- Alkaline electrolyzers use a liquid potassium hydroxide (KOH) electrolyte, operate at about 60–80 °C, and have decades of industrial use in chlor-alkali and fertilizer plants.

- PEM electrolyzers use a solid polymer membrane and typically operate at 50–80 °C, delivering very high-purity hydrogen (>99.999%), with iridium catalysts at the anode and platinum at the cathode.

- SOEC operate at 700–850 °C with a ceramic oxide-ion electrolyte, reduce steam to hydrogen, and can exceed 80% LHV electrical efficiency when heat is supplied, with Sunfire achieving about 84% LHV in a multi‑megawatt unit and NASA reporting a 4 MW SOEC system in 2023.

- CapEx estimates place alkaline around $2,000/kW, PEM around $2,450/kW, with Chinese mass‑produced alkaline as low as $750–1,300/kW, while pilot SOEC costs run roughly $2,000–$3,000/kW.

- Operating costs are dominated by electricity, with SOEC potentially lowering electricity per kg when cheap heat is available; PEM and alkaline have similar electricity costs, and maintenance varies by chemistry (electrolyte handling for alkaline, membrane/purification for PEM, and high‑temperature systems for SOEC).

- Lifetimes show alkaline stacks lasting roughly 60,000–90,000 hours (about 7–10 years), PEM stacks 60,000–80,000 hours, and SOEC demonstrations around 20,000 hours with a long‑term goal of 40,000–60,000 hours.

- PEM electrolyzers are highly flexible and well suited to intermittent renewables due to fast startup and ramping, alkaline designs have improved to follow variable loads, while SOECs are currently less compatible with frequent cycling because of their high operating temperature.

- Commercial availability shows alkaline and PEM are TRL 9 with large projects like Sinopec’s 260 MW alkaline green hydrogen facility commissioned in 2023 and Shell’s Refhyne II 100 MW PEM project with operation planned for 2027.

- Leading players include Thyssenkrupp Nucera with about 2 GW of alkaline capacity for the NEOM project, Siemens Energy with Silyzer PEM systems, Nel ASA with A-Series modules, and Bloom Energy and Sunfire leading SOEC developments, plus ITM Power and Plug Power in PEM deployments.

- Innovations and 2024–2025 developments include Hysata’s capillary-fed PEM achieving around 80% LHV efficiency in lab tests, Sunfire’s 84% LHV efficiency in pilot SOEC, and efforts to reduce precious-metal use (e.g., 90% iridium reduction via nano-coatings), along with scaling manufacturing lines like Nel’s automated alkaline line (2024) and Topsoe’s 500 MW/year SOEC factory planned online in 2025, plus Enapter’s mass-produced 2.5 kW AEM modules shipping in 2023.

Hydrogen electrolyzers are at the heart of the green hydrogen revolution. In this comprehensive comparison, we explore the three leading water electrolysis technologies – Proton Exchange Membrane (PEM), Alkaline, and Solid Oxide (SOEC) electrolyzers – highlighting how each works, their efficiency, costs, durability, and latest developments as of 2024–2025. We’ll also look at which technologies suit intermittent renewables, who the market leaders are, new innovations on the horizon, environmental considerations, and what experts are saying about the future of these electrolyzers.

Operating Principles and Chemistry

Alkaline Electrolyzers: Alkaline systems are the oldest and most established electrolyzer technology. They use a liquid electrolyte (usually potassium hydroxide, KOH) and nickel-based electrodes. When a current is applied, water at the cathode splits to produce hydrogen gas and hydroxide ions (OH⁻). The OH⁻ ions migrate through the electrolyte to the anode, where they combine to form oxygen gas and water energy.gov energy.gov. The overall reaction is simply water being split into H₂ and O₂. Because the electrolyte is liquid, alkaline cells typically operate at moderate temperatures (< 100 °C, often about 60–80 °C) energy.gov stargatehydrogen.com. This mature design has been used for decades (e.g. in the chlor-alkali industry and fertilizer plants) and is known for its robustness and simplicity. Hydrogen output from alkaline electrolyzers is high-purity but can contain small moisture or KOH traces, so downstream purification may be needed for fuel-cell grade hydrogen 1 .

Proton Exchange Membrane (PEM) Electrolyzers: PEM electrolyzers use a solid polymer membrane (a proton exchange membrane) as the electrolyte. Water is fed to the anode side, where it splits into oxygen, protons (H⁺), and electrons energy.gov. The membrane only conducts protons, so H⁺ ions travel through the membrane to the cathode. There, they recombine with electrons (supplied via the external circuit) to form hydrogen gas energy.gov. The PEM itself prevents the mixing of gases, yielding very high-purity hydrogen (often >99.999%) at the cathode stargatehydrogen.com stargatehydrogen.com. PEM electrolyzers run at relatively low temperatures (typically ~50–80 °C) similar to alkaline systems energy.gov. They require precious metal catalysts (iridium at the anode, platinum at the cathode) and a highly purified water feed. The solid electrolyte and fast proton transport enable rapid response and startup, making PEM units very flexible in operation stargatehydrogen.com 2 .

Solid Oxide Electrolyzers (SOEC): Solid oxide electrolyzer cells operate in a fundamentally different regime – at high temperatures (generally 700–850 °C) using a solid ceramic electrolyte that conducts oxygen ions (O²⁻) energy.gov energy.gov. Instead of liquid water, steam is supplied to the cathode. There, steam (H₂O) is reduced: it takes in electrons and is split into hydrogen gas (H₂) and oxygen ions energy.gov. The O²⁻ ions migrate through the ceramic electrolyte to the anode, where they release electrons and form O₂ gas energy.gov. In essence, SOECs are like solid oxide fuel cells in reverse – they use electricity (and heat) to split steam into H₂ and O₂. The high-temperature operation means some of the energy input is supplied as heat, which lowers the electrical energy required per kg of hydrogen produced. SOECs often leverage waste heat from industrial processes or concentrated heat sources (even nuclear plants) to improve efficiency energy.gov hydrogentechworld.com. This comes at the cost of complex ceramic materials and the need to maintain high operating temperatures. (Notably, R&D is ongoing into intermediate-temperature ceramic electrolysis around 500–600 °C with new materials energy.gov, but today’s commercial SOEC units still run ~750 °C or higher.)

Efficiency and Operating Temperatures

Electrical Efficiency: In practical terms, conventional alkaline and PEM electrolyzers have similar efficiencies – contrary to some perceptions that one is inherently more efficient than the other. When compared on an equivalent basis (total system efficiency at full load), “nearly all PEM and Alkaline efficiencies are within the same range” eh2.com. Typical commercial systems require roughly 55–60 kWh of electricity per kilogram of H₂ produced eh2.com, which corresponds to about 55–65% efficiency (lower heating value basis). In other words, both alkaline and PEM units consume a little under 60 kWh to produce 1 kg of H₂ (which contains ~33 kWh of energy LHV). Each technology has design nuances – for example, alkaline cells may lose some efficiency at very high current densities, and PEM systems may report slightly higher peak efficiency at part loads – but in practice their average performance is comparable eh2.com eh2.com. Recent data from dozens of projects show alkaline and PEM electrolyzers clustered in the same efficiency band when all losses (stack + balance-of-plant) are accounted for 3 .

