- By early 2025, fiber is available to over 7–8 million of about 9.3 million Dutch households, roughly 75–85% coverage.

- Fiber take-up reached about 3.2 million lines by end-2024.

- DSL is rapidly being phased out as KPN replaces copper with fiber and piloted copper network shutdowns in areas where fiber is live.

- Cable networks cover roughly 89% of homes with DOCSIS 3.1 in 2022, and Ziggo passes about 90% of homes.

- Ziggo plans to implement DOCSIS 4.0 by mid-decade, enabling multi-gigabit speeds up to about 8 Gbps on cable.

- Many fiber networks offer open access wholesale, allowing numerous ISPs to provide service over KPN’s or municipal networks.

- Odido’s fixed fiber footprint reached 8.1 million addresses by 2025, the widest in the Netherlands.

- 4G coverage exceeded 97% by the early 2020s, and 5G coverage reached about 98% of the population by 2023, with a government target of virtually nationwide 5G by end-2025.

- The Netherlands implemented a net neutrality law in 2012, prohibiting blocking and throttling and banning zero-rating, with EU-law continuing this framework.

- Starlink arrived around 2021 and, by 2025, offers a Lite plan at €35/month for ~50–100 Mbps and a standard plan at €50/month for 150–250 Mbps, plus a dish kit costing €250–€450.

Broadband Infrastructure: DSL, Cable, and Fiber

High Nationwide Coverage: The Netherlands enjoys nearly universal fixed broadband availability, with 99.3% of households able to get a fixed internet connection as of 2022 point-topic.com. Historically, Dutch broadband has relied on two main infrastructures – telephone lines (DSL) and cable TV networks – and in recent years a massive expansion of fiber-optic networks (FTTH) has taken place. As a result, gigabit-capable broadband (via cable DOCSIS 3.1 or fiber) reached about 97.9% of households by 2022 point-topic.com, making high-speed internet accessible in virtually all populated areas.

DSL (Copper) and Its Decline: DSL was once the dominant fixed broadband technology in the Netherlands, delivered over KPN’s copper telephone lines. While DSL offers broad availability and easy installation, its speeds depend on line length and have become comparatively slow (often under ~50–100 Mbps) prijsvergelijken.nl. With faster options now ubiquitous, DSL is rapidly being phased out. Incumbent KPN has been replacing copper with fiber and even piloted copper network shutdowns in areas where fiber is live lightreading.com. By the mid-2020s, DSL subscriptions have dwindled as consumers migrate to much faster cable or fiber plans.

Cable Broadband (Coax): Cable operators (notably Ziggo, part of VodafoneZiggo) serve a vast majority of Dutch homes – roughly 89% had DOCSIS 3.1 cable coverage in 2022 point-topic.com. Cable broadband in the Netherlands can deliver high speeds (up to ~1 Gbps download on DOCSIS 3.1) and provides a stable connection. However, unlike DSL/fiber, the cable network remains closed access (no wholesale to third-party ISPs), as a Dutch court overturned a regulator’s attempt to open it for competition prijsvergelijken.nl. Ziggo has been upgrading its network and plans to implement DOCSIS 4.0 by mid-decade, which will greatly increase capacity and enable multi-gigabit speeds (up to ~8 Gbps) on cable advanced-television.com. This upgrade, along with a partnership to offer Ziggo services over Delta Fiber’s network, means cable customers will continue to see faster speeds and near-nationwide service by 2026 advanced-television.com advanced-television.com.

Fiber-Optic (FTTH) Expansion: The standout trend in Dutch broadband is the explosive growth of fiber. Fiber-optic connections offer symmetric upload/download speeds often at 1 Gbps (with path to even higher, e.g. 10 Gbps) and superior reliability. Fiber rollout accelerated in the late 2010s and early 2020s thanks to multiple players: KPN (the former telecom incumbent), regional fiber companies (e.g. Delta Fiber), and new ventures like Open Dutch Fiber (backed by investment firms and partnering with T-Mobile/Odido) lightreading.com lightreading.com. By early 2025, over 7–8 million Dutch households (out of ~9.3 million) have fiber available prijsvergelijken.nl ftthconference.eu – roughly 75–85% coverage, up from just 64% in 2022 point-topic.com. Annual deployment has been around 1.2 million homes passed, and the aim is to reach near 100% fiber coverage by 2026 prijsvergelijken.nl. Not all homes passed have subscribed yet (fiber take-up was about 3.2 million lines at end of 2024) acm.nl, but adoption is rising steadily (over 5% growth in fiber subscriptions in a single quarter) as legacy DSL users switch and even cable users consider fiber lightreading.com. Importantly, the Netherlands has a competitive fiber market – KPN is the largest fiber provider but others like Delta Fiber and Open Dutch Fiber contribute significantly to new coverage lightreading.com. Many fiber networks offer open access wholesale, enabling numerous ISPs (including smaller virtual providers) to offer service over KPN’s or municipal fiber networks prijsvergelijken.nl. This open model fosters competition in fiber services, in contrast to the cable sector.

