Prudential plc’s share price has quietly turned into one of the FTSE 100’s comeback stories. On 3 December 2025, the Asia‑focused insurer is trading just under £11, close to its 52‑week high, after a year of strong operational growth and an aggressive share buyback programme that is eating through the share count. [1]

At the same time, analysts still see double‑digit upside from here, and fresh regulatory news shows that buybacks are continuing right up to year‑end. So is Prudential plc stock still a buy in December 2025, or has the easy money been made?

This article pulls together the latest news, forecasts and commentary as of 3 December 2025 to answer that question.

Where Prudential’s share price stands today

On the London Stock Exchange, Prudential plc (LON: PRU) is trading around 1,090–1,100p, after opening near 1,092p and touching an intraday high a little above 1,107p in recent sessions. [2]

Key snapshot numbers:

- Market cap: roughly £27.7–£27.9bn [3]

- 52‑week range: about 595p (low) to 1,109p (high) – the shares have almost doubled from the trough. [4]

- P/E ratio: about 18x trailing earnings [5]

- Dividend yield: roughly 1.6%, off a first‑interim dividend of 7.71 US cents per share, up 13% year‑on‑year. [6]

In New York, the PUK ADR – which represents Prudential plc shares – is trading around $29.3, almost exactly at its 52‑week high of $29.37 and more than 100% above the January low near $14.4. [7]

