Date: Thursday, November 13, 2025

Summary:

• Product launch: Caterpillar Energy Solutions (MWM brand) introduced the TCG 4170 V20 gas engine, a 2.5‑MW class unit aimed at fast, efficient distributed power for heavy industry and data centers. Caterpillar Energy Solutions

• Insider activity:Jason E. Kaiser, Group President at Caterpillar, disclosed option exercises and sales totaling 10,707 shares (executed Nov. 11) in a Form 4 filed today; the filing indicates use of a Rule 10b5‑1 trading plan. SEC

• Shares slip intraday: As of early afternoon, CAT was trading near $551, down roughly 3–4% on the session. MarketWatch

MWM’s new 2.5‑MW engine targets fast, efficient power for industry and data centers

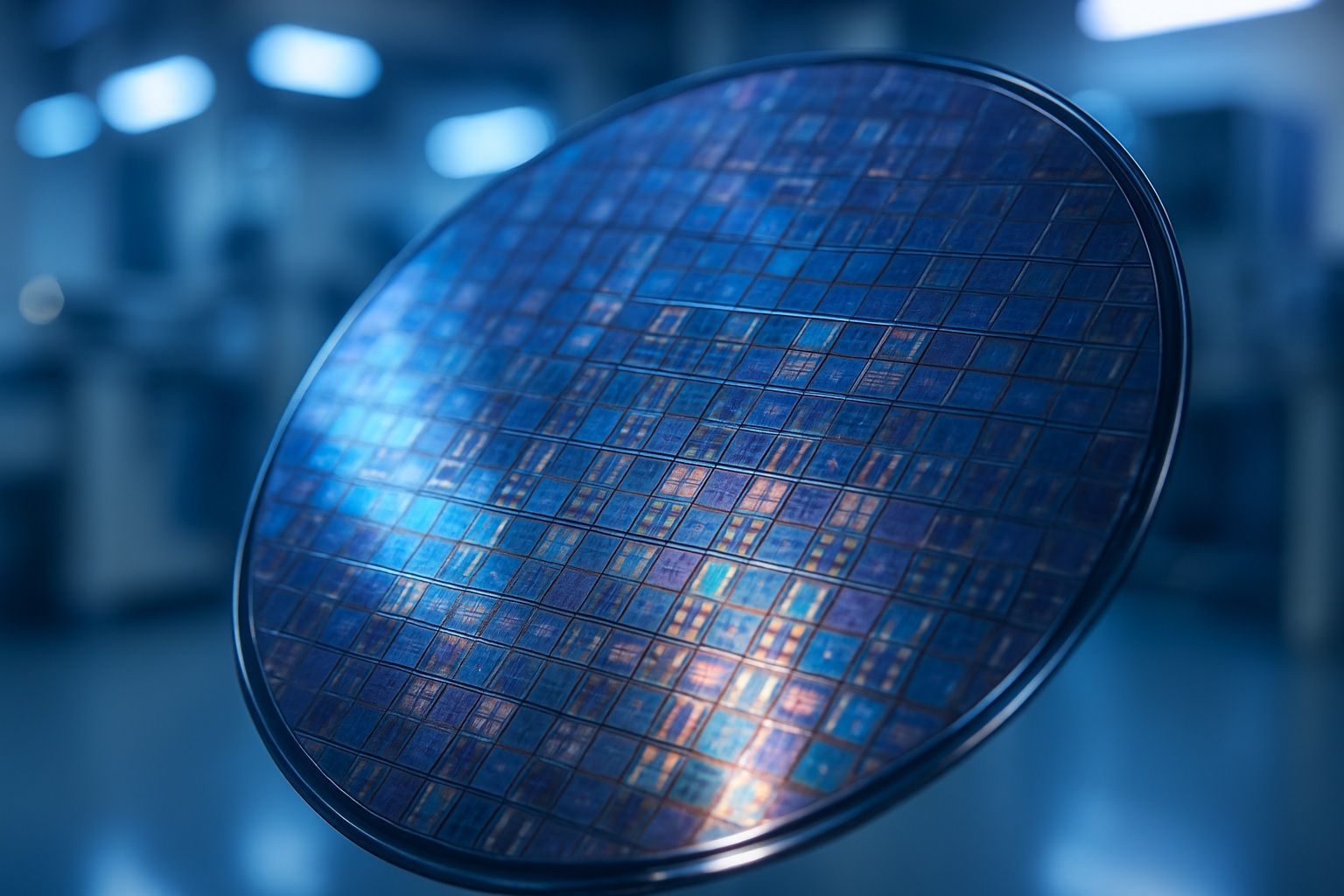

Caterpillar Energy Solutions unveiled the MWM TCG 4170 V20, expanding its gas‑engine portfolio with a model designed for high efficiency and rapid response in mission‑critical settings. The unit delivers up to ~2,536 kW on natural gas, with electrical efficiency up to 46% and overall efficiency up to ~89–90% when heat is recovered. It can reach full power in under five minutes and withstand a 60% maximum load step, making it suitable for standby or grid‑parallel roles in sectors such as petrochemicals, mining, manufacturing—and data centers, where ramp speed and reliability are prized. A 50‑Hz variant is available now; a 60‑Hz version is slated for 2026. Caterpillar Energy Solutions+1