Broadband Speeds: With widespread cable and fiber, the Netherlands boasts world-leading internet speeds. Median fixed broadband download speed was about 202 Mbps (Speedtest/Ookla, Jan 2025) en.wikipedia.org, placing the Netherlands in the global top 20 for fixed speeds. Gigabit plans (up to 1,000 Mbps or more) are increasingly common, and even the average connection speed (including DSL users) is high – nearly 200 Mbps prijsvergelijken.nl. Furthermore, landline internet in the Netherlands typically comes with unlimited data (no caps), unlike some neighboring countries prijsvergelijken.nl, and net neutrality is strongly upheld (the Netherlands was one of the first countries in the world to enact net neutrality into law in 2012) prijsvergelijken.nl.

Mobile Internet and 5G Coverage

4G Ubiquity and High Mobile Speeds: Mobile internet coverage and quality in the Netherlands are excellent. 4G LTE networks from all major operators blanket practically the entire country; by the early 2020s, 4G population coverage exceeded 97% prijsvergelijken.nl. This extensive 4G reach, combined with a dense tower infrastructure in the small, populous territory, yields very consistent mobile data access even in rural or remote spots. Dutch mobile users enjoy some of the fastest mobile data speeds in the world – as of early 2025, the Netherlands ranked around the top 10 globally with a median mobile download speed of about 173 Mbps (Ookla Speedtest, Feb 2025) en.wikipedia.org. Independent tests (e.g. OpenSignal and umlaut benchmarks) also routinely show the Dutch carriers providing excellent mobile experience, with fast download/upload speeds and low latency.

5G Rollout and Coverage: The Netherlands was aggressive in rolling out 5G, aiming for broad coverage quickly. Dutch operators initially launched 5G in 2020 using low-band spectrum (700 MHz) and dynamic sharing on 4G bands, which allowed wide-area 5G coverage early on. By the end of 2022, roughly 97% of populated areas had 5G signal available lightreading.com, albeit largely on these lower frequencies (offering coverage similar to 4G). The full 5G experience expanded after the auction of mid-band 3.5 GHz spectrum. Due to a delay (resolving prior satellite use in that band), the 3.5 GHz auction took place in mid-2024, with KPN, VodafoneZiggo, and Odido (formerly T-Mobile NL) each acquiring licenses cms.law rcrwireless.com. With mid-band 5G now being deployed, urban and suburban areas are seeing much higher 5G capacities and speeds. Users can regularly achieve hundreds of Mbps on 5G in cities, and overall mobile speeds in 2025 have climbed as 5G sites come online. Dutch 5G services are viewed as “excellent” in EU reports digital-strategy.ec.europa.eu, and the government’s target is “virtually nationwide” 5G coverage (all populated areas) by end of 2025 5gobservatory.eu – a goal that operators are on track to meet.

Mobile Network Operators: The mobile market is led by three infrastructure-based providers: KPN, VodafoneZiggo (Vodafone NL), and Odido. Odido is the new brand formed in 2023 after the merger of T-Mobile Netherlands and Tele2; it has rapidly expanded its 5G footprint and even boasts that ~98% of the population lives within its 5G coverage as of 2023 accenture.com. All three operators have launched 5G and continue to invest in capacity. Network-sharing deals and roaming agreements ensure even smaller or regional providers can serve customers, but after consolidation, the market essentially has these three nationwide 4G/5G networks. Competition in mobile remains strong, keeping data prices in check and unlimited or large data bundles popular.

Legacy Networks and Future Mobile Tech: With 4G and 5G dominant, older mobile networks are being retired. All Dutch providers shut down 3G services by 2022, reallocating that spectrum to 4G/5G. 2G (GSM) is also slated for switch-off; for example, KPN will deactivate its 2G network by the end of 2025 datacenterdynamics.com, as very few users or M2M devices still rely on it. Looking ahead, Dutch carriers are exploring 5G-Advanced features and eventually 6G (post-2030) in research pilots, ensuring the country stays at the forefront of mobile innovation. There is also growing interest in private 5G networks for industry and IoT, with local spectrum set aside for enterprise use (though the “private 5G” landscape in the Netherlands is still in early stages and highly regulated).

Urban vs. Rural Access Disparities

Bridging the Digital Divide: The Netherlands is often praised for minimizing the urban-rural digital divide. Thanks to its high population density and proactive infrastructure deployment, rural connectivity metrics are only slightly behind urban areas. Even in countryside villages, residents typically have at least one fast broadband option – often cable or increasingly fiber – and good mobile coverage. The national Connectivity Action Plan explicitly aims for “high-quality connectivity…available at competitive prices anytime and everywhere” digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu. In the EU’s Digital Economy and Society Index, the Netherlands consistently ranks among the top countries for connectivity, reflecting broad coverage in all regions lightreading.com.

