- Fluence Energy Stock Soars: Fluence Energy (NASDAQ: FLNC) shares surged over 16% on October 14, 2025, closing around $18.45 after intraday highs near $19stockanalysis.com. The jump came amid bullish news of a massive $1.5 trillion infrastructure program from JPMorgan, including $10 billion earmarked for battery storage and grid resilience, and optimistic commentary from Fluence’s CEO on booming U.S. demandstockstory.orgstockstory.org.

- Back-to-Back Rally Days: The Oct. 14 spike followed a 21% gain on Oct. 13, when Susquehanna analysts nearly doubled their price target to $17 (from $9) and reiterated a Positive rating on FLNCstockstory.org. The upgrade cited favorable clean-energy policies (like the U.S. Inflation Reduction Act) and Fluence’s robust project backlog as reasons for optimismstockstory.org.

- High Volatility, Big Rewards: Fluence’s stock has swung wildly – it’s up roughly 9% year-to-date after this week’s rally, yet still trades about 21% below its 52-week high of $23.50 (set in Nov 2024)stockstory.org. The recent run marks an 83% surge in the past month amid speculative fervor around AI-driven data center power needs and even rumors of a BlackRock buyout of Fluence’s co-founder AES Corpmuckrack.com. Such volatility isn’t new: FLNC has notched nearly 80 daily moves over 5% in the last yearstockstory.org, and short interest remains significant – fueling both sharp rallies and pullbacksts2.tech.

- Big Battery Deals and Demand: The company’s fundamentals are strengthening. In late September, Fluence won Poland’s largest battery storage project (133 MW/622 MWh), sending the stock up ~40% in a weekts2.techts2.tech. It also energized a 200 MW facility in Ukraine, opened a 35 GWh factory in Vietnam, and delivered its first U.S.-made systems – expanding global reachts2.techts2.tech. CEO Julian Nebreda highlighted that soaring data center power needs could make U.S. orders account for “half of the company’s global demand by 2026,” underscoring enormous domestic growth prospectsgurufocus.com.

- Renewables Wave Lifts Fluence: Industry trends strongly favor Fluence. Battery storage investment topped $50 billion in 2024ts2.tech, and global storage capacity is forecast to reach 400+ GW by 2030 – a 15× jump from 2021 levelsts2.tech. Clean energy policies are kicking in: the U.S. IRA offers $369 billion in green incentives, and Europe’s grid modernization plans are accelerating demand for large-scale storagets2.techts2.tech. Fluence, formed by AES and Siemens in 2018, is poised to benefit from these tailwinds if it can execute on its huge $4.9 billion order backlogts2.tech.

- Stiff Competition: In the battery energy storage space, Tesla Energy (with its Megapack systems) remains a heavyweight, and China’s Sungrow actually edges out Fluence in global market sharets2.tech. Fluence is effectively tied with Tesla for #2 among grid-scale storage integrators (~14% each)ts2.tech. Other rivals include General Electric (building utility-scale systems like Atlas), Wärtsilä, ABB, and Enphase Energy, though Enphase focuses on smaller residential unitsts2.techts2.tech. Fluence’s advantage is its “Stack” technology (Gridstack, Sunstack, etc.), software platforms, and backing by AES/Siemens – but it must move fast as new entrants (from LG Energy to CATL and even its parent AES on independent projects) crowd the marketts2.techts2.tech. Wood Mackenzie analysts note Fluence slipped from #2 to #3 globally in 2023 and warn supply-chain snags and tariffs have dented near-term salests2.tech.

- Analyst Outlook & Forecast: Despite recent euphoria, Wall Street is cautious. The consensus rating is “Hold” with an average 12-month price target around $8–9ts2.techts2.tech – less than half of the current price, implying the stock may be ahead of fundamentals. Even after Fluence’s contract wins, JPMorgan only nudged its target from $8 to $9 (neutral stance)ts2.tech. Bears highlight that Fluence is not yet consistently profitable (projected –$0.26 EPS for FY2025) and had to cut its 2025 revenue guidance to $2.6–2.8 billion (from $3.1–3.7 B) due to project delaysts2.techts2.tech. On the bullish side, FY2026 revenue is expected to jump ~22% as delayed projects come onlinets2.tech, and Susquehanna sees the company riding policy tailwinds to improved marginsstockstory.org. Technically, FLNC’s rally blasted the stock above its 50-day and 200-day moving averages (around $8.3 and $6.4, respectively) – a bullish breakout signalts2.tech. Momentum traders are invigorated, but with a beta near 2.7, investors should brace for turbulencets2.tech.

