Alphabet’s Class A shares (ticker: GOOGL) ended Monday, December 1, 2025 just under the $315 mark, snapping a recent streak of all‑time highs but holding very near record territory. The stock slipped roughly 1% during regular trading before inching slightly higher in early after‑hours action, as investors digested a torrent of fresh headlines on Gemini 3, Google’s custom AI chips, and new bullish calls from Wall Street. [1]

Despite today’s pullback, Google stock remains up around 70% year‑to‑date and nearly 90% over the past 12 months, cementing Alphabet as one of 2025’s defining mega‑cap winners. [2]

How Google Stock Traded Today and After the Bell

- Regular session (Dec. 1, 2025, Nasdaq close):

Data from MarketBeat, Investing.com and other quote providers show GOOGL closing a touch below $315(around $314.5–$314.9), down about 1% on the day. [3] - After‑hours move:

On Public.com’s extended‑hours feed, GOOGL traded at about $315.17 at 4:30 p.m. ET, up roughly 0.1% from the official close — a modest bounce in thin post‑market trading. [4]

Alphabet’s non‑voting Class C shares (GOOG) showed a similar pattern, closing near $316.6, off just over 1% after touching an intraday high above $319. [5]

Today’s dip comes after a spectacular November run. A 24/7 Wall St analysis notes that Alphabet shares have surged about 31% over the past month, climbing from roughly $244 in early November to above $320 in early December. The same report highlights that the stock recently tagged a 52‑week high of $328.83, with a relative strength index (RSI) above 70 — classic “overbought” territory. [6]

In other words: today looked more like a breather near the top than a change in trend.

Why the Market Is Obsessed With Alphabet Right Now: Gemini 3 and TPUs

The real story behind Google stock isn’t today’s one‑percent dip. It’s the AI arms race — and a growing belief that Alphabet has quietly seized the initiative.

Gemini 3 puts Google back at the AI front of the pack

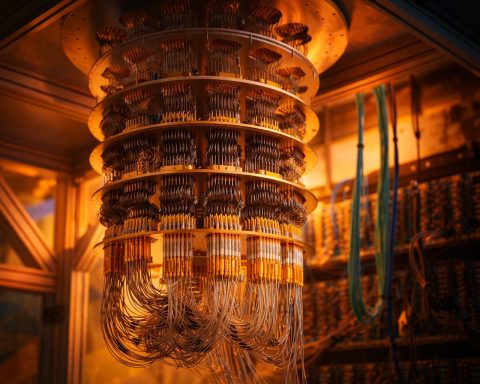

A series of pieces from 24/7 Wall St, Investing.com and TipRanks all point to the same turning point: the launch of Gemini 3, Google’s latest multimodal AI model. [7]

Key datapoints from these reports:

- Gemini 3 is described as performing better than OpenAI’s GPT‑5 on many benchmarks, with deep integration across Search, Android, Workspace and YouTube. [8]

- Google’s AI Overviews now reach about 2 billion monthly users, while the Gemini app has around 650 million monthly active users, according to figures cited by TipRanks and Barchart. [9]

- Analysts expect Gemini users to exceed 700 million by early 2026, thanks to its tight integration into existing Google products rather than a separate, standalone app. [10]

That integration is crucial. As one Investing.com analysis puts it, Alphabet has shifted from a search‑and‑ads story to a full‑stack AI platform, where Gemini quietly powers experiences across the entire Google ecosystem rather than living in a separate app icon. [11]

Custom AI chips: Google’s TPUs vs. Nvidia’s GPUs

The other pillar of the bull case is Alphabet’s aggressive push into custom silicon:

- Barchart highlights Google’s 7th‑generation “Ironwood” Tensor Processing Units (TPUs), which it says are over 4× faster than the prior generation and optimized for heavy AI workloads. [12]

- An Investing.com deep dive claims Google’s latest TPUs are around 80% more energy‑efficient than Nvidia’s H100 for certain generative AI tasks, a major advantage as power, not chip availability, becomes the main bottleneck. [13]

- 24/7 Wall St reports that retail analysts on Reddit argue Google’s TPUs are effectively “2× cheaper than Nvidia GPUs at scale,” fueling a wave of bullish sentiment and a 31% monthly surge in the stock. [14]

Perhaps most importantly, Investing.com and Simply Wall St point to a landmark cloud‑chip partnership with Meta Platforms, under which Meta is expected to deploy Google’s 7th‑gen TPUs starting as early as 2026, with a broader rollout in 2027. [15]

If Google can claw away even 10% of Nvidia’s annual data‑center revenue, one analysis estimates that could add roughly $4 billion in incremental net income per year for Alphabet — and permanently reframe the company as both a cloud and AI semiconductor heavyweight. [16]

Cloud, Cash Flows and the Numbers Behind the Hype

The AI narrative isn’t just about buzz; it’s now very visible in Alphabet’s financials:

