Published December 3, 2025

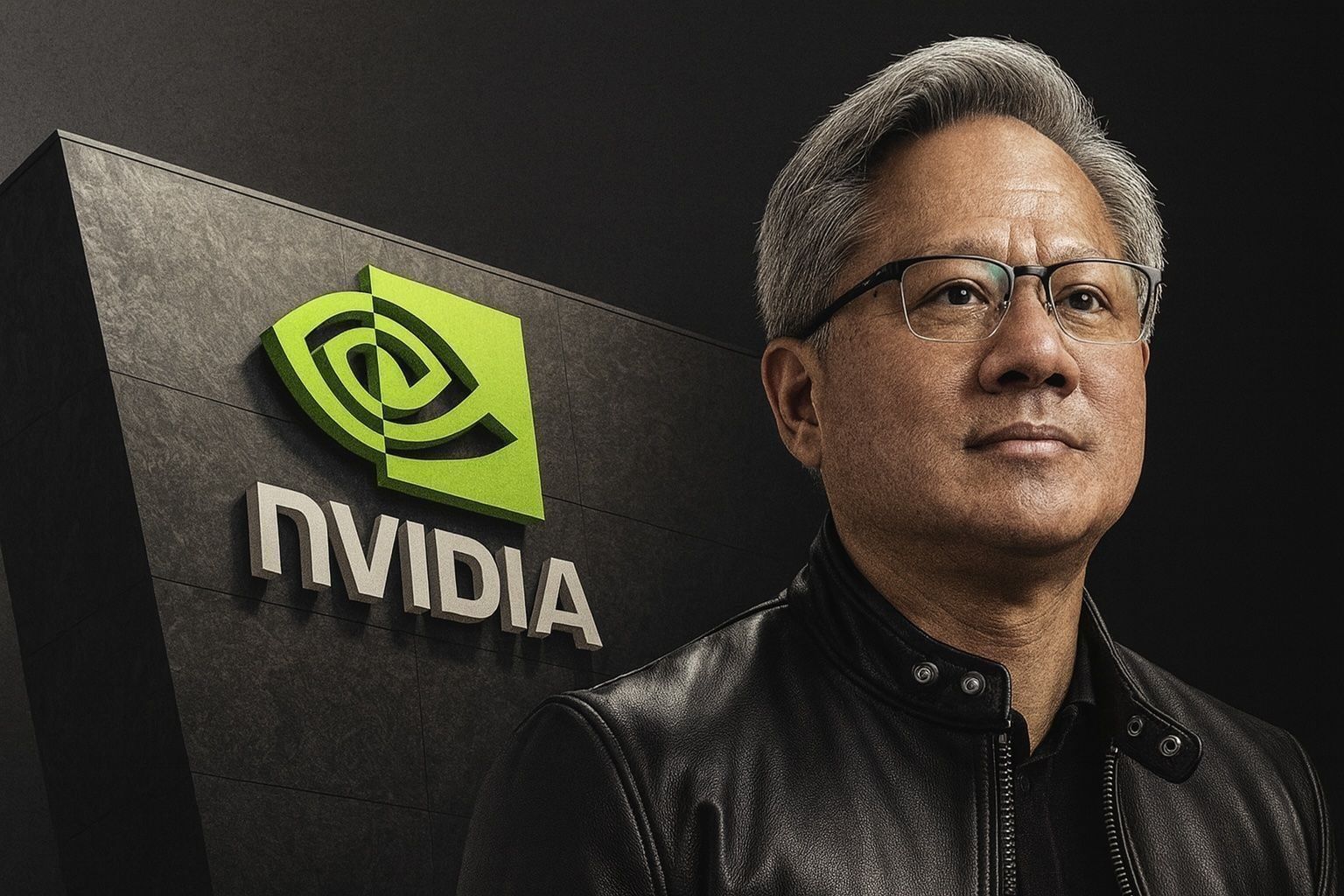

On a single news‑packed day, Nvidia CEO Jensen Huang managed to dominate the technology, business and political conversation. A new episode of The Joe Rogan Experience featuring Huang dropped, Axios published excerpts in back‑to‑back stories, Washington reported that U.S. President Donald Trump met with the Nvidia chief to talk export controls, and fresh analysis continued to surface about Huang’s internal push to “automate every task” with AI at Nvidia. [1]

Taken together, December 3, 2025 offers the clearest snapshot yet of how one of the most powerful figures in AI sees the future of work, national security and Big Tech’s business model.

Huang tells Joe Rogan: AI’s national security risks are still a mystery

In a new episode of The Joe Rogan Experience, Huang struck a surprisingly cautious tone on AI and geopolitics. Asked whether the United States “winning the AI race” is critical for national security, he replied that the real issue is understanding what, concretely, is at stake — and that he doesn’t think “anybody really knows” yet. [2]

He framed AI as part of a long‑running technology race, likening today’s moment to the Manhattan Project and the Cold War, where breakthroughs in science translated into new “superpowers” in information, energy and military capability. [3] But unlike some AI doomsayers, Huang stopped short of apocalyptic predictions, instead emphasizing uncertainty over inevitability.

