Key Facts & Stock Snapshot (as of Oct 8, 2025)

- Company & Ticker: Nuburu, Inc. (Ticker: BURU) – listed on the NYSE American exchangestocktitan.netstocktitan.net.

- Industry: High-power blue laser technology with a new strategic focus on defense & securityapplicationsts2.techts2.tech.

- Founded/Headquarters: Founded in 2015; headquartered in Centennial, Coloradoir.nuburu.net.

- Current Stock Price: ~$0.68 per share (intraday Oct 8, 2025)benzinga.com – up over 300% in the past week following defense-related announcementsbenzinga.combenzinga.com. (52-week range: $0.12 – $1.60benzinga.com)

- Market Cap: Approximately $60 million (up from ~$30M on Oct 7ts2.tech due to the latest surge).

- Valuation Profile: Penny stock with high volatility – even after the rally, shares remain ~50% below their ~$0.80 level at the start of 2025ts2.tech. Beta is low (~0.4) but the stock trades more on company-specific news than market trendsts2.tech.

- Financials: Micro-revenue ($49k in Q2 2025, –78% YoY) and large losses (Q2 net loss $12.2M)ts2.tech. Accumulated deficit ~$150M; auditors have raised “going concern” warningsts2.tech. Cash was nearly exhausted (~$0.11M mid-2025) until a recent capital raise boosted cash to ~$6Mts2.tech. No dividends.

- Leadership: Executive Chairman Alessandro Zamboni (architect of the defense pivot) and Dario Barisoni (30-year defense tech veteran) were just appointed as co-CEOs effective Oct 1, 2025ts2.tech. Co-founder Dr. Mark Zediker (inventor of Nuburu’s laser tech) previously served as CEOir.nuburu.netnuburu.net.

- Business Model: Transitioning from an R&D-stage laser manufacturer to an integrated defense technology provider. Nuburu is leveraging its proprietary blue-laser IP along with acquisitions and partnerships to enter high-value defense, aerospace, and security marketsts2.techts2.tech.

