- Fordow sits 80–100 m inside a mountain 30 km north of Qom and houses about 3,000 centrifuges, later upgraded with IR-6 machines capable of 60% enrichment.

- In 2023, IAEA inspectors detected particles enriched to 83.7% at Fordow, signaling near-weapons-grade material.

- On a June weekend, the United States used a dozen 30,000-pound MOPs in Operation Midnight Hammer, creating at least six cavernous craters in the ridge above the underground halls.

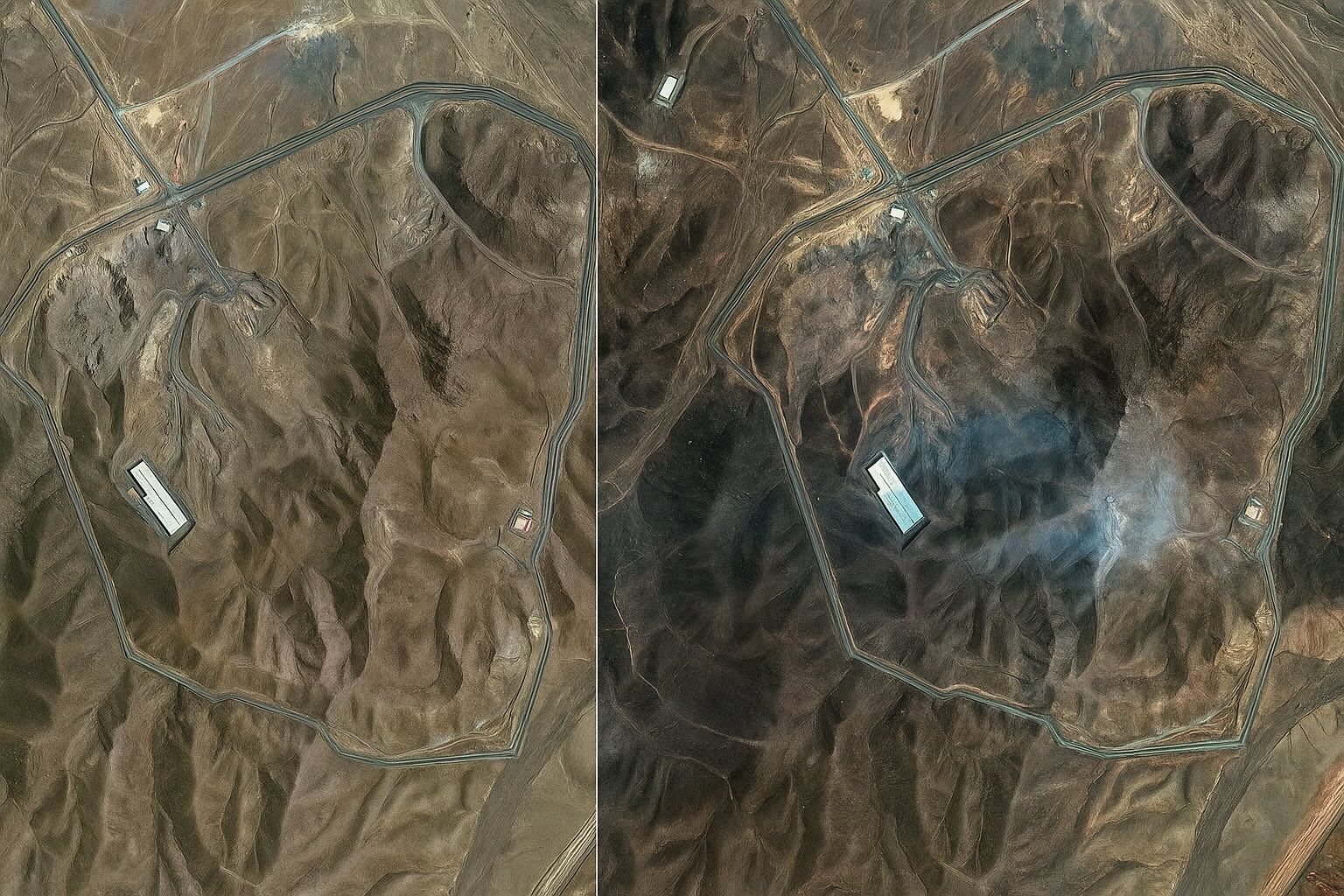

- Satellite images released on 22 June by Planet Labs and Maxar show twin clusters of three impact holes over what analysts identify as ventilation shafts.

- The Fordow centrifuge halls lie about 260 feet (approximately 80 meters) below ground, limiting confirmation of total destruction from imagery alone.

- On 20 June, hours of convoy activity suggested Iran moved 400 kg of 60% enriched uranium to an unknown location, possibly evacuating bomb-grade material.

- Jeffrey Lewis of the Middlebury Institute called the raid tactically brilliant but strategically incomplete because Iran still retains enriched uranium and possibly other hidden sites.

- CSIS’s Joseph Rodgers credited hitting the ventilation shafts as a direct route to core underground components.

- The strike triggered emergency actions such as the IAEA board meeting and prompted Iran’s parliament to threaten withdrawal from the Nuclear Non-Proliferation Treaty.