High-Temperature SOEC Efficiency: Solid oxide electrolyzers can achieve higher electrical efficiency by using heat to do part of the work of splitting water. In fact, a well-run SOEC can produce 20–25% more hydrogen per kW of input power than an equivalently sized PEM or alkaline unit hydrogentechworld.com. For example, in 2023 a 4 MW Bloom Energy SOEC system at NASA was reported to generate hydrogen 25% more efficiently than low-temperature (PEM/AWE) electrolysis hydrogentechworld.com. Sunfire (a German SOEC developer) similarly achieved about 84% LHV efficiency in its multi‑megawatt SOEC unit by utilizing waste heat iea.org. However, it’s important to note SOEC’s efficiency advantage comes only when high-temperature steam is available; energy is still needed to generate that steam. If an SOEC is fed with externally heated steam (e.g. using industrial waste heat or heat from a nuclear reactor), the electricity consumption per kg H₂ is dramatically lower than for a PEM/alkaline system iea.org hydrogentechworld.com. Without an external heat source, an SOEC would need to use some of its own input electricity to heat itself, reducing the net gain. In summary, SOEC offers the highest theoretical efficiency of the three – on the order of 80% or more – but reaching those levels depends on integrating the electrolyzer with a heat source.

Operating Temperature Ranges: Operating temperature is a key differentiator:

- Alkaline: ~60–100 °C in most designs energy.gov stargatehydrogen.com. This moderate temperature is needed for good ionic conductivity in the liquid electrolyte but is low enough for common materials (steel, nickel) to handle easily.

- PEM: ~50–80 °C, sometimes up to ~90 °C energy.gov stargatehydrogen.com. PEM systems run a bit cooler than alkaline, as the polymer membrane’s conductivity and durability are optimal in that range. The low temperature operation means quick startup and shutdown.

- SOEC:~700–850 °C for oxide-ion ceramics energy.gov energy.gov. This high temperature requires specialized ceramic cells and insulation. It also means SOECs cannot be turned on/off quickly from cold – they typically must stay hot (or be heated slowly) to avoid thermal shock.

Capital Cost (CapEx) and Operating Cost (OpEx)

Capital Expense: Alkaline electrolyzers have an edge in upfront cost thanks to their use of simple, low-cost materials and decades of manufacturing experience. In recent analyses, alkaline systems have the lowest CapEx per kW of the three technologies. For example, the International Energy Agency (IEA) reported typical installed costs of about $2,000 per kW for alkaline electrolyzers versus roughly $2,450 per kW for PEM systems iea.org. (In markets like China with mass-produced alkaline units, prices can be as low as $750–1,300/kW for alkaline stacks iea.org.) The cost gap stems from PEM’s expensive membrane and catalyst: PEM electrodes use platinum-group metals like iridium and platinum, and the membrane itself is a costly perfluorinated polymer. These specialty materials drive PEM systems to be around 20% more expensive than alkaline in current projects iea.org. That said, PEM costs have been falling rapidly – on a manufactured (uninstalled) basis, recent PEM systems are estimated around $700–1,100/kW at low production volumes energy.gov, not far above alkaline’s $500–750/kW range energy.gov. As PEM technology scales up, experts predict the gap will narrow. In fact, one Chinese PEM manufacturer projected that by 2030 PEM electrolyzers could cost only about twice as much as alkaline (down from several times higher historically) 4 .

Solid oxide electrolyzers are not yet produced at scale, so their current CapEx is high. Pilot-scale SOEC units today have been quoted in the $2,000–$3,000/kW range energy.gov. However, major cost reductions are expected as the technology matures. Companies like Bloom Energy and Topsoe aim to mass-produce SOECs on automated lines by the late 2020s, which could drive costs down into the low hundreds of dollars per kW in the long term energy.gov iea.org. In summary, Alkaline is cheapest upfront, PEM is ~20–30% higher for now, and SOEC is currently most expensive (pilot-scale pricing) but has a trajectory for improvement.

Operating Cost: The bulk of operating cost for any electrolyzer is electricity. This is why efficiency is critical – a 5% efficiency difference can significantly change the $/kg hydrogen cost when electricity is expensive. On this front, SOEC’s efficiency advantage can translate to lower electricity cost per kg H₂ if cheap heat is available (for steam). For PEM vs alkaline, since their efficiencies are similar, the electricity cost per kg is roughly the same. Instead, differences in OpEx come from maintenance and stack replacement (see next section) and how the electrolyzer is run (steady vs variable loads). One nuance: PEM electrolyzers often can operate at higher current densities (more hydrogen output per cell area) but at the expense of some efficiency loss and faster degradation energy.gov. Operators can choose to run PEM stacks a bit harder (getting more hydrogen from a smaller unit) or dial back for efficiency – this is a design/operational trade-off. Alkaline systems, by contrast, often use larger cell areas and don’t push as high current per cm², which contributes to their larger physical size but also long-term stability.

Maintenance costs (replacement parts, labor) also factor into OpEx. Alkaline systems may require periodic handling of the liquid electrolyte (e.g. filtering or replacing KOH over time) and maintenance of pumps and seals, whereas PEM systems avoid liquid handling but may need deionizer cartridges to keep water ultra-pure and careful monitoring of the membrane health. We’ll discuss lifetimes below, but if a PEM stack needs replacement more frequently than an alkaline stack, that adds to effective OpEx. On the other hand, alkaline systems often need downstream gas purification (to remove KOH mist or ensure oxygen purity) which incurs a small efficiency and maintenance cost, whereas PEM hydrogen is ultra-pure by design 1 .

Lifetime and Maintenance Requirements

One of the most important but tricky comparisons is the durability of the electrolyzer stacks and what maintenance they need over their life.

Alkaline Lifetime: Traditional alkaline electrolyzers are known for longevity – decades of operating experience in industrial settings show they can run for tens of thousands of hours. Manufacturers often quote stack lifetimes on the order of 60,000–90,000 hours (which is 7–10 years of continuous operation) before major refurbishment greenh2world.com. In fact, Sunfire reported its modern pressurized alkaline units have surpassed 90,000 operating hours in the field greenh2world.com. Part of this durability is due to the relatively mild operating conditions (no extreme pH changes at electrodes since KOH is consistent, and moderate temperatures) and use of robust materials like stainless steel and nickel. Maintenance of alkaline electrolyzers is generally considered straightforward: the technology is “easier to monitor, maintain, and operate,” as one industry analysis notes johncockerill.com. Periodic checks of the electrolyte concentration and replacement of consumables (seals, separators, or electrolyte if it becomes carbonated) are typical. Many alkaline systems can be serviced on-site with common tools, and they don’t contain fragile membrane materials that need specialized handling stargatehydrogen.com stargatehydrogen.com. However, alkaline electrodes can suffer corrosion over long periods, and their performance can slowly decline as electrodes age or impurities build up. When a stack does reach end-of-life, replacing or refurbishing it (e.g. swapping out electrode plates) is the main maintenance event.

PEM Lifetime: PEM electrolyzers, being a newer technology, historically had shorter lifetimes – early PEM stacks might last only 20,000–40,000 hours before significant degradation. But recent advancements have greatly improved durability. State-of-the-art PEM stacks are now targeting 60,000–80,000 hours of operation energy.gov (7–9 years) under optimal conditions. Still, PEMs are considered to have a somewhat shorter lifespan than alkaline of similar size stargatehydrogen.com stargatehydrogen.com. The limiting factors include membrane chemical degradation, catalyst layer wear (especially if load is cycled often), and mechanical stress on the thin polymer membrane. PEM stacks also rely on very pure water; any contaminants can foul the membrane or catalyst, so water purification systems must be maintained. In terms of maintenance, PEM systems have fewer moving parts (no liquid electrolyte circulation pumps in many designs, since water feed is simpler), but they require more specialized attention. Replacing a PEM membrane-electrode assembly (MEA) is a delicate task typically done at a refurbishing center or by the OEM, not in a regular factory workshop. The need for precious metal catalysts means recycling and reclaiming those catalysts at end-of-life is important (a cost factor but also a recycling opportunity). Overall, PEM maintenance tends to be more complex and costly than alkaline, as noted by industry sources stargatehydrogen.com stargatehydrogen.com – this includes both the higher cost of parts (membranes, catalysts) and the specialized labor to service them. Manufacturers are addressing this by improving membrane longevity and developing cheaper, modular stack designs that can be swapped out more easily.

