- The global satellite bus market is projected to rise from $14.1 billion in 2023 to $23.4 billion by 2033, a CAGR of about 5.4%.

- Lockheed Martin is developing the LM-2100 modular bus with upgradeable components, while Northrop Grumman, Boeing, Airbus, and Thales Alenia Space remain leaders in GEO and military programs.

- SpaceX has mass-produced Starlink satellites in-house, with over 6,500 launched to date and satellites comprising roughly 50% of active satellites, plus a Starshield military variant.

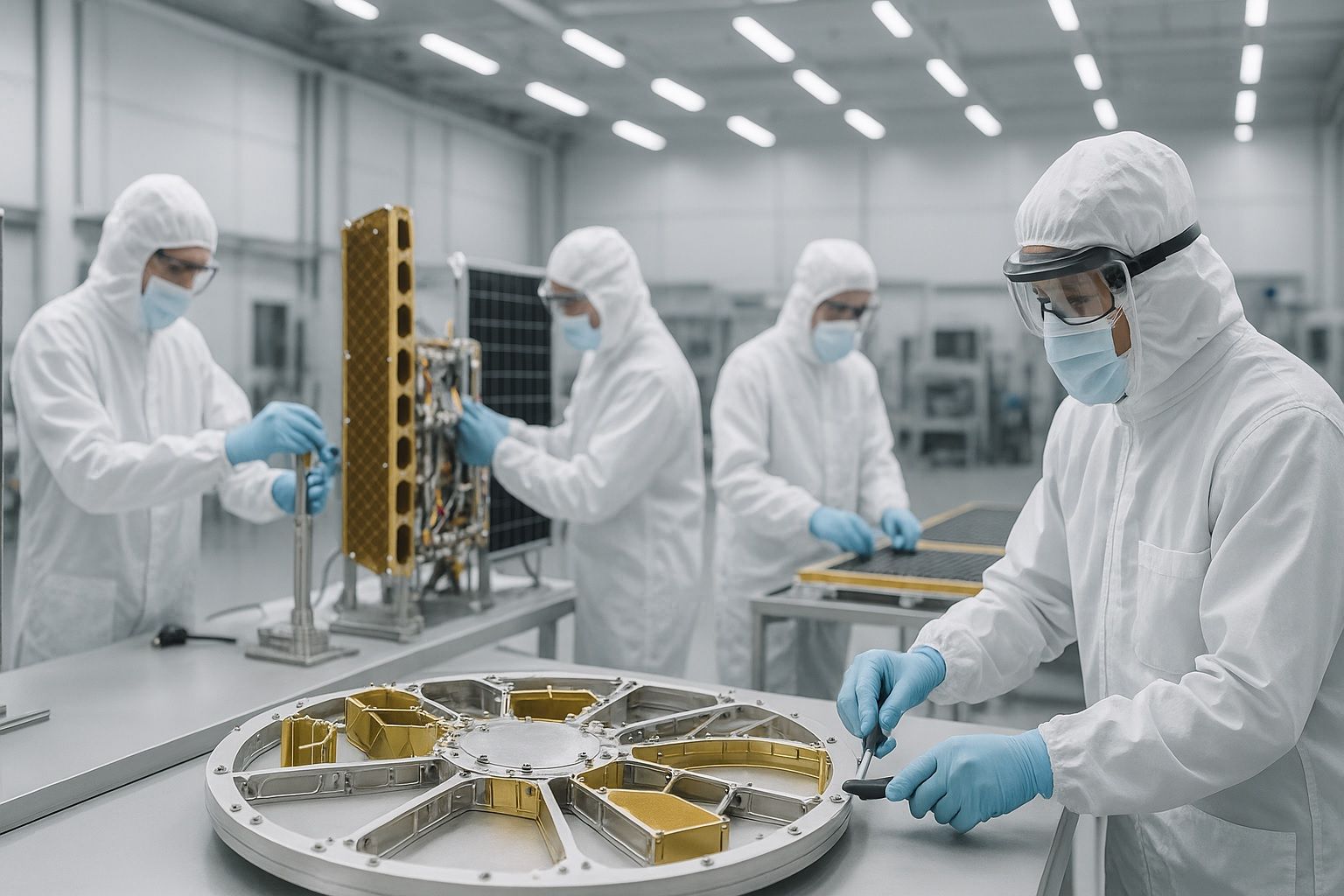

- Airbus and OneWeb formed a joint venture that manufactured hundreds of satellites on an assembly-line in Florida for mass production.

- Britain’s BAE Systems agreed to acquire Ball Aerospace for about $5.55 billion in 2023, completed in early 2024.

- In 2024, commercial projects comprised about 68% of the satellite bus market by value.

- In 2024, LEO satellites accounted for about 72% of the market by platform share, with MEO the fastest-growing segment at about 20% per year, and GEO remaining a smaller but high-value slice.

- Megaconstallations dominate demand, with Starlink targeting roughly 12,000 satellites in Gen1/Gen2, Amazon Kuiper planning 3,236 satellites, OneWeb having completed 648 satellites in its first gen, and China’s Guowang aiming for 13,000+ LEO satellites.

- In-orbit servicing and reusability plans include Northrop Grumman’s Mission Extension Vehicle (MEV) docking to extend satellites, the development of Mission Robotic Vehicle (MRV), Astroscale refueling demos, Momentus Vigoride space tugs, and OSAM investments by NASA.

- By 2030, onboard AI-enabled autonomy will allow satellites to perform autonomous maneuvering, onboard data processing, and anomaly management, enabling real-time coordination across constellations.

A New Space Race in Satellite Manufacturing

The satellite manufacturing industry is entering a boom period from 2024 through 2033, with “bus” platforms – the modular chassis of satellites – at the center of a fierce global competition. Established aerospace giants are vying with agile NewSpace startups to meet surging demand for satellites across Low-Earth Orbit (LEO) constellations, traditional Geostationary (GEO) missions, and everything in between. Market forecasts predict robust growth: the global satellite bus market (the combined value of satellite manufacturing and bus platform production) is projected to increase from about $14.1 billion in 2023 to $23.4 billion by 2033, at a moderate ~5.4% annual CAGR openpr.com. By 2030, some analyses even foresee the market roughly doubling from mid-decade levels mordorintelligence.com, reflecting unprecedented investment in space infrastructure worldwide. This report dives into the competitive landscape driving this growth – from the key manufacturers and evolving bus designs to regional market trends, major programs, and cutting-edge technology shaping the next decade.