Company Background: From Blue Lasers to Defense Tech Pivot

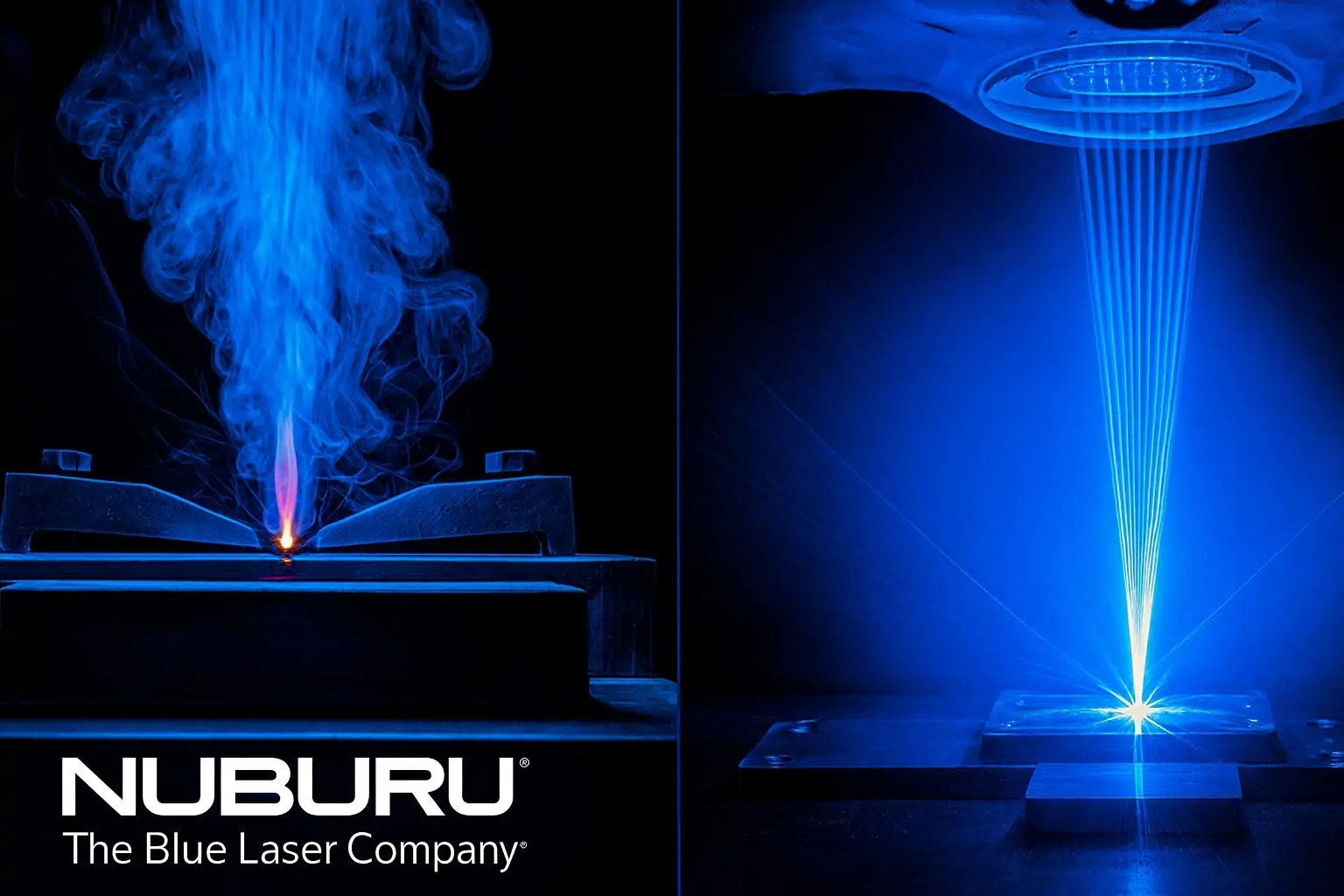

Nuburu’s Origins: Nuburu was founded in 2015 to develop high-power, high-brightness blue lasers for industrial applicationsir.nuburu.netir.nuburu.net. Blue lasers operate at shorter wavelengths than traditional infrared lasers, allowing much higher absorption in metals like copper, aluminum, gold, etc. The result is dramatically faster and higher-quality welding and 3D printing of these materials – up to 8× faster weld speeds with minimal defects compared to IR lasersts2.techts2.tech. Nuburu’s flagship products (e.g. AO series and newer NUBURU BL series lasers at 125–250 W) were designed for use in battery manufacturing, electric vehicles, aerospace, and electronics manufacturing, where copper and aluminum processing is criticalts2.techir.nuburu.net. In early 2023, Nuburu went public via a merger with Tailwind Acquisition Corp (a SPAC), listing on the NYSE American under ticker “BURU” on Feb 1, 2023ir.nuburu.net. Going public provided access to capital to fund product development – for instance, Nuburu showcased its new BL-series lasers at Photonics West 2023, highlighting their compact form factor and integration-ready designir.nuburu.netir.nuburu.net.

Core Technology Edge: Nuburu’s competitive moat is its patented high-power blue laser architecture. By combining many diode laser emitters while maintaining a very small beam parameter (high brightness), Nuburu achieved kilowatt-class blue lasers that can be fiber-coupled and scanned over large areasnuburu.netnuburu.net. This enables unprecedented processing speeds for metal welding/additive manufacturing – e.g. defect-free copper welds at high throughput – which were previously infeasible with infrared lasers. Nuburu’s lasers produce spatter-free, high-purity welds that improve yields and reliability in manufacturingnuburu.netnuburu.net. The technology earned Nuburu contracts with U.S. government agencies for R&D: notably, a U.S. Air Force SBIR project to develop a blue laser-based metal 3D printer, and multiple NASA contracts (including an $850k Phase II award in May 2025) to demonstrate laser “power beaming” for lunar applicationsts2.tech. These projects validate Nuburu’s innovation, although it’s worth noting that Nuburu’s financial struggles led to a debt restructuring in March 2025 in which its patent portfolio was transferred to creditors after a loan defaultts2.tech. (The company lists this loss of IP ownership as a risk factor going forwardts2.tech.)

