Key Facts (as of October 7, 2025)

- Stock at new highs: Richtech Robotics’ share price surged to an all-time high of about $6.76 this weekinvesting.com, capping off a meteoric rally. The stock jumped 19.77% in a single day on Oct. 3 to $6.18ts2.tech, and is up roughly 787% over the past yearinvesting.com. Recent trading volume spiked to ~79 million shares in one session – more than 3× the usual levelmarketbeat.com – signaling intense investor interest.

- Game-changing deals: The company has scored two major partnerships poised to drive growth. After a successful pilot, Richtech signed a Master Services Agreement (MSA) with one of the top U.S. auto dealership chains (widely reported as AutoNation) to deploy its service robotsts2.tech. It also inked a 2-year MSA with a leading global retailer (a partnership believed to involve Walmart) for in-store robot deploymentsinvesting.com. Analysts say these wins shift Richtech from concept to commercial execution, anchoring a recurring “Robots-as-a-Service” (RaaS) revenue modelts2.tech.

- Financial snapshot: Richtech remains unprofitable but well-capitalized. In its latest quarter (Q3 2025), it reported a net loss of ~$4 million on revenue of only $1.2 million, undershooting forecastsmarketbeat.commarketbeat.com. However, the company holds over $85 million in cash with minimal debt, giving it a massive current ratio above 100ts2.tech. This cash cushion provides runway for R&D and expansion despite ongoing losses.