Rural Coverage Gaps: That said, a few pockets of rural/remote territory still lack fiber or cable gigabit service. Approximately 19,000 households in outlying areas (e.g. scattered farms or hamlets in parts of Zeeland, Groningen, Drenthe and Limburg provinces) remain beyond the reach of current fiber plans lightreading.com. These are the truly hard-to-reach premises – sometimes dikes, islands or rural stretches where running new fiber is technically or financially challenging. The government estimates these last connections could cost up to €100,000 per household to wire due to their remoteness lightreading.com lightreading.com. To address this, the Dutch government is formulating interventions: potentially state aid subsidies or universal service obligations to ensure even these locations get at least 100 Mbps–1 Gbps service by 2030 lightreading.com lightreading.com. In some cases, fixed wireless access (4G/5G-based broadband) or satellite internet (like Starlink) may serve as interim solutions for remote farms until fiber reaches them ictmagazine.be ictmagazine.be.

Unequal Fiber Distribution: Interestingly, fiber rollout disparities haven’t been solely rural. Until recently, some dense urban areas had no fiber because legacy networks sufficed – for example, parts of the Randstad (the urbanized west, including Amsterdam and The Hague) remained on old copper or cable networks while rural towns were getting fiber. This was often due to historical right-of-way issues or the presence of upgraded cable. An interactive map by the Dutch regulator ACM revealed that as of 2022, many postal code areas in Zeeland, Groningen, and Limburg had no fiber, and likewise certain city neighborhoods were “fiber-free” zones due to reliance on cable/coax lightreading.com lightreading.com. However, these gaps are closing fast: fiber providers are overbuilding in cities and have plans (or co-investments) to cover remaining neighborhoods. For rural pockets, when running fiber is impractical, authorities are encouraging alternatives so that no one is stuck with sub-par DSL. Overall, the urban-rural gap in basic internet access is very small in the Netherlands – “strong access rates” and only isolated infrastructure issues are noted by observers freedomhouse.org – and the policy goal is to eliminate the gap entirely.

Affordability and Average Speeds

Competitive Pricing: Internet access in the Netherlands is generally affordable by Western European standards. A basic standalone broadband subscription costs roughly €30–€40 per month for DSL or entry-level cable/fiber, while high-end gigabit fiber or premium packages (often bundled with TV/phone) range around €50–€80 per month. For instance, in 2024 the cheapest internet-only plan was about €32.50/month (for ~50 Mbps DSL) and the most expensive was over €100 (for 8 Gbps fiber) prijsvergelijken.nl. Most mainstream 100–200 Mbps plans cluster in the €40–€50 range. These prices are “not high” in an international context prijsvergelijken.nl – in fact, a European Commission analysis found Dutch consumers pay around €21 on average for a basic broadband offer, well below what Starlink satellite service would cost for similar speeds politico.eu politico.eu. The presence of multiple providers and vigorous competition (especially on KPN’s open wholesale network) keeps prices in check. Additionally, the Dutch market has many promotions and bundle deals, and switching providers is common, which further drives competitive pricing.

Value for Money: Importantly, Dutch users get very fast speeds for the price. The average fixed broadband speed is about 200 Mbps prijsvergelijken.nl, meaning even mid-tier plans in the Netherlands deliver large bandwidth. This places the country among the top in the world for average internet speed and overall value. Mobile data is similarly good value – most Dutch mobile operators offer generous data bundles or even unlimited data for €25–€40/month, and EU roaming at no extra cost, making mobile internet a viable alternative or complement to fixed broadband.

Speed Performance: As noted, median speeds are ~202 Mbps down (fixed) and ~173 Mbps down (mobile) in early 2025 en.wikipedia.org en.wikipedia.org. Even upload speeds are high: fiber connections often provide equal upload (e.g. 1 Gbps up), and cable DOCSIS 3.1, while more limited on upload, still offers on the order of 40–50 Mbps up on top tiers. The consistency of service is also notable – outages are rare and networks have sufficient capacity such that there are “few homes with low internet speeds” left, aside from the aforementioned rural fringe prijsvergelijken.nl. The Dutch government tracks connectivity quality through a Digital Infrastructure report and finds that Dutch internet subscriptions reliably meet or exceed their advertised speeds in most cases, bolstered by a strong net neutrality regime (no throttling of specific content) prijsvergelijken.nl. Overall, relative to household incomes, internet access in the Netherlands is considered highly affordable and cost-effective, contributing to a very high broadband uptake rate (around 97% of households have an internet subscription).

Market Landscape and Providers

Major Fixed Broadband Providers: The Dutch broadband market is led by a few large players and supplemented by many smaller ISPs:

- KPN – The former state telecom (privatized) is the largest broadband provider. It operates the legacy copper network and the largest fiber network. KPN’s DSL network (with VDSL upgrades) once covered almost every address; now KPN is rapidly switching customers to its fiber (often offering 1 Gbps service). KPN wholesales its lines to numerous virtual providers (consumer brands like XS4ALL (now integrated into KPN), Telfort (defunct), as well as niche ISPs) due to regulatory requirements for open access. KPN had roughly 40–45% market share of broadband and has millions of customers on fiber or VDSL.

