- Oracle’s stock has pulled back sharply in mid-October, sliding about 6–7% on Oct. 17 and another ~5% on Oct. 20 financialexpress.com financialexpress.com. These drops erased roughly $24.1 billion and $14 billion of Larry Ellison’s net worth, respectively financialexpress.com financialexpress.com.

- Ellison’s fortune had surged 75% over the past year (up $144 B), briefly touching $392.6 B (Forbes) in early September reuters.com financialexpress.com. As of late Oct., he remains the world’s second-richest person at about $336–351 B (Bloomberg/Forbes) financialexpress.com. Elon Musk still leads (~$486 B financialexpress.com).

- Oracle stock is trading near $280 (Oct. 23 close) after a blockbuster 2025 run (up ~70–75% YTD) ts2.tech financialexpress.com. Analysts’ average 12‑month price target is roughly $320 (about 15% upside), but forecasts range widely from the mid-$175s to $400 ts2.tech ts2.tech.

- Bulls point to Oracle’s massive AI cloud backlog (now ~$455–500 B in remaining obligations ts2.tech) and a bold 2030 revenue goal ($166 B) as support. Jefferies, UBS and BofA see upside to $360–400 on Oracle’s AI-driven growth ts2.tech financialexpress.com. Even so, some warn the stock trades at lofty multiples (~45×–50× forward EPS ts2.tech ts2.tech) and hinges on executing a huge AI rollout.

- Technically, traders note key support in the $270s and resistance near $300 ts2.tech. Options-implied signals even suggest ORCL could revisit the mid-$300s by year-end if the AI boom continues ts2.tech – but failure to deliver on promises could send it lower.

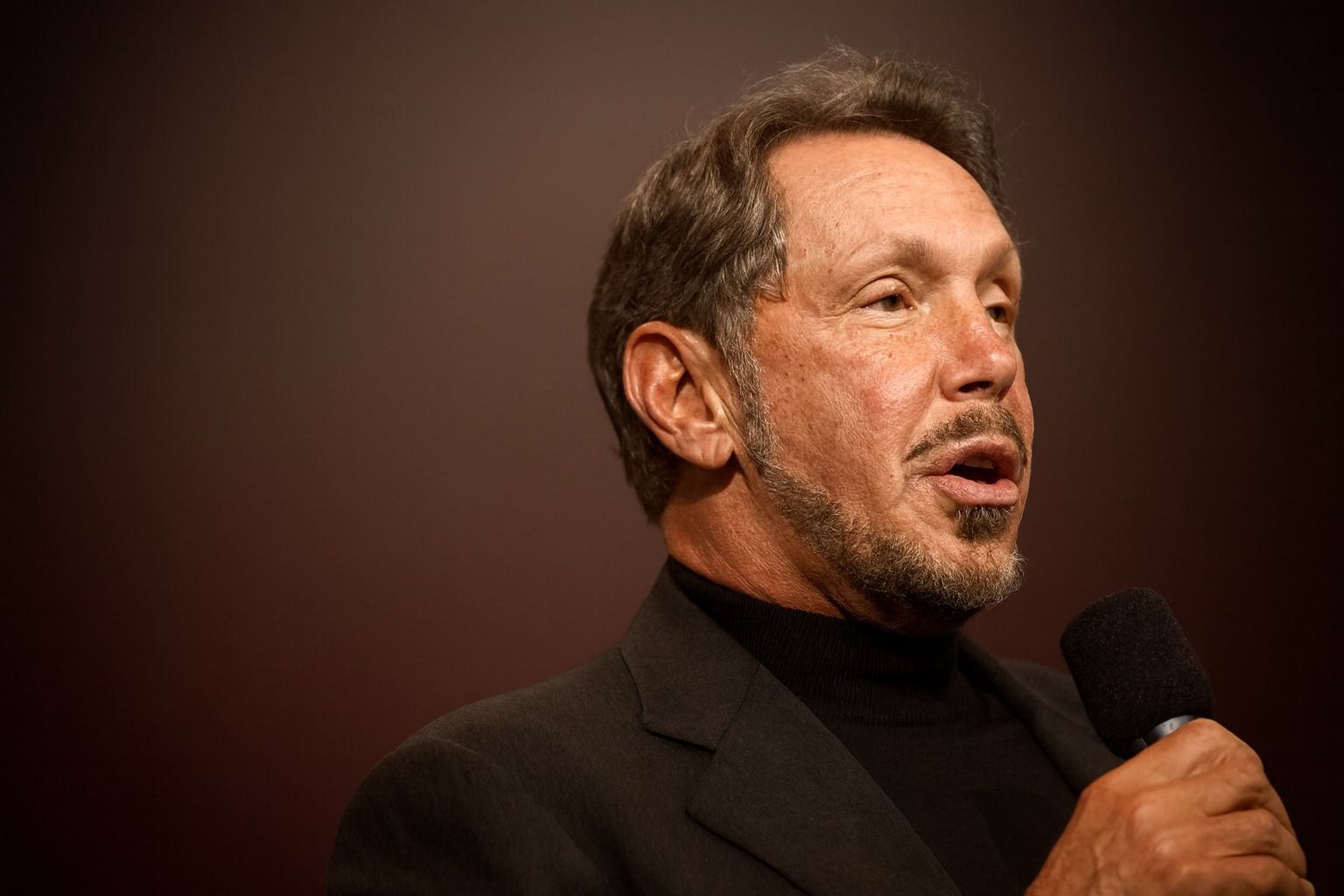

Stock Slide Hits Ellison’s Fortune

Oracle’s spectacular AI-driven rally has turned choppy in recent days. After rocketing to all-time highs in September (briefly valuing Ellison’s stake at ~$393 B) reuters.com, profit-taking set in. The stock plunged about 7% on Oct. 17 (wiping ~$24B off Ellison’s wealth) and sank nearly 5% on Oct. 20 (erasing another ~$14B) financialexpress.com financialexpress.com. The selloff reflects a shift from “euphoria to caution,” as investors booked gains after Oracle’s string of AI contract announcements. By Oct. 23, ORCL closed around $280 ts2.tech – still roughly 70% above its January price, but down from its Sept. peak (~$345).