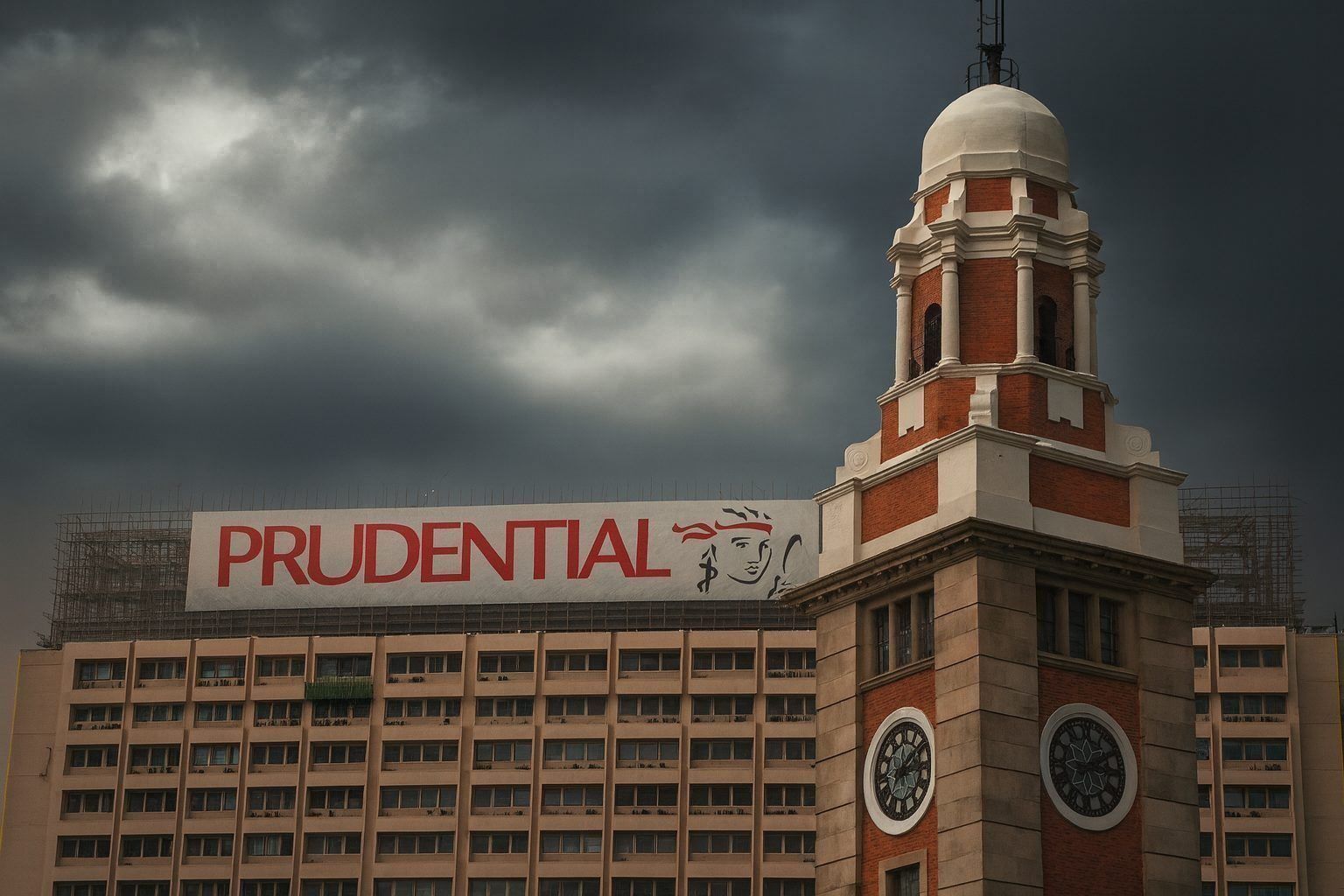

Just to be crystal clear: this is Prudential plc, the London‑ and Hong Kong‑listed Asia/Africa insurer, not Prudential Financial, Inc. in the US. The company now has dual primary listings in Hong Kong and London, a secondary listing in Singapore, and NYSE‑listed ADRs under ticker PUK, and explicitly notes that it is not affiliated with Prudential Financial. [8]

Fresh news on 3 December 2025: buybacks roll on

The key new development today is yet another “Transaction in own shares” announcement.

On 3 December 2025, Prudential published an RNS via Investegate confirming that on 2 December 2025 it: [9]

- Repurchased 272,172 ordinary shares

- At prices between £10.88 and £11.05

- With a volume‑weighted average price of £10.9965

- Intends to cancel all of these shares

After this transaction, the company states it will have 2,554,692,739 shares in issue, which is also the total number of voting rights.

That follows a similar disclosure yesterday (2 December) that on 1 December 2025 Prudential repurchased and cancelled 257,088 shares, reducing the share count to 2,555,531,090 at that point. [10]

Layer on earlier filings – including SEC and London Stock Exchange records of repurchases on 28 November 2025 (292,129 shares at around £10.91 on average) and through most of November – and the picture is very simple: Prudential is in the final sprint of a huge buyback programme, and it’s still going flat‑out into December. [11]

A Singapore‑based blog post dated 3 December 2025 summarises the latest repurchases and the impact on the issued share capital, underscoring that the share count has been drifting lower almost daily. [12]

The bigger picture: a $2bn buyback and more to come

Today’s RNS is just one pixel in a much larger capital‑return picture.

In December 2024, Prudential launched a US$2 billion share buyback programme. According to the company’s own July 2025 announcement: [13]

- First tranche: US$700m, completed 15 November 2024

- Second tranche: US$800m, completed 26 June 2025

- Third and final tranche:US$500m, launched 1 July 2025, to run until no later than 24 December 2025

The third tranche is being executed via Merrill Lynch International, with all shares to be cancelled. The company notes that $500m represents roughly 1.5% of the share capital at launch.

Prudential has gone further than that initial $2bn promise. In its half‑year 2025 results, management committed to an additional US$1.1bn of buybacks – $500m in 2026 and $600m in 2027 – alongside a plan to grow the dividend per share by 10%+ annually from 2025 to 2027. [14]

Reuters reporting and independent analysis highlight that, if executed in full, Prudential expects to have returned more than $5bn to shareholders between 2024 and 2027 through buybacks and dividends, excluding any extra capital recycled from planned disposals. TS2 Tech+1

In other words: the daily buyback RNS drip you see this week is not a sideshow – it is the main capital‑return story.