Competitive Landscape: Legacy Titans and NewSpace Upstarts

A diverse cast of companies is fueling the satellite bus boom, ranging from legacy aerospace contractors to emerging startups. The market is highly fragmented and competitive, with no single firm dominating globally alliedmarketresearch.com. Instead, a “who’s who” of aerospace is in play:

- Established Aerospace Giants: Longtime industry leaders like Lockheed Martin, Northrop Grumman, Boeing, Airbus, and Thales Alenia Space remain at the forefront mordorintelligence.com alliedmarketresearch.com. These titans leverage decades of experience building large GEO communications satellites, military spacecraft, navigation systems, and scientific missions. For example, Lockheed Martin supplies heavy-class satellites for U.S. defense (e.g. AEHF secure communications, GPS III navigation) and is adapting its bus platforms for smaller LEO uses. Boeing – known for its 702 series GEO buses – is delivering next-gen satellites like O3b mPOWER in MEO for SES, while exploring software-defined payloads for more flexible satellites. Europe’s Airbus and Thales Alenia lead their region: Airbus produces everything from OneWeb’s LEO broadband satellites to large Eurostar GEO satellites, and Thales Alenia (a Thales/Leonardo joint venture) is renowned for its Spacebus platforms and projects like the Iridium NEXT constellation. Northrop Grumman (which acquired Orbital ATK) bridges both worlds – building massive science observatories (it led the James Webb Space Telescope’s spacecraft bus) and smaller tactical satellites, and even pioneering satellite servicing vehicles. These incumbents have global reach, hefty backlogs, and deep ties to government programs, but they’re being forced to innovate faster and cut costs as competition heats up alliedmarketresearch.com alliedmarketresearch.com.

- Emerging Players and Startups: A new wave of specialized satellite manufacturers and bus platform providers has risen in the 2020s. Small-satellite specialists like Blue Canyon Technologies (now part of Raytheon), NanoAvionics (now owned by Kongsberg), Terran Orbital, GomSpace, and others are offering standardized microsatellite and CubeSat buses to commercial and institutional clients. Their plug-and-play designs have lowered entry barriers, enabling startups, universities, and even developing countries to get satellites built quickly. Notably, Sierra Nevada Corporation (SNC) expanded its satellite platform lineup with new medium and large bus offerings (the SN-200M for MEO and SN-1000 bus) mordorintelligence.com, signaling ambition to challenge the big primes. Meanwhile, vertically-integrated constellations are blurring the line between manufacturer and operator – SpaceX, for instance, mass-produces its Starlink satellites in-house at astonishing scale (over 6,500 launched to date) and is now marketing a military variant (“Starshield”), effectively turning SpaceX into one of the world’s most prolific satellite bus makers. Similarly, the Airbus-OneWeb joint venture manufactured hundreds of satellites on an assembly line in Florida, pioneering high-volume production. Government-run entities are also key players: India’s ISRO (Indian Space Research Org.) not only builds satellites for its own needs but is now courting foreign investment to ramp up domestic manufacturing alliedmarketresearch.com, and Israel Aerospace Industries (IAI) has carved out a niche exporting affordable surveillance satellite systems. China’s state-owned manufacturers, chiefly the China Academy of Space Technology (CAST) under CASC, form another heavyweight bloc – they produce a vast array of satellites (from Beidou navigation spacecraft to large DFH-series commsats) for China’s ambitious programs, and are preparing mega-constellations of their own. In short, nimble NewSpace companies and rising state players are intensifying global competition, often undercutting on price or offering rapid innovation cycles that challenge the old guard.

Competitive Matrix: Major Satellite Bus Manufacturers (Capabilities & Market Position)

To compare the leading companies head-to-head, the matrix below summarizes their satellite class coverage, key capabilities/innovations, and relative market standing in this global race:

| Company | Satellite Classes Covered | Notable Capabilities & Innovations | Market Share & Position |

|---|---|---|---|

| Lockheed Martin (U.S.) | Small to Heavy (LEO, MEO, GEO) | Strong in military & comms satellites (e.g. GPS III nav, AEHF secure comm); developing modular LM 2100 bus with upgradeable components and cyber-resilience. Pushing into smallsats via LM400 series. | Top U.S. contractor; #1 in government programs by revenue alliedmarketresearch.com, leveraging deep defense ties for ~largest global share in high-value missions. |

| Airbus Defence & Space (EU) | Small to Super-Heavy (LEO to GEO) | Broad portfolio (telecom, Earth observation, science). Built OneWeb LEO constellation with mass production; flagship Eurostar GEO bus (electric propulsion options) and new OneSat software-defined satellite for flexible coverage. | Europe’s largest manufacturer; a global top-tier player (~leading market share in Europe) alliedmarketresearch.com, exporting to many nations and commercial operators. |

| Northrop Grumman (U.S.) | Small to Large (LEO, GEO) | Heritage in GEO comm buses (via former Orbital ATK GEOStar platform) and strategic military sats. Innovator in satellite servicing (Mission Extension Vehicle docking to aging sats nationaldefensemagazine.org nationaldefensemagazine.org) and ESPAsat mini-satellite buses for rideshare. | Major U.S. player (post-Orbital ATK merger) with significant defense and NASA contracts; ~top 5 globally by sales, expanding presence in smallsat constellations. |

| Boeing Space (U.S.) | Medium to Super-Heavy (MEO, GEO) | Renowned for 702-series satellite buses (high-power GEO comsats, e.g. ViaSat-3) and MEO satellites (building O3b mPOWER). Pioneering all-electric propulsion GEO sats and digital payload tech. | Historically a top GEO comsat supplier; remains a leading global manufacturer albeit with fewer constellation projects, focusing on high-value telecom and government markets. |

