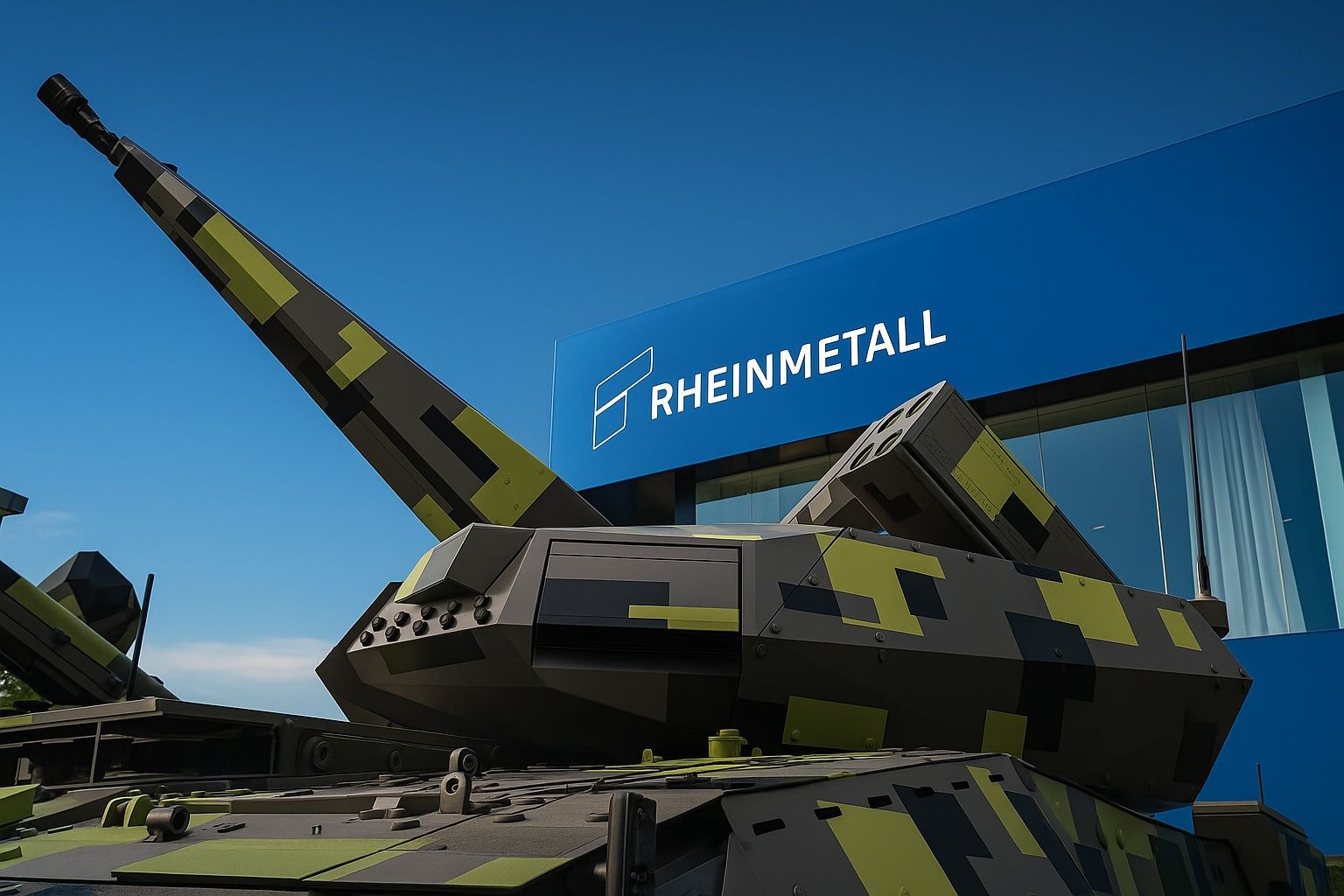

DÜSSELDORF, Germany – Rheinmetall stock spent Tuesday in the spotlight as the German defence champion used its Capital Markets Day to sketch one of the most ambitious growth plans in Europe’s defence sector, while also unveiling fresh moves in drones, supply chains and the US armoured vehicle market.

