- Apple launched Emergency SOS via satellite in late 2022 with the iPhone 14, becoming the first mainstream phone to offer satellite messaging.

- Apple’s satellite system uses Globalstar’s LEO satellites (about 1,400 km altitude) with custom hardware and extremely low bandwidth, delivering a few bytes per second and requiring the user to point and hold the phone for about 15–30 seconds per transmission.

- In late 2023 Apple added roadside assistance texting via satellite with AAA in the U.S., and iPhone purchases include two years of satellite service for free.

- Apple announced in 2024 that iOS 18 will enable standard iMessage texting via satellite when no cellular or Wi‑Fi is available on iPhone 14 and newer.

- Apple committed about $450 million to Globalstar to bolster ground stations, ordered 50 new Globalstar satellites from MDA for a next-gen constellation, and acquired roughly a 20% stake in Globalstar.

- SpaceX’s Starlink Direct-to-Cell began live beta in New Zealand in late 2024 with One NZ, using Starlink satellites as direct cellular towers and supporting unmodified Samsung and OPPO phones, with texts typically delivered in 1–3 minutes (up to about 10 minutes) and Starlink now totaling over 4,000 satellites.

- Starlink’s system uses existing carrier spectrum (for example 900 MHz Band 8 in NZ and 600 MHz Band 71 in the U.S.), with the satellite acting as a roaming base station and no hardware changes required on phones.

- SpaceX targets 2024 for beta texting, 2025 for data and IoT, and 2025+ for voice rollout, aiming for near-global basic messaging by late 2025 as more Gen2 satellites launch.

- AST SpaceMobile’s BlueWalker 3 prototype in 2023 deployed a 64 m² phased-array antenna and connected to AT&T phones, and five BlueBird satellites were launched in September 2024, with commercial service expected in 2025 and each BlueBird satellite featuring about 700 m² of antenna area and roughly 20 Mbps down and 5–10 Mbps up.

- AST has partnerships with AT&T and Verizon in the U.S., and with Vodafone Group, Vodafone Idea, Rakuten, Orange, Telefónica, Telstra and others worldwide, plus regulators like the FCC moving toward space-based mobile rules such as Supplemental Coverage from Space, with India’s Vodafone Idea deal in June 2025 marking cross-border expansion.

Introduction: A new space race is underway – not to put the next person on the Moon, but to eliminate cellphone “dead zones” by connecting ordinary phones directly to satellites. Tech giants and start-ups alike are vying to beam connectivity from orbit to your handset under open skies. Apple’s iPhone Emergency SOS kicked off this trend in 2022, and now SpaceX’s Starlink and AST SpaceMobile (backed by major carriers) are rushing to follow ts2.tech ts2.tech. This report provides an in-depth comparison of three leading satellite-to-cell technologies – Apple’s Globalstar-powered SOS service, SpaceX Starlink’s direct-to-cell initiative, and AST SpaceMobile’s BlueBird satellites – covering their current status, technology, partnerships, regulatory hurdles, use cases, and future roadmaps.

Apple’s Emergency SOS via Globalstar – Lifesaving Texts from Anywhere

Apple’s iPhone 14 introduced “Emergency Text via Satellite” for off-grid 911 messaging ts2.tech. The phone guides you to point at a Globalstar satellite when no cell signal is available (as shown above).

Status & Rollout: Apple launched Emergency SOS via satellite in late 2022 with the iPhone 14 lineup, making it the first mainstream phone to offer satellite messaging satellitetoday.com. By 2025, this feature is supported on three generations of iPhones (14, 15, and newer) and expanded to 17 countries across North America, Europe, Asia, and Australasia ts2.tech support.apple.com. Initially available in the U.S. and Canada, it rolled out to major European markets, Australia, New Zealand, and Japan in 2023–2024 support.apple.com. Apple’s service has already saved lives – multiple people stranded in remote areas have been rescued thanks to an iPhone SOS message getting through with their GPS location ts2.tech. Apple currently offers the emergency texting for free (iPhone purchases include 2 years of satellite service), and in late 2023 it even added roadside assistance texting via satellite in partnership with AAA in the U.S. (and similar services in select regions) support.apple.com support.apple.com. However, outside of emergencies (or car breakdowns), iPhone users cannot yet use satellite links for normal messaging – it’s a strictly off-grid emergency fallback.

