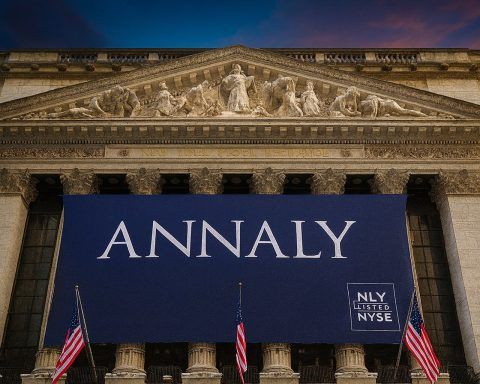

Annaly Capital (NLY) Rallies Near Highs on 13% Yield – Latest Stock News & Forecasts

What to Know Before Markets Open on October 20, 2025 Stock Price Performance & Momentum Annaly Capital’s stock price has climbed steadily through 2025, supported by easing interest rate fears and its outsized dividend yield. Shares of Annaly Capital Management are trading near their highest levels of the past year after mounting a robust recovery. The stock closed at $20.80…