The John Hancock name is in the news on two very different fronts today: on Wall Street, where the John Hancock Group of Funds has named two seasoned financial leaders as independent trustees, and on Chicago’s Southwest Side, where John Hancock College Prep is asking the community to help tip off its inaugural Thanksgiving basketball tournament.PR Newswire+1

Although the fund complex and the public high school are unrelated organizations that simply share a name, both stories center on stewardship — of investors’ money on one hand, and of young athletes and their community on the other.

John Hancock Group of Funds strengthens oversight with two new trustees

Manulife Wealth & Asset Management, through Manulife John Hancock Investments, announced today that the Board of Trustees of the John Hancock Group of Funds has appointed Christine L. Hurtsellers and Kenneth J. Phelan as independent trustees, effective immediately.PR Newswire

With their arrival, the Board now consists of 12 independent trustees and two interested trustees, a structure that aligns with industry expectations for robust, independent oversight of mutual funds and other pooled investment products.PR Newswire

Board chair Dr. Hassell McClellan said the additions are intended to deepen the Board’s expertise as the asset‑management industry navigates complex markets, regulation, and evolving investor needs. In the announcement, he emphasized that Hurtsellers and Phelan bring complementary skill sets in risk management, regulation, and corporate strategy that are expected to benefit fund shareholders.

Who are the new trustees?

Christine L. Hurtsellers

Hurtsellers is best known for her leadership at Voya Investment Management, where she previously served as Chief Executive Officer and Chief Investment Officer for Fixed Income. She also sat on the Board of Governors of the Investment Company Institute (ICI), the influential trade group for U.S. mutual funds.PR Newswire

The release highlights several areas where she is expected to be particularly impactful:

- Deep experience in fixed income investing and broader capital markets

- A background in risk management and corporate strategy

- Hands‑on knowledge of operations and regulatory compliance in a heavily regulated industry

- Board‑level leadership roles at a life and annuity reinsurance business and several large non‑profitsPR Newswire

That mix makes her a natural fit for a board that oversees complex products such as bond funds, asset‑allocation strategies, and other vehicles that can be sensitive to interest‑rate and credit cycles.

Kenneth J. Phelan

Phelan arrives with a résumé that leans heavily toward risk management and regulation. He has previously served as Chief Risk Officer for the U.S. Department of the Treasury, as well as for multiple financial institutions, and he currently sits on the boards of a bank holding company and a public company.PR Newswire

According to the announcement, he brings:

- Extensive experience in enterprise risk frameworks and regulatory compliance

- Operational knowledge of banking, investment management, and capital markets

- Boardroom experience guiding organizations through challenging market environmentsPR Newswire

Given the renewed focus from U.S. regulators on liquidity risk, derivatives use, and stress testing in funds, Phelan’s background is likely to be particularly influential in overseeing how the John Hancock funds manage risk on behalf of shareholders.

Why this matters for investors

Independent trustees in a mutual fund complex act as fiduciaries — their job is to look out for shareholders’ interests, not the fund sponsor’s. They typically oversee:

- Fees and expenses, including whether they are reasonable relative to services and performance

- Conflicts of interest, such as revenue‑sharing or affiliated transactions

- Risk management practices, especially in volatile markets

- Service providers, including investment advisers, administrators, and distributors

Manulife Wealth & Asset Management, which is part of Manulife Financial Corporation, notes that it provides investment and retirement services to about 19 million individuals, institutions, and retirement plan members worldwide, underscoring the scale of the platform that the Board helps oversee.PR Newswire

By refreshing its board with two high‑profile risk and investment experts, the John Hancock Group of Funds is signaling that it intends to keep pace with both regulatory expectations and the growing complexity of modern portfolios.