SOEC Lifetime: Solid oxide electrolyzers are still in the early stage of commercialization, and durability is one of their biggest challenges. Operating at 800 °C induces thermal stresses and material degradation that can shorten stack life. Current SOEC demonstration units have reported lifetimes on the order of 20,000 hours (just a couple of years) before significant performance drop-off energy.gov. The goal is to reach 40,000–60,000 hours with further R&D energy.gov. Failure modes for SOEC include thermal cycling cracks, electrode sintering or poisoning, and seal failures. Because of these challenges, SOEC stacks may need more frequent replacement until the technology matures. On maintenance: SOEC systems are complex – they require high-temperature insulation, heat exchangers, and sometimes steam generation equipment. This means there are more supporting components that need upkeep (burners or electric heaters for start-up, hot gas blowers, etc.). Any unplanned cooling and reheating of the stack can stress the cells, so operators try to keep SOEC stacks at temperature, idling at low power if necessary, rather than shutting down often. The high-temperature materials (ceramic cells, interconnects made of specialized alloys) are not as easily handled as metals; if a stack fails, it generally must be swapped out as a whole unit. Manufacturers like Bloom and Sunfire are leveraging their experience from solid oxide fuel cells to extend SOEC life – for instance, Bloom’s SOEC units use the same cell platform as their SOFCs which have cumulated billions of cell-hours in the field hydrogentechworld.com. Early results are promising: Bloom’s 4 MW pilot ran for 4,500 hours at full load with stable performance hydrogentechworld.com. As the technology improves, we expect SOEC maintenance intervals to lengthen and approach those of other electrolyzers, but for now, SOECs likely require more frequent stack replacements and careful thermal management.

Suitability for Intermittent Renewable Energy

Integrating electrolyzers with intermittent renewables (solar, wind) is a key use case for producing truly “green” hydrogen. Different electrolyzer types handle fluctuating power inputs differently:

- PEM electrolyzers are highly flexible and excel at handling variable power. They have fast start-up and response times, able to ramp from standby to full output in seconds or minutes stargatehydrogen.com stargatehydrogen.com. This makes PEM a great fit for directly coupling to solar/wind that can have rapid swings. They can also operate efficiently across a wide range of loads – even at 10% or 20% of capacity, a PEM electrolyzer can still produce hydrogen without major efficiency loss or risk of damage. This wide dynamic range is a big advantage for renewable integration. In practice, PEM units have been used to dynamically absorb excess grid power or follow a solar PV generation curve on a minute-by-minute basis.

- Alkaline electrolyzers historically had slower ramping and are best at steady operation, but modern designs have improved significantly. Traditional alkaline systems needed time to warm up and stabilize; additionally, sudden power changes could lead to issues like gas bubbles in the electrolyte or pressure fluctuations. New “pressurized alkaline” electrolyzers have added features to address this: they operate at higher pressure and have better internal gas separation, allowing them to ramp faster and cycle more readily johncockerill.com johncockerill.com. Manufacturers report that advanced alkaline units can now “follow variable renewable energy” load profiles much better than before johncockerill.com. That said, alkaline tech is still generally slower to start and adjust output than PEM stargatehydrogen.com. If a wind farm suddenly goes from 50% to 100% output, a PEM electrolyzer might instantly take the extra power, whereas an alkaline system might need a controlled ramp. For applications with very frequent on-off cycles or where the electrolyzer might sit idle and then fire up daily, PEM is often favored. Alkaline can certainly work with renewables – indeed many large solar-powered H₂ projects in 2023–2024 are alkaline-based – but they may run the electrolyzers more at steady-state (buffering short fluctuations with small battery or by curtailing a bit of the solar output rather than cycling the electrolyzer too hard).

- SOEC electrolyzers are less suited to intermittency in their current state. Because an SOEC must stay hot (hundreds of degrees Celsius), it’s not feasible to turn it completely off when the sun sets or the wind dies – frequent thermal cycling would drastically shorten its life. SOECs are thus envisioned for use either with constant power sources (e.g. nuclear, geothermal) or in industrial hubs where they can use stable waste heat streams. If paired with renewables, an SOEC might require some form of energy storage or supplemental heating to maintain temperature when electrical input dips. However, it’s worth noting that dynamic operation is not impossible. Bloom Energy demonstrated that their SOEC could ramp from 100% power down to 5% in under 10 minutes without adverse effects, and even at low load the efficiency remained high hydrogentechworld.com. This suggests that if an SOEC plant is kept hot (perhaps by storing heat or using a hybrid heating system), it could modulate hydrogen output somewhat. But practically speaking, SOEC is best for fairly steady, high-utilization operation, whereas PEM (and improved alkaline) can better handle direct coupling to highly intermittent sources.

In summary, PEM is often the top choice for intermittent renewable energy projects due to its fast response and partial-load efficiency stargatehydrogen.com stargatehydrogen.com. Alkaline technology is catching up with pressurized, more dynamic designs that make it viable for many renewable-driven systems (especially larger plants where slight delays or a bit of buffering are manageable) johncockerill.com johncockerill.com. SOEC, on the other hand, is currently targeted at use cases with continuous operation, though future innovations (or use of hybrid configurations) may allow them to work with variable power in niche situations.

Commercial Availability and Use Cases

Both Alkaline and PEM electrolyzers are fully commercial (TRL 9), widely deployed around the world iea.org. Alkaline is the workhorse of industrial hydrogen – it has been used for over a half-century in applications like ammonia production, oil refining (for hydrogenation processes), float glass manufacturing, and chemicals. Many older installations were small (a few MW), but alkaline units have been scaled up: multiple 100+ MW alkaline projects are underway or operational. In fact, alkaline technology currently accounts for about 70–90% of new electrolyzer capacity installations annually johncockerill.com, thanks to its lower cost and long track record. PEM electrolyzers, while newer, have quickly gained ground in applications requiring flexibility or high purity hydrogen. They are common in hydrogen fueling stations (where quick response and compact footprint are needed), in power-to-gas demonstrations, and as part of renewable energy storage projects. The largest PEM electrolyzer in operation to date is around 20 MW capacity johncockerill.com (at Air Liquide’s Bécancour plant in Canada, and similar-scale units in Germany and China) – whereas alkaline has surpassed that scale (for instance, a single alkaline plant in China is 260 MW as discussed below). Still, PEM is moving to larger projects too, with 100 MW-class PEM plants in planning or construction (such as Shell’s Refhyne II project in Germany, slated for ~2027).