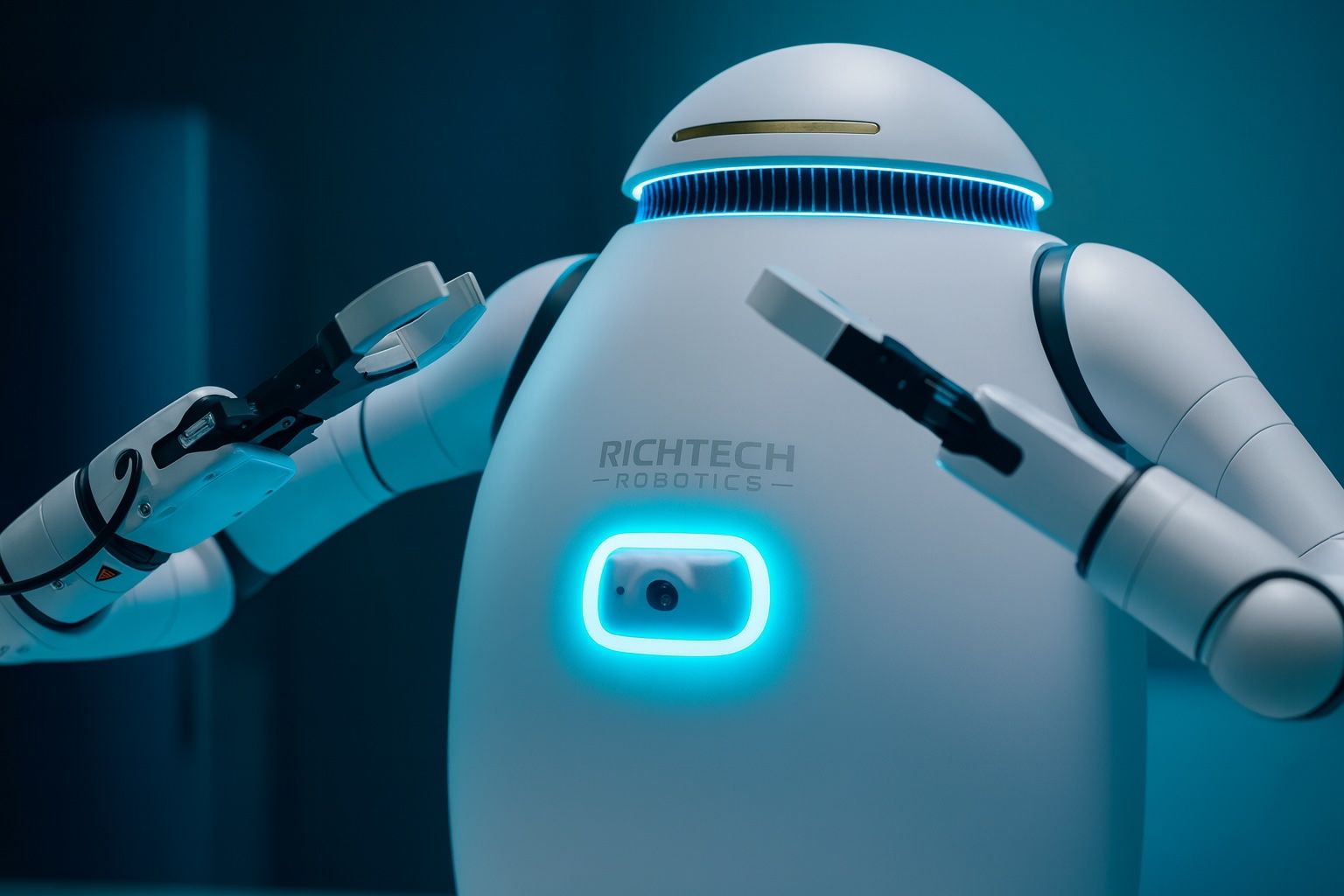

- Robots & expansion: Richtech’s innovative robots are gaining recognition. Its heavy-duty delivery robot “Titan”won a Robotics Innovation of the Year award for boosting productivity in auto service centersts2.tech. The humanoid ADAM AI barista robot has already served 16,000+ drinks at a Las Vegas caféts2.tech and even shook up “cosmic cocktails” at a U.S. Space Force gala, showcasing its publicity value. Internationally, Richtech’s joint venture in China recently secured a $4 million sales contract to roll out ADAM, “Scorpion” floor-cleaning robots and Titan units in Asiats2.tech, and entered a Beijing partnership to co-develop next-gen service robotsts2.tech.

- Controversy and scrutiny: A short-seller report in early October by Capybara Research accused Richtech of fraudulent practices – from rebranding off-the-shelf Chinese robots to inflating partnership claimsgurufocus.com. The report specifically challenged Richtech’s touted Walmart deal, saying it’s merely a limited pilot at one storerather than a major contractgurufocus.com. In the same week, Richtech filed a shelf registration to potentially issue new stock or debt, alarming investors with the prospect of dilutionsimplywall.stsimplywall.st. These events have put the company’s credibility under the microscope and injected volatility into the stock narrative.

- Analyst and expert split: Wall Street is divided on RR. H.C. Wainwright recently raised its price target from $3.50 to $6.00 and reiterated a Buy rating after the new deal announcementsinvesting.commarketbeat.com. In contrast, at least two research firms (Wall Street Zen and Weiss) have Sell ratings on the stockmarketbeat.com, arguing the rally is overextended. The consensus rating now sits at a cautious “Hold” with an average price target around $4.50marketbeat.com. Even TV pundits are weighing in – CNBC’s Jim Cramer told viewers “you buy it, but recognize it’s your speculative [stock]”, advising investors to keep RR as only a small high-risk positionwebpronews.com.

Company Overview: Robots-as-a-Service Pioneer

Richtech Robotics Inc. is a Nevada-founded, Las Vegas–based provider of AI-driven service robots for hospitality, retail, healthcare, and other service industriests2.tech. Founded in the mid-2010s (and publicly listed on NASDAQ as “RR”), the company’s mission is to automate labor-intensive tasks through robotics and artificial intelligence. Its product lineup ranges from humanoid robotic bartenders and café baristas to autonomous floor cleaners and delivery robots for restaurants and hotelsts2.techts2.tech. Notably, Richtech embraces a Robots-as-a-Service (RaaS) business model – instead of just selling robots outright, it often deploys them on subscription or revenue-sharing contracts, aiming for steady recurring incomets2.techiotworldtoday.com.

This niche makes Richtech one of the few pure-play service robotics companies in the U.S. public marketsainvest.com. The firm has garnered attention for deploying robots in real-world venues: for example, it operates robotic kitchen kiosks in partnership with Ghost Kitchens inside certain Walmart stores, where robot baristas and chefs prepare food and drinks autonomouslyiotworldtoday.comiotworldtoday.com. By integrating proprietary robots with cloud-based AI management software, Richtech promises clients improved efficiency, lower labor costs, and novel customer experiences. However, as a small-cap, pre-profit tech venture, its success hinges on scaling these deployments and proving that robots can reliably augment service jobs on a large scale.

