The battle for the future of artificial intelligence hardware intensified on Wednesday, November 26, 2025, as new details emerged about Meta’s talks to use Google’s in‑house AI chips, Nvidia defended its dominance in unusually blunt terms, and investors continued to reshuffle their bets in what had long been a one‑way “Nvidia trade”. mint+2TrendForce+2

The Wall Street Journal first framed the shift as an “AI trade” that is splintering: Alphabet is powering toward a $4 trillion valuation, even as Nvidia — until recently the world’s most valuable company — sees its stock wobble and its narrative challenged. mint+1

Key points

- Meta is in talks to spend billions on Google’s custom AI chips (TPUs) for data centers from 2027, and may start renting them from Google Cloud as early as 2026, according to reporting from The Information cited by multiple outlets. TrendForce+2Yahoo Finance+2

- Alphabet’s market value has surged to around $3.8–3.9 trillion, up nearly 70% this year, putting Google on the verge of joining the $4 trillion club largely thanks to AI and its Gemini 3 model. Reuters+1

- Nvidia’s stock has slid sharply this week as investors digest the Meta–Google chip talks and broader concerns about AI spending, even though the company still controls more than 90% of the AI accelerator market by many estimates. Barron’s+3mint+3The Indian Express+3

- Nvidia hit back on X, insisting its platform is “a generation ahead” of the industry and “the only platform that runs every AI model”, and arguing that general‑purpose GPUs remain more flexible than Google’s specialized TPUs. Outlook Business+4The Indian Express+4X (f…

- New regulatory pressure is emerging in China, where authorities have barred ByteDance from using Nvidia chips in new data centers and are pushing domestic AI processors — another sign that Nvidia’s once‑unquestioned dominance is under strain from multiple directions. Reuters

Meta–Google talks redraw the AI chip map

The immediate catalyst for this week’s turmoil was a report from The Information that Meta Platforms is in negotiations with Google to use the search giant’s custom Tensor Processing Unit (TPU) chips.

According to summaries of that report by TrendForce, Yahoo Finance and others, Meta is evaluating a multi‑billion‑dollar deal that would: TrendForce+2Yahoo Finance+2

- Deploy Google TPUs inside Meta‑owned data centers starting in 2027

- Allow Meta to rent TPU capacity from Google Cloud as early as 2026

- Potentially reduce Meta’s heavy reliance on Nvidia’s GPUs for both AI training and inference

A separate analysis notes that Google is also pitching a “TPU@Premises” program, letting large financial institutions and other customers run TPUs in their own facilities — a direct encroachment on Nvidia’s bread‑and‑butter business of supplying chips for on‑premises AI clusters. TIKR.com+2FxVerify+2

For Meta, which is expected to spend upwards of $70 billion on capital expenditures this year, diversifying suppliers is both a bargaining chip and a way to reduce dependence on a single vendor in a market where cutting‑edge GPUs can cost tens of thousands of dollars each. TIKR.com+1

Crucially, none of these talks are final. Reports emphasize the deal may not materialize, and even if it does, analysts expect Meta to keep buying Nvidia hardware in large volumes. But symbolically, the idea that one of Nvidia’s biggest AI customers is even considering running major workloads on Google’s in‑house silicon has been enough to shake markets and reset expectations. The Financial Express+2Barron’s+2

AI trade splinters: Alphabet soars, Nvidia stumbles

The Meta–Google story landed in a market that was already jittery about AI valuations — and it immediately widened a divergence between two of the sector’s flagship names.

A Wall Street Journal piece, syndicated via Mint, describes how Alphabet shares extended a months‑long rally on Tuesday, helped by enthusiasm for its AI tools, cloud business and chip efforts. Nvidia, by contrast, fell sharply, dragging the broader “AI trade” into question even as the Dow Jones Industrial Average logged its best day since August. mint

Key numbers from the past few days:

- Alphabet (Google)

- Shares recently rose more than 5% in a single session, hitting a record around $315.90 and lifting its market cap to about $3.82 trillion, according to Reuters. Reuters

- The stock is up nearly 70% year‑to‑date, and about 12–15% since mid‑November as investors embrace the Gemini 3 model, improving cloud margins, and news of Berkshire Hathaway taking a multi‑billion‑dollar stake. The Financial Express+2Reuters+2

