Strategy Inc. (NASDAQ: MSTR) — the company formerly known as MicroStrategy and still traded under the ticker MSTR — is back in the spotlight today as its stock continues to slide alongside a sharp pullback in Bitcoin.

At last check on Friday, MSTR was trading around $208–$210 per share, hovering just above a new 52‑week low after a steep drop on Thursday. The stock is now down roughly 30% year‑to‑date and more than 50% from its 2025 peak, even though Bitcoin itself remains slightly positive for the year. Coin Edition

At the same time, the company’s enormous Bitcoin treasury — officially reported at about 641,692 BTC — has grown so large that, on simple numbers, Strategy’s equity market cap has slipped to roughly the same level as the value of its coins, triggering headlines about a “negative premium” and a potential inflection point for MSTR stock. Bitcoin Treasuries+2The Economic Times+2

Below is a breakdown of what’s happening with MSTR stock today, November 14, 2025, and what investors are watching next.

MSTR stock today: price action and performance

- Last price: around $208.54 per share (recent data, Nasdaq) Coin Edition

- Thursday’s session: MSTR fell about 7%, from roughly $224.6 to $208.5, touching an intraday low near $207.03, now marked as a fresh 52‑week low. StockInvest+1

- 12‑month performance: MSTR is down about 41–42% over the past year, while Bitcoin has gained roughly 14–15% in the same period, reversing the stock’s historic tendency to outperform BTC on the upside. Coin Edition

- Year‑to‑date: as of today, MSTR is down about 30.5% in 2025, whereas Bitcoin is up around 2–3%. Coin Edition+1

Crypto‑focused outlet CoinEdition notes that since the company adopted its Bitcoin treasury strategy in August 2020, MSTR still shows roughly 16.9x total returns versus Bitcoin’s 8.2x — but that long‑term outperformance has “evaporated” over the last 12 months as the stock has sharply lagged BTC. Coin Edition

In other words, the “leveraged Bitcoin proxy” trade that worked spectacularly for years is now working in reverse.

