- Oct 25, 2025: FLNC closed at $19.52, a +21.8% gain on the dayreuters.com. The stock has been extremely volatile – after trading around the mid-$5s in early Sept it surged ~83% into the high teens by mid-Octts2.tech.

- Recent rallies: On Oct 13 FLNC jumped ~21% to about $15.89 and on Oct 14 it added ~16% to ~$18.45ts2.tech. This rally pushed the stock to roughly a 52-week high (near $24.00) before a pullbackmarketbeat.com.

- Major catalysts: Analysts point to a Susquehanna Financial upgrade (raised 12-month target from $9 to $17) and a proposed U.S. infrastructure plan with $10 B dedicated to battery storagets2.techts2.tech. These news pushed FLNC sharply higher.

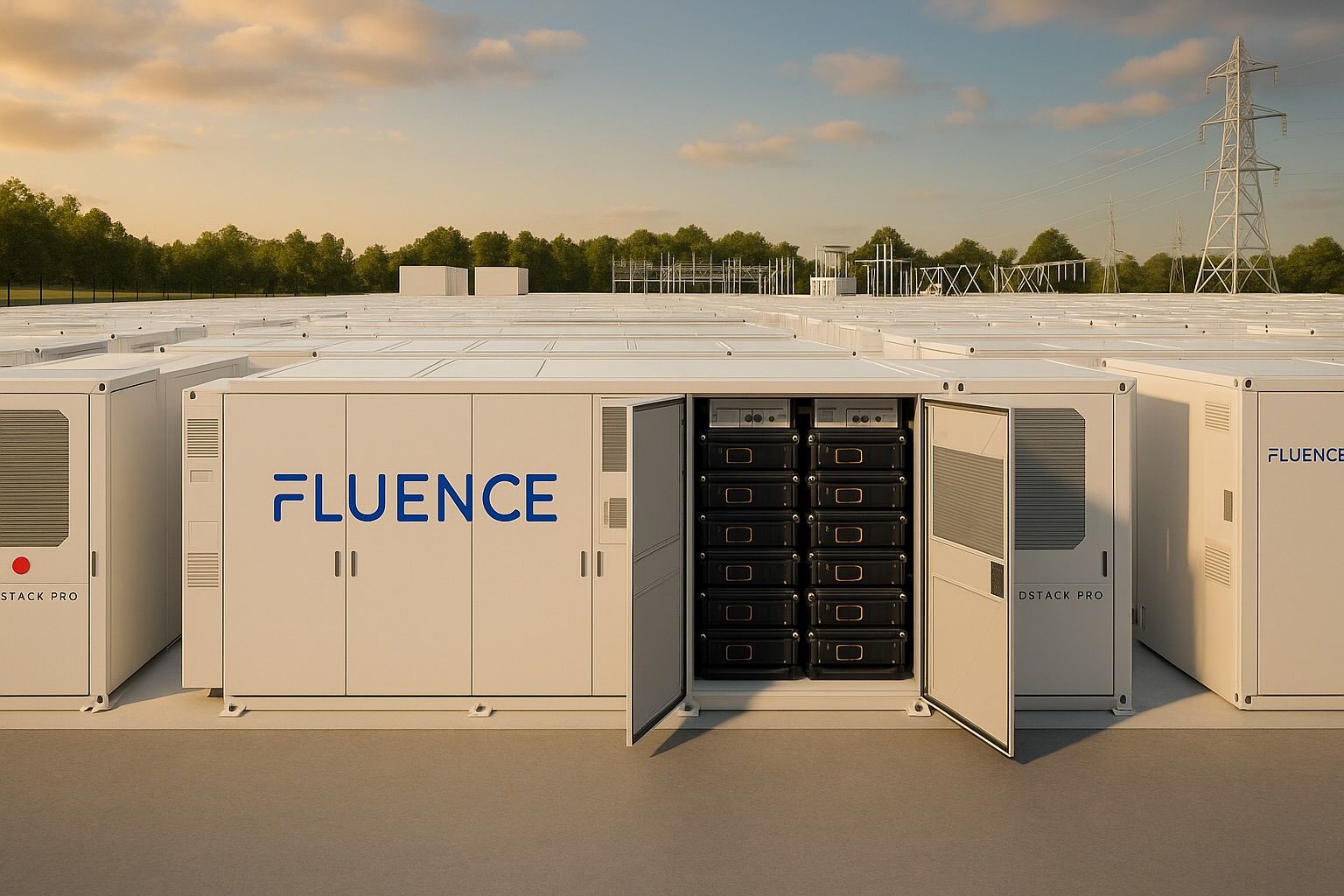

- Big projects: Fluence won several large contracts – notably supplying batteries for a 133 MW/622 MWh grid storage project in Polandrenewablesnow.com and partnering on a 160 MW/640 MWh solar-plus-storage project in Arizona (with Torch Clean Energy)renewableenergymagazine.com. Such wins have swelled Fluence’s order backlog to about $4.9 billionts2.tech.

