- Historic Stock Highs: Nvidia’s stock (NVDA) hit all-time highs in early October 2025, briefly topping a $4 trillion market cap – making it the world’s most valuable company at that momentts2.tech. Shares neared $187–$190 in late September, tripling Nvidia’s value in barely a year amid a frenzy for AI-related stocksts2.techts2.tech. (For context, Nvidia’s valuation at $4+ trillion eclipsed tech giants like Apple and Microsoft at the time.)

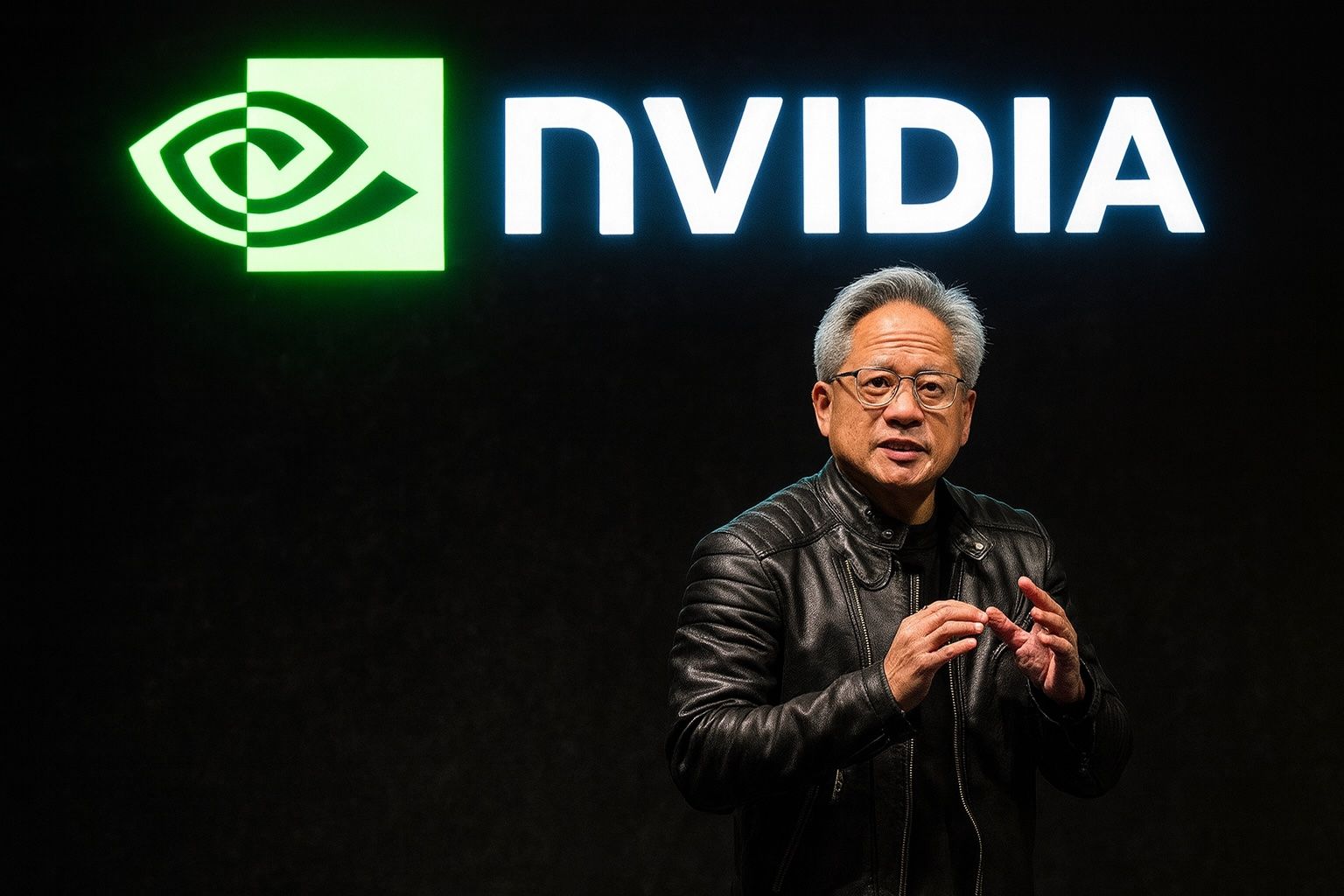

- AI Boom Fuels Revenues: Explosive demand for Nvidia’s AI chips drove a 56% YoY revenue jump last quarter to $46.7 billion with hefty 72% gross marginsts2.tech. The company raised guidance to ~$54 billion next quarter, signaling the AI boom is still acceleratingts2.tech. CEO Jensen Huang said Nvidia’s latest “Blackwell” GPUs deliver an exceptional leap in performance and are seeing “extraordinary” demandts2.tech.

- Massive Deals & Partnerships: In late September, Nvidia unveiled a $100 billion partnership with OpenAI to build next-gen AI supercomputers (deploying 10 GW of Nvidia hardware)ts2.tech. Nvidia will invest in OpenAI and supply it with millions of GPUs starting in 2026, underscoring its central role in the AI revolution. The company also took a $5 billion stake in Intel (~4% ownership) to collaborate on data-center and PC chipsreuters.com, a move that sent Intel’s stock up 20%+ts2.tech. Even Alibaba in China announced it’s partnering with Nvidia to integrate Nvidia’s AI tools into Alibaba’s cloud platform, news that sent Alibaba shares up ~10%reuters.comreuters.com.

- Rivals React – AMD’s Big Win: Nvidia’s dominance is pushing competitors to strike back. On Oct. 6, AMD announced a multi-year deal to supply AI chips to OpenAI, giving OpenAI an option to take a 10% stake in AMDreuters.com. AMD’s stock soared ~24% on the news, while Nvidia’s slipped ~1% that day as