Stock Performance: A Wild Rally to Record Highs

Richtech’s stock has been on a tear in recent weeks, transforming from penny-stock levels into a mid-single-digit rocket. After languishing below $1 for much of the past year, RR began climbing in late September 2025 and then exploded upward at the start of October. On Friday, Oct. 3, the stock spiked nearly 20% in one day to close around $6.18ts2.tech. By Oct. 6, it hit a fresh 52-week high of $6.76 intradayinvesting.com before settling near $6.58 at Monday’s close. In total, RR has now soared roughly 786% year-over-yearinvesting.com – a staggering rise that reflects both improving fundamentals and speculative fervor.

Trading activity surged alongside the price. On peak days, tens of millions of shares changed hands – e.g. over 79 million shares traded on Oct. 6 alonemarketbeat.com – which is more than triple the normal volume. Such heavy turnover suggests new investors are piling in and some short sellers may be rushing to cover. In fact, the stock saw multiple sudden jumps even before big news hit, which analysts attributed to short-covering and algorithmic tradingfueling momentum swingsainvest.comainvest.com. These volatility bursts, unlinked to any immediate news, hint that RR became a target of day traders and momentum algorithms looking to ride the wave. The stock’s float (number of shares available) isn’t very large, so enthusiastic buying (or covering of short positions) can jolt the price upward quickly.

It’s worth noting that despite reaching a ~$1.2 billion market cap at recent highsinvesting.com, Richtech remains highly volatile. In late September the shares seesawed dramatically – up 10%+ one day, down 5% the next – reacting to headlines and trading sentiment. This roller-coaster behavior underscores that RR is still largely trading on future potential rather than stable current earnings. Nonetheless, the overall trend has been sharply upward, rewarding early believers. The key question is whether this rally is sustainable or merely a speculative spike. To answer that, one must examine the drivers behind Richtech’s surge – and the risks that lurk in the background.

Catalysts: Big Deals and Partnerships Drive Optimism

The primary fuel for Richtech’s recent run has been a flurry of positive news about commercial partnerships. Investors cheered announcements that validate the company’s robots in real customer settings, potentially translating to meaningful revenue.

- Auto dealership rollout: Richtech revealed it successfully completed a pilot program with a major U.S. auto dealership chain, leading to a national Master Services Agreement. While the dealership wasn’t officially named, reports identify it as AutoNation, one of America’s largest auto retailersts2.tech. The pilot proved that Richtech’s “Titan” delivery robots and other automation could save mechanics time (by ferrying parts and tools) and streamline operations. Now, under the MSA signed in April 2025, Richtech can deploy its robots across multiple dealership locations as approved by the clientinvesting.com. This deal is significant – it marks a shift from one-off demos to a potentially scalable deployment in the auto service industry. Analysts say it legitimizes Richtech’s model (robots performing useful work in enterprise settings) and could lead to steady recurring feests2.tech if the rollout expands.

- Global retail partner: Around the same time, Richtech announced a separate 2-year Master Services Agreement with a major global retailerinvesting.com. The retailer wasn’t explicitly named in press releases, but industry observers strongly suspect Walmart – the world’s largest retail chain – given Richtech’s ongoing projects in Walmart stores. Under this agreement, Richtech will provide robotic services to the retailer’s locations for at least two years, with automatic renewal unless terminated with noticeinvesting.com. This suggests the retailer is pleased enough with initial trials to commit to a longer relationship. If the partner is indeed Walmart, the scale could be huge (Walmart has thousands of stores), but even a pilot across, say, a few dozen stores would be a huge validationfor Richtech’s technology. It indicates that mainstream retail is testing Richtech’s robots (perhaps for tasks like in-store food service, shelf-scanning, or customer assistance). Such a high-profile partner boosts Richtech’s credibility – and news of this deal helped propel RR stock upward by roughly 25% in late Septembermarketbeat.com.

- Robot restaurants in Walmarts: Earlier in the year, Richtech also expanded its presence in retail through a ghost kitchen partnership. In collaboration with Ghost Kitchens Inc., Richtech operates robotic quick-serve restaurants inside certain Walmart supercenters, using its ADAM robot baristas and automated kitchen tech. By late 2024, it had plans to open 20 robotic food outlets in Walmart stores across multiple statesiotworldtoday.com, each potentially generating up to $700k–$2M in annual salesiotworldtoday.com. This initiative is essentially a showcase of Richtech’s RaaS concept – the company isn’t just selling robots to others, it’s directly running robot-powered businesses to generate recurring revenue. While this specific venture is outside traditional robotics sales, it complements the narrative that Richtech’s technology is being put to work in high-traffic public venues. It likely influenced Walmart’s willingness to experiment further with Richtech’s solutions. (Notably, the short-seller controversy, discussed later, revolves around how Richtech portrayed this Walmart-related venture.)

