- A trade group whose members include Coca‑Cola, Nestlé, General Mills and Kraft Heinz urged Congress to ban “intoxicating” hemp products via FY26 spending language, intensifying pressure on Capitol Hill. Marijuana Moment

- Beverage‑alcohol associations echoed calls to pull hemp‑THC products from shelves until a federal framework exists. Just Drinks

- The bipartisan coalition of 39 state and territory attorneys general renewed demands for Congress to tighten hemp’s legal definition to stop unregulated intoxicants. NAAG

- The Senate stripped a House‑backed hemp‑ban provision from the agriculture‑FDA spending bill over the summer after Sen. Rand Paul (R‑KY) objected; the House language remains a live issue as negotiations continue. Cannabis Business Times+1

- Even as Washington debates bans, mainstream retail keeps moving: Circle K plans a multistate hemp‑THC beverage rollout (2025–2026), and Target piloted THC drinks in 10 Minnesota stores. MJBizDaily+1

- States are acting on their own: Ohio’s governor issued a 90‑day emergency order to halt sales of “intoxicating hemp” (temporarily blocked by a court), while Arizona’s attorney general warned that selling THC‑infused foods and drinks without a marijuana license is illegal. Azag+3Ohio.gov+3GovDelivery+3

- Industry context: New Cannabis Ventures dubs the moment a “Hemp War” as MSOs and CPG retailers push into hemp beverages; MariMed is the latest cannabis operator to announce hemp‑THC products. New Cannabis Ventures+1

Why this matters now

The seven‑year experiment that legalized hemp (2018 Farm Bill) has morphed into a high‑stakes fight over hemp‑derived intoxicants such as delta‑8, delta‑10, THCA and other cannabinoids. Today, big CPG and alcohol interests publicly pressed Congress to close the “hemp loophole,” while states tightened rules or imposed temporary bans. At the same time, major retailers are normalizing low‑dose THC beverages on mainstream shelves—accelerating a consumer trend that regulators haven’t caught up with. Marijuana Moment+3Marijuana Moment+3Just D…

What changed today

Big brands step in. The Consumer Brands Association (CBA)—whose member list includes household names—asked lawmakers to adopt appropriations language championed by Rep. Andy Harris (R‑MD) that would bar hemp products with any “quantifiable” THC, arguing the current market confuses consumers and lacks FDA oversight. The push locks arms with a fresh letter from beverage‑alcohol groups urging Congress to remove hemp‑THC products from commerce until federal rules are in place. Marijuana Moment+1

Law enforcement chief legal officers pile on. Following October’s letter, 39 attorneys general again pressed Congress to clarify hemp’s definition and curb intoxicating, youth‑appealing products—further signaling bipartisan appetite for restrictions. NAAG

The Capitol math: Ban vs. regulation

- House position: Harris‑backed language in FY26 agriculture‑FDA appropriations would redefine hemp to exclude many consumable cannabinoid products and to measure “total THC,” sweeping in THCA and synthesized isomers. Congress.gov

- Senate position: The hemp‑ban text was removed from the Senate bill after Sen. Rand Paul vowed to hold up the package, setting up a House–Senate clash. Cannabis Business Times