- VodafoneZiggo (Ziggo) – Formed by a merger of cable company Ziggo and Vodafone’s Dutch operations, it is the dominant cable operator covering most of the country. Under the Ziggo brand it provides cable broadband, digital TV, and voice. Ziggo’s cable network passes ~90% of homes point-topic.com and it historically held around 40% market share, making it neck-and-neck with KPN. Ziggo’s network currently offers up to gigabit download speeds (and ~50 Mbps upload) across its footprint. While its coax network isn’t open to competitors, Ziggo has started to diversify – e.g. partnering to deliver services over fiber in areas it lacks coverage advanced-television.com. The Vodafone side of the business is one of the mobile operators (see below).

- Odido (formerly T-Mobile NL) – Odido is the third biggest broadband provider, having aggressively entered the fixed market in the late 2010s. T-Mobile (now Odido) initially offered DSL and then started selling fiber services by partnering with fiber operators. It is the anchor tenant on Open Dutch Fiber’s new FTTH deployments and also resells KPN fiber in some areas. Odido’s fixed broadband base grew rapidly (often by undercutting KPN/Ziggo prices), and by 2025 its fiber footprint reached 8.1 million addresses – the widest in the country telecompaper.com. Odido remains smaller than KPN/Ziggo in subscriber share (roughly 10–15% of the market), but its presence drives competition and innovation. Notably, Odido has no cable or copper network of its own; it’s entirely focused on fiber for fixed internet and on its mobile network for wireless.

- Delta Fiber – Delta started as a regional cable operator in Zeeland, but has transformed into a fiber operator. Now owned by investment firms, Delta Fiber has built FTTH in mid-size towns and rural areas across the Netherlands (often where Ziggo wasn’t present). It passes a few million homes with fiber and serves customers directly as well as via wholesale. Delta’s strategy of open networks led to the partnership with VodafoneZiggo, allowing Ziggo to serve customers over Delta’s fiber in regions like Zeeland and parts of South Holland advanced-television.com advanced-television.com. Other regional fiber companies (e.g. Glasvezel buitenaf by CIF, or municipal networks in Eindhoven, Amsterdam’s Citynet, etc.) also contribute to coverage.

- Other ISPs: There are dozens of smaller ISPs in the Netherlands. Some are virtual ISPs using KPN’s network (for example, brands like Tweak, Freedom Internet, Budget, etc. lease fiber lines to sell their own service). A few local cooperatives and municipal networks provide fiber on a community level, especially in rural areas (e.g. Glasdraad, Rekam, etc., often partnering with bigger players for back-end) lightreading.com lightreading.com. For consumers, the practical choice at a given address often comes down to two or three fixed networks available (DSL/fiber from KPN or partners, cable from Ziggo, and sometimes an alternative fiber network), and a handful of retail providers that can serve that address. This multi-operator environment results in frequent discounts and customer churn, but also ensures no single provider monopolizes the market.

Major Mobile Providers: The mobile landscape features three nationwide operators:

- KPN Mobile: Part of KPN, it’s known for wide coverage (especially in more remote areas) and consistently strong network performance. KPN has been quick in 5G rollout and targets premium quality (often topping network quality awards).

- Vodafone Netherlands: Run by VodafoneZiggo, it shares infrastructure in some areas and is similarly widespread. Vodafone NL has a strong presence in cities and also serves many business customers. It was slightly behind in early 5G deployment but is now actively expanding with new spectrum.

- Odido: The merged T-Mobile/Tele2 entity, Odido has a very modern network (Tele2 and T-Mobile were pioneers in 4G and VoLTE, and now 5G). Odido’s network has excellent speeds; in fact, reports indicate it covers 98% of the population with 5G already accenture.com. Odido aggressively markets unlimited data plans and bundles with its fiber offerings.

Additionally, there are Mobile Virtual Network Operators (MVNOs) like Simyo, Youfone, Lebara, etc., which lease capacity from the big three and offer cheaper mobile plans (often SIM-only). These MVNOs give price-sensitive consumers more options, contributing to one of the most competitive mobile markets in the EU. The regulator ACM keeps an eye on the market to ensure the merger that created Odido (reducing the market from 4 to 3 MNOs) does not harm consumer interests – so far, competition remains robust, with no dramatic price hikes post-merger.

Government Policies and Initiatives

Digital Agenda and Gigabit Targets: The Dutch government has a clear strategy to remain a digital frontrunner. The Dutch Digitalisation Strategy and the Connectivity Action Plan (updated in 2021) set ambitious goals aligning with the EU’s Gigabit Society targets digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu. Key objectives included: by 2023, all households should have access to at least 100 Mbps, and a “vast majority” subscribing to 1 Gbps; by 2030, all end-users should have access to 1 Gbps and all populated areas should be covered by 5G (or future equivalent) digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu. The Netherlands essentially met the 2023 goals – virtually 100% of homes can get 100 Mbps (via cable or fiber) and gigabit networks cover around 98% of homes point-topic.com. The focus now is on the 2030 goal of universal gigabit, which translates to connecting the last few percent of addresses, as discussed earlier.

