees and tech export curbsmarkets.chroniclejournal.com. Tech stocks were hit hard at first, but Fed Chair Jerome Powell’s hint at possible rate cuts helped indices rebound by afternoonmarkets.chroniclejournal.com. Apple initially sagged amid the turmoil, underscoring its exposure to China, before paring losses as hopes rose for renewed U.S.-China talksmarkets.chroniclejournal.com.

- Surprise product launches: Apple is reportedly poised to unveil new devices via press release instead of a keynote this week. Bloomberg’s Mark Gurman and others signal imminent launches of a 14-inch MacBook Pro with an M5 chip, a new M5 iPad Pro, and an upgraded Vision Pro headsetts2.tech. At the same time, Apple has scrapped its rumored “Vision Air” AR headset project, shifting focus to smart glasses – including a paired iPhone-powered model by 2027 and a standalone AR pair to rival Meta’s Ray-Ban glassests2.tech.

- Leadership shake-up in focus: Investors are buzzing over a quiet executive succession plan in Cupertino. Hardware engineering chief John Ternus (age 50) has emerged as the “leading contender” to succeed CEO Tim Cook when the time comests2.tech. Longtime COO Jeff Williams – Cook’s de facto #2 – will retire by end of 2025, handing operations to veteran exec Sabih Khan as Apple emphasizes continuityts2.tech. The company insists Cook is “firmly at the helm” for now, but these moves show careful planning for Apple’s next erats2.tech.

- Analysts split on outlook:Bullish voices see a new “supercycle” of demand. Wedbush’s Dan Ives recently hiked his AAPL price target to $310, calling this a “golden era” fueled by record iPhone 17 salests2.tech. Bears are wary, though – Jefferies just downgraded Apple to Underperform, arguing the stock already reflects “excessive expectations” for next-gen devicests2.tech. On average, Wall Street’s 12-month target is ~$248, roughly where Apple trades now, highlighting valuation concerns despite a consensus Buy ratingts2.tech.

Apple Rides Out a Wild Day on Wall Street

Apple’s stock performance on October 14 told a story of resilience in the face of macroeconomic drama. The day began with “palpable unease” across markets as renewed U.S.-China trade tensions rattled investorsmarkets.chroniclejournal.com. President Trump’s surprise threat of massive new tariffs – 100% on all Chinese imports – and China’s rapid countermeasures (sanctioning U.S. partners and slapping fees on American-linked ships) sent the Nasdaq tumbling nearly 0.9% at the openmarkets.chroniclejournal.commarkets.chroniclejournal.com. Apple, deeply entwined with Chinese manufacturing and sales, “found itself navigating choppy waters” – its stock slid early, briefly making Apple a notable laggard amid the sell-offmarkets.chroniclejournal.com.

However, by late afternoon the tide turned. Federal Reserve Chair Jerome Powell’s remarks at an economics conference hinted that softening labor data might warrant interest rate cuts in coming months, which calmed the market’s nervesinvestopedia.com. Simultaneously, U.S. officials signaled that President Trump and China’s President Xi still plan to meet for negotiations, tempering the worst trade fearsinvestopedia.com. The result: a relief rally. The Dow Jones rebounded over 340 points and the S&P 500 swung from losses to a modest +0.3% gain by the closemarkets.chroniclejournal.com. The tech-heavy Nasdaq also clawed back most of its dropmarkets.chroniclejournal.com. Apple’s stock actually closed fractionally up around $248.66reuters.com, essentially flat on the day but a win considering the morning’s anxieties. “Cupertino’s flagship proved surprisingly resilient amid the crossfire,” noted one market commentator, as trade war jitters gave way to Fed-fueled dip-buying.

Crucially, Apple’s heavy reliance on China remains a double-edged sword. The escalating tariff battle poses a real risk to Apple’s supply chain and costs. New 25–100% import tariffs could add roughly $1.1 billion in incremental costs to Apple’s current-quarter margins if fully enactedmarkets.chroniclejournal.com. “iPhones are a very high-profile product that both the Chinese and U.S. governments understand they have leverage over,” one analyst told Reuters – until trade disputes settle, Apple is at risk of being caught in the middlereuters.com. Apple has already been shifting some production to India and Vietnam to buffer these risksreuters.com. Still, the company’s deep ties to China – both as a manufacturing base and a huge consumer market – mean any “tit-for-tat” trade blows hit Apple particularly hardmarkets.chroniclejournal.commarkets.chroniclejournal.com. That was evident on Oct. 10 (the prior Friday), when Apple’s stock plunged 3.5% in a single day to ~$245 after Trump’s initial tariff salvomarkets.chroniclejournal.com. By Oct. 14, shares were still hovering near those lows, down about 2% year-to-date – a sharp contrast to most Big Tech peers in the greenmarkets.chroniclejournal.com.

