- SiTime’s new Titan chip (launched Sept 17, 2025) is a pinhead-sized timing device targeting wearables, shrinking a component from “the size of a grain of rice to the size of a pinhead” reuters.com. It replaces fragile quartz crystals with a silicon MEMS resonator, making it far more rugged, ultra-low power, and ultra-small reuters.com.

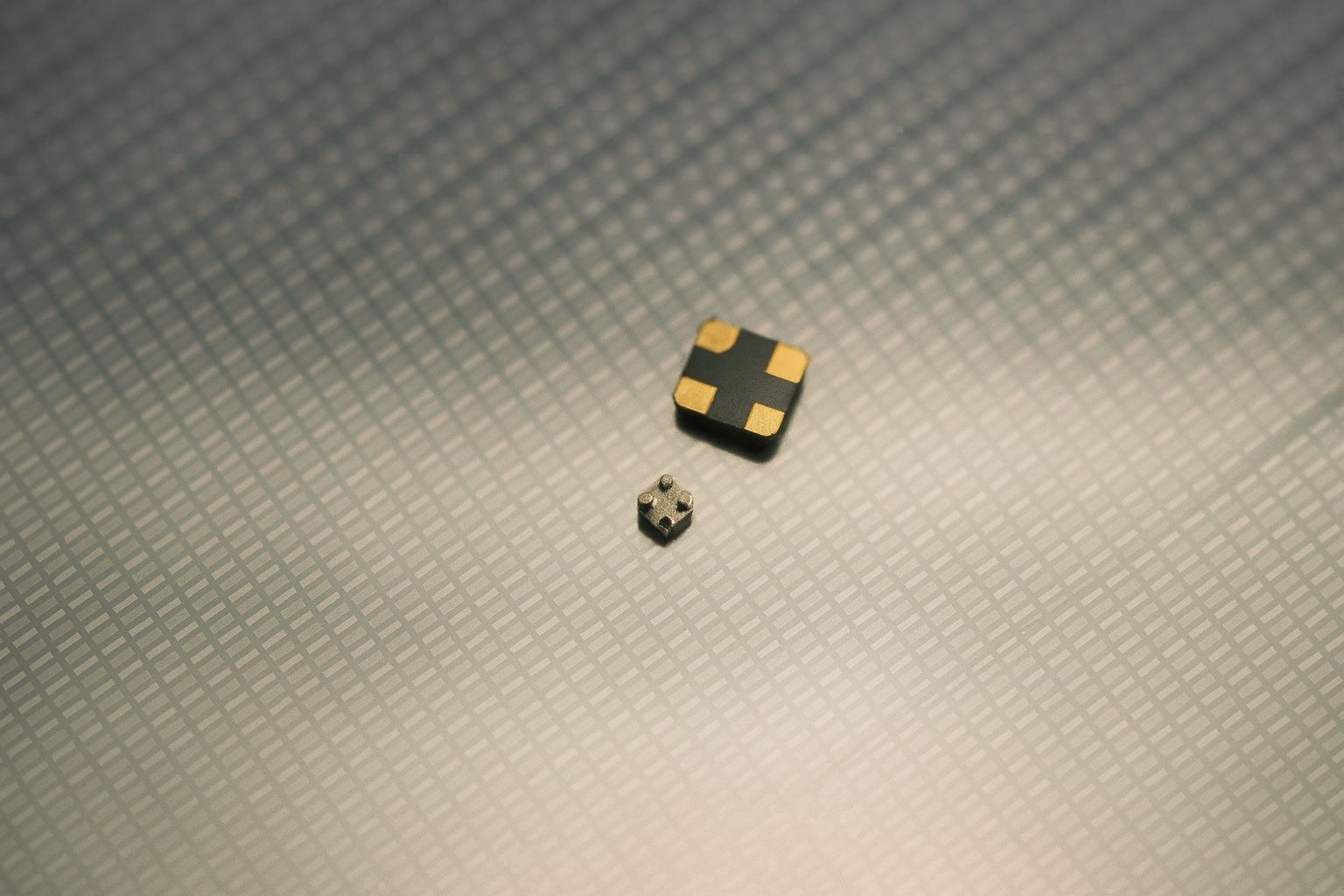

- Technical breakthrough: Titan is 4× smaller than the tiniest quartz timing devices, measuring only 0.46 × 0.46 mm (0505 chip-scale package). It slashes power use by ~50%, starts up 3× faster (with 3× less energy), and is rated 50× more shock- and vibration-resistant than legacy crystals eetimes.com. It also boasts 5× better aging stability over 5 years and tight frequency accuracy across –40°C to 125°C eetimes.com.