Market-Driven Rollout with Facilitation: Dutch broadband expansion has largely been market-led. The government relies on private ISPs to invest, while it plays a facilitating role: streamlining permit processes, standardizing rules across municipalities, and removing barriers. For example, a “Connectivity Toolbox” was implemented to harmonize permit granting for fiber ducts and 5G small cells, making deployment faster and cheaper across regions digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu. A special taskforce was set up to coordinate between national and local authorities on issues like antenna siting and access to public infrastructure digital-strategy.ec.europa.eu. Local governments have been encouraged to appoint “digital connectivity coordinators” and adopt uniform fee guidelines, so that one municipality doesn’t hold up fiber builds more than another. This cooperative approach has paid off in accelerated rollout of networks – the ACM noted an “accelerated development” in fiber deployment in recent years acm.nl, with a 25% increase in households passed in one year.

Addressing Gaps – Subsidies and USO: For the truly uneconomic areas (the ~19k remote homes), the Dutch government is considering more direct intervention. The “Brede impuls digitale infrastructuur” is a program that may use subsidies or public investment to co-fund rural fiber in provinces where needed. If the market still doesn’t cover certain locations, the government has signaled it could mandate a form of universal service obligation (USO) or other requirement for operators to serve those areas lightreading.com. These measures would ensure no one is left on outdated slow connections. The Ministry of Economic Affairs has earmarked funding (including some EU Recovery funds) to support rural broadband if needed, although in practice many rural builds are already happening via cooperatives and province-led projects.

Regulatory Oversight: The Netherlands has two key regulators in this domain: the Authority for Consumers and Markets (ACM), which oversees telecom competition and consumer protection, and the newer Dutch Authority for Digital Infrastructure (RDI) which handles technical regulation (spectrum, infrastructure sharing, etc.) digital-strategy.ec.europa.eu. ACM has conducted periodic market reviews – for instance, assessing whether KPN’s fiber network should be regulated like the copper network was. In 2019, ACM attempted to impose open-access requirements on both KPN fiber and Ziggo cable, but that decision was overturned by a court in 2020 prijsvergelijken.nl. Thus currently, KPN’s networks are voluntarily open to wholesale (due to commercial agreements), while Ziggo’s cable remains closed. The regulators continue to monitor for dominance; however, with robust infra-based competition (fiber vs cable) the government has leaned toward a light-touch regulatory approach, focusing on enabling competition rather than heavy-handed price controls.

Net Neutrality and Consumer Rights: The Netherlands has been a pioneer in internet openness. It famously passed a net neutrality law in 2012 (ahead of the EU-wide regulation), preventing ISPs from blocking or throttling online services prijsvergelijken.nl. This framework is still in effect (now under EU law) and ensures Dutch users can access all content without discrimination. The Dutch were also early to ban zero-rating practices that violate neutrality. Additionally, consumer protections like easy switching (one-month notice to cancel after a contract ends) and transparency in advertising speeds are enforced. The ACM’s Telecom Monitor reports keep track of whether ISPs deliver on promised speeds and how often outages occur, etc., with generally positive results (service quality is high and improving).

5G Spectrum and Safety: The government completed major spectrum auctions in 2020 and 2024 to support 5G. It imposed coverage obligations – e.g. by end of 2023, 5G had to cover main highways and train routes, and by 2026 virtually the entire population digital-strategy.ec.europa.eu. These obligations pushed operators to roll out quickly. There was also public concern on 5G health effects, which the government addressed by adhering to international radiation guidelines and communicating transparently. Notably, the 3.5 GHz auction was delayed due to a NATO satellite listening station using that band; the resolution involved relocating that facility so that by late 2023 the auction could proceed 5gobservatory.eu. The successful auction in mid-2024 now allows full 5G deployment. The Netherlands has not yet auctioned mmWave (26 GHz) spectrum for 5G, but is testing it for industrial uses.

Digital Inclusion: Beyond infrastructure, Dutch policies emphasize ensuring all citizens can benefit. There are programs for digital skills training and initiatives to provide affordable service to low-income households if needed (though broadband is already widely adopted, any remaining non-users tend to be the elderly or those needing digital education). Public Wi-Fi in cities and connectivity for schools and public services have also been a focus under the Digital Economy Strategy digital-strategy.ec.europa.eu. Moreover, the Netherlands actively participates in EU-wide projects like Gaia-X (for cloud) and contributes to EU’s connectivity goals (the Netherlands’ own performance often exceeds EU averages on metrics like connectivity) lightreading.com.