October 2025: FLNC Stock Surge Fueled by Policy Tailwinds

Fluence Energy’s stock is on a tear in mid-October 2025 after a one-two punch of positive news. On October 14, FLNC spiked to ~$18.50 (up 16% in one day)stockanalysis.com as investors cheered a major JPMorgan investment initiative targeting the clean energy sector. JPMorgan unveiled a decade-long, $1.5 trillion spending program, including $10 billion specifically for battery storage and grid resiliency projects – a direct boon to companies like Fluencestockstory.org. In tandem, CEO Julian Nebreda stoked optimism by revealing surging U.S. demand: power-hungry data centers (driven by the AI boom) are expected to fuel a wave of orders, with U.S. projects projected to make up about half of Fluence’s global demand by 2026stockstory.orggurufocus.com. This potent mix of policy support and customer demand lifted the entire battery storage sector.

The previous day (Oct. 13) set the stage for Fluence’s rally. Shares jumped 21.4% to ~$15.89 after Susquehanna analysts dramatically upgraded their viewstockanalysis.com. The firm maintained a bullish “Positive” rating and hiked its price target from $9 to $17 – nearly doubling their outlookstockstory.org. Susquehanna’s call cited “favorable policy developments” like the U.S. IRA incentives and Fluence’s strong backlog and domestic manufacturing base as reasons the stock could outperformstockstory.org. Coming into the week, FLNC had already been rebounding, so the analyst vote of confidence ignited heavy buying. Trading volumes topped 10 million shares on Oct. 13 and nearly 15 million on Oct. 14stockanalysis.com – many times the stock’s average – signaling intense interest from momentum traders.

Volatility has been extreme. Just days earlier on Oct. 10, FLNC plunged 12% in a single sessionstockanalysis.com, a reminder that sharp pullbacks can follow big runs. Overall, Fluence’s stock has seesawed from under $7 in early September to as high as $19 nowstockanalysis.comstockanalysis.com. That’s an 83% surge in about one month, and roughly a 3× gain from spring 2025 lows around $5. Some of this explosive rise has been attributed to speculative hype – for instance, a Seeking Alpha analysis noted that “persistent AI data center hype” helped Fluence “regain [its] mojo” in recent monthsmuckrack.com. Traders have also latched onto rumors (unconfirmed) that BlackRock might acquire AES Corporation, Fluence’s co-founding parent, in a ~$38 billion dealmuckrack.com. That speculation, if it materialized, could reshape Fluence’s ownership or strategic direction, adding another layer of intrigue to the stock’s story.

For now, Fluence’s October rally underscores how quickly market sentiment can swing on fresh catalysts. The dual boost from Wall Street (analyst upgrade) and Pennsylvania Avenue (infrastructure spending) has put FLNC firmly on investors’ radar. Yet, as the past week shows, big gains can evaporate just as fast. Nearly 80 trading days in the last year saw FLNC move over 5% in either directionstockstory.org, making it one of the most volatile stocks in clean energy. This volatility cuts both ways – while it offers traders rapid upside, it also means new investors must have a strong stomach for risk.

Company Developments and Growth Drivers

Beyond the stock chart fireworks, Fluence Energy’s business has been gathering momentum through 2025 thanks to significant project wins and strategic milestones. In late September, Fluence landed a flagship contract in Europe: a 133 MW / 622 MWh battery storage project in Trzebinia, Poland. This installation, set to be Poland’s largest battery system, will provide grid stability under a 17-year capacity contractts2.tech. News of the deal sent FLNC shares rocketing – the stock jumped 13% on Sept. 22 alone when the project was announcedts2.tech, and by Sept. 24 Fluence closed around $11.24 (up ~40% from the prior week)ts2.tech. The Poland win not only boosts revenue backlog; it also expands Fluence’s footprint in a key European market focused on weaning off coal and enhancing energy security.

Around the same time, Fluence and its partner DTEK energized a 200 MW battery system in Ukraine, marking the largest storage portfolio in that countryts2.tech. Despite the challenging environment, the project’s completion showcases Fluence’s global reach and ability to execute in emerging markets. The company has also been ramping up manufacturing capacity. This autumn, Fluence opened a 35 GWh automated factory in Vietnam to produce its latest battery systems (Gridstack Pro and Smartstack), and celebrated the first delivery of domestically manufactured systems in the U.S.ts2.tech – a milestone that could help customers qualify for federal tax credits while reducing supply chain dependencies. These moves demonstrate how Fluence is aligning its operations with geopolitical trends: increasing local content to meet U.S. and European incentives, and positioning itself as a reliable supplier amid a global push for energy storage.