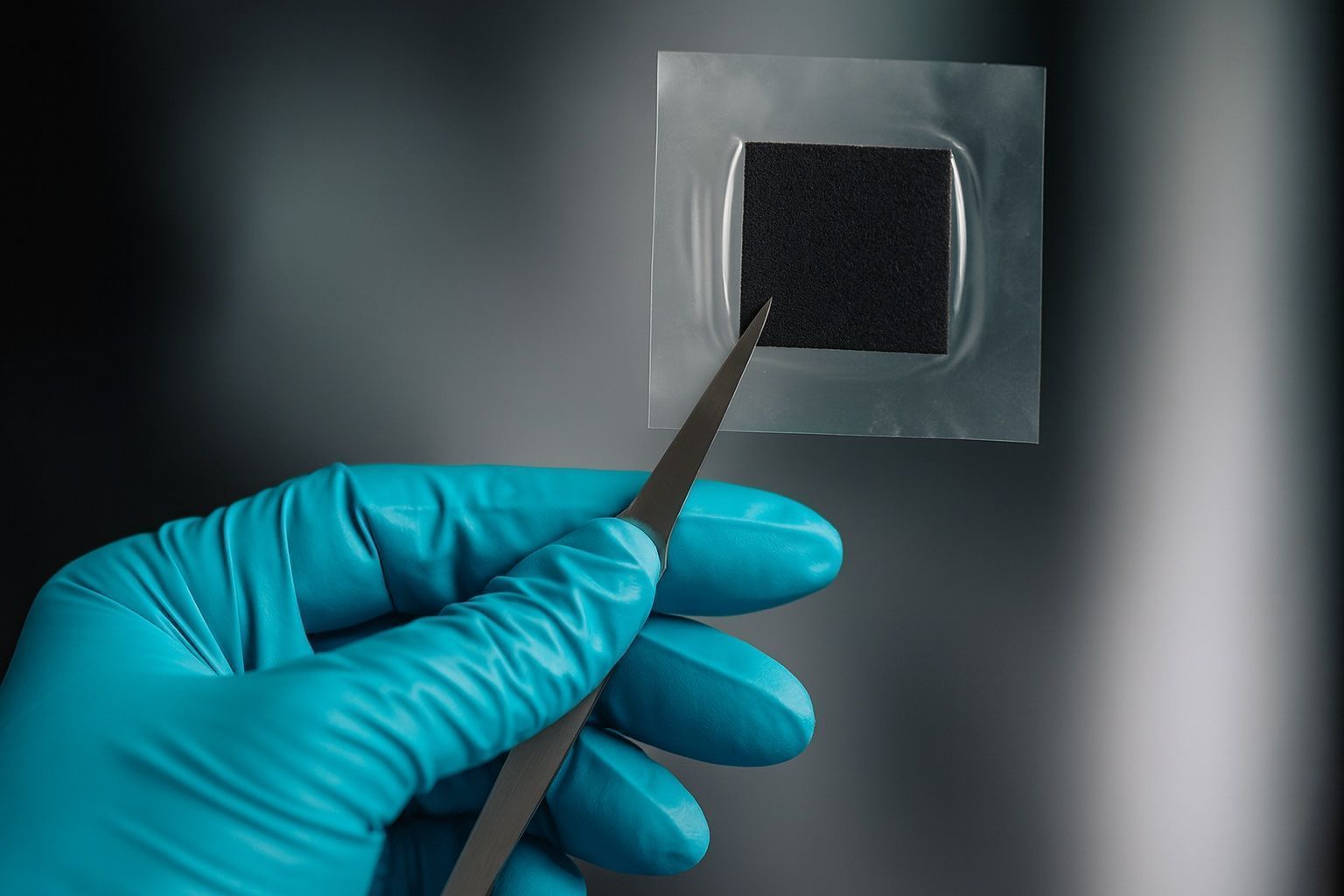

Solid Oxide (SOEC) technology is on the cusp of commercialization. It’s currently at demonstration stage (TRL 7–8), with a handful of multi-megawatt pilots proving the concept iea.org iea.org. For example, in 2023 a 2.6 MW SOEC electrolyzer was installed at a Neste oil refinery in the Netherlands – at the time, the largest SOEC system globally iea.org. Just weeks later, Bloom Energy commissioned an even larger 4 MW SOEC system at NASA’s Ames Research Center in California iea.org. These projects have shown that SOEC can be integrated into industrial environments (Neste will use the hydrogen in refining processes) and can scale to multi-MW. Use cases for SOEC leverage its high efficiency when cheap heat or steam is available. Industries like refining, petrochemicals, or steel mills – which have high-grade waste heat – are prime candidates to host SOEC electrolyzers. Another emerging use case is co-electrolysis, where SOEC can co-electrolyze steam and CO₂ together to produce syngas (a mixture of H₂ and CO) for synthetic fuel production. Companies like Sunfire have demonstrated this process to make e-fuels. While not yet widespread, co-electrolysis could be a game-changer for sustainable aviation fuels and plastics, and SOEC is uniquely suited for it (since it runs hot enough to handle CO₂ reduction).

Notable use cases and installations:

- Large-scale Green Hydrogen Plants: Alkaline electrolyzers are being deployed in “hydrogen farms” tied to renewable energy. China has been leading with massive projects – for instance, Sinopec’s green hydrogen facility in Xinjiang uses 260 MW of alkaline electrolyzers powered by a solar farm. Commissioned in 2023, it will produce 20,000 tons of H₂ per year to supply a nearby refinery, displacing hydrogen from natural gas reuters.com reuters.com. This is currently the world’s largest single electrolyzer plant. Similarly, the NEOM project in Saudi Arabia (under construction) will use hundreds of MW of alkaline electrolyzers to produce green ammonia for export. These projects favor alkaline for its economy of scale.

- Grid Balancing and Power-to-Gas: PEM electrolyzers have been used in projects where absorbing excess renewable electricity is key. In Germany, several power-to-gas sites use PEM stacks to convert surplus wind power into hydrogen, injecting it into the natural gas grid or methanating it. The ability to rapidly throttle PEM electrolyzers up and down makes them ideal for grid frequency regulation services as well. Some 10–20 MW PEM systems in Europe (like the REFHYNE 10 MW plant at Shell’s Rheinland refinery) serve as both hydrogen supply and a flexible load that can help balance the local grid.

- Transportation and Fueling: Many hydrogen fueling stations (for fuel cell vehicles) employ on-site PEM electrolyzers. Companies like Nel Hydrogen deploy compact PEM electrolyzer modules at stations since they produce high-pressure, ultra-pure H₂ that can go directly into vehicle tanks stargatehydrogen.com stargatehydrogen.com. PEM’s footprint advantage and high purity are important in this use. Alkaline systems in contrast usually output hydrogen at lower pressure (requiring an external compressor for fueling use) and potentially with trace moisture/alkali that necessitate extra purification, so PEM has dominated the transport fueling segment.

- Industrial On-Site Hydrogen: Many industries that currently truck in hydrogen cylinders or liquefied hydrogen are switching to on-site electrolyzers for reliability and cost reasons. Both PEM and alkaline are used here depending on scale: a semiconductor fab or glass plant that needs a steady 99.999% H₂ supply might choose alkaline for bulk production plus a purifier, or PEM if they want a smaller, turn-key unit. Food processing plants that use hydrogenated oils, float glass factories, electronics manufacturers (which need ultra-pure H₂ for processes) – these are all deploying electrolyzers. Alkaline’s long-term reliability is attractive in harsh industrial settings johncockerill.com, whereas PEM’s high purity and compact skids fit well in environments where space is limited or high purity is mandatory.

- Integration with Heat Sources: As a forward-looking application, SOECs are being considered for nuclear plants and concentrated solar plants. A high-temperature gas-cooled reactor or a molten salt solar tower could provide steam at 700+ °C directly to an SOEC, creating hydrogen very efficiently. Pilot programs in Europe (like coupling SOEC with research reactors) and in Japan are exploring this. If successful, it could open a niche where nuclear reactors produce hydrogen during off-peak electricity demand hours by feeding steam and power to an SOEC system.

In summary, alkaline and PEM technologies are already the backbone of the growing green hydrogen industry, each carving out niches: alkaline in large, cost-driven projects and PEM in applications needing agility or purity. SOEC is emerging for specialized industrial uses and high-efficiency integrations, expected to join the commercial mix within a couple of years as pilot projects transition to full-scale operations iea.org 5 .