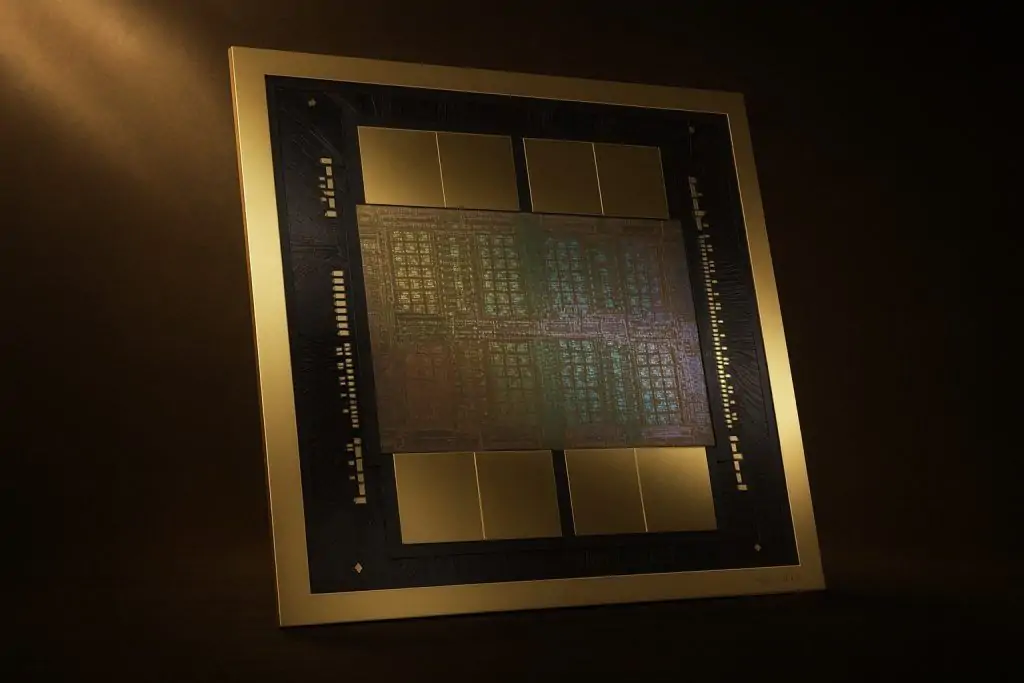

Technology & Network: Apple’s solution uses the Globalstar low-Earth orbit (LEO) satellite network. Globalstar operates dozens of satellites in ~1,400 km orbits and dedicated L-band/N-band spectrum for mobile satellite service. Because standard cellular bands and protocols aren’t used, Apple had to build custom hardware and software into the iPhone 14 to connect to Globalstar’s frequencies satellitetoday.com. The phone’s antennas and Qualcomm modem firmware were specialized so that when you dial emergency services with no signal, the phone can beam a tiny text packet to a passing satellite. Bandwidth is extremely limited – just a few bytes per second – so the interface sends preset questions and short text snippets (no images or voice). Users must also point the iPhone toward the satellite and hold still for ~15–30 seconds to transmit, as the connection is one message at a time. Latency isn’t real-time; each message may take 15 seconds up to several minutes to send depending on satellite position and terrain blockage. In practice, Apple set up an algorithmic assistant that compresses your answers to a questionnaire (about your emergency) into a concise message and optimizes the transmission for low bandwidth support.apple.com support.apple.com. On the ground, Apple invested in new infrastructure: upgraded Globalstar ground stations and relay centers that receive the satellite message and route it to the nearest emergency responder call center satellitetoday.com. If a 911 center cannot accept texts, Apple’s relay center will call them and convey your situation. This tightly integrated system – from silicon to satellite to dispatch – is proprietary to Apple and Globalstar.

Use Cases & Performance: Apple’s current service is purposely limited to critical scenarios. It supports two-way SMS-style communication with emergency services and can share your GPS location via satellite with first responders or family. In the U.S. and some regions, users can also text a roadside assistance call center via satellite if their car breaks down off-grid support.apple.com. The text messages are very basic (no emojis or media) and are focused on conveying location and distress information. Still, the impact is significant – hikers, backcountry travelers, pilots, and rural motorists have a safety net where they previously had none. Apple reports numerous successful rescues, from snowbound mountaineers to stranded boaters, thanks to an iPhone SOS message delivered by satellite ts2.tech. The service does not support casual messaging, phone calls, or internet data – it’s truly an emergency lifeline. Apple’s approach essentially turns the iPhone into a mini satellite messenger (akin to a Garmin inReach) in dire situations. The proprietary nature means iPhones do not currently work with any other satellite networks – for example, when New Zealand’s first satellite text service launched on another network in 2024, iPhones were notably not supported due to Apple’s closed system ts2.tech.

Partnerships & Strategy: Apple’s partner Globalstar is dedicating the majority of its network capacity to Apple’s iPhone users. In return, Apple has poured substantial funding into Globalstar. In early 2023, Apple committed $450 million to bolster satellite ground stations, and in February 2025 Apple went further – backing an order of 50 new Globalstar satellites from MDA to form a next-gen constellation ts2.tech. Apple even acquired a ~20% stake in Globalstar as part of this deal ts2.tech. These new satellites (planned to launch 2025–26) will augment coverage and possibly enable “Gen 2” capabilities beyond one-way texting ts2.tech. Industry experts speculate Apple’s long-term plan could allow limited personal satellite messaging – e.g. sending a check-in message via iMessage when off-grid ts2.tech. In fact, Apple announced in mid-2024 that iOS 18 will enable standard iMessage texting via satellite when no cellular or Wi-Fi is available (for iPhone 14 and later) satellitetoday.com satellitetoday.com. This would let users send/receive texts, emoji, and small messages to regular contacts over satellite, expanding beyond the emergency-use case. Apple has not signaled interest in full voice or broadband data via satellite – the bandwidth will remain focused on short messaging. Strategically, Apple’s closed approach contrasts with carrier-led initiatives: Apple controls the end-to-end experience (and keeps iPhones tethered to Globalstar’s network exclusively). This has raised questions about interoperability. Will future iPhones ever work with services like Starlink or AST? So far, Apple is silent on allowing third-party satellite networks on its devices ts2.tech. With Apple investing heavily to mainstream satellite connectivity, it clearly views this as a long-term differentiator for the iPhone – one that rivals are racing to match.

SpaceX Starlink Direct-to-Cell – Turning Starlink Satellites into Cell Towers

Status & Rollout: SpaceX’s Starlink – known for beaming broadband to dishes – is now upgrading its satellites to connect directly to normal phones. In 2022, SpaceX and T-Mobile announced a landmark plan to use Starlink satellites as “cell towers in space” for T-Mobile customers. Fast forward to 2024–2025, and this Starlink Direct-to-Cell service is moving from concept to reality ts2.tech. SpaceX began launching second-generation Starlink satellites with cellular antennas in early 2024 inform.tmforum.org starlink.com. By late 2024, New Zealand became the first country with a live beta: One NZ (formerly Vodafone NZ) rolled out a nationwide satellite texting service using Starlink ts2.tech theverge.com. In this pilot, customers on select Samsung and OPPO phones could send SMS when outside coverage, with messages typically delivered in under 3 minutes (occasionally up to 10 minutes) theverge.com. Building on that, T-Mobile USA opened a public beta in mid-2025, inviting users (even from other carriers) to test satellite connectivity for free ts2.tech ts2.tech. During this beta, participants have been able to send texts, make voice calls, and use basic data messaging through Starlink when cellular networks are unavailable ts2.tech. This marked one of the first instances of a major carrier integrating satellite fallback seamlessly into ordinary handsets. T-Mobile’s plan is to include satellite coverage at no extra cost on premium plans by late 2025, with an estimated ~$10/month add-on for other plans ts2.tech. SpaceX and its carrier partners aim to achieve truly ubiquitous coverage – “Coverage Above and Beyond” – by ensuring that wherever you have clear sky, you can get at least a text out via satellite.