Satellite Internet Access in the Netherlands

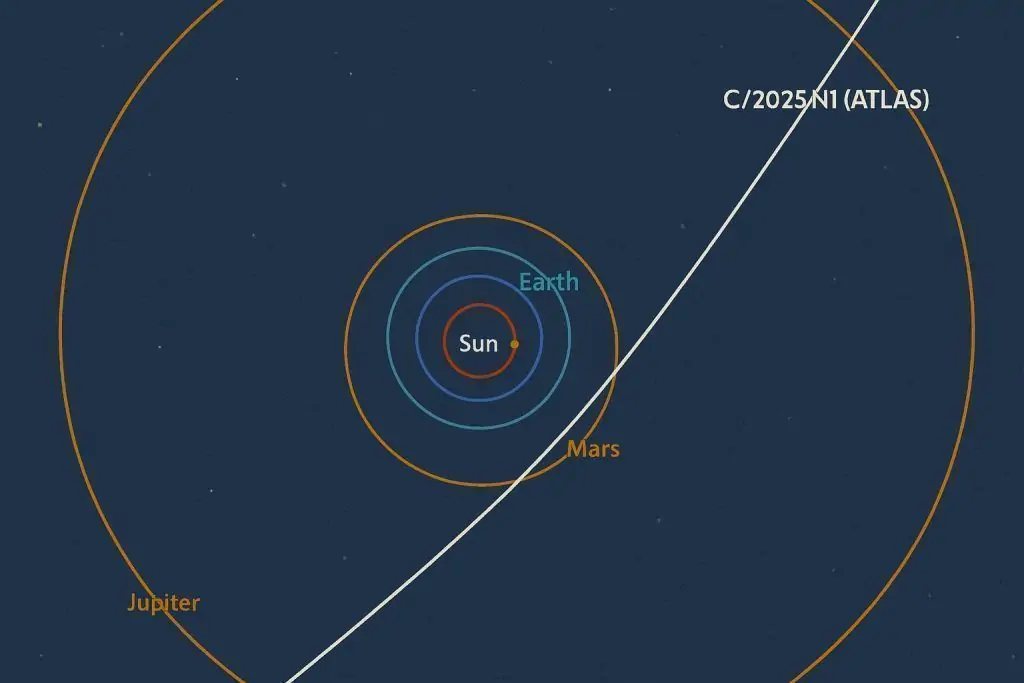

Availability of Satellite Broadband: Satellite internet is indeed available in the Netherlands, though it represents a small niche of the market. The primary option is Starlink, Elon Musk’s SpaceX satellite constellation, which became available in the Netherlands around 2021. Starlink’s low-Earth-orbit (LEO) satellites can deliver broadband to virtually any location with a view of the sky, making it particularly attractive to those few Dutch households beyond the reach of fiber or cable. As of 2025, Starlink service can be ordered throughout the Netherlands – customers receive a dish kit to install at their location, which connects to the satellites for internet access.

Starlink Performance and Plans:Starlink’s speeds in NL range roughly from 50 Mbps up to 200 Mbps (occasionally higher), depending on network load and satellite coverage politico.eu. Latency is around 20–40 ms – higher than fiber’s single-digit ms but far better than traditional geostationary satellites which have ~600 ms latency. Starlink provides a solid broadband experience suitable for streaming, video calls, and general use. However, it is “not as good as fiber” in absolute terms, especially for real-time applications like competitive gaming or ultra-low-latency needs politico.eu. Recognizing that many Europeans can get faster, cheaper fixed broadband, Starlink has adjusted its offerings: in 2025 it introduced a cheaper, lower-speed tier called “Residential Lite” at €35 per month for ~50–100 Mbps unlimited ictmagazine.be ictmagazine.be. The standard Starlink residential plan remains available at around €50 per month, offering 150–250 Mbps unlimited ictmagazine.be ictmagazine.be. There is an up-front equipment cost (approx €250–€450 for the dish kit depending on promotions). Starlink has also launched a 10 GB/month mini plan for €9 aimed at occasional use (like camping trips) ictmagazine.be ictmagazine.be, as well as mobility packages (Roam and Maritime) for RVs and boats, which Dutch consumers can use if needed coolblue.nl coolblue.nl.

Uptake and Use Cases: In the Netherlands, Starlink’s target customers are mainly those in remote rural spots without good terrestrial broadband – which is a relatively small group (thousands, not millions, of households). For these users, Starlink can be a lifeline to get modern internet speeds without waiting years for fiber. Starlink is also used by some hobbyists, boat/yacht owners (offshore connectivity), and tech enthusiasts. However, for the average Dutch household in a town or city, fiber or cable is usually available and is preferred due to lower cost and higher performance. As one telecom analyst noted, in Europe “if I can get fiber, I will take fiber… If I don’t have good broadband by traditional means, then great, I’ll have satellites” politico.eu politico.eu. This rings true in the Netherlands – Starlink fills a niche rather than competing head-to-head with mainstream ISPs. In fact, Starlink acknowledges it cannot nor intends to serve dense urban populations at scale (capacity per cell is limited) politico.eu; indeed, in some very congested areas in Europe, Starlink has had to pause new subscriptions once cells filled up politico.eu. For Dutch rural communities or enterprise backup links, though, it’s a useful addition to the connectivity mix.

