Germany’s stock market wrapped up Friday’s session in Frankfurt with a calm headline number but plenty of action under the surface. The blue‑chip DAX 40 finished essentially unchanged at 23,766 points, down just 0.01% on the day, after trading in a tight range between roughly 23,718 and 23,782. Investing.com

By contrast, mid‑caps and tech outperformed:

- MDAX (mid‑caps): 29,734.7, up about 0.7% on the day

- TecDAX (tech): 3,566.5, up 0.1% Investing.com+1

That leaves German equities higher on the week but slightly down for November: the DAX gained just under 3% since last Friday but is still about 0.8% below its end‑October level, mirroring a choppy month for global risk assets. Investing.com+1

How the main German indices performed

DAX: Flat finish after a strong rebound week

The DAX 40 spent most of Friday hovering near the flat line, ultimately closing at 23,766, just two points below Thursday’s finish. Investing.com

Key takeaways:

- Day move: around –0.01%, effectively flat

- Weekly move: up roughly 2.9% versus last Friday’s close near 23,092, as the index extended its rebound from mid‑November lows Investing.com

- Monthly move: down about 0.8% versus 31 October (23,958), meaning November is likely to go down as a slightly negative month despite the late rally Investing.com

Trading was also restrained across the continent. The pan‑European STOXX 600 slipped around 0.1% in early trade, with Germany’s DAX and France’s CAC 40 also off by about 0.1% as investors took a breather after several strong sessions. Reuters+1

MDAX and TecDAX: Mid‑caps and tech quietly lead

The real momentum was below the headline index:

- MDAX (mid‑caps)

- Closed at 29,734.7, up 0.69% on Friday

- Gained more than 5% compared with last Friday’s close near 28,264

- Now almost back to where it started the month (29,751.6 on 31 October) Investing.com

- TecDAX (tech)

- Ended at 3,566.5, up 0.09% on the day

- Up roughly 4.6% week‑on‑week, but still about 1.7% below its end‑October level around 3,629 Investing.com

The pattern is familiar: investors are still selectively adding risk, particularly in technology and mid‑caps, but remain cautious on big industrial and financial names that dominate the DAX.