Technology & Spectrum: Starlink’s direct-to-phone approach treats a satellite like a floating cellular base station. Each enabled Starlink satellite carries an advanced LTE/5G modem (eNodeB) and a large antenna array. Rather than using satellite-specific bands, SpaceX is leveraging slices of existing terrestrial cellular spectrum licensed to its partner carriers ts2.tech starlink.com. For example, One NZ’s service uses 3GPP Band 8 (900 MHz) spectrum ts2.tech, and in the US the plan is to use T-Mobile’s Band 71 (600 MHz). These low-frequency bands were chosen for their long range and penetration – a single satellite can illuminate a wide area (hundreds of km) with a cell signal that standard phones can detect. In essence, the satellite acts like a remote cell tower, and phones see it as just another network tower (with a special tracking area code). No hardware modifications are needed on the phone; as long as a device supports the frequency and has updated firmware, it can connect. This is a key distinction: Starlink’s system works within 5G/4G standards so that any off-the-shelf phone will eventually be compatible starlink.com starlink.com. Initially, only a few handset models were whitelisted in New Zealand, but broader support is coming via software updates in 2025 theverge.com.

Once a phone links to a Starlink satellite, the signal is handed off through SpaceX’s existing network. The satellite uses laser crosslinks or its own Ka/Ku-band backhaul to reach a gateway ground station, from which the traffic enters the carrier’s core network just like from any roaming cell site starlink.com. This design means latency is higher than a normal tower but still reasonable – roughly half a second end-to-end for a message in good conditions, though currently messages are often queued and delivered in minutes due to the nascent network. Throughput is very limited at first. Each satellite has only a small cellular bandwidth (on the order of a few megabits per second shared by all users on that satellite beam). In the NZ trial, texts are short and have been taking 1–3 minutes on average theverge.com. As more satellites with direct-to-cell payloads launch, capacity and responsiveness will improve. SpaceX has over 4,000 Starlink satellites in orbit already ts2.tech, and while not all have cellular capability yet, the scale works in its favor. Elon Musk noted that once enough second-gen satellites are up, global texting coverage could be enabled, with an initial target around late 2025 for basic messaging worldwide ts2.tech. Voice calls and low-speed data are expected to follow in 2026–2027 as the constellation matures and more bandwidth is deployed ts2.tech. Starlink’s Gen2 satellites (the larger models) are designed to greatly boost capacity, especially once SpaceX’s Starship rocket can deploy them in bulk starlink.com.

Starlink’s direct-to-cell architecture: an unmodified phone connects to a Starlink satellite on normal cellular bands, which relays into the existing Starlink mesh network (via laser links) and down to a gateway, entering the carrier’s network starlink.com starlink.com.

Availability & Use Cases: The promise of Starlink direct-to-cell is that your existing phone just works, anywhere. In practical terms, the initial service is text-only and geared toward emergency use or basic connectivity in remote spots. For example, a hiker in a national park or a driver on a rural highway can send an SMS even with zero bars of terrestrial signal. One early use case was disaster response: in late 2024, SpaceX and T-Mobile piloted satellite texting during hurricanes in the US, allowing residents to message when cell towers were down theverge.com. As the service improves to support voice, it could serve as a lifeline for rural communities and during power outages (imagine being able to dial 911 via satellite or call loved ones after a storm knocks out infrastructure). Beyond emergencies, it enables everyday conveniences: receiving a two-factor authentication text while camping off-grid, or letting family know “Made it to the summit, heading down soon” from a mountain. Starlink and carriers have indicated that eventually phones will seamlessly roam to satellite when terrestrial coverage drops ts2.tech. This means you might not even need to think about it – your phone will automatically switch to satellite mode in a dead zone (likely with a slight delay and a UI indicator) and reconnect you to the world. Early adopters must be patient, however. The NZ trial showed that messages can be delayed, only specific phones worked initially, and the feature is limited to outdoors (you need line-of-sight to the sky) theverge.com. Despite these limitations, One NZ touted its satellite TXT as a free inclusion on regular plans theverge.com, and T-Mobile similarly is making satellite coverage a free perk on high-end plans to differentiate themselves ts2.tech. This suggests that basic satellite messaging may become a standard feature for mobile customers – a safety net included by default.

