- ASTS Stock Hits New Highs: AST SpaceMobile’s stock surged to all-time highs in early October 2025 on the back of major satellite milestones and carrier partnershipseconomictimes.indiatimes.comts2.tech. Shares jumped ~16% on consecutive days (Oct 1–2) and reached about $74.77, before a pullback to the high-$60sts2.techbenzinga.com. The year-to-date gain topped 200% as investors piled in on space-to-cell connectivity hypeeconomictimes.indiatimes.com.

- Satellite Breakthroughs Fuel Rally: AST completed its next-gen BlueBird-6 satellite and outlined plans to rapidly deploy dozens more, aiming for 45–60 satellites in orbit by 2026ainvest.com. The company’s BlueWalker 3 test satellite already made history with the first direct-to-phone voice and video calls from space, proving AST’s tech can connect ordinary 4G/5G smartphonests2.techeconomictimes.indiatimes.com.

- New Carrier Deals & 4G Call First: In a major partnership, Bell Canada announced it will launch AST SpaceMobile’s direct-to-cell service in 2026 after successfully testing Canada’s first space-based 4G call, SMS, and broadband data using AST’s satellitets2.techeconomictimes.indiatimes.com. Vodafone similarly completed the world’s first space-based video call via AST’s network, and AST now counts 50+ mobile carriers (AT&T, Verizon, Vodafone, etc.) committed to its serviceainvest.comts2.tech.

- Funding Boosts and Dilution: To fund its aggressive rollout, AST raised $575 million in July 2025 via convertible notesainvest.com and just filed to sell up to $800 million in new shares through an at-the-market offeringbenzinga.com. The share offering news on Oct 7 caused a ~6% drop in the stock (over dilution fears)benzinga.com, even as AST held a hefty $1.5 billion cash reserve at mid-yearbenzinga.com. The company also acquired global S-band spectrum rights to bolster its footprintainvest.com.

- Analysts Split on Future: Wall Street is divided on ASTS. Barclays hiked its price target to $60 (Overweight) after AST’s satellite progress, arguing AST’s full voice/data service can command premium pricing versus rivals’ text-only satellite linksts2.techeconomictimes.indiatimes.com. UBS, however, cut its target to $43 on execution risksainvest.com. Consensus 1-year target hovers ~$45 (Hold rating)ts2.tech – implying skepticism at current valuations. Experts praise AST’s game-changing tech but warn of heavy competition and “no margin for error” going forwardts2.tech.

ASTS Stock Skyrockets in 2025 📈

AST SpaceMobile (NASDAQ: ASTS) has been one of 2025’s hottest stocks, more than tripling in value year-to-dateamid excitement around its satellite-phone technologytipranks.com. The stock’s momentum hit a crescendo in early October. On October 1, 2025, ASTS leapt 16% in a single day, breaking out from the $40s to close at $56.94ts2.tech. It then soared another ~16% on October 2, ending at $66.16 per sharets2.tech. These back-to-back rallies – accompanied by heavy trading volume about 3× the three-month average – propelled ASTS to fresh all-time highs, with a market cap roughly $20–24 billion by early Octoberts2.techts2.tech.

By October 3, ASTS hovered in the mid-$60s, representing a 5-day surge of nearly 50%ainvest.com. The exuberance was driven by concrete news (discussed below) that validated AST’s space-based cellular network plans. Retail traders on social media took notice – ASTS became a trending ticker on Stocktwits as it hit new peakseconomictimes.indiatimes.com, reflecting “extremely bullish” sentiment among individual investors.

However, volatility kicked in by Oct 6–7. After peaking near $74.77 (its 52-week high)benzinga.com, ASTS shares pulled back. On October 7 (a Tuesday), the stock slid ~6% to around $68 following news of a large share offering (a reminder that AST is still in cash-burning mode)benzinga.com. Even with that dip, ASTS was still sitting ~40% above its 50-day average and up over 200% for the yearbenzinga.comeconomictimes.indiatimes.com. Such a rapid rise has also left technical indicators like RSI flashing “overbought” levels (around 79)benzinga.com. In short, AST SpaceMobile’s stock has delivered astronomical gains in 2025, but with equally high turbulence as the company races to turn futuristic promises into reality.

Latest News & Catalysts (Early October 2025) 🚀

AST SpaceMobile’s recent rally was underpinned by big announcements in late September and early October 2025. The company achieved and publicized several milestones that excited investors:

- BlueBird-6 Satellite Ready for Launch: On October 1, AST announced that BlueBird-6, its next-generation low Earth orbit (LEO) satellite, completed final assembly and testingts2.tech. This is a pivotal satellite – the first of AST’s second-gen “Block 2” BlueBird craft designed for commercial service. BlueBird-6 (also called FM1) is scheduled to ship out for launch by mid-October and lift off before Christmas 2025ts2.tech. AST even noted BlueBird-7 is right behind it (being readied to ship to Cape Canaveral), and that it has built enough phased-array components for 46 satellites total so farts2.tech. The upshot: AST’s long-awaited satellite deployment campaign is finally kicking into high gear. CEO Abel Avellan heralded this as tangible progress in moving from R&D into the launch phasestocktitan.netstocktitan.net.

