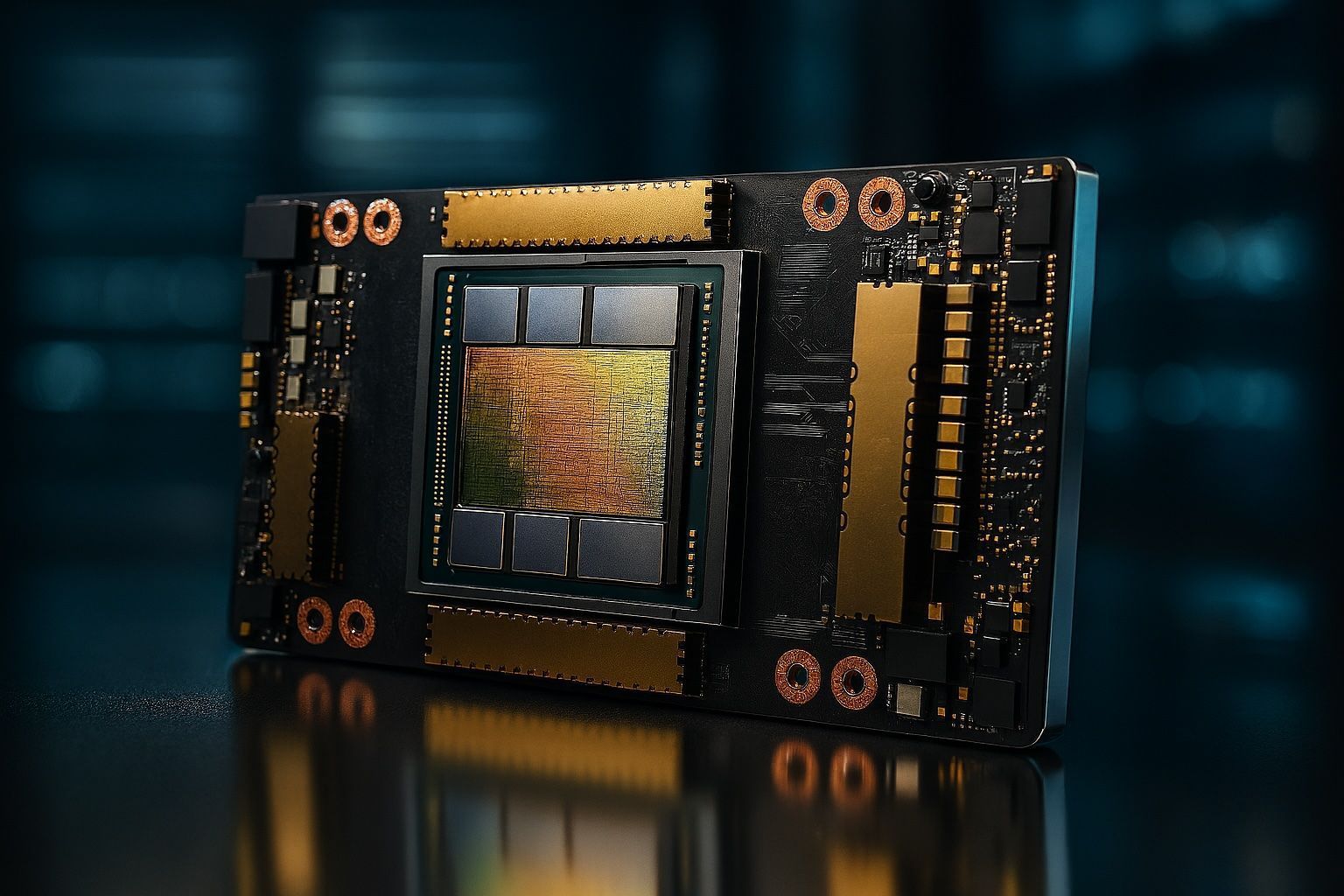

- China Halts Nvidia Chip Purchases: China’s top internet regulator (CAC) has reportedly ordered major tech firms – including Alibaba and ByteDance – to stop buying and testing Nvidia’s latest high-end AI chips (the RTX 6000D), effectively banning Nvidia’s advanced GPUs in China reuters.com. This fresh ban is even stricter than prior informal guidance discouraging use of Nvidia’s earlier H20 chips reuters.com.