Current Market Leaders and Models

The ramp-up in electrolyzer demand has spurred many companies worldwide to expand manufacturing. Here are some of the leading providers and notable models in each category:

- Alkaline Manufacturers: Long-established industrial players and new entrants are competing in alkaline electrolyzers. Thyssenkrupp Nucera (Germany, a joint venture of Thyssenkrupp and De Nora) is a top supplier for large projects – it’s providing 2 GW of alkaline electrolyzers for the NEOM project. Nel ASA (Norway) is another major player, with a history in atmospheric alkaline systems; their containerized A-Series alkaline units are used in many projects greenh2world.com. John Cockerill (Belgium) produces pressurized alkaline electrolyzers in 5 MW modular skids and has supplied units to projects in Europe and Asia greenh2world.com. In the US, Cummins (via its Hydrogenics acquisition) offers the HySTAT® line of modular alkaline electrolyzers, known for reliability and ease of scaling by linking multiple units greenh2world.com greenh2world.com. Chinese companies have rapidly grown to dominate manufacturing volume: PERIC (state-owned) and private firms like Sungrow, LONGi Hydrogen, and Tianci supply large alkaline systems for domestic projects (China now has ~60% of global manufacturing capacity) iea.org iea.org. As of 2023, alkaline technology leads in market share – it made up roughly 70–90% of annual shipments by capacity, according to BloombergNEF 6 .

- PEM Manufacturers:Siemens Energy (Germany) has a prominent PEM offering – the Silyzer product line (Silyzer 200, 300, etc.) – including systems used in Shell’s refineries. The ITM Power (UK) HGAS series is another well-known PEM system, providing containerized PEM electrolyzers with integrated purifiers and control systems greenh2world.com. Plug Power (USA) has entered the PEM market aggressively, building gigawatt-scale manufacturing in the U.S. and supplying PEM electrolyzer systems (they acquired Giner ELX and others). Cummins also produces PEM electrolyzers (its HyLYZER systems, used in e.g. a 20 MW installation in Canada). Nel offers small-to-medium PEM electrolyzers as well (originating from its acquisition of Proton OnSite in the US) for industrial and fueling uses greenh2world.com. In Japan, Kobelco and Toshiba have developed PEM units, especially for power-to-gas projects. And notably, new companies in China are focusing on PEM technology – e.g. Shanghai H-RAY, which is innovating to reduce PEM costs and was recognized in 2024 for its progress in cutting precious metal usage h-raypem.com. While PEM’s installed base is smaller than alkaline’s, many Western and emerging manufacturers are scaling up PEM production, anticipating high demand for flexible electrolyzers as renewable capacity grows.

- SOEC Developers: The field of SOEC is led by a few specialized companies. Bloom Energy (USA) is a front-runner – known for its solid oxide fuel cells, Bloom leveraged that tech to create a 4 MW SOEC system and is building out a manufacturing line for solid oxide electrolysis iea.org iea.org. Sunfire (Germany) is another pioneer, delivering the 2.6 MW SOEC to Neste and working on co-electrolysis technology; Sunfire is also unique in that it offers both SOEC and alkaline products (having acquired an alkaline maker, it sells “HyLink” alkaline modules as well as SOEC systems) greenh2world.com greenh2world.com. Topsoe (Denmark), a big name in catalysis, has developed an SOEC design and is constructing a factory capable of 500 MW of SOEC production per year, expected online in 2025 iea.org iea.org. In the UK, Ceres Power is working on a solid oxide electrolyzer (in partnership with Shell for a pilot plant) leveraging its steel-supported ceramic cell technology. Other noteworthy names include FuelCell Energy (USA), which has explored reversible SOFC/SOEC systems, and Elcogen (Estonia), which provides solid oxide cell components. As of mid-2025, SOEC suppliers are lining up first commercial orders – for example, Topsoe aims to deploy its first large SOEC units in projects by 2025–2026, and Sunfire has announced a 10 MW SOEC project in Finland’s steel industry.

It’s also worth mentioning Anion Exchange Membrane (AEM) electrolyzers as an emerging technology. AEM tries to combine advantages of PEM and alkaline (using an alkaline membrane, no liquid electrolyte, and non-precious catalysts). Companies like Enapter and Fusion Fuel are small but growing players here iea.org. However, AEM is still at early stages (small scale deployments), so the bulk of the market in the next 5 years will belong to alkaline, PEM, and perhaps the first commercial SOEC units.

Innovations and Upcoming Developments (2024–2025)

The electrolyzer field is evolving rapidly. Recent innovations and upcoming products include:

- Higher Efficiency Designs: Start-up Hysata (Australia) developed a capillary-fed electrolyzer cell that achieved a remarkable 80% efficiency (LHV) in lab tests iea.org. Instead of conventional plates, it uses a sponge-like capillary structure to reduce resistance losses. This technology, now scaling up, could significantly beat the efficiency of standard PEM/alkaline cells if proven at scale. Likewise, Sunfire’s SOEC already hit 84% efficiency LHV at pilot scale iea.org, and further improvements in high-temperature materials could push electrical efficiency closer to the theoretical limits.

- Cost Reduction in Catalysts: Given the reliance of PEM on precious metals, multiple efforts are underway to reduce or eliminate platinum-group metals (PGMs). In 2023, a company called Bspkl (UK) developed a new catalyst-coated membrane that uses 25× less iridium and platinum than conventional PEM designs iea.org. Another innovator, Clean Power Hydrogen (CPH2), has a membrane-free electrolyzer design – essentially an alkaline system that produces a mixed gas and then separates the hydrogen out, thereby using no expensive membrane or PGM catalysts iea.org. Toshiba Energy and partner Bekaert announced a technique to cut iridium usage by 90% by using nano-coatings on PEM electrodes iea.org. These developments are critical because iridium, used at PEM anodes, is extremely scarce – IRENA warned that global iridium production could limit PEM manufacturing to ~10 GW per year if usage isn’t reduced johncockerill.com johncockerill.com. By slashing catalyst loading through better utilization (or using alternative catalysts like novel alloys and oxides), PEM costs could drop and supply chain constraints ease. Even alkaline tech benefits from R&D on catalysts: new durable coatings for alkaline electrodes (e.g. nickel-iron coatings or mixed metal oxides) can improve efficiency at high currents and extend life, allowing alkaline electrolyzers to run harder without degradation.

- Scaling Up Manufacturing: A number of large factories are coming online to meet demand. Nel opened a fully automated production line for alkaline electrodes in 2024, targeting multi-GW/year output. Topsoe’s aforementioned factory in Denmark (500 MW/yr capacity for SOEC initially) is on track for 2025 iea.org. Cummins/HyLYZER is building a new PEM electrolyzer plant in Spain (with 500 MW/yr capacity) and expanding in Canada. Plug Power ramped up a gigafactory in New York for PEM stack production. These facilities should drive economies of scale and are expected to cut costs through automation and volume – the IEA notes that anticipated higher factory output can reduce investment costs for all electrolyzer technologies iea.org. By 2030, announced plans globally amount to >160 GW/yr of manufacturing capacity, up from ~25 GW/yr in 2023 iea.org 7 .

- New Entrants and Partnerships: The industry is seeing cross-technology collaboration. For example, Thyssenkrupp Nucera (mostly alkaline focused) announced in 2024 a partnership with Fraunhofer to develop its own solid oxide electrolyzers, aiming for a pilot by 2025 hydrogeninsight.com thyssenkrupp-nucera.com. This indicates established alkaline/PEM manufacturers are hedging by investing in next-gen SOEC research. Meanwhile, companies traditionally in fuel cells or other areas are entering electrolyzers: e.g. Versogen (US) and Ohmium (US/India) are startups focusing on AEM and PEM respectively, with fresh funding. Big automakers and oil & gas firms are also partnering or investing in electrolyzers to secure supply – in 2024, GM and Nel announced a partnership to develop low-cost electrolyzer stacks using automotive fuel cell manufacturing techniques.