Operational backdrop: Q3 2025 shows double‑digit growth

None of this would matter if the underlying business was wheezing. At the moment, it isn’t.

In its Q3 2025 Business Performance Update (30 October), Prudential reported: [15]

- New business profit:$705m, up 13% year‑on‑year (constant currency)

- Annual premium equivalent (APE) sales:$1.716bn, up 10%

- New business margin: up 1 percentage point to 41%

The growth is very clearly geographic:

- Hong Kong delivered another quarter of double‑digit new business profit growth, helped by a tilt toward health and protection products. [16]

- Mainland China, via the CITIC Prudential Life joint venture, saw strong volume and profit growth in both agency and bancassurance channels. [17]

- ASEAN markets are more mixed: Indonesia was hit by civil unrest and normalisation after a prior boom, while Malaysia, Singapore and a group of “growth markets and other” delivered improving or double‑digit new business profit. [18]

Management says Q3’s performance keeps Prudential on track to meet its 2025 guidance and 2027 financial objectives, which include double‑digit growth in earnings and new business profit. [19]

As a reminder, this is now an Asia‑ and Africa‑focused life and health insurer, with operations in 24 markets across the regions and no remaining UK life business (that sits with M&G after the 2019 demerger). [20]

New commentary around 2–3 December 2025: is it still cheap?

Over the last 48 hours, several pieces of coverage have landed that set the tone for December.

1. “Near 52‑week high as massive buybacks lift outlook”

A 2 December 2025 analysis on TS2 Tech notes that Prudential’s share price is hovering around its 52‑week high after a roughly 70% 12‑month gain, driven by improving Asia growth and the $2bn buyback programme. TS2 Tech+1

The article highlights:

- The scale and completion status of the buyback (with ~US$1.75bn already deployed by late Q3).

- The announced additional $1.1bn of buybacks for 2026–27.

- The planned partial IPO of ICICI Prudential Asset Management in India, which could raise around $1.2bn at a roughly $12bn valuation, with proceeds expected to support further capital returns. TS2 Tech+1

TS2 also summarises independent valuations that argue Prudential still trades at a discount to its “traditional embedded value” (TEV) and to Asian peers such as AIA, even after the rally. UBS is cited as having a “Buy” rating and a target price around 1,295p, implying roughly 15–20% upside from recent levels. TS2 Tech+1

2. The Motley Fool UK: “Sub‑£11 share price looks a bargain”

On 2 December 2025, The Motley Fool UK published an article arguing that Prudential’s sub‑£11 share price still “looks a bargain”, even after the sharp recovery. [21]

Key points from that commentary (paraphrased):

- Management expects new business profit and EPS to grow by 10%+ in 2025, consistent with previous guidance. [22]

- A discounted cash‑flow (DCF) model suggests the shares continue to trade below intrinsic value, although the “margin of safety” has shrunk as the price has climbed. [23]

Earlier in the autumn, a Yahoo Finance UK piece estimated that Prudential traded roughly 45% below fair value at lower share‑price levels; more recent estimates from Morningstar and others put the discount in the mid‑teens percentage range now that the stock has rallied. [24]

3. Institutional interest in the ADR

On the US side, a MarketBeat “instant alert” today reports that quantitative trading firm XTX Topco Ltd has increased its stake in Prudential’s NYSE‑listed ADR (PUK), lifting its holdings by over 40% in the latest quarter. [25]

While this is only one investor, it reinforces the narrative that institutional money is still rotating into the name even after the strong price run.

What do analysts think now?

If you step back from individual pundits and look at consensus data, the message is surprisingly consistent: most analysts still see Prudential as a “buy” with mid‑teens upside.