| Thales Alenia Space (EU) | Small to Large (LEO, GEO) | Co-developer of Iridium NEXT (75 LEO sats) and Europe’s Copernicus Earth observation sats. Offers Spacebus Neo GEO platform with electric propulsion and advanced avionics. Co-leading Europe’s Galileo nav satellite builds. | Europe’s #2 manufacturer; strong in commercial telecom and institutional programs. Competitive globally on megaconstellation bids (e.g. Telesat Lightspeed) thanks to proven LEO & GEO expertise. |

| CASC/CAST (China) | Small to Heavy (LEO, MEO, GEO) | Vertically-integrated Chinese producer: DFH-series standardized buses for comms (first Chinese all-electric GEO sat launched in 2024 industryarc.com), Beidou MEO nav satellites, space station modules, etc. Capabilities in low-cost mass production (planned ~13k-satellite LEO constellation). | Dominant in China’s fast-growing space sector; little international sales due to ITAR, but huge domestic market share (China now ~26% of global activity mordorintelligence.com) makes CAST a silent giant of satellite manufacturing. |

| ISRO (India) | Small to Medium (LEO, GEO) | Builds India’s satellites in-house – from lunar probes to GSAT communications sats. Emphasizes cost-effective engineering and now permitting 100% FDI to boost manufacturing alliedmarketresearch.com. Developed smallsat buses for international clients (e.g. commercial Earth observation). | Key regional player (Asia-Pacific); not a commercial vendor traditionally, but increasing output as India aims for a $47 billion space economy by 2032 alliedmarketresearch.com. Potential future exporter with foreign partnerships. |

| SpaceX (U.S.) | Small (LEO constellation class) | Disruptor: Mass-produced Starlink LEO satellites with streamlined bus design; iterative rapid innovation (next-gen Starlink with inter-satellite lasers). Leverages reusable rockets (Falcon 9, Starship) for low-cost deployment. Introducing “Starshield” service to tailor Starlink buses for government uses. | Not a traditional contractor (mostly builds for itself), but by sheer volume has launched ~50% of active satellites. For market impact, SpaceX’s model of high-speed production and deployment is shifting industry standards (forcing competitors to cut costs). |

(Sources: Allied Market Research alliedmarketresearch.com alliedmarketresearch.com; Mordor Intelligence mordorintelligence.com mordorintelligence.com; Reuters reuters.com.)

As shown above, legacy companies boast broad portfolios (covering everything from tiny CubeSats to multi-ton GEO platforms) and are integrating new technologies to stay ahead. Newer entrants often specialize – either in a mass-producible smallsat niche or in innovative services like in-orbit servicing – that give them competitive footholds. The competitive balance is also being reshaped by consolidation and partnerships, as discussed next.

Mergers, Acquisitions & Alliances Reshaping the Industry

The period 2024–2033 is witnessing significant industry realignment via mergers and strategic partnerships. Established contractors are acquiring niche players to fill capability gaps (or to eliminate rivals), while operators and manufacturers are forging alliances:

- Defense Contractor Consolidation: In a blockbuster deal, Britain’s BAE Systems agreed to acquire Ball Aerospace (a major U.S. satellite and instrument builder) for ~$5.55 billion in 2023 reuters.com. Completed in early 2024, this acquisition brings Ball’s satellite manufacturing and sensor expertise under BAE’s umbrella, reflecting how vital space tech has become to defense firms. Similarly, private equity moved into the sector – Maxar Technologies, known for high-resolution imaging satellites, was taken private by Advent International in a $6+ billion deal in 2023 spacenews.com spacenews.com. Such deals inject fresh capital and indicate bullish long-term expectations for satellite demand. Meanwhile, Raytheon acquired smallsat bus specialist Blue Canyon in 2020, and Redwire Space has snapped up various space component startups, consolidating a NewSpace supply chain under larger owners.

- Strategic Partnerships: Traditional rivals often partner for mega-projects or national programs. In Europe, collaborative ventures are the norm – e.g., Airbus and Thales Alenia teamed up on developing next-gen constellation satellites (Airbus and Thales are co-prime contractors on EU’s Galileo navigation system). Airbus also partnered with OneWeb to create OneWeb Satellites for mass production of LEO spacecraft, blending Airbus’s quality with assembly-line efficiency. In launch, Boeing and Lockheed’s United Launch Alliance (ULA) joint venture shows how even fierce competitors unite when stakes are high (ULA providing essential launch services for many government satellites) interactive.satellitetoday.com. On the commercial side, satellite operators are merging with manufacturers or service providers to offer end-to-end solutions. For instance, French operator Eutelsat’s 2023 merger with OneWeb created a combined GEO-LEO satellite operator, aimed at challenging SpaceX’s Starlink. The all-share deal valued OneWeb at $3.4 billion and forms a multi-orbit powerhouse (now Eutelsat Group) poised to grow revenues “at a double-digit CAGR” by offering integrated broadband services reuters.com reuters.com. This trend of vertical integration blurs the lines – tomorrow’s satellite “manufacturer” might also be the service provider.

- Global Collaborations: Cross-border partnerships are expanding manufacturing capacity and technology exchange. The U.S. Space Development Agency’s projects (like the Proliferated Warfighter Space Architecture LEO constellation) involve numerous contractors in collaborative roles, big and small interactive.satellitetoday.com interactive.satellitetoday.com. Countries with emerging space programs are partnering with experienced firms for knowledge transfer: e.g., Gulf nations and Australia have inked deals with Western companies to build satellites locally. Notably, India’s policy shift to allow 100% foreign direct investment in satellite manufacturing alliedmarketresearch.com is expected to draw companies like SpaceX or Amazon to establish facilities in India. Such moves could reshape manufacturing hubs and create new alliances (e.g. a SpaceX-India partnership to produce Starlink units domestically).

Overall, consolidation is creating a few big full-service providers, while strategic alliances enable sharing the huge costs and risks of satellite network projects. The net result is a more dynamic competitive landscape, where companies join forces one day and battle the next, all to secure a piece of the skyrocketing market.

