- Pinterest buy-the-dip: ARK bought 521,867 Pinterest (PINS) shares across ARKK, ARKW and ARKF after the stock slid ~20% on weak holiday‑quarter guidance. Investing.com+1

- Biotech push: Earlier this week ARK purchased 162,327 CRISPR Therapeutics (CRSP) shares and 291,001 Beam Therapeutics (BEAM) shares, signaling renewed conviction in gene editing. Investing.com+1

- Trims continue: ARK sold 105,576 Roku (ROKU) shares and 56,095 Robinhood (HOOD) shares; it also reduced Teradyne (TER) exposure. TipRanks+2TradingView+2

- Why Pinterest fell: The company guided Q4 revenue to $1.31–$1.34B, below consensus, amid softer ad spend in North America and tougher competition—sending shares down more than 20%. Bloomberg+1

- By the numbers: Pinterest’s Q3 revenue was $1.049B and monthly active users hit a record 600M, highlighting a long‑term growth base despite near‑term pressure. Q4 Capital

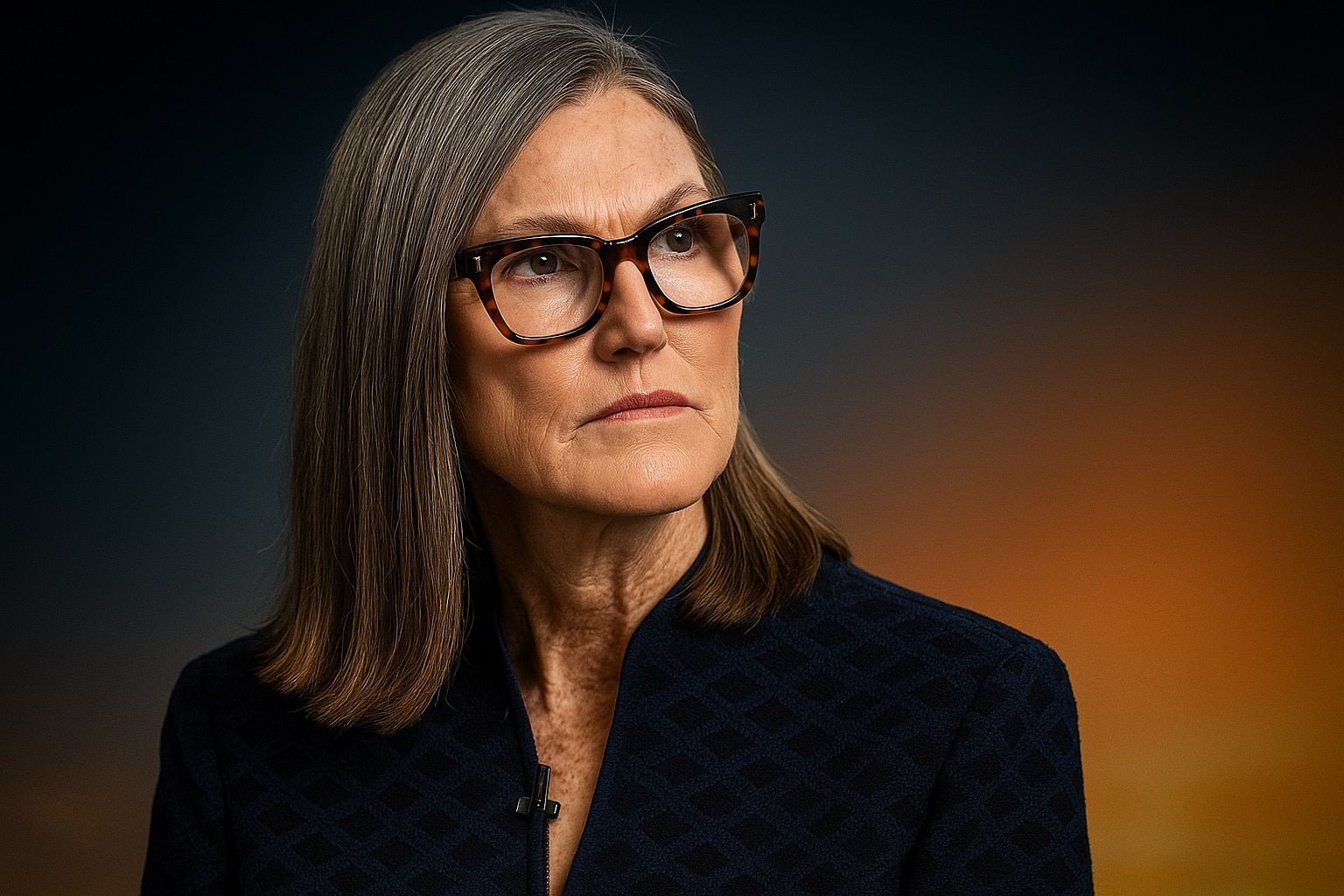

ARK pounces on Pinterest’s earnings-driven slide

ARK’s Wednesday trade disclosure shows the firm bought 521,867 shares of Pinterest across three funds (ARKK, ARKW, ARKF) after the visual discovery platform cratered on guidance. The add looks like a classic Cathie Wood “buy the dip” move: step into high‑conviction names when volatility runs hottest. Investing.com+1