Leadership & Ownership: Nuburu’s founding CEO Dr. Mark Zediker is a laser industry veteran who co-founded two prior laser companies and led Nuburu since 2015nuburu.net. However, as Nuburu’s focus shifted in 2023–2025 from pure industrial lasers toward defense applications, new leadership stepped in. Italian businessman Alessandro Zambonibecame Executive Chairman and orchestrated the strategic pivot; he has now assumed the co-CEO role (effective Oct 1, 2025) overseeing strategy, financing, and investor relationsts2.tech. Dario Barisoni, formerly a board member with three decades in European aerospace/defense, is the other co-CEO in charge of operations, M&A integration, and expanding Nuburu’s defense market presencets2.tech. This dual-CEO structure was announced to manage the “increased organizational complexity” of Nuburu’s turnaround, as the company pursues multiple acquisitions and defense programs simultaneouslyts2.techts2.tech. Management stated that adopting a co-CEO model underscores a commitment to “strategic growth and operational excellence… enabling us to capitalize on emerging opportunities and deliver long-term value for stakeholders”, as Zamboni explainedts2.tech. Insiders (management and directors) currently own <1% of shares, while ~41% of the float is held by institutions (likely legacy SPAC investors), unusual for a micro-capts2.tech. There is also a small but notable retail investor base actively trading the stock on forums.

Business Model Shift: Until 2023, Nuburu’s model was to sell laser hardware (and related service) into industrial markets. However, revenues never scaled meaningfully – trailing 12-month sales are effectively near-zero while operating expenses remain hights2.techts2.tech. Faced with cash burn and a collapsing share price, Nuburu has launched a dramatic pivot toward defense and security markets in 2025ts2.tech. The company’s new strategy (“Transformation Plan”) is to use its laser tech expertise as a cornerstone, but augment it with acquisitions of companies in complementary defense niches – thereby creating a multifaceted “Defense & Security Hub” under the Nuburu corporate umbrellats2.techir.nuburu.net. In practice, this means Nuburu formed a new subsidiary Nuburu Defense LLC in 2025 to house defense-related operationsir.nuburu.net. Through Nuburu Defense, the company is pursuing deals to acquire or partner with firms that have existing defense contracts, products, or profitable operations. This includes hardware (e.g. military vehicles, electronic warfare systems) and software (e.g. mission-critical resilience platforms), going beyond Nuburu’s own laser productsts2.techts2.tech. The aim is to integrate blue laser technology into advanced defense applications – from improved manufacturing of defense components, to next-gen directed-energy weapons, to counter-drone systems and even underwater communicationsts2.tech. Essentially, Nuburu is reinventing itself as a defense tech integrator, targeting high-value government and aerospace customers instead of commodity industrial manufacturingts2.tech. This is a bold gamble to tap much larger budgets and address urgent defense needs (e.g. NATO militaries seeking new laser-based systems). It’s also a race against time: Nuburu needs tangible revenue soon to justify its survival. Below we review the very recent developments in this pivot and what they mean for investors.

Recent News & Developments (Late Sept – Early Oct 2025)

Nuburu’s turnaround sprint has produced near-daily headlines in recent weeks, contributing to the stock’s explosive rally. Key developments in the days around October 8, 2025 include:

- Orbit Acquisition (Announced Oct 7, 2025): Nuburu revealed a binding agreement for its Nuburu Defense subsidiary to acquire Orbit S.r.l., an Italian software company specializing in operational resilience and crisis-management SaaSts2.tech. This deal expands Nuburu beyond lasers and hardware into the defense software arena, specifically platforms that help military and critical infrastructure operators anticipate and manage disruptionsts2.techts2.tech. Under the two-phase agreement, Nuburu Defense will make an initial investment (up to $5M over 36 months for ~10.7% stake) and later acquire the remaining equity by end of 2026 at a $12.5 million valuationts2.techts2.tech. Importantly, Nuburu gains “exclusive global distribution rights” to Orbit’s software for defense and mission-critical sectors immediatelyts2.techts2.tech – meaning Nuburu can start selling this SaaS to defense clients worldwide even before the acquisition fully closes. Orbit is a small but growing tech firm: independent analyses project its revenue at $3.2M in 2026, $10.8M in 2027, up to $19.3M by 2028 as its subscription model scalests2.techts2.tech. Notably, this is a related-party transaction – Orbit is currently 100% owned by Nuburu’s own Executive Chairman, Alessandro Zambonits2.techts2.tech. Nuburu’s board was transparent about the conflict, securing an external valuation and independent director approval to ensure fair termsts2.techts2.tech. Zamboni called the Orbit deal “a pivotal step in our evolution… [Orbit’s] software perfectly complements our defense hardware portfolio, allowing us to offer comprehensive, interoperable systems that protect mission-critical assets and enhance operational readiness.”ts2.tech Co-CEO Barisoni added that “together, we’re combining defense-grade hardware and software into a unified platform built for the future of mission assurance.”ts2.tech The market cheered this news – BURU stock jumped over 30% on Oct 7 when the announcement hit, with financial media noting “NUBURU stock soars after binding agreement to acquire Italian software firm.”ts2.tech. By the next day (Oct 8), shares continued to rocket up, briefly reaching around $0.85 before settling in the $0.65–$0.70 rangebenzinga.com.