Beyond these headline deals, Richtech has highlighted other achievements that demonstrate market traction. Its robots have been deployed at trade shows, hotels, casinos, and even special events (like the Space Force gala) as attention-grabbers. The company has also entered distribution agreements overseas – for instance, a joint venture in China that recently ordered several million dollars’ worth of Richtech robots for Asian clientsts2.tech. All of this feeds the story that Richtech is moving from prototype to commercialization. The excitement around RR stock is largely because investors see signs that demand for service robots is turning into signed contracts.

In summary, the stock’s surge has been underpinned by genuine business wins. The AutoNation and retailer partnerships, in particular, suggest that Richtech might secure a steady stream of revenue if these large customers scale up their deployments. That prospect – combined with the general buzz around AI and automation – has given RR a potent narrative of growth.

Red Flag: Short Seller Allegations and Credibility Concerns

Amid the euphoria, Richtech Robotics has also attracted serious scrutiny in recent days. On Oct. 2, Capybara Research, an activist short-selling firm, published a scathing report accusing Richtech of being “riddled with fraud” and calling the stock “uninvestable”x.com. These are extremely harsh claims that sparked alarm among some investors, even as the share price kept climbing. Key allegations from Capybara and others include:

- Overhyping partnerships: The short report argues that Richtech has misrepresented the scope of its deals. For example, the company’s announcements implied a broad Walmart collaboration, but Capybara contends Richtech only has a tiny pilot program in one Walmart store, run via a third-party ghost kitchen arrangementgurufocus.com. In other words, they accuse Richtech of marketing a minor trial as if it were a major Walmart corporate contract. This casts doubt on the narrative of a “leading global retailer” partnership if it’s true the rollout is extremely limited so far.

- Rebranded imports and fake innovation: Capybara claims that many of Richtech’s robots are not unique innovations but rather rebranded Chinese-made robots, and that Richtech has exaggerated its R&D. They suggest the company acts more as a marketer/distributor of existing robotic products than a true developer, despite Richtech touting its “proprietary” techx.com. If Richtech is essentially reselling others’ robots, its margins and competitive moat could be much weaker than investors think. The short report even alludes to possible insider misconduct, though such claims are unverified.

- Financial red flags: The timing of Richtech’s financing moves raised eyebrows. Mere days after the short-seller accusations went public, Richtech filed a shelf registration with the SEC to issue new securities (potentially Class B shares, preferred stock, or debt)simplywall.st. This would allow the company to raise capital quickly. While raising cash can be positive for growth, doing so right after a huge run-up (and amid fraud allegations) looked suspicious to some. It fueled fear of share dilution – that Richtech might sell a lot of new stock at these high prices, which could hurt existing shareholders’ valuesimplywall.stsimplywall.st. The optics are tricky: if management truly believed in long-term value, would they rush to issue shares now? Short sellers argue this validates their view that the rally is detached from fundamentals.

- Insider selling: Further undermining confidence, it came to light that insiders had been cashing out some shares during the run. Notably, Richtech’s COO Phil Zheng sold 100,000 shares (~9% of his stake) on Sept. 22 at around $5.11 per share, shortly after the stock’s initial spikemarketbeat.com. While executives do sell stock for many reasons, such a sale ahead of the short report and shelf filing added to investor jitters. In fact, news of insider selling caused RR shares to “gap down” briefly in late Septembermarketbeat.com before resuming their climb on the deal news.

All these issues boil down to one word: credibility. Richtech is asking investors to believe in its growth story and stay patient through losses, so any whiff of overstatement or governance issues is especially damaging. The short-seller onslaught has prompted some holders to demand clearer answers from management. Thus far, Richtech’s official response has been limited – the company broadly denied the fraud allegations in press comments, defending its partnerships and transparency (specific rebuttals have not been widely reported yet). It’s common for young companies to face skepticism, but here the claims are severe: Capybara even hinted at potential “criminal investigations” down the roadcapybararesearch.com, which is not something to take lightly (though no evidence of such action exists at this time).