- Wearable-focused: Titan is built for space-constrained, battery-powered gadgets – from smartwatches and fitness bands to wireless earbuds, smart glasses, glucose monitors, hearing aids, and even tiny “smart rings” sitime.com. These devices already “sip on power,” so any extra power savings and size reduction from Titan feed into the broader miniaturization trend in wearables reuters.com.

- $4 billion market & growth: With Titan, SiTime is entering a $4 billion resonator market and expanding its serviceable market by ~$400 million now (projected to hit $1 billion/yr in 3 years) sitime.com. Timing chips act as the “heartbeat” or “conductor” that keeps a device’s electronics in sync reuters.com, and analysts have already found SiTime’s precision timing chips in Apple iPhones and Nvidia network gear reuters.com. Titan could similarly land in upcoming wearables from major brands.

- Competition heating up: Big analog chip rivals are also pursuing tiny timing solutions for wearables. Analog Devices (ADI), for example, offers MEMS-based real-time clocks like the MAX31343 that integrate a MEMS resonator to eliminate the external 32 kHz crystal analog.com (achieving ±5 ppm accuracy over wide temperature analog.com) – ideal for wearables analog.com. Texas Instruments (TI) uses its own BAW (bulk acoustic wave) micro-resonator tech: it created the first “crystal-less” wireless MCU by embedding a BAW resonator (no 48 MHz crystal needed) in its SimpleLink CC2652RB chip prnewswire.com, and offers tiny BAW-based clock oscillators for low-power gadgets ti.com. NXP Semiconductors explored MEMS timing as well – unveiling a MEMS frequency synthesizer “20 times smaller than the smallest crystal” back in 2012 chipestimate.com – though NXP ultimately sold its MEMS unit to STMicroelectronics in 2025 embedded.com. SiTime’s Titan is arriving into this landscape touting generational leaps in integration and size, with its CEO claiming it is “years ahead of competitors” eetimes.com.

- Market impact & adoption: Industry experts are enthusiastic. “Titan resonators are a game-changer,” said Ambiq’s CTO Scott Hanson, whose ultra-low-power microcontrollers will co-package Titan to create “uniquely integrated” solutions for edge AI wearables eetimes.com. Once built into a device’s chipset, Titan becomes a permanent, invisible part of the platform – “part of what makes it all work,” as TECHnalysis analyst Bob O’Donnell explained reuters.com. “These [earbuds, smart glasses, etc.] all sip power… if you sip a little less, it’s part of that trend of miniaturization,” he noted, highlighting how Titan’s efficiency boosts battery life reuters.com. Analyst Dave Altavilla added that Titan “is a disruptor, not only for how engineers implement timing, but for the timing industry as a whole,” creating a “sticky” new business as once a Titan is designed into a wearable SoC, it remains for the product’s life eetimes.com.

- SiTime’s role & broader trends: By delivering oscillators, clocks and now resonators as a one-stop timing supplier, SiTime is solidifying its niche in the wearable and IoT supply chain sitime.com. The Titan launch comes amid a wave of wearable tech innovation in late 2025 – for example, Apple’s September 2025 event introduced new Apple Watch models (Series 11, Ultra 3) with more sensors and features wareable.com wareable.com, and even next-gen earbuds like AirPods Pro are rumored to add health monitoring wareable.com. Wearables are one of the fastest-growing consumer electronics segments, helping offset slowing smartphone sales embedded.com. At the same time, big moves like STMicroelectronics’ $950 million acquisition of NXP’s MEMS business in 2025 signal industry confidence in MEMS technology’s long-term potential embedded.com. In this context, SiTime’s Titan platform positions the company as a key enabler of the “smaller, smarter, longer-lasting” wearable devices that brands are racing to deliver.

SiTime’s “Titan” Chip – Smallest Timing Device for Wearables

SANTA CLARA, Calif., Sept 17, 2025 – SiTime Corporation has unveiled a tiny new timing chip dubbed “Titan,” designed specifically for wearable and portable electronics. The Titan chip is a type of MEMS-based timing resonator – essentially an ultra-miniaturized replacement for the quartz crystals traditionally used to keep time in electronic devices. Timing chips serve as the “heartbeat” of gadgets, keeping processors, radios, and sensors synchronized “like a conductor at the front of an orchestra,” as Reuters explains reuters.com. By launching Titan, SiTime aims to crack into a $4 billion market for resonators and win spots in next-generation smartwatches, fitness trackers, earbuds, medical wearables, and more reuters.com.

Rajesh Vashist, SiTime’s CEO, said in an interview that Titan is “basically highly ruggedized, super-low power and super small in size” reuters.com – exactly the qualities needed in wearables. The company’s earlier timing chips have already been found in tear-downs of flagship devices (like Apple iPhones and high-end networking gear) reuters.com. Now, with Titan, SiTime is targeting a broader field of battery-operated wearables and IoT devices, where saving space and power is paramount.