- Analyst outlook: Despite the surge, Wall Street remains cautious. The consensus rating is “Hold/Reduce” with an average 12-month price target around $8–$9ts2.techmarketbeat.com – well below current levels. Targets vary (e.g. RBC recently cut its target to $7 while Goldman raised theirs to $15)marketbeat.com, reflecting diverging opinions.

- Expert commentary: CEO Julian Nebreda told Bloomberg that U.S. demand is “booming”, expecting roughly half of Fluence’s orders from U.S. projects by 2026ts2.tech. However, some analysts warn the stock is running ahead of fundamentals: one market note cautioned that the rally may be “ahead of fundamentals” given Fluence’s thin profit marginsts2.tech.

- Sector tailwinds: Clean-energy stocks are broadly up as AI/data-center buildouts and EVs drive power demand. Government incentives like the U.S. Inflation Reduction Act (≈$369 B in credits) are fueling massive storage investmentts2.tech. Analysts report renewables funds have seen fresh inflows (e.g. ~$0.8 B into ETFs in Sept) and double-digit index gains, as investors return to clean-energy themesreuters.comreuters.com.

Stock Performance & Recent Volatility

Fluence’s share price has been on a roller-coaster. After languishing around the mid-$5 range in early September, FLNC surged over 80% to the high teens by mid-Octoberts2.tech. For example, on Oct 13 the stock jumped ~21% to about $15.89, and on Oct 14 it gained another ~16% to ~$18.45ts2.tech. In mid-October the shares briefly hit roughly a 52-week high near $24.00 (the past 12-month range is about $3.46–$24.00)marketbeat.com. On Oct 25, Fluence closed at $19.52, up +21.8% on the dayreuters.com, continuing a week-long rally. These swings illustrate extreme volatility: FLNC has moved by double digits on the majority of trading days since the news flow begants2.techmarketbeat.com.

Recent News & Catalysts

Investors have bid up Fluence on a torrent of positive news. On Oct 13, Susquehanna Financial analysts upgraded FLNC to “Positive” and nearly doubled their 12-month price target to $17 (from $9), citing accelerating project backlog and clean-energy policy supportts2.tech. The next day, JPMorgan unveiled a $1.5 trillion U.S. infrastructure plan that earmarked $10 B specifically for battery storagets2.tech. Fluence CEO Julian Nebreda said this would meet surging demand from data centers and AI – indeed, he expects about 50% of Fluence’s orders to come from U.S. customers by 2026ts2.techts2.tech. In combination, these catalysts lit a fire under FLNC, with Oct 14’s trading marking a new high at the timets2.tech.

Beyond October’s headlines, Fluence has been sealing large contracts. For example, it announced a partnership with Torch Clean Energy to deliver a 160 MW / 640 MWh “Winchester” solar-plus-storage facility in Arizonarenewableenergymagazine.com, slated for 2027 delivery with U.S.-made equipment for IRA tax credits. In Europe, Ukrainian energy firm DTEK’s renewables arm selected Fluence to supply batteries for Poland’s largest-ever grid storage project (133 MW/622 MWh)renewablesnow.com. Company releases also note a completed 200 MW deployment in Ukraine and a new 35 GWh factory in Vietnam to boost productionts2.tech. These and other project wins have expanded Fluence’s order backlog to roughly $4.9 billionts2.tech, underpinning future revenue but also setting high execution demands.

Analyst Ratings & Expert Commentary

Despite the news-driven rally, Wall Street analysts remain surprisingly cautious. MarketBeat data show only 4 of 24 surveyed analysts rate FLNC a Buy (16 Hold, 4 Sell), yielding a consensus “Reduce” (Hold) rating with an average 12-month target of about $9.12marketbeat.com. Several firms have sliced targets recently: Royal Bank of Canada cut its target to $7 (from $8) while Goldman Sachs bumped its target up to $15marketbeat.com. Even JPMorgan, which held a negative view earlier, now has a neutral stance with a $9 targetts2.tech. In aggregate, consensus targets remain far below the current price, reflecting Wall Street’s wariness.