Yet Tuesday’s late-day recovery showed that broader market forces can outweigh the fears. With the Fed potentially pivoting to rate cuts after an aggressive tightening cycle, high-growth tech giants like Apple tend to benefit from lower financing costs and richer valuations. Indeed, optimism over interest rates and a possible trade truce helped Apple “pare some losses by the afternoon”markets.chroniclejournal.com*. By the closing bell, AAPL stock had essentially shrugged off the trade war scare, a sign that investors remain eager to buy any dips in this $3+ trillion stalwart.

New Macs, iPads and an AR Pivot (No Keynote Needed)

Adding to the day’s intrigue was buzz about Apple’s product lineup – not from a splashy launch event, but via media leaks pointing to imminent press-release launches. Reports broke that Apple plans to drop new hardware announcements this week without a live keynote. According to Bloomberg’s well-connected reporter Mark Gurman, Apple is set to reveal a 14-inch MacBook Pro powered by a next-gen M5 chip, alongside a refreshed iPad Pro also running the M5, and even an updated version of its Vision Pro mixed-reality headsetts2.tech. The quiet rollout (expected by press release rather than an event) suggests these are spec-bump updates, but they come at a crucial time – just ahead of the holiday quarter – and could catalyze fresh consumer interest in Apple’s Mac and iPad segments.

At the same time, Apple appears to be rethinking its AR/VR strategy. The company has reportedly axed development of a lower-cost “Vision Air” headset that had been rumored as a follow-on to this year’s $3,500 Vision Prots2.tech. Instead, resources are shifting toward developing sleeker augmented-reality glasses with built-in AI features. Insiders say Apple now aims to introduce two AR smart glasses: one that works as a lightweight, display-free accessory tethered to an iPhone (targeting 2027), and another with an integrated display akin to Meta’s latest smart glasses, possibly debuting even soonerts2.tech. This pivot underscores that Apple is playing a long game in spatial computing, focusing on everyday wearable AR rather than rushing out a cheap VR headset. TechCrunch notes Apple’s new roadmap could put it in more direct competition with players like Meta on smart glasses, while also differentiating Apple’s approach by leveraging its iPhone ecosystemts2.tech.

The product news didn’t move Apple’s stock dramatically on the 14th – likely because these developments were telegraphed in advance and partly overshadowed by the macro headlines. However, they add to a picture of a company charging ahead on innovation despite external headwinds. A faster MacBook Pro and iPad Pro could entice power users (and bolster revenue in those categories, which saw modest growth lately), and an upgraded Vision Pro signals Apple’s commitment to lead in AR/VR even as rivals emerge. Importantly, shelving the “Vision Air” might be a positive in investors’ eyes: it shows Apple’s discipline in avoiding a dud product and focusing on tech with true long-term potential (i.e. AR glasses). All told, these sneak-peek launches and strategic shifts are feeding a narrative that Apple has more up its sleeve beyond the iPhone – a narrative that could support the stock’s valuation if executed well.

CEO Succession Chatter Heats Up

Beyond products, Apple’s leadership future is another simmering topic that gained new visibility. On Oct. 13, reports surfaced that Apple has been grooming its next generation of top brass – and a potential heir apparent to CEO Tim Cook. Multiple outlets (fueled by insider leaks) identified John Ternus, Apple’s Senior VP of Hardware Engineering, as the leading candidate to take over as CEO eventuallyts2.tech. Ternus, 50, has overseen the development of the iPhone, iPad and Mac hardware in recent years and was prominently featured in Apple’s recent product launches. Notably, he’s the same age Tim Cook was when he became CEO, hinting at a possible passing of the torch in the next few yearsts2.tech.

Meanwhile, Apple has methodically been reshuffling other key roles. Longtime Chief Operating Officer Jeff Williams – often seen as Cook’s right-hand man and once a presumed CEO contender – plans to retire at the end of 2025ts2.tech. Williams, 60, quietly stepped back from overseeing day-to-day operations earlier this year, and Apple announced that operations veteran Sabih Khan will assume the COO dutiests2.tech. This transition has been described by Apple as a “long-planned succession” to ensure stabilityts2.tech. It follows other senior changes like the installation of a new CFO (Apple tapped Kevan Pegula Parekh in 2025 to replace retiring finance chief Luca Maestri)ts2.tech.