- U.S. Export Curbs Set the Stage: The U.S. government had already imposed sweeping export restrictions to prevent cutting-edge chips from reaching China’s military. Rules introduced in late 2022 and tightened in 2023 blocked Nvidia’s flagship AI processors (like the A100/H100) and later closed loopholes by adding even China-specific variants (A800, H800) to the banned list reuters.com. Washington insists these curbs are for national security, while Beijing calls them political “decoupling” that violate free trade reuters.com.

- Nvidia Caught in Geopolitical Crossfire: Nvidia CEO Jensen Huang voiced disappointment at the China ban, noting that “we can only be in service of a market if a country wants us to be” reuters.com. Huang acknowledged that the U.S. and China have “larger agendas to work out” beyond Nvidia’s control reuters.com. One analyst described Nvidia as a pawn in a “digital Cold War”, caught between Washington’s security fears and Beijing’s push for tech sovereignty reuters.com.

- Impacts on Nvidia and Tech Industry: China accounted for about 13% of Nvidia’s sales last year reuters.com, and losing this market could dent future growth. Nvidia’s stock fell ~3% on news of the ban investopedia.com. The company had warned that U.S. export rules might cost it $8 billion in lost revenue in one quarter reuters.com, and it even took a $4.5 billion charge earlier this year due to unsold China-bound inventory reuters.com. U.S. rival AMD faces similar limits, and Chinese customers are reportedly turning to used or gray-market GPUs and domestic chips to fill the gap.

- China Rallies for Self-Reliance: Chinese regulators claim that homegrown AI processors from companies like Huawei and Cambricon now perform on par with Nvidia’s restricted chips tomshardware.com. Beijing has been urging local firms to replace American tech – pushing cloud giants like Tencent to develop their own AI hardware and software stack tomshardware.com. China is also heavily investing in its semiconductor sector (launching a new $40 billion state chip fund) to boost domestic chip production reuters.com reuters.com.

Background: Nvidia’s AI Chips “Not Welcome” in China

In September 2025, reports emerged that the Cyberspace Administration of China (CAC) had directed the country’s largest tech companies to halt purchases of Nvidia’s AI chips reuters.com. Specifically, firms like Alibaba and ByteDance were told to cancel orders and stop testing Nvidia’s new RTX Pro 6000D GPUs reuters.com. This model was a China-tailored chip Nvidia unveiled in July after U.S. export rules blocked its most powerful processors. Several Chinese companies had planned to buy tens of thousands of these 6000D chips and were already working with server suppliers to deploy them reuters.com. Now those plans are scrapped: suppliers were instructed to cease all work on Nvidia’s new GPUs once the CAC order came through reuters.com.

Chinese authorities have not publicly announced the ban, but insiders say it was driven by Beijing’s confidence in local alternatives and irritation at Nvidia’s dominance. This ban comes just weeks after regulators quietly told companies to stop ordering Nvidia’s previous H20 chips as well tomshardware.com. Notably, China’s State Administration of Market Regulation also opened an antitrust probe into Nvidia, accusing it of violating conditions (set during its 2020 Mellanox acquisition) to keep supplying products to China on fair terms engadget.com. In other words, Beijing signaled that Nvidia failing to fully serve Chinese customers – whether due to U.S. restrictions or its own policies – could be seen as an antitrust issue engadget.com.

Nvidia CEO Jensen Huang responded diplomatically to the news. Speaking at a press event in London (where he was traveling with a U.S. delegation), Huang said he’s “disappointed” but acknowledged that China and the U.S. have bigger geopolitical issues at play reuters.com. “We can only be in service of a market if the country wants us to be,” Huang noted, adding that Nvidia will remain “supportive” of Chinese customers “as they wish” reuters.com reuters.com. His measured tone reflects Nvidia’s tricky position: the company owes its success to U.S. innovation and counts the U.S. government as a key stakeholder, yet China has long been one of its largest markets. “Jensen Huang’s diplomatic comment about ‘larger agendas’ is CEO-speak for ‘we’re pawns in a digital Cold War,’” observed Michael Ashley Schulman of Running Point Capital Advisors reuters.com.

U.S. Export Restrictions on AI & Semiconductors to China

This Nvidia-China rift is rooted in a broader campaign of U.S. export controls targeting China’s tech sector. Starting in 2018–2019 and intensifying in 2022, the U.S. government has systematically curbed China’s access to advanced semiconductors, citing national security and military concerns reuters.com. Key milestones in this export control regime include:

- Oct 2022: The Biden Administration unveiled sweeping rules limiting the export of high-performance AI chips and chipmaking tools to China. A performance threshold was set (based on computing speed and interconnect bandwidth) that effectively banned Nvidia’s top GPUs (A100, H100) and similar chips from AMD and Intel reuters.com reuters.com. These rules also barred U.S.-built chip equipment (like EUV lithography machines) from being sold to Chinese fabs, aiming to stymie China’s ability to produce cutting-edge 7nm-and-below chips reuters.com.