Fluence’s fundamentals help explain the caution. The company only turned a small profit in 2024, and recent quarters show razor-thin margins. TS2/MarketBeat note Q2 2025 revenue was up ~24.7% YoY (~$602M) but net margin only about –0.76%ts2.tech. Analysts still expect Fluence to lose money in 2025. As one commentator put it, the lofty stock price “may be ahead of fundamentals” until Fluence proves it can convert sales into profitts2.tech.

Management’s tone has been optimistic, however. In an October interview, CEO Julian Nebreda said U.S. demand is “booming” – he expects roughly half of Fluence’s orders from American projects by 2026ts2.tech. But other market voices urge caution. Notably, a recent analysis observed that even after all the big deals, consensus price targets are far below today’s stock price, signaling that many see more risk than reward at current levelsts2.techts2.tech.

Institutional Investors & Partnerships

Several institutional investors have taken notable positions in FLNC. For example, Goldman Sachs increased its stake dramatically: in Q1 2025 it boosted its Fluence position by ~190%, ending the quarter with about 3.17 million shares (≈$15.4M)marketbeat.com. Other funds like SG Americas Securities, Geode Capital Management, and Federated Hermes also raised their holdings significantly during 2025marketbeat.com. These moves suggest that at least some deep-pocketed investors believe in Fluence’s long-term outlook and the secular growth of energy storage.

At the same time, Fluence is cementing strategic partnerships through its projects. Beyond the Torch and DTEK deals noted above, the company has collaborated with major utilities and developers worldwide (not detailed here). Its shareholder register, however, is still dominated by AES and Siemens (the JV founders) and other insiders. In sum, institutional interest is growing but hasn’t fully turned overwhelmingly positive – reflecting the balance of high conviction and caution in the market.

Sector Trends & Outlook

Fluence’s momentum is part of a broader renewable energy revival. Analysts point out that electricity demand is surging – driven by AI data-center buildouts, electrification of transport/industry, and grid upgrades. In this context, solar-plus-storage is seen as the fastest way to meet new load. As Reuters reports, “data centres need electricity in two to three years. People will just add as much renewables as they can. It’s not only the cheapest source, but also the fastest to build,” said one portfolio managerreuters.com. These shifts are moving renewables from a purely policy-driven sector to one led by real demand.

Policy support is amplifying the trend. The U.S. Inflation Reduction Act (IRA) alone commits roughly $369 billion in clean energy credits, spurring massive investment in battery projectsts2.tech. Industry groups estimate that about $50 billion went into utility-scale energy storage in 2024ts2.tech. Globally, utilities and developers are racing to add storage capacity; one IEA analysis projects battery storage needs to expand roughly six-fold by 2030 to meet climate goalsts2.tech.

Investors have begun to notice. After two years of redemptions, alternative energy funds saw net inflows in recent months (nearly $800M in Sept. 2025 alonereuters.com), and clean-energy stock indices have climbed strongly. Fluence, as a pure-play storage company, sits squarely at the intersection of these trends. Its recent share-price surge reflects that confluence of AI-driven demand and policy tailwinds – but also suggests the stock is trading as a proxy for the “clean-energy boom.”

In summary, Fluence Energy’s stock has become a real roller-coaster ride. The past weeks’ gains were driven by policy incentives, tech-sector power needs, and headline project winsts2.tech. While that places Fluence at the center of a promising growth story, investors note that the company still needs to prove it can execute profitably on its ~$4.9B backlog. The consensus Wall Street targets remain well below the current pricets2.techts2.tech, implying significant uncertainty. In the near term, FLNC is likely to stay volatile: it has upside if data-center and storage demand materialize as expected, but is vulnerable if any optimism wanes or execution stumbles.

Sources: Latest stock quotes and filings (as of Oct 25, 2025)reuters.com; analysis of Fluence Energy by TechStock²/ts2.tech and MarketBeatts2.techmarketbeat.com; Reuters and Bloomberg reportingreuters.comts2.tech; company press releasesrenewablesnow.comrenewableenergymagazine.com; sector studies by IEA and Lipperts2.techreuters.com.