- Record-Breaking Space-Based Call & New Carrier Partner: AST and partner Bell Canada made headlines by completing Canada’s first-ever space-based cellular call and data session. In early October, Bell successfully placed a 4G voice call, sent texts, and streamed video using standard smartphones connected via AST’s satellite – a “direct-to-cell” feat never done before in Canadaeconomictimes.indiatimes.comts2.tech. Following the successful tests, Bell announced it will roll out AST’s satellite-to-phone service commercially in 2026, targeting remote and rural regionsts2.tech. “What we’re intending to do in 2026 is start rolling out the service, with customer trials in that period,” said Bell’s CTO Mark McDonaldadvanced-television.com. He noted this will help bridge connectivity gaps in Canada’s vast underserved areas – a key validation of AST’s value propositioneconomictimes.indiatimes.comts2.tech. Bell’s team also highlighted that unlike text-only satellite add-ons, AST’s tech will deliver voice and broadband, bringing “significant possibilities… in sectors like natural resources [and] emergency services” that need full connectivityts2.techts2.tech.

- Global First Video Call from Space: AST’s network had already notched a world-first earlier in 2025 – in partnership with Vodafone, AST enabled the first-ever live video call via satellite to a standard mobile phonets2.tech. In that January test, a call from a smartphone in the UK to one in Europe was carried end-to-end by AST’s satellite (AST was originally spun out of a Vodafone initiative, and Vodafone remains an investor/partner). Vodafone’s CEO celebrated this “historic milestone… [that] took us one step closer to our mission to eliminate connectivity gaps,” underscoring the significance of AST’s technologyts2.techts2.tech.

- Dozens of Carrier Deals Inked: AST’s business model relies on partnering with mobile network operators, and recent news reinforced that momentum. The company now boasts agreements with 50+ carriers worldwideainvest.com – including heavyweights AT&T and Verizon in the US, Vodafone in Europe, Rakuten in Japan, and many others – to eventually offer space-based cellular service to their subscribers. Each new successful test (like Bell’s) likely strengthens these partnerships. In fact, Bell Canada was an early investor in AST, and rivals like Rogers are also exploring satellite-to-phone messaging, indicating broad industry interestts2.tech. AST’s Chief Commercial Officer Chris Ivory hailed the Bell demonstration as a “breakthrough achievement” bringing AST closer to its mission of broadband for everyonets2.tech.

- Special Shareholder Meeting: One softer headline adding a bit of uncertainty was AST’s announcement of a special stockholder meeting to amend its 2024 Incentive Award Plantipranks.com. This suggests the company may seek to increase the equity available for employee compensation or other purposes. While not a major news item for most traders, it contributed to some “turbulence” in ASTS stock as observers wondered about potential dilution or governance changestipranks.com. Overall, though, the operational milestones have far outweighed this in driving recent price action.

In summary, the first week of October 2025 brought AST SpaceMobile a perfect storm of positive catalysts: a critical new satellite ready to launch, a marquee carrier (Bell) validating the tech with real calls, and analysts taking notice of AST’s momentum. These developments provided concrete proof points that AST’s ambitious plan is moving forward, stirring investor optimism that the company can soon transition from testing to revenue-generating service.

Financial Updates and Funding Moves 💰

Building a space telecom network from scratch isn’t cheap – and AST SpaceMobile’s recent financial moves reflect the massive capital needs to launch dozens of satellites. As of October 2025, the company remains pre-revenue in terms of commercial service (though small pilot and contract revenues are just starting). It continues to operate at a loss, but management has repeatedly emphasized that they have a “fully-funded plan” to deploy the initial constellation by 2026stocktitan.net.

Here are the key financial and funding highlights:

- Second Quarter 2025 Results: In August, AST reported its Q2 2025 financials alongside a strategic updatestocktitan.net. CEO Abel Avellan affirmed, “We are confirming our fully-funded plan to deploy 45 to 60 satellites into orbit by 2026… with orbital launches every one to two months on average during 2025 and 2026.”stocktitan.net He noted AST had 6 satellites in orbit at that time (5 operational BlueBird test satellites and 1 test unit, BlueWalker 3) and that the company had assembled enough components for many morestocktitan.net. Importantly, AST projected it would finally start generating material revenue in late 2025 – forecasting $50–75 million in revenue for H2 2025 from initial commercial and government contractsstocktitan.net. If achieved, that will mark the company’s first significant sales (after years of R&D spend). Wall Street expects ongoing losses for now (analysts forecast around –$0.17 EPS for Q3 of 2025, an improvement from prior year)finance.yahoo.com, but the hope is that early revenues will grow rapidly once service comes online.

- Cash on Hand: AST SpaceMobile entered the second half of 2025 with a substantial cash war chest of over $1.5 billion in cash and equivalents (as of June 30, 2025)benzinga.com. This cash came from prior fundraising and provides runway for satellite manufacturing, launch costs, and operating expenses. AST’s balance sheet has been boosted by strategic investors and partners, including companies like Vodafone and AT&T, as well as public market raises. The cash burn remains high given the company’s aggressive deployment schedule, so maintaining adequate funding is a constant focus.