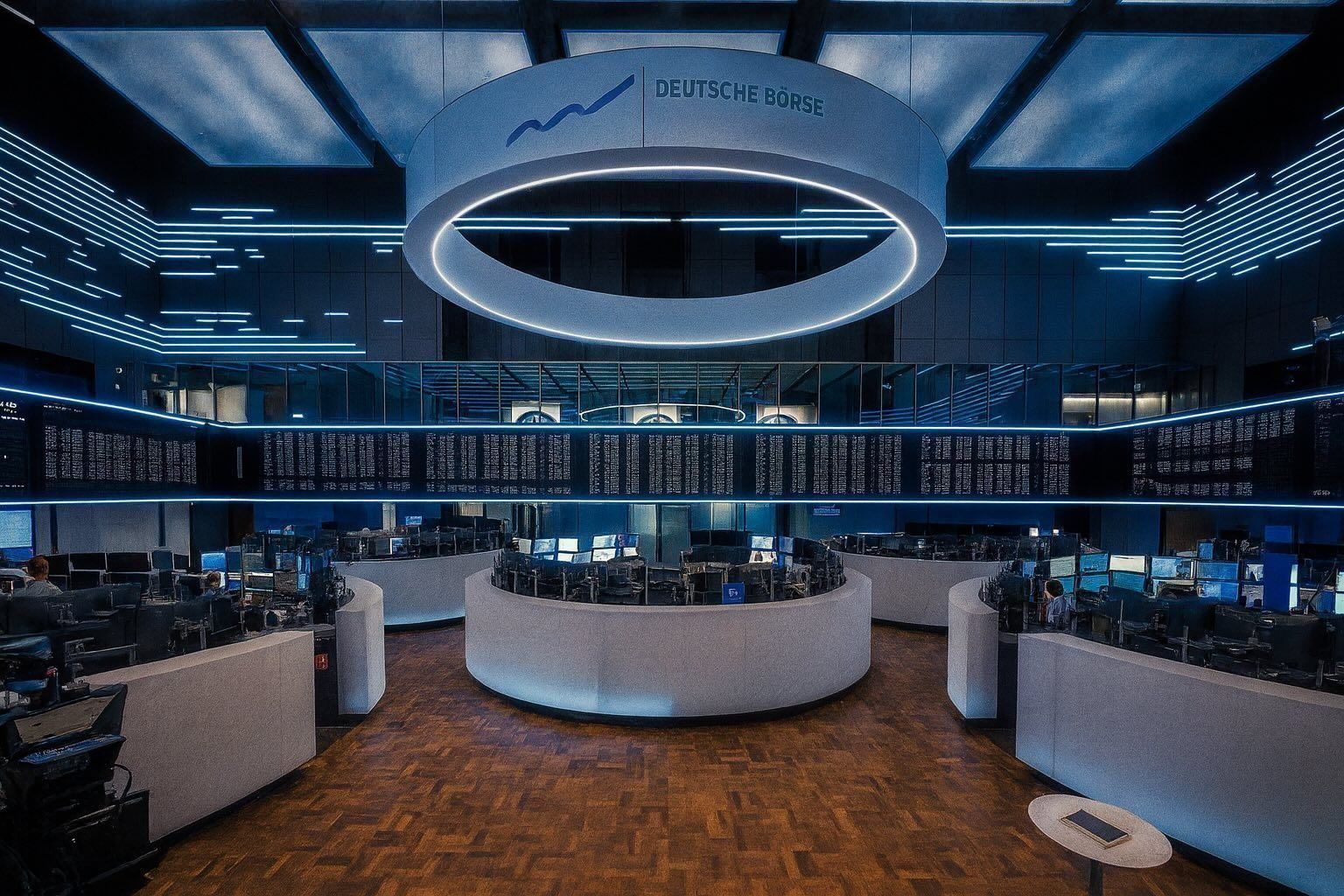

Deutsche Börse steals the show with Allfunds deal talks

The stand‑out corporate story in Frankfurt today was Deutsche Börse, the operator of the Frankfurt Stock Exchange.

Exclusive talks to buy Allfunds

Deutsche Börse confirmed it is in exclusive talks to acquire Allfunds Group, a major European fund distribution and fund‑services platform. The proposed consideration values Allfunds at about €8.80 per share, split into roughly €4.30 in cash and €4.30 in new Deutsche Börse shares, plus additional dividend entitlements for 2025–2027. XTB.com+2XTB.com+2

Different outlets estimate the overall deal value at around €5–5.3 billion in cash and stock, reflecting both the cash component and the share issuance. Financial Times+2Reuters+2

Key points from the proposed transaction:

- Allfunds’ board has unanimously agreed to an exclusivity period based on Deutsche Börse’s non‑binding proposal. XTB.com

- The deal would involve acquiring all outstanding and to‑be‑issued Allfunds shares, subject to due diligence and regulatory approvals. XTB.com+1

- Deutsche Börse’s strategic goal is to build a pan‑European fund‑distribution ecosystem, strengthening its role as a core infrastructure provider for European capital markets. XTB.com+1

Markets reacted positively. Mid‑session, Deutsche Börse’s stock was up nearly 2%, making it one of the best performers in the DAX and helping to keep the index near the flat line despite pressure in other heavyweights. XTB.com+1

Other major movers: Infineon, Merck, Rheinmetall and Delivery Hero

Infineon, Merck and Rheinmetall

According to XTB’s mid‑morning market update, Infineon Technologies and Merck KGaA joined Deutsche Börse among the stronger DAX names, while defense group Rheinmetall came under selling pressure after a period of strong outperformance. XTB.com

- Infineon and Merck benefited from continued interest in growth and defensive quality stocks, as investors brace for a potentially softer economic patch but still want exposure to structural themes like semiconductors and healthcare. XTB.com+1

- Rheinmetall shares slipped as traders took profits following a powerful multi‑month rally driven by elevated defense spending and geopolitical tensions. XTB.com

Exact percentage moves varied over the session, but the pattern was clear: stock‑specific stories mattered more than broad sector flows.

Delivery Hero lights up the MDAX

On the MDAX, the biggest headline name was Delivery Hero:

- Reuters reported that Delivery Hero shares jumped about 8% after a report that some investors are pushing management to consider a sale of the company or disposals of key businesses in a strategic review. Reuters

- The move added to the outperformance of German mid‑caps and underscores how restructuring and M&A stories are increasingly important drivers for Germany’s second‑tier index. Investing.com+1

The data behind today’s trade: inflation, jobs and spending

Friday’s session was shaped by a dense batch of German macroeconomic data released in the morning, giving investors fresh clues about the health of Europe’s largest economy.

Inflation: Flash CPI ticks up to 2.4% in November

The flash estimate for German CPI in November showed inflation accelerating slightly to 2.4% year‑on‑year, above the consensus forecast of 2.3% and up from 2.3% in October. Investing.com+1

On the EU‑harmonised HICP measure:

- Headline HICP remains close to 2.3–2.4% year‑on‑year, near but slightly above the ECB’s 2% target. Bundesbank+1

- The monthly HICP print surprised to the downside, with prices falling about 0.6% month‑on‑month, versus expectations for a small rise, reflecting lower energy prices and seasonal discounting. Investing.com

For equity investors, the message is mixed:

- Slightly higher‑than‑expected annual inflation tempers hopes of rapid ECB rate cuts.

- But falling import prices and weak retail activity (see below) suggest underlying price pressures are still easing.

Retail sales: Consumers pull back again

Fresh figures from the Federal Statistical Office (Destatis) showed German retail sales fell 0.3% month‑on‑month in October, sharply missing forecasts for a 0.1% increase and reversing September’s 0.3% gain. Investing.com+1

Persistent themes:

- Households remain cautious, squeezed by still‑elevated prices and uncertainty about the labour market.