Apple insists that Tim Cook isn’t going anywhere just yet – the 64-year-old chief executive has given no official timeline for departure, and insiders say he may stay on for a few more yearsts2.tech. Even so, the recent moves amount to “a broad changing of the guard” at Apple’s highest ranksbloomberg.com. By putting Ternus “in the spotlight” and elevating trusted lieutenants like Khan, Cook appears to be carefully orchestrating a stable successionts2.tech. Investors typically dislike uncertainty around leadership, so demonstrating a clear plan for the post-Cook era can bolster confidence. News that Apple is proactively planning for its future – without any boardroom drama – likely reassures large shareholders that the company’s culture and vision will carry on seamlessly whenever Cook eventually steps down.

Some analysts also believe a leadership transition could be a catalyst in the long run. “Ternus is a product guy with charisma – he could energize the narrative if and when he takes over,” one observer noted, adding that Wall Street might welcome a fresh face if it comes with continued operational excellence. In the near term, though, these succession rumblings are mostly background info; Tim Cook remains firmly at the helm, and any CEO handover is probably a story for later this decade. Still, it’s headline-grabbing news that one of the world’s most valuable companies is mapping out who might be its next leader.

Bulls vs. Bears: Can Apple Hit $4 Trillion?

Even as Apple navigates these cross-currents, the debate on Wall Street centers on a key question: How much upside is left in Apple’s stock? AAPL has already had a monumental run – its market capitalization is about $3.8 trillion as of mid-Octoberts2.tech, and it briefly flirted with the unprecedented $4 trillion threshold when shares hit an all-time high (~$260) in late Septemberts2.tech. After such a rally (Apple’s stock has more than doubled over the past 5 years), analysts are divided on whether Apple can keep outperforming or if it’s priced for perfection.

On the bullish side, optimists point to Apple’s ability to defy skeptics time and again. The recent iPhone 17 cycle is shaping up to be a strong one – early data indicate sales are trending 10–15% higher than last year’s iPhone 16 launch, suggesting a robust “upgrade supercycle” as consumers finally replace aging devicests2.tech. Wedbush’s star tech analyst Dan Ives calls the iPhone 17 demand “a major surprise to the upside.” He raised his AAPL price target to $310 (the highest on Wall Street) and proclaimed we’re entering a “golden era” for Apple’s ecosystem, driven by this upgrade wave and new product categories like Vision Prots2.tech. Ives and other bulls also argue that Apple’s ever-expanding Services segment (App Store, subscriptions, etc.) plus its foray into AI and custom chips will spur steady growth for years, justifying a higher valuationts2.tech. Indeed, Apple’s latest earnings (fiscal Q3 2025, reported in July) showed record revenues ($94B, +10% YoY) and a big beat on profitts2.tech. CEO Tim Cook highlighted that every major segment grew in double-digitsts2.tech – a remarkable feat for a company of Apple’s size. With momentum like that and upbeat guidance for the holiday quarter (Apple told investors to expect “mid to high single-digit” revenue growth in Q4ts2.tech), the pro-Apple camp sees the stock’s strength as fundamentally justified. In their view, any pullbacks – whether from trade scares or profit-taking – are buying opportunities on the way to new highs.

The bearish camp, however, urges caution. At ~$248 per share, Apple trades at about 38× trailing earnings, a historically rich multiple for the companyts2.tech. Some skeptics note that Apple’s stock has gotten ahead of its fundamentals, especially given only modest revenue growth. Investment firm Jefferies made waves recently by downgrading Apple’s stock to Underperform, essentially a sell ratingts2.tech. Jefferies’ analysts warned that lofty expectations for the iPhone 17 and other products are already baked into the stock pricets2.tech. Any hiccup – whether a supply chain snag, softer consumer demand, or more regulatory pressure (like the EU’s coming rules forcing Apple to open iOS to third-party app stores) – could trigger a re-rating. Bears also point out that Apple’s AI strategy remains murky; unlike Microsoft or Google, Apple has been “late to the game” on generative AI and has yet to articulate how it will integrate AI into core products beyond incremental featuresreuters.com. If AI is the next big tech revolution, doubters worry Apple might fall behind the curve or need to make expensive moves (M&A or huge R&D investments) to catch up.

Wall Street’s consensus reflects this balanced outlook. According to multiple surveys, the average 12-month price target for AAPL is in the mid-$240sts2.tech – basically around the current trading level. In other words, analysts as a whole see little near-term upside left, after accounting for risks and slower growth ahead. However, it’s notable that most analysts still rate Apple a Buy or Outperformts2.tech. The lack of expected upside is partly due to the stock’s big run, but few are willing to bet outright against the Cupertino colossus. Apple’s track record of innovation, brand loyalty, and massive cash generation makes it, as one fund manager put it, “a stock you can underweight, perhaps, but not one you comfortably short.” Even Jefferies, in cutting its rating, acknowledged Apple is a phenomenal company – their call was more about the valuation risk at these heights.

