Taiwan Semiconductor Manufacturing Company (NYSE: TSM) spent Wednesday in the spotlight as investors weighed a mix of bullish Wall Street calls, a shock 99% profit drop at its Arizona unit, fresh milestones for U.S. chip production, and a high‑profile probe into alleged theft of cutting‑edge process technology.

TSM stock price today: modest rebound after recent pullback

As of late U.S. trading on Wednesday, November 19, 2025, TSM stock was changing hands at roughly $282 per share, up about 1.6% versus Tuesday’s close near $278. Investing

Key intraday stats from major data providers:

- Last price: ≈ $282–283

- Day’s range: about $274 to $292 Investing

- Volume: roughly 10–11 million shares, in line with recent averages Investing

On a longer view, MarketBeat data show: MarketBeat

- 52‑week range: $134.25 – $311.37

- Market cap: around $1.44 trillion

- P/E ratio: ~28.5

- 50‑day moving average: about $286.69

- 200‑day moving average: about $244.07

That leaves TSM trading slightly below its recent 50‑day average, but still well above its longer‑term trend line, reflecting how strongly the stock has rerated on the back of the artificial intelligence (AI) boom.

Wall Street doubles down: Bank of America and others stay bullish on TSM

Bank of America reiterates “Buy” with aggressive upside

Before the opening bell, Bank of America Securities reiterated a Buy rating on Taiwan Semiconductor with a $390 price target, according to coverage distributed via Finviz and Insider Monkey. Finviz

Key points from that note:

- The TSM board has approved a US$14.98 billion budget to support long‑term capacity, including new fabs, advanced packaging and 2026 R&D. Finviz

- The analyst models gross margins around 60% through 2027, supported by robust foundry share and AI‑driven demand. Finviz

- Bank of America sees TSM’s strength in 2 nm nodes and high‑end packaging as a key long‑term edge versus rival foundries. Finviz

In short, one of Wall Street’s largest banks is telling clients the AI capex wave still has legs — and that TSM remains at the center of it.

Quant models and idea lists echo the bullish tone

TSM is also popping up in a variety of quant‑driven and list‑style stock ideas:

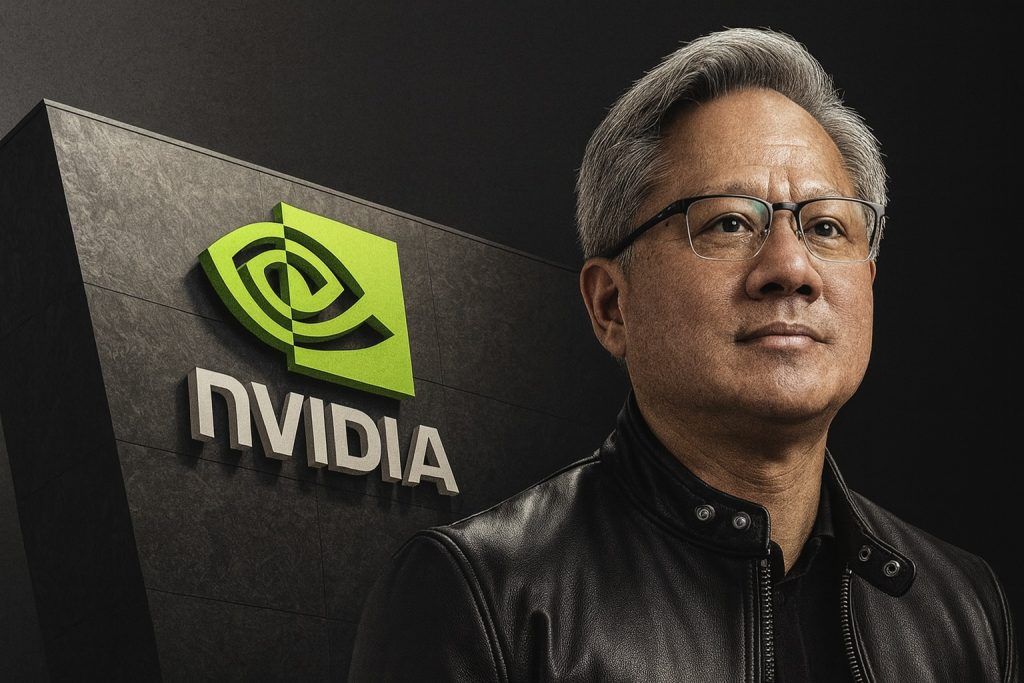

- A Zacks “Investment Ideas” feature out today highlights Taiwan Semiconductor alongside Nvidia, Apple and Vertiv, underscoring TSM’s status as an AI infrastructure bellwether. Yahoo Finance

- A Seeking Alpha “2‑Minute Analysis” segment rates TSM a “Strong Buy” in its quant system, despite flagging valuation as rich — a signal of strong earnings and momentum factors still at work. Seeking Alpha

Alternative‑data specialist Quiver Quantitative notes that social chatter around TSM has focused heavily on the nearly $15 billion investment approval and what it means for future growth — while also flagging concern about a recent slowdown in October revenue growth (more on that below). Quiver Quantitative

Quiver’s aggregated analyst data show: Quiver Quantitative

- Recent Wall Street ratings on TSM are all in the Buy/Positive camp.