Different platforms show slightly different numbers, but they rhyme:

- MarketBeat (LON: PRU):

- 5 analysts, average 12‑month target price around 1,189p

- High target: 1,350p; low: 1,000p

- Implies about 8–9% upside from a current price near 1,093p. [26]

- Investing.com consensus:

- 14 analysts, overall rating: “Buy”

- Average target around 1,269p, with a high of 1,610p and low of 1,000p – mid‑teens upside from today. [27]

- TipRanks (various listings):

- Data compiled over the last few months show a unanimous “Buy” or “Strong Buy” stance from 8–9 covering analysts, with average targets in the 1,250–1,270p region. [28]

- ADR (PUK) coverage:

- Finviz and other aggregators show 14 analysts on the ADR with a “Strong Buy” consensus.

- Average target around $33–34, versus a current price near $29, implying roughly 15–20% upside. [29]

Overlay these on the current trading band just below £11, and the City’s message is basically: “The easy money has been made, but we still see room for more.”

Valuation check: still undervalued, or priced for perfection?

Let’s put some numbers around that.

From Hargreaves Lansdown and other data providers: [30]

- P/E multiple: ~18x

- Dividend yield: ~1.6% (but with guided 10%+ growth per year to 2027)

- Price vs 52‑week range: trading very close to the top of its 595–1,109p band

Compared with slower‑growth UK life insurers, that P/E looks punchy. But Prudential today is effectively an emerging markets protection and savings play with:

- Double‑digit new business profit growth

- Improving margins

- Massive capital returns via buybacks and rising dividends [31]

Independent valuation work cited by TS2, Morningstar and others often looks at traditional embedded value (TEV) – a measure that tries to capture the present value of in‑force policies plus capital. UBS’s TEV‑based analysis, for example, suggests that Prudential trades at about 1.2x embedded value, versus closer to 1.5x for regional heavyweight AIA, indicating a discount to peers despite the rally. TS2 Tech+1

At the same time:

- The ongoing $2bn buyback (around 7–8% of market cap at launch)

- The planned $1.1bn extra in 2026–27

- And potential capital recycled from the ICICI Prudential AMC IPO

…all act as a tailwind for per‑share metrics (EPS, embedded value per share, dividend per share), because the denominator – the share count – keeps shrinking. Investegate+4TS2 Tech+4Reuters+4

So the bull case on valuation goes roughly like this:

“You may be paying 18x earnings today, but earnings, new business profit and the dividend are all growing double‑digit, and buybacks are cancelling a material percentage of the share base. That combination, plus a discount to Asian peers, leaves room for more upside.”

The bear or cautious case says:

“The share price has doubled from the lows, macro risk in China and ASEAN remains high, and much of the good news is already in the price. At 18x earnings and near a 52‑week high, the margin of safety is smaller than it was.”

Both sides are looking at the same numbers; they just disagree on how much of the future is already priced in.

Key risks investors are watching

The recent rally doesn’t mean the stock is risk‑free. Several issues keep coming up in research notes and commentary. [32]

- Macro and political risk in Asia and Africa

Prudential’s growth engines are in Greater China, ASEAN and Africa. These are attractive markets, but also exposed to:- China’s economic slowdown and property‑sector stress

- Local regulatory changes

- Political instability, as seen in the Indonesian unrest that dented Q3 results

- Currency volatility against the US dollar

- Regulatory oversight and D‑SII status

The Hong Kong Insurance Authority has designated Prudential Corporation Asia Limited as a Domestic Systemically Important Insurer (D‑SII), reflecting its scale and interconnectedness. While Prudential says this doesn’t change its capital plans today, systemically important status can come with tighter supervision and potentially higher capital requirements over time. [33] - Execution risk on capital returns

The equity story heavily depends on:- Keeping free surplus generation growing

- Completing the ICICI Prudential AMC IPO on decent terms

- Delivering the promised $1.1bn of extra buybacks through 2027

- Valuation already re‑rating

After a near‑doubling of the share price from the lows and a move to the top of the 52‑week range, expectations have shifted. If growth slows, or capital‑return plans are trimmed, the downside reaction could be sharp. [34] - Complexity

Between multiple listings, different reporting bases (IFRS, TEV), embedded‑value jargon, joint ventures and a long list of regulators, Prudential isn’t the simplest story in the FTSE 100. For some investors, that complexity justifies a discount versus more straightforward, domestic‑focused insurers.