- Quarterly Strategic Update (Sept 29, 2025): In late September, Nuburu issued a comprehensive business update via press release, outlining its recent progress and near-term plansts2.tech. Key highlights: the creation of Nuburu Defense LLC as the new hub for all defense/security activities; successful completion of a $12M capital raise(more details below) boosting cash to ~$6Mts2.tech; and an affirmation that Nuburu “does not anticipate” further share issuances under a previous financing programts2.tech – signaling that one source of dilution (related to a Silverback Capital agreement) is now closedts2.tech. The update provided concrete goals: management expects about $500k in billings in Q4 2025 (the first meaningful revenue in a long time) as initial defense deals kick ints2.tech. This would “establish a foundation for renewed revenue growth” heading into 2026 as acquisitions are consolidatedts2.tech. The company also touted the massive market opportunities it can now target: a ~$19.4 billion projected TAM in the electronic warfare sector by 2028 (relevant to the Tekne business)ts2.tech, and a $2.9–$3.6B market in 2025 for operational resilience software growing ~10% annually (Orbit’s domain)ts2.tech. Even capturing a tiny fraction of these markets could far eclipse Nuburu’s historically negligible revenuests2.tech. The update confirmed Nuburu’s plan (then in progress) to finalize the Orbit acquisition by end of Octoberir.nuburu.net. It also disclosed a second acquisition target: on Sept 23, Nuburu signed an agreement with an unnamed “key strategic partner” – described as a photonics company with advanced laser R&D, production facilities, and existing civil/military clients – to pursue acquiring a controlling stake in that partner by year-endts2.tech. Due to confidentiality, the partner wasn’t named, but this sounds like another European laser/photonics firm that would complement Nuburu’s core laser technologyts2.tech. Definitive agreements for this deal are hoped to be signed in Q4 2025ts2.tech. Finally, Nuburu’s update highlighted early wins from the Tekne alliance (see below), and noted organizational enhancements: the company is evaluating opening a new operating office in northern Virginia (close to the Pentagon and defense contractors) to support Nuburu Defenseir.nuburu.netir.nuburu.net, and has hired a new financial controller (starting Oct 1) and a revenue operations specialist to help integrate the incoming businessesir.nuburu.net. The upbeat tone of the report was underscored by Zamboni’s comment that Nuburu is “confident our focus on blue laser technology and the defense and security sectors will drive long-term growth and value creation for shareholders.”ir.nuburu.net.

- Tekne Partnership & Defense Contracts: Nuburu’s push into defense began with a deal announced in late August 2025 to acquire a majority stake in Tekne S.p.A., an Italian defense vehicle and electronics firm. While that acquisition is pending Italian regulatory approval (a “Golden Power” review by the government)ir.nuburu.netts2.tech, Nuburu has already started leveraging Tekne’s assets. According to the strategic update, after signing the agreement with Tekne on Aug 27, Nuburu helped Tekne secure and deliver a $6.6 million contract with a government agency in Bangladeshts2.tech. This contract, reportedly for military-grade vehicles or systems, was completed in Q3 – bringing immediate revenue. As one analysis noted, “the deal delivers to the company’s bottom line,” a welcome change for a firm that has had almost no revenue in recent quartersts2.tech. Nuburu and Tekne are now working to position Nuburu Defense LLC as a global reseller of Tekne’s defense products to NATO countriests2.tech. This involves setting up a U.S.-based joint venture with Tekne (80% owned by Nuburu Defense) to localize production of Tekne’s equipment for export marketsts2.tech. By doing so, Nuburu can help unlock Tekne’s hefty existing backlog (Tekne reportedly has a $500M order pipeline across various segmentsts2.tech) and funnel some of that business through Nuburu Defense. Indeed, part of the $12M fundraising is earmarked to increase Nuburu’s stake in Tekne to 67% by end of 2025 (pending approvals) and to fund working capital for the Tekne JV, which aims to deliver on ~$7.5M of Tekne’s orders in the Asia-Pacific region by assembling products in the U.S.ts2.techts2.tech. These moves should translate Tekne’s backlog into Nuburu’s revenue starting as early as Q4 2025. Nuburu management has indicated Q4 billings of ~$500k are expected, marking the first step of revenue ramp-upts2.tech. Longer term, Tekne gives Nuburu a foothold in the electronic warfare and military vehicle market, which aligns with the $19B TAM cited for electronic warfare by 2028ts2.tech.