- Notable Upcoming Products: Some examples on the horizon: Siemens Energy is working on a next-gen PEM stack with >1,000 cm² cell area to increase per-stack hydrogen output, expected to feature in the Silyzer 300 upgrades by 2025. ITM Power has redesigned its PEM stack (the Mk.2) for better reliability after learning from earlier deployments, with new 5 MW module prototypes being tested as of 2024. McPhy (France) is developing a large alkaline electrolyzer (“Augmented McLyzer”) in the 20 MW-module class, with a reference 100 MW project in Normandy planned. Ceres Power and Shell’s pilot SOEC (1 MW scale) in India will test Ceres’ unique ceramic stacks in a real industrial environment by 2025. And in the AEM realm, Enapter opened a mass-production plant in 2023 to produce standardized 2.5 kW AEM electrolyzer modules, aiming to aggregate thousands of them in larger systems 8 .

- Software and Systems Innovations: Beyond the stack hardware, improvements in power electronics and software controls are enabling better performance. For instance, more electrolyzers are now coming with smart power management that can help provide grid services (e.g. dynamically adjusting load to help balance frequency). “Digital twins” of electrolyzer plants are used to optimize operation and predictive maintenance – reducing downtime and maintenance costs by catching issues early. Also, balance-of-plant optimizations like more efficient gas separators, heat exchangers, and compressors (for pressurizing H₂) are incrementally raising overall system efficiency and lowering cost.

Overall, the period of 2024–2025 is one of rapid innovation in electrolyzers. Efficiency records are being broken and capital costs are steadily dropping. As an expert from the U.S. Department of Energy summarized, there is a concerted R&D focus to “reduce capital cost, improve efficiency and performance, and increase lifetimes” across all electrolyzer types energy.gov – and we are seeing exactly that: more durable membranes, cheaper catalysts, bigger production lines, and smarter designs.

Environmental Impact and Resource Use

In the push for green hydrogen, it’s not just the operating emissions that matter (electrolyzers running on renewable power emit no greenhouse gases) – the environmental footprint of building and operating electrolyzers is also considered. Each technology has different impacts:

- Material Resources: Alkaline electrolyzers have the advantage of using earth-abundant materials for their core components. The electrodes are typically nickel-based (sometimes with coatings of nickel oxide or iron alloy catalysts) and the separator is often asbestos-free porous plastic or zirconia-based diaphragms in modern designs (older systems did use asbestos separators, which is an environmental and health hazard that the industry has phased out). The electrolyte is KOH, which is a strong base but can be handled safely with proper procedures and can be recycled or neutralized at end-of-life. One reason alkaline systems are low cost is the absence of precious metals – no platinum or iridium is needed. This also means scaling up alkaline does not face critical raw material bottlenecks the way PEM might. Steel, nickel, and potassium hydroxide are readily available (though nickel mining has its own environmental considerations, like energy use and tailings). Alkaline systems do require a significant volume of liquid electrolyte, which is typically replaced every so often; disposal of used KOH (which may contain contaminants from corrosion) must be done carefully, but it can often be recycled by the supplier.

- PEM resource use: PEM electrolyzers rely on some scarce materials. Most notable is Iridium, used as the anode catalyst. Iridium is one of the rarest elements on Earth – a byproduct of platinum mining, with annual global production only around a few tons. As noted, if each MW of PEM uses several grams of Ir, there is a concern that without thrifting, global Ir supply could limit PEM expansion johncockerill.com johncockerill.com. Efforts to reduce iridium per MEA (e.g. advanced catalysts and deposition techniques) are thus crucial for sustainability. Platinum (cathode catalyst) is also used, though in smaller quantities and platinum is more available (and recyclable from fuel cells, etc.). The PEM membrane is usually a perfluorinated polymer (PFSA) – essentially a type of PFAS “forever chemical.” These membranes (e.g. Nafion) perform superbly, but PFAS are under scrutiny because of their persistence in the environment and potential health risks. As John Cockerill’s report highlighted, PEM membranes are PFAS, which can accumulate and pose disposal issues johncockerill.com johncockerill.com. Incineration at end-of-life can destroy PFAS, but that must be done at high temperature in specialized facilities to avoid emissions. The good news is the quantity of membrane per electrolyzer is not huge (a few kilograms), but it’s still a factor. Some research is looking into PFAS-free membranes for PEM, though none commercially match Nafion’s performance yet. On the positive side, PEM electrolyzers, by producing such high-purity hydrogen, avoid the need for additional chemical purification steps and associated chemicals.

- Solid Oxide materials: SOECs use ceramic and metal materials that differ from the above. The electrolyte is often yttria-stabilized zirconia (YSZ) – basically zirconium oxide with some yttrium. Zirconium is not rare (mined as zircon), and yttrium is moderately abundant (often sourced from rare earth mines, but needed in much smaller quantities than, say, neodymium magnets). The electrodes typically contain nickel (in a nickel-YSZ cermet) and perovskite oxides like strontium-doped lanthanum ferrite or similar. Strontium and lanthanum are also elements that need to be mined (lanthanum is a light rare earth, but again required quantities are relatively small per cell). Importantly, SOECs do not require platinum-group metals or PFAS membranes, which is a big plus from a critical materials standpoint. They do use high-temperature alloys (for interconnect plates, piping) which might include chromium or cobalt, but those are common in high-temp equipment. The main environmental concern with SOEC might be the energy and materials needed to manufacture the ceramic cells – sintering ceramics at high temperatures, ensuring tight tolerances – and the fact that, if they have shorter life, you’d be manufacturing replacements more often (which means more material use over time). Recycling SOEC stacks is an area still developing; in principle, metals like nickel can be recycled, and ceramics can be ground up, but it’s not as straightforward as recycling metals from a PEM or alkaline system.

- Water usage: All electrolyzers consume water – roughly 9 liters of water per 1 kg of H₂ produced (since the reaction is 2 H₂O → 2 H₂ + O₂). In areas where water is scarce, this could be a factor if scaling to thousands of tons of hydrogen. Alkaline and PEM typically need deionized water (to avoid mineral scaling or membrane poisoning). SOEC needs purified water too (and turned to steam). The water consumption is identical on a chemical basis; however, cooling needs can differ. Alkaline systems may need more cooling water in large plants (because they operate continuously and at lower temp, excess energy is rejected as low-grade heat), whereas SOEC might utilize high-grade heat more internally. If using electrolyzers with seawater, typically a desalination unit is placed in front – which has its own energy cost and brine output, but in big coastal projects that’s factored in (and the water requirement for, say, 1 ton H₂ is ~9 tons water, trivial compared to the water output of a medium-size desal plant). Interesting to note: a study by IEA found alkaline electrolysis for a given hydrogen output uses less high-purity water than steam methane reforming (SMR) would, but might use more seawater if you count cooling needs, though these comparisons depend on system design 9 .

- Electricity source emissions: From an environmental perspective, the carbon footprint of hydrogen via electrolysis depends entirely on the power source. If renewables or nuclear provide the electricity, the hydrogen is essentially zero-carbon. But if grid electricity (with fossil mix) is used, then the effective emissions can be significant (though in many regions falling as grids get cleaner). All three electrolyzer types themselves do not produce CO₂ – just oxygen as a byproduct. However, manufacturing them has an embodied carbon cost (steel, cement for plant construction, etc.). Life-cycle analyses show that the use-phase dominates impacts (due to electricity consumption), so decarbonizing the power is the main lever to make hydrogen “green.”