Partnerships & Coverage: SpaceX’s strategy is to partner with mobile network operators around the globe rather than offering service direct to consumers. In the U.S. it’s T-Mobile; internationally SpaceX has signed agreements with major carriers on every continent. According to SpaceX, carriers in Canada (Rogers), Japan (KDDI), Australia (Optus and Telstra), New Zealand (One NZ), Latin America (Entel in Chile/Peru), and Europe (Salt in Switzerland) are onboard so far starlink.com starlink.com. More deals are expected – SpaceX has effectively created a “coalition” of operators who will use Starlink for coverage and even allow reciprocal roaming for customers traveling between partner networks starlink.com starlink.com. Notably absent are some big players in Europe and elsewhere (e.g. no announcement yet from Vodafone Group or Orange), but this may change as the technology proves out. The regulatory aspect has been a hurdle: using terrestrial spectrum from space requires permission. In the US, the FCC began developing a framework in 2023 to permit satellite-to-phone services under existing mobile licenses, as long as the satellite operator coordinates with the license holder ts2.tech. The FCC granted SpaceX/T-Mobile experimental licenses to test the service, and by late 2024 formally approved a trial operation theverge.com theverge.com. Europe is also moving to integrate non-terrestrial networks (NTN) into 5G standards so phones can seamlessly use satellites like any roaming network ts2.tech. New Zealand, Japan, and others have already given the green light for Starlink-linked services ts2.tech. The technical coordination is complex – satellites must not interfere with ground cell sites using the same frequency – but so far, no major interference issues have been reported in tests. Coverage footprint for Starlink direct-to-cell will eventually be global (even oceans), but availability to users will depend on local carrier partnerships and licenses. By using many low-flying satellites (~500 km altitude), Starlink can provide lower latency and strong signals, but also needs a dense constellation for continuous coverage. SpaceX’s aggressive launch cadence aims to fill the skies such that at least one “cell tower satellite” is always overhead no matter where you are. If successful, the days of seeing “No Service” on your phone could largely come to an end.

Roadmap: SpaceX officially targets 2024 for beta texting, 2025 for data and IoT, and 2025+ for voice rollout starlink.com. Indeed, texting went live in 2024 (NZ) and early 2025 (other markets), and internal tests of voice calls are reportedly underway ts2.tech. By late 2025, SpaceX wants basic messaging active in many regions, and as more gen-2 satellites launch (especially via Starship, enabling larger payloads), capacity will expand to support voice calling and low-speed internet (think a few tens of kbps per user for messaging apps or emergency apps) ts2.tech theverge.com. Looking further, SpaceX has hinted at IoT connectivity – e.g. millions of devices like sensors or smart tags that could connect over satellite using LTE Cat-M or NB-IoT standards starlink.com starlink.com. This could open satellite links for asset tracking, agriculture, and more, beyond just phones. The competition is heating up too. Lynk Global, a startup, was actually first to send an SMS from a tiny satellite to an unmodified phone in 2020 and has signed pilot deals in Africa and the Caribbean ts2.tech. And in 2023, Qualcomm announced Snapdragon Satellite with Iridium for two-way messaging on Android phones. In fact, the first Android phones with satellite SMS (using Iridium’s network) debuted in 2023–24 via Motorola/Bullitt and others. Verizon opted for this route – partnering with startup Skylo to use existing geosynchronous satellites (Inmarsat/Turaya networks on L-band) to offer emergency texting for Android phones lightreading.com lightreading.com. In short, SpaceX won’t be alone in this space – but with its massive Starlink constellation and close carrier alliances, it has a strong lead in the race to directly connect mainstream mobile users. Elon Musk quipped that Starlink’s goal is that you never have to worry about losing coverage ts2.tech. By 2026, seeing a phone connecting to “Starlink” in an isolated village or on a remote lake may be as normal as seeing it roam to a local network today.

AST SpaceMobile & BlueBird – Cellular Broadband from Space via AT&T and Others

Status & Rollout: AST SpaceMobile is a Texas-based venture taking a bold approach: launching giant satellites that function as cell towers, aimed at providing 4G/5G broadband directly to standard smartphones. After years of R&D (and a close partnership with carriers like AT&T and Vodafone), AST hit a major milestone in April 2023 when its prototype satellite BlueWalker 3 unfolded a 64 m² phased-array antenna in orbit and successfully connected to phones on the ground ts2.tech. In tests, BlueWalker 3 facilitated the first-ever space-based voice calls on ordinary handsets (AT&T phones) and even a modest data session around 10 Mbps ts2.tech ts2.tech. Buoyed by that success, AST began launching its first production satellites – called BlueBirds. In September 2024, a SpaceX Falcon 9 rocket deployed five BlueBird satellites into LEO, marking the start of AST’s commercial constellation lightreading.com lightreading.com. These satellites are currently undergoing on-orbit testing. AT&T’s network president indicated that in the months after launch, a select group of AT&T users (likely including engineers and friendly customers) would start trialing the space-based coverage on their existing phones lightreading.com lightreading.com. Full commercial service from AST is expected to ramp up in 2025, once the initial satellites are proven and more are launched. Vodafone (a major investor in AST) had originally hoped for service by 2023, but timelines slipped lightreading.com. As of mid-2025, AST is on the cusp of limited service trials with AT&T in the US and possibly with partners in other regions, but widespread availability is likely 2025-2026 as the constellation grows. Notably, Verizon announced a $100 million agreement with AST in mid-2024 to also use its satellite-to-cell service satellitetoday.com. This means two of the biggest U.S. carriers – AT&T and Verizon – plan to tap AST’s network for satellite coverage. Internationally, AST has signed deals or MOUs with mobile operators in over a dozen countries, including Vodafone (covering Europe and Africa), Rakuten Mobile (Japan), Telstra (Australia), Safaricom (Kenya), and Vodafone Idea (India) ts2.tech ts2.tech. The June 2025 partnership with India’s Vodafone Idea is especially significant, aiming to bring satellite broadband to remote Indian villages and terrain where towers are impractical ts2.tech ts2.tech. In short, AST is aligning with carriers worldwide to offer roaming coverage from space, starting with text and voice and eventually data.