Evolution of Satellite Bus Designs and Technologies

Satellite bus platforms are undergoing a design renaissance to meet modern demands. Over 2024–2033, manufacturers are introducing more modular, high-performance, and autonomous bus architectures. Key aspects of this evolution include:

Modular, Standardized Platforms

Gone are the days of one-off satellites built from scratch – today’s trend is toward modularity and standardization. Manufacturers now offer bus “product lines” (small, medium, large classes) that can be rapidly tailored to different missions by swapping payloads and subsystems. This Lego-like approach improves economies of scale and shortens build times. For instance, many new satellites use monocoque or modular frame designs that maximize internal volume and provide standardized mounting points openpr.com. Standard satellite buses (sometimes called common platforms) allow constellation operators to order hundreds of identical satellites, dramatically cutting costs per unit. OneWeb’s 150 kg satellites and SpaceX’s flat-panel Starlink sats exemplify how standardized designs enable assembly-line production. Even larger GEO satellites benefit: Airbus’s new OneSat platform is fully reconfigurable via software, meaning a single bus design can serve various customers and missions by downloading different software – a leap in flexibility over custom-built predecessors. This modularity also extends to open interfaces and plug-and-play components, so operators can integrate third-party payloads with minimal custom engineering. The result is an industry shifting from craft production to mass manufacture, underpinned by modular bus architectures.

Propulsion Upgrades: Going Electric

Satellite propulsion systems are seeing a revolutionary shift, with electric propulsion (EP) now mainstream for both orbit-raising and station-keeping. Instead of large chemical fuel tanks, many modern buses carry efficient ion or Hall-effect thrusters powered by solar electricity. This can reduce a satellite’s launch mass by hundreds of kilograms, allowing either smaller rockets or more payload. By the mid-2020s, virtually every major GEO satellite platform had an all-electric variant – for example, Boeing’s 702SP and Airbus Eurostar E3000 EOR (Electric Orbit Raising) buses each use xenon ion thrusters. Thales Alenia’s Spacebus Neo line is designed from the ground up for EP, enabling satellites like Eutelsat’s Konnect to carry extra payload capacity in lieu of chemical propellant. Even China recently launched its first all-electric GEO satellite (APStar-6E) in 2023, marking a milestone in adopting this technology industryarc.com. Electric propulsion’s high efficiency does come at the cost of slower orbit transfer (taking months to reach GEO instead of weeks), but operators have largely accepted this trade-off for the huge mass and cost savings over a satellite’s ~15-year life. Beyond GEO, electric thrusters are now common on LEO smallsats too – from tiny ion engines that keep CubeSats in orbit longer, to electric propulsion tugs that reposition satellites on demand. Looking ahead, research into green propellants, hybrid chemical-electric systems, and even nuclear propulsion (for deep space missions) could further expand satellite maneuvering capabilities. But through 2033, solar-electric propulsion is the workhorse trend, enabling lighter, more capable buses across all orbit regimes.

Power and Payload Integration Advances

Satellites are essentially flying power plants and data centers, and bus designs are improving these core capacities. Electrical power subsystems have grown more robust – modern satellite buses feature high-efficiency multi-junction solar cells and battery technologies borrowed from electric vehicles. This yields higher power availability for payloads: today’s high-throughput communications sats deliver tens of kilowatts of power, a big jump from ~5 kW two decades ago. For example, Boeing’s latest 702X platform can support ~25 kW payloads for next-gen broadband satellites. Meanwhile, thermal control (keeping all that electronics cool) is enhanced through smarter heat pipes and radiators, even loop heat pipes and cryocoolers for sensitive sensors. Bus structures are also evolving to accommodate more complex payloads: satellite frames use lightweight composites and deployable elements (like extendable solar arrays, telescoping antennas, etc.) to increase payload capacity without adding too much mass. Payload integration is becoming more “plug and play” – some buses have standardized payload module slots, so a comms transponder or camera package can be integrated with minimal custom fitting. This is crucial for constellation satellites that might carry different payload mixes on the same bus (for example, some LEO satellites might host an extra AIS ship-tracking receiver along with the main comm payload). In sum, the satellite bus is no longer a passive vehicle but an active contributor to mission performance, supplying greater power, better thermal stability, and flexible payload interfaces to maximize the satellite’s functionality.

Autonomy and AI Onboard

With constellations swelling to thousands of satellites, onboard autonomy has become a necessity. Manufacturers are embedding advanced flight software and even Artificial Intelligence (AI) capabilities into satellite buses to enable more self-reliant operations. In 2025 and beyond, we’ll see AI used for autonomous maneuvering, data processing, and anomaly management in orbit interactive.satellitetoday.com interactive.satellitetoday.com. For instance, SpaceX Starlink satellites already use autonomous collision avoidance systems – they can adjust their orbit when tracking data indicates a possible conjunction, without waiting for human commands interactive.satellitetoday.com. Future satellites will take this further. AI-driven algorithms on the bus can optimize power and thermal management, or reallocate computing resources for different tasks on the fly. Edge computing in space is a game-changer: rather than beaming all raw data down, a satellite bus with AI can process imagery or signals onboard and send only relevant insights to Earth interactive.satellitetoday.com. This reduces bandwidth needs and enables real-time responsiveness (e.g., a reconnaissance satellite recognizing a target and alerting troops in near-real-time, all autonomously). The U.S. Department of Defense is heavily investing in such capabilities for a “smart” proliferated satellite network, where satellites share data and coordinate maneuvers with minimal ground control interactive.satellitetoday.com interactive.satellitetoday.com. Bus platforms are being built with radiation-hardened AI processors and neural network accelerators to support this. The overarching trend is toward greater spacecraft autonomy – satellites that can diagnose their own issues, maintain optimal orientation, dodge debris, and even cooperate with other satellites using machine-to-machine communications. By 2030, AI-enabled satellite buses could routinely handle tasks that once required entire ground teams, making space infrastructure more resilient and responsive.

