Microsoft (NASDAQ: MSFT) finished Wednesday lower as investors tried to make sense of a powerful mix of AI expansion, rising capital spending, fresh analyst calls and new cloud partnerships.

As of the U.S. close on 19 November 2025, Microsoft shares traded around $487.12, down roughly 1.3–1.4% on the day, leaving the company about 12% below its 52‑week high of $555.45 but still well above its 52‑week low of $344.79. FT Markets+1

Below is a news-style rundown of the key developments moving Microsoft stock today.

Microsoft stock price today: where MSFT stands

- Last close (Nov 19, 2025): ~$487.12

- Day’s change: about ‑1.35% Barchart.com

- Intraday range: roughly $482.8 – $495.4 Investing.com+1

- 52‑week range: $344.79 – $555.45 Investing.com+1

- Market cap: around $3.7–3.9 trillion

- Trailing earnings per share (EPS): about $14.06

- Trailing P/E multiple: mid‑30s (about 35–37x). FT Markets

Technically, MSFT is now trading below both its 50‑day and 200‑day moving averages (around $514 and $498 respectively), a sign that short‑term momentum has swung toward sellers after this year’s powerful AI‑driven run. Yahoo Finance+1

Traders are watching support in the high‑$470s to high‑$480s, with some technical analysts highlighting the $468–$480 zone as the next key area if selling pressure resumes. FX Leaders+1

1. AI megadeal with Anthropic: growth engine or capex overreach?

One of the biggest overhangs—and opportunities—for Microsoft today is its deepening push into generative AI infrastructure.

$30 billion Azure commitment and up to $5 billion MSFT investment

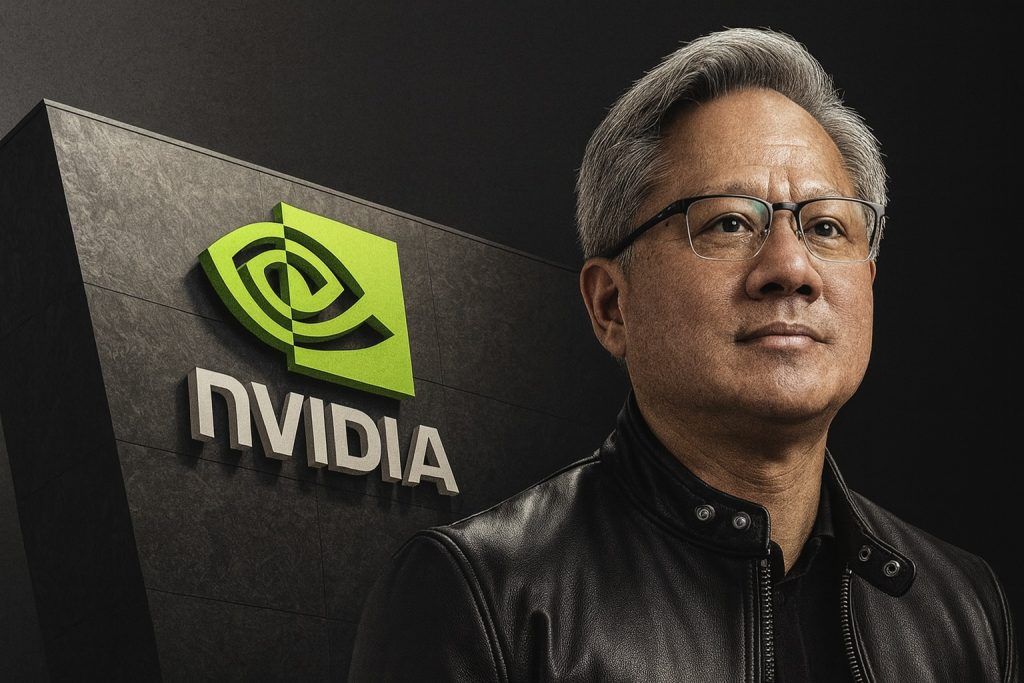

On Tuesday, Reuters reported that Anthropic will commit about $30 billion of cloud spending to Microsoft Azure, while Nvidia will invest up to $10 billion and Microsoft up to $5 billion into Anthropic as part of a new partnership. Reuters

The deal aims to:

- Secure long‑term AI workloads for Azure,

- Diversify Microsoft’s model ecosystem beyond OpenAI, and

- Tighten collaboration between Microsoft, Nvidia and Anthropic in high‑end AI compute.