- Mid 2023 – Closing Loopholes: U.S. officials noticed Nvidia and others had developed “China-only” chips – slightly downgraded versions like the A800 and H800 – designed to meet the letter of the 2022 rules while still delivering high AI performance reuters.com. In response, updated rules in October 2023 closed those loopholes by adding these variants to the banned list reuters.com. The new rules even introduced metrics to prevent workarounds using multi-chip “chiplet” designs reuters.com, ensuring that future Nvidia or AMD products couldn’t skirt limits by splitting into slower modules.

- Blocking Chinese Chipmakers: The U.S. has placed leading Chinese semiconductor firms on trade blacklists. For example, Huawei’s chip design unit (HiSilicon) and top fab SMIC were put on the Entity List, and in 2023 Chinese AI chip startups Biren and Moore Threads were added as well reuters.com reuters.com. Being blacklisted means U.S. suppliers need licenses to ship them anything – effectively cutting off vital tools and IP. (Biren and Moore Threads, both founded by ex-Nvidia engineers, protested their blacklisting, but to little avail reuters.com.)

- Widening the Scope: Washington has expanded these tech curbs beyond just China. U.S. regulators now require licenses to export advanced chips to over 40 countries deemed at risk of re-exporting to China or under arms embargoes reuters.com. They also warned Nvidia that even sales to regions like the Middle East would be scrutinized if the end customer might be a Chinese-owned entity reuters.com. This global tightening ensures that China can’t obtain U.S. AI chips via third countries.

- Retaliation & Critical Materials: China has criticized U.S. moves as “technological bullying” and responded with its own export controls on key raw materials. In July 2023, Beijing imposed restrictions on exporting gallium and germanium, minerals crucial for semiconductor production, as a form of pushback. These tit-for-tat measures underscore the evolving “chip war”, where each side leverages its strengths (U.S. in chip tech, China in materials and market access) to gain leverage.

Notably, U.S. allies have joined the effort. Under pressure from Washington, the Netherlands and Japan agreed to limit sales of advanced chip equipment to China reuters.com. Dutch firm ASML, the only maker of extreme ultraviolet lithography tools, has been barred from selling its EUV machines to China since 2019, and as of 2023 even some cutting-edge deep-UV (DUV) tools are off-limits reuters.com. ASML said these curbs may shift some sales away from China, though it downplays immediate financial impact reuters.com. The overarching goal for the U.S. and its partners is clear: delay China’s progress in advanced computing and manufacturing, especially for military-use technologies reuters.com.

Unsurprisingly, Beijing strongly objects. A Chinese embassy spokesperson in Washington said China “firmly opposes” the new chip restrictions, arguing that “arbitrarily placing curbs or forcibly seeking decoupling to serve a political agenda violates the principles of market economy and fair competition” and “undermines the international economic order” reuters.com. To China, the U.S. export controls are an attempt to maintain tech hegemony. To the U.S., they are a necessary step to prevent its technology from fueling China’s military AI – a tension at the heart of the Nvidia ban story.

Implications for Nvidia: Financial, Technological, Geopolitical

For Nvidia, the world’s most valuable semiconductor company, being cut off from China is a serious long-term concern. In the near term, Nvidia’s business is booming thanks to explosive global demand for AI chips – demand so high that Nvidia has struggled to supply enough H100 GPUs to U.S. cloud giants. Indeed, Nvidia’s revenue and stock price have skyrocketed in 2023–2025 amid the AI boom. This surge has somewhat insulated Nvidia from immediate pain: the company even noted that initial U.S. export curbs didn’t meaningfully hurt short-term results because Chinese customers bought slightly weaker “50% speed” chips (like A800) which were “still better than alternatives” reuters.com. In other words, as of mid-2023 “Nvidia [was] selling almost every chip it can produce” globally reuters.com.