- Nvidia

- After briefly touching a $5 trillion valuation in late October, Nvidia’s shares have dropped into a correction, falling double‑digits over the past month. mint+2Barron’s+2

- The stock slid as much as 7% intraday on Tuesday before closing down roughly 2–4% after the Meta–Google reports, and fell again on Wednesday, extending a recent losing streak. Barron’s+3The Financial Express+3TIKR.com+…

Other AI‑sensitive names like Advanced Micro Devices, Super Micro Computer and Oracle also sold off, while the broader S&P 500 and Dow advanced — a sign that investors are no longer treating “AI stocks” as a monolith. mint+1

Portfolio managers quoted in the WSJ piece stress that the news tapped into existing worries: that runaway AI spending may not translate into long‑term profits, that capital‑intensive data centers could become a drag in a downturn, and that Nvidia’s dominance leaves customers eager for alternatives. mint+2Investopedia+2

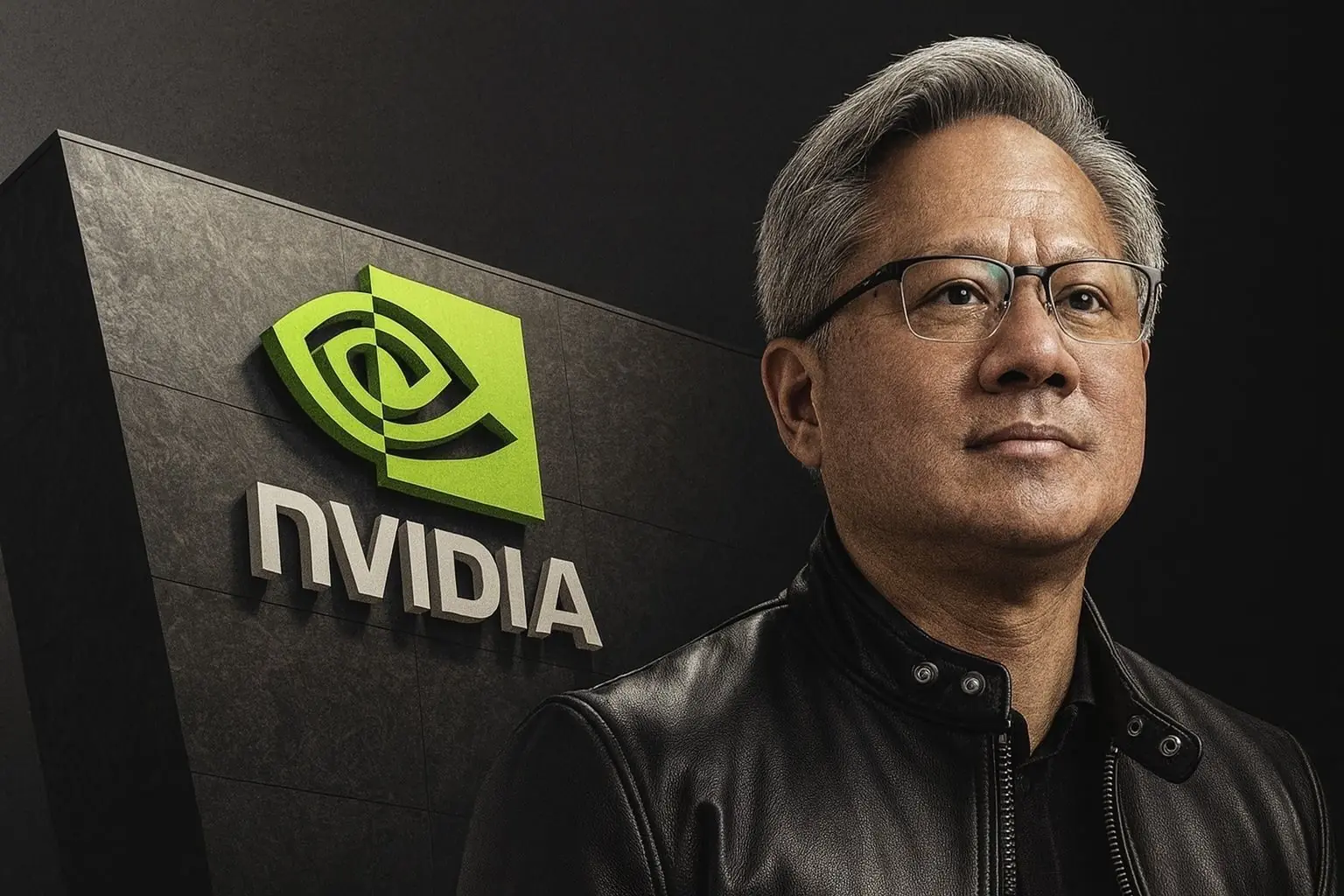

Nvidia hits back: “Generation ahead” GPUs vs Google’s TPUs

With its share price sliding and skeptics like Michael Burry openly betting against the company, Nvidia took the unusual step of defending its position in public — not just in analyst memos, but in a high‑profile post on X and in comments picked up by CNBC and international media. X (formerly Twitter)+3mint+3naked capitali…

In the statement, Nvidia congratulated Google on its AI progress and stressed that it still supplies chips to Google, but added a pointed boast: it called itself “a generation ahead of the industry” and described its platform as the only one that can run every major AI model across all the places computing happens. The Indian Express+3The Indian Express+3X …

Nvidia’s broader argument, echoed in coverage by the Indian Express, Tom’s Hardware and others, is that: TIKR.com+3The Indian Express+3Tom’s Hardwa…

- GPUs remain more flexible than specialized AI ASICs like TPUs, which are tuned to narrower workloads or specific frameworks.

- Its latest Blackwell‑generation chips are designed for both training and inference and can be deployed in a huge range of systems, from cloud superclusters to on‑premises enterprise racks.

- The entrenched CUDA software ecosystem — built up over nearly two decades — makes it hard for competitors to lure developers away, even if raw hardware specs look attractive.

Analysts still estimate Nvidia controls over 90% of the market for data‑center AI accelerators, thanks to that combination of silicon performance, networking, software and support. Tom’s Hardware+3The Indian Express+3TIKR.c…