Shares in Rheinmetall AG (XETRA: RHM, also traded as RHMG) closed around €1,716 on 18 November 2025, down roughly 0.4% from Monday’s €1,723, after an intraday session that initially saw the stock among the top gainers on Germany’s DAX index. Turnover was brisk, with about 376,000 shares changing hands versus roughly 150,000 the previous day, underscoring strong investor interest in the new long-term targets. MarketScreener+2StockAnalysis+2

Despite the small daily loss, Rheinmetall remains one of Europe’s standout defence names, trading in the upper half of its 52‑week range of about €582 to €2,008. Investing.com

Rheinmetall stock price today: how shares traded on 18 November 2025

On Tuesday 18 November:

- Last price: about €1,716 per share

- Daily move: approximately –0.4% versus Monday’s close

- Intraday range: roughly €1,703 to €1,804.50

- Volume: around 376k shares, sharply higher than Monday’s ~154k MarketScreener+2Yahoo Finance+2

Early in the session, Rheinmetall was actually the biggest gainer on the DAX, rising around 3–4% after management presented new 2030 targets at its Capital Markets Day in Düsseldorf. Reuters+1 As broader European markets later turned lower, some of those gains evaporated and the stock slipped modestly into the red by the close.

From a short‑term technical perspective, Scandinavian analytics platform StockInvest notes that Rheinmetall’s share price has pulled back for several sessions and now trades near the lower part of a wide horizontal range, with Tuesday’s high‑low spread close to 6%. Their model recently upgraded the stock from “Sell” to “Hold/Accumulate”, citing the possibility of a rebound but also highlighting rising short‑term risk after higher volume on a down day. StockInvest

Capital Markets Day 2025: Rheinmetall targets €50 billion in sales by 2030

The main driver of Tuesday’s interest was Rheinmetall’s new long‑term roadmap.

At its Capital Markets Day, management guided for annual sales of about €50 billion by 2030, roughly five times the company’s 2024 revenue of €9.8 billion. That puts Rheinmetall at the top end of a previously indicated €40–50 billion range, and well ahead of current analyst consensus. Reuters+2Investing.com+2

Key elements of the 2030 plan include:

- Revenue target: ~€50 billion in 2030

- Operating margin:>20%, implying at least €10 billion of adjusted EBIT by the end of the decade Reuters+1

- Free cash flow: management now aims for a cash conversion rate above 50%, which Jefferies estimates could mean around €5 billion of free cash flow in 2030 – more than 20% above current consensus. Investing.com

- Backlog: the group still expects its order book to climb toward €80 billion this year, up from about €63.8 billion at the end of Q3. Investing.com+1

New segment structure and exit from civil power systems

To support this growth, Rheinmetall is reorganising itself into a clearer defence‑centric structure. From next year, the company will add new segments such as Naval and Air Defence, alongside Weapons & Ammunition, Vehicle Systems and Digital. Reuters+1

A major part of this reshaping is the exit from the group’s loss‑making civilian power systems division. Rheinmetall plans to dispose of this business by the first half of 2026, sharpening its focus on higher‑margin, defence‑related activities. Reuters+1

Management reiterated that Germany will remain the key driver for vehicle systems, while NATO rearmament and ammunition stockpile rebuilding will fuel growth in weapons and ammunition. Reuters+1

Ammunition and air defence ambitions

Ammunition, especially 155mm artillery shells, remains a central pillar of Rheinmetall’s story:

- The company still plans to raise output to 1.1 million 155mm shells by 2027, and about 1.5 million by 2030, up sharply from pre‑war levels. Investing.com

- Management sees Weapons & Ammunition delivering €14–16 billion of 2030 sales with 29–31% margins, while Air Defence is guided to €3–4 billion with mid‑20% margins, supported by rising demand for counter‑drone and critical‑infrastructure protection systems. Investing.com+1

Rheinmetall estimates that protecting Germany’s nearly 2,000 critical infrastructure facilities alone could represent an €81 billion market opportunity in air defence over time, underlining the scale of potential demand. Reuters

Strategic deals: Auterion drone stake and US XM30 combat vehicle program

Beyond long‑term financial targets, Rheinmetall also announced fresh moves in uncrewed systems and US armoured vehicles that matter for the stock’s strategic profile.