However, the future outlook is cloudier. China is one of the world’s largest markets for GPUs – powering everything from e-commerce algorithms to autonomous driving R&D – and had historically contributed 20%+ of Nvidia’s revenues. Last year China made up 13% of Nvidia’s total sales reuters.com, down from roughly 21% two years prior (partly due to U.S. restrictions) reuters.com. Losing even a portion of this business can sting. Nvidia’s share price slid about 2–3% on the latest China ban news investopedia.com, as investors assessed the impact. Analysts at Piper Sandler estimated Nvidia could have earned $6 billion in upcoming quarterly revenue from China if sales were unrestrained reuters.com. Now, that upside is uncertain or gone.

Figure: Nvidia’s revenue from China has shrunk as a percentage of total sales in recent years, reflecting the impact of export controls. In FY2023, China accounted for over 20% of Nvidia’s sales; by FY2025 it was about 13% reuters.com. U.S. export bans have curbed Nvidia’s China business even as global AI chip demand soars.

Beyond raw sales, there’s also a profitability hit. In mid-2025, the Trump administration (which succeeded Biden’s) struck an unprecedented deal allowing Nvidia to export its H20 chips to China again – but on the condition that Nvidia pays a 15% cut of revenue from those sales to the U.S. government reuters.com investopedia.com. This effectively functions as an export tariff. Nvidia agreed, desperate to reopen China’s market, but such a cut would reduce margins on those products. Bernstein analysts warned that the 15% revenue share could shave 5–15 percentage points off Nvidia’s gross margin on China-bound chips, dragging its company-wide gross margin down by about 1 point reuters.com. Indeed, Nvidia’s CFO had to factor in slightly lower margin guidance once the deal was in play.

However, with China now slamming the door on Nvidia’s chips, even that deal may have limited effect. By late August 2025, Nvidia said it had not actually shipped any H20 chips to China yet, as U.S. officials were still ironing out how to implement the 15% payment mechanism reuters.com. In the meantime, Chinese regulators’ hostility was growing: first dissuading buyers, now outright banning purchases. Nvidia even reportedly halted production of H20 chips in anticipation of weak demand or regulatory blocks engadget.com.

Financially, Nvidia has already felt some pain. Back in May 2025, the company disclosed that the U.S. export controls (and China’s reluctance to buy neutered chips) would cost it around $8 billion in lost revenue for the upcoming quarter reuters.com. It also took a one-time $4.5 billion charge in early 2025, likely for inventory and obligations related to unsold chips destined for China reuters.com. These are staggering sums, highlighting how central China has been to Nvidia’s growth – and how costly this tech decoupling could become.

Geopolitically, Nvidia’s situation illustrates the dilemma facing U.S. multinationals. The company dominates the AI chip market, and that prominence has made it a strategic focus for both Washington and Beijing reuters.com reuters.com. The White House sees Nvidia as critical to maintaining U.S. AI leadership (and wants its tech kept out of rival hands), while China’s leadership fears over-reliance on a U.S. supplier for mission-critical technology. “In today’s global tech scene, multinationals like Nvidia are expected to code-switch between Washington’s national security doctrines and Beijing’s techno-sovereignty demands, all while keeping shareholders happy,” as Michael Schulman puts it reuters.com. Nvidia has responded by boosting its lobbying in Washington – it spent nearly $1.9 million on lobbying in just the first half of 2025, triple its spend from the prior year reuters.com reuters.com – hoping to shape policies that won’t kill its China business. But ultimately, the company is largely at the mercy of government policy on both sides. As CEO Huang admitted, “they have larger agendas to work out between China and the United States, and I’m patient about it” reuters.com.

Technologically, being shut out of China could spur unintended consequences for Nvidia. Chinese customers might accelerate efforts to develop software that doesn’t rely on Nvidia’s CUDA ecosystem, eroding one of Nvidia’s competitive moats over time. Also, without access to Nvidia’s top GPUs, Chinese researchers and firms could contribute more to open-source AI hardware projects or turn to alternative suppliers (such as domestic chip startups or AMD, if it finds a way to sell there). In short, Nvidia faces the risk of “designed out” of future Chinese systems – a slow burn threat to its global dominance.

Reactions in China: Tech Firms and Government Push Back

The immediate reaction among Chinese tech firms to the Nvidia ban was compliance mixed with quiet concern. Companies like Alibaba, Tencent, Baidu, and ByteDance have massive AI ambitions and had eagerly imported Nvidia GPUs in the past. Many had placed large orders for the RTX 6000D or were evaluating Nvidia’s H20 chips via local server vendors reuters.com. Now, these firms have essentially been forbidden from following through, which could delay their AI projects or force costly pivots to less optimal hardware. Chinese tech executives have not publicly commented on the ban (likely not wanting to contradict regulators), but there are reports of a scramble to secure alternatives. Some firms are holding off for Nvidia’s next-gen models in hope those might get U.S. approval engadget.com, while others have looked into secondary markets – e.g. purchasing used Nvidia GPUs or sourcing via third countries, a risky strategy given legality tomshardware.com.