Other Satellite Providers: Apart from Starlink, Dutch consumers historically could subscribe to geostationary satellite internet services (such as Viasat/EXede, HughesNet Europe, or EuropaSat via KA-SAT/Eutelsat). These services are available in the Netherlands and cover 100% of the territory since satellite beams are continental. However, they offer much lower speeds (often 10–50 Mbps) and come with high latency (~0.6 seconds) and data caps. With Starlink’s arrival, the older GEO satellite options have largely fallen out of favor except perhaps in very specialized cases. There are also companies like OneWeb (LEO constellation) which, in partnership with distribution partners, might start offering broadband to maritime or corporate clients in Europe, but as of 2025 OneWeb is not selling direct-to-consumer internet in the Netherlands.

Pricing Context: Satellite internet has traditionally been pricey, but Starlink’s price cuts have made it more competitive. On average, Starlink’s €49–€50 monthly fee in Europe is still higher than the €35 average price for a high-speed fiber connection politico.eu politico.eu. For a similar price, most Dutch households can get a much faster and unlimited fiber/cable service. This underscores why satellite is mostly a fallback option where terrestrial networks fall short. The Dutch government and EU have noted that satellite bandwidth likely won’t disrupt urban markets because consumers can “afford a much better connection at lower prices” on fiber/cable politico.eu politico.eu. Rather, satellites are viewed as complementary – great for remote farms, ships at sea, or perhaps temporary connectivity, but not the primary mode for the majority.

Regulatory Considerations: The Netherlands, like other EU countries, requires satellite operators to obtain licenses for using radio frequencies (Starlink uses Ku/Ka band frequencies). Dutch authorities have granted the necessary approvals for Starlink’s user terminals and gateways under EU framework. There was some interplay between satellite and terrestrial spectrum policy – for example, the relocation of the 3.5 GHz NATO satellite station to clear 5G spectrum was one instance of balancing satellite vs. ground network needs 5gobservatory.eu. Additionally, the EU is conscious of sovereignty and security regarding critical communications. As such, the EU is developing its own multi-orbit satellite program (IRIS²), planned to be operational by 2030, to provide secure government and broadband services in Europe politico.eu politico.eu. Until then, Starlink’s dominance in LEO broadband is acknowledged, but regulators may impose conditions (for example, under an upcoming EU Space Act) to ensure issues like space debris, spectrum interference, and foreign control are addressed politico.eu politico.eu. In the Netherlands, there hasn’t been notable public backlash against Starlink; in fact, the technology is appreciated for connecting rural areas. However, officials echo EU-wide views: satellite internet is a helpful supplement but not a substitute for expanding fiber and 5G on the ground politico.eu politico.eu.

Historical Trends and Future Outlook

Historical Trajectory: The Netherlands has a rich internet history, being one of Europe’s early adopters of the internet (the country’s universities linked to the ARPANET successor networks as far back as the 1980s). By the late 1990s and 2000s, Dutch households were rapidly getting online via dial-up and then broadband. The 2000s saw Netherlands leading in broadband penetration – DSL and cable proliferated in nearly every community. The unique mix of a strong incumbent (KPN) and many local cable TV companies (later consolidated into Ziggo) made broadband widely available by the mid-2000s. The 2010s introduced fiber rollouts (KPN’s Reggefiber initiative and municipal fiber in Almere, Amsterdam, etc.), though initial uptake was slow. Mobile broadband also took off in the 2010s as 3G/4G networks came online; by mid-2010s, smartphone adoption and mobile data usage were booming. The Netherlands’ small size and flat terrain gave it an advantage in building out networks quickly. Culturally, the Dutch embraced digital life early – from e-banking to online media – which spurred ISPs to keep improving networks. By 2020, just before the 5G era, the Netherlands had firmly established itself as one of the best-connected countries (ranking 2nd in the EU on connectivity in DESI 2022) lightreading.com.

Current 2025 Snapshot: As detailed above, the Netherlands today has near-ubiquitous fast internet. Virtually every household can get 100 Mbps+, most can get gigabit speeds point-topic.com, and both fixed and mobile networks rank among the world’s fastest. Internet usage is universal across age groups and businesses. Key challenges being tackled now are quality and upgrades (e.g., moving remaining DSL users to fiber, increasing fiber subscription take-up, boosting upload speeds on cable) and inclusion (connecting the last remote homes, improving digital literacy for all). The country’s internet freedom and reliability are robust, with little censorship and strong infrastructure resiliency freedomhouse.org. The average Dutch consumer can stream 4K video, telework, or game online with minimal issues, reflecting the success of past investments.

Emerging Innovations: Looking ahead, several developments are in the pipeline:

- Fiber to Multi-Gig and Copper Switch-off: Fiber networks will begin offering multi-gigabit tiers more widely (some providers already market 2 Gbps or even 8 Gbps plans). KPN and others are trialing XGS-PON and 25G-PON technologies to increase capacity on fiber. By 2026–2028, expect symmetrical multi-gigabit home connections to become common. Around the same timeframe, KPN aims to retire the copper PSTN network entirely, once fiber covers ~98% of addresses (likely by 2026–2027) telecompaper.com telecompaper.com. This will mark the end of DSL in the Netherlands, cutting maintenance costs and potentially freeing frequencies.

