Updated: 26 September 2025 — data current to 09:00 UTC (5:00 a.m. AST)

- Humberto is now a hurricane. At 09:00 UTC, the National Hurricane Center (NHC) upgraded Humberto to Category 1 with 75 mph (120 km/h) winds, moving NW at 3 mph over the central Atlantic. No coastal watches or warnings are in effect. 1

- Rapid strengthening expected. NHC forecasts major-hurricane (Cat 3+) intensity by Sunday, with winds peaking near 115 kt (130+ mph) late Sunday–early Monday over open water. 2

- Bermuda: “Potential Threat.” The Bermuda Weather Service (BWS) classifies Humberto as a potential threat; its nearest forecast approach is ~393 nm south of Bermuda around Mon, Sep 29 (local). 3

- East Coast surf hazards. Even without a U.S. landfall, large swells and dangerous rip currents are likely along stretches of the U.S. East Coast next week as Humberto intensifies offshore. 4

- A second system is brewing.Invest AL94 near Hispaniola/Bahamas has a high chance (80%/48h; 90%/7‑day) to develop and could influence coastal U.S. weather early next week. 5

- Rare interaction possible. Forecasters are watching for a Fujiwhara effect (two storms tugging on each other) if AL94 strengthens near Humberto—an outcome that adds uncertainty to path and impacts. 4

- Context this week: Post‑tropical Gabrielle is battering the Azores today with strong winds, high seas and flooding risk—illustrating the Atlantic’s sharp late‑September uptick. 6

The forecast at a glance

Where is Humberto now?

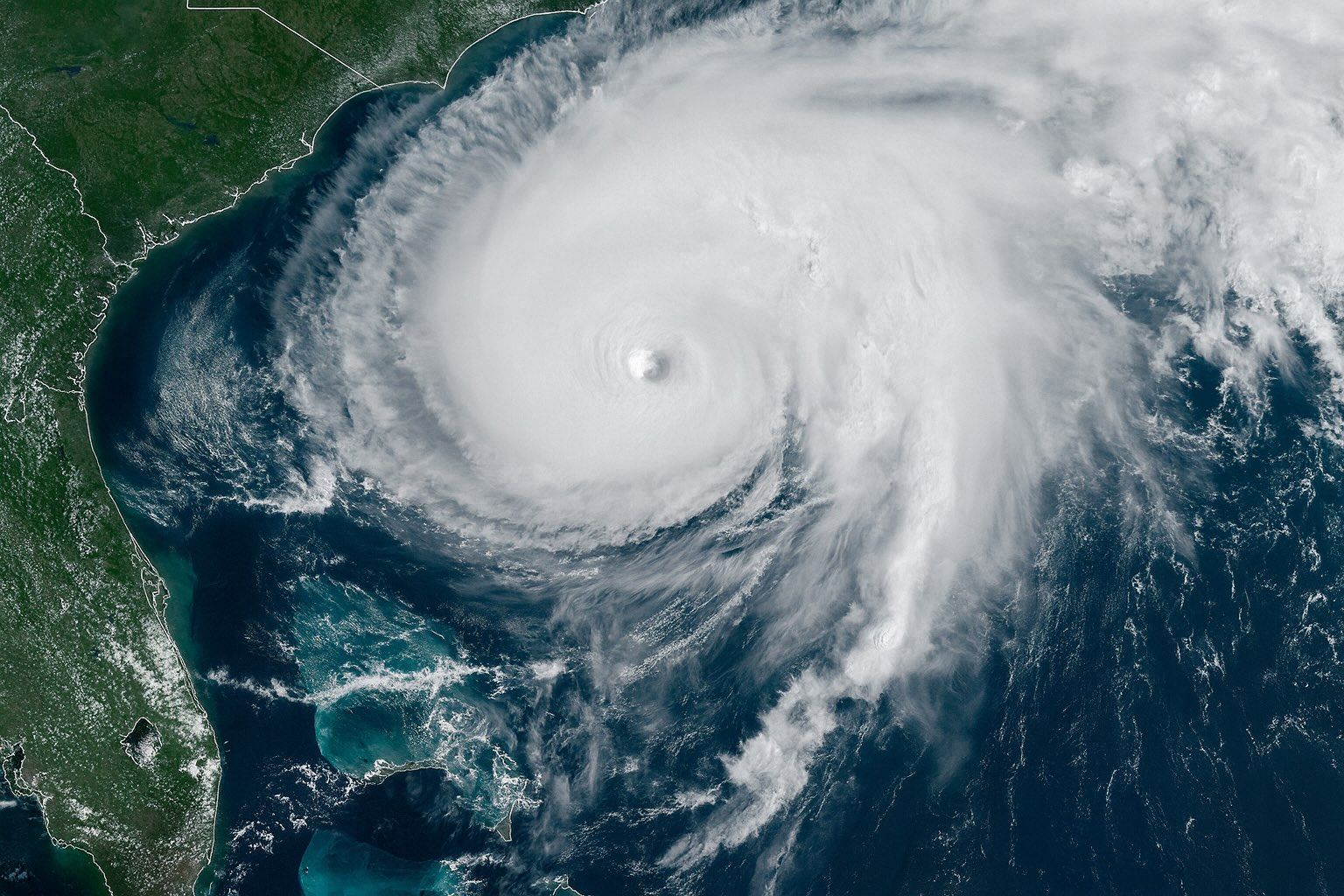

As of 09:00 UTC (5:00 a.m. AST) Fri, Sep 26, Hurricane Humberto was centered near 22.2° N, 57.3° W—about 465 miles (750 km) NE of the northern Leeward Islands—with 75 mph sustained winds and a 990 mb minimum pressure. Motion is NW ~3 mph. No coastal watches/warnings are in effect. 1

How strong will it get, and where is it headed?