Importantly, despite these red flags, Richtech’s stock has not cratered – indicating that many investors either disagree with the short thesis or are willing to look past it for now. The price briefly dipped when the accusations emerged, but then quickly rebounded to new highs, suggesting a short squeeze dynamic (whereby attempts to drive the stock down actually backfired as shorts had to cover positions). However, the overhang remains: future rallies could be limited if a large segment of the market has lingering doubts about Richtech’s honesty or if any investigation materializes.

In summary, Richtech finds itself at a crossroads of hype and scrutiny. The company’s ability to restore investor trust– by proving its partnerships are real and delivering promised results – will be crucial in the coming quarters. Otherwise, the momentum could fade fast. As one analyst put it, the focus has shifted “from revenue acceleration to near-term credibility and transparency” for Richtech’s managementsimplywall.st. How they navigate this challenge will heavily influence RR’s trajectory moving forward.

Wall Street’s Take: Bulls vs. Bears on RR

Opinions on Richtech Robotics are sharply divided between believers in its long-term potential and skeptics warning of a bubble. Here’s a look at what analysts and market experts are saying:

Bullish outlook: “This could be the next big thing in automation,” some analysts argue. After Richtech announced its high-profile deals, H.C. Wainwright – one of the few firms actively covering the stock – upgraded their view, reiterating a Buy and boosting the price target to $6.00marketbeat.com. That was in mid-September when RR was around $3–$4; now that target has essentially been met. Wainwright’s optimism is based on the expectation of rapid revenue growth from the new contracts and Richtech’s strong balance sheet to fund expansion. Similarly, MarketBeat data shows two analysts currently rate RR a Buymarketbeat.com, impressed by its niche position in a booming sector. Proponents note that Richtech is one of the only U.S.-listed pure-play robotics firms, giving investors a rare chance to ride the robotics/AI trend via a small-cap stockseekingalpha.com. They also point out that Richtech’s founder-led management and U.S.-based manufacturing could be advantages if geopolitical tensions make domestic automation solutions more attractivewebpronews.com. Some bullish commentators (on investment forums and social media) even speculate that RR could reach double-digit share prices in a couple of years if the company executes well – with $8 to $12 by 2026 thrown around as aspirational targets by the most optimistic followerswebpronews.com.

Cautious/neutral view: Many experts counsel moderation, seeing Richtech as a high-risk, high-reward play that should be handled carefully. This perspective was perhaps best encapsulated by CNBC’s Jim Cramer, who recently endorsed Richtech with an asterisk: “You buy it, but recognize it’s your speculative [stock]”webpronews.com. Cramer’s advice – allowing only a small, speculative position in one’s portfolio – reflects the significant uncertainty around RR. Likewise, the consensus on Wall Street is “Hold”marketbeat.com. The average price target of ~$4.50 implies downside from current levelsmarketbeat.com, suggesting that even supportive analysts think the stock may have overshot in the short term. These middling views acknowledge Richtech’s exciting growth angles but worry about its sky-high valuation metrics (for instance, RR now trades at an eye-watering price-to-sales ratio since its annual revenue is under $5 million). They want to see more proof in the earnings numbers before piling in. In sum, the moderate camp believes in Richtech’s long-term story (robotics in service industries will be huge), but they fret that the stock’s near-term moves are driven more by hype than by fundamentals.

Bearish outlook: On the other side are those who flat-out believe RR is overpriced and maybe even a ticking time bomb. The most extreme bears, like Capybara Research, we’ve covered – they claim Richtech is essentially a “China hustle” with questionable practicesx.com. But even independent of the fraud allegations, some analysts see a classic case of a momentum stock detached from reality. For example, Weiss Ratings (an investment research firm) slapped a “sell (E+)” rating on Richtech in late Septembermarketbeat.com, implying very poor fundamentals relative to its equity price. Another site, WallStreetZen, also downgraded RR to Sell around the same timemarketbeat.com. Their rationale: the stock’s valuation had gone far ahead of what the company has actually achieved. Indeed, at ~$6+ per share, Richtech’s market cap neared $1 billion while its annual revenue is still likely under $5 million – a ratio that even many tech startups would find hard to justify. Bears warn that competition in robotics is fierce (Richtech competes with numerous startups and some larger players in niches like cleaning robots, restaurant automation, etc.) and that cash burnwill continue for years. They predict that as the initial euphoria fades, the stock could retrace substantially – perhaps back to the $3–$4 range or lower – especially if additional shares are issued via the shelf registration (diluting value) or if any execution hiccups occur.