- Analysts say the strike demonstrates that mountains are not absolute sanctuaries, but destroying nuclear know-how is harder than crushing concrete, leaving a continued breakout risk.

In the space of a single June weekend, the Fordow Fuel Enrichment Plant—long considered Iran’s most impregnable atomic fortress—went from hidden menace to smoking headline. Newly released commercial satellite photos reveal at least six cavernous craters in the rocky ridge protecting the underground centrifuge halls, evidence that the United States unleashed a dozen 30‑thousand‑pound Massive Ordnance Penetrators (MOPs) during “Operation Midnight Hammer.” While Tehran insists the facility is merely “scratched,” independent analysts, the UN nuclear watchdog and even some Iranian insiders now concede that Fordow’s enrichment halls may be “structurally crippled,” setting off an urgent debate over what Iran moved out, what survived below, and what comes next. reuters.com reuters.com reuters.com

1. What Fordow Is—and Why It Mattered

- Location & design. Buried roughly 80–100 m inside a mountain 30 km north of Qom, Fordow was built in secret, outfitted for ~3,000 centrifuges and later upgraded with advanced IR‑6 machines capable of enriching uranium to 60 %—a stone’s throw from weapons‑grade purity. aljazeera.com news.sky.com

- Strategic hedge. Experts from the International Institute for Strategic Studies and CBS News have long warned that Fordow was Iran’s “break‑out” insurance if over‑ground sites like Natanz were hit. news.sky.com cbsnews.com

- IAEA concerns. In 2023 inspectors unexpectedly detected particles enriched to 83.7 %—an unmistakable red flag. aljazeera.com cbsnews.com

2. The Strike as Seen From Space

2.1 The Before/After Imagery

Planet Labs and Maxar frames released 22 June show twin clusters of three impact holes precisely over what analysts identify as ventilation shafts. wired.com reuters.com

“They just punched through with these MOPs … I would expect the facility is probably toast.” —David Albright, Institute for Science & International Security reuters.com

2.2 Limits of Satellite Forensics

Because the centrifuge halls lie ~260 ft below ground, imagery alone cannot confirm total destruction—a point stressed by Decker Eveleth of CNA and IAEA Director‑General Rafael Grossi. reuters.com reuters.com

3. Did Iran Empty the Vault?

Hours of truck convoys were spotted on 20 June, two days before the strike, raising the possibility that most of the 400 kg of 60 %‑enriched uranium—enough for ~9 bombs—was spirited to an unknown location. reuters.com reuters.com theguardian.com

Iranian adviser Mahdi Mohammadi later bragged that Fordow “had long been evacuated,” echoing state media claims residents “felt no major explosion.” aljazeera.com

4. Expert Verdicts: Tactical Brilliance, Strategic Question Mark

- Jeffrey Lewis (Middlebury Institute): the raid was “tactically brilliant but strategically incomplete,” because Iran still holds enriched uranium and perhaps other hidden sites. wired.com theguardian.com

- Joseph Rodgers (CSIS): targeting ventilation shafts was key—“a direct route to the core components of the underground facility.” wired.com

- Daryl Kimball (Arms Control Association): warns that if Tehran quits the Non‑Proliferation Treaty, “the world is going to be in the dark about what Iran may be doing.” reuters.com

- Richard Nephew (former U.S. negotiator): even a collapsed Fordow “won’t make the Iranian nuclear threat go away” given possible secret enrichment lines. thebulletin.org

5. Regional & Political Fallout

| Stakeholder | Immediate Reaction | Longer‑Term Moves |

|---|---|---|

| IAEA | Convenes emergency Board; seeks re‑entry for inspectors. reuters.com | May demand declaration of any relocated material. |

| U.S. Administration | Declares Fordow “severely damaged,” but withholds full assessment. reuters.com | Signals readiness to negotiate removal of stockpiles. theguardian.com |

| Iranian Parliament | Threatens withdrawal from NPT. reuters.com | Debates accelerating “invulnerable” new enrichment site. thebulletin.org |

| Israel | Says access routes remain targets and hints at further raids. news.sky.com | Maintains that complete dismantlement is non‑negotiable. |

6. What Comes Next? Four Scenarios

- IAEA‑Led Verification: Tehran permits inspectors under duress, revealing damage and material relocation. Confidence restored, sanctions ease slightly.

- NPT Withdrawal: Iran quits treaty, accelerates covert work; region faces renewed proliferation spiral.

- Follow‑On Strikes: U.S./Israel target suspected backup sites and centrifuge production lines, risking wider conflict. thebulletin.org

- Return to Diplomacy 2.0: A JCPOA‑style deal resurrected, but with tougher underground‑site provisions and longer sunsets—politically difficult yet still possible, experts say. thebulletin.org

7. Key Take‑Aways

- Fordow’s shell is cracked, but its shadow lingers. Damage appears extensive, yet uncertainty about subterranean conditions and relocated uranium keeps the breakout clock ticking.

- Intelligence gaps widen with every hour of inspector absence. Grossi’s warning underscores that only on‑site verification can confirm Fordow’s fate and secure remaining stockpiles. reuters.com

- The lesson of deep‑burial deterrence is mixed. The strike shows even mountains are not absolute sanctuaries, but it also proves that destroying nuclear know‑how is harder than crushing concrete. wired.com thebulletin.org