Analysts see the agreement as strategically important, but capital‑intensive. It comes on top of Microsoft’s already record AI infrastructure spending, which jumped to nearly $35 billion of capex in the latest reported quarter. Reuters

Capex fears: echoes of the dot‑com bubble?

In late October, Microsoft’s quarterly report showed:

- Revenue: about $77.7 billion, up 18% year‑over‑year, beating estimates

- Azure cloud growth: roughly 40%, ahead of expectations

- Capex: near $35 billion, with guidance that spending would rise further this fiscal year. Reuters

That surge in capex triggered concern that AI infrastructure spending could be outpacing visible returns, with some commentators explicitly comparing the mood to the late‑1990s tech bubble. Reuters

Those worries are very much alive today:

- FXLeaders notes that Microsoft stock is down about 5% so far this week, as investors question whether soaring AI expenses and internal tensions are undermining the bull case. FX Leaders+1

- The article highlights a failed breakout above $550+, followed by a slide below $500 and increasing focus on support around $468.

In short: the Anthropic megadeal reinforces Microsoft’s AI leadership narrative, but it also feeds a growing debate about whether Gen‑AI revenues can justify the enormous capital bill.

2. Analyst split: Redburn downgrade vs. Wall Street AI bulls

Today’s move in MSFT also reflects sharply divergent analyst views about how profitable Microsoft’s AI push will be.

Redburn: downgrade on “Gen‑AI economics” fears

On November 19, Rothschild & Co Redburn downgraded Microsoft from Buy to Neutral and cut its price target from $560 to $500. Finviz+1

Analyst Alexander Haissl argues that:

- Gen‑AI revenues create far less value than “cloud 1.0”: he estimates it may now take roughly six times more capex to generate the same level of value as traditional cloud services. Investorsobserver

- That makes the business structurally more capital‑intensive, weighing on long‑term cash‑flow potential.

- Microsoft may be suffering “value leakage” in Microsoft 365 because integrating third‑party AI models (OpenAI, Anthropic) shifts some of the economics away from Microsoft itself. Investorsobserver

The downgrade landed just as broader commentary—including a MarketWatch piece warning that Microsoft could fall behind Google on at least one “tech supremacy” measure—threw extra attention on the MSFT vs. Alphabet rivalry. MarketWatch+1

JPMorgan, Guggenheim, TD Cowen and KeyBanc stay bullish

At the same time, several big firms reiterated bullish views on Microsoft today:

- JPMorgan reissued a Buy rating, with data compiled by MarketBeat showing a consensus price target around $634 and dozens of Buy ratings versus only a handful of Holds. MarketBeat

- Guggenheim maintained a Buy rating and $675 price target, almost 37% upside from around $494 at the time of their note, while acknowledging EU investigations into Azure’s gatekeeper status under the Digital Markets Act as an overhang. Investing.com

- TD Cowen reiterated a Buy rating with a $655 target, praising Microsoft’s Ignite announcements and its Intelligence and Agent 365 control planes as tools that can ground AI in data, governance and ROI measurement. Investing.com

- KeyBanc kept an Overweight rating and a $630 target, emphasising the strategic logic of Microsoft’s up‑to‑$5 billion investment in Anthropic and its $30B Azure commitment, along with broader AI advancements showcased at Ignite. Investing.com+1

Meanwhile, a Zacks/Nasdaq note described Microsoft as a “strong growth stock” with:

- A Growth Style Score of A,

- Forecast earnings growth of ~14.4% for the current fiscal year,

- 12 upward earnings revisions for fiscal 2026 in the last 60 days, and

- An average earnings surprise of about +8.5%. Nasdaq

The net result: fundamental analysts remain mostly bullish, but valuation and AI capex risks are becoming harder to ignore, particularly after the Redburn downgrade.