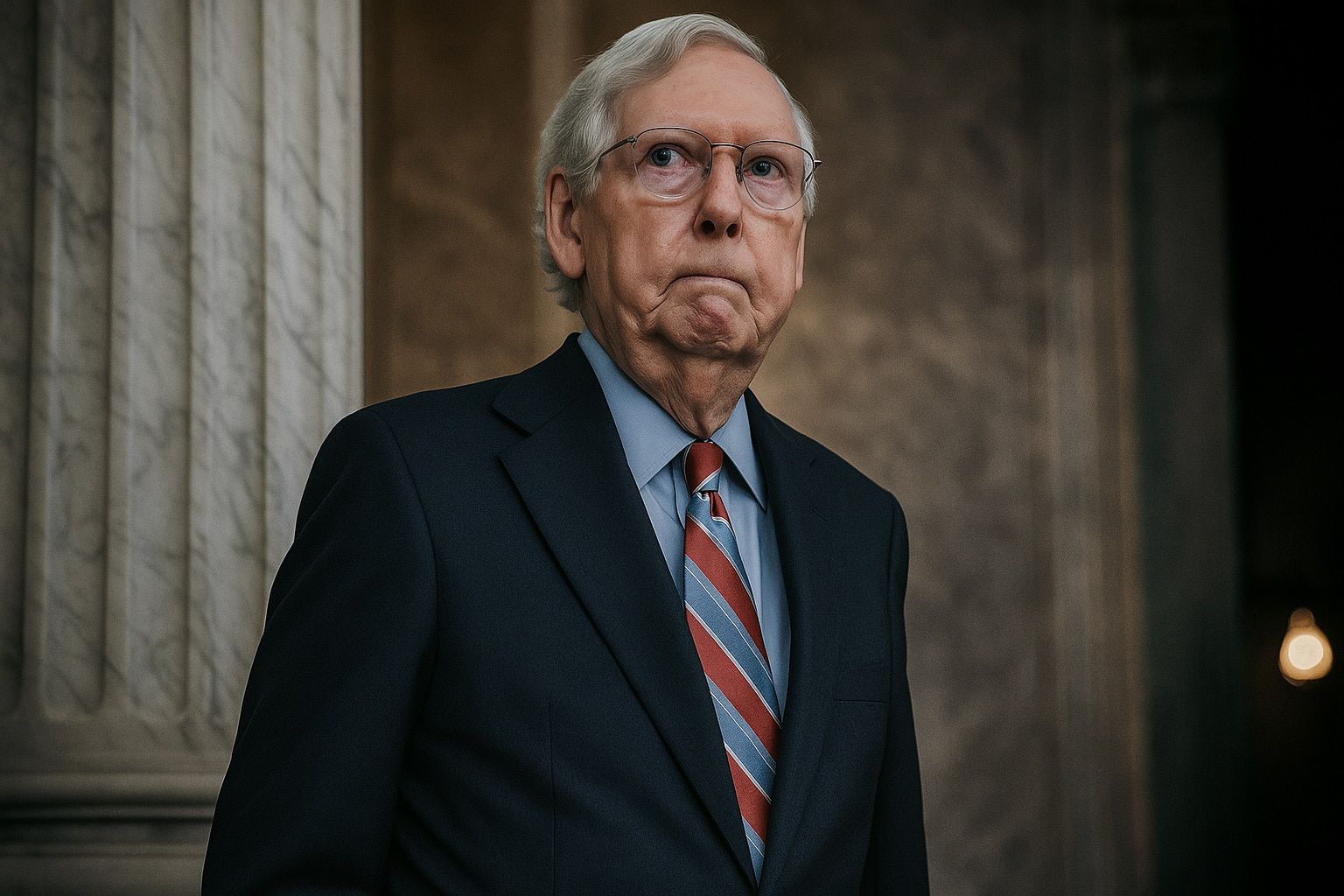

- Counter‑proposal: Paul’s HEMP Act of 2025 (S.2112) would do the opposite—raise hemp’s THC cap to 1% and direct testing toward finished products. That bill underscores GOP divisions, especially within Kentucky’s delegation, as Minority Leader Mitch McConnell has argued to “close the loophole.” Congress.gov+1

- Today’s political temperature: Commentators highlight McConnell’s shift—from hemp champion in 2018 to supporting appropriations language that would effectively end the intoxicating‑hemp market—while Paul signals he’ll keep blocking a blanket ban. counterpunch.org+1

States aren’t waiting

- Ohio: Gov. Mike DeWine declared a “consumer product emergency” to halt sales of intoxicating hemp products. A temporary restraining order now pauses enforcement as litigation proceeds. The order targeted products with >0.5 mg THC per serving or >2 mg per package sold outside licensed dispensaries. Ohio.gov+2GovDelivery+2

- Arizona: AG Kris Mayes told retailers and police that selling THC‑infused foods/drinks without a marijuana license violates state law—upending a previously thriving hemp‑drink market. Azag+1

- Minnesota: New guidance tightened testing, labeling and shipping rules, prompting some hemp companies to consider leaving the state—even as Target’s pilot underscores strong local demand. MJBizDaily+1