investors weighed this new competitive threatinvesting.com. AMD’s upcoming MI300 series AI accelerators are gaining traction, and the OpenAI partnership (projected to add >$100 billion in AMD’s revenue over four years) positions AMD as an emerging alternative in AI chipsinvesting.cominvesting.com. However, analysts note Nvidia still holds a massive head start – controlling ~90%+ of the AI accelerator market – thanks to its powerful hardware and CUDA software ecosystem that rivals struggle to matchts2.techts2.tech.

- Bullish Outlook – and Bubble Worries: Wall Street remains overwhelmingly bullish on NVDA. Roughly 38 of 45 analysts rate it a “Buy,” and the average 12-month price target is around $212 (implying ~15–20% upside from current levels)ts2.tech. Big banks have been raising targets after Nvidia’s blowout results – e.g. Citigroup upped its target to $210 and Barclays to $240ts2.tech. One veteran tech analyst even boosted his target to $275 (about +45%), arguing bears are underestimating Nvidia’s growthhotcandlestick.comhotcandlestick.com. Some ultra-bulls, like Cantor Fitzgerald, have made Nvidia their top pick and floated a path to a $10 trillion valuation in coming years given its AI leadershipts2.tech. “Nvidia could easily command 40% of the total AI infrastructure spend,” one analyst wrote, suggesting enormous runway ahead. But not everyone is euphoric – even fans warn the stock’s valuation (~50× earnings) is “baking in” years of perfectionts2.tech. Longtime investors have flashed caution: ex-Baillie Gifford fund manager James Anderson said the frenzy “reminded me of 1999” (the dot-com bubble)ts2.tech, and advisor Oliver Pursche noted “valuations are getting stretched… [markets] ignoring potential headwinds”ts2.tech. In short, Nvidia’s prospects are rosy, but any stumble – a growth slowdown or tougher competition – could spur a sharp pullback.