Titan vs. Quartz: SiTime’s Titan MEMS resonator (tiny black die at center) next to a typical miniature quartz crystal (larger packaged component). Titan’s 0.46 × 0.46 mm chip is at least 4× smaller than the smallest legacy quartz resonators, yet delivers equal or better performance eetimes.com. Its silicon-based design is far more resistant to shock and vibration than fragile quartz eetimes.com, making it well-suited to the bumps and knocks of daily wearable use.

Technical Specs – Pinhead Size, Low Power, High Stability

The technical specifications of Titan underscore its leap in miniaturization and performance for timing devices:

- Tiny Form Factor: Titan is offered in a 0505 chip-scale package, only 0.46 mm by 0.46 mm square eetimes.com – truly pinhead-sized. This represents a 7× smaller footprint than a common 1210 (1.2 × 1.0 mm) quartz resonator and 4× smaller than a 1008 (1.0 × 0.8 mm) quartz device eetimes.com. In practical terms, Titan frees up PCB space or can even be integrated directly inside a system-on-chip (SoC) package, instead of sitting as a separate “can” on the circuit board eetimes.com. This flexibility (surface-mount or bare-die integration) lets designers shrink their products or pack in additional features sitime.com.

- Ultra-Low Power and Fast Startup: According to SiTime, switching from a quartz resonator to Titan can cut the oscillator circuit’s power consumption by up to 50% eetimes.com. This means longer battery life for wearables that are always ticking in the background. Titan also starts up ~3× faster, with about one-third the startup energy of a quartz solution eetimes.com. Faster startup is beneficial for devices that wake from sleep frequently (for example, an IoT sensor that duty-cycles its radio) because the timing reference becomes ready more quickly, wasting less energy.

- Rock-Solid Stability:Frequency stability and longevity are critical for accurate timekeeping. Titan’s MEMS resonator experiences only one-fifth the aging drift of a typical crystal – it’s specified to maintain stability over 5 years even at maximum operating temperature eetimes.com. It also holds tight frequency tolerance across extreme temperatures (–40 °C to +125 °C), outperforming quartz in consistency eetimes.com. This thermal robustness suits wearables (which may face both winter cold and body heat) and industrial IoT sensors in harsh environments.

- Ruggedness: Perhaps Titan’s biggest advantage for portable gadgets is its durability. MEMS resonators are etched from silicon and can be robustly sealed. SiTime reports Titan can withstand shocks and vibrations 50× greater than a conventional crystal can handle eetimes.com. In essence, it’s “virtually indestructible in the presence of harsh environmental stressors,” the company claims eetimes.com. For a smartwatch or wireless earbud that might be dropped, bumped, or worn during intense activity, this resilience is a huge plus – reducing the risk of timing failures due to impact or motion.

- Frequencies and Integration: The Titan Platform resonators are launching at common MCU and radio clock frequencies: e.g. an initial 32 MHz Titan (SiT11100) is available now, with 38.4 MHz, 40 MHz, 48 MHz and 76.8 MHz variants sampling by end of 2025 sitime.com. These are frequencies often used for microcontroller and Bluetooth/Wi-Fi clocks, meaning Titan can directly replace the quartz crystals currently used in those designs. Manufacturers can either solder Titan as a tiny PCB-mounted device or co-package it within their own chips (attaching Titan’s silicon die alongside their IC) sitime.com. Co-packaging essentially makes the timing reference an internal part of the chipset – saving board space and simplifying design. “It’s a silicon die, so it can be put into a plastic package, which has benefits over ceramic [packages of quartz],” noted Piyush Sevalia, SiTime’s EVP of marketing eetimes.com.

Overall, Titan’s specs position it as an unprecedentedly small and robust clock source for next-gen electronics. “Titan fulfills our vision of being the only provider of complete timing components — oscillators, clocks and now, resonators,” said CEO Rajesh Vashist, emphasizing that it builds on over a decade of SiTime’s MEMS R&D sitime.com. The company’s proprietary MEMS fabrication (now in its 6th generation, dubbed FujiMEMS™) underpins Titan and, Vashist asserts, puts SiTime “years ahead of competitors” in this domain eetimes.com.