Toward Reusable and Serviceable Satellites

A bold vision on the horizon is the concept of reusable satellite buses and on-orbit servicing to extend satellite lifespans. While fully reusable satellites (in the sense of returning to Earth and launching again) remain impractical, the 2024–2033 decade will see in-orbit reusability become real. Companies like Northrop Grumman (via its SpaceLogistics subsidiary) have already demonstrated life-extension vehicles: the Mission Extension Vehicle (MEV) docks with aging satellites to take over station-keeping, effectively giving the old bus a “new lease on life” for several years nationaldefensemagazine.org nationaldefensemagazine.org. After boosting one client, these servicing craft can undock and move on to the next satellite – reusing themselves multiple times nationaldefensemagazine.org. Following two successful MEV missions, Northrop is developing a Mission Robotic Vehicle (MRV) with robotic arms to perform in-orbit repairs, upgrades, or relocation of satellites nationaldefensemagazine.org. Startups are also in the mix: Astroscale is planning refueling demos, and Momentus tested a space tug (Vigoride) that in future iterations will be refuelable and reusable for multiple orbital transfers nationaldefensemagazine.org. On the satellite design side, manufacturers are beginning to incorporate servicing-friendly features – standardized docking ports, refueling valves, or modular payload sections that could be swapped out by a robotic servicer. Space agencies (NASA, ESA) are investing in On-Orbit Servicing, Assembly, and Manufacturing (OSAM) technologies to eventually enable satellites that can be refurbished or even constructed in space nationaldefensemagazine.org nationaldefensemagazine.org. By the late 2020s, it’s expected that some GEO communications satellites will routinely get mid-life boosts or repairs, postponing the need for costly replacements. In LEO, while individual smallsats may not be worth servicing, reusable transfer vehicles (“space tugs”) will move satellites to different orbits or deorbit defunct ones, acting like orbital shuttles. All these steps point to a future where satellite buses are not single-use assets but part of a sustainable, serviceable space infrastructure – effectively reusable in function if not in form. This trend could dramatically reduce long-term costs and alleviate space debris, as operators refurbish and reuse what they already have in orbit.

Miniaturization and High-Density Tech

Finally, an underlying technology trend enabling much of the above is miniaturization. Electronic components on satellite buses continue to get lighter, smaller, yet more powerful – from compact avionics and star trackers to tiny high-capacity reaction wheels. This means even small satellites now carry capabilities once limited to big spacecraft. For example, a 100 kg microsatellite today can include high-resolution cameras, AI processors, and electric thrusters – a combination unthinkable a decade ago. The drive to shrink components has given rise to innovations like flat-panel phased array antennas (for broadband satellites to beam signals to Earth without large dishes) and stacked modular payloads the size of shoeboxes. Cubesats, the smallest bus class (often 10–30 cm cubes), have benefited hugely: modern 6U or 12U CubeSats can perform sophisticated tasks like radar imaging or ship tracking due to ultra-compact sensors and processors. This miniaturization trend, paired with the bus design advances above, is fueling the proliferation of satellites – making it feasible and affordable to launch hundreds or thousands of small, capable satellites that collectively provide services (imaging, IoT, global comms) with unprecedented coverage and redundancy. In summary, smaller, smarter, more modular buses are the foundation of the new space age, allowing the industry to scale up production and tackle ambitious missions that will define 2024–2033.

Market Forecasts and Segmentation (2024–2033)

The outlook for the satellite manufacturing and bus platforms market over the next decade is robust, with strong growth across all regions and segments. Forecasts indicate healthy expansion driven by both commercial and government demand:

Growth Projections and Value Outlook

After a sustained uptick in satellite launches in recent years, the market is set to continue growing through 2033. As noted, Allied Market Research values the global satellite bus market at $14.1 billion in 2023, projected to reach $23.4 billion by 2033 openpr.com. This implies steady growth (~5–6% CAGR) in industry revenues. Some other analyses, using broader definitions, forecast higher growth rates in the mid-teens (reflecting the explosion of smallsat constellation investment) mordorintelligence.com. Regardless of the exact figure, the consensus is clear: annual spending on satellites will increase significantly as multiple large-scale programs (commercial broadband constellations, new military satellites, scientific missions) ramp up simultaneously. By the early 2030s, yearly satellite manufacturing revenues are expected to be tens of billions of dollars, making it one of the fastest-expanding sectors in aerospace. Over 50,000 satellites could be in orbit by decade’s end if planned deployments materialize interactive.satellitetoday.com, underscoring the massive scale of production potentially needed.

Regional Market Highlights

Regionally, North America, Europe, and Asia-Pacific will dominate the market, with North America likely retaining the largest share in revenue. In 2023, North America accounted for about 34.8% of global satellite bus revenues alliedmarketresearch.com, thanks to the presence of industry leaders (Lockheed, Boeing, Northrop, etc.) and huge U.S. government outlays on space programs. This leadership is expected to continue into 2033 – North America’s advanced technology base and heavy commercial investment (e.g. SpaceX, Amazon’s Kuiper) keep it ahead. Asia-Pacific is the rising force, however. In 2024 Asia-Pacific already comprised roughly 26% of the market mordorintelligence.com, reflecting China’s and India’s burgeoning programs and a growing private sector in countries like Japan. With China’s aggressive plans (a national LEO mega-constellation, expanded BeiDou nav system, and numerous Earth observation sats) and India opening its market, Asia-Pacific is forecast as the fastest-growing region, likely increasing its global market share by 2033. Europe remains a stronghold of high-quality satellite manufacturing, contributing a significant portion of revenues (~20–25% share). Europe’s growth is steadier (about 5% annually in recent years mordorintelligence.com) as it emphasizes cutting-edge science and telecom satellites, backed by coordinated ESA and national investments. The Rest of the World (Latin America, Middle East, Africa) is a much smaller slice, generally under 10–15% of the market combined. These regions mostly procure satellites from abroad or have nascent local industries. However, wealthy Gulf states and others are upping purchases of satellites for communications and Earth monitoring, which adds incremental demand. In summary, North America leads in market value (with robust ~16% CAGR in its satellite industry expected mid-decade mordorintelligence.com), Asia-Pacific is catching up quickly, Europe holds a steady third position, and other regions play a minor but growing role alliedmarketresearch.com.