- Real consumption is likely to contribute only modestly to German GDP in Q4, limiting upside for domestic‑demand‑focused stocks such as retailers and some discretionary names. Reuters+1

Import and export prices: External disinflation continues

Destatis also reported that import prices in October were 1.4% lower than a year earlier, even as they rose 0.2% month‑on‑month. Export prices increased 0.5% year‑on‑year and 0.2% versus the previous month. Destatis

This combination — soft import prices and modest export‑price growth — reinforces the idea that external cost pressures are fading, providing a buffer against renewed domestic inflation but also hinting at subdued global demand.

Labour market: Unemployment rises less than feared

There was slightly better news from the labour market:

- Seasonally adjusted unemployment rose by just 1,000 people in November, compared with expectations of a 4,000 increase and a previous reading that showed a small decline. Investing.com+1

- The jobless rate stayed at 6.3%, unchanged from October, according to figures cited by Reuters and Investing.com. Investing.com+1

- In level terms, the number of unemployed stands near 2.97 million, underlining that the labour market is soft but not collapsing. Economy.com+1

Complementing that, a separate Destatis release noted that total employment in October was roughly 46.0 million people, “almost unchanged” after seasonal adjustment, confirming that job growth is essentially stagnating. Destatis+1

For equities, this is “less bad” rather than truly good:

- A stable unemployment rate and only a small uptick in jobless claims reduce recession fears.

- But the absence of strong job growth makes a consumption‑led recovery unlikely in the near term.

Sentiment and the wider European backdrop

Consumer sentiment: GfK shows tiny improvement

On Thursday, the latest GfK consumer climate survey signalled a slight improvement going into December:

- The consumer climate index rose from –24.1 to –23.2, in line with forecasts, as willingness to buy increased and the tendency to save fell. Reuters+1

- However, income expectations remain weak, and the index is still deeply negative, implying that overall consumption is likely to decline year‑on‑year rather than surge. Reuters+1

This backdrop helps explain why retail stocks have struggled even as some cyclical and export‑oriented names have bounced on hopes of a global recovery.

Eurozone mood: Lukewarm growth, modest sentiment uptick

Across the euro area, the European Commission’s Economic Sentiment Indicator edged up to around 97.0 in November from 96.8, still below its long‑run average of 100 and consistent with slow but positive growth. Reuters+1

Bank‑lending data showed steady, moderate credit growth, with loans to households and businesses rising around 2.8–2.9% year‑on‑year — supportive, but not enough to produce a strong upswing. Reuters

For Germany, this means:

- The external environment is no longer a major drag, but it’s not a powerful tailwind either.

- DAX companies with significant overseas exposure can still lean on global demand, but domestic‑only players remain hostage to weak local confidence.

Global market drivers: Fed cut bets and a CME outage

Friday’s trade also unfolded against a quirky global backdrop:

- A technical outage at CME Group temporarily halted trading in a wide range of futures — from currencies to Treasuries and equity indexes — further thinning already light post‑Thanksgiving liquidity. Reuters+1

- At the same time, Fed officials including Governor Christopher Waller and New York Fed President John Williams have openly signalled support for a U.S. rate cut as soon as next month, with futures markets now pricing an ~85% chance of a December cut, up from about 30% a week ago. Reuters

Reuters notes that this shift in expectations has been central to the recovery in global stocks late in November, even though both the S&P 500 and Europe’s STOXX 600 are on track for one of their weaker months this year. Reuters+1

For the DAX, which is heavy on cyclicals and exporters, the prospect of lower U.S. and European rates in 2026 continues to underpin valuations — but today’s flat close shows that investors wanted fresh domestic catalysts before chasing prices higher.

What today’s session means for investors

Putting it all together, the 28 November 2025 session on the German stock market tells a nuanced story:

- Index‑level calm hides rotation

- The DAX was flat, but mid‑caps and tech outperformed, and stock‑specific stories (Deutsche Börse, Delivery Hero) dominated flows. Reuters+3Investing.com+3Investing.com+3

- Macro data is “two steps forward, one step back”

- Inflation is still drifting down over the medium term but surprised slightly higher in November.

- Retail sales weakened again, while import prices and unemployment suggest sluggish but not collapsing domestic demand. Investing.com+3Investing.com+3Investing.co…

- Structural stories matter more than short‑term noise

- Deutsche Börse’s Allfunds move highlights a long‑running push to build scale in market infrastructure and fund services, which could reshape earnings profiles over several years. XTB.com+2Financial Times+2

- Activist pressure at Delivery Hero and ongoing M&A speculation around other German names keep corporate action firmly on traders’ radar. Reuters+1

- November likely to close slightly negative but far from disastrous

- With the DAX and TecDAX both down on the month but well above their mid‑month lows, November looks more like a consolidation phase than the start of a new bear leg. Investing.com+2Investing.com+2

As December begins, investors in German equities will be watching:

- Final November inflation data and how it feeds into expectations for ECB policy in 2026

- Further headlines on the Deutsche Börse–Allfunds negotiations

- Any sign that consumer sentiment and retail spending are stabilising into the Christmas period

For now, the message from Frankfurt on 28 November 2025 is simple: the German stock market is catching its breath — but beneath the flat index level, deal‑making and selective sector rotation are very much alive.