Built for Wearables: Use Cases from Smartwatches to Medical Implants

SiTime explicitly designed Titan with wearables and portable “edge” devices in mind, and the use cases span consumer, medical, and IoT applications:

- Smartwatches & Fitness Trackers: Modern smartwatches (Apple Watch, Garmin, Fitbit, etc.) cram an array of sensors (heart rate, GPS, accelerometers) and radios into a tiny case – while striving for all-day battery life. Titan’s ultra-small footprint and low power draw are a boon here. By replacing a rice-grain crystal with a pinhead Titan, a smartwatch maker could slightly slim the device or add a bigger battery or new sensor. Every square millimeter counts on a wrist. Titan’s resilience also means the watch’s clock won’t drift if you go for a run or drop the watch; it keeps precise time for features like fitness tracking, sleep monitoring, and connectivity. As an example, continuous glucose monitors and fitness bands are cited as beneficiaries of Titan’s low power and size sitime.com – these are devices that must be unobtrusive and reliable over long periods on the body.

- Wireless Earbuds and AR Glasses: Tiny wearables like true wireless earbuds (e.g. Apple AirPods) and emerging smart glasses are exactly the kind of “size and battery constrained” gadgets that Titan targets. “These are all things that sip on power as it is, but if you sip on it a little bit less, it’s all part of that general trend of miniaturization,” observes Bob O’Donnell of TECHnalysis Research reuters.com. For earbuds, a smaller timing chip might free room for a larger audio driver or just shave a fraction of a millimeter off the earbud’s profile. More importantly, Titan’s power savings, while modest per device, can extend playback time or standby time by trimming the budget that the timing circuitry consumes. O’Donnell also noted that a timing component like this is one of those “core ingredients – it’s way down in there, and you’re never going to see it… but it’s part of what makes it all work” in such products reuters.com. In other words, end-users won’t advertise they have a MEMS clock inside, but they will notice if their earbuds last an extra hour or their AR glasses are a bit lighter, due to component improvements like Titan.

- Health and Medical Wearables: Titan is also aimed at medical devices such as hearing aids, implantable sensors, and biosensors sitime.com. These devices often run on micro-batteries and must function reliably for years. A hearing aid, for instance, needs a stable clock for its digital signal processor and wireless link; using Titan could help extend battery life and ensure the device doesn’t require recalibration over time due to frequency drift. Moreover, the shock-proof nature of Titan is valuable – a hearing aid or a wearable heart monitor might be dropped occasionally; a pacemaker or implanted sensor will experience vibrations (and obviously cannot have its timing fail!). Titan’s high stability across temperature is also useful since body-worn devices can heat up or face varied climates. The ruggedness and longevity of the MEMS resonator mean life-critical wearables can rely on precise timing without the worry of crystal fracture or aging out of spec eetimes.com.

- Smart Home Sensors & Industrial IoT: Beyond personal wearables, Titan’s attributes apply to any small, connected gadget. SiTime lists smart home sensors, asset trackers, and industrial IoT nodes as examples that “become more compact, rugged, and power-efficient” with Titan sitime.com. Consider a temperature sensor or a tiny GPS tracker tag – by using a Titan resonator, the manufacturer can make the unit smaller (or add other features in the same form factor), and ensure the device’s clock remains accurate even in motion (important for reliable wireless communication and sensor readings). Industrial IoT devices, which might be deployed in high-vibration machinery or outdoor environments, also benefit from the shock/vibration immunity and wide-temp stability Titan provides eetimes.com. In short, Titan is positioned as an enabling technology for the next wave of innovation in edge devices, where “unprecedented miniaturization and integration” are key sitime.com.

Already, SiTime has partners in the semiconductor space embracing Titan. Low-power chip designer Ambiq, known for its energy-efficient microcontrollers used in wearables, is one early collaborator. “SiTime’s Titan resonators are a game-changer,” said Scott Hanson, Ambiq’s founder and CTO, “Our partnership with SiTime allows us to deliver a uniquely integrated solution — combining ultra-low power processing with Precision Timing” eetimes.com. By embedding Titan resonators directly with Ambiq’s processors, the combo can empower *“intelligent, connected products that push the boundaries of what’s possible, especially in edge AI applications where performance and efficiency are critical,” Hanson noted eetimes.com. This hints that future smartwatches or AR glasses could contain an Ambiq SoC that internally uses Titan for its clock, with no external crystal needed. Such integration can simplify device design and improve reliability (fewer discrete parts to potentially fail).

