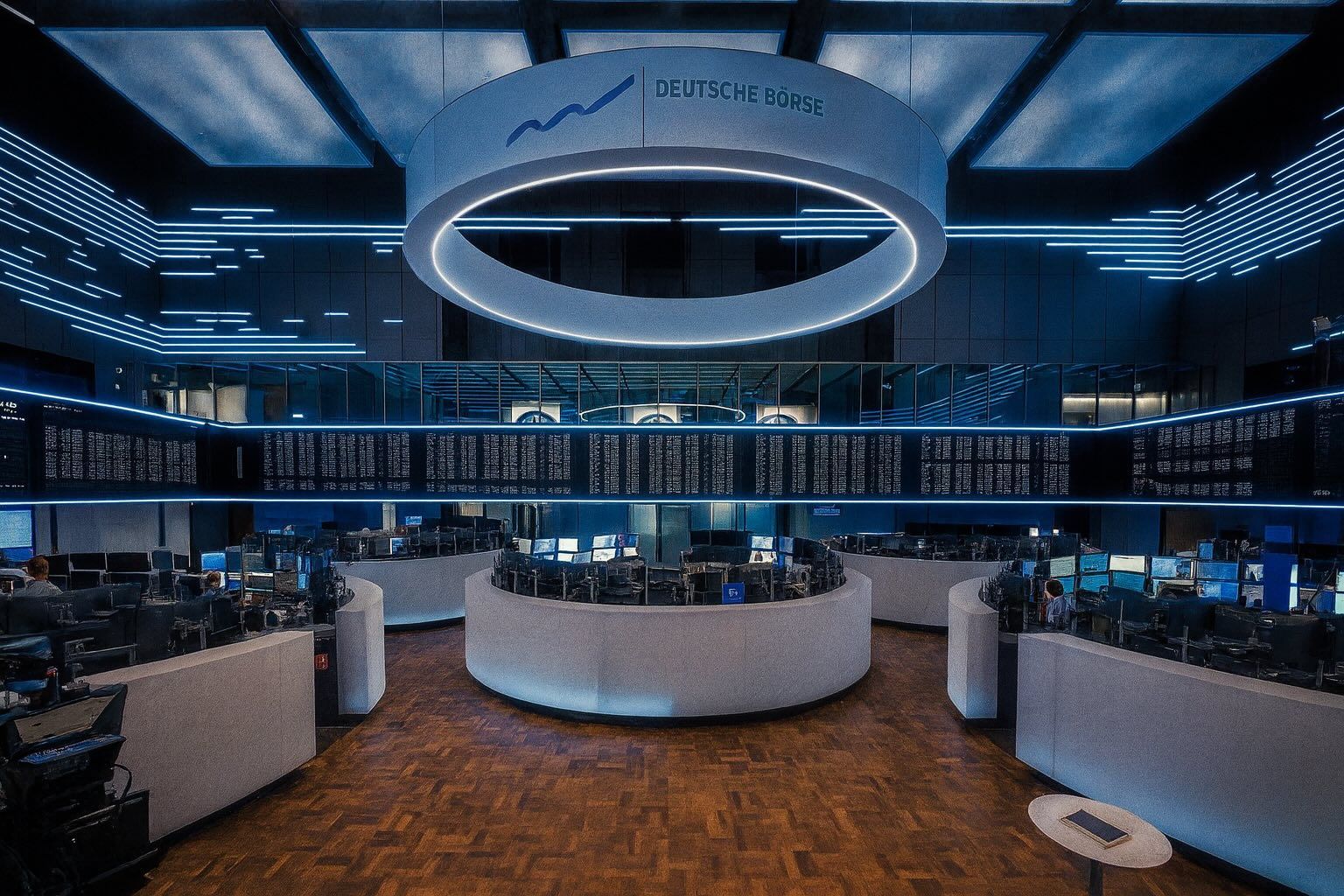

FRANKFURT – Germany’s stock market tried to catch its breath on Wednesday, 19 November 2025, as the DAX hovered around the 23,200 mark, only fractionally above yesterday’s close and still parked near five‑month lows. Trading Economics+1