Technology & Spectrum: AST’s differentiator is its emphasis on broadband speeds and standard 4G/5G protocols. The BlueBird satellites are essentially oversized cellular base stations in orbit. Each satellite is massive – BlueBirds feature about 700 m² (7,500 ft²) of antenna array area, far larger than Starlink’s, to collect and transmit strong signals across hundreds of kilometers lightreading.com lightreading.com. In AST’s design, a single satellite can create powerful cellular signals (LTE/5G) that cover an area the size of a medium country, with beams that can hop around to different cells. During tests, BlueWalker 3 connected on AT&T’s 850 MHz band (Band 5) ts2.tech. This is a low-frequency band many phones support, and AT&T lent a 10 MHz slice of it for AST’s use. Likewise, other carriers will allocate some of their licensed spectrum (often in the 700–900 MHz range, or possibly 1800 MHz in some cases) for AST to use from space lightreading.com lightreading.com. Because AST works within the carriers’ own licensed bands, phones see the satellite as just another cell tower on the carrier’s network (with a special code indicating satellite). The key challenge is that the satellite is moving rapidly relative to the Earth, and the signals travel much farther (~500 km up) than a normal tower. AST developed a proprietary beamforming and Doppler compensation technology so that a phone sees a stable signal. The large antenna array is required to focus energy on tiny phone antennas and to maintain a link budget that supports data (not just SMS). AST claims that each first-gen BlueBird satellite can provide up to ~20 Mbit/s download and ~5–10 Mbit/s upload capacity distributed across its coverage area in practice lightreading.com lightreading.com. (Theoretical peaks might be higher – AST said 120 Mbps in ideal lab conditions – but real-world throughput per user will be in the few Mbps or lower lightreading.com.) This is enough for voice calls, messaging, and basic internet (sending emails, using WhatsApp, light web browsing), but not high-definition video streaming. It’s a significant step up from the text-only systems. The latency is relatively low given ~500 km orbit altitude (perhaps 50–100 ms satellite segment), so voice calls are feasible with only a slight delay, and basic video calls or downloads could work albeit slowly.

To achieve true 4G/5G, AST’s satellites also integrate with carriers’ core networks more deeply. Each satellite acts as a 3GPP-compliant base station that connects back to a dedicated gateway on Earth tied into the carrier’s network. AST has secured spectrum rights in the U.S. and other regions to downlink from the satellite to these gateway earth stations (for example, using Ku or Ka band for backhaul, or potentially leased spectrum like Ligado’s L-band for feeder links) ts2.tech. In 2023–2024, regulators began granting AST the necessary licenses: the FCC, for instance, approved AST’s application to use AT&T’s 850 MHz spectrum for satellite service on an experimental basis ts2.tech ts2.tech. By early 2025, the FCC had also accepted AST/Globalstar proposals as it works toward new “Supplemental Coverage from Space” rules to govern these hybrid networks ts2.tech. One interesting twist: AST acquired access to some L-band spectrum from Ligado Networks in the U.S. ts2.tech. This could be used to supplement capacity or for IoT services, and hints that AST might operate on multiple frequency bands to boost performance. The BlueBird satellites are extremely complex and expensive (hundreds of millions invested in development), which is why AST is starting relatively small. The first phase of deployment is aimed at equatorial and mid-latitude coverage with 20–30 satellites. Eventually, AST envisions launching 100+ satellites for global coverage. They even plan larger second-generation satellites (roughly 2,400 ft² arrays, over 4x the area of current ones) with next-gen ASIC chips to increase capacity tenfold lightreading.com lightreading.com. Those could deliver on the promise of true broadband (AST mentioned potential 10 GHz of capacity on future models vs 1 GHz now) lightreading.com. AST has started ramping up its satellite factory, aiming to produce 4–6 satellites per month by late 2025 if demand and funding allow lightreading.com.

Use Cases & Services: AST’s service is essentially an extension of cellular networks to everywhere. The use cases mirror what you’d do with your phone today in areas with only a weak 3G/4G signal – calling, texting, messaging, and light data. Initially, AST and its partners will likely emphasize coverage for remote and rural users: enabling farmers, hikers, truckers, or residents of off-grid communities to have connectivity without waiting for a cell tower to be built. Emergency communications is another big one – both AT&T and Verizon have pointed out the value of satellite coverage in disasters (hurricanes, wildfires, etc.) where they can switch customers over to satellites if towers go down lightreading.com lightreading.com. In India, the partnership aims to support things like remote education and telehealth by bringing mobile internet to villages in rugged terrain ts2.tech ts2.tech. Because AST’s bandwidth is higher than the pure texting solutions, it could support services like WhatsApp messaging, voice calls, and even low-res video calling or web access in areas that never had data service before. Imagine being on a safari in Africa or deep in the Amazon and still being able to make a phone call or send an email – that’s what AST is targeting. For airlines or maritime users, AST’s tech could eventually allow direct phone connectivity on flights or ships (though regulatory and antenna constraints on moving vehicles are another matter). Another interesting use case: AT&T’s network president mentioned that in the long run, if satellite coverage becomes robust, carriers might decommission some sparsely used cell towers in favor of satellites covering those areas lightreading.com. This could reduce infrastructure costs for carriers, using space as an alternative to building towers in places with very few users. AST has also secured a few U.S. government contracts for its technology, indicating potential military or disaster-response applications where quick-deploy connectivity is needed lightreading.com lightreading.com. However, AST is not aiming to replace urban or suburban networks – the capacity is too low for dense populations. Instead, it’s a complementary layer to fill in gaps and provide a baseline broadband in unserved regions. In terms of service availability, AST’s model is for you to subscribe through your normal carrier (say, an AT&T plan) which will include or add-on satellite coverage. AT&T suggested it may bundle basic satellite service into premium plans and offer it as an optional add-on for others lightreading.com lightreading.com. Pricing isn’t set yet, but carriers will likely treat it similar to a roaming or extended coverage feature. Importantly, any phone that works on the carrier’s network should work with the satellite – no special device needed. AST proved this by using unmodified smartphones (Galaxy S22, iPhone, etc.) in their test calls.