By Orbit: LEO, MEO, and GEO Trends

Demand segmented by orbit type reveals a dynamic shift favoring Low-Earth Orbit (LEO) satellites. LEO satellites dominate the market by volume and share, thanks to the proliferation of communications and Earth observation constellations. In 2024, LEO satellite platforms made up roughly 72% of the total market share mordorintelligence.com, an astounding proportion driven by companies launching hundreds to thousands of small satellites for broadband (Starlink, OneWeb, etc.) and by government tactical constellations. LEO’s appeal is its low latency, cheaper access, and suitability for high-resolution sensing – and this segment will remain on top through 2033. The Medium Earth Orbit (MEO) segment, while smaller today, is actually the fastest-growing by percentage. MEO satellites (typically for navigation like GPS/Galileo or certain broadband systems) are projected to grow around 20% annually in the mid-2020s mordorintelligence.com. This surge is partly due to upgrades of GNSS (Global Navigation Satellite Systems) – e.g. deployment of new Galileo and GPS III/IIIF satellites – and new commercial initiatives in MEO such as specialized internet constellations and expanded military satcom networks. MEO offers a middle ground of broader coverage than LEO with fewer satellites, so some providers (like SES’s O3b mPOWER) are investing there. Geostationary (GEO) satellites, the traditional mainstay for communications and broadcasting, now form a smaller slice of the pie but remain crucial. The GEO segment has matured and is growing more slowly (some forecasts even show flat volumes), yet GEO birds are indispensible for certain missions – e.g. direct-to-home TV, global weather observation, and strategic military comms – that need continuous coverage over one area mordorintelligence.com. The pace of GEO orders had dipped in recent years, but with new flexible digital GEO sats (which can be reprogrammed in orbit to reallocate bandwidth), operators are ordering replacements to modernize their fleets. In addition, developing countries and commercial operators still plan GEO satellites for regional communications. So, while GEO’s share of overall satellites launched is falling, the high unit cost means GEO platforms still account for a significant portion of revenue. Summing up orbit trends: LEO is king in count and momentum, MEO is a fast-growth niche (especially for navigation and defense uses), and GEO remains a steady, high-value segment albeit with fewer satellites needed than in the past.

By End-User: Commercial vs. Government Demand

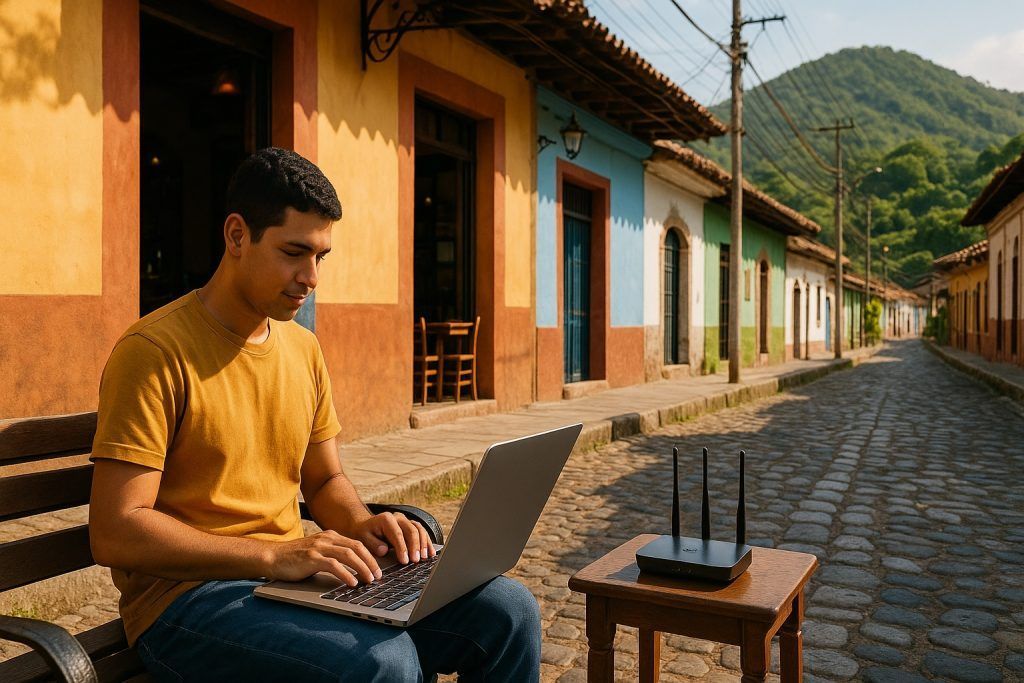

The satellite bus market can also be split by end-users: commercial enterprises vs. government (civil & military) customers. In recent years, the commercial sector has led in satellite count and even spending, driven by the private telecom and broadband push. In 2024, commercial projects comprised about 68% of the satellite bus market by value mordorintelligence.com – a dominance attributed to mega-constellations funded by tech companies and telecom operators, as well as Earth imaging and IoT ventures. Commercial players like SpaceX, Amazon, telecom operators, and Earth observation startups have poured capital into building networks for profit, making them the largest collective customer of satellite buses. This trend is expected to continue into the early 2030s: global broadband internet constellations (Starlink’s expansions, Amazon’s Project Kuiper with an initial 3,200 satellites, OneWeb’s next-gen, possibly new Chinese and Indian constellations) represent billions in bus manufacturing contracts. Additionally, commercial demand includes replacement of aging GEO comm satellites for companies like Intelsat, Inmarsat (now part of Viasat), etc., and hundreds of smallsats for imaging (e.g., Planet, Spire) and analytics services.