How Titan Stacks Up Against Competitors’ Timing Solutions

SiTime isn’t the only player pursuing tiny timing devices for wearables and IoT, but Titan appears to leapfrog prior solutions in size and integration flexibility. Here’s a look at how it compares with some competitors and alternative technologies:

- Quartz Status Quo: The main incumbent technology Titan seeks to replace is the quartz crystal resonator – a sliver of quartz in a metal or ceramic can, which vibrates at a fixed frequency. Companies like Epson, NDK, Murata, and others have spent decades refining quartz timing devices. Today’s smallest 32 kHz watch crystals and high-frequency MHz crystals are only a few millimeters in size, but Titan’s debut shows MEMS can go smaller (0.46 mm) by an order of magnitude eetimes.com. Quartz crystals also tend to be delicate (they can crack under mechanical shock) and have limitations in integration (you generally can’t put a quartz resonator inside a chip package easily due to their material and size). SiTime’s Titan, being a silicon die, can be co-packaged with semiconductor chips and is built to survive extreme shock/vibration eetimes.com. This gives Titan a substantial edge in robustness and integration over traditional quartz, especially for wearable and mobile gear that get jostled. Quartz still holds an advantage in some niche cases (very high frequency or ultra-low jitter requirements), but in the consumer wearable arena, Titan’s performance is more than sufficient, and its tiny form and resilience are more compelling for designers.

- Analog Devices (ADI)/Maxim’s MEMS RTCs:Analog Devices, via its acquisition of Maxim Integrated, has been offering MEMS-based timing solutions in the form of real-time clock (RTC) ICs. For instance, ADI’s MAX31343 is a clock chip that integrates a MEMS resonator on-chip, thereby “eliminat[ing] the external crystal requirement in the system” analog.com. This device provides a 32.768 kHz reference (the standard for timekeeping) with ±5 ppm accuracy from –40 °C to +85 °C analog.com, targeting IoT and wearable uses (the datasheet explicitly lists “Wearables” among its applications) analog.com. The key difference: ADI’s solution is an all-in-one RTC chip including the MEMS resonator and timing circuitry, whereas Titan is a standalone resonator component (meant to pair with a separate oscillator circuit or be built into an SoC). In practice, a product designer could use an ADI MEMS RTC to keep time in a fitness tracker, and indeed some wearables likely do. However, those RTCs typically operate at low frequency (32 kHz for clock/calendar). Titan, on the other hand, is tackling higher-frequency system clocks (32 MHz and up) sitime.com. This complements rather than directly conflicts with something like MAX31343 – a wearable might use Titan to clock its microprocessor and radio, while an integrated MEMS RTC provides the low-power time-of-day keeping. Notably, ADI’s MEMS timing technology originated from a startup called Sand 9, which ADI acquired in 2015 eenewseurope.com, indicating ADI’s long-term interest in silicon resonators. SiTime’s MEMS designs are often regarded as the industry leader (with billions of units shipped sitime.com), and Vashist’s comment that Titan’s tech “is years ahead of competitors” eetimes.com may be a subtle nod to players like ADI.

- Texas Instruments’ BAW Resonators:Texas Instruments (TI) has taken a different but related approach to ditching quartz: Bulk Acoustic Wave (BAW) resonator technology. BAW resonators are MEMS-like structures that use acoustic vibrations in a thin film of piezoelectric material (often integrated on silicon) to create a reference frequency. In 2019, TI made headlines by introducing the industry’s first “crystal-less” wireless microcontroller, the SimpleLink CC2652RB, which integrated a BAW resonator inside the chip package to generate its 48 MHz system clock prnewswire.com. By doing so, TI removed the need for an external high-frequency crystal on the board. TI also released a precision network synchronizer clock chip with BAW for telecom uses prnewswire.com. In wearables and IoT, TI’s approach means if you use a TI CC2652RB (or similar BAW-enabled chip) in your design, you get timing functionality without a quartz – much like using an SoC with Titan embedded. TI has also developed stand-alone BAW-based clock oscillators (the CDC6Cx series) that serve as drop-in crystal replacements ti.com mouser.com. BAW and SiTime’s MEMS likely have comparable benefits in terms of ruggedness and temperature stability. One difference is frequency: Titan’s initial offerings are in the tens of MHz, whereas BAW resonators can also target higher frequency RF ranges (TI’s BAW is used up to GHz in filters and clocks for 5G, for example) electronicdesign.com. For wearable applications, though, frequencies above ~100 MHz are less relevant for main clocks. Size-wise, Titan’s resonator (0.46 mm each side) is incredibly small; TI’s CC2652RB MCU package is around 7 mm square (though that includes a full MCU). TI’s discrete BAW oscillators (e.g., in QFN packages) are also a few millimeters in size prnewswire.com. Thus, SiTime still claims the crown for the “smallest resonator” in the timing market with Titan sitime.com. Titan’s advantage might lie in its flexibility – it can be adopted by any chip vendor or OEM, whereas TI’s integrated BAW is specific to TI’s own chips.