- A Barchart review of Q3 2025 notes Alphabet delivered its first‑ever $100+ billion quarter, with revenue of about $102.3 billion, up 16% year‑over‑year. [17]

- Google Cloud revenue jumped 34% to roughly $15.2 billion, with operating margin expanding to 23.7% from 17.1% a year earlier. [18]

- Alphabet’s cloud backlog surged 46% sequentially and 82% year‑over‑year to $155 billion, driven largely by enterprise AI demand and multi‑billion‑dollar contracts. [19]

- An Investing.com piece pegs Alphabet’s gross margin around 59% and net margin above 32%, with return on capital employed (ROCE) near 35%, even as the company spends heavily on data centers and AI infrastructure. [20]

StockAnalysis’ consensus forecasts see revenue climbing from about $350 billion in 2024 to $410 billion in 2025 and $462 billion in 2026, with EPS rising from $8.04 to $10.68 this year, and then to $11.27 next year. [21]

Put simply: growth is accelerating, and it’s being driven by the exact AI investments that had investors worried about rising costs just a couple of years ago.

Berkshire Hathaway, the “Buffett Premium” and Quantum Upside

Another December 1 headline making waves: Warren Buffett’s Berkshire Hathaway has quietly built a position in Alphabet — and it’s already paying off handsomely.

24/7 Wall St reports that Berkshire’s stake, first spotted in a recent 13F filing, has coincided with Alphabet shares rising nearly 19% in a single month as traders slap a fresh “Buffett premium” on the stock. [22]

The same article argues that even at around 31.6× trailing earnings, Alphabet’s valuation still doesn’t fully reflect:

- Leadership in AI chips (TPUs) and models (Gemini 3);

- A rapidly scaling Waymo autonomous‑driving business;

- And longer‑term quantum computing ambitions, which CEO Sundar Pichai recently compared to where AI was “five years ago.” [23]

For long‑term investors, Berkshire’s involvement is being framed as a vote of confidence that Alphabet isn’t just a mature ad business — it’s a multi‑decade AI and infrastructure compounder.

What Wall Street Is Saying Tonight: Targets and Ratings

Guggenheim’s big upgrade

On December 1, Guggenheim analyst Michael Morris reaffirmed a “Buy” rating on Alphabet and lifted his price target from $330 to $375, citing: [24]

- explosive growth and improving profitability at Google Cloud,

- a $155 billion cloud backlog and robust AI demand, and

- ongoing momentum from Gemini 3 and Google’s custom chips.

That new $375 target implies high‑teens upside from where the stock traded near the close.

Consensus is bullish…but sees limited near‑term upside

Different data providers paint a broadly similar picture:

- MarketBeat:

- 51 analysts, consensus rating “Moderate Buy”

- Average 12‑month price target: $308.73

- Range: $198 (low) to $375 (high)

- That average implies a small downside (~2%) from today’s ~$314.5 close. [25]

- StockAnalysis.com:

- 42 analysts, consensus “Buy”

- Average target: $299.36, with the same $190–$375 range, implying about 5% downside from current levels. [26]

- TipRanks:

- 31 Buys, 7 Holds → “Strong Buy” consensus

- Average target around $312, effectively flat versus today’s price. [27]

Simply Wall St takes a more narrative‑driven approach, highlighting a community “fair value” estimate of about $340 per share — roughly 5–8% above recent trading — and labeling GOOGL “5.8% undervalued” based on long‑term growth scenarios and Berkshire’s endorsement. [28]

So, across Wall Street, the story is overwhelmingly positive, but many analysts also believe the stock has already priced in a lot of good news, at least over the next year.

Valuation: Is Google Stock Overheated or Just Re‑Rated?

The key debate after the bell is whether Alphabet’s AI‑driven rerating has gone too far, too fast.

- Simply Wall St notes that Alphabet trades at about 31× earnings, roughly double the US interactive media sector average of 15–16×, but argues a premium multiple may be justified by its dominant competitive position and AI growth prospects. [29]

- Barchart estimates a forward P/E near 26×, above Alphabet’s 10‑year average of roughly 23–24×, but suggests earnings growth could catch up with the valuation over the next few years. [30]

- An Investing.com analysis goes further, claiming that given expected 35–40% AI‑driven growth, Alphabet could eventually trade at a higher forward multiple and still be considered fairly valued, especially if its market cap pushes toward $5 trillion. [31]

On the other hand, 24/7 Wall St and technical analysts point to overbought momentum signals (RSI in the mid‑70s, parabolic price action and a stock trading far above its 200‑day moving average) as reasons to expect consolidation or pullbacks, even if the long‑term story is intact. [32]

Investor’s Business Daily, which focuses on chart patterns, recently argued that as of December 1, GOOGL “needs to form a new base to be actionable” after its vertical run — code for “great story, but don’t chase it blindly at new highs.” [33]