- Broader AI Chip Context: Nvidia’s surge is happening amid a broader “AI gold rush” in tech. Companies across the sector are pouring billions into AI hardware and cloud infrastructure. For instance, Meta struck a $14 billion deal with cloud provider CoreWeave for GPU capacity, Oracle reportedly signed a $300 billion cloud contract with OpenAI, and even Tesla inked a $16.5 billion chip supply deal with Samsungreuters.comreuters.com. SoftBank just invested $2 billion into Intel, becoming a top-10 shareholder, to bolster Intel’s turnaround in chipsreuters.com. This flurry of deals underscores how AI demand is reshaping the entire semiconductor landscape – but so far, Nvidia has been the chief beneficiary. As one wealth manager remarked on Nvidia’s meteoric rise, “It highlights that companies are shifting their spend in the direction of AI and it’s pretty much the future of technology.”ts2.tech

- Competitive Landscape: Despite Nvidia’s outsize lead, it’s worth sizing up its peers. Nvidia now dwarfs other chip companies in value – at ~$4.5 trillion, its market cap is nearly 18× the size of AMD (~$261 billion) or 30× Intel (~$156 billion)ts2.tech. Even giant Broadcom (~$1.3–1.5 trillion) is only one-third of Nvidia’s valuets2.tech. Revenues mirror this gap: Nvidia’s trailing ~$165 billion annual sales tower over AMD’s ~$30 billion or Intel’s ~$53 billionts2.techts2.tech. AMD is Nvidia’s closest GPU rival and has grown its data-center business (EPYC server CPUs and new MI300/MI350 AI GPUs), but remains far smallerts2.tech. Its recent OpenAI deal is a big win that could “generate tens of billions in annual revenue for AMD”investing.com – a sign that large customers want a second source beyond Nvidia. Intel, meanwhile, has struggled with flat sales and is in cost-cutting modets2.tech. Nvidia’s $5B investment made it Intel’s third-largest shareholder and will see the two collaborate on certain chips (though notably not on Intel’s foundry business)ts2.tech. This partnership, alongside Intel’s own tie-ups (like with TSMC), shows the industry’s strange new alliances as everyone races to meet AI demandts2.techts2.tech. Qualcomm remains focused on mobile and 5G chips but is pivoting into automotive and AI processing to diversify as phone growth slowsts2.tech. Broadcom, now a $1½ trillion behemoth after acquisitions, is benefiting from networking and custom AI chips – its CEO Hock Tan boldly forecast “ten consecutive quarters” of growth driven by AI-related demandts2.techts2.tech. And Arm, fresh off a high-profile IPO, sits at ~$150 billion market cap by licensing the chip designs that power mobile and IoT devicests2.tech. While each competitor has strengths, Nvidia’s end-to-end ecosystem – from cutting-edge silicon to software (CUDA) and developer support – gives it a wide moat that others are only slowly chipping away atts2.techts2.tech.

- Regulatory & Legal Hurdles: Not everything is smooth sailing for Nvidia. Geopolitics pose a real risk. U.S. export controls have barred Nvidia from selling its top-tier AI GPUs (like H100) to China, cutting off a huge market. Nvidia even took an inventory write-down on specialized China-only chips and has excluded any potential China sales from its forecaststs2.tech. Meanwhile, a multibillion-dollar deal to supply Nvidia AI chips to the UAE (announced in spring 2025) has been stuck in limbo for months due to U.S. government delays, reportedly frustrating CEO Jensen Huangts2.techreuters.com. These restrictions underscore how strategic Nvidia’s technology has become – its chips are now seen as critical assets in the global tech race. Legal battles are also on the horizon. In November, Nvidia is slated for a jury trial over allegations that a former employee (who joined Nvidia from supplier Valeo) stole automotive self-driving tech secrets and shared them with Nvidiats2.tech. Nvidia denies the accusations, but a judge found enough evidence to proceed to trialts2.tech. While this case is relatively niche (focused on a specific ADAS/AV software issue), it highlights that Nvidia’s breakneck growth and expanding reach can make it a target for IP disputes and antitrust scrutiny. In fact, some observers have mused that Nvidia’s $100B OpenAI alliance – pairing the top AI chip supplier with the leading AI software firm – could draw antitrust questions about concentration of AI powerts2.techts2.tech. Regulators globally are undoubtedly watching the AI chip space closely, given its importance.