- End-of-Life and Recycling: Alkaline electrolyzers primarily consist of steel frames, nickel electrodes, and some plastic components – these can be recycled (nickel and steel are commonly recycled metals). The KOH electrolyte can be neutralized. PEM stacks have valuable platinum and iridium in them – recycling processes are already in place (similar to recycling used catalytic converters or fuel cell stacks) to recover these metals, which is good both economically and environmentally. The membrane (PFAS) needs careful disposal. SOEC stacks, being relatively new, don’t yet have established recycling, but researchers are looking at how to recover materials or safely dispose of spent cells. Fortunately, none of the electrolyzer types contain toxic heavy metals like lead or mercury. The main “toxic” flag is the PFAS polymer in PEM, which, as noted, is under regulatory scrutiny; the industry will likely move to ensure those polymers are either recycled or incinerated properly at end of life to avoid environmental release.

In broad strokes, alkaline electrolyzers have the smallest exotic material footprint, PEM has the challenge of precious metals and PFAS, and SOEC avoids precious metals but uses advanced ceramics and requires more energy to manufacture. On the positive side, all these technologies enable a hydrogen supply chain with zero greenhouse gas emissions at use, which is a huge environmental benefit if it displaces fossil-based hydrogen (or fossil fuels in end use). Experts emphasize that managing the supply of critical materials (like iridium) and ensuring sustainable manufacturing will be important as we scale from megawatts today to gigawatts in the coming years johncockerill.com 10 .

Expert Opinions and Perspectives

What do industry experts and analysts say about these technologies and their future? A few insightful quotes and viewpoints help paint the picture:

- No One-Size-Fits-All Solution: A recent analysis by John Cockerill (a leading electrolyzer supplier) concluded that “There is no single electrolyzer technology that performs better across all dimensions” johncockerill.com. The best choice depends on the use-case and priorities – whether it’s cost, efficiency, scalability, or purity. For example, if lowest capital cost and proven reliability are paramount (say for a large chemical plant), alkaline might be favored. If space is tight or power is variable, PEM could be better. This underscores that each technology has its niche, and many experts believe a portfolio of all will be needed. As the John Cockerill report further notes, “alkaline… can be easily scaled as needs change, offering robust and reliable output for most industries, whereas specialized sectors like transport may find PEM’s purity and compact size to be the better choice” johncockerill.com 11 .

- On the Importance of Efficiency: Dr. Ravi Prasher, CTO of Bloom Energy (which builds SOECs), highlighted how critical efficiency is for economics: “The amount of electricity needed by the electrolyzer to make hydrogen will be the most dominant factor in determining hydrogen production cost. For this reason, the efficiency … becomes the most critical figure of merit.” hydrogentechworld.com. This reflects a common expert view that, while capital costs are coming down, the operational cost (driven by power consumption) will be the key differentiator – especially as projects scale up and power becomes a major expense. His comment came as Bloom demonstrated their high-efficiency SOEC, and he noted that their 4 MW system was producing hydrogen at 37.7 kWh per kg (unusually low due to the use of steam) and that even at part load its efficiency beat other technologies hydrogentechworld.com hydrogentechworld.com. Such achievements fuel optimism that technology improvements can substantially cut hydrogen costs.

- Flexibility and Energy Storage: In reference to integrating hydrogen with renewable energy, Bloom’s CEO, KR Sridhar, emphasized the role of electrolyzers in energy storage: “Hydrogen will be essential for storing intermittent and curtailed energy and for decarbonizing industrial energy use. Commercially viable electrolyzers are the key to unlocking the energy storage puzzle.” hydrogentechworld.com. He argues that advanced electrolyzers like SOEC offer “inherently superior technology and economic advantages” in the long run hydrogentechworld.com, but this is of course the perspective of an SOEC proponent. Nonetheless, many energy experts do see hydrogen (produced by any electrolysis tech when surplus renewables are available) as a linchpin for seasonal storage and hard-to-abate sectors.

- Industry Scaling and Investment: Fatih Birol, Executive Director of the IEA, noted in late 2023 that “The growth in new projects suggests strong investor interest in developing low-emissions hydrogen production”, but he also warned that many announced projects need to actually reach construction iea.org illuminem.com. He highlighted that demand for clean hydrogen needs to firm up to give confidence for electrolyzer investments carboncredits.com. This speaks to a broader expert concern: the policy and market support must grow in tandem with technology. As of 2025, governments in Europe, North America, China, and elsewhere are rolling out incentives (tax credits, subsidies, hydrogen purchase agreements) to close the cost gap and spur adoption. These measures are crucial in the eyes of industry leaders to scale electrolyzer deployment from hundreds of MW today to the tens of GW per year needed for climate goals iea.org 12 .

- Perspective on New Technologies: Some experts in academia caution that while new tech like AEM and SOEC are exciting, they shouldn’t distract from deploying what’s available. Professor Jack Brouwer of UC Irvine (a hydrogen energy researcher) said in a 2024 panel that we should “deploy, deploy, deploy” proven PEM and alkaline now, even as R&D on next-gen continues – because achieving scale brings costs down and we learn by doing (quote paraphrased from event). This pragmatic view is common: use the commercial tools at hand (AWE/PEM) to start cutting emissions, while making sure to nurture the new tech for the future.

- Europe’s Leadership and Energy Security: Nils Aldag, CEO of Sunfire, speaking about the MultiPLHY SOEC project, stated “Groundbreaking hydrogen projects like MultiPLHY are laying the foundation to secure Europe’s position as a global leader in clean technologies.” energytech.com. This reflects a sentiment in Europe that pushing the envelope in electrolyzers (whether high-efficiency SOEC or gigawatt-scale alkaline plants) not only helps climate goals but also builds a domestic industry for the energy transition. His emphasis on Europe’s position shows how electrolyzer projects are a source of technological pride and competition internationally.

In conclusion, experts across the board recognize that each electrolyzer type has distinct strengths and that the rapid pace of innovation is a positive sign. The consensus is that we’ll need all the electrolyzer technologies to meet various demands: alkaline for bulk, low-cost hydrogen; PEM for dynamic and high-purity applications; and SOEC for high-efficiency integrated systems. The focus now is on scaling up manufacturing, driving down costs, and improving durability. As the IEA succinctly put it, continued innovation is needed to “reduce overall capital costs, though those efforts must also consider trade-offs with lifetime and efficiency” energy.gov. Balancing those factors is the name of the game.

Recent News and Developments (2024–2025)

The past two years have seen hydrogen electrolyzer projects and partnerships announced at an accelerating pace. Here are some of the noteworthy recent developments:

- Record-Breaking Projects: In mid-2023, China’s Sinopec started up the world’s largest green hydrogen plant in Xinjiang – a 260 MW alkaline electrolyzer array as mentioned earlier. By late 2024, that plant was ramping up production and highlighted both China’s ambition and some learning-curve challenges (reports indicated it initially ran at only ~30% utilization as they tuned the systems) energynews.biz. Elsewhere, in Europe, large projects reached milestones: in July 2024 Shell took a final investment decision on the 100 MW Refhyne II PEM electrolyzer in Germany (to be operational in 2027) reuters.com refhyne.eu, and in the same month the EU Green Hydrogen Bank held its first auction to support 3 million tons of H₂, giving projects long-term price support iea.org iea.org – a policy innovation to ensure offtake for big electrolyzer deployments.

- Public-Private Partnerships: Big oil and gas companies have been teaming with electrolyzer firms. For example, BP and Thyssenkrupp Nucera announced a collaboration in 2024 to deploy 500 MW of electrolyzers at BP’s refineries. ExxonMobil invested in Electric Hydrogen (a US startup developing advanced PEM systems) to work on lower-cost solutions for industrial hydrogen. And in a notable upstream move, Saudi Aramco invested in 2025 in a South Korean venture to develop solid oxide electrolysis for low-cost hydrogen, tying it with potential use of heat from refineries.