In other words, Nvidia is arguing that even if Meta and other hyperscalers diversify some workloads to TPUs or custom chips, its platform will remain the default choice for most cutting‑edge AI projects for years to come.

Google’s TPU push finally steps out of the shadows

For Google, this week’s headlines are the payoff for a strategy it has been pursuing quietly for over a decade. Alphabet has been developing TPUs since the mid‑2010s, initially to accelerate its own search, ads and YouTube workloads and then to power internal AI research. The Indian Express+2The Financial Express+…

Until recently, however, TPUs have mostly been a cloud‑only product: companies couldn’t buy the chips, only rent clusters via Google Cloud. That is now changing:

- Google is ramping up TPU production and actively courting major customers like Meta to deploy the chips in their own data centers, according to The Information and Reuters summaries. naked capitalism+3The Information+3LinkedI…

- The company has launched the Gemini 3 model, trained on TPUs rather than Nvidia GPUs, which has received strong early reviews for coding, design and analytical tasks and helped reset perceptions of Google’s AI capabilities. The Financial Express+2San Francisco Chron…

- Alphabet executives say they are seeing “accelerating demand” for both TPUs and Nvidia GPUs through Google Cloud, positioning the company as both an AI hardware rival and a key reseller of Nvidia’s chips. The Financial Express+2TIKR.com+2

Independent analysts caution that the biggest obstacle for Google is adoption, not architecture. TPUs require software to be optimized for their stack, while Nvidia’s CUDA has become the default for AI research labs, startups and hyperscalers alike. Even if TPUs are cheaper or more energy efficient for some workloads, moving large, production‑scale systems onto them is a major undertaking. The Indian Express+2Tom’s Hardware+2

There are also manufacturing constraints. Like Nvidia, Google depends on Taiwan’s TSMC for leading‑edge chip fabrication. Industry experts quoted by the Indian Express note that TSMC is deliberately cautious about over‑building capacity, wary of an AI bust that could leave it with idle fabs. That could limit how fast any new entrant — including Google — can scale, regardless of design wins. The Indian Express+1

China’s ByteDance ban shows Nvidia’s geopolitical risk

While Google challenges Nvidia in Western data centers, Chinese regulators delivered a different kind of blow on Wednesday.