- Leadership Change – Dual CEOs (Announced Sep 29, 2025): To support its transformation, Nuburu made a significant leadership change by implementing a co-CEO structure. Executive Chairman Alessandro Zamboni and board member Dario Barisoni were appointed joint Chief Executive Officers effective Oct 1ts2.tech. Zamboni retains his Exec Chairman title and leads high-level functions (corporate strategy, fundraising/finance, investor and public relations, and market strategy), while Barisoni as co-CEO handles day-to-day operations of the business and subsidiaries, executing acquisitions and integrating the new units, and driving product strategy in defense marketsstocktitan.netstocktitan.net. The company also named Zamboni as Chairman and Barisoni as CEO of the new Nuburu Defense LLC subsidiaryts2.tech. Management stated this dual-CEO move addresses the “increased organizational complexity” as Nuburu juggles multiple strategic initiativests2.tech. Zamboni noted that other growth companies have used co-CEOs successfully, and said the arrangement “underscores our commitment to strategic growth and operational excellence… enabling us to capitalize on emerging opportunities and deliver long-term value for stakeholders.”ts2.tech Barisoni expressed eagerness to “grow NUBURU’s presence in the defense market” and leverage his expertise in lasers and defense systemsts2.tech. This leadership bolstering was taken as a sign that Nuburu is serious about executing its complex turnaround. The timing coincided with rising investor optimism in early October as the pivot news rolled out.

- Capital Raise & Recapitalization (Completed Sep 16, 2025): Given its dwindling cash, Nuburu undertook a highly dilutive public offering in mid-September. On Sept 16, the company closed the issuance of roughly 32.37 million new common shares plus 51.66 million pre-funded warrants and 126 million five-year common warrants (exercise price $0.17)ts2.techts2.tech. The offering price was approximately $0.14 per share (a steep discount), and it raised $12 million gross (around $11M net)ts2.tech. This more than doubled the share count (previously ~70M) and could potentially triple it if all warrants are exercised in the futurets2.tech. While this was painful dilution for existing shareholders, it was essentially a lifesaving capital infusion: Nuburu’s cash on hand jumped from almost zero to about $6 million post-offeringts2.techts2.tech. The NYSE (which had put Nuburu on notice for low equity and share price levels) approved Nuburu’s recapitalization plan as part of giving the company time to regain listing compliancets2.tech. Management emphasized that the funds will fuel Nuburu’s acquisition program and defense growth initiatives – explicitly noting uses like supporting the Tekne deal, launching the Tekne US JV (in collaboration with Flyer Defense on military vehicles), integrating new SaaS businesses like Orbit (Orbit already has 18 enterprise clients and ~2,000 daily users that Nuburu can build upon), and pursuing “opportunistic blue laser partnerships” to reinforce its tech leadershipts2.techts2.tech. Lifting the stock price above $0.20 also helped reduce the immediate delisting risk. Indeed, Nuburu’s continued listing on NYSE American depends on executing this turnaround and improving its shareholder equity.

- Other Noteworthy Items: Earlier in 2025, Nuburu’s progress included securing an $850k NASA contract (SBIR Phase II) in May to advance its space-oriented laser power-beaming tech – aligning the company with futuristic applications in lunar explorationts2.tech. On the flipside, in March 2025 Nuburu eliminated all its long-term debt via a restructuring, but at the cost of handing over its patent portfolio to its lenders in a foreclosure arrangementts2.tech. This means Nuburu is now effectively licensing back its own core IP. While that removed debt from the balance sheet (improving the equity position), it raises risk questions about intellectual property control. These context points show that Nuburu has been actively repositioning itself (both financially and technologically) through 2025 – aligning with government projects and cleaning up liabilities – to set the stage for the late-2025 flurry of defense-focused actions.