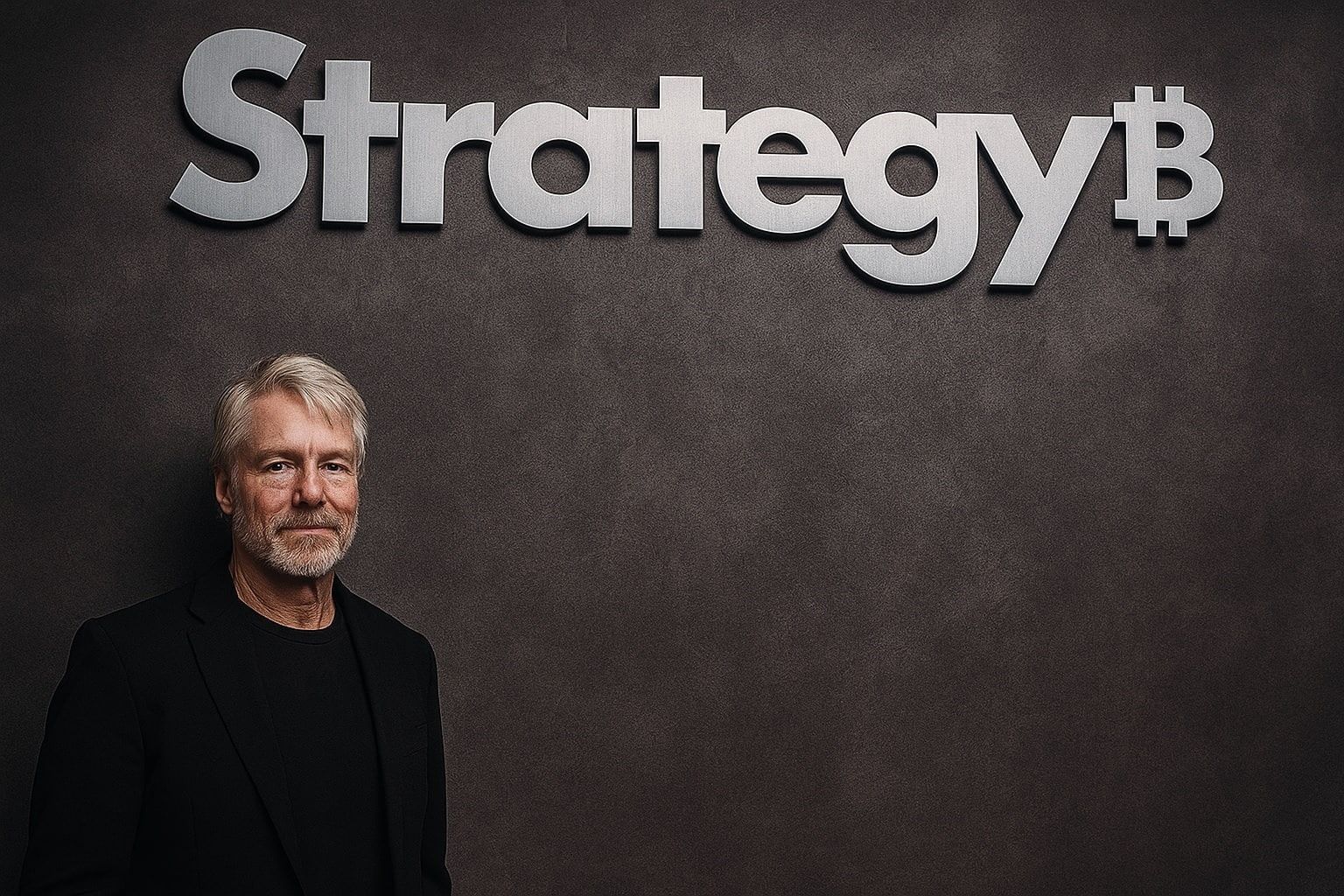

Rebrand reminder: MicroStrategy is now Strategy Inc. — but still MSTR

For readers returning to the story after a while, a quick branding update:

- In February 2025, MicroStrategy announced it was rebranding and “doing business as” Strategy, positioning itself as the world’s first dedicated Bitcoin Treasury Company. strategy.com+1

- On August 11, 2025, the firm completed a legal name change from MicroStrategy Incorporated to Strategy Inc., but kept the ticker symbol MSTR on Nasdaq. strategy.com+2Yahoo Finance+2

Most crypto media now call it Strategy, while many general‑market outlets still refer to MicroStrategy (MSTR), which is why you’ll see both names in today’s coverage.

Market cap vs Bitcoin holdings: has MSTR really gone “on sale”?

The central narrative today is about value vs. structure.

1. The simple math: equity market cap ≈ value of BTC pile

According to data compiled by BitcoinTreasuries and Strategy’s own dashboards:

- Strategy holds about 641,692 BTC.

- The cost basis of that stack is roughly $47.5 billion, or an average of about $74,085 per bitcoin. Bitcoin Treasuries+1

- At recent BTC prices near $95,000–$100,000, that treasury is worth around $60–63 billion, depending on intraday moves. Bitcoin Treasuries+2CoinDesk+2

- Strategy’s basic equity market cap is shown around $60 billion on BitcoinTreasuries and other trackers. Bitcoin Treasuries+2Veritas News+2

That means on a simple “market cap vs. liquid BTC” basis, MSTR has briefly traded at or slightly below the value of its Bitcoin holdings.

This has prompted a wave of headlines and social‑media chatter:

- 99Bitcoins called it a “stock death spiral”, highlighting how the market has flipped from paying a large premium over NAV to potentially discounting the equity wrapper. 99Bitcoins

- Protos framed it as the mNAV (modified net asset value) story coming full circle, with the once‑celebrated premium now turning negative. Protos+1

- CoinCentral and others stressed that MSTR has hit a 52‑week low just as this negative premium appears, underscoring how far sentiment has swung. CoinCentral+1

On the surface, that “discount to BTC” looks like a value investor’s dream: buy $1 of Bitcoin for 95–98 cents, plus a small software business, by owning the stock.

2. The catch: debt, preferred stock and enterprise value

However, equity market cap is only part of the story.

Multiple outlets — including CoinDesk, Jinse/Bitget and Veritas / IT Boltwise — point out that once you include Strategy’s convertible notes and preferred shares, the picture flips: CoinDesk+2Veritas News+2

- Enterprise value (EV) is estimated around $75 billion. Bitcoin Treasuries+1

- On that basis, the company’s modified NAV (mNAV) — EV divided by the value of its Bitcoin — is roughly 1.2×, not below 1. CryptoTicker+2CoinDesk+2

So:

On a pure “stock price vs. BTC holdings” metric, MSTR looks cheap. Once you layer in debt and preferred obligations, it still trades at a premium to its coins.

Analysts warn that this capital structure is exactly what makes Strategy so sensitive to market mood: when the stock trades high, issuing new shares and preferreds to buy more BTC is easy; when the stock trades low, dilution becomes painful, and refinancing risk becomes more real. CryptoTicker+2Financial Times+2

Why MSTR is under pressure: Bitcoin slump + funding fears

Today’s slide in MSTR is happening against a rough backdrop for crypto:

- Bitcoin has fallen back below the psychologically important $100,000 level, with sharp liquidations across derivatives markets and spot ETFs seeing heavy outflows in recent sessions. CoinDesk+1

For Strategy, that matters doubly:

- Treasury mark‑to‑market: When BTC drops, the economic value of the company’s main asset — its coin pile — shrinks in real time.