3. Ignite 2025: Agentic AI, Copilot upgrades and a new “AI control plane”

Microsoft’s Ignite 2025 conference in San Francisco is another major driver of today’s trading.

Full AI lifecycle vision

In an official blog post, Microsoft laid out a vision for managing the “complete lifecycle of AI”, from the datacenter and models to the tools and workflows used by end‑users, stressing that AI must be built into products “at every layer” rather than bolted on at the end. The Official Microsoft Blog

The company highlighted themes such as:

- AI woven into day‑to‑day productivity,

- New tooling to help organizations become so‑called “Frontier Firms” using AI to unlock innovation, and

- Tight integration between infrastructure (Azure, Fabric) and application layers (Microsoft 365, Copilot).

Agent 365 and AI governance

A detailed Ignite recap from Office 365 for IT Pros and coverage from TipRanks show that Microsoft introduced Agent 365, a new admin experience for managing AI agents across Microsoft 365. Office 365 for IT Pros+1

Key points:

- Agent 365 lets IT teams view, control and “quarantine” AI agents, tackling risks like agents potentially downloading malware if left unchecked. tipranks.com

- Microsoft plans to roll out agent management features across Microsoft 365, tying into Security Copilot and Purview for data‑loss prevention and compliance. Office 365 for IT Pros

- Security Copilot is being bundled into Microsoft 365 E5, with usage measured in Security Compute Units (SCUs) and the option to purchase additional capacity for intensive workloads. Office 365 for IT Pros

TD Cowen sees these tools as addressing some of the biggest enterprise AI pain points—ROI tracking, governance and security—while TipRanks notes that markets still pushed MSFT shares down nearly 1.5% intraday amid broader AI jitters. Investing.com+1

Put simply, Ignite underlines how central AI has become to Microsoft’s entire product stack, but also surfaces fears about complexity, security and cost.

4. New deals: sovereign cloud in Saudi Arabia and deeper IBM collaboration

Beyond AI infrastructure headlines, Microsoft announced or was linked to several strategic deals that help explain today’s news flow.

Saudi PIF & SITE: sovereign cloud push in the Kingdom

On Wednesday, Saudi Arabia’s Public Investment Fund (PIF), Saudi Information Technology Company (SITE) and Microsoft signed a memorandum of understanding to explore delivering Microsoft sovereign‑cloud services in Saudi Arabia. Reuters+1

According to Reuters:

- The MoU aims to boost Saudi digital infrastructure while maintaining local data sovereignty,

- It aligns with Vision 2030, the kingdom’s economic diversification plan, and

- It positions Azure as a core platform for future regulated and government workloads in the region.

The financial impact will not be immediate, but the move reinforces Microsoft’s global cloud footprint and potentially deepens its long‑term relationship with a major sovereign wealth fund.

IBM expands AI consulting with Microsoft Copilot

In a separate development, IBM announced an expansion of its collaboration with Microsoft:

- IBM’s Consulting Advantage platform will integrate Microsoft Copilot, allowing IBM consultants to access the AI platform directly from within Word, Excel, PowerPoint, Teams and Outlook. Nasdaq

- IBM estimates the integrated tools delivered the equivalent of 250,000 hours saved annually, or about $35 million in value, in tests—illustrating the productivity lift AI copilots can provide. Nasdaq

While this headline is framed around IBM, it underscores growing enterprise adoption of Microsoft’s AI stack, which can support usage‑based revenue growth for Microsoft over time.