What could move Prudential’s share price next?

Looking forward from 3 December 2025, several catalysts are likely to drive the next leg – up or down. [35]

- Completion of the $2bn buyback (December 2025)

Daily RNS announcements like today’s will continue until the third tranche ends, no later than 24 December 2025. Markets will be watching how close Prudential gets to the full $2bn and how much the share count ultimately shrinks. - Full‑year 2025 results (expected March 2026)

Investors will want confirmation that:- New business profit growth remains double‑digit

- Margins are holding up

- Capital generation supports ongoing buybacks and dividend growth

- ICICI Prudential AMC IPO

Details on timing, stake size, valuation and use of proceeds will matter. A strong IPO at a rich valuation would reinforce the narrative of additional capital returns on top of the existing programmes. TS2 Tech+1 - Macro news flow from China and ASEAN

Any signs of stabilisation – or further deterioration – in Chinese growth, regulatory stance on foreign insurers, or political conditions in markets like Indonesia will filter into sentiment on Prudential very quickly. [36] - Further rating changes and target‑price revisions

The stock has already enjoyed upgrades (e.g., by Autonomous Research and others), but if the share price keeps climbing, brokers may either lift targets or start to rotate to a more neutral stance. [37]

Bottom line: Prudential plc in December 2025

Putting everything together:

- The share price is now near its 52‑week high, after a very strong 12 months. [38]

- The business is showing double‑digit growth in new business profit and APE sales, with improved margins across key Asian markets. [39]

- The company is mid‑flight on a $2bn buyback programme and has another $1.1bn of repurchases queued for 2026–27, while also growing dividends. [40]

- Fresh RNS announcements on 1–2 December 2025 confirm that buybacks are still happening daily and are meaningfully shrinking the share count. [41]

- Analysts’ consensus remains firmly positive, with most targets pointing to mid‑teens percentage upside from today’s level. [42]

The tension is straightforward: strong growth and huge capital returns versus high emerging‑market risk and a share price that’s no longer obviously cheap.

For risk‑tolerant investors who believe in the long‑term growth of Asian and African middle‑class savings and protection, Prudential remains a concentrated way to play that theme, with buybacks and dividends acting as a powerful kicker. For more cautious investors, the combination of macro uncertainty and a near‑peak share price might argue for patience and a better entry point.

References

1. www.hl.co.uk, 2. www.hl.co.uk, 3. www.hl.co.uk, 4. www.hl.co.uk, 5. www.hl.co.uk, 6. www.prudentialplc.com, 7. www.indmoney.com, 8. www.investegate.co.uk, 9. www.investegate.co.uk, 10. www.reuters.com, 11. www.londonstockexchange.com, 12. www.minichart.com.sg, 13. www.prudentialplc.com, 14. www.prudentialplc.com, 15. www.prudentialplc.com, 16. markets.ft.com, 17. www.reuters.com, 18. markets.ft.com, 19. markets.ft.com, 20. www.prudentialplc.com, 21. www.fool.co.uk, 22. www.fool.co.uk, 23. www.fool.co.uk, 24. uk.finance.yahoo.com, 25. www.marketbeat.com, 26. www.marketbeat.com, 27. www.investing.com, 28. www.tipranks.com, 29. finviz.com, 30. www.hl.co.uk, 31. www.prudentialplc.com, 32. www.reuters.com, 33. www.prudentialplc.com, 34. www.lse.co.uk, 35. www.prudentialplc.com, 36. www.reuters.com, 37. www.marketscreener.com, 38. www.hl.co.uk, 39. www.prudentialplc.com, 40. www.prudentialplc.com, 41. www.reuters.com, 42. www.marketbeat.com