Pinterest’s post‑earnings sell‑off was sharp and swift. Management projected holiday‑quarter revenue of $1.31–$1.34B, a touch below Wall Street expectations, and flagged softer ad budgets in the U.S. and Canada amid competitive pressure—an outlook that knocked the shares more than 20% at the open. Bloomberg+1

Underneath the headline, though, Pinterest’s Q3 revenue climbed to $1.049B (+17% YoY), and global MAUs reached 600M, an all‑time high—data points ARK likely weighed as it averaged down. Q4 Capital

A fresh tilt toward gene editing

On Tuesday, ARK boosted its genomics sleeve, purchasing 162,327 shares of CRISPR Therapeutics (split between ARKK and ARKG) and 291,001 shares of Beam Therapeutics. These buys, totaling tens of millions of dollars at reported prices, suggest ARK is leaning back into platforms it views as long‑duration compounding opportunities. Investing.com+1

ARK also topped up Guardant Health (GH) with 33,823 shares via ARKG, continuing a healthcare/diagnostics theme that has been a recurring counterweight to its higher‑beta tech holdings. TipRanks

Trimming streaming and fintech exposure

To fund buys and rebalance risk, ARK continued paring some long‑time positions:

- Roku (ROKU):105,576 shares sold through ARKK, extending a pattern of gradual reductions in the streaming platform. TipRanks+1

- Robinhood (HOOD):56,095 shares sold, a modest trim after recent strength. TipRanks+1

- Teradyne (TER):27,423 shares sold (Tuesday), part of an ongoing lightening in semiconductor test gear exposure. Investing.com

Across the week, ARK also adjusted smaller positions (e.g., Adaptive Biotechnologies, Ionis, Rocket Lab, AeroVironment), consistent with its active, high‑velocity style. Investing.com

Why the Pinterest bet now?

Two data tracks define the setup:

- Near‑term pressure: Pinterest’s holiday outlook undershot consensus, and advertisers in key categories have pulled back. Competitive intensity against platforms with broader reach and increasingly sophisticated AI ad stacks remains a headwind. That’s what triggered the 20%+ reset. Reuters

- Long‑term traction: Even so, engagements and users are rising to records (600M MAUs), and revenue is compounding at a mid‑teens clip—an underpinning ARK often prioritizes when it averages down. Q4 Capital

In other words, ARK appears to be exchanging momentum for time: trimming winners or riskier cyclicals (streaming/fintech) to add duration in platforms (social commerce, gene editing) where it believes the multi‑year payoff outweighs quarter‑to‑quarter noise.

What it means for investors

- Expect continued rotation within ARK: The fund’s model is to reprice risk quickly and lean into dislocations. This week’s combo—buy PINS weakness, add CRSP/BEAM strength, trim ROKU/HOOD/TER—fits that playbook. Investing.com+1

- Pinterest remains a battleground: Watch ad‑spend trends into December, product updates for advertisers, and whether MAU gains convert to improved ARPU despite competitive pressure. Reuters

- Biotech catalysts matter: For CRISPR and Beam, upcoming clinical and commercial milestones will drive sentiment; ARK’s adds suggest it wants exposure into that catalyst path. (General context based on trade data and sector dynamics.) Investing.com

Quick trade ledger (Nov 4–5, 2025)

| Ticker | Action | Shares | Noted fund(s) |

|---|---|---|---|

| PINS | Buy | 521,867 | ARKK, ARKW, ARKF Investing.com |

| CRSP | Buy | 162,327 | ARKK, ARKG Investing.com |

| BEAM | Buy | 291,001 | ARKK, ARKG Investing.com |

| GH | Buy | 33,823 | ARKG TipRanks |

| ROKU | Sell | 105,576 | ARKK TipRanks |

| HOOD | Sell | 56,095 | ARKK TipRanks |

| TER | Sell | 27,423 | ARKK Investing.com |

Methodology note

Figures reflect ARK Invest’s daily trade disclosures (excluding creations/redemptions and IPO transactions). Share counts and fund attributions are drawn from same‑day compilers (TipRanks, Investing.com, GuruFocus/TradingView). For issuer fundamentals (e.g., Pinterest results), we referenced company filings/press releases and major wire services. Q4 Capital+4Ark Invest+4TipRanks+4

Disclosure: This article is for informational purposes only and does not constitute investment advice.