This product drop lands as Caterpillar’s power businesses ride a secular upswing from AI‑driven data‑center demand. Weeks ago, Reuters highlighted that strong orders for power‑generation systems helped Caterpillar top Q3 profit and revenue estimates, with the Energy & Transportation unit a key driver. Reuters

Industry reporting has also noted Caterpillar’s plan to more than double gas‑turbine capacity to meet the surge in data‑center power needs—context that underlines why fast‑ramping, high‑efficiency engines like the TCG 4170 V20 matter strategically. Bloomberg

Insider activity filed today: Jason E. Kaiser (Group President)

In a Form 4 filed Nov. 13, Group President Jason E. Kaiser reported option exercises and open‑market sales executed on Nov. 11. The transactions, recorded across multiple trades at prices mostly in the $561–$569 range, total 10,707 shares sold; the filing includes the check box indicating the trades were made pursuant to a Rule 10b5‑1(c) plan. Form 4 filings do not state reasons for sales and do not, by themselves, signal a change in business outlook. SEC

(Separately this week, a Nov. 12 Form 4 disclosed insider transactions by Anthony D. Fassino, another Caterpillar executive, reflecting continued use of option exercises and share sales around current price levels.) SEC

Stock moves on Nov. 13, 2025

CAT shares traded lower intraday, with MarketWatch showing ~$551.36 around 1:02 p.m. ET, down roughly 3.8% on the day. Intraday performance can reflect broader market risk‑off moves, sector rotation, and headline‑driven volatility; the company has had a strong multi‑month run into its fall events and earnings season. MarketWatch

How today’s developments fit the bigger picture

1) Power demand tailwinds: The MWM launch aligns with Caterpillar’s near‑term growth lane: backup/fast‑response generation and distributed energy for industrial sites and data centers. The fast ramp and high efficiency specs speak directly to operators facing tight utility capacity and stricter uptime requirements. Caterpillar Energy Solutions

2) Recent results and signals: In late October, Caterpillar reported Q3 2025 sales and revenues of $17.6 billion (+10% Y/Y) and adjusted profit per share of $4.95, while deploying $1.1 billion for dividends and buybacks—providing financial backing for continued investment in capacity and product roadmaps. https://www.caterpillar.com/en.html

3) Data‑center narrative keeps building: Reporting has emphasized how AI infrastructure is reshaping the power landscape, lifting orders for gas‑fueled turbines and engines used as standby or supplemental generation—an area where Caterpillar’s Energy & Transportation and Solar Turbines businesses are central. Reuters+1

What to watch next

- Commercial traction for the TCG 4170 V20: Look for early deployments in data centers and heavy industry, and updates on the 60‑Hz version timing in the Americas. Caterpillar Energy Solutions

- Follow‑on filings: Additional Section 16 disclosures can provide transparency into executive trading activity during year‑end windows. SEC

- Operating cadence into year‑end: Management’s Q3 release and recent investor‑day materials frame expectations for backlog, margin cadence, and capital allocation as the company navigates tariffs, rates, and demand pockets across construction, mining, and power. https://www.caterpillar.com/en.html+1

Sources

- MWM TCG 4170 V20 launch (Caterpillar Energy Solutions) — product specs, timing, and use cases. Caterpillar Energy Solutions+1

- Insider activity (SEC Form 4) — Jason E. Kaiser filing dated Nov. 13, 2025, detailing Nov. 11 transactions and Rule 10b5‑1 plan disclosure. SEC

- Intraday share performance — MarketWatch real‑time quote for CAT on Nov. 13, 2025. MarketWatch

- Macro/segment context — Reuters on Q3 outperformance aided by AI‑driven data‑center power demand; Bloomberg on planned expansion in gas‑turbine capacity. Reuters+1

- Q3 2025 results (Caterpillar) — official press release with revenue, EPS, and capital returns. https://www.caterpillar.com/en.html

This article is for information purposes only and is not investment advice.