Partnerships & Market Strategy: AST SpaceMobile has consciously partnered with incumbent telecom operators rather than compete with them. Its investors and collaborators include Vodafone Group, American Tower, Samsung, Rakuten, Vodafone Idea, Orange, Telefónica and others, alongside AT&T and Verizon ts2.tech. This gives AST a wide footprint if its service comes online – Vodafone alone covers dozens of countries, and AT&T/Verizon cover ~200 million U.S. subscribers. In Africa and Latin America, AST’s deals with regional carriers could bring service to areas that never had reliable connectivity. Regulators in developing markets (e.g. India, Africa) are increasingly supportive, seeing satellite integration as critical for rural coverage ts2.tech ts2.tech. There are still hurdles: each country’s telecom authority must permit the use of spectrum from space. Some countries historically banned satellite phones (for example, due to security concerns), but attitudes are shifting now that the services are tied to local carriers (meaning governments can maintain oversight) ts2.tech ts2.tech. AST will need to navigate these regulatory approvals country by country. On the competitive front, AST’s biggest rival is indeed SpaceX Starlink’s direct-to-cell effort lightreading.com. Both aim to serve ordinary phones via LEO satellites, but their approaches differ (AST pursues higher bandwidth per satellite with far fewer satellites; SpaceX leverages many satellites but each with lower per-unit capacity initially). In interviews, AST executives have acknowledged the challenge of building a constellation business – it requires huge upfront investment and regulatory coordination before revenue flows lightreading.com. “Building constellations has been a terrible business” in the past, AST’s president said, noting the firm’s advantage is having strong backing from big carriers to ensure a market lightreading.com. Indeed, AT&T and Verizon signing on gives AST credibility (and likely future revenue). Another competitor is Lynk Global for basic messaging, but Lynk’s tiny satellites can’t do broadband and are more of an interim solution. There’s also a possibility that Amazon’s Project Kuiper (a planned Starlink competitor) may eventually dip into direct-to-phone services, given Amazon’s patents in that area ts2.tech. But Kuiper is years behind, and AST’s head start in 4G from space is notable.

Roadmap: Following the September 2024 launch of 5 BlueBirds, AST’s next milestones include validating those satellites’ performance and then scaling up deployment. The company aims for another launch of larger next-gen BlueBirds in Q1 2025 lightreading.com, and potentially bimonthly launches thereafter. By mid-2025, AST hopes to incorporate new custom chipsets into its satellites to increase capacity lightreading.com lightreading.com. If manufacturing accelerates, AST could start offering initial commercial service in select regions (likely the U.S. and parts of Europe/Africa) with a dozen or two satellites in orbit. Continuous global coverage might require ~100 satellites, which could take until 2026–2027 to launch. In the interim, service might be intermittent – e.g. a given rural area might have satellite coverage for certain hours per day as satellites pass over, rather than 24/7. For critical uses like emergency response, even intermittent coverage is a game-changer, and as more satellites launch the gaps will close. Looking ahead, AST’s Phase 2 with the ultra-large 2,400 ft² satellites would push into true 5G territory, potentially enabling hundreds of Mbps of throughput shared across a region lightreading.com. That could mean not just texting and voice, but streaming video or providing home broadband from a satellite to phones. It’s an audacious vision – essentially space-based cellular networks parallel to terrestrial ones. AST’s CEO Abel Avellan paints it as a way to connect the billions who still lack internet by bypassing ground infrastructure entirely. The next 1–2 years are critical for AST to prove its tech at scale and to secure more funding (the partnerships with AT&T, Verizon, etc. help on that front). By the late 2020s, if all goes well, AST SpaceMobile and its BlueBird fleet could be a household name, delivering mobile connectivity in areas that once were blank spots on the coverage map.

Key Differences and Comparison

All three of these initiatives – Apple/Globalstar, SpaceX/T-Mobile, and AST SpaceMobile – share the same goal of extending connectivity beyond the reach of terrestrial cell towers. But they differ significantly in approach, capability, and business model. Below is a summary comparison of their key attributes:

| Aspect | Apple Emergency SOS (Globalstar) | SpaceX Starlink Direct-to-Cell | AST SpaceMobile BlueBird |

|---|---|---|---|

| Launch & Availability | Launched Nov 2022 on iPhone 14. Now active in 17 countries (US, Canada, Europe, Aus/NZ, Japan) for emergency use support.apple.com. Not available in Asia/Africa yet (pending regulatory) support.apple.com. | Beta texting started late 2024 (NZ) theverge.com; expanding in 2025 (US, Canada, Japan, Europe via partner carriers). Full messaging coverage expected ~late 2025 as more satellites launch ts2.tech. Voice/data to roll out 2025–2027 ts2.tech. | No public service yet. Test satellite (BlueWalker 3) in 2023 proved 4G calls ts2.tech. First 5 commercial satellites launched Sept 2024 lightreading.com, testing through 2025. Initial service for partner customers expected starting ~2025 once enough sats are operational. |

| Primary Use Cases | Emergency SOS texting to 911/services when off-grid. Also roadside assistance texts in some regions. Not for casual or continuous use (intended for life safety). | Coverage extension for general use – starting with SMS texting (for emergencies or convenience in dead zones), later enabling voice calls and basic internet (messaging, email) theverge.com. Ideal for rural connectivity, hikers, boaters, disaster backup. | Full mobile connectivity in remote areas – voice calls, SMS, and 4G/5G data directly to phones ts2.tech. Aims to serve rural communities, developing regions without towers, and act as backstop in disasters. Eventually could offer broadband-ish speeds for data (tens of Mbps shared) enabling web access, IoT, etc. |