- The Road Ahead – Can Nvidia Keep Dominating? Looking forward, Nvidia’s trajectory into 2026 will hinge on whether the company can maintain its breakneck momentum in the face of rising challenges. In the next few weeks, Nvidia’s Q3 FY2026 earnings (due in November) will be a crucial benchmark – investors will watch if Nvidia meets its aggressive ~$54 billion revenue guidance and whether demand is still outstripping supply. Any hint of a slowdown could jolt the stock, given its high expectations. Conversely, another beat-and-raise could reaffirm Nvidia’s status as the premier “AI picks-and-shovels” provider. Strategically, Nvidia is doubling down on infrastructure and software to cement its lead. Besides GPUs, the company offers networking (InfiniBand/NVLink), cloud services, AI frameworks, and even an AI “Omniverse” simulation platform. It’s also pushing into emerging areas like robotics and autonomous vehicles – recently unveiling open-source tools like the Newton physics engine and Isaac robot AI to jump-start “physical AI” developmentts2.tech. The aim is clear: make Nvidia hardware and software indispensable for every AI application, from data centers to self-driving cars to humanoid robots. This end-to-end approach could keep Nvidia embedded at the heart of the AI boom, even as competitors try to encroach. Analysts largely believe the AI investment cycle has legs. “Every gigawatt of AI data center capacity is worth about $50 billion in revenue” for Nvidia, one expert estimatedts2.tech – and OpenAI alone is planning 10+ GW with Nvidia, implying a huge pipeline. There’s also talk of entirely new markets (national AI projects, AI in healthcare, etc.) that could sustain growth for years. That said, investors will be watching a few key risk factors. One is competition: AMD’s OpenAI deal shows top clients want alternatives, and by late 2026 AMD’s MI450 GPUs will arrive, potentially narrowing the gapinvesting.cominvesting.com. If rivals like Intel, Google (TPUs), or startups make a technological leap, Nvidia could feel pressure on its pricing power and market share. Another factor is the macro climate – a tech spending slowdown or higher interest rates could cool the exuberance for high-valuation stocks like NVDA. And if the AI “hype cycle” were to deflate (e.g. if enterprises take longer than expected to adopt AI at scale), Nvidia’s growth could normalize faster than forecast. So far, though, there’s little sign of that: cloud giants, enterprises, and governments alike are racing to pour more into AI. As Susquehanna’s Chris Rolland noted, Nvidia may eventually have a flat growth year that “freaks out” investors, “though I’m not getting off the train just yet” given the near-term momentumts2.techts2.tech.

Bottom Line:Nvidia has ridden the AI wave to unprecedented heights – achieving a market cap and growth numbers once unthinkable for a chip company. Its GPUs are effectively the “shovels” enabling the AI gold rush, and for now Nvidia enjoys an enviable position with cutting-edge tech, booming demand, and strong execution. In the coming months, observers expect continued strength as AI investment ramps up globally (from Silicon Valley to Beijing to the Middle East). Nvidia’s challenge will be living up to sky-high expectations and fending off intensifying competition. The company’s strategic bets – like the OpenAI alliance and stake in Intel – indicate it’s not resting on its laurels. If the AI revolution continues full-steam, Nvidia’s juggernaut could still have room to run, potentially smashing more records. But if cracks appear in the AI growth story or in Nvidia’s armor, this trillion-dollar high-flyer could be in for some volatility. As one market strategist put it, Nvidia is “certainly in a sweet spot” now, but the true test will be how long it can sustain this AI-fueled dominancets2.tech. For investors and tech enthusiasts alike, Nvidia’s next chapter – be it soaring even higher or navigating new challenges – will be one of the most closely watched stories in tech.

Sources: NVIDIA and OpenAI press releasests2.techts2.tech; Reuters news on market milestones, partnerships, and chip industry trendsts2.techreuters.comreuters.com; Yahoo Finance and Bloomberg analyst commentary; Tech industry analysis by TS2 Techts2.techts2.tech and others. (All information is current as of October 7, 2025.)