- July 2025 Convertible Notes: To further strengthen its finances, AST raised approximately $575 million in July 2025 via a private convertible bond offeringainvest.com. These senior notes carry a 2.375% coupon (due 2032) and were notable for having a conversion price roughly 20% above ASTS’s share price at that timets2.tech. The successful raise – including an oversubscription – signaled investor confidence in AST’s story, and it immediately bolstered AST’s cash reserves for satellite production. However, it also added debt (increasing AST’s debt-to-equity to about 56%)ts2.tech. The convertible nature means these notes could later turn into equity if AST’s stock stays strong (mitigating some debt load but diluting shares).

- October 2025 $800 M At-the-Market Equity Offering: In a move that caught the market’s attention, AST filed a prospectus on Oct 7, 2025 to sell up to $800 million in new Class A shares through an at-the-market (ATM) programstocktitan.netstocktitan.net. Under this arrangement, AST can periodically sell stock into the open market over the next three years, as needed, to raise capital. The sales agents (banks including Barclays, BofA, Deutsche Bank, etc.) will take a small commission up to 3%stocktitan.netstocktitan.net. AST is not obligated to use the full $800M, but establishing this program gives it flexibility to tap additional funds opportunistically. The timing suggests AST’s management wants to ensure it can finance the upcoming rapid launch cadence (1–2 satellites per month) without financial strainstocktitan.net. Investors reacted warily – news of the ATM plan immediately sent ASTS down ~6% on Oct 7benzinga.com, as any new share issuance raises dilution concerns. Still, analysts noted that such capital raises are “essential for the company to continue building and launching its satellite network”ainvest.com given the high upfront costs.

- Strategic Spectrum Acquisition: In August 2025, AST announced a deal to acquire EllioSat Ltd., a company holding valuable S-band satellite spectrum rights (1980–2010 MHz / 2170–2200 MHz) across global marketsts2.tech. The purchase price is ~$26 million upfront plus up to ~$20–45 million in milestone paymentsts2.tech. This move secures critical wireless spectrum for AST’s space-to-phone service, ensuring it can operate over licensed frequencies in key regions. Essentially, AST is buying the “space wireless real estate” it needs to deliver robust coverage. CEO Avellan highlighted this “path for premium spectrum on a global basis” as uniquely valuable alongside AST’s patented technologystocktitan.net. Controlling spectrum should give AST an edge and possibly allow it to charge premium prices for faster data (the CEO touted potential 120 Mbps peak data rates per cell using those bands)stocktitan.net.

- Upcoming Earnings: AST’s next earnings report (for Q3 2025) is expected in November. Investors will be watching for updated cash burn figures, progress on satellite manufacturing, and any refinement to the deployment or revenue timeline. No major surprises are anticipated in terms of earnings, as the real inflection point will come once satellites start delivering commercial service. However, the company’s guidance and commentary on things like operating expenses, launch schedule, and partnership pipeline will be closely parsed. AST has warned in SEC filings that its future “hinges on building a large constellation and signing commercial contracts with carriers”, with little room for delayts2.tech. Thus, how management addresses execution risks on the earnings call will be key.

In summary, AST SpaceMobile’s financial strategy in 2025 has been to raise ample funds ahead of revenue ramp-up, while proving to the market that it’s spending wisely to achieve its milestones. The balance of diluting shareholders versus maintaining a “fully funded” plan is a tricky tightrope AST must walk. So far, investors have shown willingness to finance AST’s vision – as long as the company keeps hitting technical milestones that bring revenue within sight.