| Phone Compatibility | iPhone 14/15/16 (with special hardware). Not available on other phones or older iPhones satellitetoday.com satellitetoday.com. Users must have clear view of sky and manually point phone at satellite via on-screen guide support.apple.com. Messaging is done through Apple’s UI (Emergency SOS or Messages app in iOS 18+). | Any standard 4G/5G phone that supports partner carrier’s band (e.g. 600–900 MHz). No hardware changes or apps required starlink.com – appears as normal network signal. Initially limited to specific models via firmware update theverge.com, but expanding to most devices. Works outdoors (phone will auto-connect to satellite when no tower signal). | Any standard phone on partner carriers (no mods needed) as long as it supports the frequency (e.g. 850 MHz for AT&T/Verizon lightreading.com). Tested on unmodified Samsung and Apple phones with success. Users would connect automatically when out of tower range. Standard phone calling & texting interfaces used (it’s the same network, just roaming to satellite). |

| Spectrum & Network | Uses Globalstar LEO satellites (~1,400 km orbit) on satellite L-band/N-band frequencies (~1.6 GHz uplink, 2.4 GHz downlink). Custom modem firmware in iPhone to access these bands satellitetoday.com. Globalstar’s network and ground stations relay messages to emergency services satellitetoday.com. Dedicated network (does not integrate with cellular carriers). | Uses Starlink LEO satellites (~500 km orbit) with existing cellular bands (e.g. LTE Band 71, 8) as “space cell towers.” Each satellite has an LTE/5G base station and connects into carrier’s core via Starlink’s backhaul starlink.com starlink.com. Requires cooperation with mobile carriers (who provide spectrum). Leverages Starlink constellation size for global coverage. | Will use BlueBird LEO satellites (~500–700 km orbit) acting as 4G/5G cell sites. Operates on carrier partner spectrum (e.g. AT&T’s 850 MHz band lightreading.com, others’ LTE bands). Each satellite communicates to carrier’s network through gateway stations. Essentially part of carrier’s network (appears as 4G/5G cells to the phone). Large antenna arrays to support broadband frequencies and multiple users. |

| Data & Capacity | Very low data rate – only short text messages (roughly ~160 characters at a time). No voice or true data. Each message transmission can take 15–60+ seconds. Suitable for one-way SOS and GPS coordinates, not a conversation beyond a few exchanges. | Low data rate initially – SMS (~160 bytes) in 0.5–3 min typically theverge.com. Early tests show up to 2–4 Mbit/s total per satellite cell, which is shared. Enough for texting and maybe one call at a time per beam. Future upgrades aim for perhaps Messaging/WhatsApp and very basic web or IoT data by 2025 starlink.com starlink.com. Voice calls will likely be compressed (similar to VoLTE) and limited by available slots. Not intended for high-speed internet – think kilobits per user initially. | Moderate data rate – target ~20 Mbit/s down and ~5 Mbit/s up per satellite (real-world) lightreading.com. This is shared among users in the footprint. Allows standard voice calls (hundreds of simultaneous calls per sat), SMS, and 4G data (enough for emails, social media text, low-res media). Could support a few users streaming audio or low-res video at a time. Next-gen satellites aim for 10× capacity (~200 Mbps per sat) with advanced tech lightreading.com. Ultimately trying to approach terrestrial 4G speeds in low-density areas. |

| Latency | High latency (store-and-forward) – messages are queued through satellite passes. User may experience tens of seconds to a few minutes for SOS to send and get a response support.apple.com. Not real-time interactive. (LEO propagation time ~50ms, but system overhead dominates.) | Low-to-moderate latency – a text message can be delivered in under 1 minute in ideal cases, but current beta sees up to a few minutes theverge.com. Once network is fully up, latency for an active call or data session should be ~half-second or less (satellite <-> ground ~20-40 ms one-way, plus routing). Sufficient for voice calls and basic connectivity. | Low latency – aiming for similar to cellular. Light data and voice should feel nearly real-time (one-way lag perhaps 30–50 ms plus routing). In tests, phone calls via satellite were successfully maintained. Some extra delay vs terrestrial 4G, but acceptable for conversation. The main delay might be if a satellite handover occurs or if network is congested. Overall snappier than Apple’s system due to continuous link. |

| Satellite Constellation | 24 Globalstar satellites (second-gen) currently in orbit; Apple funding 50 new satellites launching 2025–26 for enhanced service ts2.tech. Globalstar orbits are higher, so fewer satellites needed for coverage but with lower signal strength. Apple devices get priority use of this network ts2.tech. | ~4,000 Starlink satellites already (though not all have cell payload). SpaceX plans >>12,000 satellites. Using many satellites in lower orbits for continuous global coverage. New “Direct-to-Cell” equipped sats launched on Falcon 9 in 2024, with larger batches on Starship forthcoming starlink.com. Very high redundancy and capacity scaling by sheer numbers. | 5 BlueBird satellites in orbit (as of late 2024). Plans for ~20 in near term, and ~100 for global coverage. Each BlueBird is very large and expensive, but covers big area. AST planning to mass-produce more satellites (4–6 per month) and even larger models by 2025 lightreading.com. Constellation will be much smaller than Starlink’s, but each satellite far more capable per unit. |

| Key Partnerships | Globalstar (satellite operator). Emergency services agencies (Apple set up relay centers to contact 911). AAA (in US for roadside texts). Apple is sole device maker and service provider; no carrier involvement. Long-term exclusive partnership with Globalstar (Apple investing ~$1.5B in it) ts2.tech ts2.tech. | T-Mobile US (flagship partner), plus Rogers (Canada), One NZ, Optus & Telstra (Australia), KDDI (Japan), Salt (Switzerland), Entel (Chile/Peru), Kyivstar (Ukraine), etc. starlink.com. More carriers likely joining. Model: act as a wholesale satellite provider to carriers who bundle the service. Also working with regulators (FCC, ITU) to get permissions ts2.tech ts2.tech. | AT&T and Verizon (USA) – both signed on to use AST for satellite coverage satellitetoday.com. Vodafone Group (investor/partner covering Europe & Africa), Vodafone Idea (India) ts2.tech, Rakuten (Japan), Orange, Telefónica, MTN, Telstra, Etisalat, and others through the “SpaceMobile Alliance”. Essentially partnering with many mobile operators who will offer the AST service to their customers. Collaborating with NASA and FCC on spectrum trials. |

