Updated: November 19, 2025

At a glance

- Close: $74.92 (flat on the day)

- Intraday range: $72.88 – $77.37; open: $75.00

- After‑hours: $82.02 (+9.5% as of 5:17 p.m. ET)

- Volume (regular session): ~22.2M

- 52‑week range: $33.52 – $187.00

- Approx. market cap: ~$37.3B

These figures reflect official close and after‑hours prints as recorded on market data trackers and the Financial Times markets page. StockAnalysis+1

What happened to CRWV today

CoreWeave shares finished essentially unchanged at $74.92, with a wide intraday swing, then bounced to the low‑$80s after hours. The session continued a volatile November for CRWV, which several outlets note has seen a steep month‑over‑month drawdown before today’s stabilization. StockAnalysis+1

Investor commentary today focused on two threads: (1) renewed analysis of the stock’s recent slide and fundamentals and (2) fresh disclosures of institutional positions that crossed the wires during the trading day. The Motley Fool (syndicated by Nasdaq) published a same‑day explainer for investors, underscoring the heightened skepticism surrounding AI infrastructure names like CoreWeave after a sharp, recent pullback. Separately, Yahoo Finance highlighted that CoreWeave has plunged roughly 50% in a month, framing the debate around whether the move is a red flag or a potential opportunity. Nasdaq+1

Today’s CRWV headlines (Nov 19, 2025)

- Analysis – “Coreweave Stock Investors Need to Know These Facts” (The Motley Fool via Nasdaq): A same‑day explainer recapping the stock’s volatility and investor questions around AI demand vs. execution risk. Nasdaq

- Institutional flow – HHM Wealth Advisors: MarketBeat reported that HHM Wealth Advisors LLC opened a new position (~$679,000) in CoreWeave (from a recent 13F filing), adding to a growing list of funds disclosing stakes. While 13F snapshots are backward‑looking, the disclosure posted today contributed to the day’s chatter. MarketBeat

- Institutional flow – BNY Mellon: A separate MarketBeat item said Bank of New York Mellon Corp purchased 77,273 shares (≈$12.6M) in Q2, another sign of large‑cap institutions appearing on the register; that article also hit today. MarketBeat

- Tape‑driven note – TipRanks: An auto‑generated update flagged volatility tied to revenue‑timing concerns, reflecting the market’s ongoing recalibration after CoreWeave’s guidance reset last week. TipRanks

- Industry cross‑current – AI spend watch: Investor’s Business Daily highlighted Meta’s rising multi‑cloud commitments (including smaller agreements with CoreWeave), a datapoint that keeps AI infrastructure spending—and CRWV’s demand backdrop—in focus. Investors

- Shareholder‑rights bar on the move: A press release from Bronstein, Gewirtz & Grossman, LLC encouraged CoreWeave stockholders to contact the firm following the post‑earnings drop earlier this month—typical after a swift sell‑off in a newly public name. Stockhouse

Why the background matters

Last week’s Q3 beat + guidance cut remains the macro driver behind November’s turbulence. CoreWeave topped revenue expectations (~$1.36B) but trimmed its 2025 outlook due to delays at a third‑party data‑center partner, which sparked a sharp sell‑off and several analyst target resets. Today’s flat close and after‑hours bounce come against that backdrop of execution timing vs. demand durability—a tension the market is still pricing. Business Insider+1

Key levels and context for traders

- Volatility risk: Today’s $4.49 intraday spread underscores high realized volatility in CRWV; options markets have priced elevated swings in recent sessions. StockAnalysis

- Range context: Shares are now down far from the June high near $187, but well above the April low near $33.5. That wide 52‑week corridor amplifies the impact of headlines on day‑to‑day price discovery. FT Markets

What to watch next

- Any update on the delayed data‑center timeline and whether management reiterates that revenue is largely timing‑related (not demand‑related). Look for follow‑through commentary from the company or conference appearances. Reuters

- Further 13F or insider‑trading disclosures that could validate or challenge the “buy‑the‑dip” institutional narrative that surfaced in today’s headlines. MarketBeat+1

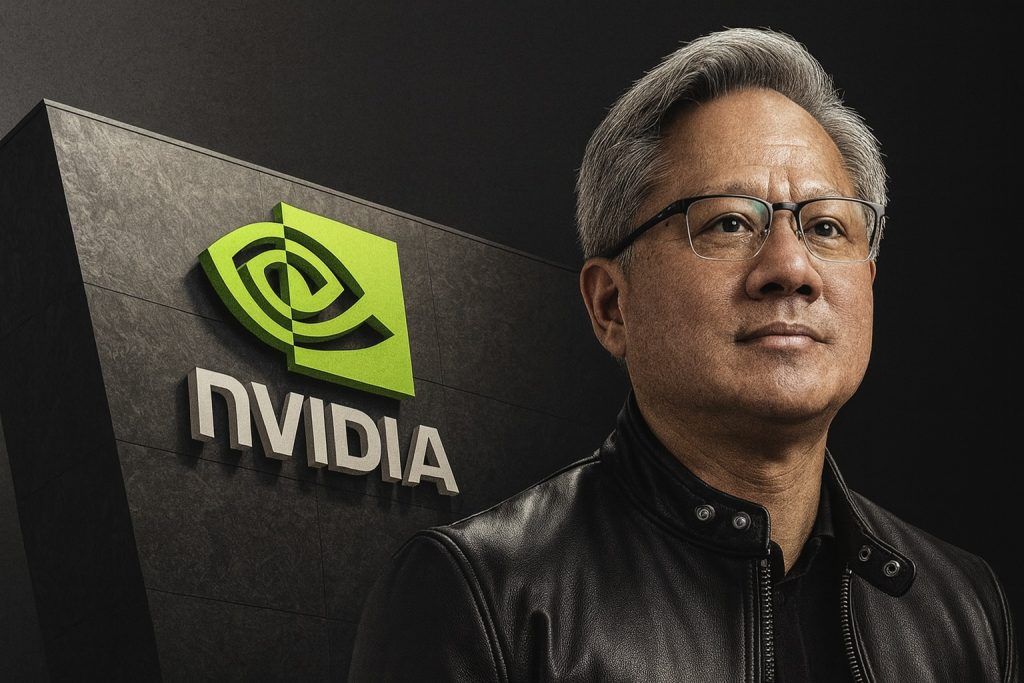

- AI capex signals from mega‑cap customers—Meta, Nvidia partners, and hyperscalers—because any tightening or expansion in those budgets tends to ripple into AI‑cloud providers like CRWV. Investors

Bottom line

CoreWeave (CRWV) steadied into the close on Nov 19 and rallied after hours, as the news tape mixed cautious analysis with visible institutional interest. The near‑term path still hinges on clearing execution bottlenecks and on customer AI budgets holding up, but today’s tone suggested the market is starting to differentiate between demand and delivery timing—with price action swinging accordingly. StockAnalysis+2Yahoo Finance+2

This article is for informational purposes only and is not investment advice.