Satellite Technology Progress: BlueWalker to BlueBird 🛰️

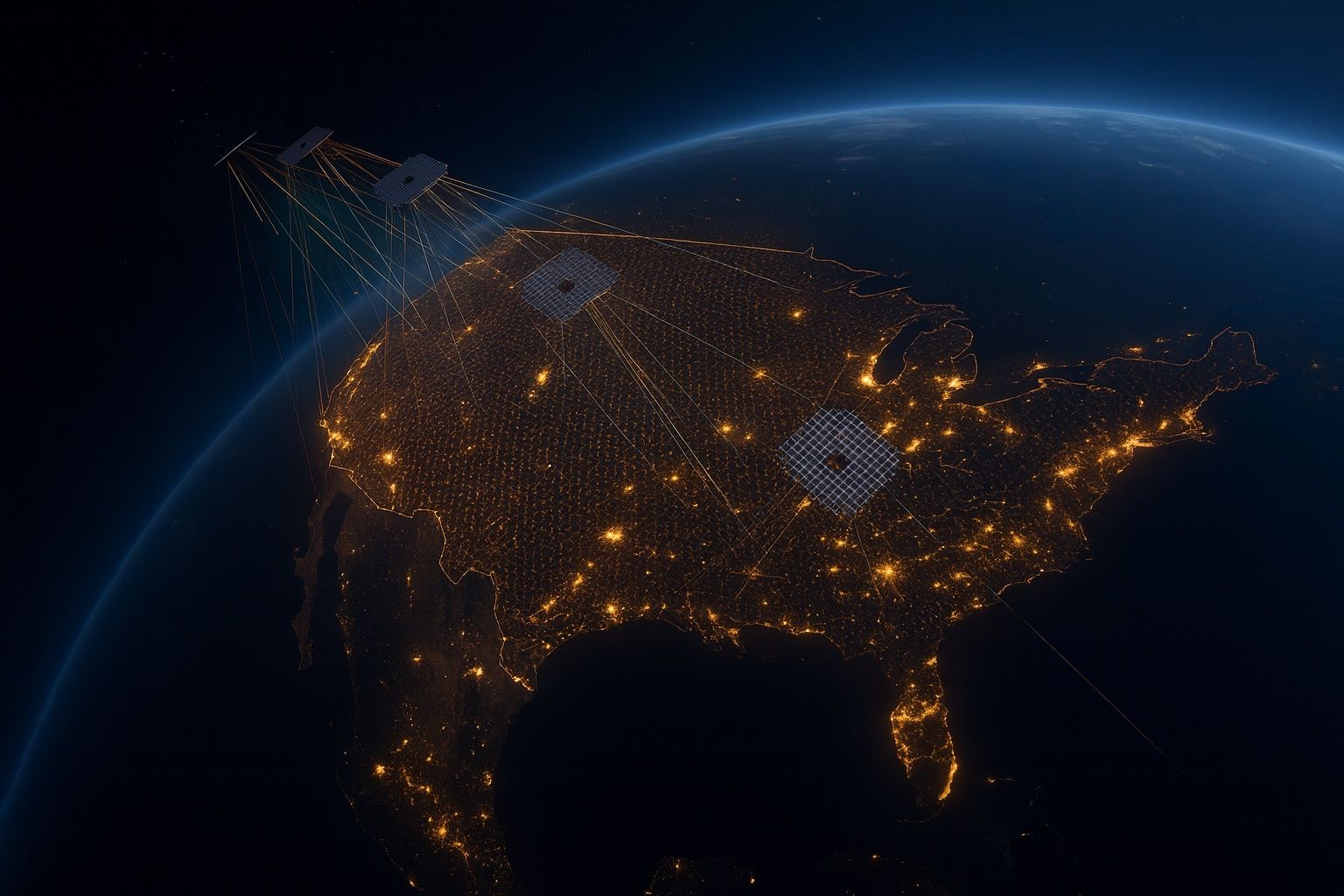

AST SpaceMobile’s entire proposition rests on its innovative satellite technology that can communicate directly with everyday mobile phones. Unlike traditional satellites that require dish antennas or specialized phones, AST’s system acts as a cell tower in space, linking to normal 4G/5G smartphones. As of October 2025, the company has demonstrated this technology works, and is now scaling it up:

- BlueWalker 3 Proved the Concept: AST’s first breakthrough came with BlueWalker 3 (BW3) – a prototype satellite launched in 2022. BlueWalker 3 unfolded one of the largest commercial arrays in space (64 m²) and was used throughout 2023 to test two-way cellular links. In September 2023, AST made history by completing the first-ever voice calls directly between standard smartphones via the BW3 satellite, in collaboration with AT&T and othersast-science.com. By mid-2023, they even achieved a space-based 5G connection and conducted a video call using BW3 as the relayabout.att.com. These feats demonstrated that AST’s large phased-array satellites could deliver broadband and voice service straight to normal phones on the ground. BlueWalker 3 essentially served as a “proof-of-concept” low-orbit cell tower, de-risking the core technology.

- Early BlueBird Test Satellites: Building on BW3, AST launched a batch of initial BlueBird satellites (Block 1 versions) in September 2024 on a SpaceX Falcon 9ts2.tech. By early 2025, five of these BlueBird test satellites were in orbit and operational, forming a prototype network for continued trialsts2.tech. These satellites, built at AST’s Midland, Texas facility, were used to conduct the Vodafone video call test in January 2025 and other demonstrationsts2.tech. The BlueBird satellites are AST’s workhorse design – each one is a massive phased-array antenna designed to blanket huge areas with cellular signal. They effectively mimic a terrestrial cell tower’s signal but from space, and can connect to phones over standard cellular frequencies (hence the importance of AST acquiring spectrum rights). The early BlueBirds allowed AST and its carrier partners to fine-tune network integration, ensuring that a phone sees the satellite as just another cell site (albeit 500 km overhead!).

- BlueBird-6 and Next-Gen Satellites: AST’s focus in 2025 has been completing the “Block 2” BlueBird satellites, which are the first units intended for commercial service rollout. BlueBird-6, as noted, finished assembly and will launch by the end of 2025ts2.techts2.tech. BlueBird-7 is close behind, with shipment to the launch site expected in October as wellts2.tech. AST revealed it has already built 40+ satellite worth of phased array modules – meaning the subcomponents for up to 46 satellites are ready, and manufacturing is ongoing at a steady clipts2.tech. The company plans to launch satellites at a cadence of every month or two through 2026 to rapidly populate its networkts2.tech. If they achieve their high-end goal of ~60 satellites, AST will have enough coverage for continuous broadband service across major markets (initial targets include the US, Europe, Japan, and more)stocktitan.net.