A tentative rebound in heavyweight names like Daimler Truck, Siemens Energy and Qiagen helped offset ongoing weakness in chemicals, autos and some big financials, but sentiment remained fragile as investors fixated on tonight’s blockbuster Nvidia earnings and a string of U.S. data that could reshape the global rate‑cut story. RTT News+1

DAX today: tiny bounce after a bruising Tuesday

After a heavy sell‑off on Tuesday, when the DAX dropped about 1.7% to roughly 23,180 points, its weakest level in several months, Frankfurt opened Wednesday on the back foot. BSS+2teletrade.org+2

Early in the European session, Germany’s benchmark index slipped around 0.2% to 23,136.63, mirroring a cautious tone across global markets. WRAL News+1 As the morning wore on, dip‑buyers nudged the market slightly higher:

- Around mid‑morning, the DAX was up about 0.1% at 23,195.60, according to intraday data. RTT News

- Composite quotes for Germany’s main stock market index (DE40) later showed it around 23,188 points, only about 0.03% above Tuesday’s close – effectively flat on the day. Trading Economics

- Real‑time component data put the DAX at roughly 23,205 points, a gain of around 0.14% in early afternoon trading. Investing.com

In other words: Germany’s stock market today is stabilising, not rallying. The index has still lost more than 5% over the past week and remains near five‑month lows after breaking below its 200‑day moving average. MarketScreener+1

Across the continent, the mood is similar. The pan‑European STOXX 600 was down about 0.2%, holding close to a more‑than‑one‑month low after Tuesday’s 1.7% slide, as investors question whether the AI‑driven tech rally has morphed into a bubble. Reuters+1

Nvidia earnings and AI valuation jitters dominate sentiment

The single biggest story hanging over German and European equities today is Nvidia.

Global markets have spent days unwinding AI‑linked trades, with tech‑heavy indices in the U.S. and Asia falling as investors reassess sky‑high valuations. Reuters notes that global stocks are on their fifth straight day of losses, while Europe’s STOXX 600 is down about 4% from record highs set less than a week ago. Reuters

An AFP/BSS wrap of Tuesday’s action summed it up bluntly: tech‑focused selling on Wall Street helped trigger “global contagion”, sending Frankfurt’s DAX down about 1.7% and dragging London and Paris more than 1% lower as well. BSS

Today, markets are essentially in “show me” mode:

- Nvidia’s earnings, due after the U.S. close, are seen as a make‑or‑break moment for the AI trade that helped push global stocks to all‑time highs this year. Reuters+1

- Analysts warn that Nvidia’s share price is “priced for perfection”; any disappointment on AI chip demand could deepen the correction in tech and spill over into broader indices like the DAX. Reuters

- Futures data and trading in Nvidia’s Frankfurt‑listed shares suggest investors are braced for a highly volatile reaction. Reuters

For German stocks, which now include several AI‑ and chip‑sensitive names (Infineon, SAP, Siemens Energy, and industrials exposed to automation), the earnings print could set the tone for the rest of the week.

Top movers on the DAX: trucks, utilities and telecoms try to lead a rebound

Despite the cautious headline index move, there was real stock‑picking activity under the surface of the Germany stock market today.

Biggest winners

Intraday data and market commentary highlight a cluster of cyclical and growth names that outperformed:

- Daimler Truck Holding jumped roughly 3–3.5%, topping the DAX after recent weakness and as investors rotated back into selected industrials. RTT News+1

- Siemens Energy climbed about 2.4–2.7%, extending Tuesday’s strong performance and benefiting from relief that regulatory and balance‑sheet risks remain manageable. RTT News+1

- Qiagen gained close to 2%, while Zalando added around 1.7–1.8%, supporting the index from the healthcare and e‑commerce sides. RTT News+1