- Cable Network Evolution: VodafoneZiggo’s planned DOCSIS 4.0 upgrade around 2025–2026 will allow the cable network to offer similar gigabit symmetry and even higher download speeds advanced-television.com. This “10G” cable initiative (10 Gbps-capable) will keep cable competitive with fiber. We may see cable operators also improving uploads and latency to match fiber’s performance, possibly through technologies like Low Latency DOCSIS for better gaming/VR performance.

- 5G Advanced and 6G Prep: In mobile, after nationwide 5G coverage is achieved, operators will implement 5G-Advanced features (3GPP Release 18+) to enhance capacity and speeds further – think 5G carrier aggregation across more bands, network slicing for specialized services, etc. There’s also likely to be an auction for 26 GHz mmWave spectrum later in the decade if demand for ultra-high bandwidth in dense areas (stadiums, industrial parks) emerges. Dutch universities and companies (like TNO, TU Delft) are involved in 6G research, meaning the groundwork for post-2030 wireless is already being laid. By late 2020s, pilot projects for 6G or advanced IoT networks may start to appear.

- Integration of Satellites and New Players: Satellite broadband will continue to supplement Dutch connectivity. Starlink’s constellation will grow (SpaceX had ~6,000 satellites by late 2024 ictmagazine.be), improving capacity and possibly allowing lower prices or higher speeds. Europe’s IRIS² constellation in 2030 will provide an alternative for government and niche uses, potentially also offering rural broadband service via EU-supported packages ictmagazine.be. It’s also possible new satellite competitors (Amazon’s Kuiper, OneWeb’s next-gen) could expand service in Europe by the end of the decade, giving consumers more choice for off-grid internet. The Dutch might see local telecom providers resell satellite service as part of bundles (e.g., a provider offering a satellite broadband package for remote customers, similar to how Orange does in France ictmagazine.be).

- Smart Infrastructure and IoT: The high connectivity will enable smarter infrastructure – the Netherlands is already deploying connected traffic systems, smart grids, and IoT sensors (for flood control, agriculture in rural areas, etc.). With nationwide 5G and fiber, expect growth in these applications. For example, ports like Rotterdam are implementing 5G/edge computing for logistics. Rural areas may benefit from IoT for smart farming if connectivity is in place. The government’s strategy also highlights emerging tech like quantum communication and cybersecurity – having robust networks is foundational for these innovations digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu.

Continued Government Role: The Dutch government will continue a balancing act of letting market competition drive improvements while stepping in where needed. Given that the Netherlands already “maintains a good business environment for digital innovation” digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu, we can expect stable pro-competition policies, support for new entrants (e.g., facilitating new fiber investors or niche wireless ISPs), and a watchful eye on keeping internet affordable and open. There may be further pushes on issues like open access (perhaps revisiting regulation if any one player dominates fiber in the future) and security (ensuring telecom networks use trusted vendors and are resilient to cyber threats).

In summary, the Netherlands enters 2025 as a connectivity leader, with widespread gigabit broadband, extensive 5G, and even satellite options to cover every corner. Historical investments and forward-looking policies have paid off in making internet access almost ubiquitous and high-quality. Going forward, the country is poised to hit the remaining 100% coverage targets and embrace next-generation technologies, cementing its position as one of Europe’s (and the world’s) most connected and digitally empowered societies. Internet access in the Netherlands is not only among the fastest but also continually improving, ensuring that urban and rural citizens alike can benefit from the digital economy and future innovations lightreading.com digital-strategy.ec.europa.eu.

Sources:

- European Commission – Digital Connectivity in the Netherlands (policies and targets) digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu

- Authority for Consumers & Markets (ACM) – Telecom Monitor Q4 2024 (fiber rollout data) acm.nl

- Point Topic – Netherlands Country Profile 2022 (coverage statistics) point-topic.com point-topic.com

- Pricevergelijken.nl – Ultimate Guide to Internet in NL [2025] (speeds, providers, net neutrality) prijsvergelijken.nl prijsvergelijken.nl

- Light Reading – “Netherlands plots ways to close stubborn fiber gap” (rural fiber costs, DESI ranking) lightreading.com lightreading.com

- Ookla Speedtest Global Index – (Jan/Feb 2025 speed rankings) en.wikipedia.org en.wikipedia.org

- POLITICO EU – “Starlink not ready to rule Europe’s airwaves” (satellite vs fiber, costs) politico.eu politico.eu

- ICT Magazine (NL) – Starlink introduces cheaper plans (Starlink NL pricing and performance) ictmagazine.be ictmagazine.be

- Advanced Television – VodafoneZiggo to deliver services over Delta Fiber (DOCSIS 4.0 plans) advanced-television.com

- 5G Observatory/EU – (5G strategy and spectrum in NL) lightreading.com rcrwireless.com.