- Technical Capabilities: Each BlueBird satellite is enormous – roughly the size of a typical bus with its solar panels and antenna unfurled, and weighing in the order of 1.5 tons. They sport a giant flat antenna array that can form multiple beams, effectively acting like hundreds of cellular base station antennas in the sky. AST has stated that their system could support up to ~120 Mbps peak data speeds per user on 4G/5G, depending on spectrumstocktitan.net. The goal is to deliver not just texting or SOS messaging, but voice calls and true mobile broadband speeds directly to phones. This far exceeds what early “satellite phone” services or the new smartphone SOS features provide (which are extremely low-bandwidth). Achieving this requires cutting-edge technologies in power management, signal processing, and antenna design – areas where AST has filed thousands of patent claimsstocktitan.net. BlueBird satellites essentially carry a cellular base station payload that operates in standard mobile bands and can hand off connections to terrestrial networks when in range.

- Regulatory and Infrastructure Progress: AST’s tech progress also depends on regulatory green lights. In the US, the FCC granted AST permission to test and eventually operate its satellites in certain bands, and international regulators are also onboard, thanks in part to partnerships with carriers who already hold licenses (e.g., Bell in Canada holds the necessary spectrum and is securing government approvals to use AST’s system)ts2.techts2.tech. Meanwhile, ground infrastructure is being prepared – AST will need gateway stations and integrations with carrier networks to route calls and data from satellites into terrestrial telecom systems. The company has been working on these aspects quietly with partners.

Overall, AST SpaceMobile’s satellite tech is moving from experimental to operational. BlueWalker 3 proved that connecting a normal smartphone to a satellite could be done for voice and data. Now the BlueBird constellation aims to scale that up to a global service. By late 2025, AST expects to begin intermittent trial services (for example, AST mentioned plans for beta service in the U.S. by end of 2025)stocktitan.net, and to rapidly expand coverage through 2026 as more BlueBirds come online. This period is critical – AST must demonstrate that its satellites can deliver reliable coverage and quality (without draining phone batteries or overloading networks) at a commercially viable cost. If it succeeds, it will truly realize the vision of everyday smartphones connecting anywhere on the planet, far beyond the reach of cell towers.

Competition and Industry Landscape 🌍

AST SpaceMobile is pioneering a new frontier – direct-to-mobile satellite connectivity – but it’s not alone. The broader industry is in a “space race” to extend coverage everywhere, and several powerful players are charting different paths. Here’s how AST stacks up against the competition:

- SpaceX Starlink (and T-Mobile): SpaceX’s Starlink has launched thousands of LEO satellites to deliver broadband internet, primarily via dedicated user terminals (dishes). However, Starlink is evolving toward direct-to-cell services as well. SpaceX and T-Mobile announced a partnership in 2022 to enable text messaging from regular phones via future Starlink satellites. In fact, SpaceX has started launching “Starlink V2” satellites equipped with direct-to-cellular antennas, aiming to provide basic connectivity (like SMS and eventually voice/data) to standard phonests2.techts2.tech. As of 2025, SpaceX is running trials and has hundreds of these upgraded satellites in orbit. The contrast: Starlink’s initial direct-to-phone offering is limited (text-only in beta)and piggybacks on T-Mobile’s spectrum for noweconomictimes.indiatimes.com. In the Economic Times, Barclays analysts noted T-Mobile/Starlink plan to charge ~$10/month for text SOS service, whereas AST’s service is more advanced – supporting voice and broadband – which could justify higher price pointseconomictimes.indiatimes.com. SpaceX’s sheer scale and resources make it a formidable competitor if it can get full phone service working. But AST’s head start in demonstrating voice/data and its exclusive partnerships with other carriers (AT&T, Vodafone, etc.) give it an opening to establish a niche that Starlink hasn’t yet dominatedts2.tech.

- Amazon’s Project Kuiper: Amazon is deploying its own LEO constellation known as Kuiper, with plans for 3,236 satellites to provide global broadband coverage. Kuiper’s first test satellites launched in late 2023, and Amazon intends to begin customer service by 2025–2026. Currently, Kuiper is positioned similar to Starlink’s original model – using terminals (antennas) for home/business internet rather than connecting to normal phones. Direct smartphone connectivity has not been Kuiper’s initial focus, but given Amazon’s ambitions, it could explore that in future or partner with phone makers. Where Kuiper does compete is for general satellite internet market share and spectrum/orbital resources. Amazon has deep pockets (committing over $10 billion to Kuiper) and could be a long-run threat if AST tries to expand into broadband markets. For now, though, AST’s unique selling point is the carrier integration and phone-native service, which Kuiper isn’t yet addressing.

- Legacy Satellite & Others (OneWeb, Iridium, Apple/Globalstar, Lynk): There are several other relevant players:

- OneWeb/Eutelsat: OneWeb (now merged with Eutelsat) is deploying hundreds of LEO satellites aimed at enterprise, aviation, and cellular backhaul markets. OneWeb’s network works with fixed terminals and has partnered with carriers to extend coverage to remote areas via small cells. However, it does not connect directly to standard handsets – it could complement AST by providing backhaul for remote cell sites, but it’s a different approach.