Market Reaction, Analyst Commentary & Outlook

Nuburu’s rapid string of developments has radically altered market sentiment on the stock – at least in the short term. In the first week of October 2025, BURU shares skyrocketed ~78% (from ~$0.12 to ~$0.22) in just a few days as news of the defense pivot spreadts2.tech. Momentum then fed on itself: retail traders on social media jumped in, with Stocktwits message volume +1,500% and bullish sentiment scoring an “extremely bullish” 98 out of 100 during the rallyts2.techcoincentral.com. By Oct 7, the stock hit an intraday high of $0.34ts2.tech – and after the Orbit acquisition news, BURU spiked above $0.60–0.70 (+305% week/week) on Oct 8benzinga.combenzinga.com. One trader exulted that “shorts [are] in shambles,” as many who had bet against the company scrambled to cover positionsts2.techcoincentral.com. In fact, short interest in Nuburu had been very high (nearly 45% of the float in mid-2024) but dropped to about 9% by late 2025ts2.tech, likely due to short sellers closing out as the stock rebounded.

No major Wall Street analysts formally cover Nuburu (it’s under the radar given its tiny market cap and penny-stock status)tipranks.com. Thus, there are no official consensus estimates or price targets. Expert commentary has come mainly from independent analysts and financial media. Tech Space 2.0 (ts2.tech), a market analysis site, noted that Nuburu’s story is now a “binary outlook”: on one hand, the bold defense pivot and strategic wins have “ignited speculative buying and a short-term rebound,” but on the other hand the underlying fundamentals remain very weak – negligible revenue, ongoing big losses, and a reliance on repeated dilution to stay afloatts2.tech. The market will be watching closely to see if Nuburu can actually convert its flurry of announcements into sustainable revenue and eventual profitsts2.tech. This sentiment was echoed by company management: Zamboni, in a Sept 9 letter to shareholders, acknowledged the heavy lifting ahead but maintained optimism, saying “we are executing the plan we laid out and steadily building the foundation for sustained value creation… the months ahead will bring critical milestones.”ts2.tech. He also emphasized Nuburu would seek “stable investors” and avoid toxic financing structures that could “undermine shareholder value.”ts2.tech After the recent capital raise, the balance sheet is momentarily shored up, but Nuburu likely needs to start generating real revenue by 2026 to justify its new defense ventures and to fund itself without massively diluting shareholders further.

Financial analysts focusing on micro-caps have pointed out the high-risk/high-reward nature of Nuburu now. The company’s market cap (~$60M) prices in a lot of future success, considering year-to-date revenue is under $0.2M and the firm’s cumulative deficit is $150M+ts2.techts2.tech. The bull case: if Nuburu’s defense gambit succeeds, the new contracts and acquisitions could transform the income statement over the next 2–3 years (Orbit alone projects ~$19M revenue by 2028ts2.tech, Tekne has hundreds of millions in potential ordersts2.tech). The bear case: the company might fail to close or integrate these deals, or the deals might not deliver enough profit, and Nuburu could burn through its cash again – especially since the company’s own laser product sales have dried up. Until tangible results appear, investors should expect high volatility: this is still very much a speculative turnaround play. Indeed, daily swings of 30–40% have occurred on Nuburu just on news and trading sentimentts2.techbenzinga.com.

MarketWatch/Benzinga Coverage: Financial news outlets picked up Nuburu’s sudden rally. Benzinga noted that Nuburu’s stock was “surging… up over 300% in a week” after the Orbit deal, calling it a major “strategic shift”integrating Nuburu’s lasers with software to target a ~$3 billion defense resilience marketbenzinga.combenzinga.com. They also highlighted that the micro-cap’s run was “bolstered by other positive developments, including the closing of a $12M capital raise and a new $6.6M contract in Bangladesh.”benzinga.com Benzinga’s technical analysis pointed out that after the jump, BURU was trading well above its 50-day, 100-day, and 200-day moving averages (which were $0.18, $0.24, $0.26 respectively) – a clear bullish momentum signalbenzinga.com. The stock’s 52-week high of ~$1.60 (from a brief spike in late 2022) could act as an upper bound, but more immediately resistance is around the recent intraday peak ~$0.85, while new support might form around prior breakout levels (e.g. ~$0.30) if the price pulls backbenzinga.com. In short, the chart went parabolic entering October, and traders are watching whether this breakout holds or fades.