- Equity sentiment: Revenue from the underlying software business is relatively small compared to the BTC bet, so equity investors treat MSTR almost like a high‑beta Bitcoin ETF with leverage and credit risk attached.

Recent coverage highlights several additional headwinds:

- CryptoTicker notes that Strategy has dramatically slowed its Bitcoin accumulation, from more than 400,000 BTC purchased over the past 12 months to only about 12,746 BTC since August 11, suggesting that raising fresh capital at today’s lower stock price is getting much harder. CryptoTicker+1

- The company has leaned heavily on perpetual preferred shares, with annual dividend obligations reportedly exceeding $700 million, which amplifies pressure on the common stock when the share price is weak. CryptoTicker

- Convertible notes totaling more than $8 billion begin to mature in 2028; if MSTR is still depressed then, converting that debt into equity will be difficult, raising the specter of refinancing or even Bitcoin sales to raise cash. CryptoTicker

In a detailed technical note this week, FXStreet’s Elliott Wave team went so far as to call the chart a “confirmed bearish sequence”, projecting potential downside targets between $138 and $63 before a long‑term bottom forms — though they also expect a significant bounce once that “extreme” zone is reached. FXStreet

Rumors of a 47,000 BTC sale: what we know (and don’t)

Adding fuel to the debate today is a new on‑chain rumor:

- StreetInsider, citing crypto analytics firm Arkham, reported this morning that wallets linked to Strategy sold roughly 47,000 BTC, allegedly reducing tracked holdings from 484,000 to 437,000 coins. The piece is explicitly filed under “Rumors” and “Trader Talk.” StreetInsider.com

So far:

- Strategy has not publicly confirmed any large Bitcoin sale via press release or SEC filing.

- Independent trackers such as BitcoinTreasuries still show the company with 641,692 BTC as of November 10, following a modest 487‑BTC purchase earlier this week. Bitcoin Treasuries

There are several possibilities here:

- Arkham’s wallet tagging could be flagging internal movements (for custody, collateral, or credit products) that don’t actually represent a disposal of BTC.

- The trackers that show 641k BTC may not yet have updated for any potential sale.

- Or the on‑chain interpretation could simply be wrong or incomplete.

Until Strategy issues a formal statement, most analysts are treating the 47k‑BTC figure as unconfirmed and potentially misinterpreted, but traders are clearly paying attention — especially because forced or voluntary BTC sales have always been seen as a key tail‑risk in the MSTR story.

Insider selling: EVP Shao Wei‑Ming continues pre‑planned stock sales

Another storyline today involves insider activity:

- Crypto news site Coinfomania reports that Shao Wei‑Ming, Strategy’s Executive Vice President and General Counsel, sold 2,600 MSTR shares for about $581,535 at an average price of $223.67, under a pre‑scheduled Rule 10b5‑1 trading plan. Coinfomania

- The article notes that this follows 10,668 shares sold earlier in the week, and larger blocks earlier in 2025 — including 52,500 shares in July and 30,000 shares in October — bringing his total stock sales this year into the tens of millions of dollars. Coinfomania+1

Crucially, the reporting — and the associated SEC Form 4 filings — frame these transactions as part of a long‑running, structured exit tied to Shao’s retirement planning, not a sudden reaction to recent price action.

Nonetheless, the optics of continued insider selling at a time when the stock is hitting new lows add to the sense that insiders may be taking some risk off the table, even as the company continues to accumulate Bitcoin at the corporate level.

Saylor stays ultra‑bullish: “Bitcoin will be bigger than gold”

Despite the drawdown in MSTR, Executive Chairman Michael Saylor continues to lean into his ultra‑bullish Bitcoin thesis.

At Yahoo Finance’s Invest event, summarized today by The Economic Times, Saylor said he has “no doubt” that Bitcoin will become a larger asset class than gold by 2035. With gold’s market value around $29 trillion, that projection implies a potential Bitcoin price above $1.4 million per coin over the next decade. The Economic Times

Key takeaways from that appearance:

- Saylor framed current negative sentiment as an opportunity, arguing that “fundamentals are better than they were 12 months ago” even as prices wobble. The Economic Times+1

- He reiterated that Strategy’s strategy is to use equity, debt and operating cash flows to accumulate as much Bitcoin as possible, treating BTC as “digital capital” rather than a speculative asset. Investopedia+2CoinGecko+2

- Recent filings show Strategy added another 487 BTC, bringing its stack to 641,692 BTC — roughly 3% of all coins that will ever exist. Bitcoin Treasuries+1

In short, while the stock is wobbling, the message from the top remains unchanged: stay long Bitcoin, stay long Strategy, and ride out volatility.

How analysts and traders are reading today’s setup

Different camps are seeing very different stories in the same data.