5. Growth profile and valuation: still a premium AI blue chip

Despite the recent pullback, Microsoft remains one of the most profitable and fastest‑growing megacap tech stocks:

- Earnings and revenue have consistently beaten expectations, most recently with EPS of $4.13 vs $3.65 and revenue of $77.67 billion, up 18.4% year‑over‑year. MarketBeat+1

- Zacks currently rates MSFT a Rank #3 (Hold) but gives it a Growth Score of A and notes strong upward revisions in earnings estimates. Nasdaq

- TipRanks data cited by TipRanks and Investing.com show 33 Buys and only 2 Holds in the last three months, with an average price target near $630, implying around 30% upside from current levels. tipranks.com+1

That said, the stock already trades at a mid‑30s P/E, a premium that bakes in robust AI‑driven growth and leaves little room for disappointment if AI capex fails to deliver high returns. FT Markets

6. Competitive pressure from Alphabet and the broader AI trade

Today’s move in MSFT can’t be viewed in isolation. AI‑linked megacaps are trading as a group, and Microsoft is juggling both leadership and rivalry:

- A Wall Street Journal live blog noted that Alphabet is getting close to surpassing Microsoft in market capitalization for the first time in seven years, as Google’s Gemini 3 launch and AI momentum lift GOOGL shares. wsj.com

- MarketWatch coverage highlighted how Microsoft’s downgrade by Redburn reflects deeper worries about the economics of Gen‑AI across hyperscalers, not just Microsoft. MarketWatch+1

- Broader macro coverage from Barron’s has framed today’s trading as part of a tug‑of‑war between AI spending fears and the conviction that companies like Microsoft, Nvidia and Alphabet “won’t blink” on long‑term investment. barrons.com+1

With Nvidia reporting earnings after the close, investors see Microsoft as a key piece of the broader “AI infrastructure” trade, which has become highly sensitive to any hint of an AI bubble or spending slowdown. investopedia.com+1

7. What today’s Microsoft stock action means for investors

For investors watching MSFT today, 19 November 2025, several themes stand out:

- Short‑term tone is cautious but not panicked

- The stock is down about 12% from its 52‑week high and roughly 5% this week, but remains up strongly over the last 12 months. Barchart.com+1

- Technicals have weakened (below the 50‑ and 200‑day averages), yet support zones in the $470s–$480sremain intact for now. Yahoo Finance+2FX Leaders+2

- Fundamentals are strong, but AI ROI is under the microscope

- Azure and Microsoft Cloud continue to post high‑teens to 20%+ growth, and earnings are beating expectations. Reuters+1

- The question is not whether AI will drive revenue, but how profitable that growth will be given massive capex needs and revenue sharing with partners like OpenAI and Anthropic. Reuters+2Investorsobserver+2

- Wall Street remains overwhelmingly bullish, but more nuanced

- Most big banks keep Buy/Overweight ratings with ambitious price targets ($630–$675+), yet Redburn’s downgrade and bubble talk show that skepticism is rising at the margin. Investorsobserver+3Investing.com+3Investin…

- AI product momentum is real

- Ignite announcements around Agent 365, Security Copilot and Copilot enhancements should deepen Microsoft’s grip on enterprise productivity and security workloads, potentially supporting multi‑year growth in both cloud and seat‑based licensing. Office 365 for IT Pros+2The Official Micro…

- Regulation and competition are wild cards

- EU DMA investigations into Azure, Alphabet’s rising market cap and broader regulatory scrutiny of big tech cloud players could affect long‑term margins and strategic flexibility. Investing.com+2wsj.com+2

8. Key things to watch after today

Looking beyond today’s closing print, investors in Microsoft may want to track:

- Nvidia’s earnings and guidance – any signal about AI demand or spending discipline will ripple through Microsoft and other AI leaders. investopedia.com+1

- Further commentary on the Anthropic deal – including details on contract structure, timing of Azure revenue recognition and capital intensity. Reuters

- Updates on EU cloud investigations and any other regulatory actions targeting Azure and Microsoft 365. Investing.com

- Adoption data for Agent 365, Copilot and Security Copilot, which could help quantify AI’s monetisation path inside Microsoft 365. Office 365 for IT Pros+2tipranks.com+2

- Additional analyst revisions to price targets and ratings as the market processes Redburn’s cautious stance vs. bullish targets from JPMorgan, TD Cowen, Guggenheim and KeyBanc. Investorsobserver+4MarketBeat+4Investing.c…

For now, Microsoft stock on November 19, 2025 sits at the crossroads of exceptional AI‑driven growth and historically large capital spending, with today’s modest decline reflecting that delicate balance between long‑term optimism and near‑term AI fatigue.