Financially, Fluence’s growth trajectory is solid, though not without challenges. For the quarter ended June 2025, the company posted revenue of $602.7 million, up ~24.7% year-over-yearts2.tech. Gross margins turned positive in 2025 (around 12–13%), a significant improvement after prior years of negative marginsts2.tech. Adjusted EBITDA has hovered near break-even, indicating Fluence is inching toward profitability. The order backlog hit a record ~$4.9 billion by mid-2025ts2.tech, reflecting strong demand. In fact, Fluence added over $500 million in new orders in the June quarter and another $1.1 billion in July–August alonets2.tech – a testament to its sales momentum. Management expects roughly $2.5 billion of that backlog to convert into revenue in FY2026 as delayed projects come onlinets2.tech.

However, execution issues have tempered near-term expectations. In late summer, Fluence trimmed its full-year 2025 revenue guidance to $2.6–2.8 billion (from an originally ambitious $3.1–3.7 billion) due to project delays and supply chain bottlenecksts2.tech. These delays aren’t lost on investors – they imply some revenue and profit will slip into next year. The company also faces ongoing cost pressures; while it managed a small GAAP profit of $0.01 per share last quarter by beating the earnings consensusts2.tech, cash burn continues. Free cash flow was negative in recent periods as Fluence invests in manufacturing and project execution capacity. The balance sheet remains reasonably strong: as of Q3 2025, Fluence held ~$460 million in cash (total liquidity ~$903 million including credit lines)ts2.tech. Debt is moderate (debt-to-equity ~0.75) and was bolstered by a $400 million convertible notes issuance in late 2024 to fund expansionts2.tech. In short, the company is spending to grow, and investors are watching to see if those investments pay off in sustainable profits.