- Among financials, Deutsche Telekom, Deutsche Bank, Commerzbank and Henkel booked 0.5–1% advances, according to intraday reports. RTT News+1

Real‑estate heavyweight Vonovia traded modestly higher as well (around +0.2–0.4%), continuing its slow recovery from Germany’s recent property slump. vonovia.com+1

Biggest laggards

On the downside, defensives and growth names with stretched valuations remained under pressure:

- Merck fell around 1–1.7%, leading losses among healthcare majors. RTT News+1

- Bayer slid roughly 1%, extending a multi‑year period of volatility driven by litigation and restructuring headlines. RTT News+1

- Infineon Technologies, Volkswagen, RWE, Siemens Healthineers, Munich Re, Porsche SE and Adidas all traded between about 0.4–1% lower, reflecting ongoing caution around cyclicals, semiconductors and consumer names. RTT News+1

The pattern fits with the broader European picture: banking stocks and tech have shifted from market darlings to relative drags this week as investors nervously reassess growth, rates and AI valuations. Reuters+1

Beyond the DAX: mid‑caps, buybacks and energy‑transition themes

Away from the blue chips, several corporate developments in Germany today could matter for sector‑focused investors, even if they don’t move the DAX directly.

7C Solarparken ramps up share buyback

Solar park operator 7C Solarparken AG announced that its management board has increased the volume of its 2025 share repurchase programme to up to 2.5 million shares, under an existing authorization from its June AGM and with supervisory board approval. TradingView+1

- The buybacks will be executed on the stock exchange, with the maximum purchase price capped at €1.85 per share. TradingView

- The stock trades on the regulated market in Frankfurt and several regional exchanges, highlighting the continuing importance of capital‑return stories in Germany’s mid‑cap renewable space. TradingView+1

This move plays into a broader investor preference for companies that use balance‑sheet strength to support share prices, especially in volatile markets.

Massive battery storage project underlines energy‑transition momentum

In the energy‑transition ecosystem, HyperStrong International (Germany) GmbH and LEAG Clean Power GmbHsigned an EPC contract for a 1.6 GWh utility‑scale battery energy storage system (BESS) project in Germany – one of the largest such facilities in Europe once completed. Vietnam Investment Review – VIR

The GigaBattery Boxberg 400 project, part of LEAG’s “GigawattFactory” concept, aims to pair large‑scale storage with solar, wind and hydrogen‑ready power plants, providing flexibility and grid stability as the country shifts away from fossil fuels. Vietnam Investment Review – VIR

While neither HyperStrong nor LEAG are DAX constituents, large‑scale storage projects like this tend to support sentiment in utilities, grid operators, industrial suppliers and selected renewables stocks listed in Frankfurt.

BASF pushes further into certified low‑carbon chemicals

Chemicals giant BASF added ISCC EU certification to its biomass‑balanced methanol portfolio, meaning its methanol products are now certified under four major sustainability schemes (ISCC PLUS, REDcert², ISCC EU and REDcert‑EU). BASF

The move:

- Helps BASF serve both the chemical industry and the biofuel sector with certified low‑carbon intermediates.

- Supports customers in cutting fossil feedstock use and meeting emissions targets under EU rules. BASF

While the share price reaction was modest today, sustainability‑linked product lines are increasingly important to long‑term valuations in Germany’s chemicals sector.

Frankfurt as a hub for digital‑asset products

In the digital‑assets space, Deutsche Digital Assets (DDA), based in Frankfurt, and Swedish exchange Safello launched trading of the Safello Bittensor Staked TAO ETP (ticker: STAO) on SIX Swiss Exchange, with the product physically backed by the Bittensor (TAO) token and offering staking rewards within a regulated wrapper. Deutsche Digital Assets

Although listed in Switzerland, the product underlines Frankfurt’s role as a structuring hub for crypto‑linked exchange‑traded products – relevant for investors following German‑listed financials, market‑infrastructure companies and specialist asset managers.

Macro backdrop: inflation cooling, ECB on alert, Fed in focus

Today’s Germany stock market action is happening against a busy macro and policy backdrop.