| Regulatory & Approvals | Service is approved in supported countries (Apple worked with regulators to allow use of Globalstar MSS spectrum for consumer device). Still absent in regions like China/India due to regulatory barriers or requirement for local gateways ts2.tech ts2.tech. Apple/Globalstar received FCC approval for next-gen constellation in 2025 ts2.tech ts2.tech. | FCC and other agencies crafting new rules to allow satellites to use mobile spectrum – experimental licenses granted in US theverge.com. Some initial approvals: NZ, US, Japan, EU (in progress) ts2.tech. Needs coordination to avoid interference with terrestrial networks. SpaceX working closely with regulators via “Supplemental Coverage from Space” proceedings ts2.tech. | Received FCC experimental license to operate on AT&T’s frequencies ts2.tech. Regulators in India, Africa, EU showing support as it promises to expand coverage ts2.tech. Still needs country-by-country spectrum permission; partnerships with local carriers help smooth this. Global standards for NTN (Non-Terrestrial Networks) in 5G being developed to integrate services like AST’s into mainstream telecom ts2.tech. |

| Future Plans | Possibly allow personal iMessage and SMS via satellite (starting with iOS 18 in late 2024) for off-grid users satellitetoday.com satellitetoday.com. Continue to expand to more countries as regulations allow ts2.tech. New Apple devices may enhance satellite antenna performance. No announced plans for voice or high-speed data – likely to remain focused on critical messaging and safety features. | 2025: roll out texting globally across partner networks; begin beta of voice calling and low-rate data ts2.tech. 2026–27: scale up to near-global coverage, improve throughput (perhaps enabling 911 calls, MMS, messaging apps). Long term: integrate with IoT devices (cars, sensors) using LTE Cat-M/NB standards starlink.com. Leverage Starship launches to deploy thousands of direct-to-cell satellites for full capacity. Competing with Lynk and others, but aims to be the ubiquitous solution for basic connectivity everywhere. | Late 2025: initial commercial service for texting/voice with AT&T, Verizon, Vodafone, etc., in regions with some satellite coverage. Launch dozens more BlueBirds through 2026 for wider, more continuous coverage. Integrate 5G capabilities as new satellites with advanced ASICs launch (mid-2025 onward) lightreading.com. Eventually offer mobile broadband at tens of Mbps to standard phones – essentially 5G from space. Plans for larger satellites to boost capacity, potentially using multiple launch providers lightreading.com. Ambition to make satellite coverage a standard part of mobile service globally by 2030, erasing the digital divide in remote areas. |

Expert Outlook: Analysts note that Apple’s head start put satellite messaging in consumers’ hands first, but its walled-garden approach may limit broader adoption ts2.tech. Globalstar’s chief product officer recently argued that Globalstar’s higher-orbit satellites cover larger areas, giving Apple an advantage in emergency reach – but also acknowledged that competitors are “catching up” fast. SpaceX’s Starlink, with its vast constellation, is seen as a game-changer if it can execute – “We’re treating satellites as just another cell tower,” T-Mobile’s president said, highlighting the seamlessness ts2.tech. Early user feedback from the NZ trial praised the concept but noted the initial quirks (few supported devices, minutes-long message delays) theverge.com. One NZ’s network director reminded users this is “an initial service that will get better… texts take longer now but will get quicker over time” as the technology matures theverge.com. On AST’s side, carriers are optimistic: AT&T’s network chief called space-based cellular transformative for covering remote areas, even suggesting it could eventually replace some physical towers lightreading.com. However, AST faces a steep road – AST’s president has candidly stated, “You need regulatory approvals, you need financing upfront for a business case that may not pay off for years. Building constellations has been a terrible business.” lightreading.com. He believes their alliances with big carriers and governments give them a fighting chance to succeed where past satellite phone ventures faltered.

Regulatory Hurdles: Regulators largely appear supportive of these innovations, as they could improve public safety and rural connectivity. The FCC is working on new rules to share spectrum between terrestrial and satellite uses ts2.tech. In Europe, officials have even discussed mandating satellite capability in phones for 112 emergency access by 2027 ts2.tech ts2.tech. Still, coordination is complex: satellites must not interfere with ground networks, and issues like cross-border spectrum use and legal interception of satellite calls need solutions ts2.tech ts2.tech. Some countries with strict telecom regimes (e.g. China, Russia) may prefer their own state-run satellite systems over Western offerings ts2.tech ts2.tech. But globally, the momentum is toward integration, not restriction, of satellite-to-phone services ts2.tech ts2.tech.

The Bottom Line: In the span of just a few years, what sounded like science fiction – using an unmodified smartphone to reach a satellite – has become reality. Apple’s Emergency SOS has already proven the life-saving value of the idea. SpaceX and AST are now pushing the envelope, aiming to make “no signal” a thing of the past for everyday connectivity. Each has a different philosophy (Apple is device-driven and emergency-focused, Starlink is network-driven for basic coverage, AST is carrier-driven for broader service), and it’s likely all three will co-exist, serving different needs. In a few years, your phone could have multiple satellite options: your iPhone might send an SOS via Globalstar, while your carrier automatically routes your calls through a Starlink or AST satellite if you stray off the grid. The race is on, and the ultimate winner will be consumers – especially those in remote, rural, and underserved areas for whom the sky is about to deliver more bars on their phone.