- NXP and Others (Emerging Efforts):NXP Semiconductors, a major supplier of chips for IoT and automotive, has also dabbled in MEMS timing. Back in 2012, NXP showcased a MEMS-based frequency synthesizer as a “crystal-free” timing solution, using a silicon die “more than 20 times smaller than the smallest crystal” available then chipestimate.com. That early prototype touted high stability and low jitter, aimed at communications gear chipestimate.com chipestimate.com. However, NXP never quite commercialized a broad MEMS timing line; the timing market remained dominated by specialized firms like SiTime and traditional quartz vendors. Notably, in September 2025, STMicroelectronics agreed to acquire NXP’s MEMS sensor business for $950 million embedded.com. This deal was more about motion and pressure sensors (to bolster ST’s automotive portfolio) than timing resonators specifically. Still, it underscores how valuable MEMS expertise has become – big players are willing to invest heavily to get an edge in microfabricated devices. STMicro itself is a competitor in timing via its MEMS oscillator products (ST has made MEMS-based “auto-grade” timers eetimes.com). Other notable mentions in the competition landscape include Murata, which manufactures timing components and has developed its own tiny MEMS resonators for clocks embedded.com, and Silicon Labs, a clock generator specialist (though Silicon Labs often uses integrated CMOS PLLs with either external crystals or buying MEMS from someone like SiTime for their modules). In the timing industry, SiTime’s fiercest competition historically came from IDT (Integrated Device Technology) and Epson/Toyocom, but IDT’s timing unit was acquired by Renesas (another big microcontroller company) and some IDT silicon MEMS technology (like the earlier “PiezoMEMS” resonators) ended up in products like Renesas’s tunable clock chips. Renesas/IDT and Microchip (which acquired another MEMS timing firm, Discera) are also in the mix of MEMS timing solutions eetimes.com. However, SiTime today stands out as “the Precision Timing company” with a singular focus, having shipped over 3.5 billion MEMS timing devices to date sitime.com. Titan’s introduction extends that leadership into the domain of resonators, completing SiTime’s portfolio (the company now offers oscillators, clock generators, and resonators as building blocks sitime.com).

In summary, SiTime’s Titan enters a competitive yet rapidly evolving arena. Traditional quartz crystal makers are being pressured by MEMS alternatives that offer smaller size and better robustness. Companies like ADI (Maxim) and TI have demonstrated that integrating MEMS or BAW resonators can improve products from wearable gadgets to infrastructure. Titan’s claim to fame is being the smallest of them all and highly versatile in implementation. If its performance claims hold true in real-world use, Titan could significantly tilt the scales in favor of MEMS timing for wearables, much like how MEMS inertial sensors (accelerometers/gyros) long ago displaced older discrete sensor tech in smartphones.

Market Impact: Will Major Wearable Brands Embrace Titan?

The wearable technology sector in 2025 is booming, which bodes well for a solution like Titan. Consumers are buying more smartwatches, health trackers, and wireless wearables than ever, even as smartphone sales plateau embedded.com. Each new generation of wearable demands more functionality in the same or smaller size, and often with improved battery life. This puts pressure on component suppliers to innovate. SiTime’s Titan addresses exactly that pressure for the timing subsystem.

Major wearable brands are likely potential adopters of Titan or similar MEMS timing devices:

- Apple – known for its stringent design and size optimization – has used SiTime’s MEMS oscillators in some products (analysts spotted SiTime parts in iPhone teardowns reuters.com). Apple’s Apple Watch is a top-selling smartwatch that pushes the envelope on features like health sensors and durability (the Apple Watch Ultra model emphasizes ruggedness and long battery life). In Apple’s September 2025 launch event, the company announced the Watch Series 11 and Ultra 3, continuing to refine its wearable lineup wareable.com wareable.com. Incorporating a robust, tiny timing chip could help Apple shave precious space inside the Watch for other components or battery. While Apple never discloses its suppliers, it’s notable that Titan’s qualities align with Apple’s needs: Apple designs their S-series smartwatch chips in-house, and Titan could be a candidate to integrate into a future Apple SiP (system-in-package) to eliminate the external timing crystal. Additionally, Apple’s rumored AirPods Pro 3 (also anticipated around late 2025) are expected to add new health sensors (like heart-rate monitoring) wareable.com, meaning more electronics packed into the earbuds. A smaller timing device like Titan might find a place in such densely packed wearables to keep everything in sync without wasting space.

- Samsung, Google (Fitbit), Garmin, and others: Many other companies making wearables could benefit similarly. Samsung’s Galaxy Watch and Google’s Pixel Watch/Fitbit devices compete in the smartwatch arena, where differentiation often comes from sleek design and battery endurance. If Titan delivers a measurable power saving and size reduction, it could appeal to these manufacturers or to the chip vendors supplying them. Qualcomm, for example, provides Snapdragon Wear SoCs for Wear OS watches – Qualcomm could consider building a Titan-like MEMS resonator into its future smartwatch chipsets to help customers simplify their designs. Garmin, known for GPS fitness watches, might appreciate Titan’s fast startup and stable timing for quicker GPS lock times (precise clock helps with GNSS synchronization planetanalog.com). Medical wearable firms (like Dexcom or Medtronic for continuous glucose monitors, or Cochlear for implants) are typically cautious but would see value in a more reliable clock source that needs no maintenance or replacement over years.