- Iridium and Globalstar: These legacy satellite operators offer specialized satellite phone services (Iridium for sat phones, Globalstar powering Apple’s iPhone SOS text feature). Apple’s iPhone 14 introduced emergency texting via Globalstar satellites, which brought mainstream attention to satellite-to-phone capabilitiests2.tech. But those services are very low bandwidth and limited in scope (emergency use or basic messaging). Apple’s move does indicate that smartphone makers are interested in satellite connectivity, potentially paving the way for broader adoption. AST’s advantage is that its solution doesn’t require special chipsets – it works with existing phones by leveraging the carriers.

- Lynk Global: A startup often mentioned in this space, Lynk has launched a few small satellites and demonstrated text messaging direct to normal phones. It’s pursuing deals with rural carriers to offer emergency SMS from space. Lynk’s approach is similar in concept to AST’s but on a smaller scale (and without AST’s large high-capacity satellites, Lynk’s service is limited to texting and low-rate data). Lynk underscores that AST is not the only pure-play doing “cell tower in space,” but AST is far ahead in funding, partnerships, and technology maturity.

- Market Size and AST’s Edge: The total addressable market for satellite-enhanced connectivity is huge. Bank of America analysts estimated the global telecom market that space players could tap is around $200 billion annually – spanning wireless, broadband, and defense segmentsadvanced-television.com. Essentially, any dollar spent on connectivity in remote areas or on augmenting mobile coverage is up for grabs. BoA’s report suggested that direct-to-device satellite services could capture a significant slice of the $30 billion wireless market segment, potentially $15 billion/year if a provider like AST can win even half of that nicheadvanced-television.com. In other words, there is room for multiple winners in the satellite-to-phone arena, given the vast number of currently unconnected people and devices worldwide.

AST SpaceMobile’s competitive moat is its first-mover advantage in true broadband-to-phone service and its strong alliances with mobile operators. It is literally building a space-based extension of the cellular networks. This cooperative model means carriers see AST as enabling their expansion (rather than threatening to bypass them). By contrast, Starlink so far has mostly a direct-to-consumer model (except the T-Mobile pact) and could be seen as a competitor to telcos. An AT&T executive, Joe Russo, explained why AT&T chose AST: “They bring great technology and super innovation to get us beyond emergency texting into more and more value-added services… we partnered with AST [so] customers can do all the things they love to do on a terrestrial network” even in the 1% of areas without coverageadvanced-television.com. This highlights AST’s collaborative approach with telecom providers.

That said, AST faces giants with deep pockets in SpaceX and Amazon, plus the reality that technology gaps can close quickly. SpaceX is already equipping satellites for phone service, Apple is integrating satellite features in iPhones, and others are eyeing the same prize. Also, satellite launches have gotten cheaper (thanks to SpaceX’s reusable rockets), lowering barriers to entryts2.tech. AST’s large satellites are complex and costly, which means its deployment might be slower or more expensive than constellations of many small sats. Furthermore, if global satellite broadband capacity leads to price wars (as some analysts warn, with bandwidth prices already dropping in recent yearsts2.tech), AST will need to execute flawlessly to earn healthy returns. In summary, AST is racing not just to build its network, but to lock in market share before competitors catch up. The next 1-2 years, as AST launches its fleet and others ramp up their efforts, will be decisive in determining the winners of this new space connectivity era.

What Analysts and Experts Are Saying 💬

AST SpaceMobile’s bold vision has attracted both enthusiastic bulls and skeptical bears on Wall Street. Analyst commentary in recent weeks reflects a mix of excitement over AST’s progress and caution about its challenges.Here are some of the key perspectives:

- Barclays – Bullish on Execution: After AST’s early October announcements, analysts at Barclays grew more optimistic. They raised their price target from $37 to $60 and maintained an Overweight (buy) ratingainvest.com. Barclays cited AST’s improved medium-term outlook now that satellite launches are underwayts2.tech. Crucially, they highlighted AST’s competitive differentiation: with T-Mobile/Starlink only offering text-based satellite links at the moment, AST’s ability to provide voice and broadband data could let it “capture more value per user” by commanding premium pricingts2.tech. In other words, AST might monetize each customer at higher rates than the bare-bones satellite services currently on the market. Barclays also noted that AST’s partnerships reduce go-to-market friction – carriers will effectively market AST’s service to their own subscribers once it’s available.

- UBS – Cautious on Valuation: Not all analysts are convinced. UBS in September 2025 actually downgraded ASTS and cut its target to $43, expressing concern about the timeline to monetize this new networkts2.tech. UBS analysts worry that even if AST launches satellites successfully, will the company be able to quickly sign up paying customers and generate cash flow? The service is planned to start in 2026, but widespread adoption could take time, and AST will be burning money in the interim. At ASTS’s current lofty stock price, UBS feels a lot of growth is already priced in. This skepticism is echoed in the broader consensus: as of early October, of about 10 analysts covering ASTS, the average rating was “Hold” and the average 12-month price target around $45ts2.tech. That median target implies analysts collectively see limited upside (and even some downside) from the ~$68–70 range where the stock was trading after the spike. Price targets ranged from roughly $30 on the low end to $60 on the high endts2.tech, underscoring the wide divergence in views.