Beijing, for its part, has framed the issue as an opportunity to wean itself off U.S. technology. Chinese state media and officials have recently played up the line that Nvidia’s chips are “unsafe” or “outdated” for China’s needs tomshardware.com tomshardware.com. Officials from the Ministry of Industry and Information Technology (MIIT) reportedly concluded that domestic AI accelerators are now “comparable or have even exceeded” the performance of Nvidia’s curbed chips engadget.com. On that basis, regulators convened domestic chip companies (like Huawei, Baidu’s Kunlun chip unit, Tencent’s AI chip team, and startups such as Cambricon) to assess their capabilities versus Nvidia engadget.com. The message was clear: Chinese tech firms should trust and buy Chinese chips.

This policy aligns with broader government mandates. In recent years, Beijing has issued directives for state agencies and critical industries to reduce reliance on foreign tech – from banning some government use of foreign-brand PCs and software to, reportedly, telling tech giants to source at least 50% of their chips from domestic producers in the near future tomshardware.com. So the Nvidia ban is not an isolated incident but part of a continuum of Chinese policies aiming at self-sufficiency.

Another notable reaction came in the form of regulatory pressure on Nvidia itself. Just days before the CAC ban, China’s competition regulator accused Nvidia of breaching antitrust law by failing to honor the conditions of its 2020 Mellanox acquisition approval engadget.com. Those conditions required Nvidia to continue supplying certain products to China on fair and non-discriminatory terms. By investigating Nvidia now, Beijing is possibly laying groundwork to penalize or fine the company, or to justify actions like the chip ban under the guise of Nvidia not meeting its obligations engadget.com. It’s an ironic twist: U.S. law prevents Nvidia from freely supplying China, and then China claims Nvidia is at fault for not supplying China enough. This reflects the untenable position U.S. tech firms find themselves in amidst dueling regulations.

Meanwhile, Chinese media has heralded the rise of local champions. When Huawei unexpectedly released a new flagship smartphone in 2023 featuring a domestically-made 7nm chip (the Kirin 9000S fabricated by SMIC), it was seen as a symbolic victory over U.S. sanctions tomshardware.com. Similarly, news of Chinese AI companies designing chips that rival Nvidia’s has been amplified. There’s also a sense of nationalistic rallying: Chinese netizens and commentators argue that each U.S. ban only strengthens China’s resolve to build its own “core technologies”. This sentiment puts additional patriotic pressure on tech firms in China to adopt homegrown solutions even if they currently lag in certain aspects.

Similar Cases: Huawei, ASML, and the Tech Iron Curtain

The Nvidia-China saga is one chapter in a larger story of tech decoupling. Similar high-profile cases illustrate the pattern of tit-for-tat restrictions and their fallout:

- Huawei’s Blacklisting (2019): Once China’s crown jewel in smartphones and 5G equipment, Huawei was effectively cut off from advanced semiconductors when the U.S. Department of Commerce added it to the Entity List in 2019. This meant TSMC (Taiwan) could no longer manufacture Huawei’s Kirin chips using U.S.-licensed technology, and Google could not provide Android software to Huawei phones. As a result, Huawei’s smartphone business collapsed globally, and its market share plummeted as it ran out of cutting-edge chips csis.org. Huawei pivoted to enterprise and domestic markets, and has been racing to develop in-house solutions. The recent launch of a Huawei phone with a 7nm chip (produced in China, likely through extraordinary measures) shows Huawei is still trying to innovate around sanctions, albeit at a technology node several generations behind the latest Apple or Qualcomm chips bloomberg.com. The Huawei case underscores how U.S. bans can cripple a company – but also how they can spur indigenous innovation as a long-term response.

- ASML and Chip Equipment (2018–2023): ASML, a Dutch company, is the sole supplier of extreme ultraviolet lithography machines – essential for manufacturing cutting-edge chips (5nm, 3nm processes). Under U.S. pressure, the Dutch government blocked ASML from selling EUV tools to China starting around 2018. This has prevented China’s fabs from mass-producing the most advanced chips. In 2023, the Netherlands extended restrictions to certain advanced DUV machines as well, aligning with U.S. goals reuters.com. ASML publicly stated it “did not expect a material impact” on its near-term financials reuters.com, implying China’s share of its sales wasn’t huge – but strategically, this move is pivotal. Without advanced lithography, China cannot easily catch up in high-end chip fabrication. The ASML case highlights how the U.S. leveraged allied control over critical equipment to bottle-neck China’s semiconductor ambitions. (China is trying to develop its own lithography tools, but it remains years behind in that arena.)