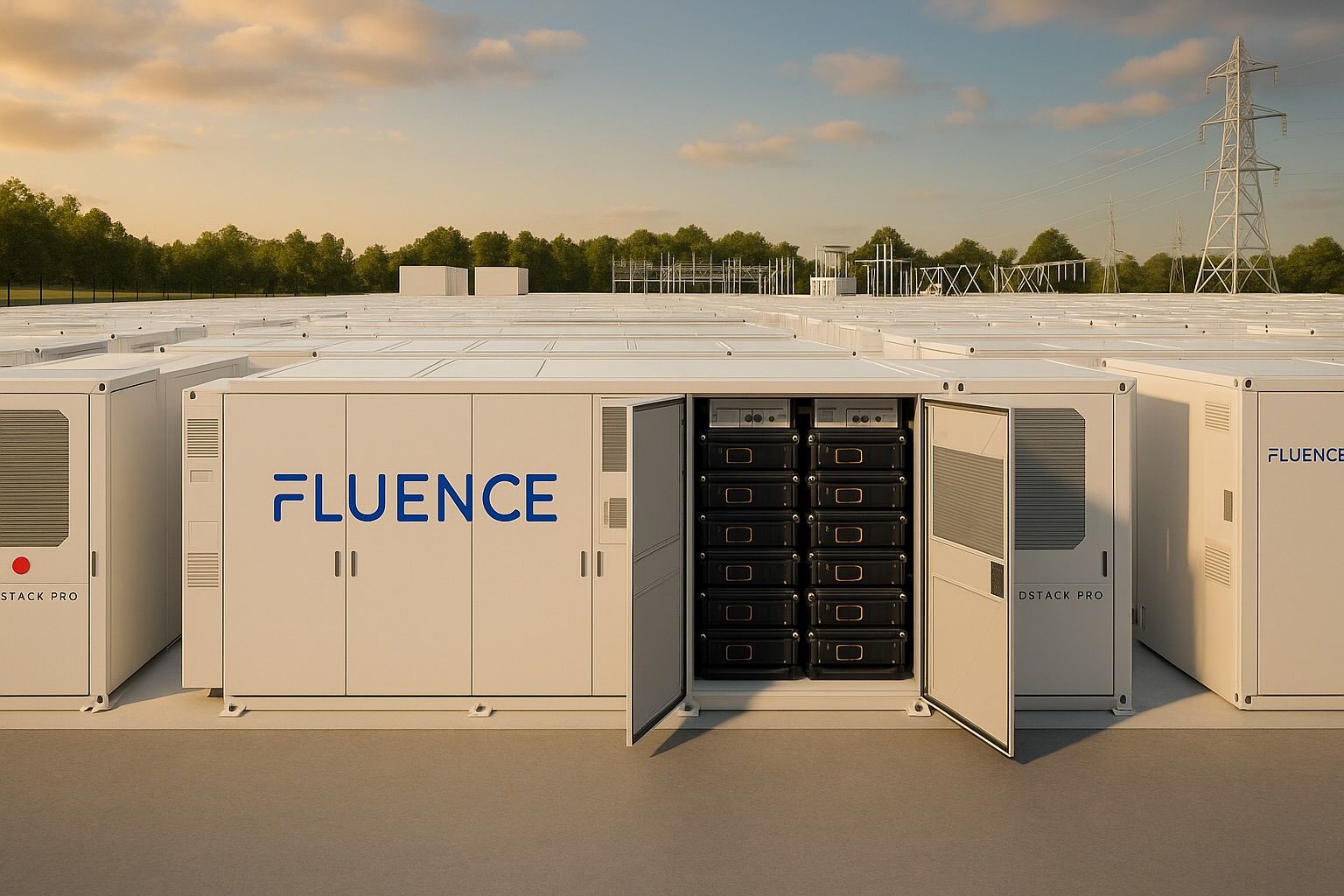

Crucially, Fluence’s management insists the growth story is intact. CEO Nebreda has downplayed near-term hiccups, suggesting that tariff-related cost spikes and manufacturing delays are “temporary” issues being ironed outts2.tech. The company’s strategy is to leverage its modular technology and software to deliver projects faster and optimize performance for customers. For example, Fluence’s SmartStack™ and Gridstack battery solutions (pictured below) use standardized, containerized modules that can be rapidly deployed and scaledts2.tech. Fluence’s products – often installed at solar farms, wind farms, or substations – help store excess renewable energy and inject it into the grid when needed, reducing blackouts and balancing supply and demand.

Fluence specializes in large-scale battery energy storage systems, like these modular Gridstack units, to help modernize and stabilize electric grids.

The combination of cutting-edge projects, strategic manufacturing moves, and a growing backlog gives Fluence a strong fundamental platform. The key question is whether the company can execute smoothly on its record pipeline (>$23 billion) of potential projectsts2.tech and convert orders to revenues on schedule. If it can, Fluence stands to ride the renewable energy wave as a central player in grid transformation. If not, any missteps could validate the skeptics who warn the recent rally may be getting ahead of itself.

Renewable Energy Boom and Industry Tailwinds

Fluence Energy operates at the intersection of two powerful trends: the global shift toward renewable power and the rapid scaling of battery storage to support that shift. Industry analysts almost unanimously agree that demand for energy storage will grow exponentially this decade. BloombergNEF projects over 400 GW of stationary battery storage will be installed by 2030 – more than 15 times the capacity in 2021ts2.tech. The International Energy Agency likewise forecasts that renewables (solar, wind, etc.) will become the world’s top electricity source by 2026, overtaking coalts2.tech. To integrate all this renewable generation, grids need flexibility – and that’s where battery storage comes in, smoothing out the intermittent nature of solar and wind.

Huge investments are flowing into the sector. The World Economic Forum reports that global battery storage investment exceeded $50 billion in 2024, as both governments and private companies finance new projectsts2.tech. In the U.S., the Inflation Reduction Act (IRA) is a game-changer: its $369 billion in climate and energy funding includes lucrative tax credits for energy storage deployments, effectively subsidizing projects that companies like Fluence supplyts2.tech. Europe is also stepping up, with EU member states rolling out “Fit for 55” policies and multi-billion euro programs to expand renewables and storage capacityts2.techts2.tech. These policy tailwinds create a favorable demand environment for Fluence if it remains competitive on technology and cost.

One specific driver boosting Fluence’s outlook is the data center boom, propelled by surging demand for cloud services and AI computing. Large data centers consume enormous power and require ultra-reliable electricity – they can’t afford outages. Fluence’s CEO noted that demand from data center operators is “expected to fuel a surge in U.S. orders”, potentially accounting for half of Fluence’s global demand by 2026stockstory.orggurufocus.com. Essentially, the rise of AI and Big Tech’s server farms is indirectly driving a need for battery storage to stabilize grids and provide backup power. This is a new and growing segment of the market beyond the traditional utility projects.