On Chicago’s Southwest Side, ‘Harvest Havoc’ tournament needs community assist

While the Boston‑based fund board focuses on governance, John Hancock College Prep in Chicago is gearing up for a very different kind of challenge: hosting its 2025 Inaugural Harvest Havoc Thanksgiving Basketball Tournament and covering the costs that come with it.Southwest Regional Publishing

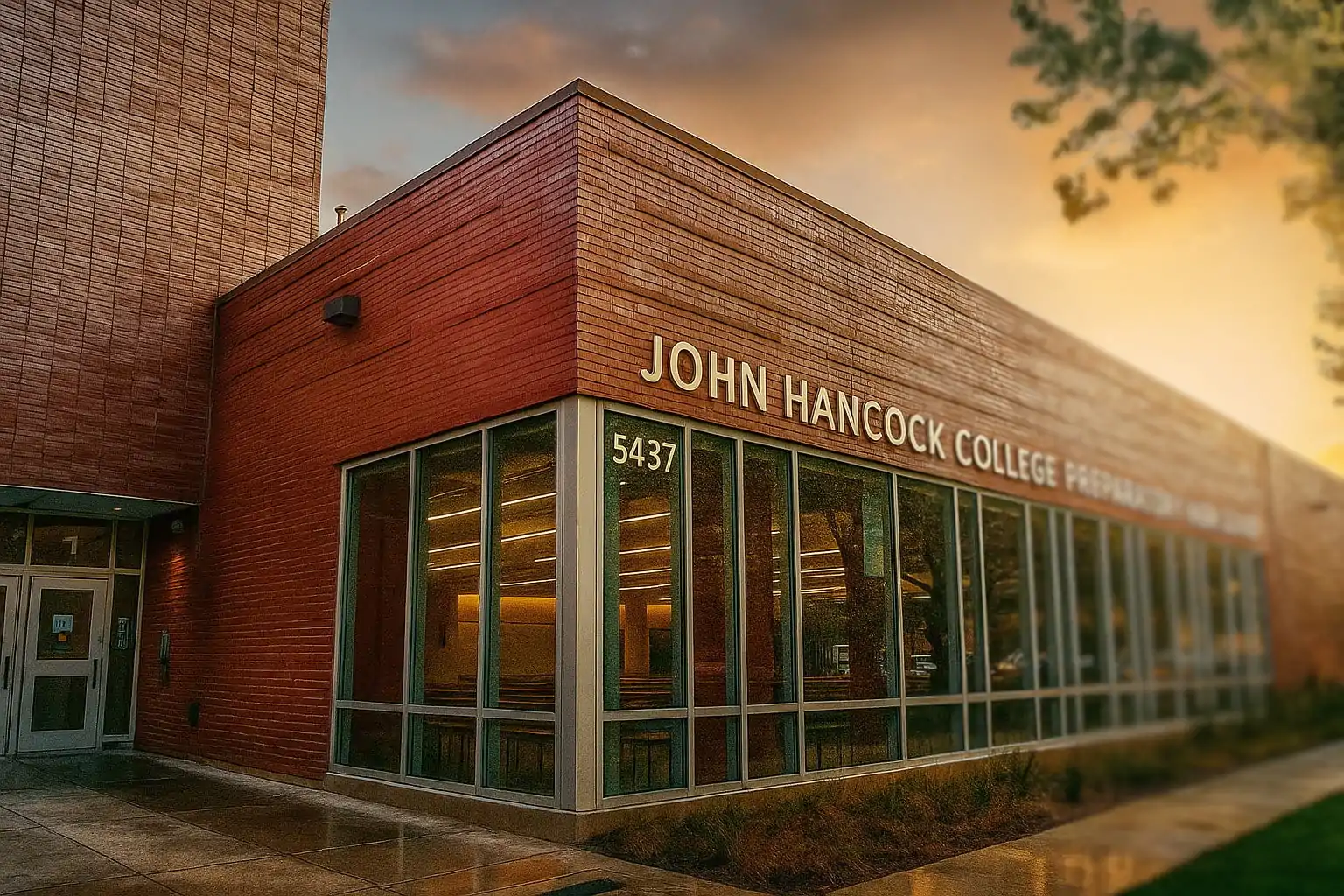

The public high school, located at 5437 W. 64th Place in Chicago’s Clearing neighborhood, is inviting community members and local businesses to contribute sponsorships and donations to support the multi‑day event.Southwest Regional Publishing

Tournament details

According to reporting from Southwest Regional Publishing, the tournament will run across the Thanksgiving holiday period on the following dates:Southwest Regional Publishing

- November 24 & 25 – evening games starting at 5:30 p.m.

- November 26 – games beginning at 2:30 p.m.

- November 28 & 29 – daytime schedule from 11 a.m. to 5 p.m.