The interview also veered directly into U.S. politics. Huang praised President Trump, saying the public “negative narratives” about him don’t fully capture his outlook. In Huang’s telling, Trump is focused on keeping “critical technology” and advanced manufacturing in the United States and on re‑industrializing the country to support jobs. [4]

The episode lands as Rogan’s show continues to dominate podcast rankings. Spotify’s 2025 year‑end list once again placed The Joe Rogan Experience at the top, while Apple’s newly released charts show Rogan dethroning The Daily as America’s most popular podcast — evidence of the show’s outsized reach across platforms. [5]

Rogan himself has a complicated relationship with AI. He has previously criticized deepfake audio after a fully synthetic “Rogan vs. Sam Altman” episode — generated by an AI voice model — went viral, underscoring how AI can mimic public figures without consent. [6] Against that backdrop, a three‑hour conversation with the CEO of the world’s leading AI‑chip maker carries extra symbolic weight.

“We only build”: Huang claims Nvidia is the world’s only true tech giant

In a separate Axios interview, also pegged to the Rogan episode, Huang delivered one of the most attention‑grabbing soundbites of the day: he argued that Nvidia is “the only company in the world that’s large whose only business is technology.” [7]

Most of today’s tech behemoths, he noted, ultimately make their money from advertising and social media or content distribution, even if they are powered by sophisticated software. [8] Nvidia, by contrast, generates revenue by designing and selling advanced chips and systems rather than by monetizing user attention.

Huang’s point comes with hard numbers behind it. Nvidia has become the defining stock of the AI boom:

- The company now represents roughly 1% of the entire global stock market and about 8% of the U.S. market. [9]

- Big Tech firms are expected to spend around $500 billion in 2025 on AI infrastructure such as data centers and GPUs, much of it flowing to Nvidia’s hardware. [10]

At the same time, Nvidia faces increasing “coopetition.” Major cloud providers like Amazon are pouring money into their own custom silicon, hoping to reduce reliance on Nvidia’s premium GPUs even as they remain some of Nvidia’s largest customers. [11]

Despite that tension, Huang admitted that nobody yet knows how AI will ultimately reshape business models — including Nvidia’s. From ad‑supported social networks to enterprise software, he said, the industry is still experimenting with how generative AI will actually make money. [12]

Inside Nvidia: A directive to automate “every task” with AI

Externally, Huang talks about uncertainty. Internally, his message is anything but ambiguous.

At an all‑hands meeting held after Nvidia reported yet another quarter of record results, Huang told employees that any task that can be automated with AI should be automated with AI. [13]

According to TechRadar and other outlets that reviewed the remarks, Huang reacted sharply to reports that some managers were urging staff to dial back their AI usage. His response: that attitude is misguided — and, in his words, “insane.” [14]

Key points from that internal call:

- Huang wants “every task that is possible to be automated” to be handled by AI systems, from coding to routine operational work. [15]

- Nvidia’s engineers heavily rely on the AI coding assistant Cursor, and Huang is encouraging them to use tools like it even when they are imperfect, helping improve them over time. [16]

- AI should not be feared as a job‑killer inside Nvidia, he told staff, because the company is both growing fast and still “short” of the people it needs. [17]

TechSpot’s reporting backs that up with concrete figures: Nvidia’s headcount grew from about 29,600 employees at the end of fiscal 2024 to 36,000 a year later, and Huang has said the firm is “probably still about 10,000 short” of its desired staffing level as it expands offices in Taipei, Shanghai and multiple U.S. locations. [18]

Yet his automation push isn’t happening in a vacuum. The same TechRadar piece notes that Huang is delivering this message amid mounting Wall Street anxiety that the AI trade is starting to look frothy. Nvidia’s share price dropped the day after those “exceptional” earnings, as some investors fretted about the sustainability of AI spending and whether the sector is in a bubble. [19]

Huang, though, has consistently dismissed AI‑bubble fears. Speaking at the U.S.-Saudi Investment Forum earlier this year, he argued that skeptics focus too much on valuations and not enough on underlying technological shifts, including the end of Moore’s Law and the need for new computing paradigms to satisfy soaring AI demand. [20]

In his view, companies are pouring capital into GPUs out of necessity — to keep up with real workloads in finance, healthcare, search and engineering — not just speculation. [21]

Trump and Huang meet again — this time over export controls

While Huang was talking about AI’s uncertain national‑security future with Joe Rogan, events in Washington underscored just how central Nvidia has become to that debate.