Additionally, battery technology has improved and costs have plummeted, making projects more economically viable. According to industry data, lithium-ion battery costs have fallen roughly 90% since 2010ts2.tech (and even around 80% just in the past year for raw lithium pricests2.tech). While commodity prices can fluctuate, the long-term trend of cheaper, denser batteries opens up new use cases. For instance, five years ago, multi-hour grid storage at scale was extremely costly; today it’s increasingly common as costs per MWh have come down. Fluence, with its global procurement and manufacturing, benefits from these cost declines, though it also faces margin pressure when prices spike (as seen with recent lithium and electronics inflation).

Of course, the industry isn’t without challenges. High interest rates worldwide have made financing large infrastructure projects more expensive, which can slow down storage deployments or squeeze developers’ budgets. Supply chain bottlenecks (from semiconductors to power electronics) have caused delays in some Fluence projects, prompting the company’s push for more vertically integrated production. Geopolitical factors also loom – for example, new U.S.–China trade tensions (like tariffs on battery components or export controls) could impact supply chains. In fact, one macro news item last week saw stocks like Fluence dip after the U.S. threatened higher tariffs on China in response to tech export restrictionsstockstory.org. Such policy crosswinds can introduce volatility in the sector.

Net-net, the macro picture for Fluence remains very promising: the world needs vastly more energy storage, and soon. Fluence’s status as one of the top pure-play providers in this booming market gives it a strong wind at its back. The company’s ability to capitalize on that opportunity – by scaling production, innovating on technology, and managing costs – will determine how much of the renewables gold rush translates into shareholder value.

Competitive Landscape: Fluence vs. Tesla and Others

In the race to dominate grid-scale energy storage, Fluence faces formidable competitors but also holds notable advantages. Fluence’s heritage as a joint venture of AES Corporation and Siemens means it was born with deep industry knowledge and global reach. Today, it stands as one of the market leaders in deploying large Battery Energy Storage Systems (BESS) worldwide.

Tesla Energy is often the first name investors mention in the battery space. Tesla’s utility-scale Megapack batteries have gained significant market share, leveraging Tesla’s brand and vertical integration (Tesla makes its own battery cells with partners and has massive manufacturing scale). By some measures, Tesla was effectively tied with Fluence for the #2 spot among global storage integrators in 2022–2023, each holding roughly 14% of the marketts2.tech. Both trail Sungrow, a Chinese company that reached about 16% share to claim #1ts2.tech. This indicates that Fluence is competing at the top tier of its industry, neck-and-neck with Tesla on the global stage – an impressive feat for a much smaller firm focused purely on storage. Fluence has deployed or contracted over 22,000 MWh of storage across 90+ projects in the U.S. alone (per a recent company release)ir.fluenceenergy.com, and many more internationally.

However, unlike Tesla (which enjoys hefty profits from its EV business to fund its energy ventures), Fluence is a more specialized BESS pure-play and must stand on its own financial footing. General Electric (GE), via its GE Vernova division, is another big entrant, offering battery storage solutions (like the Atlas platform) alongside its renewables equipment – GE’s power industry clout could make it a strong contenderts2.tech. Industrial conglomerates Wärtsilä and ABB have also entered the large-scale storage integrator marketts2.tech, often bundling storage with their power generation or grid offerings. AES Corporation, Fluence’s co-parent, interestingly both supports Fluence and competes in a way – AES continues to develop and own battery projects (many likely using Fluence’s tech, but AES could also choose other suppliers or even be acquired by a bigger fish like BlackRock as rumors suggest). This dual role of AES means Fluence has a guaranteed pipeline from its parent’s projects, but it also means AES’s strategic moves (like a potential sale) could impact Fluence’s independence.

On the battery manufacturing side, Fluence doesn’t make its own cells; it integrates battery modules and adds its proprietary software and controls. So firms like CATL, LG Energy Solution, Panasonic, and Samsung SDI are key suppliers rather than direct competitors. Securing reliable and cost-effective cell supply is critical – Fluence has struck partnerships (e.g. with AESC for U.S. supply) and opened that Vietnam factory to ensure it can meet demand with high-quality batteriests2.tech.