Tech Titans: Apple vs. The Field

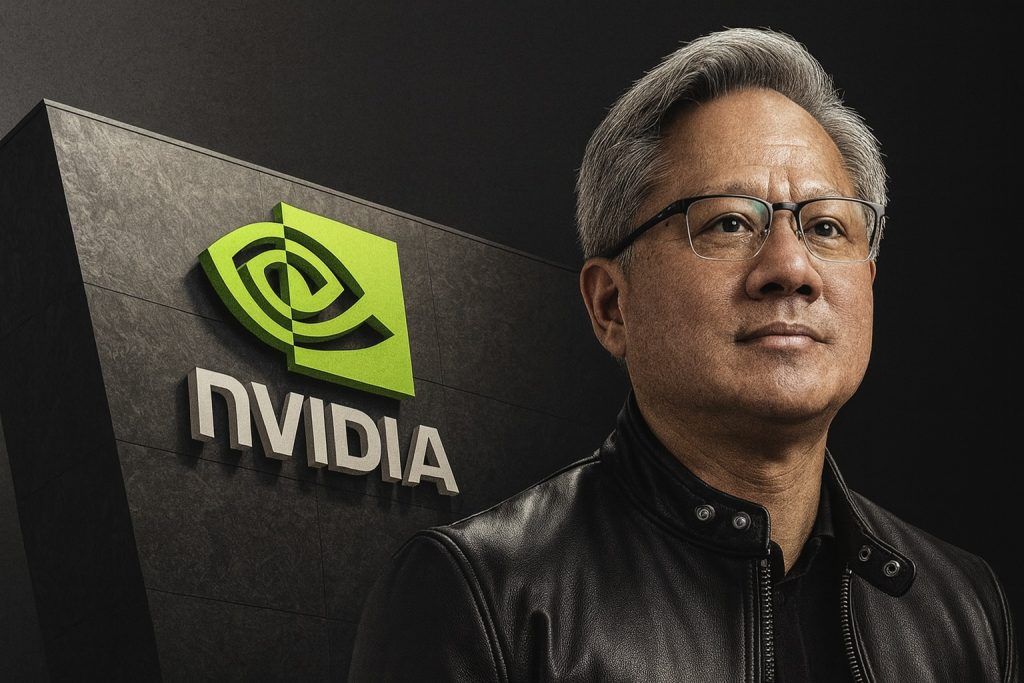

One reason some see limited headroom for Apple’s stock is that many of its mega-cap peers have outperformed it this year – potentially offering more attractive stories. In 2025, Apple’s share price has only notched a small single-digit gain (roughly flat to +2% YTD as of mid-October)ts2.tech. That’s a far cry from the rallies seen in other “Magnificent Seven” tech giants. For example, Nvidia – buoyed by an AI chip boom – has soared +35% year-to-datets2.tech. Microsoft is up about +23% in the same period, riding enthusiasm for AI-powered software and its partnership with OpenAIts2.tech. Google’s parent Alphabet has climbed roughly +29% YTD amid a rebound in digital ad spending and AI initiativests2.tech. Even the overall Nasdaq-100 index has outpaced Apple, thanks to surges in semiconductor and cloud stocks. In short, Apple has been a relative laggard in 2025. Part of that is simply because Apple started the year near all-time highs, leaving less room for dramatic gains. But it also reflects how investor attention shifted to AI-centric names, whereas Apple – which hasn’t made a splashy AI move – was seen as yesterday’s trade earlier in the yearts2.tech.

Now, with Apple hovering just below its peak and the crucial holiday quarter ahead, the question is whether it can reclaim leadership or will continue trailing its peers. Apple’s sheer size (over $3.5T market cap) means that its growth rates naturally tend to be lower than smaller rivals – it’s the law of large numbers. Yet Apple’s stability and cash flow also make it something of a safe haven. Indeed, during periods of market volatility, Apple often holds up better than more volatile stocks like Nvidia. We saw some of that on Oct. 14: while chipmakers Nvidia and Intel sank ~4% each on trade war headlines and an analyst downgradeinvestopedia.cominvestopedia.com, Apple’s dip was comparatively mild and short-lived. Its diversified business and loyal customer base provide a buffer against severe swings.