Reuters reports that authorities have barred TikTok‑owner ByteDance from deploying Nvidia chips in new data centers, citing a report from The Information. ByteDance was reportedly the largest Chinese buyer of Nvidia hardware in 2025 as it stockpiled GPUs ahead of U.S. export curbs. Reuters+1

The ban is part of a broader Beijing campaign to reduce reliance on U.S. technology:

- Regulators previously asked local firms to halt new orders of Nvidia AI chips and urged them to adopt domestic processors instead. Reuters

- New data‑center projects that receive any state funding must now use only locally produced AI chips, according to Chinese government guidance described in the report. Reuters

- U.S. rules already prevent Nvidia from selling its most advanced GPUs into China, forcing it to design scaled‑down versions like the H20 and RTX6000D; demand for those variants has been “tepid” as Chinese firms look to homegrown solutions. Reuters+1

A Nvidia spokesperson told Reuters that the “regulatory landscape” no longer allows the company to offer competitive data‑center GPUs in China, effectively ceding that “massive market” to rivals. Reuters

Taken together with Meta’s flirtation with Google TPUs, the Chinese moves underscore a single theme: Nvidia’s AI grip is being chipped away from multiple directions at once — competitive, regulatory and geopolitical.

For investors and the AI ecosystem, it’s not a simple Google‑vs‑Nvidia coin flip

Despite the stock‑price drama, most Wall Street analysts are not calling for Nvidia’s demise. Barron’s notes that firms like Mizuho and Citi still rate the stock “Outperform” or “Buy”, with price targets well above current levels, arguing that the company’s diversified GPU roadmap and deep relationships with players like Meta and Microsoft should sustain demand even in a more competitive world. Barron’s+1

MarketWatch makes a similar point: the key question isn’t whether Nvidia or Google “wins” the chip war, but whether the overall AI compute market keeps growing fast enough to support multiple vendors and justify the sector’s huge capital spending. Nvidia itself has talked about roughly $500 billion in cumulative revenue through 2026 from its current and next‑generation platforms — a figure that only makes sense if AI infrastructure spending remains torrid. MarketWatch+2Investors+2

At the same time, high‑profile skeptics are getting louder. The WSJ and later commentators have chronicled how Michael Burry has built a sizable short against Nvidia, likening today’s AI enthusiasm to the dot‑com bubble and, in some cases, comparing Nvidia’s position to Cisco’s pre‑2000 peak. mint+2naked capitalism+2

What seems clear is that:

- AI hardware is moving from a de facto monopoly to a multi‑chip world.

Amazon has Trainium, Microsoft is working with its own Maia accelerators, and now Google is positioning TPUs as a serious alternative for hyperscale workloads. Investors+2Edgen+2 - Customers want optionality.

Meta exploring a TPU deployment doesn’t mean abandoning Nvidia; it means gaining leverage and resilience. The same logic will drive banks, telcos and enterprises to test non‑Nvidia options. TrendForce+2TIKR.com+2 - Software ecosystems and supply chains matter as much as raw FLOPS.

Nvidia’s CUDA moat, TSMC’s capacity decisions, U.S.–China export controls and cloud‑provider integration will collectively shape winners and losers more than any single benchmark chart. Tech in Asia+3The Indian Express+3Reuters+…

Outlook: from Nvidia story stock to contested AI infrastructure giant

As of November 26, 2025, the AI chip story looks very different from just a few months ago. Nvidia is still the dominant supplier of AI accelerators and an essential partner for virtually every major AI company on the planet. But it is no longer the only story investors are willing to tell themselves about AI hardware.

Google’s TPU push — combined with a powerful rally in Alphabet’s stock, the success of Gemini 3 and the possibility of a marquee Meta deal — has given markets a credible “second pillar” in AI infrastructure. TIKR.com+3The Financial Express+3Reuters+3

Layer on top of that China’s move to squeeze Nvidia out of new data‑center builds, Berkshire’s high‑profile bet on Alphabet, and growing skepticism from big‑name investors about AI bubbles, and you get exactly what we’re seeing in the tape this week: a splintering of the once‑monolithic AI trade into a more complex, more contested landscape.naked capitalism+3Reuters+3mint+3

For now, the message from markets is simple:

- The AI boom is still very much alive.

- But Nvidia no longer has the stage to itself — and Google just stepped into the spotlight.