Eurozone and German inflation near target

Fresh data showed Eurozone annual inflation at 2.1% in October, down slightly from September’s 2.2%, keeping it close to the European Central Bank’s 2% target. Germany’s inflation eased to 2.3% from 2.4%, while France saw a sharper drop to 0.8%. RTT News

Cooling inflation supports the view that ECB policy is near peak tightness, but the central bank remains cautious given patchy growth and global risks.

ECB warns banks about “unprecedentedly high” risk of shocks

On Tuesday, the ECB published a widely‑watched warning that euro‑area banks face an “unprecedentedly high” risk of extreme but low‑probability shocks, citing geopolitical tensions, trade frictions, climate risks and technological disruptions. Reuters

Key takeaways:

- Banks are urged to maintain strong capital buffers and robust risk management, with supervisors planning more intrusive oversight and reverse stress tests. Reuters

- The ECB flagged sectors like automotive, chemicals and pharmaceuticals – all heavily represented in the DAX – as vulnerable in a downside scenario where U.S.–EU trade tensions worsen. Reuters

The warning helps explain why European bank stocks, despite big gains earlier this year, have been under pressure this week and are now a drag on indices like the DAX and STOXX 600. Reuters+1

Fed minutes and U.S. jobs data up next

On the other side of the Atlantic, investors are watching:

- Minutes from the latest Federal Reserve meeting, due later today, for clues on whether a December rate cut is still on the table. MarketScreener+1

- A delayed U.S. jobs report, scheduled for Thursday, which could either revive or further dim rate‑cut expectations. Reuters+1

Global coverage notes that the dollar has been clawing back some of its earlier losses this year as rate‑cut hopes fade, while Bitcoin briefly dipped below $90,000 before rebounding, underscoring broader risk aversion. Reuters+1

For German exporters and multinational DAX companies, the interplay between U.S. growth, the dollar and global financial conditions remains a critical driver of earnings expectations and share prices.

What German investors are watching for the rest of the week

With the DAX stuck near multi‑month lows but no longer in free‑fall, several catalysts could decide whether the Germany stock market today marks the start of a base‑building phase or just a pause before another leg down:

- Nvidia earnings (tonight)

- A strong beat and upbeat guidance on AI demand could stabilise global tech, ease “bubble” fears and help growth‑sensitive DAX names like Infineon, SAP and Siemens Energy.

- A miss or cautious outlook might extend the derating of AI‑linked shares worldwide and keep the DAX under pressure. Reuters+1

- Fed minutes & U.S. jobs report (next 24–48 hours)

- Any signal that the Fed might delay or scale back further cuts could keep bond yields elevated and weigh on rate‑sensitive sectors such as real estate and some financials. Reuters+1

- Ongoing ECB communication

- After Tuesday’s warning about bank risks, investors will be alert to any follow‑up comments that might affect euro‑area financials, a crucial part of the German equity story. Reuters

- Company‑specific moves

- Reactions to share buybacks (like 7C Solarparken), sustainability initiatives (BASF) and sector events (energy storage projects, defence and industrial capital‑markets days) will continue to shape performance in Germany’s mid‑cap and thematic segments. TechStock²+3TradingView+3BASF+3

Bottom line: fragile calm on the Frankfurt exchange

The Germany stock market today is caught between relief and unease:

- Relief, because the DAX has stopped sliding and managed a slim gain after Tuesday’s sharp sell‑off.

- Unease, because the index is still near five‑month lows, technical momentum is weak, and the near‑term outlook hinges on a handful of high‑stakes data points and earnings releases. TradingView+1

For now, Germany’s DAX is signalling “wait and see” rather than all‑clear. Investors looking at Frankfurt today are seeing a market that is resilient but not yet convinced that the worst of the AI‑driven correction and global risk re‑pricing is over.

This article is for informational purposes only and does not constitute investment advice. Always do your own research or consult a professional advisor before making investment decisions.