Stake in US drone software company Auterion

On Tuesday, CEO Armin Papperger confirmed that Rheinmetall has acquired a direct stake in US drone specialist Auterion, a software‑focused company known for its open‑architecture operating systems for drones. MarketScreener

Key points from the deal:

- The transaction was completed “a few days ago”; financial terms were not disclosed. MarketScreener

- Rheinmetall and Auterion are co‑developing operating systems for combat drones, building on an existing cooperation agreement.

- Rheinmetall’s drone systems based on this technology are already in service with the German Bundeswehr and have seen operational use in Ukraine, underlining real‑world validation rather than purely experimental projects. MarketScreener

For investors, the stake reinforces Rheinmetall’s push into software‑defined, networked defence platforms, a theme that features prominently in its new Digital and Air Defence segments.

American Rheinmetall and Curtiss‑Wright team up on XM30 turrets

In the United States, American Rheinmetall scored a notable win via a partner announcement: Curtiss‑Wright revealed it has been selected to provide its Turret Drive Stabilization System (TDSS) for the prototype phase of the US Army’s XM30 Combat Vehicle program. defenseandmunitions.com

According to Curtiss‑Wright:

- The TDSS will provide stabilized turret control on XM30 prototypes, enabling accurate fire on moving targets while the vehicle operates over rough terrain.

- During the current Engineering and Manufacturing Development (EMD) phase, American Rheinmetall will build eight prototype vehicles for government testing ahead of a planned down‑select in 2027. defenseandmunitions.com

While the contract value was not disclosed, the news is strategically important: XM30 is one of the US Army’s flagship next‑generation combat vehicle programs. If Rheinmetall’s US team secures production, it would help diversify the company’s revenue geographically and deepen its foothold in the US market.

Supply chain shift: CEO pledges to source more European steel

Another notable headline on 18 November came from a separate Reuters interview with CEO Armin Papperger: Rheinmetall intends to buy most of its steel in future from Europe, especially Germany, instead of previously relying heavily on suppliers in India and China. Reuters

Given that steel is a core input for many of its defence products, the shift has several implications:

- Supply security: sourcing closer to home reduces geopolitical and logistical risk at a time when global supply chains remain fragile.

- ESG and politics: European sourcing aligns with EU and NATO goals of strengthening regional industrial bases, which could be politically advantageous in future tenders.

- Cost and margin: European steel typically comes at a price premium. The impact on margins will depend on Rheinmetall’s ability to pass higher input costs on to customers through contract pricing, something defence firms often manage due to long‑term, cost‑plus or inflation‑linked contracts.

For investors, the message is clear: Rheinmetall is positioning itself not just as a supplier of defence systems, but as a strategic European industrial champion, including in its raw‑materials footprint.

What analysts say about Rheinmetall stock after the update

Analysts responded quickly to the Capital Markets Day announcements.

JPMorgan: Overweight, target €2,250

US investment bank JPMorgan reiterated its “Overweight” rating on Rheinmetall on Tuesday and set a price target of €2,250. Analyst David Perry wrote that the midpoint of Rheinmetall’s 2030 EBIT forecast is about 18% above current consensus, highlighting the company’s more optimistic view versus the market. MarketScreener

Perry also pointed to the sharp correction in Rheinmetall’s share price since late September as a factor that improves the risk‑reward profile, especially given the stronger long‑term guidance. MarketScreener

Consensus: strong Buy with ~27% upside

MarketScreener and Investing.com data show a broad base of analyst support:

- Consensus rating:Buy, based on around 17 analysts

- Average 12‑month target price: about €2,173 per share

- Implied upside: roughly +26–27% from Tuesday’s close around €1,716 MarketScreener+2Investing.com+2