- Other Cases: The U.S. has repeatedly targeted Chinese tech entities considered security risks. For instance, ZTE (a Chinese telecom firm) was briefly banned from receiving U.S. parts in 2018, almost causing its bankruptcy, until a deal was struck with heavy fines and oversight. More recently, Chinese drone maker DJI and AI surveillance firms (like Hikvision and SenseTime) have faced U.S. blacklists, cutting them off from American components or capital. On the flip side, China has also flexed its regulatory muscles: from banning certain Apple products for government use to delaying or denying mergers involving U.S. companies. In 2023, when the U.S. restricted memory chip exports, China retaliated by banning Micron’s memory chips in critical infrastructure projects, citing security concerns. Each of these instances adds a brick to the “tech iron curtain” that seems to be descending between the U.S. and China.

The Nvidia ban also invites comparison to how the U.S. treated ASML and Huawei. In each case, a global leader was prevented from supplying China, forcing China to either do without or find a domestic replacement. For Huawei (a Chinese firm cut off from U.S. tech), the result was a steep short-term decline but an intensified long-term effort at self-reliance (e.g. developing the HarmonyOS system and new chip designs). For Nvidia and ASML (Western firms cut off from the Chinese market), the immediate effect is lost sales and potentially lost market share if China successfully substitutes away. All these cases illustrate a classic lose-lose of decoupling: U.S. firms lose a huge market, Chinese firms lose top-tier suppliers, and both sides incur significant costs to redesign supply chains.

China’s Response: Boosting Domestic Semiconductor Might

China has anticipated these tech export restrictions for years and has launched a nationwide drive to develop its own semiconductor ecosystem. The Nvidia ban is likely to accelerate several ongoing Chinese responses:

- Surge in Domestic Chip Investment: The Chinese government is pouring billions into chip R&D and manufacturing. In late 2023, it set up a new $40 billion state-backed semiconductor fund, its largest ever, to bankroll everything from fab equipment to AI chip startups reuters.com reuters.com. This “Big Fund” (now on its third round since 2014) is tasked with closing the gap in critical areas like lithography machines, EDA software, and advanced materials. President Xi Jinping has explicitly stressed self-sufficiency in semiconductors as a strategic priority, especially after the U.S. escalated export controls reuters.com.

- Homegrown AI Chips: China’s tech giants and startups have been developing their own AI accelerators to replace Nvidia’s. For example, Huawei’s Ascend series of AI chips (like the Ascend 910) targets data-center AI training and inference. Baidu has its Kunlun AI chips deployed in its cloud. Alibaba’s T-Head semiconductor division has developed AI inference chips for its data centers. And specialized startups like Cambricon Technologies supply AI accelerators used in everything from cloud servers to smartphones. Initially, many of these Chinese chips lagged Nvidia in absolute performance or energy efficiency. But they are improving rapidly, often by customizing to specific use-cases (e.g., Huawei’s Ascend chips excel at telecom AI tasks). According to the Financial Times, Chinese officials now believe domestic AI processors can meet most of the needs that Nvidia’s restricted chips were serving investopedia.com. In fact, right after blocking the 6000D, regulators convened companies including Huawei and Baidu’s Kunlun team to compare benchmarks, essentially validating that local solutions were “good enough” engadget.com.

- Ramping Production and Adoption: With Nvidia off the table, Chinese suppliers are gearing up for a surge in orders. Huawei’s chip arm (HiSilicon) and others are reportedly ramping up production of AI chips to capture the demand that will be diverted from Nvidia tomshardware.com. Government incentives may further boost this: e.g., subsidies or procurement mandates favoring Chinese chips. There is also an effort to improve supporting software – Nvidia’s dominance isn’t just hardware but its CUDA software ecosystem and libraries. To compete, Chinese firms (and open-source communities) are working on alternative AI development frameworks and tools optimized for domestic chips (such as Huawei’s MindSpore and Baidu’s PaddlePaddle frameworks). If Chinese companies can smooth the software learning curve, their hardware will become more viable replacements.