- A median price target around $360 per share.

- MarketBeat’s survey of analysts pegs the consensus rating as “Moderate Buy” with an average target near $372. MarketBeat

Arizona in the spotlight: 99% profit drop vs. Nvidia Blackwell milestone

If you only read the headlines on Wednesday, TSMC’s U.S. expansion might look like a contradiction: a profit collapse in Arizona on one side and a major production milestone on the other.

Q3: Arizona subsidiary profit collapses 99%

A report from Taiwan News says TSMC’s Arizona subsidiary posted Q3 profit of just NT$41 million (about US$1.3 million), down from NT$4.2 billion in Q2 — a 99% sequential drop. Taiwan News

According to that report:

- The parent company’s overall Q3 operating profit still reached NT$500.7 billion, up 8% quarter‑on‑quarter, highlighting how small Arizona remains in the group context. Taiwan News

- Analysts attribute the U.S. unit’s profit plunge to heavy ramp‑up costs, workforce training, and supply chain immaturity relative to Taiwan and Japan. Taiwan News

- A second Arizona fab is being installed and is expected to host 3 nm production in 2027, with profitability unlikely to normalize until volumes scale. Taiwan News

In other words, Arizona is currently a margin drag — but that’s typical of large greenfield fabs in their early years.

At the same time: first Nvidia Blackwell wafers from Arizona

Balancing that grim near‑term profit picture is a more upbeat development. The European Business Review reports that TSMC’s “Fab 21” in Phoenix has produced its first wafer for Nvidia’s Blackwell architecture using a specialized 4N process, marking one of the first truly advanced GPU‑class wafers manufactured on U.S. soil. European Business Review

Key details from that story:

- The wafer milestone was celebrated in October and is pitched as a symbolic win for U.S. chip manufacturingunder the CHIPS Act. European Business Review

- Wafers fabricated in Arizona are still shipped back to Taiwan for advanced CoWoS packaging, since that capability is not yet fully available in the U.S. European Business Review

- U.S. production is estimated to be 5–20% more expensive than in Taiwan due to higher labor and operating costs, but policymakers and TSMC argue the supply‑chain resilience premium justifies it. European Business Review

For TSM investors, the message is clear: Arizona hurts margins today but bolsters strategic positioning with governments and hyperscalers who want more geographically diversified chip supply.

Data‑leak probe: former TSMC executive under scrutiny over sub‑2nm secrets

Another theme hanging over TSM stock today is intellectual‑property risk.

Taiwan launches investigation into ex‑SVP Lo Wei‑jen

Multiple outlets report that Taiwanese prosecutors have opened a probe into former TSMC senior vice president Lo Wei‑jen over allegations he removed sensitive process documents before retiring and later joined Intel. The Tribune

According to coverage syndicated from Focus Taiwan and local press: The Tribune

- Lo is suspected of taking information tied to 2 nm, A16 and A14 process technologies as he left TSMC in July.

- Reports say he may have left with dozens of boxes – possibly more than 80 – of documents and notebooks, triggering internal alarm.

- He then appeared at Intel later in the year, raising fears that trade secrets could have been passed to the U.S. rival.

TrendForce notes that some local sources argue many of these materials could be personal handwritten notes rather than official TSMC documents, underscoring that facts are still being contested. TrendForce

For now, this is an early‑stage investigation, not a confirmed IP theft case. But it highlights:

- The strategic sensitivity of sub‑2nm know‑how, and

- How geopolitical competition between U.S. and Asian chipmakers is increasingly playing out through talent moves and legal scrutiny.

Investors will be watching closely for any sign that the probe leads to sanctions, tighter export controls, or changes in client sentiment — none of which are evident yet.

Growth engine still powered by AI: Q3 blowout, Japan expansion, October wobble

Away from the daily noise, the core fundamental story for TSM remains firmly tied to AI infrastructure demand.

Q3: record profit and higher growth outlook

In mid‑October, TSMC reported a record Q3 net profit of roughly T$452.3 billion (about US$14.8 billion), up nearly 40% year‑on‑year, driven by AI accelerators and high‑performance computing (HPC) demand. Reuters

Highlights from recent earnings coverage and follow‑up analysis: Reuters

- Revenue jumped around 30–40% YoY (depending on base and currency).