There’s also the matter of valuations. After their big 2025 runs, Microsoft, Alphabet, and others aren’t exactly cheap either. If anything, Apple’s price/earnings ratio, while high in its own historical context, is not wildly out of line with other tech giants. And Apple has something many peers lack: a mountain of cash (nearly $200 billion on hand) and the ability to return tons of capital via buybacks/dividends. Those levers can support the stock if growth moderates. By comparison, companies like Amazon or Tesla (not direct peers in business, but fellow mega-caps) rely more on future growth with less emphasis on shareholder returns. So Apple’s allure to investors also lies in its blend of growth and stability.

Lastly, Apple’s performance must be viewed in the context of the broader economy. Tech stocks as a whole have been influenced by macro trends – notably the trajectory of interest rates and the specter of a possible economic slowdown. Earlier this year, as the Federal Reserve kept hiking rates to combat inflation, high-priced tech shares wobbled. Apple’s stock actually fell about 17% from its peak at one point in the first half of 2025 amid market rotationts2.tech. But as inflation showed signs of cooling and the Fed paused hikes, tech roared back. Now, with talk of Fed rate cuts potentially starting by year-end (Powell suggested the Fed could be positioned for two rate reductions in 2025 if the economy weakensinvestopedia.com), the macro backdrop is turning more favorable for big tech. Lower rates tend to boost growth stock valuations and ease global demand conditions. If the economy avoids a hard landing and interest rates indeed come down, Apple and its peers could all ride higher together. However, if inflation resurges or the Fed stays hawkish longer, it could cap the upside for these richly valued stocks.

Outlook: Cautious Optimism Into Year-End

Looking ahead, Apple faces a mix of opportunities and challenges as it heads toward the end of 2025. Market sentiment around the company is best described as cautiously optimistic. On the one hand, Apple is expected to report its fiscal Q4 earnings on Oct. 30, and expectations are high for a strong finish to the year. Analysts predict Apple’s July–September results will show solid iPhone 17 sales (some forecasts call for ~13% iPhone revenue growthreuters.com) and continued growth in services – all contributing to modest overall revenue gains despite foreign exchange headwinds. Any upside surprise in those numbers or holiday quarter guidance could be a positive catalyst for the stock. Apple’s own forecast for the holiday quarter (Q1 FY2026) isn’t formally given, but after raising its outlook last quarterts2.tech, investors will be keen to see if momentum is sustained. The launch of new Macs and iPads, plus the upcoming launch of Vision Pro in early 2026, could add incremental revenue streams as well.

On the other hand, external risks abound. The U.S.-China trade dispute remains a wild card – negotiations could ease tensions (which would rally Apple shares), or a collapse in talks could lead to actual implementation of tariffs on iPhones and components (which would hurt Apple’s earnings and sentiment). This geopolitical overhang won’t disappear overnight. Similarly, the competitive landscape is intensifying: Apple’s rivals in Silicon Valley and beyond are not standing still. Alphabet and OpenAI are pushing AI boundaries in ways Apple has yet to match; Samsung and other handset makers are targeting any slip-up in iPhone demand; and regulators globally are scrutinizing Big Tech’s market power, with Apple’s App Store practices in the crosshairs. Any development on these fronts could swing investor mood.

For now, most signs suggest Apple will stay on its current trajectory of steady, if not spectacular, growth. The stock’s valuation implies the market believes in Apple’s resilience and future innovation potential – but also that upside will be incremental. “Apple isn’t likely to double in value from here in the next year, but it doesn’t have to,” noted a Bloomberg analyst. “If it continues delivering high-single-digit earnings growth and expanding its ecosystem, the stock can grind higher and keep rewarding shareholders.”ts2.tech Many portfolio managers are content to hold Apple as a core position, counting on its stability, dividends, and buybacks, even if sexier AI names grab more headlines in the short term.

Bottom line: Apple managed to weather a storm on Oct. 14 – a microcosm of the balance it must strike going forward. The company’s strong fundamentals and savvy leadership helped it “shrug off” immediate fearsmarkets.chroniclejournal.com, and upcoming product catalysts plus an eventual CEO transition plan provide a hopeful storyline for investors. Yet macroeconomic squalls and high expectations mean the journey might be choppy. As Apple approaches a possible $4 trillion valuation, it faces the challenge of living up to the hype. For the time being, the consensus is that Apple will keep doing what it does best: executing reliably, innovating gradually, and navigating external headwinds – a formula that has made it the world’s most valuable company. Barring any unforeseen shocks, analysts see Apple’s stock trading in the mid-$200s over the next yearts2.tech, with the potential to break out higher if new growth drivers (like AR glasses or breakthrough AI features) emerge. In the words of one market strategist, “Apple isn’t aiming for overnight miracles. It’s playing the long game – and that’s why it remains a staple in portfolios, come hell or high water.” ts2.techts2.tech