Market watchers describe the recent pullback as a case of “buyer exhaustion,” not the end of Oracle’s story. “The guidance was so incredible, hard to think that this story is over,” said Dennis Dick of StockTraderNetwork reuters.com. Yet the flat U.S. equity market and a broader rotation out of megacap tech may also be pressuring ORCL. On the positive side, even after the slide Oracle’s market cap is near $780–790 B ts2.tech, making it one of the world’s most valuable tech firms. In percentage terms, this year’s 70–75% rally “left even the ‘Magnificent Seven’ tech stocks trailing” ts2.tech.

AI-Fueled Surge and Backlog of Deals

Oracle’s surge this year was fueled by a wave of AI and cloud deals. In early September the company reported a blowout quarter (Q1 FY2026): revenue of $14.93 B (+12% YoY), with cloud sales up ~28% ts2.tech ts2.tech. CEO Safra Catz announced four massive multi-billion-dollar contracts in that quarter alone – including reports that OpenAI will spend ~$300 B on Oracle cloud over five years reuters.com ts2.tech. These deals vaulted Oracle’s remaining performance obligations (backlog) to roughly $455 B (up 359% YoY) ts2.tech. Management even projects that RPO will exceed half a trillion dollars in coming months (Safra Catz said “RPO is likely to exceed half-a-trillion dollars” reuters.com).

At Oracle’s AI World conference (Oct. 15–16), the company doubled down on its forecasts. It raised its FY2030 revenue guidance from $144 B to $166 B ts2.tech, implying roughly 75% annual growth. This aggressive outlook – along with launches like an “AI Agent Marketplace” and new partnerships (e.g. Oracle-IBM AI agents, Zoom on Oracle Cloud) – bolstered the bull case. Analysts applauded the quarter: Jefferies’ Brent Thill called it “truly historic” and lifted his ORCL target to $360 ts2.tech. Deutsche Bank’s Brad Zelnick said the results were “truly awesome,” reinforcing Oracle’s leadership in AI ts2.tech.

Analyst Forecasts: Bulls vs. Bears

Wall Street is largely optimistic but divided. The consensus 12-month price target on ORCL is in the low-$300s ts2.tech, implying roughly 10–15% upside from ~$280. Many bullish analysts have higher targets: Jefferies now sees $400, UBS and BofA $360–370 ts2.tech financialexpress.com. TipRanks’ database shows an average target around $354 (≈+29%) ts2.tech. Even Citigroup raised its ORCL target to $410 ts2.tech. These bulls point to Oracle’s massive AI backlog, accelerated cloud growth, and new partnerships (with companies like Meta, xAI, OpenAI) as drivers of future gains.

However, skeptical analysts sound warnings. Redburn Partners recently initiated coverage with a Sell rating and only a $175 target, calling the $300B OpenAI deal “very risky” ts2.tech. JPMorgan’s Mark Murphy notes that implied ~75% long-term growth is “virtually unheard-of” for a company of Oracle’s size ts2.tech. The stock now trades at roughly 11× sales ts2.tech (versus Amazon ~31×, Microsoft ~28×), reflecting stretched expectations. Even bulls admit risks: Jefferies’ Thill acknowledged that Oracle provided scant detail on financing the huge data-center buildout needed for AI ts2.tech. Morningstar’s Dave Sekera quipped that Oracle’s 2030 targets give “late-90s… vibes” – a nod to dot-com era-style hyper-growth forecasts ts2.tech.

Technically, analysts see key levels in play. Chart-watchers note support around the high-$270s and resistance near $300 ts2.tech. If the bull case holds, option markets suggest ORCL could revisit the mid-$300s by year-end ts2.tech. Conversely, failure to meet lofty AI expectations could send it back toward the $270s or lower ts2.tech.

Ellison’s Broader Empire and Outlook

Larry Ellison’s personal story also grabs headlines. At 81 he’s become a Silicon Valley elder statesman, with ventures ranging from databases to Hollywood. (Ellison’s media holdings include Skydance and a controlling stake in Paramount Global, and he’s played a role in TikTok’s U.S. strategy reuters.com.) But for now, his Oracle stake – ~41% of the company – dominates his net worth. Forbes wealth editor Matthew Durot observes that Ellison’s AI pivot “got the last laugh – at least for now” reuters.com, crowning him briefly the world’s richest man in September.

Looking ahead, the key question is whether Oracle can deliver on its ambitious AI cloud promises. A successful ramp-up could justify the high valuation and keep Ellison in contention for the top billionaire spot. “After such a run, it must deliver on its backlog to sustain investor confidence,” one commentator noted ts2.tech. As Wall Street’s Dennis Dick put it: the stock is taking a breather, but the incredible guidance suggests the story isn’t finished reuters.com.

Sources: Recent reports from Reuters reuters.com reuters.com, Financial Express financialexpress.com financialexpress.com, TS2.tech analysis ts2.tech ts2.tech, and others provide data on Oracle’s stock moves, Ellison’s net worth and expert commentary. All figures and quotes are as of Oct. 23, 2025 (markets closed) and reflect the latest publicly available information.