Market Forecast & Stock Analysis: Given the lack of Wall Street coverage, price forecasts for Nuburu come from automated models or retail-oriented services – which must be taken with caution. Prior to the defense news, some quantitative forecasts predicted BURU might stagnate or fall; for instance, one algorithmic model in early 2025 foresaw the stock averaging ~$0.18 for the yearstockscan.io (a projection now upended by recent events). Looking ahead, the stock’s trajectory will likely depend on milestone execution: closing the Orbit and Tekne acquisitions, winning additional defense contracts, and showing revenue traction in 2026. On fundamentals, Nuburu’s valuation is extreme if judged by traditional metrics – its price-to-sales is off the charts (because sales are near zero) and it trades below book value (P/B ~0.3)tipranks.comtipranks.com, reflecting past losses. However, investors now value Nuburu on a story of future growth. The good news: Nuburu has reinvented itself into a company that can tell a growth story (defense technology, big TAMs, government clients) rather than a failed laser maker. The bad news: it is essentially a startup-like venture again, but saddled with a public listing’s costs and a history of shareholder dilution. Expect continued dilution over time – even the Orbit deal will be paid partly in Nuburu equity by 2026stocktitan.netstocktitan.net, and management has signaled more stockholder votes will be needed (e.g. to increase the share authorization for granting new stock rewards, etc.)stocktitan.netstocktitan.net. No immediate profitability is on the horizon; the hope is that by combining multiple small businesses (Tekne’s revenues, Orbit’s SaaS sales, etc.), Nuburu can reach a sustainable revenue base and then scale up with the help of its unique laser offerings.

Investor Sentiment: At present, sentiment is predominantly driven by retail traders/speculators. Social media hype has been a factor – with some comparing Nuburu’s pivot to other “story stocks” that made dramatic comebacks. The Stocktwits community, for example, scored sentiment at 98/100 bullish during the height of the rallycoincentral.comcoincentral.com, indicating almost euphoric expectations. Nuburu also received a “high momentum” score (85/100) from Benzinga’s analytics following the surgebenzinga.com. These are short-term indicators and could reverse quickly if the news flow cools or if traders cash out gains. There is no traditional analyst rating to temper expectations, so volatility is amplified by rumor and momentum. Long-term value investors would likely wait for evidence of contracts turning into revenue and a clearer path to breakeven. Near-term catalysts to watch include: any definitive agreement or closing news on the Tekne acquisition (which would be a big validation if completed), progress updates on Orbit integration (e.g. landing a first U.S. defense customer for Orbit’s platform), and the company’s next earnings release or shareholder update (to gauge how Q4 2025 “billings” are progressing against that ~$500k goalts2.tech). Also, Nuburu’s continued listing on the NYSE American may hinge on maintaining compliance – as of October the stock price is safely above the $0.20 minimum, but any slide could reignite delisting risks.

Conclusion: High Risk, High Hopes

Nuburu, Inc. has undergone a striking transformation in 2025: from a struggling laser maker on the brink of insolvency, to a self-declared “pioneer” in defense technology with grand ambitions. Its high-power blue laser IP remains a valuable asset, now being repurposed for defense and aerospace uses where its advantages (precision and efficiency in metal processing, directed energy, etc.) could be game-changingts2.tech. The company’s flurry of deals – Tekne for defense hardware, Orbit for software, and another pending photonics target – indicate a “go big or go home” strategy. If even a portion of the promised $500M Tekne backlog and multi-million Orbit revenues materialize, Nuburu’s currently minuscule sales could explode in coming years. That upside is what speculators are betting on, as evidenced by the stock’s recent surge. However, Nuburu is not out of the woods: it must integrate cross-border acquisitions, navigate regulatory approvals, and likely raise more capital down the line (hopefully at higher share prices) to fund growth. The balance sheet has improved post-offering (virtually no debt now, and a few quarters of cash runwaytipranks.com), but execution risk is high. In summary, Nuburu offers a compelling story at the intersection of cutting-edge laser physics and defense modernization, but it remains a penny-stock turnaround with all the associated perils. Investors should closely monitor upcoming developments and be prepared for turbulence. As one market analysis succinctly put it, Nuburu’s pivot has given it a “second life” – now it must prove that its blue lasers and new acquisitions can actually shine in the real world of defense contracts and revenuets2.tech.

Sources: Nuburu Investor Relationsir.nuburu.netbusinesswire.com; Tech Space 2.0 analysists2.techts2.tech; Semiconductor Todayts2.techts2.tech; Benzinga Newsbenzinga.combenzinga.com; CoinCentral/Trader Edgecoincentral.comcoincentral.com; MarketBeat/Investing.comts2.tech; StockTitan (SEC filings)stocktitan.netstocktitan.net; Business Wire Press Releasesir.nuburu.netbusinesswire.com.