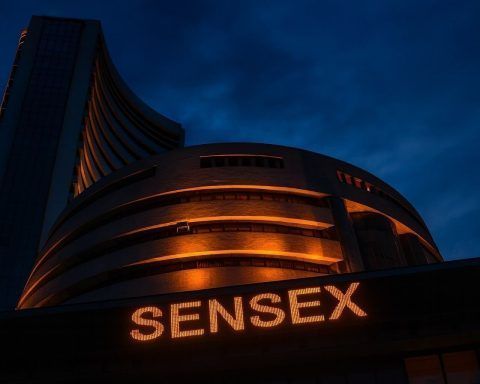

Stock Market Today: Sensex, Nifty Slip as Rupee Hits ₹90/USD Ahead of RBI Policy — Key Highlights for 3 December 2025

Indian stock markets ended slightly lower on Wednesday, 3 December 2025, as a record‑weak rupee, persistent foreign portfolio outflows and caution ahead of the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decision kept investors on the back foot. The benchmark indices closed almost flat, but the damage was deeper under the surface in mid- and small‑cap shares. The…