Business keeps moving: Retail rollout & MSO pivots

Despite regulatory headwinds, mainstream retailers are leaning in. Circle K plans to stock Allen Iverson‑branded hemp‑THC beverages in select Southern states this quarter, with expansion into as many as 3,000 U.S. stores next year where allowed. Target placed a dozen THC drink brands into 10 Minnesota stores as a test. MJBizDaily+1

On the operator side, multistate cannabis companies are using hemp to reach consumers beyond dispensaries. MariMed announced hemp‑derived THC products (starting with its Vibations drink mix), joining Curaleaf and Trulieve in building hemp beverage lines and distribution. As New Cannabis Ventures put it in today’s newsletter: the “Hemp War” is here, pitting state‑licensed cannabis players and CPG retailers against a fast‑evolving patchwork of rules. Cannabis Business Times+1

By the numbers

The USDA’s National Agricultural Statistics Service estimates the value of U.S. hemp production reached $445 million in 2024—up ~40% year‑over‑year—driven largely by floral hemp. Industry advocates claim the broader hemp economy touches $28+ billion and hundreds of thousands of jobs (advocacy estimate), amplifying the stakes of any federal clampdown. cannabissciencetech.com+1

What’s actually in the proposed federal changes?

A CRS explainer shows the House/Senate committee language would:

- redefine hemp using total THC (including THCA);

- exclude synthetic or non‑naturally occurring cannabinoids; and

- allow HHS/USDA to deem products with “quantifiable” THC outside hemp’s definition—sending them back under controlled‑substance rules.

The Senate‑passed bill removed the provision, but House negotiators could revive it in conference. Congress.gov

Investor & founder takeaway: details determine margins

For early‑stage hemp beverage brands, regulatory strategy is now a core operating expense. Where you sell—and how you package, label, test and ship—can make or break unit economics. States imposing alcohol‑style licensing, in‑state testing mandates, mail‑order limits or child‑resistant packaging rules will materially change COGS and time‑to‑shelf. That’s why capital is favoring teams with compliance roadmaps tailored market‑by‑market. JD Supra

What to watch next

- Appropriations endgame: Does the final FY26 ag‑FDA bill include any hemp definitions or bans—and can McConnell/Harris keep them intact against Paul’s opposition? Congress.gov

- Retail normalization vs. state crackdowns: Will Circle K and Target expansions continue—or hit more Ohio‑ or Arizona‑style roadblocks? Azag+3MJBizDaily+3Marijuana Moment+3

- Alternate federal pathways: If a sweeping ban stalls, Congress could still mandate FDA/HHS rulemaking on age gates, labeling, potency caps and testing—an approach now favored by some industry groups and several senators. Marijuana Moment

Sources & further reading (selected)

- Consumer Brands, big‑brand pressure & Hill dynamics: Marijuana Moment report (Nov. 6, 2025). Marijuana Moment

- Beverage‑alcohol groups’ letter: Just‑Drinks coverage (Nov. 6, 2025). Just Drinks

- 39 AGs letter: NAAG press office (Oct. 24, 2025). NAAG

- Senate removal of hemp‑ban text: Cannabis Business Times (July 30, 2025). Cannabis Business Times

- CRS explainer on FY26 hemp provisions: Congress.gov (updated Aug. 28, 2025). Congress.gov

- Ohio emergency order & TRO: Governor’s office; court update via Buchanan Ingersoll & Rooney (Oct. 2025). Ohio.gov+2GovDelivery+2

- Arizona AG enforcement posture: AG’s press release and letter (Mar. 24, 2025). Azag+1

- Minnesota market changes: MJBizDaily (Nov. 5, 2025). MJBizDaily

- Target pilot; Circle K rollout: Marijuana Moment (Oct. 10, 2025); MJBizDaily (Oct. 23, 2025). Marijuana Moment+1

- MariMed hemp entry: Cannabis Business Times (Nov. 4, 2025). Cannabis Business Times

- Industry lens—“The Hemp War”: New Cannabis Ventures newsletter (Nov. 6, 2025). New Cannabis Ventures

- Hemp production stats: Cannabis Science & Tech summary of NASS 2024 report (Apr. 29, 2025). cannabissciencetech.com