Investor sentiment: Retail investor communities have also been buzzing about RR. On platforms like Reddit and X (Twitter), Richtech has trended in forums related to penny stocks and robotics. Some retail traders are extremely bullish, viewing Richtech as a potential “multi-bagger” that could keep climbing if the company’s story gains mainstream attention or if a short squeeze intensifies. Others preach caution, echoing that it’s a speculative bet and advising profit-taking after the huge run-up. The stock’s popularity has even drawn comparisons to meme stocks, given its rapid ascent and heavy trading by non-institutional players. As of now, institutional ownership of RR is minuscule – well under 1% of shares are held by big fundsmarketbeat.commarketbeat.com – which means the stock’s fate is largely in the hands of retail momentum and a few small-cap focused investors. That can lead to outsized volatility.

In summary, the bulls see a robotics revolution play with first-mover advantage, while the bears see a bubbly story stock that could implode. Both agree on one thing: Richtech’s future will depend on real-world results in the coming quarters. Major milestones to watch for include any revenue ramp-up from the auto and retail deals (will those translate into millions in sales next year?) and how the company manages its finances (will it need to raise more cash, and can it do so without spooking the market?). These factors will likely determine whether analysts revise their targets upward or whether skepticism prevails.

Sector Outlook: Robotics and AI Transforming Service Industries

Richtech Robotics is riding a broader wave: the rapid growth of automation, AI, and robotics in service sectors. As labor shortages and cost pressures persist in industries like hospitality, retail, and food service, companies are increasingly exploring robots to fill the gaps. This macro context provides a tailwind for Richtech – though it also means competition and high expectations.

The hospitality and service robotics market is projected to expand explosively over the next decade. Market researchers forecast that the hospitality robot segment will grow at over 70% annually through 2034nasdaq.com, albeit from a small base. Another estimate pegs the global hospitality robots market to increase by about $660 million from 2025 to 2029, which is a healthy ~17% compound annual growthtechnavio.com. While exact figures vary, the trend is clear: double-digit (or even exponential) growth is anticipated as hotels, restaurants, shopping centers, and hospitals adopt automation. A major driver is the acute labor shortage in service jobs – many businesses still struggle to hire and retain staff for repetitive or off-hour tasks. Robots like Richtech’s can run 7×24 without breaks, potentially saving 30–40% in operational costs for establishments that implement themnasdaq.comnasdaq.com. For instance, autonomous vacuum robots can clean hotel hallways at night, and robot baristas can serve coffee all day with minimal human oversight, directly addressing staffing gaps.

Another driver is the push for enhanced customer experiences. Modern consumers are intrigued by novel tech experiences – a hotel guest might post a video of a cute robot butler delivering towels, effectively giving the hotel free marketing. According to industry surveys, many guests (especially younger ones) are open to interacting with robots for routine services, and some even prefer the efficiency and personalization that AI can offernasdaq.comnasdaq.com. Richtech’s ADAM robot, which can engage customers in conversation while preparing custom lattes, is a good example of leveraging AI for personalized service. This aligns with the broader trend of AI in hospitality, from smart chatbots for concierge services to automated check-in kiosks.

On the flip side, as the market opportunity expands, so does competition. Richtech is far from alone in targeting hospitality and service automation. Dozens of robotics startups worldwide are developing delivery robots, cleaning bots, and kitchen robots. Companies like Bear Robotics (maker of restaurant server robots) and Serve Robotics (sidewalk delivery robots spun off from Uber) are also gaining traction. Meanwhile, some giants are circling the space: Panasonic, LG, and SoftBank have all shown off service robots; even Tesla has hinted at general-purpose humanoid robots that one day might do service jobs. While Richtech prides itself on U.S.-based production and a broad product lineup, it will need to keep innovating to fend off rivals that might offer cheaper or more advanced systems. The service robotics sector in 2025 is analogous to the early PC industry – fast-moving, full of new entrants, and with no guarantee which names will dominate long term.

Importantly, the industry’s growth is not guaranteed to be smooth. Adoption challenges remain: Some customers still prefer human interaction, and some businesses are hesitant to invest in unproven tech. Pilots can take a long time to convert into large orders. Also, regulatory and safety considerations (e.g. health regulations for robot food handlers, or liability for autonomous machines in public spaces) are evolving. That said, the overall direction is one of increasing automation. Many experts see the 2020s as the decade when service robots go from gimmick to mainstream utility, much like industrial robots did in factories decades ago.