- SOEC in Steelmaking: A groundbreaking pilot was launched by CSIRO and BlueScope Steel in Australia, where a tubular SOEC electrolyzer was run for 1,000 hours using waste heat from a steel plant to produce hydrogen csiro.au. This late-2024 trial demonstrated both efficiency and durability, marking one of the first real-world tests of SOEC in the steel industry (which could eventually use hydrogen to replace coal in iron reduction). In Europe, Salzgitter Steel is working with Sunfire to incorporate an SOEC unit into a steelworks by 2025 as part of Salzgitter’s SALCOS project to decarbonize steel production.

- Power Companies Entering Hydrogen: Electricity producers are eyeing electrolyzers to store surplus power and create new revenue. In 2024, NextEra Energy (a major renewables developer in the US) announced plans for several hundred MW of electrolyzers to use curtailed wind and solar in Texas to produce green hydrogen for nearby industries. Similarly, EDF in France started a project pairing a nuclear reactor with a 30 MW PEM electrolyzer to supply hydrogen for fertilizer production – interestingly using the steady nuclear output rather than letting the reactor modulate, indicating even baseload producers see hydrogen as an offtake.

- Hydrogen Hubs and Funding: The US “Hydrogen Hub” program (backed by the 2021 infrastructure law) awarded in late 2023 nearly $8 billion to regional consortia, many of which involve large electrolyzer deployments. For instance, the California hydrogen hub plans ~150 MW of electrolyzers (some PEM, some alkaline) to supply transport fuel; the Midwest hub will use nuclear power for hydrogen (likely PEM or alkaline tech), and the Texas hub integrates massive wind/solar for hydrogen in petrochemical use. These hubs will spur orders for electrolyzer manufacturers and serve as proving grounds for different tech under various conditions.

- New Products Shipping: On the corporate front, Nel Hydrogen delivered the first units of its new fully automated alkaline electrolyzer line to a 20 MW project in 2024, demonstrating their ability to cut manufacturing costs by up to 40%. Plug Power unveiled a 5 MW modular PEM electrolyzer skid (dubbed the “ML 5”) targeted at easy deployment for projects around 100 MW (by installing 20 skids). McPhy began construction of its Gigafactory in France for both alkaline and AEM electrolyzers after securing large orders. And Enapter started shipping its mass-produced AEM electrolyzer modules from its new German plant in 2023, aiming to install them by the thousands in a scalable way.

- Safety and Standards: Alongside growth, there’s a focus on safety and standards. In 2024, the International Electrotechnical Commission (IEC) released updated standards for electrolyzer safety, covering everything from electrical isolation to hydrogen leak detection, which manufacturers are adopting. There was also an incident at a large project in Asia where some alkaline electrolyzer modules had to be shut down due to seal failures causing lye leaks hydrogeninsight.com – reinforcing the need for robust engineering and sharing of best practices as more first-of-a-kind big plants come online. The industry responded by forming a new safety forum under the Hydrogen Council to disseminate lessons learned.

- Market Dynamics: By 2025, we’ve seen a slight oversupply of manufacturing in some regions (e.g. China), which actually helped drive prices down. IEA noted that global manufacturing capacity (25 GW/yr in 2023) is far above current deployment (~1 GW/yr) iea.org iea.org. This has led to competitive pricing and some consolidation – e.g. in early 2025 it’s rumored that a major oil & gas equipment firm may acquire one of the smaller electrolyzer start-ups to integrate into their portfolio.

All these developments point to one thing: electrolyzer technologies are moving out of the lab and pilot phase into mainstream industry deployment. Governments are backing it, big companies are investing, and engineering challenges are being solved one by one. As deployments scale, we’ll see even more learning and refinement of each technology’s role.

Conclusion

By comparing PEM, alkaline, and solid oxide electrolyzers side-by-side, it’s clear each has unique advantages:

- Alkaline electrolysis offers low-cost, time-tested reliability and is ideal for large-scale hydrogen production where space and steady operation are available.

- PEM electrolysis provides flexibility, fast response, and high purity hydrogen, making it perfect for variable renewable integration and use cases demanding compact, high-performance systems.

- Solid oxide electrolysis holds the promise of top efficiency and integration with heat sources, potentially revolutionizing hydrogen production in industrial settings if its durability and costs continue to improve.

The choice between them depends on project specifics – power source, required hydrogen output and purity, budget, and dynamic operating profile. As one industry source wisely put it, “depending on your use case, one may be better suited – cost of electricity, pressure needs, footprint, and other factors will drive the decision” johncockerill.com 13 .

What’s encouraging is that all three technologies are advancing rapidly. Costs are coming down (thanks to R&D and economies of scale), efficiencies are inching up, and new solutions are addressing past limitations (from better catalysts in PEM, to more responsive alkaline systems, to longer-life SOEC stacks). The period of 2024–2025 especially has shown a flurry of innovation and the first implementations of many “next-gen” concepts.

Experts believe that green hydrogen will play a crucial role in a net-zero economy – and achieving that will rely on deploying the right electrolyzer for the job. Whether it’s an alkaline unit churning out hydrogen for ammonia fertilizer, a row of PEM units load-following a wind farm, or a high-temp SOEC sipping waste heat at a refinery, each contributes to cutting emissions in sectors that have few other options (like heavy industry, chemicals, and long-haul transport).

The coming years will likely see a huge scale-up in electrolyzer capacity globally – from around 1 GW total installed today to hundreds of GW planned by 2030 iea.org iea.org. This scale-up, supported by policy and private investment, will further drive improvements. In time, we may also see hybrid systems (using both PEM and alkaline together to cover different operating ranges, or SOEC for baseline plus PEM for peak loads, etc.). Collaboration and healthy competition among the technologies will spur efficiency gains and cost reduction, benefiting the hydrogen economy as a whole.

In summary, PEM, alkaline, and SOEC electrolyzers each have a vital part to play. The “winner” of this showdown is not one technology beating the others, but rather the climate and industries that gain a suite of solutions to produce clean hydrogen. As hydrogen expert Paul Martin quipped, asking which electrolyzer is best is like asking “what’s the best tool: a hammer, a wrench, or a screwdriver?” – it depends on the job, and it’s best to have a well-equipped toolbox. With continued innovation and deployment, these electrolyzer technologies will together drive the green hydrogen transition from a niche to a globally transformative solution.

Sources:

- U.S. Department of Energy – Hydrogen Production: Electrolysis (How electrolyzers work, operating conditions) energy.gov 14

- International Energy Agency (IEA) – “Electrolysers” 2024 report (technology status, costs, efficiencies, and projects) iea.org 15

- Electric Hydrogen Co. – White paper 2024 (analysis of PEM vs alkaline efficiency and costs) eh2.com 3

- John Cockerill Hydrogen – Technical brief 2024 (alkaline vs PEM comparison, market share, and materials) johncockerill.com 16

- Hydrogen Insight – Leigh Collins, “World’s largest solid-oxide electrolyser installed” (SOEC efficiency and cost advantage) 17

- Hydrogen Tech World – “Bloom Energy begins producing hydrogen at NASA SOEC” (Bloom 4 MW SOEC performance and expert quotes) hydrogentechworld.com 18

- EnergyTech Magazine – “Sunfire installs 2.6 MW SOEC at Neste” (SOEC operating details and quote from Sunfire CEO) energytech.com 19

- Reuters – Andrew Hayley, “Sinopec’s first green hydrogen plant starts production” (260 MW alkaline project details) reuters.com 20

- IEA – Innovation insights (iridium reduction, new electrolyzer efficiency records, Toshiba catalyst) iea.org 21

- Stargate Hydrogen – “PEM vs Alkaline Electrolysers” blog (accessible explanation of pros/cons) stargatehydrogen.com 22

- Shanghai H-Ray – News release 2024 (PEM cost reduction and outlook) 4