NHC’s official track intensifies Humberto steadily, reaching Cat 3 by Sunday, then peaking near 115 kt (Category 4) late Sunday into Monday while it tracks NW then N toward the western Atlantic, later curving NE. Forecast positions keep the core over open water through early next week. (Reminder: 4–5‑day track errors can be large.) 2

Bermuda outlook

BWS has flagged Humberto as “a potential threat to Bermuda.” The agency’s midnight bulletin (03:00 UTC) projects the nearest approach ~393 nm S of the island around Mon, Sep 29, but emphasizes the forecast is subject to change with each update. Expect building swells, strong surf and rip currents ahead of the storm’s closest pass. 3

U.S. East Coast impacts (for now)

For the U.S. mainland, the primary risk next week is in the surf zone: increasing long‑period swells from Humberto will escalate rip‑current danger and produce rough surf along portions of the East Coast, even if the storm stays far offshore. Local NWS beach forecasts and the NHC rip‑current map point to elevated risk as seas build. 4

The wildcard: a second system and a possible “storm dance”

The western Atlantic disturbance (AL94) near Hispaniola and the Bahamas is showing better organization and carries high odds of becoming a tropical depression or storm in the next day or two. The NHC notes increasing chances of wind, rainfall and surge impacts for parts of the Southeast U.S. coast during the next several days, although track and intensity remain uncertain. 5

Meteorologists are also monitoring the Fujiwhara effect—an uncommon scenario in the Atlantic in which two cyclones close enough in proximity can rotate around a shared midpoint, altering each other’s paths. As The Washington Post puts it, the forecast is “anything but straightforward” when systems sit so close together. Meanwhile, the National Weather Service explains Fujiwhara as storms that “begin an intense dance around their common center” when sufficiently near. 4

“The official forecast continues to call for significant strengthening during the next few days.” — NHC forecaster Richard Pasch, late Thursday. 7

“The forecast for both of these systems is anything but straightforward… they’re so close to one another [it] complicates the outlook.” — Meteorologist Michael Lowry, via The Washington Post. 8

How today compares with similar storms and scenarios

- Humberto (2019): The last Atlantic storm with this name intensified to a Category 3 and passed near Bermuda, delivering damaging winds there and long‑period swells to the U.S. East Coast—without a U.S. landfall. This year’s Humberto is again projected to intensify over open water and recurve north and east. 9

- Franklin (2023): A major hurricane that never made U.S. landfall yet battered East Coast beaches with hazardous surf and rip currents—an analog for Humberto’s surf risk next week. 10

- Paulette (2020): A counter‑example—direct Bermuda landfall as a Category 2 hurricane—illustrates that track shifts near the island matter; small north/west changes can greatly alter impacts there. 11

- Why recurvature near Bermuda is common: In late summer and early fall, the Bermuda (Azores) High often steers Atlantic hurricanes west then allows a north or northeast turn when mid‑latitude troughs erode the ridge—a key reason many storms curve away from the U.S. coast. 12

Meteorology behind the intensification

Satellite analysis overnight showed strengthening central convection and a growing central dense overcast (CDO) as wind shear eased—a setup that favors rapid intensification over very warm waters and a moist environment. That’s why NHC guidance calls for major hurricane status by Sunday, with model consensus (HCCA) aligned to high‑end Category 3. 7

What to watch through the weekend

- NHC advisories (every 6 hours): Track the cone and intensity flyers; note the forecast peak and the timing of Humberto’s northward turn near ~70°W. 2

- Bermuda updates: BWS Tropical Update Bulletins will adjust threat level and closest point of approach. Marine and coastal hazards may arrive well before the nearest pass. 3

- AL94 development: Formation odds are high; if and when it consolidates, model skill improves, and forecasters can better assess Southeast U.S. risk early next week. 5

- Surf & rip currents: If you’re planning beach activities from the Carolinas northward, check local NWS beach forecasts and heed flags/lifeguards; dangerous rip currents are often the first mainland impact. 13

Quick safety notes for the public

- In Bermuda: Prepare for high surf and strong rip currents; follow official guidance. Secure loose items; review hurricane plans in case the track shifts closer. 3

- U.S. East Coast: Even without a landfall, don’t underestimate surf hazards. Most storm‑related U.S. beach fatalities are from rip currents, not wind. Swim near lifeguards and follow local advisories. 13

Sources & further reading

- National Hurricane Center (NHC): Hurricane Humberto Public Advisory #7; Forecast/Advisory #7. Authoritative position, intensity, and official forecast. 1

- NHC Forecast Discussion #6 (technical reasoning). 7

- NHC 2‑Day Outlook: High development odds for AL94 near the Bahamas. 5

- Bermuda Weather Service (BWS): Tropical Update Bulletin — “Potential Threat to Bermuda.” 3

- East Coast surf hazards: Capital Weather Gang overview; NHC rip‑current page. 4

- Comparatives: NHC Tropical Cyclone Reports for Humberto (2019), Franklin (2023), Paulette (2020). 9

- Fujiwhara effect (what it is): NWS explainer. 14

- Atlantic naming list (confirming “Imelda” next): NHC storm‑name roster. 15

Editorial note: Forecasts change. For the latest, consult the NHC and your local meteorological service.