- Technical and Sentiment Signals: Some market observers point out that ASTS’s rapid ascent has made the stock’s valuation metrics sky-high. With essentially zero current revenue, traditional multiples are meaningless – TS2.tech humorously calculated AST’s trailing P/S (price-to-sales) ratio at over 4,000×ts2.tech. While that will improve once sales start, it shows how much investors are valuing AST purely on future potential. There’s also a sizable short interest in ASTS (though exact figures aren’t cited here, high volatility names often attract shorts). Retail sentiment is split between true believers and those expecting a pullback. As one financial blogger put it, ASTS is a “high-risk, high-reward play”, generating “excitement” for its space-to-cell breakthroughs but also caution due to execution hurdlests2.tech. On forums like X (Twitter), many applaud AST’s accomplishments, while others note the stock’s dips during early September 2025 as a sign of how choppy the ride can bets2.tech.

- Industry Experts and Partners: Telecom industry experts generally acknowledge AST SpaceMobile as a pioneer in the direct-to-phone arena. The successful tests with carriers lend credibility. Bell Canada’s CTO (Mark McDonald), after the recent tests, lauded the “significant possibilities” opened up by AST’s tech for industries like energy and mining in remote regionsts2.tech. At AT&T, which has been testing AST’s system in the U.S., executives have been public about their support. AT&T’s network chief said the goal is enabling customers to do “all the things they love to do on a terrestrial network” even outside coverage, and that AST brings “super innovation” beyond emergency use casesadvanced-television.com. Such endorsements from carrier partners are gold for AST’s credibility – it implies that telecom giants see AST not as a science project but as a real solution to extend their services (and revenues).

- Competitive Commentary: Analysts also frequently compare AST to SpaceX/Starlink in their notes. A recent industry analysis even opined that “AST SpaceMobile is in a stronger position than Starlink’s current direct-to-consumer offering”, given AST’s focus on leveraging existing mobile providers and spectrumadvanced-television.com. The argument is that Starlink has millions of customers for home internet, but for direct-to-device cellular, Starlink is just beginning, whereas AST’s system is built ground-up for that purpose. Still, the same analysis cautioned that ultimately, satellite connectivity will likely complement terrestrial networks rather than replace them, and the market is big enough that multiple systems (Starlink, AST, etc.) could coexistadvanced-television.com. The presence of Amazon, SpaceX, and even defense-backed projects means AST must keep innovating to stay ahead.

In essence, the expert take on AST SpaceMobile boils down to: revolutionary potential, but significant challenges to overcome. Supporters see AST as a “game-changer” that could plug coverage gaps worldwide and generate billions in new revenue – if it executes welladvanced-television.com. Skeptics see a company valued in the tens of billions that has yet to generate a dollar of commercial telecom service, facing well-funded rivals and technological unknowns. As one commentary put it, AST’s recent progress has swung sentiment toward optimism, but “there is no margin for error” in the coming yearts2.tech. Every satellite launch, service demo, and partnership deal will be scrutinized as the company works to justify the hype.

Outlook and Forecasts: The Road Ahead for ASTS 🔮

Looking forward, the next 12–24 months are make-or-break for AST SpaceMobile. By the end of 2025 and into 2026, we’ll see the theoretical promise translate (or not) into actual service and revenue. Here are key things to watch and what analysts predict:

- Commercial Service Launch (2025–2026): AST plans to initiate intermittent service in select regions by late 2025, followed by broader commercial launches in 2026stocktitan.net. For example, after enough satellites are up, carriers like Bell Canada aim to start direct-to-cell trials with customers in 2026advanced-television.com. By 2026’s end, with perhaps 45+ satellites in orbit, AST hopes to offer continuous coverage in several areas (North America, Europe, Japan, etc.). This timeline is extremely aggressive – essentially deploying a global network in just over a year. Success would mean AST begins generating recurring service revenue, turning the corner from pure R&D spending. Analysts will closely monitor if AST hits its launch schedule. Any significant delays (due to supply chain, launch availability, technical hiccups) could spook investors, given the high expectations built into the stock.

- Financial Inflection Point: Wall Street projections (though hazy) generally assume AST will start seeing revenue in 2025 and ramp through 2026–2027. The consensus price targets (~$45) imply that many analysts are taking a wait-and-see approach – they want to see evidence of paying customers and maybe initial ARPU (average revenue per user) figures before baking in lofty growth. If AST’s service launch goes well, there could be upside revisions. Barclays’ $60 bull-case target for instance likely assumes AST will successfully monetize its partnerships and perhaps even charge a premium for its superior capabilitiests2.tech. On the flip side, if the rollout hits snags or adoption is slow, the stock could correct to the lower end of targets (around $30). For now, forecasts are wide-ranging. MarketBeat’s survey of analysts shows revenue estimates that climb from virtually nothing in 2024 to tens of millions in 2025, and then into the hundreds of millions by 2026/27 – but these are highly speculative at this stagets2.techts2.tech.