The “deep value” / Bitcoin‑bull view

This camp argues:

- At or below “BTC‑par” market cap, MSTR starts to resemble a levered closed‑end fund on Bitcoin, with a free call option on the analytics software business and any future fee‑based Bitcoin products. Bitcoin Treasuries+2PANews Lab+2

- If BTC eventually follows anything like Saylor’s “bigger than gold” path, the current drawdown may look like a temporary air pocket in a much longer trend. The Economic Times

Some long‑term holders are therefore framing today as an accumulation opportunity, especially for investors who already wanted Bitcoin exposure but are comfortable with extra volatility and corporate‑governance risk.

The “structural risk” / skeptic view

Skeptics, including several crypto and traditional‑finance commentators, focus on:

- The shrinking premium between enterprise value and BTC holdings, which makes the equity less attractive as a vehicle for new capital raises. CoinDesk+2Financial Times+2

- Heavy reliance on preferred shares, at‑the‑market equity programs and convertible notes, which creates a loop of ongoing dilution and leverage just to maintain BTC buying. CryptoTicker+1

- The risk that if Bitcoin’s price stalls or falls while interest rates remain elevated, Strategy might be forced to slow or halt BTC accumulation — and, in more bearish scenarios, could eventually need to sell coins to meet obligations.

That’s why some outlets, like CryptoTicker and 99Bitcoins, use charged language such as “shareholders lost everything” or even speculate about “another FTX” if the equity keeps collapsing — although their own analysis explicitly concludes the situation is dangerous, not yet existential, assuming BTC does not suffer a prolonged crash. CryptoTicker+1

Technical traders

Chart‑focused traders are watching:

- The break below February 2025 lows, which FXStreet’s Elliott Wave team interprets as confirmation of a larger corrective pattern with potential continuation toward the $138–$63 range before a durable bottom. FXStreet

- Elevated options activity around near‑dated puts and calls, with Nasdaq data showing tens of thousands of contracts changing hands today, as traders position for further volatility. Nasdaq

What today’s move could mean for investors

For short‑term traders:

- Volatility is likely to remain high as long as Bitcoin is whipsawing around the $95,000–$100,000 band and rumors about Strategy’s on‑chain moves circulate.

- Intraday headlines — especially any confirmation or denial of a large BTC sale — could trigger sharp spikes in both directions.

For long‑term Bitcoin believers:

- Today’s pricing reinforces that MSTR is no longer a simple, clean proxy for BTC. It’s a levered, structurally complex vehicle whose returns can diverge significantly from the underlying coin, especially in a choppy late‑cycle environment. Coin Edition+2CoinDesk+2

- Understanding mNAV, debt maturities, preferred obligations and dilution mechanics is now as important as having a view on Bitcoin itself.

For cautious or traditional investors:

- The S&P 500’s recent decision to exclude Strategy from the index despite its size, and commentary from banks like JPMorgan and outlets like the Financial Times, suggest that some institutional gatekeepers increasingly view MSTR as closer to a crypto investment fund than a typical operating company. Financial Times+2MarketWatch+2

- If that stance persists, MSTR may see less passive inflow than its market cap alone would otherwise justify, which can amplify volatility on both the upside and downside.

Key risks and catalysts to watch next

Going forward, MSTR watchers will be tuned into:

- Bitcoin price direction: A sustained move back above prior highs would relieve pressure; a deeper slide toward Saylor’s average cost ($74k) or below would intensify it. Bitcoin Treasuries+1

- Clarification on the 47k BTC rumor: Any filing or press release confirming or denying large sales will be critical for sentiment. StreetInsider.com+1

- Updates to the BTC treasury dashboard: If Strategy’s own site or BitcoinTreasuries revises holdings sharply lower, that would validate on‑chain interpretations and force a reevaluation of NAV math. Bitcoin Treasuries+1

- Future capital raises: New preferred share offerings, bond issuances or at‑the‑market equity programs will show whether the company can still tap markets on acceptable terms. Bitcoin Treasuries+1

- Macro and rates: Higher‑for‑longer interest rates increase the cost of funding Strategy’s BTC bet and reduce the appeal of speculative risk assets generally.

Final word (and a quick disclaimer)

Today, November 14, 2025, MSTR sits at the intersection of historic conviction and mounting structural risk:

- It is simultaneously one of the largest corporate Bitcoin holders in the world and a deeply controversial, highly leveraged equity whose valuation now swings more on crypto and credit sentiment than on software fundamentals.

Whether that makes MSTR a rare bargain or a value trap depends on your views about:

- Bitcoin’s long‑term trajectory, and

- Strategy’s ability to manage its balance sheet and capital structure through turbulence.

Nothing here is financial advice. This article is for information and news purposes only. If you are considering investing in MSTR, Bitcoin, or any related instruments, you should do your own research and, where appropriate, consult a qualified financial advisor.