- Gross margin is hovering near 59–60%, at the high end for global chip manufacturers.

- Management raised its full‑year 2025 USD revenue growth forecast to the mid‑30% range, up from ~30%.

- TSMC kept capex guidance up to about US$42 billion, with the lower bound lifted to US$40 billion, reflecting confidence in sustained AI demand.

MarketBeat and Nasdaq‑syndicated commentary also emphasize that a new US$14 billion facility in Japan — TSMC’s second factory there — is a central plank in its AI strategy, helping diversify capacity while staying close to key customers in autos and industrials. Nasdaq

October revenue: growth slows, but still strong

Short‑term, there has been a wobble. GuruFocus reports that October revenue grew 16.9% year‑on‑year to NT$367.4 billion, below market expectations of around 27.4% and marking TSMC’s slowest monthly growth since February of last year. GuruFocus

Even so:

- Revenue for the first ten months of 2025 is up 33.8% vs. the prior‑year period, showing how strong the broader trend remains. GuruFocus

That slowdown is one reason some traders are cautious, especially with Nvidia’s earnings looming and sentiment toward AI chips already very optimistic.

Institutional flows, dividends and positioning

MarketBeat’s filings round‑ups today show both buying and trimming among institutional investors: MarketBeat

- Heritage Wealth Advisors boosted its stake in TSM by about 630% in Q2, now holding 2,557 shares (roughly US$579,000 at the time of filing).

- Renaissance Group LLC trimmed its position by about 1.9%, ending Q2 with just over 47,000 shares worth around US$10.7 million.

- Quiver Quant’s aggregated data show 1,500+ institutions adding TSM in their latest quarter, versus just over 1,100 reducing exposure.

Income‑focused investors also note that TSM has raised its quarterly dividend to roughly US$0.97 per ADR (annualized about US$3.87), implying a yield around 1.2–1.4% at current prices. MarketBeat

While not a high‑yield play, the dividend growth is another signal of management confidence in sustained cash generation from AI‑related demand.

How the market is digesting today’s TSM headlines

Put together, Wednesday’s TSM news flow paints a mixed but still broadly positive picture:

Positives for the bull case

- Share price bounced about 1–2% after recent weakness, with TSM still comfortably above its 200‑day moving average. MarketBeat

- Bank of America’s Buy rating and a $390 target reinforce Street conviction that the AI upcycle is far from over. Finviz

- The Arizona Blackwell wafer milestone and $14B Japan fab plan show TSMC executing on a multi‑continent capacity strategy aligned with government incentives and hyperscaler needs. European Business Review

- Q3 results and guidance suggest mid‑30% revenue growth in 2025 with margins near 60% — rare numbers for a mega‑cap industrial tech name. Reuters

Risks and watch‑points

- The 99% profit plunge at TSMC Arizona highlights how costly U.S. fabs are before they scale, and why consolidated margins might face pressure as more overseas plants ramp. Taiwan News

- The data‑leak investigation into ex‑SVP Lo introduces headline risk around trade secrets and competitive advantage at sub‑2nm, even if the legal outcome remains uncertain. The Tribune

- October’s weaker‑than‑expected revenue growth has sparked debate about whether AI demand is normalizing from “insane” to merely “very strong.” GuruFocus

- At a P/E near 28–29x, TSM is no longer the bargain it once was; a lot of AI optimism is already reflected in the price. MarketBeat

For short‑term traders, the combination of high expectations and rising geopolitical/IP headlines could mean more volatility — something options strategists are already targeting, with trade ideas such as near‑term iron condors popping up around TSM. Market Chameleon

Longer‑term investors, meanwhile, will likely focus on whether TSM can keep converting AI demand into durable earnings growth while managing the cost and political complexity of fabs in the U.S. and Japan.

Key takeaways for TSM stock on November 19, 2025

- TSM stock closed the day higher, recovering some of this week’s losses and trading around $282 per share. Investing

- Bank of America reaffirmed a Buy with a $390 target, leaning on TSM’s dominant position in 2 nm and advanced packaging and its nearly $15B capex plan. Finviz

- TSMC Arizona remains a near‑term profit drag, with a 99% quarterly profit drop — but it also just produced its first Nvidia Blackwell wafer, a symbolic win for U.S. manufacturing. Taiwan News

- Taiwan has launched a probe into alleged theft of TSMC trade secrets by a former senior executive now at Intel, adding an IP and geopolitics subplot to the investment story. The Tribune

- Despite an October revenue slowdown, TSMC’s Q3 results, upgraded 2025 growth outlook, and aggressive global expansion keep it firmly positioned at the heart of the AI chip megatrend. Reuters

This article is for information and news purposes only and does not constitute financial advice, investment recommendation, or a solicitation to buy or sell any security. Always do your own research or consult a licensed financial adviser before making investment decisions.