The Most Aggressive Bulls Say the AI War Is Already Won

One of today’s more eye‑catching headlines came from TipRanks, where 5‑star investor Luca Socci declared that the “AI war is already over — and Alphabet has won.” [34]

Socci’s thesis rests on:

- Alphabet’s massive distribution advantage (Search, Android, YouTube, Gmail, Maps, Chrome);

- A fully integrated ecosystem where AI becomes a feature of everything rather than a standalone product;

- And Gemini 3 plus TPUs making it increasingly hard for rivals to match Google’s scale, data and cost structure. [35]

That’s the ultra‑bullish end of the spectrum. More cautious voices still see room for competition from Microsoft, OpenAI, Anthropic, Nvidia and others — and warn that AI, like cloud before it, could eventually normalize into lower‑margin, commoditized infrastructure.

Key Risks Investors Are Weighing After the Bell

Even on a day dominated by good news, several risk factors keep surfacing in analyst notes and long‑form research:

- Valuation and technical froth

- After eight straight months of gains and multiple double‑digit monthly advances, GOOG/GOOGL are extended by historical standards. One analysis points out the stock trades more than 60% above its 200‑day moving average, a level often associated with at least short‑term corrections. [36]

- Regulatory and antitrust scrutiny

- An Investing.com piece notes that a key US antitrust case was resolved in Alphabet’s favor in September 2025, removing the immediate threat of a forced breakup. Still, regulators in the US and EU remain focused on AI, data privacy and platform power — all areas where Google is front and center. [37]

- Digital ad and macro sensitivity

- Simply Wall St warns that any surprise weakness in digital ad spending or a macro slowdown could hit Alphabet’s still‑dominant ads business and force investors to rethink the premium they’re paying for AI exposure. [38]

- Competition from Nvidia and other hyperscalers

- While Google’s TPUs look compelling on paper, Nvidia is hardly standing still, and both Amazon and Microsoft are racing ahead with their own custom silicon. Morningstar and others argue that the AI chip war is far from settled, even if Alphabet has clearly gained ground. [39]

What to Watch Next For Google Stock

As of around 10 p.m. ET on December 1, the post‑earnings, post‑Gemini 3 rally is still very much alive, even if today brought a minor pullback. Looking ahead, traders and long‑term investors will be watching:

- Whether GOOGL can build a new base in the low‑to‑mid‑$300s instead of snapping sharply lower from overbought levels. [40]

- Updates on Meta’s rollout of Google’s Ironwood TPUs and any additional cloud‑chip customers following suit. [41]

- Signals on Waymo’s path to profitability and expanded robotaxi deployments, which could turn a multibillion‑dollar drag into a new profit engine later this decade. [42]

- Any fresh AI product launches or Gemini enhancements, especially in Search monetization and YouTube, where even small improvements can move billions in revenue. [43]

Bottom Line

After the bell on December 1, 2025, Google stock is pausing, not collapsing. Alphabet has transformed a “missed the AI wave” narrative into one of the market’s clearest AI leadership stories, powered by Gemini 3, a booming cloud business and increasingly credible custom AI chips.

At the same time, the stock now trades at premium valuations, and many analysts think the price is at least near fair value on a one‑year view, even if the long‑term runway remains huge.

For anyone following GOOGL or GOOG:

- The fundamental story — AI, cloud, TPUs, Gemini, Waymo, Berkshire’s vote of confidence — has rarely looked stronger.

- The technical picture and valuation suggest that patience and risk management may matter just as much as raw enthusiasm, especially after such a historic run.

As always, this article is for informational purposes only and does not constitute financial advice. Before buying or selling any stock, including Alphabet, you should consider your own goals, risk tolerance and financial situation, and if needed, consult a qualified financial professional.

References

1. www.investing.com, 2. simplywall.st, 3. www.investing.com, 4. public.com, 5. stockanalysis.com, 6. 247wallst.com, 7. 247wallst.com, 8. 247wallst.com, 9. www.tipranks.com, 10. www.investing.com, 11. www.investing.com, 12. www.barchart.com, 13. www.investing.com, 14. 247wallst.com, 15. www.investing.com, 16. www.investing.com, 17. www.barchart.com, 18. www.barchart.com, 19. www.barchart.com, 20. www.investing.com, 21. stockanalysis.com, 22. 247wallst.com, 23. 247wallst.com, 24. www.investing.com, 25. www.marketbeat.com, 26. stockanalysis.com, 27. www.tipranks.com, 28. simplywall.st, 29. simplywall.st, 30. www.barchart.com, 31. www.investing.com, 32. 247wallst.com, 33. www.investors.com, 34. www.tipranks.com, 35. www.tipranks.com, 36. www.investing.com, 37. www.investing.com, 38. simplywall.st, 39. www.morningstar.com, 40. www.investors.com, 41. www.investing.com, 42. www.investing.com, 43. www.barchart.com