New York, January 11, 2026, 13:22 (EST) — Market closed.

Edwards Lifesciences will head into Monday’s session without a deal it pitched as a shortcut into a new heart-valve market, after a U.S. judge granted the Federal Trade Commission an injunction blocking the company’s planned acquisition of JenaValve Technology. The FTC called it a “major win” for the Trump-Vance administration, while Edwards said it would not proceed and disagreed with the decision. (Reuters)

The timing stings because it lands just as executives and bankers crowd into San Francisco for the J.P. Morgan Healthcare Conference, where deal chatter can set the tone for months. “That has made people dust off the playbook on the art of the possible,” said Jeremy Meilman, global co-head of healthcare investment banking at JPMorgan, speaking more broadly about deal appetite. (Reuters)

Edwards tried to offset the legal loss with a modest lift to its 2026 outlook. The company raised its full-year adjusted earnings per share forecast to $2.90 to $3.05 from $2.80 to $2.95, a metric that strips out certain items such as some litigation expenses, and said it will keep pushing its own aortic regurgitation program, including its SOJOURN transcatheter valve and the JOURNEY pivotal trial. (Edwards Lifesciences)

The FTC has argued the deal would curb competition in devices aimed at a potentially fatal heart condition, and it has an administrative case pending. (Federal Trade Commission)

Edwards shares last closed up 0.7% at $85.13. Other medtech names were lower, with Medtronic down about 1.2%, Boston Scientific off about 0.8% and Abbott down roughly 0.2%.

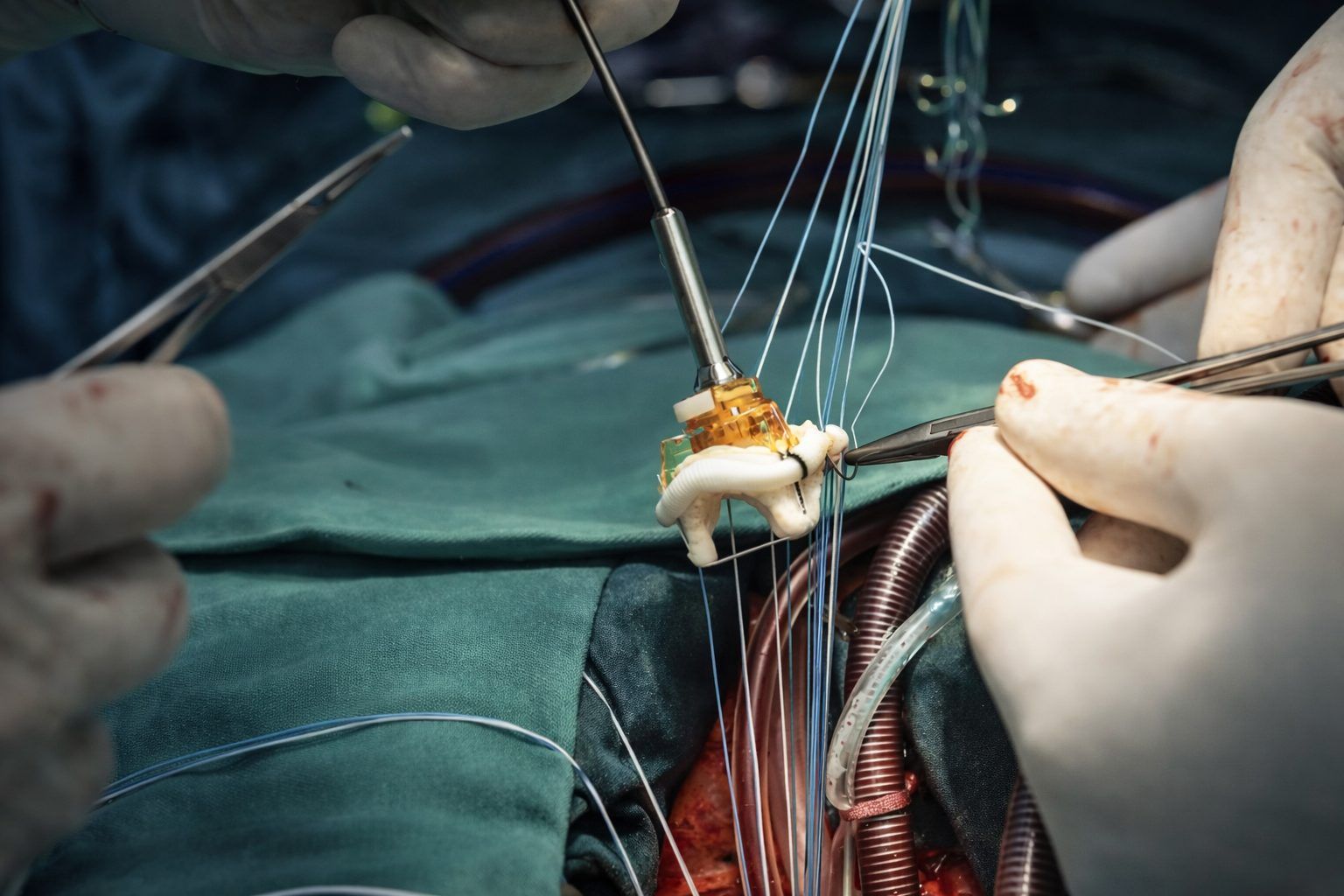

The fight is over a niche but high-stakes corner of structural heart care. Transcatheter aortic valve replacement, or TAVR, is a valve swap done through a catheter rather than open-heart surgery. Aortic regurgitation is a leaky valve problem — the valve does not close properly, and blood can flow backward.

For traders, the question is less about the lost headline and more about pace. If Edwards can’t buy a faster route into aortic regurgitation, investors will look for signs it can push its own program through trials without delays or cost creep, and still protect margins in its core valve business.

But the downside is straightforward: trial setbacks, slower enrollment, or tougher-than-expected regulatory demands could turn a deal setback into a revenue gap, especially if competitors move faster in adjacent catheter-based heart therapies.

Next up, Edwards is scheduled to present at the J.P. Morgan Healthcare Conference on Jan. 12 at 11:15 a.m. PT, a stage investors often use to test management’s tone and timelines. The company’s next hard catalyst after that is its fourth-quarter earnings conference call on Feb. 10 at 5:00 p.m. ET. (Edwards Lifesciences)