In the residential and small commercial segment, companies like Enphase Energy (known for solar microinverters and home batteries) and SolarEdge cater to home and business storage, which is adjacent but not core to Fluence’s marketts2.tech. Those players operate at a different scale (kilowatt-hour systems vs. Fluence’s megawatt-hour systems) and customer base. So while Enphase is sometimes cited as a “competitor” in energy storage, it’s not vying for the same utility-scale contracts that Fluence and Tesla are.

Another competitive dimension is software and energy management. Fluence offers an AI-driven platform (Fluence IQ, built in part from its acquisition of AI startup Nispera in 2022stockstory.org) that helps optimize battery performance and trading on energy markets. Competitors like Stem Inc. (an energy storage software company) or auto manufacturers dabbling in energy (like Tesla) also have software for energy management. Fluence’s ability to bundle intelligent software with its hardware can be a differentiator when bidding for projects that require not just installation but ongoing optimization.

According to a Wood Mackenzie report, Fluence was ranked #3 globally among storage system integrators in 2023, down from #2 priorts2.tech. This suggests competition is fierce. The report also cautioned that supply-chain issues and policy uncertainties have “impaired near-term sales” for Fluence and peersts2.tech – meaning that even strong demand can be undermined if companies can’t deliver on time or if incentives change. To stay ahead, Fluence is emphasizing its strengths: a massive installed base, a broad international presence (active in ~30 countries), and a diverse product lineup (Gridstack for large front-of-meter systems, Sunstack tailored for solar-plus-storage, Edge for commercial sites, etc.). With Siemens and AES in its corner, Fluence often has an edge in credibility when vying for big utility contracts, as those legacy partners have decades-long relationships in the power sector.

Ultimately, Fluence’s competition underscores both its opportunities and risks. The pie of energy storage is expanding rapidly, so multiple winners can thrive – but the company must execute flawlessly to secure contracts against well-funded rivals. Investors comparing FLNC to peers will note that, at around $18/share, Fluence’s market cap (~$3.2 billion) is a fraction of Tesla’s, but its valuation is rich relative to current earnings (since Fluence is barely breaking even). That means Fluence is being valued on future growth potential. If it can continue to win marquee projects (like the Polish and Ukrainian deals) and maintain a top-tier market share, it could justify that optimism. If competitors start snatching away deals or undercutting on price, Fluence could feel the pressure. For now, the company’s solid ranking and partnership lineage put it in a strong position to capture a healthy slice of the booming storage market.

Analyst Sentiment and Stock Forecast

After Fluence’s blistering share-price run, investors are naturally asking: what comes next for FLNC stock? On this front, analysts offer a mixed picture, with a notable gap between near-term consensus and long-term optimism. As mentioned, the consensus of Wall Street analysts rates Fluence a “Hold”, and the average 12-month price target is only about $8.13ts2.tech. This figure is over 50% below the current trading price, reflecting that many analysts issued cautious forecasts before the recent rally. In fact, throughout August and September – even as Fluence’s stock began climbing – several firms actually cut their targets (for example, Barclays trimmed its target to $8 and RBC to $7)ts2.tech. These revisions were based on concerns about valuation and execution risk, indicating some analysts felt the stock had run ahead of fundamentals when it was in the $7–$12 range. Now, with FLNC in the high teens, those old targets look very conservative (and likely due for upward revisions if the company’s outlook has indeed improved).

That said, a couple of analysts have more aggressively updated their views. Susquehanna’s new $17 target is one example of the Street acknowledging Fluence’s brighter prospectsstockstory.org. Even JPMorgan, which is generally neutral, raised its target modestly from $8 to $9 during the late-September spikets2.tech – not exactly a bullish call, but at least a nod to the company’s recent wins. Some research outfits have pointed to macro tailwinds like the IRA and falling battery costs as reasons Fluence could surprise to the upsidets2.tech, whereas others remain focused on micro challenges like the slow ramp of its U.S. factory or margin pressures. As of late September, the analyst tally stood at 4 Buys, 17 Holds, and 3 Sells on FLNCts2.tech. This skew toward hold/sell suggests many analysts are in “wait-and-see” mode – impressed by Fluence’s market opportunity but wary of its steep valuation and lack of consistent profitability.