That said, government and defense demand is surging and will claim a growing slice of the pie. Governments worldwide are investing heavily in space for both national security and civil purposes openpr.com. The “Military & Government” segment of satellite buses is projected to grow at ~20% CAGR through the mid-2020s mordorintelligence.com – a remarkable pace for traditionally slower-moving procurement. This is fueled by several factors: militaries are now treating space as a warfighting domain, leading to big programs like the U.S. Space Force’s missile-warning and communications constellations, as well as similar defense initiatives in China, Russia, and NATO countries. Secure communication satellites, spy satellites with advanced sensors, and even early-warning satellites are being funded at levels not seen since the Cold War. For example, the U.S. is deploying new OPIR missile detection satellites and proliferated LEO tracking layers (SDA’s PWSA) with dozens to eventually hundreds of satellites, all requiring state-of-the-art buses. Governments are also investing in civil satellites for science and infrastructure: NASA and NOAA have a queue of Earth science missions (for climate, weather, etc.), Europe’s ESA is launching new Copernicus Sentinel satellites, and countries like Japan, India, and China have numerous environmental and scientific satellites planned. Many of these are one-off or small series, but collectively they add steady demand for highly sophisticated bus platforms (often contracted to commercial manufacturers). In emerging space nations, governments are buying communications and remote-sensing satellites to establish sovereign capabilities, often procuring the satellite (bus + payload) from foreign manufacturers – another source of government-driven bus market growth.

In summary, commercial demand currently outstrips government in sheer scale (especially because of the telecom constellations) mordorintelligence.com, but government (civil + defense) is a robust second pillar that is accelerating. By 2030, we can expect a more balanced mix: commercial ventures keep launching large constellations, while government and defense programs ensure a baseline of high-value satellite projects. Notably, the lines are blurring – governments are now major customers of commercial satellite services (e.g., buying imagery from private sats, or military leasing of commercial comm capacity), and commercial players sometimes partner on government missions. The key takeaway is broad-based growth: virtually every user segment of satellites, from broadband internet for consumers to advanced military surveillance, is driving up demand for satellite buses heading into 2033.

Major Programs and Drivers of Demand

What specific programs and initiatives are propelling this unprecedented demand? There are several major commercial and governmental projects acting as catalysts in the 2024–2033 timeframe:

- Megaconstellations for Broadband: The single biggest demand-driver is the race to provide global internet coverage from LEO. SpaceX’s Starlink constellation (planned ~12,000 satellites in its Gen1 and Gen2) is the poster child – it has already launched thousands of satellites and continues at a monthly cadence. Amazon’s Project Kuiper is hot on its heels, with production of its first 3,236 satellites underway and initial launches in 2024. OneWeb’s first-gen of 648 satellites is complete, and a second generation is expected. Beyond these, China’s government has approved a comparable megaconstellation (nicknamed “Guowang” or Thousands of Sails) aiming for 13,000+ LEO satellites to provide broadband by late 2020s interactive.satellitetoday.com. These massive constellations alone account for tens of billions of dollars in satellite manufacturing. They emphasize small, relatively inexpensive buses built in high volume – creating a new paradigm of factory-like satellite production. The economic model is risky (Starlink and others are spending huge sums up front), but if successful, they promise to connect billions of people and IoT devices, which drives continuing investment. Notably, these programs also spur ancillary demand: ground stations, launch services, and replacement satellites (each Starlink has ~5-year lifespan, so constant replenishment is needed). The broadband constellation boom is the prime engine of commercial satellite demand today alliedmarketresearch.com alliedmarketresearch.com.

- Defense and Intelligence Satellites: Global tensions and the militarization of space are resulting in many government programs that require advanced satellite buses. The U.S. National Defense Space Architecture (run by the Space Development Agency) will deploy hundreds of LEO satellites in tranches for secure communications, missile tracking, and targeting – a radical shift from a few big military satellites to a network of many small ones interactive.satellitetoday.com. The Next-Gen Overhead Persistent Infrared (Next-Gen OPIR) program is fielding new high-altitude IR surveillance sats to replace SBIRS, contracting big primes like Lockheed and Northrop. Spy satellites (electro-optical and radar imaging) are in high demand – the U.S. NRO is augmenting government sats with commercial imagery buys, and countries like India, Germany, Japan, and of course China are launching their own high-resolution reconnaissance satellites. Many of these are very advanced buses (agile, autonomous, often smallsat form factors to be harder to target). Military communications programs also abound: the U.S. continues with WGS and introduces Protected Satcom systems; China and Russia expand their military satcom constellations; Europe initiates a EU Govsatcom and national defense satcom (e.g., France’s Syracuse 4, Italy’s SICRAL 3, UK’s Skynet 6). All require either cutting-edge GEO buses or constellations of secure LEO/MEO satellites. The war in Ukraine underscored the value of satellites (Starlink terminals kept communications up, commercial SAR satellites tracked Russian units), prompting NATO to invest in space assets reuters.com. In sum, global defense programs are a huge growth driver, ensuring a steady pipeline of new satellite bus contracts well into the 2030s.

- Navigation and Positioning Systems: The major Global Navigation Satellite Systems are undergoing renewal. The U.S. GPS III program is delivering new satellites (Lockheed Martin-built) into MEO to upgrade positioning services, and follow-on GPS IIIF satellites are on order into late 2020s. Europe’s Galileo is deploying a second generation of satellites (Airbus and Thales Alenia are building at least 12 new Galileo sats) to enhance accuracy and services. Russia’s GLONASS and China’s Beidou are also adding satellites to maintain their constellations. Additionally, regional navigation systems (India’s NavIC, Japan’s QZSS) are expanding coverage. These programs involve extremely high-value, precision-engineered satellite buses with advanced atomic clocks, etc. While not huge in number (dozens of satellites), their large budgets and critical importance make them a key segment. The success of these systems also spurs demand for augmentation satellites or commercial satnav services, possibly an emerging niche by 2030.

- Earth Observation and Climate Programs: Climate change and security concerns are prompting major Earth observation satellite programs. The European Commission’s Copernicus program will launch new Sentinel satellites (Sentinel-7, -8, etc.) for CO2 monitoring, ice observation, and more – many contracts for these multi-satellite series have gone to Airbus, Thales, etc. NASA and NOAA have missions like Landsat Next, JPSS weather satellites, PACE ocean color sat, a new generation of geostationary weather sats (GeoXO) – each requiring state-of-the-art buses (often provided by Lockheed, Northrop, or Maxar). Countries in Asia are also expanding Earth observation fleets (e.g. Japan’s ALOS-3, India’s RISAT radar sats, China’s Gaofen series). Commercially, companies like Planet, Maxar, BlackSky, Satellogic are either maintaining or expanding constellations to image the Earth daily or provide analytics (some replacing older systems with newer tech). Even startups planning weather data from small satellites (microwave sounders, etc.) are adding to demand. These Earth observation programs – both government and private – collectively push bus development (for high stability, precise pointing, high data throughput) and generate a steady stream of contracts. Also, environmental monitoring drives international collaboration: for instance, NASA might supply an instrument to mount on an Indian or Japanese satellite bus, fostering cross-market activity.