- Advancements despite Restrictions: The case of Huawei’s Kirin 9000S chip in 2023 sent a strong signal: despite being cut off from EUV lithography and 5nm foundry tech, China’s SMIC managed to produce a 7nm-class SoC for Huawei’s flagship phone bloomberg.com. It likely required innovative (albeit less efficient) techniques like multiple patterning on older equipment, and it may have low yields, but it proved a point. China also recently achieved 19nm DRAM production at Changxin Memory and is progressing on 3D NAND memory at YMTC – not world-leading, but closing the gap. These developments suggest that while U.S. sanctions are a significant roadblock, they have not completely halted China’s semiconductor progress. They have, however, made progress more expensive and time-consuming (SMIC’s 7nm is roughly four years behind cutting edge internationalbanker.com and possibly only viable in limited quantity).

- Supply Chain Diversification: Chinese companies are also seeking ways to bypass reliance on U.S. tech by sourcing from non-U.S. suppliers or fostering local alternatives. For instance, for GPU needs, they might turn to AMD (if AMD’s forthcoming MI300 accelerator could be sold under license) or even look at European or Taiwanese chip designers. In cloud computing, Chinese firms might offload some AI workload to cloud providers in friendly countries or use more CPUs in parallel instead of a few powerful GPUs. Additionally, China could increase imports of slightly older generation chips which are not banned – e.g., Nvidia’s previous-generation A100 (if available), or use larger clusters of lower-end GPUs. None of these are ideal, but they’re stopgap measures to keep AI development going in China’s tech industry.

From the Chinese government’s perspective, these responses are part of a long game to achieve tech independence by 2025–2030 (as outlined in national plans like “Made in China 2025”). Every new U.S. restriction has been met with a redoubled commitment in Beijing to invest, innovate, and where necessary, retaliate. As one CSIS analysis put it, China is undertaking a “whole-of-nation effort” to reduce vulnerability to U.S. tech pressure csis.org. This includes not just industrial policy but also education (training tens of thousands more semiconductor engineers) and international partnerships (e.g., cooperating with countries like Russia or in regions like the Middle East to obtain know-how and capital outside U.S. influence).

It’s worth noting, however, that self-reliance comes with costs. Duplicating a supply chain as complex as semiconductors domestically is enormously expensive and inefficient. There will likely be short-term pain for Chinese tech firms as they transition – their AI initiatives might slow down or become less efficient compared to Western peers that can use the latest Nvidia silicon. But China seems willing to bear those costs for the sake of long-term resilience.

Expert Commentary and Analysis

Industry experts and analysts are closely watching the Nvidia-China ban as a bellwether of the tech decoupling trend. There is a general agreement that this episode highlights a “Tech Cold War” dynamic where businesses are being forced to choose sides or operate under split regimes.

“We’ve got to get clarity from these two governments first – whether China even wants the chips and whether the [U.S.] administration will allow it. And if so, how is that going to work?” said Jamie Meyers, a senior analyst at an Nvidia investor firm reuters.com. His comment underscores the uncertainty companies face: policy, not just market demand, dictates who can sell what to whom in the semiconductor world now. Until clear rules (or peace treaties) emerge, companies like Nvidia must navigate a moving maze of regulations and political maneuvers.

On Nvidia’s strategic position, some analysts note that the company’s near-monopoly in high-end AI chips made it an inevitable target. “Nvidia is unique in that it receives notable attention from both the White House and from Beijing,” Reuters observed, because its chips are essentially must-have infrastructure for cutting-edge AI reuters.com. This means Nvidia’s fortunes are unusually sensitive to geopolitical moves. Yet, Nvidia’s dominance also gives it a form of leverage – global firms (even in China) have few alternatives at the same level of performance. This perhaps explains Jensen Huang’s confidence that Nvidia can “be patient” while the U.S. and China sort out their issues reuters.com. He’s betting that, eventually, demand for Nvidia’s unbeatable AI technology will bring China back to the table or prompt the U.S. to carve out exceptions, because the cost of a complete break is too high for both sides.

Chinese tech commentators, on the other hand, emphasize how this ban could be a turning point for China’s chip industry. By forcing the hand of Chinese companies to use domestic chips, it could accelerate development cycles. “If you can’t get Nvidia, you’ll use Huawei – and that will make Huawei (or others) better, faster,” is a common refrain on Chinese social media, reflecting a spirit of making the best of the situation. Some experts caution, however, that catching up to Nvidia in AI chips is not easy. As long as Nvidia can sell to the rest of the world, its R&D budget (bolstered by massive revenues) will dwarf that of any single Chinese rival, enabling it to maintain a lead in technology. Thus, completely displacing Nvidia might be unrealistic in the short term, but China could aim to cover, say, 70-80% of its needs with domestic chips to mitigate risk.