On the technical analysis front, momentum indicators have been flashing bullish signals but also warning of overheating. With the stock’s surge from $6 to $18 in a matter of weeks, FLNC blew past its key moving averages – by Oct 1 it was already trading far above the 50-day (~$8.30) and 200-day (~$6.40) linests2.tech, triggering golden-cross-like patterns and breakout alerts. Such moves tend to attract trend-following traders. Volume has been massive on up-days, another positive sign from a chart perspective (confirming strong buying interest). However, oscillators like RSI (Relative Strength Index) are likely at or near overbought levels after the parabolic move. Traders and analysts note that Fluence’s beta (~2.6–2.7) is one of the highest in the clean-tech sectorts2.tech, meaning the stock is inherently volatile. It often magnifies broader market swings: if growth stocks rally, FLNC might overshoot; if the market stumbles or interest rates jump, FLNC can plunge quickly.

One striking statistic: over the last 12 months, Fluence had 79 trading days with moves greater than ±5%stockstory.org. Even for a young tech company, that’s a rollercoaster – and it underlines why some pros say FLNC is suitable only for risk-tolerant investors. The high short interest (a sizeable portion of the float has been sold short by investors betting on a decline) can exacerbate swings, as rallies force short-sellers to cover positions (pushing the stock higher), while any negative news could see shorts piling on again.

Looking ahead, what do forecasters see for Fluence’s financial performance? According to consensus estimates compiled in late September, Fluence is expected to post a net loss for FY2025 (around -$0.25 to -$0.30 EPS), despite strong revenue growthts2.tech. This reflects heavy spending on expansion and some project cost overruns. By FY2026, analysts anticipate revenue in the ballpark of ~$3.2–3.3 billion (roughly +22% vs 2025) as deferred revenue hits the booksts2.tech. At that scale, Fluence could edge closer to breakeven or slight profitability (EPS in the range of -$0.05 to +$0.05 is implied by some models). In other words, the Street is modeling continued growth with narrowing losses, but not a sharp leap to big profits yet. Cash burn will be a focal point – with about $900 million liquidity, Fluence has over a year of runway at the recent burn ratestockstory.org, but it will eventually need to turn cash-flow positive or consider raising more capital if expansion continues at this clip.

The stock forecast thus comes down to a debate: bulls vs. bears on execution. Bulls argue that Fluence’s recent contract wins and the tidal wave of demand for storage set the company up to exceed these conservative forecasts. They point to the company’s improving margins, enormous backlog, and the likelihood that policy support (in the U.S., Europe, and Asia) will keep orders flowing. From this view, Fluence could surprise on the upside – for instance, if it lands additional big contracts or if its new manufacturing capacity drives down costs faster, boosting margins. Some optimists even speculate that a larger entity (maybe an industry conglomerate or infrastructure fund) could see Fluence as an attractive acquisition target given its technology and market position.

Bears, on the other hand, emphasize that Fluence’s valuation is now quite stretched relative to its earnings. After the rally, FLNC trades at well over 50× forward EV/EBITDAstockstory.org (a level one analyst team called “aggressive” given the fundamentalsstockstory.org). They warn that a lot of good news is already priced in. Any slip – be it a delay in a key project, a supply shortage, or an earnings miss – could trigger a sharp correction. The fact that consensus targets are far below the current price signals that many experts think the stock’s enthusiasm has gotten ahead of itself. Indeed, one sector analyst recently suggested selling FLNC on this “elevated valuation” rally, noting that high expectations are baked in and cautioning that near-term earnings could disappointts2.techts2.tech.

In summary, the stock’s short-term trajectory may hinge on news flow and sentiment. Positive catalysts – such as new contract announcements, policy wins, or an earnings beat in the next report – could keep the momentum going. Negative surprises or even just profit-taking by early investors could lead to pullbacks. The long-term outlook for Fluence remains bright in a world increasingly powered by renewables and balanced by batteries, but the company will need to execute quarter after quarter to grow into its newfound market valuation. As it stands, Fluence Energy’s stock is a high-potential but high-volatility bet on the clean energy revolution – one that has electrified portfolios lately, and now faces the test of turning promise into profitable reality.

Sources: Recent stock performance and analyst commentary from StockStorystockstory.orgstockstory.org and StockAnalysisstockanalysis.com; company developments from TS2.techts2.techts2.tech and GlobeNewsWire; industry data from BloombergNEF, World Economic Forum, and IEAts2.techts2.tech; competitor and market share info from PV Magazine and Wood Mackenziets2.tech; and CEO/management insights via GuruFocus and press interviewsgurufocus.com. All information is up-to-date as of Oct. 14, 2025.