For Richtech, this means the wind is at its back. The potential market for its products is expanding rapidly, and public awareness of service robots is growing. The company’s strategy of high-visibility deployments (like the Walmart in-store cafes and the Space Force event) is likely aimed at normalizing the idea of robots in daily life. If the sector grows as expected, even a small market share could translate into substantial revenue for Richtech given how many hotels, malls, and hospitals exist. However, the company will need to execute well – landing flagship clients, maintaining reliability, and controlling costs – to capitalize on the robotics gold rush while distinguishing itself from the pack.

Investor Sentiment: Balancing Opportunity and Risk

With Richtech Robotics, investors are essentially betting on a vision of the future – one where robot helpers are ubiquitous in stores, restaurants, and hotels. The opportunity is enormous: Richtech’s addressable market (service industry automation) spans millions of potential endpoints and many billions of dollars in value. Yet, the risks are just as large, given the company’s early stage. Here we outline the key opportunities and risks that investors are weighing:

Opportunities and Strengths:

- First-mover advantage & niche focus: Richtech is among the very few publicly-traded firms focusing solely on service-sector roboticsseekingalpha.com. This gives it a certain scarcity premium – investors who want exposure to this theme don’t have many alternatives. If Richtech can establish itself as a leader in, say, hospitality automation, it could build brand recognition and partnerships before others catch up. Its strategy of showcasing real deployments (cafés, hotels, auto shops) is building a portfolio of case studies that could attract new customers.

- Robust cash position: With over $85 million in cash on handts2.tech, Richtech has a fairly long runway (at its current burn rate, likely a couple of years or more) to develop products and scale its operations. This reduces short-term insolvency risk. It can invest in R&D, customer support, and marketing to grab market share during this formative period for the industry. The minimal debt also gives it flexibility to raise capital if needed, though doing so via equity might dilute shares (a concern, as noted). Still, a cash-rich, debt-light balance sheet is a positive in an uncertain macroeconomic climate.

- High-profile partnerships as validation: The deals with an auto retail giant and (apparently) Walmart put a stamp of approval on Richtech’s offeringsts2.techinvesting.com. These companies are notoriously selective; if they’re engaging Richtech, it suggests the technology delivered real value in pilot tests. Such validation can help Richtech pitch other clients. For instance, success with one big-box retailer could open doors to partnerships with other national chains (home improvement stores, supermarkets, etc.) looking to automate tasks. The same goes for the auto sector – a contract with one large dealership group could lead others to explore robot assistants in their service bays to stay competitive.

- Robust gross margin potential: According to analysis cited on Investing.com, Richtech boasts a gross profit margin of ~76%investing.com. This likely reflects the economics of selling/servicing robots (hardware plus software services can carry high margins once R&D is paid for). If that figure is accurate and sustainable, it means Richtech could become highly profitable at scale – each additional deployment could contribute strongly to the bottom line after covering fixed costs. High gross margins are typical in software and tech – it’s an encouraging sign if Richtech’s business can achieve that in practice.

- Sector momentum and government support: The push for automation isn’t just from private companies; there are also regulatory tailwinds. For example, some U.S. states have loosened rules to allow delivery robots on sidewalks and are considering allowing more robots in food prep. Globally, countries like Japan (with labor shortages) are heavily incentivizing service robotics. As a U.S.-based manufacturer, Richtech might also benefit from any “Buy American” trends or tech subsidies aimed at competing with Chinese automation. Overall, public sentiment has warmed to robots, especially after the pandemic highlighted the need for resilient operations. This momentum could mean investors remain interested in the sector, giving Richtech some valuation support even through ups and downs.

Risks and Challenges:

- Execution risk: Perhaps the biggest risk is that Richtech fails to convert its pilots and hype into sustainable revenue growth. It’s one thing to announce deals; it’s another to roll out hundreds of robots successfully. Any significant stumble – say, a major client pulling out due to unsatisfactory performance, or deployment delays – could hurt Richtech’s credibility badly. The company’s revenue is still extremely small (just over $1 million last quarter)marketbeat.com. It needs to grow that figure dramatically to justify the current stock price. If growth disappoints (e.g. only a few million in sales next year), the stock could correct sharply.