On December 3, Reuters reported that President Trump met with Nvidia’s CEO to discuss export controls on advanced chips, citing a CBS News reporter’s post on X. Nvidia declined to comment on the report. [22]

The meeting is the latest chapter in a running saga over how freely U.S. chipmakers should be allowed to sell cutting‑edge AI processors abroad, especially to China:

- Earlier this year, Huang publicly welcomed the Trump administration’s move to tweak a three‑tiered system of export curbs for AI chips, arguing that previous rules were overly restrictive. [23]

- Nvidia has already taken a $5.5 billion charge linked to U.S. limits on exports of its H20 AI chips to China, where its market share has fallen from around 95% to about 50%, according to Reuters reporting. [24]

- As recently as late November, Trump was said to be weighing whether to allow Nvidia to resume sales of more advanced AI chips to China, highlighting ongoing internal debate over how strict export controls should be. [25]

Huang has consistently signaled that he wants clearer, more flexible rules. In previous comments reported by Bloomberg and Reuters, he argued that Washington should revise AI export regulations so U.S. companies can better compete globally while still respecting security concerns. [26]

The closed‑door meeting on December 3 suggests that, even as Huang publicly plays down the clarity of AI’s national‑security implications, Nvidia is deeply involved in the policy fight over how tightly U.S. technology should be controlled.

How one CEO is trying to redefine “tech company,” “job” and “security” at once

What makes December 3 so striking is not just the volume of Jensen Huang coverage — it’s how his messages, across very different audiences, interlock:

- To the public (via Joe Rogan):

AI is transforming everything, but its geopolitical consequences are still uncertain. Technology confers “superpowers,” yet it’s too early to say exactly how the AI race translates into national‑security outcomes. [27] - To investors and the wider market (via interviews and forums):

Nvidia is not just another ad‑supported platform. It is, in Huang’s framing, the only mega‑cap whose core business is pure technology — specialized chips and systems that others rely on. That, he argues, makes the AI boom more than a speculative bubble. [28] - To employees (via internal meetings):

Use AI for everything you reasonably can. Don’t fear automation; fear being the person who doesn’t know how to use the tools. Nvidia will keep hiring, and humans will still have “work to do,” even if the nature of that work changes. [29] - To policymakers (via ongoing lobbying and Trump meetings):

Overly strict export controls risk ceding markets and influence, especially in China, without fully resolving national‑security concerns. Huang wants rules that acknowledge both the risks and the economic stakes of AI hardware. [30]

These narratives don’t always sit comfortably together. On the one hand, Huang is telling a mass audience that nobody really understands AI’s long‑term security risks; on the other, he is urging both his workforce and corporate customers to accelerate automation as fast as possible, and asking governments to relax some constraints on where Nvidia’s most powerful chips can go.

That tension is exactly why his words are being picked apart so closely by workers, investors, regulators and rivals alike.

What to watch next

Several big questions now sit at the intersection of these storylines:

- Will the Trump administration loosen or tighten AI chip export rules?

The outcome of Huang’s latest meeting with the president could shape where Nvidia can sell its most advanced GPUs — and how quickly China and other regions can build their own AI data‑center capacity. [31] - How far will companies follow Huang’s “automate everything” mantra?

Nvidia, Microsoft, Meta, Google and Amazon are all pushing employees to incorporate AI throughout their workflows, from coding to office productivity. That could redefine what “skilled work” means inside tech — and far beyond it. [32] - Can Nvidia maintain its “pure tech” identity as the AI stack evolves?

As hyperscalers build their own chips and startups explore alternatives, Nvidia will have to defend both its technical lead and its claim to be distinct from ad‑funded peers. [33] - Will AI’s economic reality match the hype?

Huang insists the world is “voting with real capex,” not just speculation, and that AI demand is grounded in structural changes to computing. Skeptical investors — and regulators worried about systemic risk — will be watching closely to see if that story holds.

For now, one thing is clear: on December 3, 2025, the global conversation about AI — from podcast charts to the Oval Office to internal corporate Slack channels — kept circling back to the same figure in a leather jacket.

References

1. www.axios.com, 2. www.axios.com, 3. www.axios.com, 4. www.axios.com, 5. www.axios.com, 6. www.axios.com, 7. www.axios.com, 8. www.axios.com, 9. www.axios.com, 10. www.axios.com, 11. www.axios.com, 12. www.axios.com, 13. www.techradar.com, 14. www.techradar.com, 15. www.techradar.com, 16. www.techradar.com, 17. www.techspot.com, 18. www.techspot.com, 19. www.techradar.com, 20. timesofindia.indiatimes.com, 21. timesofindia.indiatimes.com, 22. www.investing.com, 23. www.reuters.com, 24. www.reuters.com, 25. www.reuters.com, 26. www.reuters.com, 27. www.axios.com, 28. www.axios.com, 29. www.techradar.com, 30. www.reuters.com, 31. www.investing.com, 32. www.techradar.com, 33. www.axios.com