Several brokers, including Jefferies, have emphasised that the new 2030 guidance – especially on margins and cash‑conversion – sits materially ahead of previous expectations, even though details on future M&A remain to be fleshed out. Investing.com+1

At the same time, some commentators have been cautious about valuation after an extraordinary multi‑year rally. A Seeking Alpha piece earlier this year noted that Rheinmetall’s share price had risen roughly 2,000% in recent years, warning that such gains increase downside risk if defence spending normalises. Seeking Alpha Others, like Morningstar, see the stock as moderately undervalued even after the run, arguing that Europe’s defence supercycle is still underappreciated. Morningstar+1

Fundamental backdrop: Q3 2025 earnings and the defence supercycle

The strong long‑term story rests on a solid, if not flawless, near‑term earnings base.

On 6 November 2025, Rheinmetall reported Q3 2025 results:

- Revenue: €2.78 billion, +13% year‑on‑year, but slightly below the company‑compiled consensus of €2.815 billion.

- Net profit: €173 million, below analyst expectations of about €235.5 million.

- Operating profit: €360 million, just above expectations of ~€355 million.

- Order intake: €2.36 billion for the quarter, lifting the order backlog to about €63.8 billion. Investing.com

Management blamed part of the earnings drag on delays in German procurement decisions, but stressed that key programmes for the Bundeswehr are now secured in budget plans, supporting a strong Q4. Investing.com

Importantly for today’s stock reaction, Rheinmetall reaffirmed its 2025 guidance, even before upgrading its 2030 ambitions at the Capital Markets Day. Investing.com+1

Strategically, the company stands at the centre of a structural shift in European defence:

- EU and NATO members are working toward (and often above) 2% of GDP defence‑spending targets, driving multi‑year procurement cycles in ammunition, vehicles and air defence. Morningstar+1

- Rheinmetall has been a prime beneficiary, becoming a core DAX component and a symbol of Europe’s rearmament push. Wikipedia

Key risks and what to watch next for Rheinmetall investors

For readers following Rheinmetall stock after 18 November, a few themes will likely dominate the next quarters:

- Execution on 2030 roadmap

- Can management successfully exit the civil power systems business by mid‑2026 and redeploy capital into higher‑growth defence segments? Reuters+1

- Will the new segment structure (Naval, Air Defence, Digital) deliver the margins and scale laid out on Capital Markets Day?

- Order flow and political risk

- The €80 billion backlog target assumes continued strong orders from Germany and other NATO partners. Any sudden change in defence‑budget trajectories, peace initiatives, or export‑control politics (for example in relation to Israel or Ukraine) could affect growth. MarketScreener+2MarketScreener+2

- US exposure via XM30 and other programmes

- The XM30 program is still in its prototype phase, with a down‑select planned in 2027. Whether American Rheinmetall makes it into full‑rate production will influence how diversified Rheinmetall’s revenue becomes beyond Europe. defenseandmunitions.com

- Technology bets in autonomy and air defence

- The Auterion stake and Rheinmetall’s Mission Master unmanned systems, showcased recently at NATO’s REPMUS/DYMS exercise in Portugal, signal a strong push into software‑defined, autonomous defence solutions. Investors will watch whether these platforms translate into recurring software and services revenue, not just hardware sales. Rheinmetall+1

- Valuation and volatility

- After a multi‑year surge and with the stock still trading not far from record highs, price swings are likely to remain large. High expectations for 2030 leave less room for disappointment if execution slips or the macro backdrop cools.

Bottom line

On 18 November 2025, Rheinmetall’s share price finished slightly lower, but that headline masks a more important development: the company has reset the bar higher for its long‑term growth, profitability and cash generation, while layering on fresh strategic moves in drones, US armoured vehicles and European supply chains.

For now, the analyst community remains broadly positive, with consensus price targets implying double‑digit upside from current levels. But after such a dramatic multi‑year rally, the stock is increasingly a high‑conviction, high‑expectation play on the durability of Europe’s defence supercycle and Rheinmetall’s ability to execute on an exceptionally ambitious plan.

This article is for informational purposes only and does not constitute investment advice, a recommendation to buy or sell any security, or a substitute for independent financial research.