Global tech strategists also draw parallels to historical trade conflicts. In a Brookings analysis, scholar John Villasenor noted that overly aggressive tech bans can backfire by “encouraging adversaries to double down on self-sufficiency and depriving U.S. companies of revenue that fuels innovation”. In this case, while the U.S. succeeded in limiting China’s access to Nvidia’s best chips, it may also have incentivized China to succeed independently in semiconductors, a field the U.S. had a strong lead in. Over time, if China’s gambit works, the U.S. could actually be less secure as a result (having a peer competitor in AI hardware). This debate – security vs. competitiveness – is at the heart of U.S. policy discussions. American policymakers are trying to strike a balance: hobble China’s military ambitions without unduly undermining U.S. industry. The 15% Nvidia sales cut deal, for instance, was an unconventional attempt to allow some trade while maintaining leverage reuters.com. It shows creative thinking, but also the awkwardness of mixing commerce with national security.

Finally, voices in the investment community point out that Nvidia’s China troubles do not occur in isolation. The entire semiconductor value chain is being realigned. “This is not just a Nvidia story, it’s about re-wiring the global tech supply chain,” says one venture capital analyst. Consider that Taiwan’s TSMC (which manufactures Nvidia’s chips) is building fabs in the U.S., while U.S. firms are diversifying production to Vietnam, India, and elsewhere. China meanwhile is investing in fabs in neighboring countries (like a potential fab project in Singapore or Malaysia) to circumvent domestic bottlenecks. The Nvidia ban thus feeds into a larger decoupling where, over the next decade, we might see a distinct “Techno-Bloc” system: one camp of countries using mostly U.S.-aligned technology, and another camp using Chinese-aligned technology. AI and chips, critical as they are, might bifurcate along these lines if the conflict escalates.

In summary, experts describe Nvidia’s export ban to China as a critical flashpoint in the U.S.-China tech rivalry. It demonstrates the immediate efficacy of export controls – denying an adversary the best hardware – but also lays bare the long-term costs and challenges. For Nvidia, the best-case scenario is that the ban is temporary or partial, and China eventually finds a compromise (perhaps purchasing a limited quantity under strict conditions). The worst-case scenario is that this marks the beginning of a permanent estrangement from the Chinese market, forcing Nvidia to write off billions in future revenue and cede that space to an emergent Chinese competitor.

As of late 2025, Jensen Huang is publicly “patient” and hoping diplomacy or new U.S. rules will restore some access reuters.com. Chinese firms, meanwhile, are wasting no time in doubling down on domestic innovation. The world is watching to see whether this ban will indeed supercharge China’s chip development or whether Nvidia’s products are so essential that workarounds will be found to keep them flowing into Chinese data centers. One thing is certain: the battle over semiconductor supremacy – from Silicon Valley to Shenzhen – is far from over.

Sources:

- Reuters – Nvidia CEO Huang caught between US, China’s ‘larger agendas’ reuters.com reuters.com reuters.com reuters.com

- Reuters – Biden cuts China off from more Nvidia chips, expands curbs reuters.com reuters.com

- Reuters – Nvidia results to spotlight fallout of China-US trade war reuters.com reuters.com

- Engadget – China reportedly bans tech companies from buying Nvidia’s AI chips engadget.com engadget.com

- Tom’s Hardware – China bans tech firms from acquiring Nvidia chips (homegrown chips now match H20) tomshardware.com tomshardware.com

- Investopedia – China Bans Top Tech Firms from Buying Nvidia Chips investopedia.com investopedia.com

- Financial Times (via Investopedia) – China bans tech companies from buying Nvidia’s AI chips investopedia.com

- Reuters – Exclusive: China to launch $40 billion state fund to boost chip industry reuters.com reuters.com

- Reuters – October 2023 export curbs (blacklisting Biren, Moore Threads) reuters.com reuters.com

- Reuters – Trump’s 15% revenue cut deal for Nvidia reuters.com investopedia.com

- Reuters – China’s response and chip self-sufficiency goals engadget.com reuters.com

- BBC / Bloomberg / etc. – Commentary on Huawei’s 7nm Kirin chip and U.S. sanctions impact csis.org bloomberg.com.