- Commercial Satcom Replacements and Expansion: Outside of megaconstellations, traditional commercial satellite operators are modernizing their fleets. Companies like Intelsat, SES, Eutelsat (now with OneWeb), Viasat/Inmarsat, Hispasat, Arabsat, etc., are ordering next-gen GEO communications satellites that can provide flexible connectivity for airplanes, ships, and broadband on demand. A trend here is fewer, more powerful GEO sats – each new satellite (with digital beam-forming, multi-band payloads) can do the job of several old ones. For manufacturers, that means contracts for high-capability bus platforms like Airbus’s Eurostar Neo, Thales’s Spacebus Neo, or newer Boeing/Lockheed designs. Additionally, some operators are exploring Medium orbit communications (e.g. SES’s O3b mPOWER in MEO uses 11 Boeing-built buses with sophisticated processing). The inflight internet boom, maritime communications, and 5G backhaul from space are all commercial use-cases expanding, requiring both big GEO satellites and complementary smallsat constellations. One interesting program is AST SpaceMobile’s BlueBird satellites – very large LEO satellites with 64 m² antennas to connect directly to standard smartphones. They are essentially “cell towers in space,” pushing the limits of bus design to support huge deployable structures. AST has launched prototypes and plans a constellation, which if realized means dozens of bus orders (initially being built by an contract manufacturer, possibly Terran Orbital). Similarly, Lynk Global is launching small sats for direct-to-phone texting. This emerging Direct-to-Device satellite communications trend could fuel hundreds more satellites by private companies, all requiring reliable bus platforms. In summary, beyond the headline-grabbing constellations, routine commercial satellite fleet upgrades and new communications applications will continue to generate business for bus manufacturers each year.

- Space Exploration and Science Missions: While a smaller slice of the market in dollar terms, national space exploration programs also influence bus platform advancement. NASA’s Artemis program (return to the Moon) is spurring development of specialized satellites: e.g., lunar Gateway modules (essentially space station segments), lunar communications relay satellites, and small satellites orbiting the Moon (Artemis program has CubeSats rideshares, etc.). These involve unique bus designs for deep space. Likewise, upcoming Mars missions, asteroid explorers, space telescopes – each needs a high-performance spacecraft bus (often bespoke). The tech developed often trickles down to commercial buses (for radiation-hardened electronics, autonomous navigation, etc.). Internationally, China plans a permanent lunar base and Mars sample return, requiring new satellite and relay infrastructure. Even emerging countries are planning Moon-orbiting small sats or Mars probes (e.g. UAE’s upcoming missions). While these are one-off projects, they keep high-end engineering teams engaged and sometimes lead to partnerships (a private company might build a lunar microsat for NASA, for example, as part of a commercial initiative). Over the decade, a few high-profile science missions like NASA’s Nancy Grace Roman Space Telescope or ESA’s JUICE (to Jupiter) will launch – big flagship buses that showcase ultimate capabilities (1000+ kg payloads, huge solar arrays, etc.). Such missions don’t drive volume but do drive innovation in bus subsystems, which can eventually benefit the mainstream market.

Collectively, these programs paint a picture of unprecedented demand across all fronts. Never before has the satellite industry had to support simultaneously: multiple constellations of thousands of satellites, modernize crucial civil infrastructure (nav, weather), fulfill new military space strategies, and push exploration boundaries. It’s this convergence that underpins the optimistic market forecasts and the frenetic competition among manufacturers to gear up production.

Conclusion: An Industry Reaching New Heights

By 2033, the global satellite manufacturing and bus platform market will be markedly transformed. We’ll see a larger cast of competitive players – from entrenched aerospace giants that successfully evolved, to new entrants carving out lucrative niches – all delivering satellites at rates once deemed impossible. Technological innovation in satellite buses will have made spacecraft more capable, autonomous, and even serviceable, fundamentally changing how we operate in orbit. The market’s expansion is fueled by a perfect storm of commercial ambition (internet constellations, connectivity for all) and governmental resolve (security, climate action, exploration), making space a priority domain.

The “satellite bus showdown” of legacy titans versus NewSpace mavericks will likely benefit customers with lower costs and faster turnaround, as competition drives efficiency. It may also spawn creative collaboration, as we’ve seen with joint ventures and mergers aiming to combine strengths. We can expect satellite buses to become increasingly commoditized in lower orbits (hundreds of interchangeable sats working in concert) and ultra-sophisticated in higher orbits (large satellites with reconfigurable, mission-critical roles). In other words, the industry will cater to both ends: the mass-produced and the custom-built – and many shades in between – to fulfill the diverse demands of the next decade.

In this high-stakes race to orbit, those companies that innovate rapidly, form smart partnerships, and execute reliably will capture the market’s growth. With space becoming ever more integral to the global economy and security, the satellite bus market’s trajectory is unmistakably upward. The period 2024–2033 is set to be one of explosive growth, intense competition, and groundbreaking advancements – a truly engaging new chapter in the space age where the world’s best are battling and collaborating to connect and observe our planet as never before.

Sources: Global market and industry data from Mordor Intelligence mordorintelligence.com mordorintelligence.com mordorintelligence.com and Allied Market Research alliedmarketresearch.com alliedmarketresearch.com; company and trend information from industry news (Reuters, SpaceNews) reuters.com reuters.com; technology trend insights from SatelliteToday and National Defense Magazine interactive.satellitetoday.com nationaldefensemagazine.org; and various space agency and corporate releases. All information reflects the state of the industry as of 2025, with forward-looking projections based on cited analysts’ forecasts and announced programs.