- OEMs & supply chain integration: SiTime’s strategy with Titan also involves partnering at the chip level (like Ambiq for microcontrollers eetimes.com). If Titan becomes integrated in popular wearable chipsets (Bluetooth SoCs, sensor hubs, etc.), it can achieve wide adoption behind the scenes. It’s a “building block” that could quietly proliferate. As tech analyst Dave Altavilla put it, “Once a Titan resonator is integrated, it becomes part of the SoC or MCU platform for the life of that product” eetimes.com. This suggests a stickiness – if a chip vendor qualifies Titan in their design, they are likely to keep using it for that chip’s entire production run (which could span years and millions of units). Altavilla emphasizes that Titan “represents a very sticky new revenue stream for SiTime” precisely because of this long-term design win nature eetimes.com. For wearable brands, that means if their chosen chipset comes with Titan inside, they benefit from Titan’s features by default.

- Concerns or hurdles: No adoption story is complete without potential challenges. Wearables is a cost-sensitive market in many segments. Quartz crystals are commodity components, and their costs are well-known (often <$0.10 in bulk for simple watch crystals). SiTime will have to price Titan attractively to entice manufacturers to switch. Also, designers tend to trust what’s proven – quartz has decades of field history. MEMS resonators are still relatively new in high-volume consumer electronics (though billions have shipped, many were in smartphones as auxiliary clocks). SiTime will need to demonstrate Titan’s reliability over time in real products to win over any skeptics. That said, the trends are in its favor: the industry has steadily been moving towards integrated and solid-state timing solutions. Even in the highly conservative telecom field, network equipment is adopting MEMS oscillators for better resilience embedded.com. In wearables, the tolerance for trying a new approach might be higher, given the huge premium placed on size and power.

One sign of market confidence in such technologies is investment moves. The STMicro–NXP MEMS deal in September 2025 showed a big player doubling down on MEMS across the board embedded.com. The MEMS market overall is projected to grow strongly (from $15.4 billion in 2024 to $20 billion by 2028) with wearables cited as a contributor to that growth spurt embedded.com embedded.com. This environment indicates that if Titan delivers on its promises, the market is ready to absorb a better timing solution. Wearable device makers compete on having the latest and best tech, so being able to tout improved durability or battery life – even indirectly via a component like Titan – is appealing. For SiTime, landing a design win in a blockbuster wearable (say, the next Apple Watch or a top-selling fitness band) would validate Titan and likely lead to a cascade of adoption in the industry.

Industry Reactions & Expert Commentary

The introduction of Titan has generated positive buzz among industry observers and experts, who see it as part of a larger shift in electronics design:

- Bob O’Donnell (TECHnalysis Research) – highlighted Titan’s role in the incremental improvements that make wearables better. He pointed out that reducing power draw even slightly in tiny devices like earbuds or smart glasses contributes to longer battery life and smaller form factors. “If you sip on [power] a little bit less, it’s all part of that general trend of miniaturization,” O’Donnell told Reuters, referring to Titan’s low-power advantage reuters.com. He likened such components to unseen ingredients in a recipe: “way down in there… part of what makes it all work” reuters.com. This underscores that end-users won’t directly notice a timing chip, but they will appreciate the results (like gadgets that are more compact or run longer).

- Rajesh Vashist (SiTime CEO) – in press materials, emphasized the integration and industry impact of Titan. He stated, “By integrating resonators into SoCs, MCUs, and wireless chip packages at scale, customers can capture more system value and revenue with their products. This integration is transformative for the entire electronics industry.” eetimes.com. This comment reflects SiTime’s strategy to work closely with other chip makers (so that Titan might be embedded inside many kinds of chips). Vashist also positioned Titan as the fruition of a decade of MEMS innovation, built on SiTime’s proprietary processes (FujiMEMS) which he claims put the company ahead of would-be rivals eetimes.com. It’s a confident stance, suggesting that SiTime sees Titan not just as one product, but as a platform it can expand (the Titan Platform™ family) to maintain a technological lead.