- Unproven profitability: Richtech is deeply in the red now, and profitability is likely years away. Losses are running around $4 million a quarter and could rise as the company scales staffing and support for new contracts. There’s a risk that operational costs – for manufacturing robots, servicing deployed units, and running those ghost kitchen restaurants – might be higher than anticipated, delaying the break-even point. If capital markets get tighter (higher interest rates, risk-off environment), an extended unprofitable period could put downward pressure on the stock and force unfavorable financing.

- Dilution and financing needs: The specter of dilution looms due to the shelf registration. If Richtech issues a large amount of new stock to raise cash, existing shareholders’ stakes will be watered down. For instance, raising, say, $50 million at ~$6/share would mean ~8 million new shares (roughly a 5% increase in share count). While that money could fund growth, short-term the market often reacts negatively to dilution. Moreover, the very hint that the company plans to issue shares could cap the stock price (as buyers wait for a potentially lower entry post-dilution). Investors will be watching closely whether Richtech actually sells shares, and if so, at what valuation. Ideally, management would only raise equity if it sees opportunities to greatly accelerate growth that justify the dilution.

- Credibility and governance: The allegations of misrepresentation could dampen investor confidence if not addressed. Richtech needs to be transparent and straight with its communication. Any further missteps – for example, if future press releases are found to exaggerate or if insiders keep dumping shares quietly – could seriously undermine the stock. Trust, once lost, is hard to regain. Until Richtech delivers a few clean quarters (meeting its own guidance, growing revenue, etc.), this cloud of skepticism may keep some investors away. In the worst case, if any regulatory probe or legal action emerged from the short-seller claims (again, there’s no confirmation of this, but hypothetically), it would be a major distraction and risk.

- Market volatility and macro factors: As a small-cap speculative stock, RR is especially vulnerable to market sentiment. Any pullback in the broader market or rotation out of high-risk assets can hit it disproportionately. We’ve seen in 2022–2023 how dramatically such stocks can swing when interest rates rise or when liquidity contracts. If inflation or other macro concerns make investors more risk-averse, Richtech’s valuation (which is heavily based on future potential) could compress significantly. Also, should the current AI/robotics “buzz” cool off, some of the premium in RR’s stock could deflate even without company-specific bad news.

- Competition and technological risk: Lastly, Richtech faces the classic tech risk – what if a competitor builds a better (or cheaper) robot mousetrap? The field is evolving rapidly. It’s conceivable that a rival or a big tech company introduces a product that undercuts Richtech’s offerings or makes them look outdated (for example, a more advanced AI software that enables competitor robots to perform tasks better). Richtech will have to continuously invest in R&D to stay ahead. Additionally, large customers might develop in-house solutions or source from larger established companies (like Siemens or Honeywell in automation) if those emerge as options, which could limit Richtech’s market share.

In conclusion, investing in Richtech Robotics is a high-stakes proposition. There is a plausible path where the company grows into a much larger enterprise – robots proliferate in everyday venues and Richtech earns a solid slice of that pie, rewarding shareholders handsomely. At the same time, there’s a non-trivial chance that things do not go as planned – growth could stall or dilution and competition could erode the story, leading to a significant stock pullback.

For now, the stock’s momentum and news flow are positive, but prudent investors are keeping an eye on execution metrics. The next earnings releases and operational updates from Richtech will be critical in distinguishing real, sustainable progress from mere hype. As the saying goes, in the long run, the proof will be in the pudding (or perhaps, in the coffee – brewed by a robot barista). Will Richtech Robotics live up to its bold promise and justify the bulls’ enthusiasm? Or will reality fall short, vindicating the skeptics? The answer will unfold in the coming quarters, and it’s this tension that makes RR one of the market’s most watched – and debated – small-cap stocks of 2025.

Sources: Richtech Robotics deep-dive analysists2.techts2.techts2.tech; Yahoo Finance via MarketBeatmarketbeat.commarketbeat.com; Investing.com newsinvesting.cominvesting.com; Simply Wall St market commentarysimplywall.stsimplywall.st; WebProNews/CNBC (Cramer)webpronews.com; GuruFocus summarygurufocus.comgurufocus.com; MarketBeat news digestmarketbeat.com; AInvest analysisainvest.comainvest.com; IoT World Today reportiotworldtoday.comiotworldtoday.com; Nasdaq/PR Newswire on hospitality tech trendsnasdaq.comnasdaq.com.