The event is designed to bring local, accessible high‑school basketball to the Southwest Chicagoland region and to give student‑athletes a high‑energy competition close to home.

The John Hancock College Prep boys’ basketball team includes 18 athletes who, as the article puts it, are seeking an outlet for skill development, discipline, and healthy competition alongside community involvement.Southwest Regional Publishing

Covering the cost of referees

One of the biggest line items for any tournament is officiating, and Harvest Havoc is no exception. Organizers estimate that:Southwest Regional Publishing

- The schedule will require 2–3 referees per game

- With 2–4 games per day, that adds up to roughly 36 referee assignments over the course of the tournament

- About $2,000 in donations would cover half of the total referee cost

Sponsorships start at $100, making it feasible for small businesses and individual supporters to participate. In return, donor business information will be shared with coaches, referees, and families from all eight participating schools, offering local exposure while supporting youth sports.Southwest Regional Publishing

Who’s playing?

The tournament field is a strong snapshot of the region’s basketball culture. Schools expected to participate include:Southwest Regional Publishing

- Hancock College Prep (host)

- Richards (Oak Lawn)

- Johnson Prep

- St. Rita

- St. Laurence

- Tinley Park

- Evergreen Park

- University High

Beyond the scoreboard, the goal is to build a recurring event that anchors Thanksgiving break for student‑athletes and families, turning the gym into a community gathering place.

A school built around community

John Hancock College Prep’s emphasis on community connection isn’t limited to basketball. The school’s modern campus in the Clearing neighborhood has been highlighted by its architects for the way it serves as a “community nucleus”, with facilities such as a black‑box theater, full‑size auditorium, and gym spaces designed to be shared with the neighborhood year‑round.

The student body is predominantly Hispanic and largely from economically disadvantaged households, making accessible, local programming like Harvest Havoc especially meaningful for families who might not have the resources to travel far for showcase events.Southwest Regional Publishing

Organizers have provided a dedicated contact at the school for those seeking to donate or learn more about sponsorship opportunities, as detailed in the original local report.Southwest Regional Publishing

Different arenas, shared themes: stewardship and opportunity

On the surface, a global fund complex appointing new trustees and a neighborhood high school raising money for referees could not be farther apart. But both stories unfolding this week under the John Hancock name revolve around a few common themes:

- Stewardship and oversight:

The John Hancock Group of Funds Board is explicitly charged with overseeing investment risks, fees, and long‑term strategy on behalf of millions of investors.PR Newswire+1

At Hancock College Prep, tournament organizers are effectively stewarding scarce resources to create a safe, competitive environment for teens — and doing so transparently by outlining exactly how donations will be used.Southwest Regional Publishing - Risk management in different forms:

In Boston, Phelan’s and Hurtsellers’ expertise in market and regulatory risk is being added to the boardroom.PR Newswire

In Chicago, coaches and administrators are managing the practical risks of organizing a multi‑day tournament — from securing enough officials to ensuring games stay fair and well‑run. - Investing in the future:

For Manulife John Hancock Investments, “investing” is literal — helping clients pursue long‑term financial goals through a multimanager investment platform.PR Newswire

For Hancock Prep, the investment is in youth development: using sports as a vehicle for discipline, teamwork, and exposure to college‑level competition.

It’s also a reminder that the John Hancock name spans multiple contexts — from financial products governed by a sophisticated board to a public high school building bridges in an underserved community. While they are separate institutions, both sets of decisions made this week could have a tangible impact over the coming years: on investors’ portfolios in one case, and on teenagers’ memories, résumés, and sense of possibility in the other.

What to watch next

- For investors and advisors:

- Monitor future regulatory filings and shareholder reports from the John Hancock Group of Funds to see how board committees and oversight responsibilities evolve with the new trustees in place.

- Watch for any strategic shifts or new product launches that may follow as the board’s expertise deepens.

- For Chicago‑area families and businesses:

- Mark the Nov. 24–29 tournament dates if you’re looking for family‑friendly, local sports over the Thanksgiving period.Southwest Regional Publishing

- Consider how sponsorship or in‑kind support — from printing services to food donations — might help the tournament become a sustainable annual tradition.

As November 13, 2025 unfolds, the John Hancock stories making headlines serve as a neat snapshot of how governance and community‑level effort both play essential roles in shaping financial and social futures.