- Scott Hanson (Ambiq CTO) – gave a perspective from a partner/early adopter viewpoint. Calling Titan resonators “a game-changer,” Hanson said integrating SiTime’s precision timing with Ambiq’s ultra-low-power processing enables customers to “push the boundaries of what’s possible” in intelligent wearable and edge AI devices eetimes.com. This is telling: an ultra-low-power MCU can only perform as well as its support components allow. If the clock source uses less power and wakes up faster (as Titan does), the whole system benefits, especially in Edge AI scenarios where a device might frequently cycle between sleep and active states to conserve energy. Hanson’s endorsement suggests that chip makers see real value in offering Titan-equipped versions of their products to OEMs.

- Dave Altavilla (HotTech Vision & Analysis) – an industry analyst (and Forbes contributor) who has followed SiTime, remarked on Titan’s business implication. He said, “The Titan platform is a disruptor… for the timing industry as a whole. It also represents a very sticky new revenue stream for SiTime.” eetimes.com. By “sticky,” he means that once a manufacturer designs Titan in, they are likely locked in as customers for the long haul, since swapping out a fundamental component like a timing resonator is not trivial. Altavilla also noted, “Once a Titan resonator is integrated, it becomes part of the SoC or MCU platform for the life of that product” eetimes.com. This speaks to the strategic importance of Titan for SiTime – it’s not just selling a one-off chip; it’s potentially securing a slot in many future devices continuously. For the industry, a disruptor like Titan challenges the status quo of quartz timing. It may prompt competitors to accelerate their own MEMS timing R&D or to form partnerships (for example, a microcontroller company that hasn’t invested in MEMS might team up with SiTime or another MEMS provider to stay competitive).

- Wider industry context: The timing of Titan’s release is interesting in light of other September 2025 tech news. As mentioned, this month saw major wearable product launches (Apple and others) and significant deals like ST’s MEMS acquisition. Analysts noted that after a slight downturn, the MEMS sector is rebounding strongly by 2024/2025, with growth driven by wearables, IoT, automotive, and telecom, and they highlight “precision timing devices” as essential in emerging high-speed networks and systems embedded.com embedded.com. Wearables specifically are flagged as helping compensate for slowing smartphones embedded.com, meaning companies supplying components for wearables have a ripe opportunity. The consensus is that “precision timing is now a critical enabler” in everything from mobile devices to industrial IoT planetanalog.com. Publications like Planet Analog pointed out earlier this year that SiTime’s move into integrated clock generators with MEMS (e.g., the Symphonic SiT30100 for mobile GNSS/5G chips) was part of ensuring reliable timing for advanced wireless and AI applications planetanalog.com planetanalog.com. Titan’s launch extends that narrative to even smaller devices at the network’s edge.

Conclusion: SiTime Titan and the Future of Wearable Tech Timing

In summary, SiTime’s Titan chip represents a significant step in the ongoing trend of replacing legacy quartz timing devices with silicon MEMS timing solutions in consumer electronics. For the general public, the Titan itself is an invisible component – you won’t directly interact with it – but it could indirectly improve your experience with the next wave of wearables and gadgets. Whether it’s a smartwatch that’s a bit thinner and tougher, earbuds that last a little longer on a charge, or a health monitor implant you can trust for years, advancements like the Titan resonator help make it possible.

SiTime’s entry into the wearable-focused timing market also highlights how critical tiny behind-the-scenes components have become in enabling big-picture innovations. As wearables add more sensors (from blood pressure monitoring to ambient AI capabilities) and as devices like AR glasses strive to look and feel “normal,” every milliwatt and millimeter saved in the electronics counts. Timing chips may not get the spotlight, but they are literally what keep the time in our devices – and increasingly, they keep everything else in sync, from processor operations to wireless communications.

The competition in this space is likely to heat up, with traditional analog giants and specialized firms alike vying to provide the clock of choice for wearables. This could mean faster development of even more advanced resonators – perhaps MEMS oscillators that integrate temperature compensation and calibration to outright replace high-precision oven-controlled crystals, or even programmable multi-frequency solutions that can adapt on the fly. For now, SiTime’s Titan has set a new bar in terms of size, power efficiency, and robustness for one of the most fundamental components in electronics. If the wearable tech industry embraces this tiny chip – as early feedback suggests it will – it could hasten the day when quartz crystals join mechanical watch springs in the museum of old timing tech, fully replaced by silicon’s heartbeat in our digital wearables.

Sources: SiTime press release sitime.com eetimes.com; Reuters reuters.com reuters.com; EE Times eetimes.com eetimes.com; BusinessWire sitime.com; TECHnalysis Research via Reuters reuters.com; HotTech analyst comment eetimes.com; Analog Devices datasheet analog.com; TI documentation prnewswire.com; NXP announcement chipestimate.com; Embedded.com (ST/NXP deal) embedded.com embedded.com; Wareable (Apple event) wareable.com wareable.com.