- Burn Rate and Capital Needs: AST has been forthright that more satellites equal more spending. Even with $1.5B+ in cash and the new $800M ATM facility, the company could potentially need additional funding if costs run over or if it pursues faster expansion. Investors will be looking at the cash burn rate each quarter. The good news is AST’s recent fundraising gives it a cushion likely through the first big wave of launches. The concern is if revenues don’t start by 2026, will AST need to tap debt or equity markets yet again? The company’s ability to manage costs and maybe strike government deals (for subsidized rural connectivity or military use) could help its financial longevity. Notably, AST’s service has attracted interest for government and disaster-response applications, which might bring in non-consumer revenue streams in early years (the company guided $50M+ could come from such contracts in late 2025)stocktitan.net.

- Market Adoption Unknowns: One question mark is pricing and uptake for satellite cellular service. It’s a novel product – how many people will pay, and how much, for connectivity outside terrestrial coverage? Some carriers might include it as a bundle for premium plans, or sell it as an add-on (T-Mobile indicated $5–10/month for text service; full voice/data would cost more). If AST’s partners price the service too high, adoption might be niche (e.g., hikers, remote workers, maritime, etc.). If they price it too low, the volume might be high but AST’s revenue cut might be lower than investors hope. This balance will become clearer once commercial trials start. Analysts will look for any ARPU guidance or pilot program results to gauge the revenue potential per user. The TAM (total market) is huge in theory – billions of mobile users worldwide and all the “dead zones” that could be coveredadvanced-television.comadvanced-television.com. But AST will have to convert that into real subscriptions. Some foresee enterprise and government users (think: shipping, airlines, emergency responders) being early adopters willing to pay a premium, with consumer uptake growing as coverage and marketing expand.

- Competitive Response: As AST executes, competitors won’t sit still. By late 2025, SpaceX is expected to have hundreds of direct-to-cell capable Starlink satellites in orbit, and could start enabling basic services on them. Amazon’s Kuiper will likely launch dozens of satellites in 2024–25 and start demos. It’s possible by 2026 there will be multiple offerings for satellite-to-phone connectivity. This could actually help validate the market – much like multiple cellular carriers created awareness – but it could also lead to noise and competition on price/features. If AST can maintain a technical edge (e.g. higher data rates, seamless integration), it can differentiate itself. Its patents and head start might give it a defensible lead, but technology in space evolves quickly. We’ll also watch if any consolidations or partnerships occur: for example, if a big tech or aerospace company decided to invest in or partner with AST to accelerate deployment (similar to how Apple partnered with Globalstar for a feature). AST’s independence and pure-play status are attractive to stock investors now, but the landscape could change if alliances shift.

- Regulatory & Global Expansion: On the regulatory front, AST will need approvals in each country it operates. Working through carriers helps, since carriers have existing relationships with regulators. But there could be unforeseen hurdles, especially around spectrum coordination and avoiding interference (AST’s satellites must coexist with terrestrial networks without causing cross-talk). Thus far, no major regulatory roadblocks have emerged – indeed, AST received an FCC license for a 5-year commercial trial period and international regulators appear supportiveainvest.com. If anything, regulators are keen on solutions to connect rural areas. But it’s something to monitor, as spectrum is finite and AST’s use of cellular bands from space is a relatively new concept.

All told, the consensus is that AST SpaceMobile sits at the cusp of a transformative opportunity – but must execute near-flawlessly to fulfill it. The next year will likely bring a flow of news: satellite launches every month or two, first customers getting online, and perhaps new carrier deals in regions like Asia or Africa. Each successful milestone could drive the stock higher; any serious stumble (like a launch failure or tech issue) could have the opposite effect. As one industry consultant noted, “billions are flowing into constellations, and telecom companies want to plug coverage gaps via space” – AST is in the pole position for the “satellite gold rush” of direct-to-phone servicets2.techts2.tech. Its competitive moat is the combination of first-mover tech and strong mobile operator alliances, but it faces heavyweightsin SpaceX and Amazon who also have their eyes on the prizets2.tech.

For investors and tech enthusiasts, AST SpaceMobile’s journey through late 2025 and beyond will be thrilling to watch. The company embodies a bold bet: that a small company can deploy a global network to connect everyone, everywhere with ordinary smartphones. If AST succeeds, it could reshape the $1.5 trillion telecommunications industry and bring connectivity to the remotest corners of the globe. If it stumbles, it will serve as a cautionary tale of space ambition outpacing reality. As of October 2025, the momentum is in AST’s favor, with tangible progress boosting credibilityts2.tech. Now the challenge is to maintain that momentum through the gauntlet of launches and commercialization ahead. In the words of AST’s CEO Abel Avellan, they are “one step closer” to eliminating connectivity gaps – but many steps remaints2.techts2.tech.

Sources: Financial data and stock prices from Yahoo Finance and Benzingabenzinga.com; AST SpaceMobile press releases and SEC filingsstocktitan.netstocktitan.net; News reports from TS2.space Tech, Yahoo Finance, The Economic Times, and industry outletsts2.techeconomictimes.indiatimes.comadvanced-television.com; Analyst commentary from Barclays, TipRanks, MarketBeat, etc.ts2.techts2.tech; Industry analysis from Advanced Television and othersadvanced-television.comts2.tech. All information is up-to-date as of Oct 7, 2025.